Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Issue</strong> 1 | march 2013<br />

privatedebtinvestor.com<br />

GSO’s headquarters,<br />

345 Park Avenue, NYC<br />

FROM NYC<br />

TO LONDON<br />

WHY GSO SEES<br />

OPPORTUNITY<br />

IN EUROPE<br />

THE LONG ROAD TO CLOSING<br />

The fundraising challenge<br />

LEVERAGED FINANCE<br />

A tale of two markets<br />

WHEN THE MUSIC’S OVER<br />

Hilco to HMV’s rescue?<br />

PLUS: the Transatlantic divide | Funds of debt funds | Debt in the Dell deal<br />

Fund structures | and more...

FOR THE WORLD’S PRIVATE EQUITY MARKETS<br />

Read, trusted and acted on by<br />

the world’s most successful private<br />

equity professionals<br />

Comprising a monthly magazine, an industry-leading<br />

website and daily email news alerts, Private Equity<br />

International provides the insights you need to stay<br />

one step ahead of the competition.<br />

Not just news...news analysis<br />

We tell you what’s going on, why<br />

it matters, and how it could<br />

affect your investment strategy.<br />

Privately Speaking<br />

Up close and personal with the<br />

world’s private equity thought<br />

leaders.<br />

Country reports<br />

We examine in meticulous detail<br />

the state of play for private<br />

equity country by country.<br />

On the record<br />

Private equity practitioners give<br />

their views on the hot topics of<br />

the day.<br />

Intelligence on LP appetites<br />

and allocations<br />

What LPs are looking for, what<br />

they avoid, and how they<br />

allocate their assets.<br />

Breaking news<br />

News alerts keeping you on top<br />

of events as they happen.<br />

“I read PEI regularly as it focuses on insightful<br />

aspects of our business on a global basis – the<br />

interviews are excellent, the updates are<br />

timely, the articles are thoughtful. It is a must<br />

read publication in this industry.”<br />

Mounir Guen, MVision Private Equity Advisers<br />

For more information<br />

and to subscribe:<br />

Visit<br />

www.peimedia.com/pei<br />

Call<br />

+1 212 645 1919<br />

+44 (0)20 7566 5444<br />

Email<br />

subscriptions@peimedia.com

editorial comment<br />

Private Debt Investor: march 2013<br />

The new debt paradigm<br />

ISSN 2051-8439<br />

<strong>Issue</strong> 1 | march 2013<br />

Editor, Private Debt Investor<br />

Oliver Smiddy<br />

Tel: +44 20 7566 4281<br />

Oliver.s@peimedia.com<br />

Contributors<br />

Magda Ali<br />

Bruno Alves<br />

Evelyn Lee<br />

Robin Marriott<br />

David Rothnie<br />

Editorial Director<br />

Philip Borel<br />

Tel: +44 207566 5434<br />

Philip.b@peimedia.com<br />

Advertising Manager<br />

Beth Piercy<br />

Tel: +44 20 7566 5464<br />

beth.p@peimedia.com<br />

Publishing Director<br />

Paul McLean<br />

Tel: +44 20 7566 5456<br />

paul.m@peimedia.com<br />

Head of Production<br />

Tian Mullarkey<br />

Tel: +44 20 7566 5436<br />

tian.m@peimedia.com<br />

Production and Design Manager<br />

Miriam Vysna<br />

Tel: +44 20 7566 5433<br />

miriam.v@peimedia.com<br />

Group Managing Director<br />

Tim McLoughlin<br />

Tel: +44 20 7566 4276<br />

tim.m@peimedia.com<br />

Co-founders<br />

David Hawkins, Richard O’Donohoe<br />

david.h@peimedia.com<br />

richard.o@peimedia.com<br />

Deputy Director Conferences<br />

Nicholas Lockley<br />

Tel: +44 20 7566 5450<br />

Nicholas.l@peimedia.com<br />

Research and Analytics<br />

Dan Gunner<br />

Tel: +44 20 7566 5423<br />

Dan.g@peimedia.com<br />

Subscriptions<br />

Fran Hobson (London) +44 20 7566 5444<br />

Jill Garitta (New York) +1 212 645 1919<br />

Ryan Ng (Hong Kong) +852 2153 3140<br />

© PEI 2013<br />

No statement in this magazine is to be construed as a<br />

recommendation to buy or sell securities. Neither this<br />

publication nor any part of it may be reproduced or<br />

transmitted in any form or by any means, electronic or<br />

mechanical, including photocopying, recording, or by any<br />

information storage or retrieval system, without the prior<br />

permission of the publisher. Whilst every effort has been<br />

made to ensure its accuracy, the publisher and contributors<br />

accept no responsibility for the accuracy of the content in<br />

this magazine. Readers should also be aware that external<br />

contributors may represent firms that may have an interest<br />

in companies and/or their securities mentioned in their<br />

contributions herein.<br />

Dear Reader,<br />

Welcome to Private Debt Investor.<br />

The debt markets are going<br />

through fundamental structural<br />

changes. Investment banks are<br />

responding to regulatory and<br />

political pressures with greater<br />

circumspection. The role they<br />

play in the markets is changing,<br />

and the volume of debt they’re<br />

able to provide is reduced, at least<br />

for the moment, as they endeavour<br />

to delever.<br />

The departure from the European<br />

market of most current<br />

CLOs over the next year or so<br />

also leaves a sizeable hole.<br />

Yet demand for debt still exists,<br />

from investors as well as the end<br />

users. Private equity, real estate, and infrastructure<br />

sponsors still have sizeable amounts of equity to<br />

deploy, but they need debt to underwrite their<br />

deals.<br />

Into this breach steps a new breed of credit<br />

supplier. A geographically, structurally and strategically<br />

diverse array of private debt providers<br />

are poised to capitalise on the dislocation in the<br />

credit markets.<br />

We believe that this cohort of managers,<br />

together with the advisory community and investors<br />

in their products, needs a publication focused<br />

on their world. We also think investment banking<br />

professionals should take an interest in how the<br />

new players interact with the established credit<br />

ecosystem. Just look at the role Microsoft is playing<br />

in the buyout of Dell, committing $2 billion<br />

in debt to complement a ‘traditional’ senior debt<br />

package from four banks (page 8).<br />

Many in this rapidly evolving industry began<br />

their careers in banking. Our keynote interviewee,<br />

GSO’s Tripp Smith, served his apprenticeship at<br />

DLJ during the mid-1980s (together with his<br />

“A GEOGRAPHICALLY,<br />

STRUCTURALLY AND<br />

STRATEGICALLY<br />

DIVERSE ARRAY<br />

OF PROVIDERS<br />

ARE POISED TO<br />

CAPITALISE ON THE<br />

DISLOCATION”<br />

co-founders at GSO). His current<br />

firm is further along the road than<br />

most, having been launched in 2005.<br />

It’s now the second biggest part of<br />

The Blackstone Group by assets<br />

under management. Turn to page<br />

22 to read about the development<br />

of a private debt powerhouse.<br />

We also chart the challenges facing<br />

managers on the fundraising trail<br />

(page 28), and talk through typical<br />

fund structures and terms (page 32).<br />

A key theme this month is the<br />

schism between the European and<br />

North American markets. Nowhere<br />

is this more pronounced than in the<br />

CLO industry, although there are<br />

promising signs of resurgence in<br />

Europe (page 10). From a leveraged<br />

finance perspective, the US continues to lead the<br />

way in issuance, as we discuss on page 34.<br />

Tracking the ever more diverse group of debt<br />

professionals out there and giving them a forum<br />

for debate is one of our key objectives. We’ll be<br />

hosting a dedicated conference, The Capital Structure<br />

Forum 2013, in London this July which we<br />

encourage you to attend. And our website, www.<br />

privatedebtinvestor.com, will bring you breaking<br />

news of deals, fundraising and people moves as<br />

they happen, together with analysis and commentary.<br />

We hope you enjoy the magazine, and<br />

welcome your feedback.<br />

Happy reading,<br />

Oliver Smiddy<br />

Editor<br />

What do you think?<br />

Have your say<br />

e: oliver.s@peimedia.com<br />

March 2013 | Private Debt Investor 1

Private Debt Investor: march 2013<br />

contents<br />

8 Debt in the Dell deal<br />

22 GSO’s European push<br />

28<br />

Fundraising<br />

NEWS ANALYSIS<br />

features<br />

comment<br />

4 The two-minute month<br />

The biggest stories in private debt<br />

from around the globe.<br />

8 Does the Dell deal<br />

smack of déjà vu?<br />

What does the debt underpinning<br />

Silver Lake’s $24bn bid say about<br />

the availability of credit today?<br />

10 CLOs: the Transatlantic<br />

divide<br />

The appearance of several new<br />

CLOs suggests there’s hope for<br />

the ailing European market yet.<br />

12 A forest of new funds<br />

Growth in the private debt market<br />

is driving demand from investors<br />

for funds of funds. But can the<br />

metric work?<br />

20 Termsheet<br />

The collapse of HMV, and<br />

its potential rescue from<br />

administration by distressed debt<br />

investor Hilco.<br />

22 Capital Talk<br />

GSO Capital Partners’ co-founder<br />

Tripp Smith explains why the firm is<br />

bullish on Europe<br />

32 The shape of things<br />

to come<br />

Weil Gotshal’s James Gee maps out<br />

the different structures and terms in<br />

use by private debt providers.<br />

34 Leveraged Finance:<br />

A tale of two markets<br />

A review of trends in the<br />

leveraged finance markets on<br />

both sides of the Atlantic.<br />

1 Editor’s Letter<br />

14 The Lawyer<br />

Ashurst banking partner Mark<br />

Vickers warns managers must heed<br />

the lessons of the past<br />

15 The Advisor<br />

Ross Hostetter and Ryan McNelley<br />

of Duff & Phelps discuss the<br />

valuation of debt products.<br />

36 The Investor<br />

Gregg Disdale of Towers Watson<br />

reveals what investors are looking<br />

for when debt funds pitch.<br />

44 The Last Word<br />

Private debt is the most interesting<br />

area for Partners Group, explains<br />

René Bider.<br />

Book excerpt<br />

17 Investing in Private Debt<br />

ICG’s Max Mitchell maps out the<br />

private debt opportunity.<br />

Special report<br />

28 Fundraising: The long<br />

road to closing<br />

The challenges facing new and<br />

existing managers seeking to raise<br />

capital.<br />

data<br />

38 Data Room<br />

Private debt funds in market,<br />

sponsor-backed public offerings,<br />

leveraged loan and high yield bond<br />

markets data.<br />

2<br />

Private Debt Investor | March 2013

3<br />

O N L I N E<br />

USERS<br />

FOR THE PRICE<br />

OF ONE<br />

£995 | $1,695 | €1,165<br />

SPECIAL OFFER<br />

Subscribe to Private Debt Investor by Friday March 29, 2013, and receive<br />

2 additional online users with your subscription at a special price<br />

Subscribe online today at:<br />

www.peimedia.com/pdimulti<br />

Or contact our subscriptions team via email at subscriptions@peimedia.com,<br />

or call on +44 (0) 20 7566 5444 | +1 212645 1919 (ext 115)

News<br />

two minute month<br />

Private Debt Investor | march 2013<br />

REFINANCING<br />

UK bond market tapped<br />

for HS1 refinancing<br />

The Channel Tunnel Rail Link - known as<br />

HS1 – has completed a £1.6 billion (€1.9<br />

billion; $2.5 billion) refinancing of the £1.3<br />

billion of bank debt that was deployed<br />

when Canadian institutional investors<br />

Borealis and Ontario Teachers Pension<br />

Plan (OTPP) paid £2.1 billion to acquire a<br />

30-year concession to own and operate the<br />

UK high-speed rail line in November 2010.<br />

HS1 was able to raise £760 million in<br />

the UK bond market – well in excess of<br />

a target amount of £455 million. Other<br />

funding was raised from a US private placement<br />

last year and a new bank facility. The<br />

new debt structure will amortise over the<br />

life of the concession.<br />

“Market conditions and the fact that<br />

HS1 is low risk, good quality high-performing<br />

infrastructure has meant our<br />

proposition has been very well received,”<br />

said HS1 chief financial officer Graeme<br />

Thompson in a statement.<br />

Banks involved in the bond issue<br />

included BNP Paribas, Lloyds, RBS, NAB<br />

Borealis and OTPP raised £760m in bonds to refinance the Channel Tunnel rail link<br />

and Scotiabank. Export Development<br />

Bank of Canada participated in the bank<br />

facilities.<br />

HS1 connects St Pancras International<br />

station in central London with the UK<br />

entrance to the Channel Tunnel, linking the<br />

UK to the European high-speed network<br />

with direct routes from London to Paris,<br />

Lille, Brussels and beyond.<br />

In paying £2.1 billion for HS1 in<br />

November 2010, Borealis – the investment<br />

arm of Ontario Municipal Employees<br />

Retirement System – and OTPP exceeded<br />

the UK government’s expectations of raising<br />

between £1.5 billion and £2.0 billion.<br />

The Canadian pairing beat off competition<br />

from three other consortia led by Eurotunnel,<br />

Morgan Stanley and Allianz.<br />

PROJECT FINANCE<br />

‘Shadow banking’ could<br />

lead to a credit bubble<br />

Standard & Poor’s (S&P) estimates private<br />

debt sources – what it calls ‘shadow banking’<br />

– can provide up to $25bn of project<br />

finance loans this year. The rating agency<br />

reported one-quarter of all project finance<br />

lending last year in the US came from institutional<br />

investor-fuelled alternative debt<br />

sources, almost as much as the amount of<br />

project finance debt raised from the public<br />

bond markets. The ratings agency added<br />

that Europe, the Middle East, Africa and<br />

Asia Pacific were following a similar trend.<br />

S&P argues banks will continue to be the<br />

dominant force in infrastructure financing,<br />

although it predicts that regulatory<br />

pressure on banks combined with yieldhungry<br />

institutional investors will continue<br />

to boost the private infrastructure debt<br />

market.<br />

PEOPLE<br />

ICG builds team for debut<br />

US fund<br />

UK-listed ICG is working to put together<br />

its first US-focused private debt fund. In<br />

so doing, the firm is also building up its<br />

US team headed by former Blackstone<br />

mezzanine executive Sal Gentile. Several<br />

sources who have had recent conversations<br />

with the firm said Gentile, who ICG officially<br />

announced hiring in December, is<br />

hiring additional people to work in the<br />

New York office, including an investor<br />

relations professional to help with the<br />

fundraising.<br />

FUNDRAISING<br />

Canadian debt fund<br />

concludes maiden<br />

fundraising<br />

Greypoint Capital has held a final close<br />

for its maiden fundraising. The fund, which<br />

4<br />

Private Debt Investor | March 2013

News<br />

had a target of $200 million, closed on an<br />

undisclosed amount according to a statement.<br />

Founder Holly Allen launched the<br />

process last March, having conducted premarketing<br />

with a select group of investors<br />

with whom she had worked in the past.<br />

Greypoint’s LP base comprises family<br />

offices, high net worth individuals, small<br />

pension funds and foundations, a source<br />

said. The fund will provide senior debt<br />

facilities, stretch senior debt, second lien,<br />

mezzanine, acquisition facilities and other<br />

debt products to Canadian companies with<br />

enterprise values in the $100 million to<br />

$1.5 billion range, and which have strong<br />

real estate or fixed asset holdings, or commercial<br />

real estate businesses.<br />

REFINANCING<br />

Brookfield refinances<br />

Washington office<br />

Mesa West Capital has provided Brookfield<br />

Asset Management with a nearly $100<br />

million loan to refinance a Washington<br />

DC office property that the global asset<br />

manager has owned for almost 10 years.<br />

According to a statement from the Los<br />

Angeles-based real estate lender, Mesa<br />

West furnished Brookfield Real Estate<br />

Opportunity Fund I with a $95.5 million<br />

first mortgage loan against 64 New York<br />

Avenue NE in Washington DC. A spokesman<br />

noted that the firm provided the<br />

financing on behalf of its Mesa West Real<br />

Estate Income Fund II, which closed on<br />

$615 million in 2010.<br />

PEOPLE<br />

Carlton Group builds<br />

presence in Frankfurt with<br />

senior hire<br />

The Carlton Group has appointed Fernando<br />

Salazar as head of its real estate<br />

investment banking division in Frankfurt.<br />

He will be responsible for originating and<br />

closing new deals on behalf of financial<br />

institutions and borrowers, as well as<br />

establishing the new office. Prior to joining<br />

Carlton Group Salazar, who holds dual<br />

German and Spanish citizenship, was head<br />

of real estate and commercial banking at<br />

Eurohypo from 2006 to 2010 and has<br />

been in the banking business for the last<br />

30 years. He has been heavily involved in<br />

more than $10 billion of loan originations<br />

and restructurings.<br />

FUNDRAISING<br />

Gávea raises R$1bn credit<br />

fund<br />

Christ the Redeemer in Rio<br />

Gávea Investimentos has raised R$1 billion<br />

(€372 million; $503 million) for its<br />

Crédito Estruturado FIDC fund, falling<br />

short of the R$1.25 billion target it had<br />

set in the vehicle’s prospectus, according<br />

to a Valor Economico report. Crédito<br />

Estruturado FIDC will provide longterm<br />

debt financing to Brazilian private<br />

companies, addressing “the deficiency of<br />

long-term lending from private sector<br />

entities in Brazil, which exposes many<br />

strong companies to refinancing risks<br />

and reduces their efficiency and competitiveness”,<br />

according to an International<br />

Finance Corporation release. The IFC has<br />

committed $29 million to the fund.<br />

➥<br />

march 2013<br />

the data<br />

$55bn<br />

The amount of new CLOs issued in the US<br />

in 2012<br />

$9.9bn<br />

US CLO issuance in January 2013<br />

174<br />

The number of private debt funds currently<br />

in market<br />

$24.4bn<br />

The value of Silver Lake’s offer for Dell<br />

4<br />

The number of investment banks<br />

underwriting the debt for the deal<br />

-141%<br />

HMV’s total debt to equity ratio for the<br />

2012 financial year.<br />

$56.4bn<br />

GSO’s AUM at year end 2012<br />

¥50bn<br />

Shanghai International Group’s fundraising<br />

target for its Sailing Capital International<br />

private debt<br />

March 2013 | Private Debt Investor 5

News: analysis<br />

march 2013<br />

Said and done<br />

“Imagine you’re a VP<br />

at a private equity<br />

firm. You take a deal<br />

to a partner, and<br />

not only do you<br />

pitch that you’ll<br />

finance it with a<br />

debt instrument<br />

he’s never heard of,<br />

but you’re going to<br />

source it from a firm<br />

he’s never heard of<br />

either. It’s a tough<br />

sell.”<br />

A London-based private debt<br />

fund manager reveals there’s still<br />

work to do to educate sponsors<br />

about the asset class.<br />

“They should<br />

probably change the<br />

name. They’re bonds,<br />

and they provide<br />

yield, but the ‘high’<br />

bit isn’t necessarily<br />

appropriate these<br />

days.”<br />

An experienced debt lawyer<br />

suggests the high yield market isn’t<br />

quite what it’s cracked up to be.<br />

“If you pitched a £10<br />

billion take-private<br />

now, you wouldn’t<br />

be viewed as barking<br />

mad. Three months<br />

ago you’d have been<br />

laughed out of<br />

town.”<br />

A senior banking source admits the<br />

Dell and Virgin deals have changed<br />

market perceptions of big buyout<br />

financing.<br />

Affinity Water benefitted from a £95m direct loan<br />

Cornerstone<br />

from USS<br />

seals first UK deal since Laxfield tie-up<br />

REFINANCING<br />

USS lends to Infracapital/<br />

Morgan Stanley water firm<br />

The UK’s second-largest pension fund,<br />

Universities Superannuation Scheme<br />

(USS), has provided £95 million (€110<br />

million; $150 million) of 20-year class<br />

B inflation-linked financing to UK water<br />

firm Affinity Water. The borrower, Affinity<br />

Water, is owned by Infracapital Partners<br />

and Morgan Stanley, which acquired the<br />

company last summer for £1.24 billion<br />

from French firm Veolia Environnement.<br />

The deal was made through a private<br />

placement, USS said. Affinity Water has<br />

issued £480 million of bonds as part of its<br />

recently implemented £2.5 billion multicurrency<br />

bond programme.<br />

PEOPLE<br />

Goldman pair join former<br />

colleague at CVC<br />

Steve Hickey, chief risk officer at CVC<br />

Credit Partners (CVCCP), has lured two<br />

former colleagues from investment bank<br />

Goldman Sachs, the firm confirmed in<br />

a statement. Mark DeNatale and Scott<br />

Bynum have joined their former colleague<br />

Hickey, who moved to the debt arm of<br />

buyout firm CVC Capital Partners from<br />

Goldman in April last year. CVCCP was<br />

launched as CVC Cordatus in 2006 and<br />

has since expanded significantly. Last year,<br />

CVC Capital Partners sold a 10 percent<br />

stake in itself to a trio of sovereign wealth<br />

funds, proceeds from which were used<br />

in past to expand the credit business. It<br />

also announced a tie-up with US manager<br />

Resource America to combine Apidos<br />

Capital Management with CVC Cordatus<br />

last June.<br />

PROJECT FINANCE<br />

Ageas helps fund €300m<br />

French prisons PPP<br />

The insurance company is providing a<br />

30-year, fixed rate tranche as part of a<br />

€100m loan put together by Natixis for a<br />

French prison’s PPP. The deal is the first<br />

from a €2bn debt partnership between<br />

the French bank and Ageas, signed last<br />

October. The partnership between Belgian<br />

insurance company Ageas and French bank<br />

Natixis has yielded its first deal – a €100<br />

million loan to help fund three French<br />

prisons. Natixis acted as mandated lead<br />

arranger, hedging bank, agent, and account<br />

bank on a €300 million public-private<br />

partnership (PPP) to build three prisons<br />

in Valence, Riom and Lutterbach with a<br />

combined capacity for 1,742 inmates. The<br />

project sponsor is a consortium of fund<br />

managers Barclays Infrastructure Funds<br />

and FIDEPP together with French developer<br />

Spie Batignolles and prisons expert<br />

GEPSA, a GDF Suez subsidiary.<br />

how hilco might<br />

rescue hmv<br />

Termsheet, p.20<br />

6<br />

Private Debt Investor | March 2013

The widest coverage of real-time intelligence<br />

and data, with comprehensive analysis for<br />

financial professionals in the distressed debt<br />

and leveraged finance markets.<br />

Debtwire is an invaluable resource that provides<br />

timely reporting and enables me to not only keep up<br />

on news regarding my clients but also generate new<br />

business leads. Quinn Emanuel Urquhart & Sullivan, LLP<br />

www.debtwire.com<br />

For more information or to inquire about a trial please call:<br />

Europe and EEMEA:<br />

+44 (0)20 7059 6113<br />

Americas:<br />

+1 212-686-5374<br />

Asia Pacific:<br />

+65 6349 8060

News analysis<br />

buyouts<br />

Does the Dell deal<br />

smack of déjà vu?<br />

Silver Lake set a new post-crisis benchmark with its audacious $24.4 billion offer for PC manufacturer<br />

Dell last month. But does the deal presage a return to the highly-levered excesses of the pre-Lehman<br />

buyout bubble, asks Oliver Smiddy<br />

“Oh my God, it’s 2006 all over again.” That<br />

was the reaction of one Private Debt Investor<br />

colleague to the news of Silver Lake’s<br />

audacious bid for PC manufacturer Dell<br />

last month. And while it’s too early to call<br />

the return of the so-called mega-buyout,<br />

the numbers involved – particularly on the<br />

debt side – are redolent of the heady days<br />

of the private equity’s ‘golden era’ where<br />

debt was cheap, plentiful, and de rigeur.<br />

Silver Lake’s $13.65 per share offer, worth<br />

$24.4 billion in total, would be the biggest<br />

take-private by a private equity firm in the<br />

post-Lehman era if it completes.<br />

Silver Lake doesn’t wont for firepower –<br />

it’s still raising its latest buyout vehicle, which<br />

has already gone past the $7 billion mark on<br />

the way to its $7.5 billion target. But it’s no<br />

buyout behemoth in the Blackstone or KKR<br />

mould, and the key to this deal is a hefty debt<br />

package, including a sizeable $2 billion cheque<br />

from an unlikely source.<br />

First, the traditional lenders: BofA Merrill<br />

Lynch, Barclays, Credit Suisse and RBC Capital<br />

Markets have provided debt financing to<br />

support the buyout, Dell said. That includes<br />

$4 billion in ‘B’ term loans, $1.5 billion of<br />

‘C’ term loans and a bridge of about $3.25<br />

billion. The latter could well be refinanced<br />

via the European high yield bond market,<br />

sources suggest. Existing debt is being rolled<br />

over, Dell’s spokesman added.<br />

But a key component to the deal is a $2<br />

billion loan from technology giant Microsoft,<br />

reportedly in the form of a mezzanine tranche<br />

or other convertible loan instrument. Such<br />

a loan would rank amongst the largest mezzanine<br />

deals ever, sources suggested.<br />

Michael Dell - $4.5bn of skin in the game<br />

“The US debt markets are extremely liquid<br />

at the moment, sufficient to make a deal like this<br />

possible,” commented a senior North American<br />

banker interviewed by Private Debt Investor.<br />

Interest rates in the US have also made<br />

senior bank debt highly attractive, while Dell’s<br />

sizeable cash surplus allows it to support a<br />

significant debt burden with relative comfort.<br />

“Across the marketplace, you’re seeing<br />

increased availability of leverage,” another<br />

industry source said. “That’s driven by the cost<br />

of leverage and a search for yield across the<br />

capital structure.”<br />

The buoyant US CLO market means there’s<br />

no shortage of appetite for leveraged loans, suggesting<br />

the banking quartet should be able to<br />

syndicate the debt package with relative ease.<br />

The last piece of the capital structure<br />

jigsaw is about $4.5 billion in equity from<br />

company founder Michael Dell. So this is<br />

no Barbarians at the Gate scenario – it’s<br />

very much a consensual process, although<br />

an upwelling of shareholder opposition to<br />

the buyout could yet complicate matters.<br />

Buyout industry sources were quick to<br />

question whether the deal would herald a<br />

return to so-called mega-buyouts however.<br />

“The size of the deal is not a trend. It’s very<br />

specific to this deal,” one senior US private<br />

equity figure remarked. “You have an owner<br />

with a massive amount of money he can roll<br />

over, and there’s the Microsoft connection, so<br />

that’s the opportunity.”<br />

“The credit markets have been very accommodating<br />

for some time and there was already<br />

a general perception that you could do a very<br />

large deal at frankly quite attractive average rates<br />

in the credit markets,” said Blackstone Group<br />

president Tony James during an earnings call last<br />

month. “Dell doesn’t really move that needle<br />

because they have a lot of investment grade debt<br />

that’s assumable. You can certainly do a deal well<br />

above $10 billion in the credit markets if it made<br />

economic sense to the equity.”<br />

News of a $28 billion joint bid by Warren<br />

Buffett’s Berkshire Hathaway and 3G Capital<br />

for New York-listed H.J. Heinz, and a mooted<br />

€3.5 billion secondary buyout of French catering<br />

company Elior as we went to press suggests<br />

that others apparently agree. n<br />

8<br />

Private Debt Investor | March 2013

WHERE EQUITY AND CREDIT<br />

COME TOGETHER<br />

S&P Capital IQ combines two of our strongest<br />

brands – S&P, with its long history and experience<br />

in the financial markets and Capital IQ, which is<br />

known among professionals globally for its accurate<br />

financial information and powerful analytical tools.<br />

Contact<br />

www.spcapitaliq.com<br />

emea-marketing@spcapitaliq.com<br />

+44 (0)20 7176 1233<br />

S&P Capital IQ provides multi-asset class data, research<br />

and analytics to private equity firms around the world. We<br />

offer a broad suite of capabilities designed to help assess<br />

rated & unrated entities, monitor your universe, identify<br />

new investment opportunities and perform risk analysis.<br />

The analyses, including ratings, of Standard & Poor’s and its<br />

affiliates are statements of opinion as of the date they are<br />

expressed and not statements of fact or recommendations to<br />

purchase, hold, or sell any securities or make any investment<br />

decisions. Users of ratings or other analyses should not rely<br />

on them in making any investment decision. Standard &<br />

Poor’s opinions and analyses do not address the suitability of<br />

any security. Standard & Poor’s does not act as a fiduciary or<br />

an investment advisor except where registered as such.<br />

Copyright (c) 2013 by Standard & Poor’s Financial <strong>Services</strong><br />

LLC (S&P), a subsidiary of The McGraw-Hill Companies, Inc. All<br />

rights reserved. STANDARD & POOR’S and S&P are registered<br />

trademarks of Standard & Poor’s Financial <strong>Services</strong> LLC.<br />

CAPITAL IQ is a registered trademark of Capital IQ.

News analysis<br />

Structured credit<br />

CLOs: the transatlantic divide<br />

The contrast between the thriving CLO industry in the US and its ailing<br />

European counterpart could not be more stark. Yet the appearance of a<br />

handful of new-issue European CLOs suggests a tentative resurgence is<br />

taking hold, writes Magda Ali<br />

In the US, January was the busiest month<br />

for CLO issuance since November 2007,<br />

with $9.9 billion of funds issued, according<br />

to JPMorgan data. And in Europe? Virtually<br />

nothing. It’s been a similar story since the<br />

credit crisis, with only a two new European<br />

CLOs formed in the post-Lehman<br />

era – one from European Capital marketed<br />

by Deutsche Bank in 2011, and the<br />

second by ICG Group in 2012, according<br />

to Bloomberg.<br />

In Europe, around €70 billion of CLOs<br />

were used to underpin many private equity<br />

deals prior to the financial crisis, but most<br />

are now coming to the end of their five to<br />

seven year lives. The departure of those<br />

CLOs from the market will leave a big hole<br />

in the continent’s credit supply, given the<br />

lack of new issuance.<br />

All that could be set to change, however.<br />

UK-based credit asset manager Cairn<br />

Capital, for instance, is poised to launch<br />

a new CLO in partnership with Credit<br />

Suisse. Many in Europe will be watching<br />

eagerly to see both how it is received by<br />

the market, and how it is structured.<br />

But why the disparity between the US<br />

and European CLO markets?<br />

“CLOs have offered investors strong relative<br />

value. The market has been resilient,<br />

“The biggest problem<br />

is supply. There aren’t<br />

enough deals to get<br />

a CLO running”<br />

Sucheet Gupte<br />

providing investors with 17 percent cash<br />

returns on average,” explains Steven Miller,<br />

analyst at S&P Capital IQ. “In 2012, $55<br />

billion of new CLOs were issued in the<br />

US, more than the total combined issuances<br />

between 2008 and 2011. The market<br />

could top $90 billion if the fourth quarter<br />

run-rate holds up [this year].”<br />

In Europe, however, there are significant<br />

structural and economic reasons for the<br />

withering of the CLO industry.<br />

First, there is the regulatory environment.<br />

Many cite the onerous ‘skin in the<br />

game’ requirements for European CLOs,<br />

which requires mandating managers (the<br />

originator, sponsor or original lender) of<br />

CLOs to hold an economic interest equivalent<br />

to five percent of the total value of<br />

the fund or securitisation. Cairn is getting<br />

round this cleverly, holding the five percent<br />

in a managed credit fund which will act as<br />

counterparty to the total return swap with<br />

Credit Suisse, someone with knowledge of<br />

the deal told Private Debt Investor.<br />

Some are confronting the issue headon,<br />

lobbying regulators for a removal of<br />

stringent risk retention rules.<br />

Nicholas Voisey, director at the Loan<br />

Market Association (LMA), tells Private<br />

Debt Investor: “There are two main reasons<br />

why there has been virtually no issuance of<br />

CLOs in Europe. Firstly, market conditions<br />

have been unfavourable and secondly, regulatory<br />

risk retention requirements arising<br />

from the European Capital Requirements<br />

Directive 2 are largely prohibitive.”<br />

“If CLO managers were able to raise<br />

cheap money, they would do it,” explains<br />

Simon Gleeson, partner at law firm Clifford<br />

Chance.<br />

Voisey adds: “Most CLO managers do<br />

not have the capacity to hold the retention<br />

required however. The LMA has been<br />

in talks with regulators, seeking ways to<br />

solve the regulatory requirement so that<br />

this important source of funds, particularly<br />

to the sub-investment part of the market,<br />

can function effectively”, he says.<br />

10<br />

Private Debt Investor | March 2013

News analysis<br />

A spokesman for the European Banking<br />

Authority responds: “The CRDIV/CRR<br />

proposal currently discussed at EU level<br />

includes a mandate for the EBA to draft<br />

regulatory technical standards (RTS) on<br />

securitisation retention rules. The discussions<br />

are still ongoing and a public consultation<br />

on the RTS will be organised later<br />

this year. In this respect, it is too early to<br />

draw conclusions on what the final text<br />

will look like.”<br />

Some, like S&P Capital IQ director<br />

Sucheet Gupte, feel regulation isn’t to<br />

blame however. “Regulation is a hurdle<br />

that most people get around. I don’t see<br />

it as a hindrance for the market,” Gupte<br />

says. “Most of the large CLOs would have<br />

no problems with the risk retention rate.<br />

There just aren’t enough deals to get the<br />

CLO market moving,” he says.<br />

In order for investors to make any substantial<br />

returns from CLOs, managers are<br />

typically required to buy at least 100 loans<br />

and subsequently package them into one<br />

pool. Institutional investors buy portions<br />

of this pool, offering different payouts<br />

depending on the level of risk the investor<br />

takes.<br />

“The biggest problem is supply,” believes<br />

Gupte. “There aren’t enough deals to get<br />

a CLO running – and asset spreads have<br />

tightened for the underlying loans, so the<br />

economics are not attractive either.”<br />

Romain Cattet, partner at debt advisory<br />

group Marlborough Partners, agrees:<br />

“Though there are some encouraging signs<br />

of CLOs making a comeback, the European<br />

market is incomparable with the<br />

US market. Primarily, there isn’t yet the<br />

breadth and depth of assets in the market<br />

to allow for CLOs to ramp up quickly.”<br />

“Then, there are still issues with available<br />

leverage quantum and pricing for<br />

new vehicles. It is a mathematic exercise.<br />

A CLO’s cost of liabilities needs to be lower<br />

than the yield of the assets acquired in<br />

order for it to be profitable. Unlike in the<br />

US, the arbitrage doesn’t work quite as<br />

well as it used to in Europe.”<br />

Investors are still wary after many were<br />

burnt by the crisis. “Normally CLO debt<br />

tranches are reasonably liquid, but when<br />

you really need to get out, it’s like trying<br />

to get out of a burning house,” says James<br />

Newsome, managing partner at placement<br />

agent and consultancy Avebury Capital<br />

Partners. “At the moment, a European<br />

“The obvious providers<br />

of AAA credit have<br />

disappeared”<br />

Nick Fenn<br />

market with active CLO issuance is either<br />

two to three years away, or never coming<br />

back. In the US, it’s an artificial market created<br />

by massive intervention by the Fed. We<br />

might be seeing good deals and it might be<br />

gaining momentum but it has been falsely<br />

created. Having been through the cycles<br />

in the credit markets I am concerned<br />

that this is what securitisation of private<br />

debt through CLOs will do – provide<br />

too much funding now, distort incentives<br />

and ultimately deteriorate performance,”<br />

Newsome adds.<br />

“In the US, they’ve breathed life into the<br />

CLO model but over here it’s a different<br />

story,” says Nick Fenn, founding partner of<br />

London-based mezzanine firm Beechbrook<br />

Capital. “The obvious providers of AAA<br />

credit have disappeared, so you can’t get<br />

the leverage at the fund level you used to.<br />

It’s unclear whether there will be a new<br />

generation of CLO, though institutional<br />

fund managers are working hard to develop<br />

alternative debt structures.”<br />

That uncertainty is one reason all eyes<br />

will be on Cairn’s new vehicle. Whilst it<br />

would be overstating things to say the fate<br />

of the European CLO industry rests on<br />

the fortunes of one manager, a successful<br />

launch will certainly prove a shot in the<br />

arm to an industry that has lagged behind<br />

its US sibling for several years now.<br />

“In Europe it will be interesting to see<br />

if the new CLOs that people like Cairn are<br />

starting to market will get off the ground<br />

or not,” says a financing specialist at a large<br />

UK-based private equity firm. “A new wave<br />

of those would be good for the European<br />

market but it’s still early days and we may<br />

be a while off from heavy new CLO issuance<br />

on this side of the Atlantic.” n<br />

CAIRN UNVEILS RARE<br />

EUROPEAN CLO<br />

read more at http://goo.gl/qkwou<br />

March 2013 | Private Debt Investor 11

News: analysis<br />

funds of funds<br />

A forest of new funds<br />

Growth in the private debt market is driving demand from investors for fund of funds-type instruments to<br />

help them navigate through the thicket of new vehicles. Magda Ali looks at the challenges such a model<br />

presents, and how a handful of managers are tailoring their products in response<br />

One bellwether of a developing asset class<br />

is the presence of funds of funds targeting<br />

it. Such vehicles require not only investor<br />

demand for the manager selection services<br />

they provide, but also a deep enough pool of<br />

managers to choose from. So the launch of<br />

several funds of private debt funds in recent<br />

months is an important landmark in the<br />

development of the industry.<br />

The market for dedicated funds of private<br />

debt funds is relatively small, but is<br />

slowly gaining momentum. Fund of fund<br />

managers Golding Capital, Access Capital<br />

Partners, WP Global, and even Morgan<br />

Stanley are beginning to see a surge in<br />

investors outsourcing decision-making to<br />

managers who understand the nuances of<br />

investing in debt.<br />

One of the pioneers of funds of debt<br />

funds (FoDF) is Frankfurt-based fund manager<br />

Golding Capital. The firm currently<br />

manages more than €1.8 billion in assets,<br />

and though debt funds account for a comparatively<br />

diminutive segment of that total,<br />

its FoDF strategies are gaining traction with<br />

German investors.<br />

Poggioli: seeing increased LP appetite<br />

“The underlying growth of the asset<br />

class has led to dedicated private debt funds<br />

assuming the role banks and CLOs played<br />

in the past,” says Jeremy Golding, founding<br />

partner at Golding Capital. The increased<br />

appetite in the market for private debt will<br />

also lead to the growth of dedicated fund of<br />

(private debt) funds, and could see larger<br />

asset managers developing tailored product<br />

offerings to their investors, he adds.<br />

There is rising interest by institutional<br />

investors in the private debt asset class in<br />

general through broader credit opportunities<br />

funds, but also for specific sub-segments<br />

such as distressed debt, mezzanine or dedicated<br />

senior loan funds, explains Golding.<br />

“The ways in which to access the asset<br />

class differ by type as well as size of investor,”<br />

adds Golding. “Larger institutions invest<br />

directly into funds or even have in-house<br />

teams to do deals directly [like Allianz,<br />

which is building an infrastructure debt<br />

team]. Small to medium-sized institutions<br />

either invest directly into funds or via funds<br />

of funds; there is also a trend among these<br />

types of investors to go through individual<br />

segregated (managed) accounts.”<br />

Golding Capital currently manages a €150<br />

million fund of debt funds – smaller than<br />

some of its private equity-focused vehicles.<br />

“Overall, the market – particularly in Europe<br />

– is still relatively small. The additional layers<br />

of fees are an unattractive component of FoFs<br />

in the debt fund space. It definitely needs to<br />

be justified by market performance through<br />

better fund selection,” Golding admits.<br />

12<br />

Private Debt Investor | March 2013

News analysis<br />

“On the private equity<br />

side, the fund of funds<br />

model is dying. But with<br />

private debt funds it’s a<br />

whole new ballgame”<br />

Theo Dickens<br />

Funds of funds who allocate to the<br />

larger debt managers may end up doubling<br />

down on the same underlying debt<br />

investments because these managers are<br />

in the same deals. “The more diverse and<br />

often stronger strategies are developed by<br />

the smaller funds,” says Jeremy Newsome,<br />

managing partner at fund placement and<br />

advisory group Avebury Capital Partners.<br />

“Through the expertise gained by using FoF,<br />

and although they have initially outsourced<br />

their own decision-making to fund managers,<br />

they are able later to allocate their own<br />

internal teams to select managers.”<br />

Newsome explains: “The emphasis by<br />

private debt fund managers should be on<br />

allocating to real opportunities, and not just<br />

mega buyouts – a fund of funds in the debt<br />

space works when a big fund invests in a<br />

pool of small fund managers who then invest<br />

in companies with high growth prospects.”<br />

“There is a strong shift in demand from<br />

investors for high yielding assets,” says Theo<br />

Dickens, partner at UK-based debt fund<br />

manager Prefequity.”Fund of funds have<br />

been very heavily discussed this year and<br />

most managers are trying to figure how<br />

to extract yields, but with all the layers<br />

involved in the process, it is proving a difficult<br />

task.”<br />

Fund selection is the key skill required,<br />

explains Golding; “Volatility of fund<br />

returns is still pretty high and therefore<br />

selecting the right managers and avoiding<br />

the losers is crucial to achieving abovemarket<br />

returns.”<br />

Due to the cyclicality of credit markets,<br />

most people agree it is necessary to build<br />

a diversified and well-balanced portfolio<br />

combining different investments strategies,<br />

including senior loans, mezzanine, credit<br />

opportunities and distressed debt.<br />

“On the private equity side, the fund of<br />

funds model is dying. This is due to the fact<br />

that FoF strategies have been overplayed in<br />

the private equity space, and the numbers<br />

have reached their peak,” says Dickens. “In<br />

the private debt fund space, it’s a whole<br />

new ballgame, and with the emergence of<br />

new debt funds, we expect many investors<br />

to opt for employing a fund of fund<br />

manager to do debt selection for them.”<br />

The main question for private debt<br />

managers in the US and Europe is whether<br />

to decide on outsourcing capabilities or<br />

having dedicated teams in-house and invest<br />

directly in funds. “Dedicated fund of fund<br />

managers as well as larger asset managers<br />

need to have an established platforms, an<br />

established investor base and a proven track<br />

record [to be successful],” says Golding.<br />

Philippe Poggioli, managing partner<br />

at French fund of funds manager Access<br />

Capital Partners, says his firm had seen<br />

uptake from investors for funds that invest<br />

across mezzanine, junior and senior debt.<br />

As a result, it’s broadened the remit for its<br />

second fund of debt funds beyond the mezzanine-only<br />

strategy of its maiden 2007<br />

vehicle. “We are broadening our scope. The<br />

strategy allows us to invest across Europe.<br />

It gives us the mandate to cover larger segments<br />

of the debt market, and we are less<br />

dependent on mezzanine dealflow into this<br />

fund,” explains Poggioli.<br />

The firm secured its first commitment<br />

for its €250 million fund of debt funds this<br />

month. Addressing the issue of fees, Poggioli<br />

says that co-investing alongside the<br />

funds Access backs would allow the firm<br />

to reduce management fees and improve<br />

performance.<br />

Access Capital hopes to receive investment<br />

from institutional investors, pension<br />

funds, and insurance companies. “Our<br />

coverage is broader, and so is our target<br />

[audience]. We expect to see interest from<br />

a wider range of investors. Having a niche<br />

is really important, but so is covering a<br />

breadth of sectors and regions.”<br />

Besides traditional fund of fund structures,<br />

a trend is developing towards individual<br />

solutions such as managed accounts,<br />

where investors determine geographies and<br />

segments, and outsource decision-making<br />

regarding allocation to a fund manager.<br />

Rather than marketing a fund of funds,<br />

Morgan Stanley’s managed accounts division<br />

is looking to invest in real estaterelated<br />

debt instruments on behalf of<br />

investors. “Investors are starting to realise<br />

that now is a good time to be building<br />

debt exposure,” explains a source close to<br />

the bank. “The window to access the debt<br />

side of real estate will stay open for at least<br />

another three years,” the source adds.<br />

For an asset class that is still, relativelyspeaking,<br />

in its infancy, funds of funds<br />

could prove an attractive proposition for<br />

investors eager to access this developing<br />

opportunity. The key for the providers and<br />

managers of such funds will of course be<br />

the fee issue – structuring their products<br />

so as to still deliver attractive returns after<br />

twin layers of fees have been deducted<br />

remains the most pressing issue. n<br />

ACCESS SEALS FIRST<br />

COMMITMENT<br />

read more at http://goo.gl/RF7hH<br />

March 2013 | Private Debt Investor 13

comment<br />

LEGAL NOTES<br />

Making sense of the legals<br />

The growing pains of an<br />

innovative new market<br />

comment<br />

The burgeoning private debt<br />

funds industry faces a few<br />

hiccups, warns Ashurst partner<br />

Mark Vickers<br />

One of the prominent features of the private<br />

debt market in leveraged lending in<br />

the last 12 months has been the gathering<br />

momentum of credit funds.<br />

In 2007, European leveraged loan issuance<br />

maxed out at €220 billion; in the<br />

year just completed, new European leverage<br />

lending was a mere 12 per cent of that<br />

peak - at €27 billion.<br />

As many lenders, (in hindsight now<br />

styled ‘traditional lenders’) grapple with<br />

capital constraints, restrictive regulatory<br />

change and legacy stigmas associated with<br />

historic exposure to leveraged finance, the<br />

liquidity gap is being filled by alternative<br />

credit providers.<br />

The European high yield market has had<br />

a blistering run over the last year, fuelled<br />

by over €29 billion of inflows and below<br />

average default rates (indeed the asset class<br />

outperformed US high yield and emerging<br />

market bonds over the last 12 months).<br />

And encouragingly, the green shoots of a<br />

renaissance in the CLO market may also<br />

be emerging.<br />

However, of all the sources of alternative<br />

debt funding, it is the credit funds area<br />

which is the fastest evolving sector.<br />

The new community of credit funds is<br />

diverse – including traditional heavyweights<br />

such as ICG, Apollo, GSO, Carlyle, Oaktree,<br />

Ares, Fortress, Sankaty, Babson and Haymarket<br />

Financial among others. There are<br />

now upwards of 40 credit funds focussing<br />

on mid-market leverage finance, including<br />

Summit, Triton, Butler Capital, Prefequity,<br />

to name but a few, with new entrants entering<br />

all the time such as 3i alumni Jonathan<br />

Russell and Andrew Golding’s Spire Partners,<br />

announced last month.<br />

“A vexed question is<br />

how the new world<br />

of credit funds is likely<br />

to perform in the<br />

short term”<br />

xxxxxxxxxxxxx<br />

A vexed question is how the new world<br />

of credit funds is likely to perform in the<br />

short term, until the supply-demand equilibrium<br />

for mid-market debt comes closer<br />

into alignment. The proliferation of funds,<br />

and the paucity of good quality credits is, for<br />

the time being, making it difficult for the<br />

funds to deploy their capital. At the upper<br />

end of the mid-market the issue is being<br />

compounded by the burgeoning high yield<br />

market, and its encroachment into a domain<br />

hitherto seen as too small in terms of deal<br />

size for high yield.<br />

Alternative debt providers are seen as<br />

having a stronger appetite for risk compared<br />

to the more conservative traditional<br />

bank lenders, with a more flexible approach<br />

to the credit requirement of specific deals.<br />

The preponderance of unitranche deals for<br />

example have bullet repayments after five to<br />

eight years with covenant-lite protection.<br />

In this lean deal environment, it is difficult<br />

for new entrants with no direct track<br />

record to compete: unless a fund has an<br />

‘edge’, the competitive drivers in winning<br />

deal mandates become quantum of debt<br />

and price.<br />

There is evidence that leverage ratios<br />

are trending upwards, margins are trending<br />

downwards and covenants are becoming<br />

looser. Credit funds are not adverse to<br />

lending up to 6.75 times EBITDA in appropriate<br />

cases, whereas traditional banks are<br />

more comfortable with a senior structure<br />

typically around 4.5 times, with mezzanine<br />

taking leverage to 6.5 times. Margins on<br />

senior A were 4.5-5 percent six months ago;<br />

now 4-4.25 percent is not unusual. It is<br />

not surprising, therefore, that at least nine<br />

sizeable transactions completed in the last<br />

six months by major sponsors are looking<br />

to re-price by reducing the margins on their<br />

existing leverage loans.<br />

Competitive pressures on credit funds<br />

to do deals may in the short term nudge<br />

them to complete by stretching debt fundamentals.<br />

These are the growing pains of<br />

an assertive, dynamic and innovative market,<br />

but only the unwise would ignore the lessons<br />

of the bad behaviour of 2007. The<br />

proper pricing of risk, and not just a search<br />

for yield, is still a premium skill. n<br />

Mark Vickers is a partner in the banking department at<br />

London-headquartered law firm Ashurst, and is co-head<br />

of banking strategy.<br />

What do you think?<br />

Have your say<br />

e: oliver.s@peimedia.com<br />

14<br />

Private Debt Investor | March 2013

the ADVISOR<br />

Expert opinion on key aspects of private debt<br />

comment<br />

Illiquid debt – par for the<br />

course, or not?<br />

comment<br />

The alternatives industry may<br />

be comfortable establishing Fair<br />

Value for equity, but for debt<br />

products it’s a different story,<br />

explain Duff & Phelps executives<br />

Ross Hostetter and Ryan<br />

McNelley<br />

The economic uncertainty across the<br />

Eurozone continues to make headlines<br />

– some for posing significant challenges<br />

for Europe’s policymakers and businesses,<br />

and others for creating investing<br />

opportunities. The widely anticipated<br />

credit shortage arising from banks’<br />

shrinking balance sheets and tightening<br />

of lending standards has created an<br />

opening for new entrants in the market<br />

to fill the capital void. Not surprisingly,<br />

the alternative investment community<br />

has stepped in with a flurry of fundraising<br />

activity as it rises to the challenge.<br />

Although investing in European credit<br />

securities is hardly new ground for alternative<br />

investment fund managers, less<br />

than 10 percent of Europe’s corporate<br />

lending has historically been provided<br />

by non-bank lenders. So there will be<br />

challenges along the way as fund managers<br />

increase their exposure to this asset<br />

class. Chief among those challenges is<br />

determining Fair Value, which, even for<br />

performing debt, may not equate to par.<br />

Most alternative investment funds<br />

are required to report their investments<br />

on a Fair Value basis. Whether defined<br />

under IAS or US GAAP, the task is the<br />

same: to determine “the price that<br />

would be received to sell an asset or<br />

paid to transfer a liability in an orderly<br />

transaction between market participants<br />

at the measurement date” (as defined in<br />

IFRS 13 and in FASB ASC Topic 820).<br />

The definitional requirement appears<br />

straightforward. However, there are<br />

many complications in determining the<br />

Fair Value of loans in particular. First,<br />

the accounting guidance is essentially<br />

silent on the specifics of valuing loans.<br />

IFRS 13 and ASC Topic 820 highlight<br />

the importance of “market participant”<br />

assumptions, but provide no specific<br />

guidance as to sources for the assumptions<br />

and only high-level guidance on the<br />

appropriateness of standard valuation<br />

methodologies.<br />

While much of the industry guidance<br />

on valuing illiquid securities is centered<br />

on equity, little has been written on the<br />

subject of valuing loans.<br />

Further, the lack of transparency<br />

in the private loan market – the very<br />

attribute that often gives rise to the<br />

investment opportunity – creates the<br />

biggest challenge where the accounting<br />

guidance favours observable inputs over<br />

managerial discretion.<br />

Finally, and perhaps most significantly,<br />

industry norms are difficult to break. After<br />

all, the lending market was long referred<br />

to as “the par loan trading” market for a<br />

reason; loans traded at par, so there was<br />

no challenge in setting the mark. Further,<br />

the preponderance of traditional<br />

bank loans (often cited as the target of<br />

new fund raises) are classified as “held to<br />

maturity,” so have historically been marked<br />

on an amortised cost basis in accordance<br />

with IAS 39. These historical practices,<br />

however, are not consistent with a Fair<br />

Value standard that requires an assumption<br />

of a liquidity event at the measurement<br />

date, irrespective of any intent to hold to<br />

maturity. So, before discussing a roadmap<br />

for valuing loans, the biggest challenge may<br />

be affecting the change in mindset that will<br />

be required in marking this asset class to<br />

Fair Value.<br />

Despite these difficulties, fund managers<br />

still have to fulfill their fiduciary<br />

obligation to determine Fair Value.<br />

Although the debt valuation framework<br />

does not always lead to par, it does lead<br />

to a robust and defensible Fair Value. In<br />

the process, it may also create a differentiated<br />

product offering. n<br />

This article was co-authored by Ross Hostetter (New<br />

York) and Ryan McNelley (London), who are members<br />

of the alternative asset advisory practice of Duff<br />

& Phelps.<br />

For graphics that set out a hierarchy for selecting the<br />

appropriate valuation approach and establish a framework<br />

for model-based valuations, read this article on<br />

www.privatedebtinvestor.com.<br />

What do you think?<br />

Have your say<br />

e: oliver.s@peimedia.com<br />

March 2013 | Private Debt Investor 15

comment<br />

THE CONSULTANT<br />

Inside views on private debt in the portfolio<br />

Is private debt a panacea for<br />

yield-starved investors?<br />

comment<br />

The hype surrounding private<br />

debt is justified, but there are<br />

several key issues that need to<br />

be addressed if managers are to<br />

successfully win commitments,<br />

argues Towers Watson’s Gregg<br />

Disdale<br />

Private debt has become increasingly interesting<br />

to institutional investors during the<br />

ongoing financial crisis. This is perhaps<br />

unsurprising given the paucity of yields<br />

available in financial markets, a significant<br />

issue for investors with liabilities to meet.<br />

As a result investors are increasingly considering<br />

allocating to risky and/or illiquid<br />

assets to achieve their required returns.<br />

One approach is via private debt strategies<br />

and the current dynamics in lending<br />

markets suggest now is an opportune time<br />

to consider it. With increased aversion to<br />

illiquidity, increased regulations making<br />

lending less attractive for banks and a need<br />

for those same banks to deleverage, it is<br />

unsurprising that spreads between private<br />

and public debt have increased. In the US,<br />

for example, spreads between middle-market<br />

lending and broadly-syndicated loans<br />

reached post-crisis highs in 2012.<br />

Which strategies interest<br />

investors?<br />

Despite much commentary about the<br />

merits and demand for private debt, capital<br />

raised remains below pre-crisis levels. This<br />

is mainly because fundraising in mezzanine,<br />

which is highly correlated with fundraising<br />

in private equity, is below peak levels despite<br />

it looking a comparatively more attractive<br />

strategy. It is a challenging strategy<br />

to undertake on a standalone basis in an<br />

environment where high-yield debt markets<br />

are being particularly accommodating to<br />

companies that can access it.<br />

Where we do see growing appetite is<br />

for those strategies driven by bank disintermediation,<br />

namely real estate and infrastructure<br />

debt and senior secured lending<br />

to sub-investment grade and/or smaller<br />

companies which cannot access public<br />

markets. In the US, private debt strategies<br />

have long been part of the shadow banking<br />

infrastructure and consolidation in the US<br />

banking market and elevated spreads have<br />

led to increased interest in these areas. In<br />

Europe, these are still emerging asset classes<br />

for institutional investors as previously they<br />

have been dominated by banks. While we<br />

expect banks still to be meaningful participants<br />

in Europe, there is an opportunity<br />

to participate alongside them to fill what<br />

appears to be a significant funding gap.<br />

What are the impediments?<br />

There are numerous impediments to fundraising<br />

but key among these is what actually<br />

makes these asset classes attractive: a scarcity<br />

of risk capital and a desire for liquidity.<br />

When looking at these strategies, investors’<br />

first consideration is whether there is sufficient<br />

compensation for locking up capital.<br />

Answering this question is relatively subjective<br />

and needs to be considered in the<br />

context of an individual investor’s portfolio.<br />

Hand in hand with the above consideration<br />

is the cost of accessing these strategies.<br />

Often the spread over liquid alternatives<br />

appears attractive but management and<br />

performance fees can eat into a significant<br />

portion of this. Practices in this space that<br />

we believe need changing include investment<br />

managers charging fees on leverage<br />

and a full catch-up on profits after the<br />

preferred return for the performance fee.<br />

While recognising a meaningful infrastructure<br />

is required to manage these strategies,<br />

investors need to fund these assets from<br />

liquid alternatives so the net-of-fees proposition<br />

needs to be extremely compelling on<br />

a relative basis to justify locking up capital.<br />

Tax considerations require careful navigation,<br />

as do governance constraints which<br />

make allocating across a number of illiquid<br />

strategies challenging.<br />

The case still appears<br />

compelling<br />

Investor appetite for private debt strategies<br />

appears genuine, which is reflected in the<br />

proliferation of funds and strategies looking<br />

to take advantage of bank disintermediation.<br />

This in itself should not motivate investors<br />

to invest – indeed caution is advised – but<br />

subject to careful consideration, we believe<br />

there is a compelling macro-economic case<br />

for institutional investors to exploit their<br />

long-term capital in these strategies. n<br />

Gregg Disdale is a senior investment consultant at<br />

Towers Watson.<br />

What do you think?<br />

Have your say<br />

e: oliver.s@peimedia.com<br />

16<br />

Private Debt Investor | March 2013

ook excerpt<br />

Investing in Private Debt<br />

INVESTING IN<br />

PRIVATE DEBT<br />

A global guide to private debt as an asset class<br />

and an integra layer of the capital structure<br />

feature<br />

New sources of liquidity<br />

in the European market<br />

In an excerpt from PEI Media’s forthcoming guide ‘Investing in Private Debt’,<br />

ICG’s Max Mitchell maps out the opportunities and challenges facing private<br />

debt fund managers<br />

The provision of private debt to the<br />

European buyout market has historically<br />

been dominated by the<br />

European banks, which typically funded<br />

their loan books using their balance<br />

sheet. However, following the recent<br />

financial crisis, the European banks’ ability<br />

to provide liquidity has significantly<br />

contracted and this contraction is negatively<br />

impacting private equity transactions<br />

(both involving existing portfolio<br />

companies and potential new buyouts)<br />

in Europe.<br />

We believe that for the European<br />

buyout market to return to a more<br />

‘normal’ state (including dealing efficiently<br />

with refinancing requirements<br />

of existing private equity owned portfolio<br />

companies), it will need to transition<br />

from a heavily banked market to<br />

Banks provided 51%<br />

of European buyout<br />

finance compared to a<br />

mere 15% in the US in the<br />

first 9 months of 2012<br />

xxxxxxxxxxxxx<br />

a more balanced bank and institutional<br />

market, as has happened many years ago<br />

in the US.<br />

The evolution of non-bank<br />

lending in Europe<br />

Unlike the US, Europe remains primarily<br />

a banking market. Banks provided 51%<br />

of European buyout finance compared<br />

to a mere 15% in the US in the first 9<br />

months of 2012. The US market benefits<br />

from a deep institutional market which<br />

provides consistent liquidity and is highly<br />

developed and diversified, including<br />

CLOs, mezzanine funds, direct investments<br />

by insurance companies, credit<br />

hedge funds, distressed debt funds and<br />

Prime Rate funds. The latter are a material<br />

component of the US market and<br />

raise capital from both retail and institutional<br />

investors.<br />

By contrast, the European institutional<br />

market is still in its infancy. Historically<br />

the only significant non-bank<br />

lenders in the European private debt<br />

market have been CLOs and the independent<br />

mezzanine funds.<br />

As the traditional bank and CLO lenders<br />

exit the market, we are seeing a new<br />

breed of non-bank lenders coming to the<br />

fore. From a borrowers’ perspective the<br />

decision as to whether to work with<br />

➥<br />

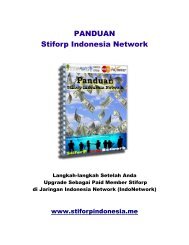

chart title<br />

US buyout funding sources<br />

European buyout funding sources<br />

n Banks 14% n Banks 51%<br />

n Institutions 84% n Institutions 47%<br />

n Others 2% n Others 2%<br />

Source: S&P<br />

March 2013 | Private Debt Investor 17

feature<br />

private debt funds will be driven by a<br />

wide range of matters specific to each<br />

borrower and / or each deal. However,<br />

from our experience to date, most borrowers<br />

have been open to working with<br />

private debt funds, particularly those<br />

that are managed by fund managers with<br />

whom they have existing relationships.<br />

Some other key considerations are:<br />

1. Reduced complexity: private debt<br />

funds are generally looking to make<br />

significant investments in individual<br />

transactions. Fundamentally this<br />

means that deals can be done with<br />

smaller clubs or even on a bilateral<br />

basis, which has the benefit of significantly<br />

reduced complexity.<br />

2. Certainty / cost: private debt funds<br />

are generally take-and-hold investors,<br />

which removes need for onerous syndication<br />

language / risk of market<br />

flex. In addition, given their decision<br />

structures, private debt funds are typically<br />

more fleet of foot in terms of<br />

delivery of approval.<br />

3. Flexibility: compared to a conventional<br />

bank-led financing, private<br />

debt funds are often more flexible<br />

around loan features (including nonstandard<br />

amortisation) as long as the<br />

overall balance of risk is appropriate.<br />

We are aware that a number of the<br />

private debt funds do require noncall<br />

protection but we note that it<br />

is typically significantly shorter than<br />

that required by traditional mezzanine<br />

funds and therefore is more suitable<br />

for refinancings where the sponsor is<br />

not looking to remain in the investment<br />

for a further three or more years.<br />

What type of transactions will<br />

private debt funds target?<br />

It is likely that new funds will broadly<br />

focus on two different investment strategies,<br />

each of which will be more relevant<br />

depending on the particular circumstances<br />

of the transaction.<br />

Deals can be done with<br />

smaller clubs or even<br />

on a bilateral basis<br />

xxxxxxxxxxxxx<br />

The first is to partner with remaining<br />

active European banks to provide borrowers<br />

with capital solutions on a ‘club’<br />

basis. This is essentially a bank replacement<br />

strategy and is targeted at performing,<br />

consistently structured, ‘mainstream’,<br />

borrowers. Most of these ‘clubs’<br />

would comprise of typically 2-6 lenders,<br />

including at least one bank. Loans in these<br />

‘clubs’ would typically be senior secured<br />

loans pricing at LIBOR (or Euribor) plus<br />

550bps – 850bps margin with arrangement<br />

fees. We believe that this is the<br />

strategy that is most likely to become<br />

the primary funding solution to replace<br />

the bank and CLO liquidity that has left<br />

the market.<br />

The second is to focus on those<br />

transactions which the European banks<br />

are typically moving away from as they<br />

reduce their risk tolerances. Whilst the<br />

return on these transactions may be<br />

higher, they inherently include a higher<br />

level of risk, including higher leverage or<br />

potentially sub-ordinated debt investing.<br />

In some instances, this strategy will compete<br />

with the banks where the quality<br />

of the business is on the margin. This is<br />

more of a bank substitution or bank disintermediation<br />

strategy, and often there<br />

will be no bank present in the syndicate.<br />

We see this as more of an extension to<br />

the traditional mezzanine market and,<br />

as such, demand for this product will<br />

be lower and these funds will establish<br />

themselves as a niche product.<br />

Who will private debt funds<br />

appeal to and how do they<br />

invest?<br />

In our experience only a few of the larger<br />