Af-RALux2010Neide:Layout 1 - paperJam

Af-RALux2010Neide:Layout 1 - paperJam

Af-RALux2010Neide:Layout 1 - paperJam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Law of July 27, 2000 stipulates that banks must also belong<br />

to an investment Guarantee scheme. This additional Guarantee<br />

covers the reimbursement of claims resulting from investment<br />

transactions up to the amount of EUR 20,000.<br />

The total amount of the Guarantees which will in no case<br />

exceed EUR 120,000 per customer (EUR 100,000 deposit<br />

guarantee and EUR 20,000 investor compensation) represents<br />

an absolute figure and cannot be increased by any interest,<br />

charges or any other amount.<br />

As at December 31, 2010 and 2009, the Bank has set up a<br />

provision in recognition of its potential liabilities under the<br />

Guarantees within the limits set out in the Grand-Ducal<br />

Regulation of December 21, 1991 enacting Article 167 § 1 (5)<br />

of the income tax Law of December 4, 1967 (see note 18).<br />

During the year 2010, the additional amount of EUR 664,392<br />

(2009 (see note 1): EUR 508,287) has been allocated to the<br />

AGDL provision.<br />

No advances were paid in 2010 (2009 (see note 1): EUR<br />

600,815). During the year 2010, the Bank received<br />

reimbursements from AGDL for an amount of EUR 139,788<br />

(2009 (see note 1): EUR 326,692), posted in “Other operation<br />

income” (see note 27).<br />

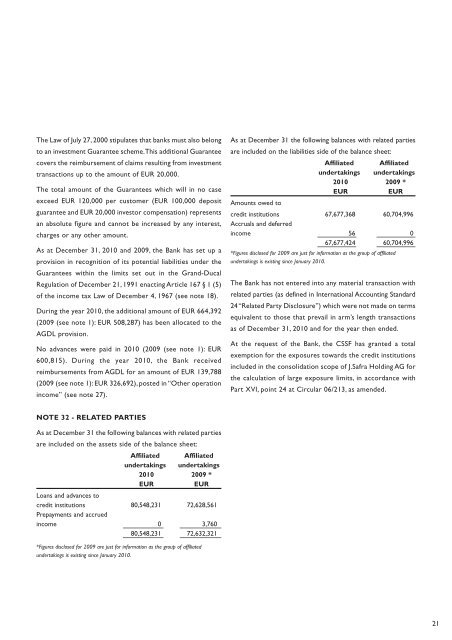

As at December 31 the following balances with related parties<br />

are included on the liabilities side of the balance sheet:<br />

<strong>Af</strong>filiated <strong>Af</strong>filiated<br />

undertakings undertakings<br />

2010 2009 *<br />

EUR<br />

EUR<br />

Amounts owed to<br />

credit institutions 67,677,368 60,704,996<br />

Accruals and deferred<br />

income 56 0<br />

67,677,424 60,704,996<br />

*Figures disclosed for 2009 are just for information as the group of affiliated<br />

undertakings is existing since January 2010.<br />

The Bank has not entered into any material transaction with<br />

related parties (as defined in International Accounting Standard<br />

24“Related Party Disclosure”) which were not made on terms<br />

equivalent to those that prevail in arm’s length transactions<br />

as of December 31, 2010 and for the year then ended.<br />

At the request of the Bank, the CSSF has granted a total<br />

exemption for the exposures towards the credit institutions<br />

included in the consolidation scope of J.Safra Holding AG for<br />

the calculation of large exposure limits, in accordance with<br />

Part XVI, point 24 at Circular 06/213, as amended.<br />

NOTE 32 - RELATED PARTIES<br />

As at December 31 the following balances with related parties<br />

are included on the assets side of the balance sheet:<br />

<strong>Af</strong>filiated <strong>Af</strong>filiated<br />

undertakings undertakings<br />

2010 2009 *<br />

EUR<br />

EUR<br />

Loans and advances to<br />

credit institutions 80,548,231 72,628,561<br />

Prepayments and accrued<br />

income 0 3,760<br />

80,548,231 72,632,321<br />

*Figures disclosed for 2009 are just for information as the group of affiliated<br />

undertakings is existing since January 2010.<br />

21