Service Tax from ILDOs - Not applicable to BSNL

Service Tax from ILDOs - Not applicable to BSNL

Service Tax from ILDOs - Not applicable to BSNL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

c( ) R I)()RA.t.t.t () t,.tf<br />

'l':\\,\'flON<br />

lC l,<br />

SILtC'tt( ) N<br />

l ,' [rl,()()l{<br />

I]IJi\RAI. SANC]II:\R<br />

F]TIA\\IAN<br />

.ttNI,.{1'lt, Ntit\\, t)1._t.iil i<br />

NrIl<br />

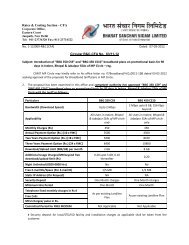

No 1002-62/2OOZnaxatrontesNl/<br />

q =<br />

io<br />

CGMM STRAIVTR/N rR/Frflt MH circle /Chennai Telephones<br />

BHARAT SANCHAR NIGAM LIMITED<br />

lA (iovernmr:nt of Inclia linlerrlrisr:i<br />

--*--'_-_o-a&q-Lq-q1.?A]2-'<br />

sub: Applicability of service <strong>Tax</strong> on Telecommunication service received <strong>from</strong><br />

<strong>ILDOs</strong> {Foreign Telecom Opera<strong>to</strong>rs) by <strong>BSNL</strong> *reg.<br />

Ref I his office ietter n0<br />

(Annexure_,,<br />

1002-6212007/l axat<strong>to</strong>n,r[lsNl /257 Dated. :Solo7r,aaE<br />

Kindly refer <strong>to</strong> letter crted above whereby cBEC,<br />

No<br />

MOF<br />

111110512a09-sT<br />

Govt. of Indra<br />

was circulated<br />

circular<br />

and intrmaied that <strong>Service</strong> tax is not revrable on<br />

I!fti**unication servrce received <strong>from</strong> rLDo; froreign Terecom cpera<strong>to</strong>rs) by<br />

Incidentally rt rs stated that, CBEC had issued crrcutar vide<br />

service<br />

F<br />

tax<br />

No. 13/21<br />

Dated<br />

Da11-<br />

Julv.]5, 2011 ( Ao0sxl{:ejl) anJ ctarified<br />

Prlvate<br />

that the<br />

L'eased<br />

International<br />

circuit (IPLC) charges receivedlrom abroad rs<br />

tax<br />

chargeable<br />

under Business<br />

<strong>to</strong> service<br />

Support ServrceJsection 65(lOSifzzzqiL at the franOs<br />

sttuated rn<br />

of reciprents<br />

Incjia in terms of sec 664 of the [:rnance Act 1gg4 read<br />

of<br />

with<br />

tl!e<br />

Rule<br />

Servrce <strong>Tax</strong><br />

2(1)(rJ)(iv)<br />

Ruies 1gg4 and provislons of <strong>Tax</strong>atron of .gsrvls6s (provrded)<br />

oLltSlde Indra anC recerved p<br />

<strong>from</strong><br />

lndra Rules 2006 apply<br />

ijowever thrs matter has been re_examrned by Ci3L:C MOF, Govt<br />

ts<br />

of<br />

clarifled vide<br />

IncJiand it<br />

F NC 13112,112011-<strong>Service</strong> tax Dated December jg 2011 that,<br />

i-stpLC<br />

specifically covered by the definition of Telecommunrcation service given rn<br />

65[109a(rv)]<br />

clause<br />

of the Fjrnance Act 1994. As per said section these services are taxable<br />

otrly when provided by a person who has been granted a lrcence under the frrst provtso<br />

<strong>to</strong> sub section (1) section 4 of the Indian Telegraph Act, 1g85. lt is only because the<br />

foreign telecom servtce provider cannot constitute a telegraph authority ,ndul- an Indian<br />

law that they remarn outside the taxability clause of the ietecommunication servrce<br />

( Copy rs enclosed as AnlgXUtQ:[l)<br />

Hence tt rs clarified that <strong>Service</strong> tax is not applicahle on Telecommunication<br />

service received <strong>from</strong> <strong>ILDOs</strong> (Foreign Telecom opera<strong>to</strong>rs) by <strong>BSNL</strong>. cB[c<br />

Circular dated 1g 122011 nrentioned above may kindly be brough<strong>to</strong> the 'otrce of ail<br />

concerned and produced before the Central Excise/ Senyrce <strong>Tax</strong> author.ities. if needed<br />

Encl As above<br />

Copv for rnformatron and necessarv action <strong>to</strong><br />

1 CGM of all <strong>BSNL</strong> Crrcles<br />

2 lFAs of all <strong>BSNL</strong> crrcles<br />

3 Sr cM(lt-D). <strong>BSNL</strong> CO New Dethi<br />

. t rl'L '<br />

( Smita Choudhary)<br />

GM(<strong>Tax</strong>ation)

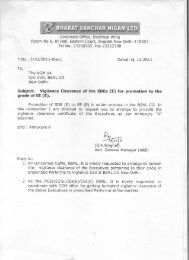

CORPORATE OFFICE<br />

TAXATION SEC'I'ION<br />

Isl'IILOOR,<br />

BHARAT SANCIIAR BHAWAN<br />

.]ANP,A'I'II, NIi\\' DDI-FIJ. I<br />

No: 1002-62 / .\OOT l<strong>Tax</strong>aii;n/<br />

To<br />

M<br />

BHARAT<br />

i<br />

-:ll.<br />

::11'j**<br />

<strong>BSNL</strong>/zs,z<br />

-/--<br />

SANCHAR NIGAM LIM]]'IIDD<br />

[A Government of Inclia Enterprise]<br />

I<br />

I<br />

i<br />

i<br />

I<br />

I<br />

(1) IFA, o/,, g6'14, western Maintenance Region, <strong>BSNL</strong>, Mumbai.<br />

(2) GM(F), t i/o cGM Information Technolugip.o3".t circle ,<strong>BSNL</strong>,pune-l!)<br />

sub: - Applic;rbitity of service tax on IUC invoices of rLDos _ reg.<br />

Ref:- 1) GM(Fl, IT Projecr Circle pune letter no. ITpC,/ IOBAS/tL DO /2OO7 _C)B<br />

Dated 28.O9.2OO2 &<br />

1,2<br />

3 l.OT .2OOT.<br />

2) cGMIu, wrR retter no. wrR/cA/S.raxlcenvat credit<br />

Datecl 29.O9.2OOT<br />

l2oor-oBl2T<br />

.<br />

3) This t,'l'fice letter of even no. 06 Dated 02-o1-2008 ancl 397 Dateci I1-<br />

07-2008.<br />

I(indly rcfer this office letter of even no.06 Dated 02-01-200g wherein it<br />

was tntimalcti that the case has been referrecl <strong>to</strong> cBEC, New Delhi for seeking<br />

clarification

f<br />

,ao,u ).r.,dr<br />

il 'i--<br />

F.No. 137 / 2t / ZO1 1-<strong>Service</strong> <strong>Tax</strong><br />

Government of India<br />

Ministry of Finance<br />

Department of Revenue<br />

Central Board of Excise & Cus<strong>to</strong>ms<br />

New Delhi<br />

Dated: July 15,2011<br />

Subject: <strong>Tax</strong>abrlrty rn respec<strong>to</strong>f International privateLeased amendment rn<br />

Circuit (IpCL)<br />

lhe definrtion<br />

charges and<br />

of Telegraph Authority u/s<br />

rpn<br />

65 (111) of the Finance Acr,<br />

'<br />

rgg4-<br />

vy.<br />

Representatrons have been received seeking clarificatrorr<br />

charges<br />

regarding<br />

incurred<br />

taxability<br />

in foreign<br />

of IpcL<br />

currency by BPoTMNCs against<br />

servtce provider<br />

recelpt of servrces<br />

situated<br />

<strong>from</strong><br />

outslde<br />

the<br />

India/group companLs under reverse<br />

lsectron 664 of the<br />

charge<br />

Finance<br />

mechanisrri<br />

Act, 1994 read with Rule 2 (1) (d) (iv)<br />

19941.<br />

of the service <strong>Tax</strong> Rutes<br />

'2' The matter has been examined. The actrvities are rn<br />

presently<br />

the nature of Lease

I<br />

/\ 1'1]-r-1. x \.) r. "il<br />

r;,:,Print thts paqc<br />

I No. 137l21 /ZOtl' * <strong>Service</strong> <strong>Tax</strong><br />

Government of tndia<br />

Ministry of Finance<br />

Department of Revenue<br />

{Central tsoard of Excise & Cus<strong>to</strong>ms}<br />

New Delhi,<br />

Datr:d: Decembr:r tr9, 2011<br />

subject: <strong>Tax</strong>ability in respect of International Private Leased circuit {lpl-c} r:harges and amenrJment in the<br />

definition of Telegraph Authority uis 6r {I11) of the Finance Acr, L994* reg"<br />

Pieaser refer tr: the'rlarifir..;ttcln'; ir;sLted vrrie i.loard's letter of even number daterr 1\ {)7)o1l on the lubiect<br />

mentroned;)bove<br />

7].Iht.rn;ltter|t;lsbeenrei]X.)n1|nt'].J.]|l{:;1's.;e€]ntha1theiPl'i-i.;specifrca||i,r'i;vtlrcrJbythedefinitiirloft|ltl<br />

lelerr.ommllrrir-ation servic(' gir,'en irl r:l;;ustr 55 i109a(iv)] of the Finance Act, irl9.4 As pet" tirtt said secrron the.;e<br />

servtr:es are tax;rblc only whertl 5ltr.rvtrletrl tly,r prtrson who has beerr Jl,rantert.i lic.r,nce irnder t!.re firsl r;rovr.;6 i6<br />

sub-:;oction(1)r;ist'ction4of thelndiarr lelegraphAcl, 1985. ltisonlybecaLrselheforeigrrteiecomssrvi(.c<br />

prtlvider cailnot constiti.rte a telegraph aUflroiltV unrjer an Indian law that Lhcv rerrJin outsicje thr: iaxabilitv<br />

cla t t sc of f fr o I r,: I er:ctrrr m u r r il:;lti o n srl r.vi t.e.<br />

li. Therefrlrtl, iiti'view takel il Llre s.ricJ letier thal what orherwrscl<br />

woulci an<strong>to</strong>rtnI io "ilusiness.il.tpfJ()rl rervir:e' is e,rroneous,<br />

(.onstrtr.t<strong>to</strong>\ n<br />

" 1 eit'r onrrn llrr ication sc.rvice:<br />

4 Ihe r:larifit,)t<strong>to</strong>t) tssue(l rrrcle lhr:,rbove rnenlioner,. letter sl,trrrls r{)ar{.clecl ,ri citrr_.tingly<br />

Deepankar Aron<br />

Direc<strong>to</strong>r {<strong>Service</strong> <strong>Tax</strong>}<br />

CBEC, trlew Delhi