Annual Report and Audited Financial Statements 2011 - The Kenya ...

Annual Report and Audited Financial Statements 2011 - The Kenya ...

Annual Report and Audited Financial Statements 2011 - The Kenya ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

1

2 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

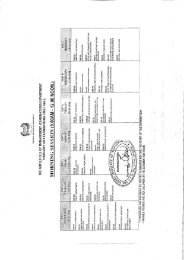

Table of Contents<br />

KIM Officials 2<br />

Notice of the <strong>Annual</strong> General Meeting 3<br />

Minutes of the <strong>Annual</strong> General Meeting, 2010 4 – 9<br />

Chairman’s <strong>Report</strong> 10<br />

CEO’s <strong>Report</strong> 11<br />

Corporate Information 12<br />

Corporate Governance <strong>Report</strong> 14 – 15<br />

Corporate Social Responsibility 16 –17<br />

<strong>Report</strong> of the Council 18<br />

Statement of Council's Responsibilities 20<br />

Independent Auditor’s <strong>Report</strong> 21 – 22<br />

<strong>Financial</strong> <strong>Statements</strong>:<br />

Statement of Comprehensive Income 24<br />

Statement of <strong>Financial</strong> Position 25<br />

Statement of Changes in Accumulated Fund 26<br />

Statement of Cash Flows 27<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong> 29 – 45<br />

Proxy Form 47<br />

Notes 48<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

3

KIM Officials<br />

Mrs Salome Gitoho<br />

Vice Chairperson<br />

Mr. Alfred Lenana<br />

Chairman of Council<br />

Mr. David Muturi<br />

KIM Executive Director / CEO<br />

Mr Richard Isiaho<br />

Council Member<br />

Mr Dan Awendo<br />

Council Treasurer<br />

Stella Muendo<br />

Council Ag. Secretary<br />

Esther Jowi<br />

Council Member<br />

Mr Philip Kisia<br />

Council Member<br />

Dr Jonathan Ciano<br />

Council Member<br />

Mr Wilson Soy<br />

Council Member<br />

Mr Richard Gikuhi<br />

Council Member<br />

Alice Owuor<br />

Council Member<br />

Prof David TK Serem<br />

Council Member<br />

4 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Notice of the <strong>Annual</strong> General Meeting<br />

Notice is hereby given that the 46th <strong>Annual</strong> General Meeting of the <strong>Kenya</strong> Institute of Management will be held<br />

on Friday, June 29th 2012 at the Intercontinental Hotel Nairobi at 4.00 p.m to transact the following business<br />

1. To read the Notice convening the meeting.<br />

2. To confirm the Minutes of the 45th <strong>Annual</strong> General Meeting held on May, 27th <strong>2011</strong>.<br />

3. To receive <strong>and</strong> adopt the Executive Director’s <strong>Report</strong> for the year ended 31st December <strong>2011</strong>.<br />

4. To receive <strong>and</strong> adopt the Chairman’s report for the year ended 31st December <strong>2011</strong>.<br />

5. To receive, consider <strong>and</strong> adopt the <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> for the year ended 31st December<br />

<strong>2011</strong>.<br />

6. To note that P.K.F <strong>Kenya</strong> Certified Public Accountants Auditors will continue in office as Auditors for the Institute<br />

by virtue of Section 159 (2) of the Companies Act (Cap. 486 of the Laws of <strong>Kenya</strong> ) <strong>and</strong> authorize the Council to<br />

fix their remuneration.<br />

7. To receive the Institute’s Strategic Plan 2012 - 2016.<br />

8. To receive the results of the just concluded National <strong>and</strong> Branch elections <strong>and</strong> ratify those elected.<br />

9. To consider any other business for which due notification will have been received by the Secretary to the Council<br />

forty eight (48) hours before the <strong>Annual</strong> General Meeting.<br />

Dated the 6th day of June 2012<br />

By Order of the Council<br />

STELLA K. MUENDO,<br />

SECRETARY TO THE COUNCIL<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

5

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

MINUTES OF THE 45 TH ANNUAL GENERAL MEETING OF THE KENYA INSTITUTE OF<br />

MANAGEMENT HELD ON FRIDAY, 27 TH MAY <strong>2011</strong>, AT THE INTERCONTINENTAL HOTEL<br />

STARTING AT 4.00 P.M.<br />

Present<br />

Council Members<br />

Name:<br />

Registration No.<br />

1. Dr. Reuben Mutiso 12022<br />

Chairman<br />

2. David Muturi 42325<br />

Chief Executive Officer<br />

3. Richard Isiaho 42318<br />

4. Salome Gitoho 33707<br />

5. Austin Kapere 8750<br />

6. Constantine K<strong>and</strong>ie 11202<br />

7. Jonas Okwaro 22000<br />

Fellows:<br />

1. Dr. J J Mageria 31<br />

Chairman, Board of Fellows<br />

2. Dr Mwangi Ngumo 08255<br />

3. Adrian Muteshi 3092<br />

4. James Foster 611<br />

5. James Murigu 12940<br />

6. Peter Kubebea 1267<br />

7. Alice Owuor 08809<br />

8. Michael M Karanja 03048<br />

9. Mwai wa Kihu 1801<br />

10. Sultan Amri 05753<br />

11. Nyaboga Morara Anderea 05345<br />

Members<br />

1 Eng John Moguche, HSC 5361<br />

2 Godfrey Makau 43104<br />

3 Geoffrey Lipale 42924<br />

4 Duncan Kabiru 11730<br />

5 Michael Karanja 3048<br />

6 John Magua Njoroge 42958<br />

7 Anthony Kariuki 42173<br />

8 Shadrack Mutunga 29293<br />

9 Mohammed Katelo 42410<br />

10 Mary M Ichangi 42875<br />

11 Joel Mukhanji 42862<br />

12 Roger Kimuli 42377<br />

13 Edward Ogolla 28808<br />

14 Gabriel Juma 42209<br />

15 Miriti E. M. 11714<br />

16 Johnson Ireri 28757<br />

17 Alex<strong>and</strong>er Opicho 42398<br />

18 Lee Kanyago 23650<br />

19 Mugo Mungai 00735<br />

20 Lazaro Kimanga 03865<br />

21 Nimrod N Kareko 31429<br />

22 Kizito Omolo 16551<br />

23 Lucy Onyango 43316<br />

24 Emygdius Wanyama 42192<br />

25 Amos Mwangi Maingi 42726<br />

26 Maxwell S<strong>and</strong>e 42192<br />

27 Paul Munene 42667<br />

28 Dr. Wilson Soy 7570<br />

29 Francis Oloo 42864<br />

30 John Wekesa Ndombi 31241<br />

31 Felix Onyango 29320<br />

32 Amos Gayo 43111<br />

33 Bernard Siero 28891<br />

34 Silas Katam 33815<br />

35 Julius Barno 12072<br />

36 George K Rutto 42759<br />

37 Samuel Maina 32787<br />

38 Okoth Boniface 42192<br />

39 Kareko Nimrod 31429<br />

40 Nikasius M Muverethi 02917<br />

41 Samuel Ngeno 27988<br />

42 Aggrey Kivisi 24533<br />

43 Rev. Charles Orodi 05540<br />

44 Patrick Mulwa 42741<br />

45 Mohamed Godana 42410<br />

46 Kizito Machani 29200<br />

47 Mbarak Said Twahir 7614<br />

48 Praxedes Otieno 42639<br />

49 Charles Murunga 335<br />

50 Grace Alinyo 42570<br />

51 Sang’anyi Omambia Joseph 05783<br />

52 Mwenda Itumbiri 33933<br />

53 Ndirangu Ngunjiri 42993<br />

54 Judith Rintari 42613<br />

55 Ben Osuga 42776<br />

56 Tom Odongo 42367<br />

57 Agnetta Nyalita 42525<br />

58 Leonida M. Mulindi 20686<br />

59 Joseph Ogutu 42241<br />

60 Pamela Eng’airo O 43118<br />

61 Henry Njerenga 22015<br />

62 Priscah Andwah 33714<br />

6 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

63 Patrick Mwangi 26913<br />

64 Gordon Otieno Odundo 0350<br />

65 Henry Kerongo 26895<br />

66 Gideon Indeche 02532<br />

67 Osborne Kilasi 42572<br />

68 Misheck Gu<strong>and</strong>aro 43037<br />

69 Prof. David Serem 42994<br />

70 Oscar Waswa 25120<br />

71 Kiprotich D K 32352<br />

72 Mutuku Nthuli 42305<br />

73 Cornel A. Ragen 25965<br />

74 Stephen Irungu 43237<br />

75 Esther Jowi 42831<br />

76 Edwin Agwa 29296<br />

77 Roger Kimuli 42377<br />

78 S K Nguturi 42719<br />

79 Christopher Kipkemei 00044<br />

80 David Miya 43173<br />

81 Leonard Sang 23633<br />

82 David Kinyua 42460<br />

83 Richard Gikuhi 07064<br />

In attendance<br />

1. Koka Koimburi & Tucker<br />

Auditors<br />

2. Stella Muendo<br />

Company Secretary<br />

3. Nicholas Letting<br />

Director<br />

4. David Mwaura Director<br />

5. Leah Munyao Director<br />

6. Joseph Ouma<br />

7. Selina Makokha<br />

8. Kimathi Muchiri<br />

9. Caroline Karangi<br />

10. Eunice Njenga<br />

11. Judith Wambura<br />

12. Beatrice Karugo<br />

13. Ruth Kiilu<br />

14. Stephen Kamau<br />

15. Ann Wainaina<br />

16. John Ambeyi<br />

17. Naomi Nashipae<br />

18. Lilian Kam<strong>and</strong>e<br />

19. Ezbon Mwangi<br />

20. A Ondeng<br />

21. Johnson K Soi<br />

22. Mercy Mbochu<br />

23. Edwin Murithi<br />

24. David Gathanju<br />

25. Paul Machoka<br />

26. Hillary Migoyi<br />

Absent with Apologies<br />

Name:<br />

Registration No.<br />

1 . D r. M a r a n g i M b o g h o 0 2 4 1 0<br />

2 . J a m e s F o s t e r 0 0 6 11<br />

3. Stephen Kilungya 14224<br />

4. Mung’athia Fredrick 33892<br />

5. Esther Jowi 42831<br />

6. Melvin Asava 42499<br />

7. Francis Mugo 05135<br />

8. Susan Addero 32760<br />

9. P L O Lumumba 42850<br />

10. Johnstone Muchira 1098<br />

11. Ibrahim Kibutu 26940<br />

12. Lumiti Protus Atsali 14194<br />

13. Dr. V. Yamo 42501<br />

14. Raiser Resource Group 42102<br />

<strong>The</strong> Meeting was called to order by the Chairman of the<br />

Council of the Institute at 4.30 p.m. <strong>and</strong> opened with a<br />

word of prayer by Mr. Nicholas Letting.<br />

MIN.1 /AGM/<strong>2011</strong>: READING OF THE NOTICE<br />

CONVENING THE MEETING<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

7

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

<strong>The</strong> Chairman invited the Secretary to read the Notice convening the 45 th <strong>Annual</strong> General Meeting of the Institute.<br />

MIN. 2/AGM/<strong>2011</strong>: ADOPTION OF THE MINUTES OF THE LAST ANNUAL<br />

GENERAL MEETING<br />

<strong>The</strong> Minutes of the 44 th <strong>Annual</strong> General Meeting held on Wednesday, the 11 th day of August, 2010, having been<br />

earlier circulated to all members, were confirmed as a true record of the proceedings <strong>and</strong> adopted on a proposal by<br />

Mr. Morara Anderea, <strong>and</strong> seconded by Mr. Rutto Josiah subject to the correction of the Name of the Chairman to<br />

read Dr. Arch. Reuben Mutiso.<br />

MIN. 3/AGM/<strong>2011</strong>: ADOPTION OF THE CHAIRMAN’S REPORT ENDED 31 ST DECEMBER 2010.<br />

<strong>The</strong> Chairman read the Council <strong>Report</strong>, which was appended to the <strong>Annual</strong> report <strong>and</strong> formed part thereof, it had<br />

the following highlights:-<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

(v)<br />

(vi)<br />

(vii)<br />

(viii)<br />

(ix)<br />

During the year under review, the Institute took management <strong>and</strong> leadership capacity building services to<br />

the Gambia, the Democratic Republic of Congo, Southern Sudan, Rw<strong>and</strong>a <strong>and</strong> Tanzania thereby achieving<br />

massive expansion outside <strong>Kenya</strong>.<br />

<strong>The</strong> Organizational Performance Index (OPI), a global excellence tool, was formally launched thus giving a<br />

new st<strong>and</strong>ing to the respected company of the year Awards (COYA) as the new yardstick for the awards.<br />

<strong>The</strong> Institute is now geared to take the Organizational performance Index (OPI) to the rest of Africa. To this<br />

end, partnership with a Tanzanian association has commenced, <strong>and</strong> dialogue with the Africa Leadership<br />

Forum (ALF) of Nigeria is in progress.<br />

<strong>The</strong> Institute has applied for recognition of Organizational Performance Index as a global excellence model<br />

by the Global Excellence Model (GEM).<br />

<strong>The</strong> first Governance, Leadership <strong>and</strong> Management Convention was held in Mombasa. <strong>The</strong>re was high<br />

level participation by business leaders <strong>and</strong> Government officials, both local <strong>and</strong> from Ghana, Sudan,<br />

Ug<strong>and</strong>a <strong>and</strong> Nigeria. In the month of June, there was remarkable attendance by distinguished leaders, such<br />

as H.E Chief Olusegun Obasanjo, the former President of the Federal Republic of Nigeria Local leaders,<br />

such as the Vice President Hon. Kalonzo Musyoka amongst others, were also in attendance.<br />

<strong>The</strong> Institute hosted the 2nd Education Conference by the KIM School of Management. <strong>The</strong>re was a good<br />

regional representation from the Great Lakes Countries. <strong>The</strong> papers presented have been published to<br />

form the Journal of the Institute. <strong>The</strong> journal will enrich thoughts on the linkage between education <strong>and</strong><br />

Industry, while also providing academic <strong>and</strong> intellectual professional growth <strong>and</strong> excellence.<br />

<strong>The</strong> Institute participated actively in the Constitution making for the Country by organizing <strong>and</strong> sponsoring<br />

15 special forums around the country. This was aimed at providing education <strong>and</strong> help <strong>Kenya</strong>ns underst<strong>and</strong><br />

the contents <strong>and</strong> to make independent decisions in the referendum. <strong>The</strong> Institute has positioned itself<br />

strategically to make professional interventions <strong>and</strong> provide education in the implementation process on the<br />

basis of its core competences <strong>and</strong> business focus.<br />

<strong>The</strong> Institute has continued to engage with the Commission for Higher Education owing to the impending<br />

Sponsorship of the Management University. <strong>The</strong> Letter of Interim Authority is about to be issued, thus<br />

making the dream of the University a reality.<br />

<strong>The</strong> Memor<strong>and</strong>um <strong>and</strong> Articles of Association were revised <strong>and</strong> adopted. Both the Council <strong>and</strong> Branch<br />

elections were held on the basis of the revised document. <strong>The</strong> alignment of the branch structure <strong>and</strong><br />

network, <strong>and</strong> the harmonization, is also to be done under the new governance structures.<br />

8 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

(x)<br />

<strong>The</strong> institute has participated in Corporate Social Responsibility interventions which included book<br />

donations to schools for the needy, blood donations <strong>and</strong> environmental conservation exercise.<br />

<strong>The</strong> Chairman’s <strong>Report</strong> was adopted on a proposal by Mrs. Salome Gitoho <strong>and</strong> seconded by Mr. Mwai wa Kihu.<br />

MIN 4/AGM/<strong>2011</strong>: ADOPTION OF THE EXECUTIVE DIRECTORS REPORT<br />

FOR THE YEAR ENDED 31 ST DECEMBER 2010<br />

<strong>The</strong> Executive Director read the Management report as appended to the <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong><br />

statements for the year 2010. <strong>The</strong> main highlights of the report <strong>and</strong> <strong>Financial</strong> <strong>Statements</strong> were:-<br />

(i)<br />

(ii)<br />

That as a membership organization, the management has embarked on quality membership service with<br />

emphasis on Continuous Professional Development ( CPD) <strong>and</strong> other various activities <strong>and</strong> events in all<br />

branches across the Country.<br />

<strong>The</strong> Management has continued to identify gaps <strong>and</strong> to develop so as to provide solutions to customers in the<br />

core business of governance, leadership <strong>and</strong> management.<br />

(iii) <strong>The</strong> Management has placed emphasis on efficiency <strong>and</strong> effectiveness in customer care <strong>and</strong> service.<br />

(iv) <strong>The</strong> Management Magazine has been revamped <strong>and</strong> re-launched to make it the East Africa’s premier business<br />

(v)<br />

management <strong>and</strong> leadership monthly. This has not only served members as a reliable forum for management<br />

<strong>and</strong> leadership, but has also raised the Institute's profile <strong>and</strong> respectability.<br />

<strong>The</strong>re have been public forums for members across the country. In Nairobi, there were seven (7) public forums,<br />

an annual dinner <strong>and</strong> a golf tournament in addition to the other activities, such as the graduation at the school<br />

of Management, a vibrant conference, the convention, the COYA /gala night, the KABA. <strong>The</strong> average is one key<br />

event in Nairobi per month, with several others at the branches.<br />

(vi) <strong>The</strong> institute has entered into partnerships <strong>and</strong> collaborations with like-minded Institutions. <strong>The</strong> Africa<br />

Leadership Forum of Nigeria has joined with the Institute to support the convention, <strong>and</strong> the University of<br />

South Africa has collaborated with KIM to get into an arrangement to offer Doctorate programs in Business<br />

Leadership.<br />

(vii) On the financial platform, the Institute has continued to embrace prudent financial <strong>and</strong> business management<br />

practices with a turnover of 20% growth compared to the previous year. <strong>The</strong> growth is driven by increase in<br />

student numbers, professional fees from Centre for Enterprise Development <strong>and</strong> advertisement sales from<br />

Media Services Unit. <strong>The</strong> turnover stood at Kshs. 962 Million with a surplus of Kshs.75 Million up from Kshs.66<br />

Million representing an improvement of 14%.<br />

(viii) <strong>The</strong> direct costs increased by 20% from the previous year. This increase is attributable to lecturers fees as a<br />

result of an increase in student numbers. In terms of costs to turnover, there was therefore a slight increase<br />

from 35% to 37%. Staff benefits <strong>and</strong> membership reserves increased by 74% as a result of providing for an<br />

additional Kshs. 9.6 Million in staff benefits.<br />

(ix) Accumulated revenue grew by 24% following a Net surplus of Kshs. 75 million achieved.<br />

On a proposal by Mr. Richard Gikuhi <strong>and</strong> seconded by Mr. Joseph Nyutu the <strong>Report</strong> was Adopted.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong><br />

9

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

MIN. 5/AGM/<strong>2011</strong>: ADOPTION OF THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31ST<br />

DECEMBER 2010.<br />

<strong>The</strong> <strong>Financial</strong> <strong>Statements</strong> were presented to Members by the Honorary Treasurer, a Council member, who is the<br />

chairman of Finance Committee. It had the following highlights:-<br />

(i) <strong>The</strong> total revenue increased by 20% owing to increase in student registration, fees earned by the business<br />

units, consultancies, <strong>and</strong> members subscriptions.<br />

(ii) Direct costs increased by 26 %. This was attributed to increase in Lecturers fees, printing <strong>and</strong> stationery,<br />

examination costs, advertising <strong>and</strong> publishing, accommodation, graduation expenses, telephone <strong>and</strong><br />

postage among many others.<br />

(iii) <strong>The</strong> Gross profit increased by 18% owing to the Institute's ability to generate income.<br />

(iv) Administrative expenses increased by 30% due to increased salaries <strong>and</strong> wages, staff welfare<br />

development, medical scheme, staff Insurance, <strong>and</strong> directors' remuneration.<br />

(v) Surplus for the year had increased with 13% <strong>and</strong> the same was expected to continue going up since<br />

turnover has also increased with new businesses <strong>and</strong> innovations.<br />

(vi) Other expenses amounted to Kshs. 229,085,500 in 2010 as compared to 219,800,957 in 2009.<br />

(vii) <strong>The</strong> Non current assets have increased to 246 Million, up from 208 Million in 2009, whereas current Assets<br />

have increased from 250 million to 335 million in 2010, making the total assets to be 381 million in 2010.<br />

(viii) <strong>The</strong> total current liabilities increased from 143 million to 191 million in 2010.<br />

(ix) <strong>The</strong> total accumulated Fund had increased from 315 million to 390 million.<br />

MIN. 6/AGM/<strong>2011</strong>: BALANCE SHEET AND ACCOUNTS UPTO 31 ST DECEMBER 2010<br />

A representative from KOKA KOIMBURI & CO. Certified Public Accountants read the Independent Auditors <strong>Report</strong><br />

<strong>and</strong> duly confirmed that:-<br />

(i) <strong>The</strong> <strong>Financial</strong> statements of the Institute had been audited in accordance with the International Finance<br />

<strong>Report</strong>ing St<strong>and</strong>ards <strong>and</strong> the Provisions of the Companies Act.<br />

(ii) <strong>The</strong> <strong>Financial</strong> statements gave a true <strong>and</strong> fair view of the <strong>Financial</strong> state of affairs of the Institute.<br />

(iii) <strong>The</strong> Auditors took the chance to express their gratitude to Management for the opportunity to serve them since<br />

they were retiring.<br />

On a proposal by Ms Alice Owour <strong>and</strong> seconded by Mr Jonas Okwaro, the <strong>Audited</strong> Accounts for the Institute for<br />

the year ended 31 st December 2010 as presented by the Auditors were adopted.<br />

Comments<br />

(i) <strong>The</strong> decrease of revenue from the Jitihada project from Kshs.17 million to 1 million was questioned by<br />

members. It was complained that the Government had delayed in signing the second phase of the contract.<br />

(ii) <strong>The</strong> Barclays Bank cash deposit was explained from the perspective of the pending Court case with <strong>Kenya</strong><br />

Re- Insurance, which necessitated a short term deposit with the Bank.<br />

(iii) <strong>The</strong> Management was commended for the good financial records <strong>and</strong> an audit job well done.<br />

10 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Minutes of the 45th <strong>Annual</strong> General Meeting<br />

MIN. 7/AGM/<strong>2011</strong>: NATIONAL AND BRANCH NOMINATION AND ELECTION PROCESS<br />

<strong>The</strong> returning officer, Dr. JJ Mageria, the Chairman, Board of Fellows read the report of the concluded National <strong>and</strong><br />

Branch elections. <strong>The</strong> main highlights were:-<br />

(i)<br />

(ii)<br />

(iii)<br />

<strong>The</strong> process was done with great professionalism.<br />

Online voting was time saving <strong>and</strong> would be more encouraged in future.<br />

<strong>The</strong> process was fair, free <strong>and</strong> above board with no suspicion at all.<br />

Pursuant to the provisions of the Article of Association, the names of the successful c<strong>and</strong>idates were presented to<br />

the <strong>Annual</strong> General Meeting for ratification.<br />

On a proposal by Mr Julius Barno <strong>and</strong> seconded by Mr Sammy Maina the report was adopted.<br />

MIN. 8/AGM/<strong>2011</strong> – APPOINTMENT OF AUDITORS<br />

<strong>The</strong> Council sought authority from the members to appoint <strong>and</strong> fix the remuneration of the new Auditors, the term<br />

of the current Auditors having expired. On a proposal by Mr Mwai wa Kihiu, seconded by Mr Francis Oloo it was<br />

adopted <strong>and</strong> authority granted.<br />

MIN. 9/AGM/<strong>2011</strong> – REPORT ON COUNCIL EXPENSES.<br />

<strong>The</strong> management reported that:-<br />

(i) <strong>The</strong> Council members were not paid, but only given an allowance for expenses that are incurred in fuel,<br />

transport <strong>and</strong> re-imbursement, <strong>and</strong> on retreats for strategic planning.<br />

(ii) <strong>The</strong> council was commended for the professionalism exhibited <strong>and</strong> the transparency <strong>and</strong> accountability in<br />

minding the affairs of the Institute.<br />

(iii) <strong>The</strong> extraordinary drive by Council members to attend meetings was commented <strong>and</strong> the exemplary service<br />

offered to the Institute recognized.<br />

<strong>The</strong>re being no other business the meeting ended at 6.00P.M<br />

CONFIRMED ______________________________________<br />

CHAIRMAN<br />

DATE ____________________________________________<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 11

Chairman’s <strong>Report</strong><br />

I<br />

am pleased <strong>and</strong> privileged to present to you my inaugural<br />

report for the period that ended 31 December <strong>2011</strong> as<br />

the Chairman of the governing Council of the Institute.<br />

Since its inception in 1954, the Institute has continued to<br />

steer good practices in management <strong>and</strong> leadership in the<br />

country <strong>and</strong> beyond through various platforms. I am happy<br />

to report that during the period under review, the Institute<br />

recorded commendable achievements despite the dynamic<br />

business environment we operated in.<br />

I report with contentment that the Council is at the<br />

forefront of championing good corporate governance. <strong>The</strong><br />

Institute enjoys excellent relationships with Members, the<br />

Council, the Management <strong>and</strong> other stakeholders. Last year,<br />

one third of Council members retired <strong>and</strong> new members<br />

were nominated <strong>and</strong> elected. <strong>The</strong> process was conducted<br />

on an electronic platform. Elections held both at branch <strong>and</strong><br />

national level were conducted with greater efficiency <strong>and</strong><br />

effectiveness. Further, the Council went through a vigorous<br />

evaluation process to determine how well it was carrying its<br />

responsibilities <strong>and</strong> to identify any gaps <strong>and</strong> strategies to<br />

develop areas that needed improvement.<br />

In the same vein, the Council <strong>and</strong> the Institute is<br />

committed to establishing a centre of excellence. <strong>The</strong><br />

centre will provide Members <strong>and</strong> stakeholders cutting edge<br />

services that will promote excellent governance, leadership<br />

<strong>and</strong> management practices.<br />

Members, you are informed that our membership<br />

threshold at the branch level is defined by 150 paid up<br />

members as provided for in our MAA. With this in mind, there<br />

is a need for the Institute to consider re-aligning its branches<br />

to fit into the new dispensation. In all instances, we will be<br />

guided by the need to create a national access to Institute<br />

services with special focus on the needs of every county,<br />

viability of the branch, <strong>and</strong> dem<strong>and</strong> for Institute services<br />

from its members.<br />

Last year, after many years of pursuing the dream of<br />

establishing a comprehensive management, leadership <strong>and</strong><br />

governance oriented university, the Institute as the sponsor<br />

witnessed the birth of the Management University of Africa.<br />

<strong>The</strong> University was granted the Letter of Interim Authority by<br />

the Commission for Higher Education on the 2nd September<br />

<strong>2011</strong>. This was followed by the installation of the founding<br />

Chancellor Dr. Arch. Reuben Mutiso, the Vice Chancellor<br />

Prof. Jude Mathooko <strong>and</strong> the inauguration of the Board of<br />

Trustees <strong>and</strong> Council of the University.<br />

As the sponsor, the Institute is committed to nurturing the<br />

new University <strong>and</strong> supporting it throughout its formative<br />

years. While the task may appear daunting, it is not impossible.<br />

I am pleased to report that the Institute bequeathed key<br />

assets to the University, worth KShs. 360 million. Among the<br />

fixed assets that were transferred include an ultra modern<br />

management centre with state of the art classrooms <strong>and</strong><br />

information <strong>and</strong> communication technology facilities,<br />

conducive for<br />

research <strong>and</strong><br />

learning in a world<br />

class <strong>and</strong> efficient<br />

environment.<br />

In addition, the<br />

Institute h<strong>and</strong>ed<br />

over some of<br />

its key staff<br />

members to see<br />

the University set<br />

off. I am delighted<br />

to report that the<br />

University took<br />

off in earnest with<br />

its first intake in<br />

January 2012.<br />

You will recall the Institute launched an annual continental<br />

forum under the Patronage of H.E Olusegun Obasanjo,<br />

former President of the Republic of Nigeria. <strong>The</strong> Second<br />

<strong>Annual</strong> Africa Governance, Leadership <strong>and</strong> Management<br />

convention was held in Mombasa in August. <strong>The</strong> forum was<br />

graced by two former statesmen, H.E Olusegun Obasanjo,<br />

Former President of the Republic of Nigeria <strong>and</strong> H.E Thabo<br />

Mbeki, former President of the Republic of South Africa. As<br />

was expected, the event was a great success, attended by<br />

renowned business leaders <strong>and</strong> government officials across<br />

Africa. <strong>The</strong> Third <strong>Annual</strong> Africa Governance, Leadership <strong>and</strong><br />

Management convention is scheduled this August. Towards<br />

this front, we have made contacts with the Africa Union<br />

with the intention of working together to disseminate the<br />

convention output.<br />

I am glad to announce the inaugural KIM <strong>Annual</strong><br />

Manager’s Conference. This will be an annual platform<br />

bringing together managers of various businesses <strong>and</strong><br />

organizations to interrogate global management practices.<br />

<strong>The</strong> knowledge shared will help them excel in their<br />

managerial responsibilities <strong>and</strong> offer leadership to their<br />

teams for overall organizational productivity.<br />

I am pleased to report that the Council commissioned<br />

the implementation of the Enterprise Resource Planning<br />

(ERP) to improve service delivery in our Branch network. <strong>The</strong><br />

process is ongoing. We envisage a highly effective Institute<br />

at the cutting edge of technology once the project is fully<br />

implemented<br />

Lastly, I wish to attribute our success in the past year to our<br />

unwavering commitment to our vision <strong>and</strong> to the support<br />

of our Members, the Governing Council, Management <strong>and</strong><br />

Staff.<br />

Thank you very much <strong>and</strong> God bless you.<br />

Alfred Lenana<br />

Chairman, KIM Council<br />

12 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

I<br />

am glad to present to you the Institute’s <strong>Annual</strong> <strong>Report</strong>.<br />

This report reaffirms our strategic visionary thrust to<br />

become a distinguished continental hub of excellence<br />

in organizational <strong>and</strong> business management practices.<br />

As a professional membership organization, we are driven<br />

by our mission to steer <strong>and</strong> champion excellence, integrity<br />

<strong>and</strong> competitiveness in individuals <strong>and</strong> organizations<br />

throughout Africa <strong>and</strong> beyond.<br />

I am pleased to report that during the period under review,<br />

the Institute has registered tremendous growth in revenue<br />

through prudent use of resources <strong>and</strong> innovativeness. Our<br />

membership base has grown incredibly. This has been as<br />

a result of reinventing our service excellence strategies to<br />

consolidate our exceptional performance. In the same stride,<br />

our students’ population continues to grow yearly. This<br />

growth can be attributed to the efforts made in refurbishing<br />

<strong>and</strong> relocating some of our branches to spacious <strong>and</strong> modern<br />

premises. In addition, our computer labs have been up-scaled<br />

<strong>and</strong> equipped to state of the art facilities countrywide. Last<br />

year, the Institute achieved Kshs. 1billion turnover. This was<br />

a 10% growth in turnover against an economic background<br />

of high inflation, high interest rates <strong>and</strong> economic crunch.<br />

In the same year, the Institute was ranked as the top<br />

business school in the country according to the study<br />

conducted by Webometrics, a Spanish research firm.<br />

Webometrics is an independent public research organization<br />

that aims at promoting the web presence of business<br />

schools <strong>and</strong> MBA granting institutions worldwide. Web<br />

presence measures the activity <strong>and</strong> visibility of institutions<br />

<strong>and</strong> reflects the commitment of institutions to st<strong>and</strong>ards<br />

in dissemination of knowledge. <strong>The</strong> ranking summarizes<br />

the global performance of the schools <strong>and</strong> provides useful<br />

information for c<strong>and</strong>idate students <strong>and</strong> scholars. This was<br />

not a mean achievement.<br />

Our staff remains dedicated <strong>and</strong> committed to our vision<br />

<strong>and</strong> mission. We have put mechanisms in place to create<br />

good working environment. Enhanced staff welfare <strong>and</strong><br />

training is a strategy that has enabled us to attract <strong>and</strong> retain<br />

some of the best <strong>and</strong> brightest brains in the industry.<br />

We continue to seek <strong>and</strong> build strategic alliances with<br />

like-minded individuals <strong>and</strong> organizations in our pursuit<br />

to positioning the Institute as a hub of excellence. To<br />

achieve this, we strive to enrich our product offering. We<br />

have introduced new programmes, including Institutional<br />

Governance <strong>and</strong> Leadership Excellence programme, Women<br />

in Governance, Monitoring <strong>and</strong> Evaluation, Health <strong>and</strong><br />

Safety, the Six Sigma <strong>and</strong> Kaizen Programmes which will be<br />

launched in the current year.<br />

Our Business Intelligence <strong>and</strong> Research Unit has played a<br />

key role in informing new product development <strong>and</strong> product<br />

improvement through feasibility studies, new product<br />

research, market analysis <strong>and</strong> tracking services. Besides<br />

this, the Unit has achieved major outst<strong>and</strong>ing milestones<br />

in the area of research. A number of research activities have<br />

been carried out <strong>and</strong> findings published. <strong>The</strong>se include, the<br />

Tristat report, Perception of Women in Leadership Positions<br />

CEO’s <strong>Report</strong><br />

in <strong>Kenya</strong> <strong>and</strong> KIM<br />

Alumni traceability<br />

survey.<br />

<strong>The</strong> membership<br />

services have been<br />

revamped to include<br />

the Continuous<br />

Professional<br />

Development<br />

(CPD) activities<br />

geared towards<br />

enhancing members’<br />

participation <strong>and</strong> development. <strong>The</strong>se activities include<br />

trainings, networking <strong>and</strong> monthly management forums.<br />

<strong>The</strong> OPI tool has continued to attract interest among<br />

<strong>Kenya</strong>n organizations <strong>and</strong> in the region. <strong>The</strong> tool was<br />

introduced in Rw<strong>and</strong>a <strong>and</strong> was well received. <strong>The</strong> OPI in<br />

partnership with the German Development Cooperation<br />

(GIZ) under a Public Private Partnership implemented the<br />

OPI model in 30 companies in Rw<strong>and</strong>a. A gala night was held<br />

in November last year to celebrate the winners.<br />

I am pleased to report that the Institute was awarded a<br />

four year contract by KEPSA to train approximately 16,000<br />

youth on life skills. KEPSA was identified by the World Bank<br />

to champion <strong>Kenya</strong> Youth Empowerment Project (KYEP).<br />

<strong>The</strong> programme saw youths participate in internships <strong>and</strong><br />

mentorship programmes. In the same vein, the Institute<br />

signed up the second phase of the JITIHADA project as<br />

the lead consultants. JITIHADA Business Plan Competition<br />

is a national initiative of the Micro Small <strong>and</strong> Medium<br />

Enterprises (MSME) Competitiveness Project of the Ministry<br />

of Industrialization.<br />

We reviewed our strategic plan rolling over for a period of<br />

five years, 2012-2016. <strong>The</strong> review process was also informed<br />

by the Organizational Performance Index report <strong>and</strong> the risk<br />

management framework that KIM took part in. <strong>The</strong> Institute<br />

underwent an intensive exercise to identify core risks<br />

exposures that could affect its operations. This is in addition<br />

to the fact that the Institute is ISO registered in compliance<br />

with the ISO 9001: 2008 St<strong>and</strong>ards. We further underwent a<br />

surveillance audit to keep us in check <strong>and</strong> are now living the<br />

ISO spirit.<br />

Our commitment to good corporate governance <strong>and</strong><br />

corporate social responsibility has remained solid. In the<br />

period under review, we gave back in numerous ways to<br />

the society. <strong>The</strong>se activities have continued to make visible<br />

positive impacts on the wellbeing of our Members <strong>and</strong><br />

stakeholders.<br />

Lastly, I want to recognize the Members, the Council,<br />

Management <strong>and</strong> staff of the Institute for their continued<br />

guidance <strong>and</strong> support in what has again been another<br />

successful year, <strong>and</strong> request that these be sustained.<br />

David Muturi<br />

Chief Executive Officer<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 13

Corporate Information<br />

COUNCIL MEMBERS : Mr. Alfred Lenana - Chairman<br />

: Dr. Arch Reuben M. Mutiso - Former Chairman (Retired 27th May <strong>2011</strong>)<br />

: Ms. Salome Gitoho - Vice Chairperson<br />

: Mr. Dan Awendo - Honorary Treasurer<br />

: Mr. Richard Isiaho - Council Member<br />

: Mr. Richard K. Gikuhi - Council Member<br />

: Mr. Philip Kisia - Council Member<br />

: Ms. Esther Jowi - Council Member<br />

: Dr. Jonathan Ciano - Council Member<br />

: Ms. Alice Owour - Council Member<br />

: Prof. Tuikong D.K. Serem - Council Member<br />

: Dr. Wilson Soy - Council Member<br />

: Mr. Richard Ndubai - Council Member (Appointed February 2012)<br />

: Ms. Rose Bosobori Osoro - Council Member (Appointed February 2012)<br />

: Mr. David Muturi - Executive Director/CEO<br />

: Stella Muendo - Company Secretary<br />

: Eng. Samuel Muchemi - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Eng. Michael S.M. Kamau - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Peter Kubebea - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Josiah K. A. Rutto - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Austin Kapere - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Jonas Okwaro - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Henry N. Njerenga - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Oscar Waswa - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Julius K. Barno - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Mr. Samuel K. Maina - Council Member (Retired 27th May <strong>2011</strong>)<br />

: Ms. Constantine K<strong>and</strong>ie - Council Member (Retired 27th May <strong>2011</strong>)<br />

REGISTERED OFFICE<br />

AUDITORS<br />

: Management Centre<br />

: South C, Off Popo Road<br />

: P.O.Box 43706-00100<br />

: NAIROBI<br />

: PKF <strong>Kenya</strong><br />

: Certified Public Accountants<br />

: P.O. Box 14077, 00800<br />

: NAIROBI<br />

INSTITUTE SECRETARY<br />

: Stella K. Muendo<br />

: S. K. Muendo <strong>and</strong> Company Advocates<br />

: St<strong>and</strong>ard/Wabera Street<br />

: P.O. Box 14191-00100<br />

: NAIROBI<br />

: KENYA<br />

PRINCIPAL PLACE OF BUSINESS<br />

: Luther Plaza, 2nd & 3rd floors<br />

: Uhuru Highway/Nyerere Road Junction<br />

: P.O.Box 43706-00100<br />

: NAIROBI<br />

14 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Corporate Information (Continued)<br />

PRINCIPAL BANKERS<br />

: BARCLAYS BANK OF KENYA LIMITED<br />

Queensway House<br />

P.O. Box 30011-00100<br />

NAIROBI<br />

: COMMERCIAL BANK OF AFRICA LIMITED<br />

Wabera Street Branch<br />

P.O. Box 30437-00100<br />

NAIROBI<br />

: COOPERATIVE BANK OF KENYA LIMITED<br />

University Way Branch<br />

P.O. Box 60800-00200<br />

NAIROBI<br />

: ECOBANK<br />

Ecobank Towers Branch<br />

P.O. Box 49584-00100<br />

NAIROBI<br />

: EQUITY BANK<br />

Westl<strong>and</strong>s Bank Branch<br />

P.O. Box 75104-00200<br />

NAIROBI<br />

: KCB RWANDA SA<br />

Avenue DE La Paix<br />

P.O. Box 5620<br />

KIGALI<br />

RWANDA<br />

: ECO BANK RWANDA SA<br />

Parcelle No. 314, Ave De La Paix<br />

BP 3268<br />

KIGALI<br />

RWANDA<br />

ADVOCATES<br />

: S. K. MUENDO AND COMPANY ADVOCATES<br />

St<strong>and</strong>ard/Wabera Street<br />

P.O. Box 14191-00100<br />

NAIROBI<br />

KENYA<br />

NYAKUNDI & COMPANY ADVOCATES<br />

3rd Floor, College House<br />

P.O. Box 50913-00100<br />

NAIROBI<br />

KENYA<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 15

Corporate Governance <strong>Report</strong><br />

COMMITMENT TO CORPORATE GOVERNANCE<br />

<strong>The</strong> <strong>Kenya</strong> Institute of Management is committed to<br />

good corporate governance. <strong>The</strong> Institute pursues<br />

professional st<strong>and</strong>ards <strong>and</strong> norms in h<strong>and</strong>ling its<br />

business relationships, which are directed towards<br />

enhancing the performance of its business to the benefit<br />

of its customers, members, employees, partners <strong>and</strong><br />

other stakeholders. We promote a culture that values<br />

<strong>and</strong> recognizes the highest ethical st<strong>and</strong>ards as well as<br />

personal <strong>and</strong> corporate integrity. <strong>The</strong> Council members<br />

<strong>and</strong> employees are expected to act with integrity in line<br />

with our m<strong>and</strong>ate of promoting excellence <strong>and</strong> integrity in<br />

the practice of management.<br />

<strong>The</strong> KIM Council is responsible for the governance<br />

of the Institute, while the members are responsible<br />

for the election of the Council through the <strong>Annual</strong><br />

General Meeting. Adherence to corporate governance<br />

principles is articulated in the Institute’s Memor<strong>and</strong>um<br />

<strong>and</strong> Articles of Association (MAA), which outlines the<br />

role of management, Council <strong>and</strong> members in the<br />

management of the Institute. <strong>The</strong> Council of the Institute<br />

seeks to adhere to, <strong>and</strong> comply with, the Principles for<br />

Corporate Governance in <strong>Kenya</strong> <strong>and</strong> the Sample Code<br />

of Best Practice for Corporate Governance as otherwise<br />

modified by global developments.<br />

<strong>The</strong> Council meets <strong>and</strong> conducts business, adjourns or<br />

regulates their meetings as they deem fit in accordance<br />

with the MAA with at least one meeting every quarter.<br />

<strong>The</strong> following are the key aspects of the Institute’s<br />

approach to corporate governance:<br />

MEMBERS’ RESPONSIBILITIES<br />

<strong>The</strong> members’ role in governance is to elect the Council,<br />

appoint external auditors <strong>and</strong> hold the Council to account<br />

for the attainment of organizational objectives. Members<br />

are expected to act jointly <strong>and</strong> severally uphold good<br />

conduct <strong>and</strong> remain committed to the ideals of the<br />

Institute.<br />

THE COUNCIL’S RESPONSIBILITIES<br />

<strong>The</strong> Council is responsible for the governance of the<br />

Institute <strong>and</strong> gives policy guidance in all strategic affairs<br />

of the Institute on behalf of the members. <strong>The</strong> Council is<br />

responsible for conducting such business of the Institute<br />

with integrity <strong>and</strong> in accordance with the MAA <strong>and</strong><br />

generally accepted corporate practices, by upholding<br />

transparency, accountability <strong>and</strong> responsibility. To<br />

discharge its m<strong>and</strong>ate effectively, the Council delegates<br />

its authority to Council committees, which then meet<br />

quarterly <strong>and</strong> whenever the need arises. <strong>The</strong> authority<br />

of the day-to-day running of the Institute is delegated to<br />

the Executive Director with the help of three executive<br />

directors <strong>and</strong> a management team.<br />

COMPOSITION OF THE COUNCIL<br />

<strong>The</strong> Council shall consist of not less than nine <strong>and</strong> not<br />

more than 13 members with the twelve (12) Council<br />

members elected by or ratified at the <strong>Annual</strong> General<br />

Meeting; <strong>and</strong> the Chief Executive Officer. Out of the 12<br />

council members, seven (7) are elected by the members<br />

at a general meeting, while the other five (5) members are<br />

nominated from the branch level <strong>and</strong> ratified at the <strong>Annual</strong><br />

General Meeting. In accordance with the Institute’s MAA,<br />

the Council may co-opt up to three additional members<br />

at any given time if the Council is of the opinion that such<br />

co-opted members possess knowledge <strong>and</strong> skills that<br />

the Council needs to resource upon.<br />

TERMS OF SERVICE<br />

Elected Members of Council shall serve for a term of<br />

three years <strong>and</strong> are eligible for re-election for a further<br />

three-year term. No Member of Council shall serve for<br />

more than two continuous terms of three years. However,<br />

they may be eligible for re-election after staying out of<br />

the Council for one term of three years. At every <strong>Annual</strong><br />

General Meeting of the Institute, a third of the members<br />

of the Council shall be expected to retire from office.<br />

SEPARATION AND DISTRIBUTION OF POWERS<br />

BETWEEN THE COUNCIL AND MANAGEMENT<br />

<strong>The</strong> roles of the Council <strong>and</strong> management are clearly<br />

defined <strong>and</strong> separated. <strong>The</strong> Council has full responsibility<br />

for the oversight, direction <strong>and</strong> control of the Institute.<br />

<strong>The</strong> responsibility of implementing strategy <strong>and</strong> day-today<br />

operations of the Institute is delegated by the Council<br />

to the Executive Director, <strong>and</strong> the management team.<br />

INFORMATION TO THE COUNCIL<br />

<strong>The</strong> Council is continuously appraised on the operations<br />

of the Institute through regular reports from the various<br />

management <strong>and</strong> Council committees; reports from the<br />

Executive Director <strong>and</strong> other formal events.<br />

CONFLICT OF INTEREST<br />

<strong>The</strong> Institute has put in place elaborate policies <strong>and</strong><br />

frameworks for monitoring transactions with Council<br />

members <strong>and</strong> related parties to ensure that any conflict<br />

of interest is addressed appropriately <strong>and</strong> any such<br />

transactions are disclosed in the financial statements<br />

<strong>and</strong> at all appropriate levels.<br />

COMMITTEES OF THE INSTITUTE<br />

<strong>The</strong> Council delegates some of its authorities,<br />

powers, discretion, <strong>and</strong> duties to committees to ensure<br />

organizational effectiveness in decision making <strong>and</strong><br />

implementation, but reserves unto itself the primary<br />

functions <strong>and</strong> residue powers of final decision.<br />

COMMITTEES OF THE COUNCIL<br />

<strong>The</strong> MAA empowers the Council to set up the following<br />

st<strong>and</strong>ing committees:<br />

16 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Corporate Governance <strong>Report</strong><br />

<strong>The</strong> General Purposes Committee, whose function is<br />

to advise the Council on all policy matters <strong>and</strong> to ensure<br />

that there is sufficient co-ordination, harmonization <strong>and</strong><br />

consensus on major strategic issues of the Institute <strong>and</strong><br />

between the various committees <strong>and</strong> programmes of the<br />

Institute. <strong>The</strong> composition of this committee is as follows:<br />

Chairperson, Vice Chairperson of Council, All chairmen<br />

of committees, Treasurer, Council Secretary, <strong>and</strong> the<br />

Chief Executive Officer/Executive Director.<br />

<strong>The</strong> Membership Development Committee, whose key<br />

responsibilities are the recruitment, admission, grading,<br />

upgrading, development <strong>and</strong> discipline of the members.<br />

<strong>The</strong> Committee is made up of two co-opted members<br />

<strong>and</strong> three members representing the branches. <strong>The</strong><br />

branch representatives organize themselves in clusters<br />

of three branches, with each cluster appointing one of<br />

their number as a representative.<br />

<strong>The</strong> Finance <strong>and</strong> Investment Committee: to see to the<br />

appropriate utilization of Institute’s finances <strong>and</strong> advise<br />

the Council on the financial <strong>and</strong> investment affairs of the<br />

Institute.<br />

<strong>The</strong> Human Resources Development Committee.<br />

<strong>The</strong> key responsibilities is to exercise oversight of the<br />

framework governing the human resource policies<br />

<strong>and</strong> to monitor, evaluate, <strong>and</strong> make recommendations<br />

to the Council with respect to policies <strong>and</strong> strategic<br />

matters related to the human resources <strong>and</strong> personnel<br />

issues; <strong>and</strong> particularly so as to ensure that the Institute<br />

complies with all relevant regulations, st<strong>and</strong>ards <strong>and</strong><br />

codes of practice; occupation <strong>and</strong> environmental health<br />

<strong>and</strong> safety legislation. <strong>The</strong> m<strong>and</strong>ate of the committee is<br />

to ensure the proper development <strong>and</strong> welfare of Institute<br />

staff to ensure that it attracts, maintains <strong>and</strong> retains the<br />

highest quality <strong>and</strong> calibres of human resources.<br />

<strong>The</strong> Audit <strong>and</strong> Governance Committee: <strong>The</strong> key<br />

responsibilities are to exercise oversight on behalf of the<br />

council <strong>and</strong> in accordance with powers delegated to it<br />

by the Council, over the audit compliance, disclosure,<br />

audit, <strong>and</strong> governance arrangements of the Institute <strong>and</strong><br />

report thereon to the Council. <strong>The</strong> committee comprises<br />

of independent members of the Council, which ensures<br />

that good governance practices are being followed. <strong>The</strong><br />

officers of the Board – the Chairman, Vice-chairman,<br />

Secretary <strong>and</strong> Treasurer- are not be members of the<br />

Committee. <strong>The</strong> Chief Executive Officer attends all the<br />

open sessions of the committee, but may not attend any<br />

closed sessions if the committee so decides.<br />

Business Committee: <strong>The</strong> key responsibilities are<br />

to advice the Council on all matters relevant to the<br />

technical business activities of the Institute. <strong>The</strong><br />

Business Committee is charged with the responsibility of<br />

ensuring harmony, consistency <strong>and</strong> technical adequacy<br />

in the planning <strong>and</strong> implementation of all the business<br />

activities of the Institute, particularly so as to ensure that<br />

the activities promote the image <strong>and</strong> reputation of the<br />

Institute as a centre of excellence in Management <strong>and</strong><br />

enhance the st<strong>and</strong>ards, underst<strong>and</strong>ing <strong>and</strong> knowledge in<br />

the art, science <strong>and</strong> practice of management.<br />

ADVISORY BODIES, AD HOC AND TECHNICAL<br />

COMMITTEES<br />

In addition to its st<strong>and</strong>ing committees, the Council may at<br />

any time appoint advisory boards or ad hoc committees<br />

<strong>and</strong> technical advisory committees, consisting of such<br />

persons as the Council may select to consider or report<br />

on any specific matter or matters.<br />

<strong>The</strong> Board of Fellows<br />

<strong>The</strong> Board is only comprised of Fellows <strong>and</strong> shall not<br />

exceed eleven members in total. <strong>The</strong> business of the<br />

Board is to advise Council on all major strategic issues<br />

of the Institute; Support Council in public relations, fundraising<br />

<strong>and</strong> national affairs; <strong>and</strong> h<strong>and</strong>le any other issues<br />

requested by the Council <strong>and</strong>/ or a General Meeting of<br />

the members.<br />

Technical Advisory Committees<br />

Recommends to the Council the establishment of<br />

technical advisory committees as are deemed relevant to<br />

the needs of the Institute.<br />

CONDUCT OF BUSINESS AND PERFORMANCE<br />

REPORTING<br />

<strong>The</strong> institute’s business is conducted in accordance<br />

with clearly formulated strategy, annual business plans<br />

<strong>and</strong> budgets, which set out very clear objectives <strong>and</strong><br />

measurement indicators. Performance against objectives<br />

is reviewed <strong>and</strong> discussed monthly <strong>and</strong> quarterly<br />

by management team <strong>and</strong> shared with the various<br />

committees. In this framework, performance trends <strong>and</strong><br />

projections as well as actual performance against targets<br />

are closely monitored <strong>and</strong> evaluated.<br />

In order to entrench the culture of performance monitoring<br />

<strong>and</strong> reporting, the Council of the Institute has put in place<br />

Council <strong>and</strong> individual Council member performance<br />

evaluation on an annual basis. It is expected that this<br />

process will be cascaded to the branch committees<br />

during the next financial year.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 17

Corporate Social<br />

Responsibility <strong>Report</strong><br />

KIM’s commitment to Corporate Social Responsibility (CSR) is grounded in the values that define our community: humanity,<br />

humility, integrity <strong>and</strong> excellence. Using our branch networks, our CSR has strengthened its ability to effectively support the<br />

communities.<br />

<strong>The</strong> Institute's desire is to share its strength for the common good towards building <strong>and</strong> sustaining strong communities,<br />

environmental stewardship <strong>and</strong> global human rights.<br />

We partner with communities in the following ways:<br />

Nelly Muluka<br />

from Redcross<br />

receives a<br />

cheque from<br />

KIM staff<br />

Students receive book donations from our branch<br />

networks countrywide<br />

Football matches<br />

Ofafa Jericho students celebrate victory after a football<br />

match during a leadership forum<br />

Students receive book donations from our branch<br />

networks countrywide<br />

Developing<br />

young leaders<br />

through career<br />

talks in high<br />

schools<br />

Visitation to the elderly home in Thiogio, Kikuyu<br />

Mzee Ngina celebrates 100 years<br />

Embu branch staff spend time with children with HIV<br />

18 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

CSR REPORT <strong>2011</strong><br />

Corporate Social<br />

Responsibility <strong>Report</strong><br />

Students from various schools receive book donations from<br />

our branch networks countrywide<br />

Tree planting in Naivasha<br />

<strong>Annual</strong> charity Manager’s Golf Tournament where<br />

funds were raised towards pallative treatment<br />

Staff participating in the Stanchart Marathon<br />

KIM Alumni spend time with the elderly<br />

KIM staff serves food they prepared for the elderly<br />

Staff, lecturers <strong>and</strong> students donate blood at the annual<br />

KIM Blood Donation Drive<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 19

<strong>Report</strong> of the Council<br />

for the year ended 31 Dec <strong>2011</strong><br />

<strong>The</strong> Council submit their report <strong>and</strong> the audited financial statements for the year ended 31 December <strong>2011</strong>. It<br />

discloses the state of affairs of the Institute.<br />

PRINCIPAL ACTIVITY<br />

<strong>The</strong> Institute deals with the provision of services to members in the areas of management, development through<br />

training, research <strong>and</strong> consultancy.<br />

RESULTS <strong>2011</strong> 2010<br />

Shs<br />

Shs<br />

Surplus for the year 70,786,736 84,616,694<br />

ACCUMULATED FUND<br />

<strong>The</strong> accumulated fund balance of the Institute is set out in note 17 of these financial statements.<br />

COUNCIL<br />

<strong>The</strong> members of the council who held office to the date of this report are shown on page 1. In accordance with the<br />

Institute's Articles of Association, two directors are due for retirement by rotation.<br />

INDEPENDENT AUDITOR<br />

PKF <strong>Kenya</strong> was appointed during the year <strong>and</strong> continues in accordance with Section 159(2) of the Companies Act<br />

(Cap. 486).<br />

BY ORDER OF THE COUNCIL<br />

DIRECTOR<br />

NAIROBI<br />

_______________________ 2012<br />

20 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

ORGANISATIONAL PERFORMANCE INDEX (OPI), OUR INNOVATION<br />

COMPANY OF THE YEAR AWARDS (COYA), OUR INNOVATION<br />

KIM ANNUAL BUSINESS AWARDS (KABA), OUR INNOVATION<br />

Innovating towards driving excellence <strong>and</strong> global competitiveness in<br />

African organizations<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 21

Statement of Council’s Responsibilities<br />

for the year ended 31 Dec <strong>2011</strong><br />

<strong>The</strong> Companies Act (Cap. 486) requires the Council to prepare financial statements that give a true <strong>and</strong> fair view of<br />

the state of affairs of the Institute as at the end of the financial year, <strong>and</strong> of the results for that year. It also requires<br />

the Council to ensure that the Institute maintains proper accounting records, which disclose with reasonable<br />

accuracy the financial position of the Institute. <strong>The</strong> Council is also responsible for safeguarding the assets of the<br />

Institute.<br />

<strong>The</strong> Council accept the responsibility for the financial statements, which have been prepared using appropriate<br />

accounting policies supported by reasonable <strong>and</strong> prudent judgements <strong>and</strong> estimates, consistent with previous years,<br />

<strong>and</strong> in conformity with International <strong>Financial</strong> <strong>Report</strong>ing St<strong>and</strong>ards <strong>and</strong> the requirements of the Companies Act (Cap.<br />

486). <strong>The</strong> Council is of the opinion that the financial statements give a true <strong>and</strong> fair view of the state of the financial<br />

affairs of the Institute as at 31 December <strong>2011</strong> <strong>and</strong> of its operating results for the year then ended. <strong>The</strong> Council<br />

further confirm the accuracy <strong>and</strong> completeness of the accounting records maintained by the Institute, which have<br />

been relied upon in the preparation of the financial statements, as well as on the adequacy of the systems of internal<br />

financial controls. <strong>The</strong> financial statements have been prepared on a going concern basis, which is dependent on<br />

the continued financial support from shareholders <strong>and</strong> other related parties.<br />

Approved by the board of Council on 19th April 2012 <strong>and</strong> signed on its behalf by:<br />

_____________________<br />

COUNCIL MEMBER<br />

___________________<br />

COUNCIL MEMBER<br />

22 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Independent Auditor’s <strong>Report</strong><br />

To the members of <strong>Kenya</strong> Institute of Management<br />

<strong>Report</strong> on the <strong>Financial</strong> <strong>Statements</strong><br />

We have audited the accompanying financial statements of <strong>Kenya</strong> Institute of Management set out on pages 7 to<br />

23 which comprise the statement of financial position as at 31 December <strong>2011</strong>, <strong>and</strong> the statement of comprehensive<br />

income, the statement of changes in members' funds, <strong>and</strong> the statement of cash flows for the year then ended. It also<br />

contains a summary of significant accounting policies <strong>and</strong> other explanatory information.<br />

Council's responsibility for the financial statements<br />

<strong>The</strong> Council is responsible for the preparation of financial statements that give a true <strong>and</strong> fair view in accordance<br />

with International <strong>Financial</strong> <strong>Report</strong>ing St<strong>and</strong>ards <strong>and</strong> the Companies Act, Cap 486, <strong>and</strong> for such internal control as<br />

management determines is necessary to enable the preparation of financial statements that are free from material<br />

misstatement, whether due to fraud or error.<br />

Auditor’s responsibility<br />

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in<br />

accordance with International St<strong>and</strong>ards on Auditing. Those st<strong>and</strong>ards require that we comply with ethical requirements<br />

<strong>and</strong> plan <strong>and</strong> perform the audit to obtain reasonable assurance about whether the financial statements are free from<br />

material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts <strong>and</strong><br />

disclosures in the financial statements. <strong>The</strong> procedures selected depend on the auditor’s judgment, including the<br />

assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making<br />

those risk assessments, the auditor considers internal control relevant to the entity’s preparation <strong>and</strong> fair presentation<br />

of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not<br />

for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes<br />

evaluating the appropriateness of accounting policies used <strong>and</strong> the reasonableness of accounting estimates made by<br />

management, as well as evaluating the overall presentation of the financial statements.<br />

We believe that the audit evidence we have obtained is sufficient <strong>and</strong> appropriate to provide a basis for our audit<br />

opinion.<br />

Opinion<br />

In our opinion, the accompanying financial statements give a true <strong>and</strong> fair view of the financial position of the <strong>Kenya</strong><br />

Institute of Management as at 31 December <strong>2011</strong>, <strong>and</strong> of its financial performance <strong>and</strong> its cash flows for the year<br />

then ended in accordance with International <strong>Financial</strong> <strong>Report</strong>ing St<strong>and</strong>ards <strong>and</strong> the requirements of the <strong>Kenya</strong><br />

Companies Act.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 23

Independent Auditor’s <strong>Report</strong><br />

To the members of <strong>Kenya</strong> Institute of Management (Continued)<br />

<strong>Report</strong> on other legal requirements<br />

As required by the Companies Act (Cap. 486), we report to you, based on our audit, that:<br />

(i)<br />

we have obtained all the information <strong>and</strong> explanations which to the best of our knowledge <strong>and</strong> belief were<br />

necessary for the purposes of our audit;<br />

(ii)<br />

in our opinion, proper books of account have been kept by the company, so far as appears from our examination<br />

of those books; <strong>and</strong><br />

(iii) the company's statement of financial position <strong>and</strong> statement of comprehensive income <strong>and</strong> retained earnings are<br />

in agreement with the books of account.<br />

Certified Public Accountants<br />

PIN NO. P051130467R<br />

NAIROBI<br />

___________________________2012<br />

292/12<br />

24 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

OUR BELIEF, A BETTER KENYA<br />

OUR DREAM, A DEVELOPED AFRICA<br />

Creating platforms for continental dialogue on the<br />

African Renaissance<br />

<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong> 25

Statement of Comprehensive Income<br />

for the year ended 31 Dec <strong>2011</strong> - Continued<br />

<strong>2011</strong> 2010<br />

(Restated)<br />

Note Shs Shs<br />

Revenue 1 1,053,767,949 960,746,202<br />

Direct costs 2 (395,883,511) (352,008,115)<br />

Gross profit 657,884,438 608,738,087<br />

Other income 534,960 1,198,161<br />

658,419,398 609,936,248<br />

Administrative expenses (395,072,469) (371,713,544)<br />

Other operating expenses (192,560,193) (153,606,010)<br />

(587,632,662) (525,319,554)<br />

Total surplus for the year 70,786,736 84,616,694<br />

Other comprehensive income:<br />

Revaluation surplus 248,046,360 -<br />

Total comprehensive income for the year 318,833,096 84,616,694<br />

<strong>The</strong> significant accounting policies on pages 29 to 33 <strong>and</strong> the notes on pages 34 to 43 form an integral part of the<br />

financial statements.<br />

<strong>Report</strong> of the independent auditor - pages 21 <strong>and</strong> 22.<br />

26 <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Audited</strong> <strong>Financial</strong> <strong>Statements</strong> <strong>2011</strong>

Statement of <strong>Financial</strong> Position<br />

for the year ended 31 Dec <strong>2011</strong> - Continued<br />

As at 31<br />

December<br />

Restated<br />

Note <strong>2011</strong> 2010 2009<br />

RESERVES Shs Shs Shs<br />

Accumulated surplus 460,945,200 390,158,464 315,149,189<br />

Special reserves 20,443,899 22,629,619 13,022,200<br />

Revaluation Reserve 248,046,360 - -<br />

Members funds 729,435,459 412,788,083 328,171,389<br />

REPRESENTED BY<br />

Non-current assets<br />

Property, plant <strong>and</strong> equipment 6 498,963,811 220,657,568 197,111,074<br />

Prepaid operating lease rentals 7 - - -<br />

Intangible assets 8 4,232,858 4,715,987 4,599,080<br />

Organizational performance index (OPI) 9 7,149,190 5,949,934 5,850,000<br />

Investment in MUA 10 82,208,576 14,271,283 -<br />

592,554,435 245,594,772 207,560,154<br />

Current assets<br />

Trade <strong>and</strong> other receivables 11 320,032,268 265,036,322 174,816,607<br />

Cash <strong>and</strong> cash equivalents 12 11,478,794 48,788,734 57,045,776<br />

331,511,062 313,825,056 231,862,383<br />

Current liabilities<br />

Trade <strong>and</strong> other payables 13 127,592,325 84,140,488 71,784,375<br />

Provisions <strong>and</strong> accruals 14 3,743,039 1,774,668 2,831,150<br />

Bank overdraft 15 63,294,674 60,716,589 36,635,623<br />

194,630,038 146,631,745 111,251,148<br />

Net current assets 136,881,024 167,193,311 120,611,235<br />

729,435,459 412,788,083 328,171,389<br />

<strong>The</strong> financial statements on pages 7 to 23 were authorised for issue by the Board of Directors on<br />

______________________2012 <strong>and</strong> were signed on its behalf by:<br />

_____________________<br />

COUNCIL MEMBER<br />

___________________<br />

COUNCIL MEMBER<br />

<strong>The</strong> significant accounting policies on pages 29 to 33 <strong>and</strong> the notes on pages 34 to 43 form an integral part of the<br />

financial statements.<br />

<strong>Report</strong> of the independent auditor - pages 21 <strong>and</strong> 22.<br />