TATA Motors - Fortune Financial Services

TATA Motors - Fortune Financial Services

TATA Motors - Fortune Financial Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Forex losses dent good operational results<br />

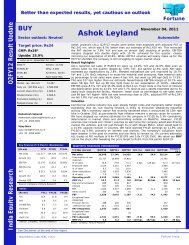

<strong>Fortune</strong><br />

India Equity Research Q2FY12 Result Update<br />

BUY November 15, 2011<br />

Sector outlook: Neutral<br />

Target price: Rs230<br />

CMP: Rs181<br />

Upside: 27%<br />

* Price as on November 15, 2011<br />

500570 Sensex: 16,883<br />

<strong>TATA</strong>MOTORS Nifty: 5,068<br />

TAMO.BO 52 W-H/L: 276/138<br />

TTMT.IN<br />

Face Value-Rs2<br />

Market cap (Rs mn) 531,979*<br />

Daily vol. (3M NSE avg.) 4,061,663<br />

Current share O/S (mn) 3,173*<br />

Diluted shares (mn) 3,323*<br />

Promoters holding (%) 35.05<br />

Pledged shares (%) 2.92<br />

* Including DVR shares<br />

Mahantesh Sabarad<br />

mahantesh.sabarad@fortune.co.in<br />

+91 22 4300 3821<br />

Vijay Nara<br />

vijay.nara@fortune.co.in<br />

+91 22 4300 3822<br />

Key financial - Consolidated (Y/E March)<br />

(Rs mn) FY11 FY12E FY13E<br />

Net sales 1,231,333 1,435,884 1,600,668<br />

Growth (%) 33.1 16.6 11.5<br />

EBITDA 177,800 186,232 201,041<br />

EBITDA (%) 14.4 13.0 12.6<br />

PAT 92,736 77,725 93,020<br />

Growth (%) 939.3 (16.2) 19.7<br />

Diluted EPS 27.9 23.4 28.0<br />

Source: Company, <strong>Fortune</strong> Research<br />

Valuation / Ratios<br />

(x) FY11 FY12E FY13E<br />

P/E 6.5 7.7 6.5<br />

P/B 3.2 2.1 1.7<br />

EV/EBITDA 4.2 3.6 3.1<br />

EV/Sales 0.6 0.5 0.4<br />

RoE (%) 68.6 32.6 28.7<br />

RoCE (%) 23.2 18.6 19.5<br />

Source: Company, <strong>Fortune</strong> Research<br />

<strong>TATA</strong> <strong>Motors</strong><br />

Automobiles<br />

Tata <strong>Motors</strong> (TML) Q2FY12 consolidated PAT was 13.1% below expectation, while<br />

operating profit was marginally better. MTM forex loss of Rs4.4 bn dragged down<br />

operational performance. Revenues met our expectations while absolute EBITDA was just<br />

3.2% better with the margin at 13.3% being 39 bps better than expected. Standalone<br />

profit at Rs1.0 bn was 80.5% lower than our expectation as TML reported an exceptional<br />

loss on forex of Rs2.9 bn. Its UK-based subsidiary JLR gave a steady performance<br />

masking the poor standalone showing with an EBITDA of 14.9% that fell 166 bps YoY and<br />

13 bps QoQ along expected lines. However, the JLR unit had a £94 mn (Rs7.2 bn) MTM<br />

loss on forex and commodity option hedges that under Indian GAAP were amortized over<br />

remaining contract period limiting their P&L. From the end of quarter till date, loss on<br />

these options has been mostly (2/3) reversed out.<br />

Result highlights: TML’s consolidated net sales were up 25.8% YoY and 7.8% QoQ to<br />

Rs362 bn. Standalone net sales were Rs129.5 bn, expanding 12.6% YoY and 8.9% QoQ.<br />

Adverse mix and higher raw material prices led to a fall in standalone EBITDA margin by<br />

251 bps YoY and 119 bps QoQ to 7.2%. Consolidated EBITDA too fell 123 bps YoY, but<br />

was flat QoQ to 13.3%. JLR’s margin fell as a result of adverse currency movements to<br />

14.9%, down 166 bps YoY and 13 bps QoQ. Absolute consolidated EBITDA at Rs48.2 bn<br />

rose 15.1% YoY and 7.9% QoQ, bettering our estimate by 3.2%. Forex MTM losses of<br />

Rs4.4 bn and higher depreciation and amortization costs dragged the PBT down by<br />

10.0% YoY and 3.2% QoQ. PAT, at Rs18.8 bn, fell 15.6% YoY and 6.1% QoQ, which was<br />

lower than our estimate by 13.1%. The addition of Rs3.16 bn to JLR’s pension provision<br />

pulled shareholder reserves down. TML’s net debt, excluding vehicle loans, position is<br />

now comfortably placed at 0.7x or 1.12x, including vehicle loan. In fact JLR’s net debt is<br />

at a mere Rs15 bn.<br />

Valuation: At the CMP of Rs181 TML trades at a P/E of 6.5x its FY13E consolidated<br />

estimates. We have lowered our estimates, more for FY12E than FY13E. This revision is<br />

mainly linked to the poor performance of its Indian passenger vehicles division. JLR<br />

volume momentum is building up and, moving forward, is set to retain its current<br />

financial performance. Given the continuing positive cash flow generation at JLR, TML<br />

should be able to tackle its debt exposures rather well. In fact, the equity dilutions from<br />

convertible bonds may not happen as they get paid out in June. We continue to value<br />

TML 8x on its forward earnings with the company averaging 7.7x in the past year.<br />

Finally, leaving our price target untouched, we retain our BUY rating on the stock.<br />

Quarterly financials (Consolidated)<br />

Y/E Mar (Rs mn) Q2FY12 Q2FY11 Q1FY12 YoY (%) QoQ (%) Q2FY12E<br />

Variance<br />

(%)<br />

Net sales 361,975 287,820 335,725 25.8 7.8 361,542 0.1<br />

Consmp. of RM 241,388 184,496 219,352 235,642<br />

% of sales 66.7 64.1 65.3 259 bp 135 bp 65.2 151 bp<br />

Employee costs 28,656 22,742 25,925 28,307<br />

% of sales 7.9 7.9 7.7 7.8<br />

Other expenditure 43,777 38,743 45,831 50,924<br />

% of sales 12.1 13.5 13.7 14.1<br />

Operating profit 48,154 41,839 44,617 15.1 7.9 46,670 3.2<br />

OPM (%) 13.3 14.5 13.3 -123 bp 1 bp 12.9 39 bp<br />

Dep. & amort. 16,423 12,770 13,691 14,661<br />

Interest 5,251 5,313 7,659 6,979<br />

EBT 26,481 23,757 23,267 11.5 13.8 25,029 5.8<br />

Other income 608 195 761 411<br />

PBT 27,089 23,953 24,028 13.1 12.7 25,440 6.5<br />

Exc. item (Reported) 4,390 (1,276) 570 -<br />

Provision for tax 3,630 3,131 3,519 3,886 4.0<br />

- effective tax rate 13.4 13.1 14.6 15.3<br />

'Minority share /Profit<br />

share in Assoc.<br />

(296) 134 57 46<br />

PAT (Reported) 18,773 22,232 19,996 (15.6) (6.1) 21,601 (13.1)<br />

Exc. item (Adj-post<br />

tax)<br />

- - - -<br />

PAT (Adjusted) 18,773 22,232 19,996 (15.6) (6.1) 21,601 (13.1)<br />

NPM (%) 5.2 7.7 6.0 -254 bp -77 bp 6.0 -79 bp<br />

Source: Company, <strong>Fortune</strong> Research<br />

See Disclaimer at the end of the report. 1<br />

Bloomberg Code FEBL <br />

<strong>Fortune</strong> Group

<strong>Fortune</strong> Group<br />

Quarterly financials (Standalone)<br />

Y/E Mar (Rs mn) Q2FY12 Q2FY11 Q1FY12 YoY (%) QoQ (%) Q2FY12E<br />

Variance<br />

(%)<br />

Net sales 129,538 115,041 118,979 12.6 8.9 132,249 (2.1)<br />

Consmp. of RM 95,761 81,643 82,312 92,334<br />

% of sales 73.9 71.0 69.2 296 bp 474 bp 69.8 411 bp<br />

Employee costs 6,829 5,810 6,211 7,242<br />

% of sales 5.3 5.1 5.2 5.5<br />

Other expenditure 17,617 16,413 20,470 20,695<br />

% of sales 13.6 14.3 17.2 15.6<br />

Operating profit 9,331 11,176 9,986 (16.5) (6.6) 11,978 (22.1)<br />

OPM (%) 7.2 9.7 8.4 -251 bp -119 bp 9.1 -185 bp<br />

Dep. & amort. 4,471 3,546 3,972 3,937<br />

Interest 2,121 3,072 2,532 2,328<br />

EBT 2,739 4,558 3,483 (39.9) (21.4) 5,714 (52.1)<br />

Other income 568 775 1,155 613<br />

PBT 3,307 5,333 4,638 (38.0) (28.7) 6,326 (47.7)<br />

Exc. item (As<br />

reported)<br />

2,942 (38) (24) -<br />

Provision for tax (655) 1,045 650 1,089<br />

- effective tax rate -19.8 19.6 14.0 17.2<br />

'Minority share /Profit<br />

share in assoc.<br />

PAT (Reported) 1,020 4,327 4,013 (76.4) (74.6) 5,237 (80.5)<br />

Exc. item (Adj. - post<br />

tax)<br />

- - - -<br />

PAT (Adjusted) 1,020 4,327 4,013 (76.4) (74.6) 5,237 (80.5)<br />

NPM (%) 0.8 3.8 3.4 -297 bp -259 bp 4.0 -317 bp<br />

Source: Company, <strong>Fortune</strong> Research<br />

Exhibit 01: Estimates dropped as we cut Nano volumes and introduce expenses<br />

on adverse forex movement<br />

Standalone Revised estimates Earlier estimates % revision<br />

FY12E FY13E FY12E FY13E FY12E FY13E<br />

Sales (Nos) 872,973 1,077,532 923,620 1,100,169 (5.5) (2.1)<br />

8.7 23.4 15.0 19.1 -630 bps 430 bps<br />

Net sales (Rs mn) 540,263 621,453 538,310 617,269 0.4 0.7<br />

EBITDA (Rs mn) 45,392 55,773 51,420 57,680 (11.7) (3.3)<br />

EBITDA (%) 8.4 9.0 9.6 9.3 -120 bps -40 bps<br />

Adj. PAT (Rs mn) 17,206 26,529 22,660 27,485 (24.1) (3.5)<br />

EPS (Rs) 5.2 8.0 7.0 8.5 (26.5) (6.6)<br />

Consolidated Revised estimates Earlier estimates % revision<br />

FY12E FY13E FY12E FY13E FY12E FY13E<br />

Net sales (Rs mn) 1,435,884 1,600,668 1,391,179 1,549,674 3.2 3.3<br />

EBITDA (Rs mn) 186,232 201,041 181,829 192,643 2.4 4.4<br />

EBITDA (%) 13.0 12.6 13.1 12.4 -10 bps 10 bps<br />

Adj. PAT (Rs mn) 77,725 93,020 89,542 93,500 (13.2) (0.5)<br />

EPS (Rs) 23.4 28.0 27.8 29.1 (16.0) (3.7)<br />

JLR Revised Estimates Earlier Estimates % Revision<br />

FY12E FY13E FY12E FY13E FY12E FY13E<br />

Sales (Nos) 270,419 290,160 267,739 287,284 1.0 1.0<br />

Net sales (Rs mn) 844,907 922,962 802,153 876,092 5.3 5.3<br />

EBITDA (Rs mn) 125,982 128,603 116,082 118,298 8.5 8.7<br />

EBITDA (%) 14.9 13.9 14.5 13.5 40 bps 40 bps<br />

Adj. PAT (Rs mn) 60,100 63,586 62,547 57,153 (3.9) 11.3<br />

Source: <strong>Fortune</strong> Research Estimates<br />

<strong>TATA</strong> <strong>Motors</strong> 2

<strong>Fortune</strong> Group<br />

Exhibit 02: Q2FY12 fared badly due to forex losses<br />

Exhibit 03: JLR profits don’t rise as expected due to tax<br />

burden on China sales<br />

Tata <strong>Motors</strong> (standalone)<br />

JLR<br />

146,006<br />

115,041 115,196<br />

118,979<br />

129,538<br />

2,660<br />

2,736 2,712<br />

2,929<br />

2,247<br />

4,327 4,101 5,734 4,013 1,020<br />

238 275<br />

384<br />

219 238<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Sales (Rs mn)<br />

Adjusted PAT (Rs mn)<br />

Sales (GBP mn)<br />

PAT (GBP mn)<br />

Exhibit 04: TDCV PAT hit by rising costs<br />

Exhibit 05: Tata Technologies gains appreciably<br />

TDCV<br />

Tata Technologies<br />

5,874<br />

6,582<br />

7,825<br />

8,778 9,018<br />

2,951<br />

3,133<br />

3,432 3,351<br />

3,716<br />

77<br />

337 157 26<br />

366 283<br />

474 396 484<br />

(44)<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Sales (Rs mn) PAT (Rs mn)<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Sales (Rs mn)<br />

PAT (Rs mn)<br />

Exhibit 06: Profits up ~28% as CV sales continue<br />

growth<br />

Exhibit 07: 230 bps YoY drop in NIMs results in slower<br />

PAT growth<br />

TML Drivelines<br />

Tata <strong>Motors</strong> Finance<br />

1,457 1,460<br />

1,798 1,754<br />

1,654<br />

3,733<br />

4,090<br />

4,713<br />

3,414 3,318<br />

614 572 549<br />

428 415<br />

449<br />

328 259<br />

485 524<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

Sales (Rs mn)<br />

PAT (Rs mn)<br />

Sales (Rs mn)<br />

Adjusted PAT (Rs mn)<br />

Source: Company, <strong>Fortune</strong> Research<br />

Note: HVAL & HVTL have been merged into TML<br />

drivelines Ltd.<br />

<strong>TATA</strong> <strong>Motors</strong> 3

<strong>Fortune</strong> Group<br />

Exhibit 08: Standalone business metrics weakening<br />

Exhibit 09: EBITDA margin shrinks considerably<br />

('000s)<br />

640<br />

630<br />

620<br />

610<br />

600<br />

590<br />

580<br />

570<br />

560<br />

64<br />

627<br />

618 616<br />

617<br />

56<br />

52<br />

54<br />

580<br />

45<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

('000s)<br />

70<br />

60<br />

50<br />

40<br />

(Rsmn)<br />

13,500<br />

13,000<br />

12,500<br />

12,000<br />

11,500<br />

11,000<br />

10,500<br />

10,000<br />

9,500<br />

9,000<br />

10.4<br />

9.7<br />

8.8<br />

8.4<br />

7.2<br />

11,176<br />

11,960<br />

12,831<br />

9,986<br />

9,331<br />

Q2FY11 Q3FY11 Q4FY11 Q1FY12 Q2FY12<br />

(%)<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

Realisation Per veh.(LHS)<br />

EBITDA per Veh.(RHS)<br />

EBITDA (LHS)<br />

EBITDA Margin (RHS)<br />

Source: Company, <strong>Fortune</strong> Research.<br />

Exhibit 10: Valuations now settling close to 8x on P/E basis<br />

(x)<br />

12.0<br />

11.0<br />

10.0<br />

9.0<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

(x)<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

Nov-10<br />

Dec-10<br />

Jan-11<br />

Feb-11<br />

Mar-11<br />

Apr-11<br />

May-11<br />

May-11<br />

Jun-11<br />

Jul-11<br />

Aug-11<br />

Sep-11<br />

Oct-11<br />

Nov-11<br />

Source: Bloomberg, <strong>Fortune</strong> Research<br />

PE (RHS) P/BV (LHS) EV/E (LHS)<br />

<strong>TATA</strong> <strong>Motors</strong> 4

<strong>Fortune</strong> Group<br />

Consolidated financial tables (Y/E March)<br />

(Rs mn)<br />

Income statement FY09 FY10 FY11 FY12E FY13E<br />

Net sales 709,389 925,193 1,231,333 1,435,884 1,600,668<br />

% growth 99.0 30.4 33.1 16.6 11.5<br />

Raw materials 480,556 614,954 790,084 947,427 1,035,267<br />

% of net sales 67.7 66.5 85.4 102.4 111.9<br />

Employee cost 72,974 87,518 93,427 111,999 148,062<br />

% of net sales 10.3 9.5 10.1 12.1 16.0<br />

Other expenses 133,893 136,579 170,023 190,226 216,298<br />

% of net sales 18.9 14.8 18.4 20.6 23.4<br />

EBITDA 21,965 86,142 177,800 186,232 201,041<br />

EBITDA margin (%) 3.1 9.3 14.4 13.0 12.6<br />

Depn & amortn. 28,545 43,853 56,180 66,798 74,823<br />

EBIT (6,580) 42,288 121,620 119,435 126,218<br />

Interest exps. 19,309 22,397 20,454 25,685 23,580<br />

EBT (25,889) 19,891 101,166 93,750 102,639<br />

Other income 7,990 17,931 896 1,850 1,868<br />

Extraord. (Inc.)/Exps. 3,393 2,596 (2,310) 4,960 0<br />

PBT (21,293) 35,226 104,372 90,640 104,507<br />

Tax-Total 3,358 10,058 12,164 13,093 12,041<br />

Tax rate (%) - Total (15.8) 28.6 11.7 14.4 11.5<br />

Profit after tax (24,650) 25,169 92,208 77,547 92,466<br />

PAT Margin(%) (3.5) 2.7 7.5 5.4 5.8<br />

Share of profit in<br />

Invest.in assoc.<br />

(517) 845 1,014 590 1,099<br />

Share of minority in<br />

profit<br />

(115) 303 485 411 546<br />

Misce exp.in subsidi 0 0 0 0 0<br />

Reported PAT (25,053) 25,711 92,736 77,725 93,020<br />

Extra ord.inc./(Exps.) (9,749) (16,788) 0 0 0<br />

Adjusted PAT (34,802) 8,923 92,736 77,725 93,020<br />

PAT margin (%) (4.9) 1.0 7.5 5.4 5.8<br />

% growth (283.2) (125.6) 939.3 (16.2) 19.7<br />

Source: Company, <strong>Fortune</strong> Research<br />

Balance sheet FY09 FY10 FY11 FY12E FY13E<br />

Sources of funds<br />

Equity capital 5,141 5,706 6,377 6,348 6,348<br />

Reserves and surplus 54,266 76,359 185,338 282,344 356,779<br />

Shareholders’ funds 59,407 82,065 191,715 288,692 363,127<br />

Minority interest 4,030 2,135 2,466 2,877 3,423<br />

Secured loans 137,055 212,900 199,271 195,771 170,771<br />

Unsecured loans 212,684 140,935 128,643 67,457 82,868<br />

Total loan funds 349,739 353,835 327,914 263,228 253,639<br />

Deferred tax liab. - Net 6,802 11,536 14,638 13,488 12,337<br />

Total liabilities 419,977 449,571 536,733 568,285 632,526<br />

Appl. of funds<br />

Gross block 584,694 648,518 714,629 807,660 893,768<br />

Accumulated depn. (332,691) (344,135) (396,987) (453,486) (517,289)<br />

Capital WIP 105,330 80,680 117,289 112,289 107,289<br />

Net fixed assets 357,333 385,063 434,931 466,463 483,767<br />

Other investments 12,574 22,191 25,443 39,437 32,063<br />

Goodwill 37,187 34,229 35,848 34,848 33,848<br />

translation difference 6,365 0 0 0 0<br />

Inventories 109,506 113,120 140,705 180,505 199,365<br />

Sundry debtors 47,949 71,912 68,774 89,420 102,001<br />

Other current assets 26 24 19 22 20<br />

Cash and bank balances 41,213 87,433 109,479 98,475 151,890<br />

Loans and advances 128,166 152,807 191,372 207,954 241,092<br />

Total current assets 326,860 425,296 510,349 576,376 694,368<br />

Current liabilities 239,802 340,773 371,147 448,096 499,503<br />

Provisions 81,400 76,435 98,692 100,743 112,017<br />

Total current liab. 321,202 417,208 469,838 548,839 611,520<br />

Net current assets 5,658 8,088 40,511 27,537 82,848<br />

Misc. expenditure 861 0 0 0 0<br />

Total assets 419,977 449,571 536,733 568,285 632,526<br />

Source: Company, <strong>Fortune</strong> Research<br />

Ratios FY09 FY10 FY11 FY12E FY13E<br />

O/s shares (mn) 2,570 2,853 3,173 3,173 3,173<br />

Fully diluted shares (mn) 3,323 3,323 3,323 3,323 3,323<br />

Per share (Rs)<br />

Basic EPS (13.5) 3.1 29.2 24.5 29.3<br />

FDEPS (10.5) 2.7 27.9 23.4 28.0<br />

Cash EPS 1.1 20.9 44.8 43.5 50.5<br />

Book value 17.3 24.1 57.3 86.4 108.8<br />

DPS 1.2 3.0 4.0 5.0 5.0<br />

Valuation (x)<br />

P/E NM 67.5 6.5 7.7 6.5<br />

Price/Book value 10.5 7.5 3.2 2.1 1.7<br />

EV/Sales 1.2 0.9 0.6 0.5 0.4<br />

EV/EBITDA 38.4 9.2 4.2 3.6 3.1<br />

Profit ratios (%)<br />

RoE (48) 12.9 68.6 32.6 28.7<br />

RoCE (4.1) 5.9 23.2 18.6 19.5<br />

Leverage ratio<br />

Debt/Equity (x) 5.9 4.3 1.7 0.9 0.7<br />

Net Debt/Equity (x) 5.2 3.1 1.1 0.5 0.2<br />

Cash flow FY09 FY10 FY11 FY12E FY13E<br />

Net cash from<br />

operating activities<br />

52,949 107,422 125,569 169,120 153,865<br />

Net cash used in<br />

Investing activities<br />

(316,194) (73,978) (99,482) (101,025) (72,734)<br />

Net cash used in<br />

financing activities<br />

266,127 12,776 (4,041) (79,099) (27,716)<br />

Net increase/<br />

decrease in cash<br />

2,882 46,220 22,046 (11,004) 53,415<br />

Cash at beginning<br />

of the year<br />

38,332 41,214 87,434 109,480 98,476<br />

Cash at end of the<br />

year<br />

41,214 87,434 109,480 98,476 151,891<br />

Source: Company, <strong>Fortune</strong> Research<br />

Source: Company, <strong>Fortune</strong> Research<br />

<strong>TATA</strong> <strong>Motors</strong> 5

<strong>Fortune</strong> Group<br />

Investment ratings (Returns)<br />

Buy (>10%) Hold (-10 to 10%) Sell (