Key Information Memorandum & Common Application Form Key ...

Key Information Memorandum & Common Application Form Key ...

Key Information Memorandum & Common Application Form Key ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ICICI Prudential Mutual Fund<br />

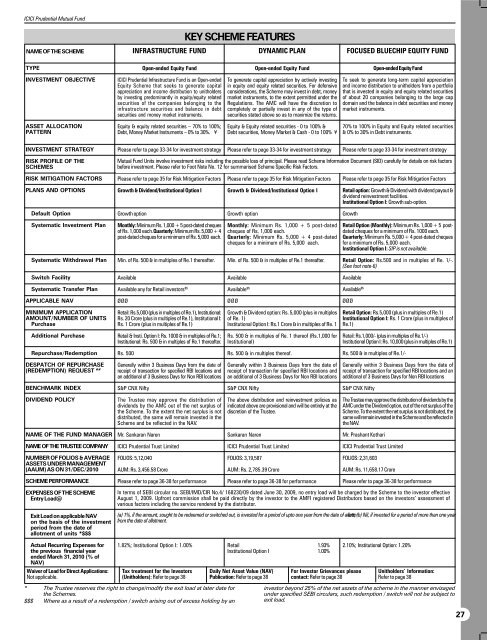

KEY SCHEME FEATURES<br />

NAME OF THE SCHEME<br />

INFRASTRUCTURE FUND<br />

DYNAMIC PLAN<br />

FOCUSED BLUECHIP EQUITY FUND<br />

TYPE<br />

Open-ended Equity Fund<br />

Open-ended Equity Fund<br />

Open-ended Equity Fund<br />

INVESTMENT OBJECTIVE<br />

ICICI Prudential Infrastructure Fund is an Open-ended<br />

Equity Scheme that seeks to generate capital<br />

appreciation and income distribution to unitholders<br />

by investing predominantly in equity/equity related<br />

securities of the companies belonging to the<br />

infrastructure securities and balance in debt<br />

securities and money market instruments.<br />

To generate capital appreciation by actively investing<br />

in equity and equity related securities. For defensive<br />

considerations, the Scheme may invest in debt, money<br />

market instruments, to the extent permitted under the<br />

Regulations. The AMC will have the discretion to<br />

completely or partially invest in any of the type of<br />

securities stated above so as to maximize the returns.<br />

To seek to generate long-term capital appreciation<br />

and income distribution to unitholders from a portfolio<br />

that is invested in equity and equity related securities<br />

of about 20 companies belonging to the large cap<br />

domain and the balance in debt securities and money<br />

market instruments.<br />

ASSET ALLOCATION<br />

PATTERN<br />

Equity & equity related securities – 70% to 100%;<br />

Debt, Money Market Instruments – 0% to 30%. ¥<br />

Equity & Equity related securities - 0 to 100% &<br />

Debt securities, Money Market & Cash - 0 to 100% ¥<br />

70% to 100% in Equity and Equity related securities<br />

& 0% to 30% in Debt instruments.<br />

INVESTMENT STRATEGY<br />

Please refer to page 33-34 for investment strategy<br />

Please refer to page 33-34 for investment strategy<br />

Please refer to page 33-34 for investment strategy<br />

RISK PROFILE OF THE<br />

SCHEMES<br />

Mutual Fund Units involve investment risks including the possible loss of principal. Please read Scheme <strong>Information</strong> Document (SID) carefully for details on risk factors<br />

before investment. Please refer to Foot Note No. 12 for summarised Scheme Specific Risk Factors.<br />

RISK MITIGATION FACTORS<br />

PLANS AND OPTIONS<br />

Please refer to page 35 for Risk Mitigation Factors<br />

Growth & Dividend/Institutional Option I<br />

Please refer to page 35 for Risk Mitigation Factors<br />

Growth & Dividend/Institutional Option I<br />

Please refer to page 35 for Risk Mitigation Factors<br />

Retail option: Growth & Dividend with dividend payout &<br />

dividend reinvestment facilities.<br />

Institutional Option I: Growth sub-option.<br />

Default Option<br />

Growth option<br />

Growth option<br />

Growth<br />

Systematic Investment Plan<br />

Monthly: Minimum Rs. 1,000 + 5 post-dated cheques<br />

of Rs. 1,000 each.Quarterly: Minimum Rs. 5,000 + 4<br />

post-dated cheques for a minimum of Rs. 5,000 each.<br />

Monthly: Minimum Rs. 1,000 + 5 post-dated<br />

cheques of Rs. 1,000 each.<br />

Quarterly: Minimum Rs. 5,000 + 4 post-dated<br />

cheques for a minimum of Rs. 5,000 each.<br />

Retail Option (Monthly): Minimum Rs. 1,000 + 5 postdated<br />

cheques for a minimum of Rs. 1000 each.<br />

Quarterly: Minimum Rs. 5,000 + 4 post-dated cheques<br />

for a minimum of Rs. 5,000 each.<br />

Institutional Option I: SIP is not available.<br />

Systematic Withdrawal Plan<br />

Min. of Rs. 500 & in multiples of Re.1 thereafter.<br />

Min. of Rs. 500 & in multiples of Re.1 thereafter.<br />

Retail Option: Rs.500 and in multiples of Re. 1/-.<br />

(See foot note-6)<br />

Available<br />

Available $$<br />

ØØØ<br />

Switch Facility<br />

Systematic Transfer Plan<br />

APPLICABLE NAV<br />

Available<br />

Available any for Retail investors $$<br />

ØØØ<br />

Available<br />

Available $$<br />

ØØØ<br />

MINIMUM APPLICATION<br />

AMOUNT/NUMBER OF UNITS<br />

Purchase<br />

Retail: Rs.5,000 (plus in multiples of Re.1), Institutional:<br />

Rs. 20 Crore (plus in multiples of Re.1), Institutional I:<br />

Rs. 1 Crore (plus in multiples of Re.1)<br />

Growth & Dividend option: Rs. 5,000 (plus in multiples<br />

of Re. 1)<br />

Institutional Option I: Rs.1 Crore & in multiples of Re. 1<br />

Retail Option: Rs.5,000 (plus in multiples of Re.1)<br />

Institutional Option I: Rs. 1 Crore (plus in multiples of<br />

Re.1)<br />

Additional Purchase<br />

Retail & Insti. Option I: Rs. 1000 & in multiples of Re.1;<br />

Institutional: Rs. 500 & in multiples of Re.1 thereafter.<br />

Rs. 500 & in multiples of Re. 1 thereof (Rs.1,000 for<br />

Institutional)<br />

Retail: Rs.1,000/- (plus in multiples of Re.1/-)<br />

Institutional Option I: Rs. 10,000 (plus in multiples of Re.1)<br />

Repurchase/Redemption<br />

Rs. 500<br />

Rs. 500 & in multiples thereof.<br />

Rs. 500 & in multiples of Re.1/-<br />

DESPATCH OF REPURCHASE<br />

(REDEMPTION) REQUEST ##<br />

Generally within 3 Business Days from the date of<br />

receipt of transaction for specified RBI locations and<br />

an additional of 3 Business Days for Non RBI locations<br />

Generally within 3 Business Days from the date of<br />

receipt of transaction for specified RBI locations and<br />

an additional of 3 Business Days for Non RBI locations<br />

Generally within 3 Business Days from the date of<br />

receipt of transaction for specified RBI locations and an<br />

additional of 3 Business Days for Non RBI locations<br />

BENCHMARK INDEX<br />

S&P CNX Nifty<br />

S&P CNX Nifty<br />

S&P CNX Nifty<br />

DIVIDEND POLICY<br />

The Trustee may approve the distribution of<br />

dividends by the AMC out of the net surplus of<br />

the Scheme. To the extent the net surplus is not<br />

distributed, the same will remain invested in the<br />

Scheme and be reflected in the NAV.<br />

The above distribution and reinvestment policies as<br />

indicated above are provisional and will be entirely at the<br />

discretion of the Trustee.<br />

The Trustee may approve the distribution of dividends by the<br />

AMC under the Dividend option, out of the net surplus of the<br />

Scheme. To the extent the net surplus is not distributed, the<br />

same will remain invested in the Scheme and be reflected in<br />

the NAV.<br />

NAME OF THE FUND MANAGER<br />

NAME OF THE TRUSTEE COMPANY<br />

NUMBER OF FOLIOS & AVERAGE<br />

ASSETS UNDER MANAGEMENT<br />

(AAUM) AS ON 31/DEC/2010<br />

SCHEME PERFORMANCE<br />

Mr. Sankaran Naren<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 5,12,040<br />

AUM: Rs. 3,456.58 Crore<br />

Please refer to page 36-38 for performance<br />

Sankaran Naren<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 3,19,587<br />

AUM: Rs. 2,785.39 Crore<br />

Please refer to page 36-38 for performance<br />

Mr. Prashant Kothari<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 2,31,603<br />

AUM: Rs. 11,658.17 Crore<br />

Please refer to page 36-38 for performance<br />

EXPENSES OF THE SCHEME<br />

Entry Load@<br />

In terms of SEBI circular no. SEBI/IMD/CIR No.4/ 168230/09 dated June 30, 2009, no entry load will be charged by the Scheme to the investor effective<br />

August 1, 2009. Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of<br />

various factors including the service rendered by the distributor.<br />

Exit Load on applicable NAV<br />

on the basis of the investment<br />

period from the date of<br />

allotment of units *$$$<br />

(a) 1%, if the amount, sought to be redeemed or switched out, is invested for a period of upto one year from the date of allotm ent; (b) Nil, if invested for a period of more than one year<br />

from the date of allotment.<br />

Actual Recurring Expenses for<br />

the previous financial year<br />

ended March 31, 2010 (% of<br />

NAV)<br />

Waiver of Load for Direct <strong>Application</strong>s:<br />

Not applicable.<br />

1.82%; Institutional Option I: 1.00%<br />

Tax treatment for the Investors<br />

(Unitholders): Refer to page 38<br />

Retail 1.93%<br />

Institutional Option I 1.00%<br />

Daily Net Asset Value (NAV)<br />

Publication: Refer to page 38<br />

For Investor Grievances please<br />

contact: Refer to page 38<br />

2.10%; Institutional Option: 1.20%<br />

Unitholders’ <strong>Information</strong>:<br />

Refer to page 38<br />

* The Trustee reserves the right to change/modify the exit load at later date for<br />

the Schemes.<br />

$$$ Where as a result of a redemption / switch arising out of excess holding by an<br />

investor beyond 25% of the net assets of the scheme in the manner envisaged<br />

under specified SEBI circulars, such redemption / switch will not be subject to<br />

exit load.<br />

27