Tax Workshop for Foreign Nationals - Tax Services

Tax Workshop for Foreign Nationals - Tax Services

Tax Workshop for Foreign Nationals - Tax Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

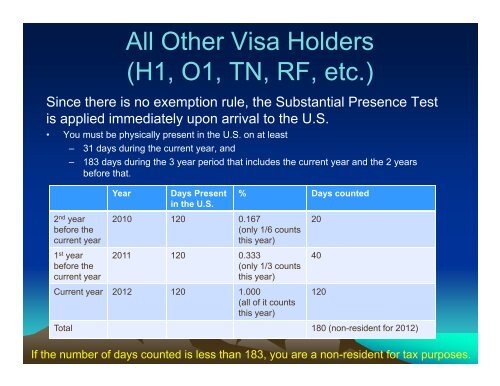

All Other Visa Holders<br />

(H1, O1, TN, RF, etc.)<br />

Since there is no exemption rule, the Substantial Presence Test<br />

is applied immediately upon arrival to the U.S.<br />

• You must be physically present in the U.S. on at least<br />

– 31 days during the current year, and<br />

– 183 days during the 3 year period that includes the current year and the 2 years<br />

be<strong>for</strong>e that.<br />

Year<br />

Days Present<br />

in the U.S.<br />

% Days counted<br />

2 nd year<br />

be<strong>for</strong>e the<br />

current year<br />

1 st year<br />

be<strong>for</strong>e the<br />

current year<br />

2010 120 0.167<br />

(only 1/6 counts<br />

this year)<br />

2011 120 0.333<br />

(only 1/3 counts<br />

this year)<br />

20<br />

40<br />

Current year 2012 120 1.000<br />

(all of it counts<br />

this year)<br />

120<br />

Total 180 (non-resident <strong>for</strong> 2012)<br />

If the number of days counted is less than 183, you are a non-resident <strong>for</strong> tax purposes.