Telco 2020 â How Telcos transform for the ... - Roland Berger

Telco 2020 â How Telcos transform for the ... - Roland Berger

Telco 2020 â How Telcos transform for the ... - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

<strong>Telco</strong> <strong>2020</strong> – <strong>How</strong> <strong>Telco</strong>s <strong>trans<strong>for</strong>m</strong> <strong>for</strong> <strong>the</strong> "Smartphone Society"<br />

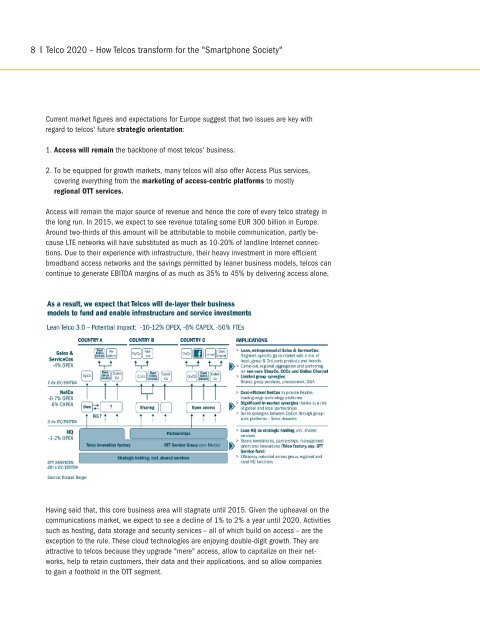

Current market figures and expectations <strong>for</strong> Europe suggest that two issues are key with<br />

regard to telcos' future strategic orientation:<br />

1. Access will remain <strong>the</strong> backbone of most telcos' business.<br />

2. To be equipped <strong>for</strong> growth markets, many telcos will also offer Access Plus services,<br />

covering everything from <strong>the</strong> marketing of access-centric plat<strong>for</strong>ms to mostly<br />

regional OTT services.<br />

Access will remain <strong>the</strong> major source of revenue and hence <strong>the</strong> core of every telco strategy in<br />

<strong>the</strong> long run. In 2015, we expect to see revenue totaling some EUR 300 billion in Europe.<br />

Around two-thirds of this amount will be attributable to mobile communication, partly because<br />

LTE networks will have substituted as much as 10-20% of landline Internet connections.<br />

Due to <strong>the</strong>ir experience with infrastructure, <strong>the</strong>ir heavy investment in more efficient<br />

broadband access networks and <strong>the</strong> savings permitted by leaner business models, telcos can<br />

continue to generate EBITDA margins of as much as 35% to 45% by delivering access alone.<br />

Having said that, this core business area will stagnate until 2015. Given <strong>the</strong> upheaval on <strong>the</strong><br />

communications market, we expect to see a decline of 1% to 2% a year until <strong>2020</strong>. Activities<br />

such as hosting, data storage and security services – all of which build on access – are <strong>the</strong><br />

exception to <strong>the</strong> rule. These cloud technologies are enjoying double-digit growth. They are<br />

attractive to telcos because <strong>the</strong>y upgrade "mere" access, allow to capitalize on <strong>the</strong>ir networks,<br />

help to retain customers, <strong>the</strong>ir data and <strong>the</strong>ir applications, and so allow companies<br />

to gain a foothold in <strong>the</strong> OTT segment.