2011 - 2012 Annual Report - Tourism Australia

2011 - 2012 Annual Report - Tourism Australia

2011 - 2012 Annual Report - Tourism Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

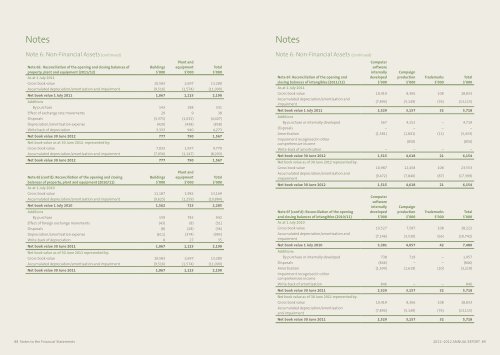

Notes<br />

Note 6: Non-Financial Assets (continued)<br />

Note 6E: Reconciliation of the opening and closing balances of<br />

property, plant and equipment (<strong>2011</strong>/12)<br />

Buildings<br />

$’000<br />

Plant and<br />

equipment<br />

$’000<br />

Total<br />

$’000<br />

As at 1 July <strong>2011</strong><br />

Gross book value 10,583 2,697 13,280<br />

Accumulated depreciation/amortisation and impairment (9,516) (1,574) (11,090)<br />

Net book value 1 July <strong>2011</strong> 1,067 1,123 2,190<br />

Additions<br />

By purchase 143 188 331<br />

Effect of exchange rate movements 29 9 38<br />

Disposals (3,375) (1,032) (4,407)<br />

Depreciation/amortisation expense (420) (438) (858)<br />

Write back of depreciation 3,333 940 4,273<br />

Net book value 30 June <strong>2012</strong> 777 790 1,567<br />

Net book value as at 30 June <strong>2012</strong>, represented by:<br />

Gross book value 7,833 1,937 9,770<br />

Accumulated depreciation/amortisation and impairment (7,056) (1,147) (8,203)<br />

Net book value 30 June <strong>2012</strong> 777 790 1,567<br />

Note 6E (cont’d): Reconciliation of the opening and closing<br />

balances of property, plant and equipment (2010/11)<br />

As at 1 July 2010<br />

Buildings<br />

$’000<br />

Plant and<br />

equipment<br />

$’000<br />

Total<br />

$’000<br />

Gross book value 11,187 1,982 13,169<br />

Accumulated depreciation/amortisation and impairment (9,625) (1,259) (10,884)<br />

Net book value 1 July 2010 1,562 723 2,285<br />

Additions<br />

By purchase 159 783 942<br />

Effect of foreign exchange movements (43) (8) (51)<br />

Disposals (8) (28) (36)<br />

Depreciation/amortisation expense (611) (374) (985)<br />

Write-back of depreciation 8 27 35<br />

Net book value 30 June <strong>2011</strong> 1,067 1,123 2,190<br />

Net book value as of 30 June <strong>2011</strong> represented by:<br />

Gross book value 10,583 2,697 13,280<br />

Accumulated depreciation/amortisation and impairment (9,516) (1,574) (11,090)<br />

Net book value 30 June <strong>2011</strong> 1,067 1,123 2,190<br />

Notes<br />

Note 6: Non-Financial Assets (continued)<br />

Note 6F: Reconciliation of the opening and<br />

closing balances of intangibles (<strong>2011</strong>/12)<br />

As at 1 July <strong>2011</strong><br />

Computer<br />

software<br />

internally<br />

developed<br />

$’000<br />

Campaign<br />

production<br />

$’000<br />

Trademarks<br />

$’000<br />

Total<br />

$’000<br />

Gross book value 10,419 8,306 108 18,833<br />

Accumulated depreciation/amortisation and<br />

impairment<br />

(7,890) (5,149) (76) (13,115)<br />

Net book value 1 July <strong>2011</strong> 2,529 3,157 32 5,718<br />

Additions<br />

By purchase or internally developed 567 4,152 – 4,719<br />

Disposals – – – –<br />

Amortisation (1,581) (1,841) (11) (3,433)<br />

Impairment recognised in other<br />

comprehensive income<br />

(850) (850)<br />

Write-back of amortisation – – – –<br />

Net book value 30 June <strong>2012</strong> 1,515 4,618 21 6,154<br />

Net book value as of 30 June <strong>2012</strong> represented by:<br />

Gross book value 10,987 12,458 108 23,553<br />

Accumulated depreciation/amortisation and<br />

impairment<br />

(9,472) (7,840) (87) (17,399)<br />

Net book value 30 June <strong>2012</strong> 1,515 4,618 21 6,154<br />

Note 6F (cont'd): Reconciliation of the opening<br />

and closing balances of intangibles (2010/11)<br />

As at 1 July 2010<br />

Computer<br />

software<br />

internally<br />

developed<br />

$’000<br />

Campaign<br />

production<br />

$’000<br />

Trademarks<br />

$’000<br />

Total<br />

$’000<br />

Gross book value 10,527 7,587 108 18,222<br />

Accumulated depreciation/amortisation and<br />

impairment<br />

(7,146) (3,530) (66) (10,742)<br />

Net book value 1 July 2010 3,381 4,057 42 7,480<br />

Additions:<br />

By purchase or internally developed 738 719 – 1,457<br />

Disposals (846) – – (846)<br />

Amortisation (1,590) (1,619) (10) (3,219)<br />

Impairment recognised in other<br />

comprehensive income<br />

Write-back of amortisation 846 – – 846<br />

Net book value 30 June <strong>2011</strong> 2,529 3,157 32 5,718<br />

Net book value as of 30 June <strong>2011</strong> represented by:<br />

Gross book value 10,419 8,306 108 18,833<br />

Accumulated depreciation/amortisation<br />

and impairment<br />

(7,890) (5,149) (76) (13,115)<br />

Net book value 30 June <strong>2011</strong> 2,529 3,157 32 5,718<br />

88 Notes to the Financial Statements <strong>2011</strong>–<strong>2012</strong> ANNUAL REPORT 89