Tax Workshop for Foreign Nationals - Tax Services

Tax Workshop for Foreign Nationals - Tax Services

Tax Workshop for Foreign Nationals - Tax Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

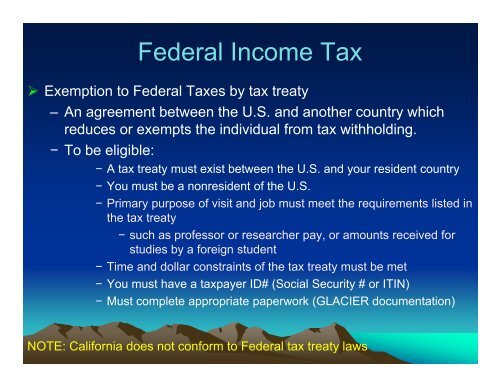

Federal Income <strong>Tax</strong><br />

‣ Exemption to Federal <strong>Tax</strong>es by tax treaty<br />

– An agreement between the U.S. and another country which<br />

reduces or exempts the individual from tax withholding.<br />

− To be eligible:<br />

− A tax treaty must exist between the U.S. and your resident country<br />

− You must be a nonresident of the U.S.<br />

− Primary purpose of visit and job must meet the requirements listed in<br />

the tax treaty<br />

− such as professor or researcher pay, or amounts received <strong>for</strong><br />

studies by a <strong>for</strong>eign student<br />

− Time and dollar constraints of the tax treaty must be met<br />

− You must have a taxpayer ID# (Social Security # or ITIN)<br />

− Must complete appropriate paperwork (GLACIER documentation)<br />

NOTE: Cali<strong>for</strong>nia does not con<strong>for</strong>m to Federal tax treaty laws