Workstation Calculation Guide - Morningstar

Workstation Calculation Guide - Morningstar

Workstation Calculation Guide - Morningstar

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Introduction<br />

All descriptions, formulae and examples utilize a Reinvested Income Price Series (RIPs) rather<br />

than the fund or indices pricing series. This is because RIPs are an aggregation of prices,<br />

income, splits and other corporate actions thus allowing fair and easy comparison between funds<br />

and indices.<br />

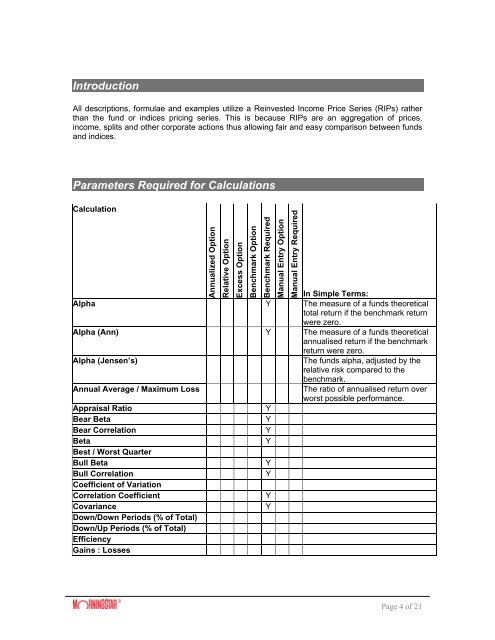

Parameters Required for <strong>Calculation</strong>s<br />

<strong>Calculation</strong><br />

Annualized Option<br />

Relative Option<br />

Excess Option<br />

Benchmark Option<br />

In Simple Terms:<br />

Alpha Y The measure of a funds theoretical<br />

total return if the benchmark return<br />

were zero.<br />

Alpha (Ann) Y The measure of a funds theoretical<br />

annualised return if the benchmark<br />

return were zero.<br />

Alpha (Jensen’s)<br />

The funds alpha, adjusted by the<br />

relative risk compared to the<br />

benchmark.<br />

Annual Average / Maximum Loss<br />

The ratio of annualised return over<br />

worst possible performance.<br />

Appraisal Ratio Y<br />

Bear Beta Y<br />

Bear Correlation Y<br />

Beta Y<br />

Best / Worst Quarter<br />

Bull Beta Y<br />

Bull Correlation Y<br />

Coefficient of Variation<br />

Correlation Coefficient Y<br />

Covariance Y<br />

Down/Down Periods (% of Total)<br />

Down/Up Periods (% of Total)<br />

Efficiency<br />

Gains : Losses<br />

Benchmark Required<br />

Manual Entry Option<br />

Manual Entry Required<br />

Page 4 of 21