Key Information Memorandum & Common Application Form Key ...

Key Information Memorandum & Common Application Form Key ...

Key Information Memorandum & Common Application Form Key ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ICICI Prudential Mutual Fund<br />

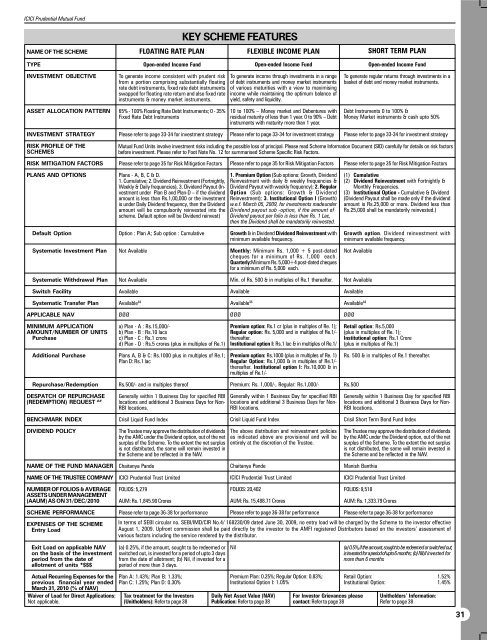

NAME OF THE SCHEME<br />

FLOATING RATE PLAN<br />

KEY SCHEME FEATURES<br />

FLEXIBLE INCOME PLAN<br />

SHORT TERM PLAN<br />

TYPE<br />

Open-ended Income Fund<br />

Open-ended Income Fund<br />

Open-ended Income Fund<br />

INVESTMENT OBJECTIVE<br />

ASSET ALLOCATION PATTERN<br />

To generate income consistent with prudent risk<br />

from a portion comprising substantially floating<br />

rate debt instruments, fixed rate debt instruments<br />

swapped for floating rate return and also fixed rate<br />

instruments & money market instruments.<br />

65% - 100% Floating Rate Debt Instruments; 0 - 35%<br />

Fixed Rate Debt Instruments<br />

To generate income through investments in a range<br />

of debt instruments and money market instruments<br />

of various maturities with a view to maximising<br />

income while maintaining the optimum balance of<br />

yield, safety and liquidity.<br />

10 to 100% – Money market and Debentures with<br />

residual maturity of less than 1 year. 0 to 90% – Debt<br />

instruments with maturity more than 1 year.<br />

To generate regular returns through investments in a<br />

basket of debt and money market instruments.<br />

Debt Instruments 0 to 100% &<br />

Money Market instruments & cash upto 50%<br />

INVESTMENT STRATEGY<br />

Please refer to page 33-34 for investment strategy<br />

Please refer to page 33-34 for investment strategy<br />

Please refer to page 33-34 for investment strategy<br />

RISK PROFILE OF THE<br />

SCHEMES<br />

RISK MITIGATION FACTORS<br />

Mutual Fund Units involve investment risks including the possible loss of principal. Please read Scheme <strong>Information</strong> Document (SID) carefully for details on risk factors<br />

before investment. Please refer to Foot Note No. 12 for summarised Scheme Specific Risk Factors.<br />

Please refer to page 35 for Risk Mitigation Factors<br />

Please refer to page 35 for Risk Mitigation Factors<br />

Please refer to page 35 for Risk Mitigation Factors<br />

PLANS AND OPTIONS<br />

Plans - A, B, C & D.<br />

1. Cumulative; 2. Dividend Reinvestment (Fortnightly,<br />

Weekly & Daily frequencies), 3. Dividend Payout (Investment<br />

under Plan B and Plan-D – if the dividend<br />

amount is less than Rs.1,00,000 or the investment<br />

is under Daily Dividend frequency, then the Dividend<br />

amount will be compulsorily reinvested into the<br />

scheme. Default option will be Dividend reinvest)<br />

1. Premium Option (Sub options: Growth, Dividend<br />

Reinvestment with daily & weekly frequencies &<br />

Dividend Payout with weekly frequency); 2. Regular<br />

Option (Sub options: Growth & Dividend<br />

Reinvestment); 3. Institutional Option I (Growth)<br />

w.e.f. March 05, 2009, for investments made under<br />

Dividend payout sub -option, if the amount of<br />

Dividend payout per folio is less than Rs. 1 Lac,<br />

then the Dividend shall be mandatorily reinvested.<br />

(1) Cumulative<br />

(2) Dividend Reinvestment with Fortnightly &<br />

Monthly Frequencies.<br />

(3) Institutional Option - Cumulative & Dividend<br />

(Dividend Payout shall be made only if the dividend<br />

amount is Rs.25,000 or more. Dividend less than<br />

Rs.25,000 shall be mandatorily reinvested.)<br />

Default Option<br />

Option : Plan A; Sub option : Cumulative<br />

Growth & in Dividend Dividend Reinvestment with<br />

minimum available frequency.<br />

Monthly: Minimum Rs. 1,000 + 5 post-dated<br />

cheques for a minimum of Rs. 1,000 each.<br />

Quarterly:Minimum Rs. 5,000+4 post-dated cheques<br />

for a minimum of Rs. 5,000 each.<br />

Min. of Rs. 500 & in multiples of Re.1 thereafter.<br />

Available<br />

Available $$<br />

ØØØ<br />

Growth option. Dividend reinvestment with<br />

minimum available frequency.<br />

Not Available<br />

Systematic Investment Plan<br />

Not Available<br />

Systematic Withdrawal Plan<br />

Switch Facility<br />

Systematic Transfer Plan<br />

APPLICABLE NAV<br />

Not Available<br />

Available<br />

Available $$<br />

ØØØ<br />

Not Available<br />

Available<br />

Available $$<br />

ØØØ<br />

MINIMUM APPLICATION<br />

AMOUNT/NUMBER OF UNITS<br />

Purchase<br />

Additional Purchase<br />

a) Plan - A : Rs.15,000/-<br />

b) Plan - B : Rs.10 lacs<br />

c) Plan - C : Rs.1 crore<br />

d) Plan - D : Rs.5 crores (plus in multiples of Re.1)<br />

Plans A, B & C: Rs.1000 plus in multiples of Re.1;<br />

Plan D: Rs.1 lac<br />

Premium option: Rs.1 cr (plus in multiples of Re. 1);<br />

Regular option: Rs. 5,000 and in multiples of Re.1/-<br />

thereafter.<br />

Institutional option I: Rs.1 lac & in multiples of Re.1/<br />

-<br />

Premium option: Rs.1000 (plus in multiples of Re. 1)<br />

Regular Option: Rs.1,000 & in multiples of Re.1/-<br />

thereafter. Institutional option I: Rs.10,000 & in<br />

multiples of Re.1/-<br />

Retail option: Rs.5,000<br />

(plus in multiples of Re. 1);<br />

Institutional option: Rs.1 Crore<br />

(plus in multiples of Re.1)<br />

Rs. 500 & in multiples of Re.1 thereafter.<br />

Repurchase/Redemption<br />

Rs.500/- and in multiples thereof<br />

Premium: Rs. 1,000/-, Regular: Rs.1,000/-<br />

Rs.500<br />

DESPATCH OF REPURCHASE<br />

(REDEMPTION) REQUEST ##<br />

Generally within 1 Business Day for specified RBI<br />

locations and additional 3 Business Days for Non-<br />

RBI locations.<br />

Generally within 1 Business Day for specified RBI<br />

locations and additional 3 Business Days for Non-<br />

RBI locations.<br />

Generally within 1 Business Day for specified RBI<br />

locations and additional 3 Business Days for Non-<br />

RBI locations.<br />

BENCHMARK INDEX<br />

Crisil Liquid Fund Index<br />

Crisil Liquid Fund Index<br />

Crisil Short Term Bond Fund Index<br />

DIVIDEND POLICY<br />

The Trustee may approve the distribution of dividends<br />

by the AMC under the Dividend option, out of the net<br />

surplus of the Scheme. To the extent the net surplus<br />

is not distributed, the same will remain invested in<br />

the Scheme and be reflected in the NAV.<br />

The above distribution and reinvestment policies<br />

as indicated above are provisional and will be<br />

entirely at the discretion of the Trustee.<br />

The Trustee may approve the distribution of dividends<br />

by the AMC under the Dividend option, out of the net<br />

surplus of the Scheme. To the extent the net surplus<br />

is not distributed, the same will remain invested in<br />

the Scheme and be reflected in the NAV.<br />

NAME OF THE FUND MANAGER<br />

NAME OF THE TRUSTEE COMPANY<br />

NUMBER OF FOLIOS & AVERAGE<br />

ASSETS UNDER MANAGEMENT<br />

(AAUM) AS ON 31/DEC/2010<br />

Chaitanya Pande<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 5,279<br />

AUM: Rs. 1,845.90 Crores<br />

Chaitanya Pande<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 20,402<br />

AUM: Rs. 15,488.71 Crores<br />

Manish Banthia<br />

ICICI Prudential Trust Limited<br />

FOLIOS: 9,518<br />

AUM: Rs. 1,333.79 Crores<br />

SCHEME PERFORMANCE<br />

EXPENSES OF THE SCHEME<br />

Entry Load<br />

Please refer to page 36-38 for performance Please refer to page 36-38 for performance Please refer to page 36-38 for performance<br />

In terms of SEBI circular no. SEBI/IMD/CIR No.4/ 168230/09 dated June 30, 2009, no entry load will be charged by the Scheme to the investor effective<br />

August 1, 2009. Upfront commission shall be paid directly by the investor to the AMFI registered Distributors based on the investors’ assessment of<br />

various factors including the service rendered by the distributor.<br />

Exit Load on applicable NAV<br />

on the basis of the investment<br />

period from the date of<br />

allotment of units *$$$<br />

(a) 0.25%, if the amount, sought to be redeemed or<br />

switched out, is invested for a period of upto 3 days<br />

from the date of allotment; (b) Nil, if invested for a<br />

period of more than 3 days.<br />

Nil<br />

(a) 0.5%, if the amount, sought to be redeemed or switched out,<br />

is invested for a period of upto 6 months; (b) Nil, if invested for<br />

more than 6 months.<br />

Actual Recurring Expenses for the<br />

previous financial year ended<br />

March 31, 2010 (% of NAV)<br />

Waiver of Load for Direct <strong>Application</strong>s:<br />

Not applicable.<br />

Plan A: 1.43%; Plan B: 1.33%;<br />

Plan C: 1.25%; Plan D: 0.30%<br />

Tax treatment for the Investors<br />

(Unitholders): Refer to page 38<br />

Premium Plan: 0.25%; Regular Option: 0.83%;<br />

Institutional Option I: 1.05%<br />

Daily Net Asset Value (NAV)<br />

Publication: Refer to page 38<br />

For Investor Grievances please<br />

contact: Refer to page 38<br />

Retail Option: 1.52%<br />

Institutional Option: 1.45%<br />

Unitholders’ <strong>Information</strong>:<br />

Refer to page 38<br />

31