Financial Statements - Tung Lok Restaurants 2000 Ltd

Financial Statements - Tung Lok Restaurants 2000 Ltd

Financial Statements - Tung Lok Restaurants 2000 Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

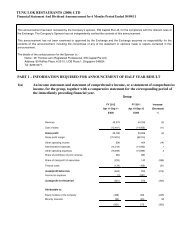

Notes to<br />

<strong>Financial</strong> <strong>Statements</strong><br />

March 31, 2008<br />

On disposal of a subsidiary, the attributable amount of goodwill is included in the determination<br />

of the profit or loss on disposal.<br />

The group’s policy for goodwill arising on the acquisition of joint venture and associate is<br />

described under “Interests in Joint Ventures” and “Associates” below.<br />

INTANGIBLE ASSETS - Intangible assets acquired separately are reported at cost less accumulated<br />

amortisation and accumulated impairment losses. Intangible assets with finite useful lives are<br />

amortised on a straight-line basis over their estimated useful lives. The estimated useful life<br />

and amortisation method are reviewed at the end of each annual reporting period, with the<br />

effect of any changes in estimate being accounted for on a prospective basis. Intangible assets<br />

with indefinite useful lives are not amortised. Each period, the useful lives of such assets are<br />

reviewed to determine whether events and circumstances continue to support an indefinite useful<br />

life assessment for the asset. Such assets are tested for impairment in accordance with the policy<br />

below.<br />

IMPAIRMENT OF TANGIBLE AND INTANGIBLE ASSETS EXCLUDING GOODWILL - At each<br />

balance sheet date, the group reviews the carrying amounts of its tangible and intangible assets<br />

to determine whether there is any indication that those assets have suffered an impairment<br />

loss. If any such indication exists, the recoverable amount of the asset is estimated in order to<br />

determine the extent of the impairment loss (if any). Where it is not possible to estimate the<br />

recoverable amount of an individual asset, the group estimates the recoverable amount of the<br />

cash-generating unit to which the asset belongs.<br />

Intangible assets with indefinite useful lives and intangible assets not yet available for use are<br />

tested for impairment annually, and whenever there is an indication that the asset may be<br />

impaired.<br />

Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing<br />

value in use, the estimated future cash fl ows are discounted to their present value using a pre-tax<br />

discount rate that refl ects current market assessments of the time value of money and the risks<br />

specific to the asset.<br />

If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than<br />

its carrying amount, the carrying amount of the asset (cash-generating unit) is reduced to<br />

its recoverable amount. An impairment loss is recognised immediately in the profit and loss<br />

statement.<br />

Where an impairment loss subsequently reverses, the carrying amount of the asset (cashgenerating<br />

unit) is increased to the revised estimate of its recoverable amount, but so that<br />

the increased carrying amount does not exceed the carrying amount that would have been<br />

determined had no impairment loss been recognised for the asset (cash-generating unit) in<br />

prior years. A reversal of an impairment loss is recognised immediately in the profit and loss<br />

statement.<br />

ASSOCIATES - An associate is an entity over which the group has significant infl uence and that<br />

is neither a subsidiary nor an interest in a joint venture. Significant infl uence is the power to<br />

participate in the financial and operating policy decisions of the investee but is not control or<br />

joint control over those policies.<br />

The results and assets and liabilities of associates are incorporated in these financial statements<br />

using the equity method of accounting. Under the equity method, investments in associates are<br />

carried in the consolidated balance sheet at cost as adjusted for post-acquisition changes in the<br />

group’s share of the net assets of the associate, less any impairment in the value of individual<br />

investments. Losses of an associate in excess of the group’s interest in that associate (which<br />

includes any long-term interests that, in substance, form part of the group’s net investment in the<br />

associate) are not recognised, unless the group has incurred legal or constructive obligations or<br />

made payments on behalf of the associate.<br />

58