Corporate Presentation - Bajaj Electricals

Corporate Presentation - Bajaj Electricals

Corporate Presentation - Bajaj Electricals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strictly Private and Confidential<br />

<strong>Bajaj</strong> <strong>Electricals</strong> Limited<br />

<strong>Corporate</strong> <strong>Presentation</strong><br />

November 2009

Disclaimer<br />

This presentation has been prepared by <strong>Bajaj</strong> <strong>Electricals</strong> Limited (the “Company”) solely for providing information about the Company. This presentation is<br />

confidential and may not be copied or disseminated, in whole or part, in any manner. This presentation has been prepared p by the Company based on<br />

information and data which the Company considers reliable, but the Company makes no representation or warranty or undertaking, express or implied,<br />

whatsoever, and no reliance shall be placed on, the truth, accuracy, completeness, fairness, correctness and reasonableness of the contents of this<br />

presentation. This presentation has not been approved and will not be reviewed or approved by any statutory or regulatory authority in India or by any Stock<br />

Exchange in India and may not comply with all the disclosure requirements prescribed thereof. This presentation may not be all inclusive and may not<br />

contain all of the information that you may consider material. Any liability in respect of the contents of, or any omission from, this presentation is expressly<br />

excluded. No representation or warranty, express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or<br />

correctness of such information or opinions contained herein. Neither the Company nor any of its respective affiliates, advisers or representatives, shall have<br />

any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in<br />

connection with this presentation. The information contained in this presentation is only current as of its date. Certain statements made in this presentation<br />

may not be based on historical information or facts and may be “forward-looking statements”, including those relating to the Company’s general business<br />

plans and strategy, its future financial condition and growth prospects, and future developments in its industry and its competitive and regulatory<br />

environment. Actual results may differ from these forward-looking statements due to a number of factors, including future changes or developments in the<br />

Company’s business, its competitive environment, information technology and political, economic, legal and social conditions in India and worldwide. The<br />

Company undertakes no obligation to update forward looking statements to reflect events or circumstances after the date thereof. This presentation and any<br />

information presented herein are not intended to be, offers to sell or solicitation of offers to buy the Company’s equity shares or any of its other securities<br />

and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful. The Company’s equity shareshave<br />

not been and will not be registered under the U.S. Securities Act 1993, as amended (the Securities Act”) or any securities laws in the United States and, as<br />

such, may not be offered or sold in the United States or to, or for the benefit of, U.S. persons (as such term is defined in Regulation S under the Securities<br />

Act) absent registration or an exemption from the registration requirements of the Securities Act and applicable laws. Any offering of the equity shares made,<br />

if any, in the United States (or to U.S. persons) was made by means of a prospectus and private placement memorandum which contained detailed<br />

information about the Company and its management, aswell as financiali statements. t t The Company may alter, modify orotherwise change in any manner<br />

the content of this presentation, without obligation to notify any person.

Table of Contents<br />

<strong>Bajaj</strong> <strong>Electricals</strong> – An Overview<br />

Financials<br />

Strategic Business Units<br />

Key Highlights<br />

g<br />

3

Legacy of the “<strong>Bajaj</strong>” Group<br />

Shri. Jamanalal <strong>Bajaj</strong><br />

• One of the oldest business conglomerates in India<br />

• A group comprising of 25 companies<br />

• Turnover over INR 280 Billion (~USD 6 Billion, at INR 46 per USD)<br />

• Around 36,000 Employees<br />

• Headed by Mr. Rahul <strong>Bajaj</strong>, currently Member of Parliament and active leader in CII, WEF etc.<br />

Brief on select <strong>Bajaj</strong> group companies<br />

• <strong>Bajaj</strong> Auto… Group's flagship company is one of the world's leading 2 & 3 wheeler manufacturer<br />

• A brand well-known across Latin America, Africa, Middle East, South and South East Asia<br />

• The company is currently engaged in life insurance; general insurance and consumer finance businesses<br />

• It has plans to expand its business by offering a wide array of financial products and services in India<br />

• Deals in the financing of consumer durables, personal and small business loans, loan against property/shares<br />

• Achieved a disbursal of INR 24 bn (~USD 0.52 bn) in FY09 under its various financing schemes<br />

• General and Life Insurance Joint venture between <strong>Bajaj</strong> Finserv and Allianz SE (74:26 holding)<br />

• Assets under management of INR 22 bn (~USD 0.47 bn) as on 2008-09<br />

• Received the “Business Leader in General Insurance” award by NDTV Profit Business leadership in 2008<br />

• Mukand Ltd. is one of the leading manufacturers of alloy and stainless steel long products in India<br />

• The company also builds machines and plays an active role in turnkey projects and highway construction<br />

4

<strong>Bajaj</strong> <strong>Electricals</strong> Ltd.… leader in the space with 7 decades of history<br />

Business Overview<br />

<br />

Headed by Shekhar <strong>Bajaj</strong>, Chairman and MD<br />

Evolution<br />

<br />

Manufactures & Markets Appliances, Fans, Lighting and<br />

<br />

<br />

<br />

Luminaires<br />

Also has interests in Engineering & Projects, High Masts,<br />

Turnkey Lighting Projects, Transmission Line Towers,<br />

Rural Electrification and Wind Energy<br />

Extensive manufacturing facilities all over India<br />

Strengths in Logistics, Supply Chain, Distribution,<br />

Sourcing Arrangement, Project execution, R&D and<br />

Marketing<br />

Shareholding Pattern as on Sept 09<br />

11%<br />

16%<br />

Promoter and<br />

Promoter Group<br />

Public Institutions<br />

73% Public Non-<br />

Institutions<br />

Project Smile – Implementation of ERP from Oracle<br />

Crossed INR 18 billion turnover mark in 2008-0909<br />

2007-09<br />

Acquired 32% share holding in Starlite Lighting<br />

Limited a CFL manufacturing unit<br />

Mission Excell – Change Management initiative<br />

2003-0606<br />

<br />

undertaken.<br />

Successful Financial turnaround of the company<br />

Rights Issue of Rs 108 mn in October 2003<br />

Shifted vendor base to Himachal & Uttaranchal<br />

2000-02 Set up High Mast and TLT manufacturing unit at<br />

Ranjangoan near Pune<br />

Tied up with Morphy Richards<br />

Amalgamated Matchwel Electrical Ltd which<br />

manufactured fans, die-casting components and<br />

1971-99 magneto assembly<br />

<br />

Company set up fan manufacturing unit at Chakan<br />

Set up wind farm near Vankusewade near Satara<br />

Commenced operations in Lahore<br />

1940-70 Company started marketing small appliances &<br />

lighting products reserved for manufacturing by the<br />

Small Scale Sector<br />

5

Organization structure<br />

Mr. Shekhar <strong>Bajaj</strong><br />

Chairman & Managing Director<br />

Mr. R. Ramakrishnan<br />

Executive Director<br />

Mr. Anant <strong>Bajaj</strong><br />

Executive Director<br />

Appliances<br />

SBU<br />

Lighting<br />

SBU<br />

Fans<br />

SBU<br />

Luminaires<br />

SBU<br />

E & P<br />

SBU<br />

<strong>Corporate</strong><br />

Finance<br />

HR &<br />

Admin<br />

Morphy<br />

Richards<br />

Advtg. & Brand<br />

Development<br />

Internal<br />

Audit<br />

Secretarial &<br />

Legal<br />

Branch Sales<br />

Support<br />

Customer<br />

Care<br />

IT<br />

6

Table of Contents<br />

<strong>Bajaj</strong> <strong>Electricals</strong> – An Overview<br />

Financials<br />

Strategic Business Units<br />

Key Highlights<br />

7

Strategic business units<br />

<strong>Bajaj</strong> Appliances<br />

FY09 Sales: INR 4,640 mn<br />

As a % of total sales: 26%<br />

<strong>Bajaj</strong> Engg & Projects<br />

<strong>Bajaj</strong> Fans<br />

FY09 Sales: INR 5,230 mn<br />

As a % of total sales: 30%<br />

FY09 Sales: INR 2,950 mn<br />

As a % of total sales: 16%<br />

<strong>Bajaj</strong> Luminaires<br />

<strong>Bajaj</strong> Lightng<br />

FY09 Sales: INR 2,820 mn<br />

As a % of total sales: 16%<br />

FY09 Sales: INR 2,090 mn<br />

As a % of total sales: 12%<br />

8

SBU wise sales growth<br />

Sales (INR mn)<br />

17,700<br />

6,490<br />

8,440<br />

10,770<br />

13,730<br />

FY05 FY06 FY07 FY08 FY09<br />

(INR mn) FY05 FY06 FY07 FY08 FY09 GOLY CAGR<br />

Total 6,490 8,440 10,770 13,730 17,700 29% 29%<br />

Lighting 1,000 1,090 1,340 1,760 2,090 19% 20%<br />

Luminaires 1,210 1,550 1,930 2,300 2,820 23% 24%<br />

Appliances 1,410 1,940 2,600 3,630 4,640 28% 35%<br />

Fans 1,090 1,410 1,850 2,410 2,950 21% 28%<br />

Engg. & Proj. 1,780 2,450 3,050 3,630 5,230 44% 31%<br />

9

Key Profit & Loss metrics<br />

Gross Sales/Income from Operations (INR mn)<br />

Diversified revenue mix across high growth verticals<br />

CAGR (FY05-09): 28%<br />

18,007<br />

14,046<br />

6,763<br />

8,801<br />

11,146<br />

FY05 FY06 FY07 FY08 FY09<br />

EBITDA (INR mn)<br />

PAT (INR mn)<br />

1,432<br />

1,798<br />

CAGR (FY05-09): 48% CAGR (FY05-09): 60%<br />

429<br />

692<br />

869<br />

FY05 FY06 FY07 FY08 FY09<br />

10

Key Balance sheet metrics<br />

Networth (INR mn)<br />

2,450<br />

CAGR (FY05-09): 27%<br />

1,748<br />

807<br />

901<br />

1,168<br />

FY05 FY06 FY07 FY08 FY09<br />

Reducing debt-equity ratio<br />

Return on Capital Employed<br />

2.1 2.1<br />

2.0<br />

1.4<br />

16%<br />

17%<br />

24%<br />

26%<br />

0.9 9%<br />

FY05 FY06 FY07 FY08 FY09 FY05 FY06 FY07 FY08 FY09<br />

11

Other important metrics<br />

Market Capitalization (INR mn) and Share Price (INR) as on March, 31 st<br />

16,000<br />

900<br />

14,000<br />

12,000<br />

13,800 791 800<br />

700<br />

600<br />

1:1 Bonus during FY 08<br />

10,000000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

7,492<br />

434<br />

4,333<br />

250 3,364<br />

2,593 194<br />

2,532<br />

150<br />

146<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Market Cap<br />

Stock Price<br />

Earning Per Share (INR)<br />

0<br />

FY05 FY06 FY07 FY08 FY09 16-Nov-09<br />

Return on Equity<br />

0<br />

50%<br />

51.69<br />

36%<br />

38%<br />

43%<br />

42.31<br />

18%<br />

15.80<br />

32.63<br />

44.58 42.31<br />

51.69<br />

FY05 FY06 FY07 FY08 FY09 FY05 FY06 FY07 FY08 FY09<br />

12

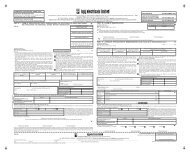

5 year financial summary (INR mn)<br />

Particulars FY 05 FY 06 FY 07 FY 08 FY 09<br />

Gross Sales & Income from<br />

operations<br />

6,763 8,801 11,146 14,046 18,007<br />

Net Sales 6,496 8,459 10,789 13,745 17,705<br />

PBIDT 429 692 869 1432 1798<br />

% Sales 660% 6.60% 8.17% 806% 8.06% 10.42% 10.16% 16%<br />

Interest 164 180 231 293 370<br />

Depreciation 60 64 73 75 86<br />

Operating profit 205 448 566 1064 1343<br />

Other Income (Net) 13 22 43 50 57<br />

PBT 218 470 609 1114 1400<br />

% Sales 3.35% 5.55% 5.64% 8.11% 7.91%<br />

PAT 138 298 390 731 894<br />

% Sales 2.13% 3.53% 3.61% 5.32% 5.05%<br />

13

Half-Yearly performance (INR mn)<br />

Particulars<br />

Financial Year<br />

ended Mar 09<br />

Half Year<br />

ended Sept 08<br />

Half Year<br />

ended Sept 09<br />

Growth over<br />

Previous period<br />

Net sales 17,705 6,969 8,775 25.92%<br />

PBIDT 1,798 565 912 61.36%<br />

% to sales 10.16% 8.11% 10.39%<br />

Interest 370 178 171<br />

Depreciation 86 39 46<br />

Profit before tax 1,400 348 696 99.83%<br />

% to sales 7.91% 5.00% 7.93%<br />

Profit after tax 894 224 456 103.53%<br />

% to sales 5.05% 3.21% 5.20%<br />

14

Table of Contents<br />

<strong>Bajaj</strong> <strong>Electricals</strong> – An Overview<br />

Financials<br />

Strategic Business Units<br />

Key Highlights<br />

15

Overview<br />

Products<br />

Products:<br />

Mixers Grinders, Juicers, Food Processors, Water Heaters,<br />

Air Coolers, Iron, Ovens Toasters Grillers (OTG), Room<br />

Heaters , Toasters & S/W makers, Hand Blenders, Water<br />

Purifiers & Filters, Microwave Ovens, Gas stoves, Electric<br />

Kettles, Coffee / Tea Makers<br />

Competitors: Philips, Kenstar, Usha, Maharaja, Merloni,<br />

Spherehot, Sumeet, CG, National, Black & Decker, Tefal,<br />

Braun<br />

Tie-ups:<br />

17

Sales Performance (INR mn)<br />

APPLIANCES Total W. Heaters Mixers R. Coolers Irons Others<br />

GOLY<br />

CAGR (over 4 yrs.)<br />

28% 17% 35% 18% 37% 28%<br />

35% 30% 45% 24% 31% 37%<br />

18

Key highlights<br />

Water<br />

<br />

<br />

Wide<br />

<br />

Strong<br />

One of the leading players in small appliances market, especially in Mixers, Irons, OTG,<br />

Heaters and Room Cooler<br />

Product Portfolio and highly trusted brand in the small appliances market<br />

distribution network with more than 25,000 retail outlets<br />

Business strategy<br />

• Introduction of new models in Mixers, Water Heaters, Iron & Coolers<br />

• Continue Network expansion and rural penetration<br />

• Improve presence in organized retail<br />

• Ensure success of PLATINI, Gas Appliances and New products such as Home Inverters, DVD players<br />

Key industry growth drivers<br />

• Increase in purchasing power of Indian middle class and rapid urbanization<br />

• Sales in unorganized segment will shift to organized segment as prices reduce<br />

• Organised retail will improve shopping experience and brand presence<br />

19

<strong>Bajaj</strong> Platini Product Range<br />

20

Morphy Richards Product Range<br />

21

Overview<br />

Products<br />

• Domestic-use: Ceiling, Table, Pedestal & Wall mounted<br />

Fans, Personal Fans, <strong>Bajaj</strong>-Disney Children’s Fans<br />

• Industrial-use: use: Industrial Exhaust fans, Commercial Air<br />

Circulators, Cooler kits and Pumps<br />

Tie-ups<br />

Products<br />

23

Sales Performance (INR mn)<br />

29%<br />

31%<br />

30%<br />

10%<br />

1,090<br />

1,410<br />

1,850<br />

2,410<br />

22%<br />

2,950<br />

FY05 FY06 FY07 FY08 FY09<br />

Total revenue<br />

% Growth<br />

FANS Total Ceiling TPW<br />

GOLY 22% 25% 9%<br />

CAGR (over 4 yrs.) 28% 29% 23%<br />

24

Key highlights<br />

<br />

One<br />

<br />

<br />

<br />

<br />

Tie<br />

of the leading players in fan industry with over 15% market share (source: IFMA)<br />

One of the leading players in Premium segment<br />

Tie up with Midea – One of the leading fan manufacturing companies in the world<br />

Business strategy<br />

• Introduction of new models in Premium/ Decorative and Under-Light fans, Fans decorated with more Disney<br />

Characters, Remote controlled Fans<br />

• Focus on Pumps, Motors and Industrial fans<br />

• Expand dealer network, rural penetration and presence in institutional segment<br />

Key industry growth drivers<br />

• Construction and housing industry revival<br />

• Replacement market will improve due to Consumer boom<br />

• With tax reforms, sales from unorganized segment will shift to organized segment as prices will be lower<br />

25

Overview<br />

Products<br />

• Lamps: GLS Lamps, Fluorescent tube lights,<br />

Compact Fluorescent Lamps<br />

• Others: Domestic Luminaires, Ballasts & Starters,<br />

LED Torches<br />

Manufacturing facility:<br />

Hind Lamps, Shikohabad and Starlite Lighting, Nashik<br />

Products<br />

27

Sales Performance (INR mn)<br />

1,000 1,090<br />

9%<br />

23%<br />

1,340<br />

31%<br />

1,760<br />

2,090<br />

19%<br />

4%<br />

FY05 FY06 FY07 FY08 FY09<br />

Total revenue<br />

% Growth<br />

LIGHTING Total CFL GLS&FTL Fittings<br />

GOLY 19% 23% 10% 28%<br />

CAGR (over 4 yrs.) 20% 61% 2% 21%<br />

28

Key highlights<br />

<br />

One<br />

<br />

Good<br />

<br />

Acquired<br />

of India’s oldest lighting company with respected brand image<br />

progress in CFL market<br />

significant stake in Starlite Lighting - a strategic move<br />

Business strategy<br />

• Network expansion and consolidation in Kirana segment, Modern Retail formats. Already covering more than<br />

300,000 outlets<br />

• Focus on CFL since demand for GLS and FTL is not growing g fast. Significant capacity expansion in Starlite Lighting<br />

g<br />

• Motivate consumers to shift to energy saving lamps<br />

Key industry growth drivers<br />

• High growth in CFL due to reduced prices and energy conservation drive at residential, commercial and<br />

government level<br />

• Greater focus on Environment and Climate change amongst Consumers<br />

• Rural electrification and higher Power availability will spur future demand<br />

29

Overview<br />

Products:<br />

• Luminaires: Industrial, Commercial, Decorative, Street<br />

light, Flood light, LED, Lighting Electronic, Lighting Control<br />

• HID lamps: Mercury & Sodium vapor lamps, Halogen<br />

lamps, Metal halide and Fluorescent Lamps<br />

Tie-ups<br />

Products<br />

Technical lighting<br />

IBMS & HVAC<br />

Fire Alarms & Security systems<br />

31

Sales Performance (INR mn)<br />

28%<br />

25% 25%<br />

1,930<br />

1,550<br />

1,210<br />

2,300<br />

19%<br />

2,820<br />

23%<br />

FY05 FY06 FY07 FY08 FY09<br />

Total revenue<br />

% Growth<br />

LUMINAIRE Total Fittings HID<br />

GOLY 23% 24% 15%<br />

CAGR (over 4 yrs.) 24% 25% 17%<br />

32

Key highlights<br />

<br />

<br />

Offers<br />

One of the leading players in street Lights, flood Lights and industrial applications<br />

the latest and cutting edge Security and BMS (Building Management Systems) to<br />

its institutional customers in partnership with Delta Controls of Canada<br />

Business strategy<br />

• Focus on new segments IT/BPO/Retail/Healthcare/Pharma<br />

• Promote products to builders / Electrical Consultants / Architect segment<br />

• Introduction of new products with LED light source<br />

• Focus on energy efficiency products and Green Building applications<br />

Key industry growth drivers<br />

• Rapid urbanization, emerging segments like retail formats, malls, showrooms, IT parks, Tourism, Services<br />

• Govt. and Private sector spending on infrastructure<br />

Major Customers<br />

• Industrial: TATA Group, Reliance Group, Reliance ADAG, L&T, Aditya Birla Group, Siemens, ABB<br />

• Government Clients: Airport Authority of India, Container Corporation of India, State Electricity Boards, NTPC,<br />

Municipal Corporations & Councils, MSRDC, BEST, DAE<br />

33

Overview<br />

Fields of operation:<br />

• Special Projects: Turnkey Lighting Projects, Factory<br />

lighting, Air-port Lighting, Sports Lighting, Rural<br />

Electrification etc.<br />

• High Mast & Poles: High Mast Lighting, Signage,<br />

Transmission Lines, Energy-efficient Illumination<br />

• Towers: Design, Supply, Erection and commissioning of<br />

Transmission lines and Telecommunication Towers,<br />

Monopoles etc.<br />

Products<br />

Telecom Towers Power Distribution Illumination Projects<br />

Tie-up:<br />

Sports Lighting<br />

Street Furniture<br />

Signages<br />

Power Transmission<br />

High Mast<br />

35

CNC Profile Cutting Machine CNC Press Brake from LVD GODREJ Make Shearing Machine<br />

Ranjangaon factory<br />

Pole Welding Machine Welding of High Mast Section 30,000 TPA Tunnel Enclosed Bath

Sales Performance (INR mn)<br />

87%<br />

5,230<br />

1,780<br />

38%<br />

2,450<br />

3,050<br />

24%<br />

3,630<br />

19%<br />

44%<br />

FY05 FY06 FY07 FY08 FY09<br />

Total revenue<br />

% Growth<br />

E&P<br />

Total<br />

Special<br />

Projects High Mast Towers<br />

GOLY 44% 57% 39% 39%<br />

CAGR (over 4 yrs.) 31% 56% 36% 15%<br />

37

Division wise Sales Performance<br />

53% 58%<br />

49%<br />

32% 29%<br />

35%<br />

15% 13% 16%<br />

33% 32%<br />

39% 38%<br />

28% 30%<br />

Orders In Hand – As on Oct 2009<br />

(INR mn)<br />

Segment<br />

Order Book<br />

Towers 3,974<br />

High Mast & Pole 1,046<br />

Special Projects 3,480<br />

Total 8,500<br />

FY05 FY06 FY07 FY08 FY09<br />

Special Projects High Mast Towers<br />

Particulars<br />

Total<br />

Special<br />

Projects H. Mast Towers<br />

Sales FY09 (INR mn) 5,230 1,600 1,980 1,650<br />

GOLY 44% 57% 39% 39%<br />

CAGR (over 4 yrs.) 31% 56% 36% 15%<br />

38

Key highlights<br />

<br />

One of the leading player in sports lighting, power plant lighting and High Masts space<br />

Diversification into related businesses such as Rural Electrification etc<br />

Industry growth drivers<br />

Special Projects<br />

• Huge Investments expected in Power and Infrastructure sector<br />

• Electricity connections to 800 mn households in 125,000 villages will be given in 5 yrs under RGGVY - investment<br />

of INR 1,200 bn<br />

• Major opportunities in Rural electrification and Transmission Line Towers<br />

• Airport Authority of India to develop 25 non metro Airports<br />

• Construction of IT parks / BPO / Shopping Mall / Special Economic Zones<br />

High Mast & Poles<br />

• Jawaharlal Nehru National Urban Renewal Mission within 7 yrs… 23 cities to be transformed involving an<br />

investment of INR 400 bn<br />

Towers<br />

• 60000 CKM transmission network to be added by 2012<br />

• Present capacity of power transfer to be increased from 9000 MW to 30000 MW – Investment of INR 2,000 bn<br />

• 350,000 TCT by 2010 –investment of INR 1,050 bn<br />

39

GMC Balayogi Football cum Athletic Stadium<br />

Hyderabad<br />

BAJAJ Engineering & Projects BU

Sawai Mansingh Cricket Stadium, Jaipur<br />

BAJAJ Engineering & Projects BU

Main Tennis Stadium At Fateh Maidan<br />

Hyderabad

Kothagudam – APSEB - 2 x 210 MWTPP

Queen’s Necklace At Marine Drive - Mumbai

Highmast for Telecommunication &<br />

Antenna Mast<br />

Telecommunication<br />

Application<br />

Antenna Mast for Reliance<br />

Infocom-VPT Project

Signages & Gantry

Flag Mast<br />

Installed at Kaithal & Ladwa, a Haryana<br />

ana<br />

Largest National Flag (22 x<br />

14 mtrs) installed at Kaithal<br />

& Ladwa in Haryana<br />

The India’s tallest mast 63<br />

mtrs (48x72ft)<br />

Hoisted & lowered through<br />

high speed<br />

motorised winching<br />

arrangement. This<br />

Mast is manufactured at<br />

Ranjangaon and<br />

Erected by <strong>Bajaj</strong> E&P BU<br />

team

Transmission i Line Towers<br />

•

Monopole Tower Manufactured At Ranjangaon Plant

Monopoles For Power Transmission- PGCIL’s Dadri Ballabhgarh 400<br />

KV D/C Monopole

132 kv d/c Transmission Line at Pachpatta, Nasik - for ABB /<br />

Enercon / MSETCL

Table of Contents<br />

<strong>Bajaj</strong> <strong>Electricals</strong> – An Overview<br />

Financials<br />

Strategic Business Units<br />

Key Highlights<br />

53

Key Highlights<br />

Nationwide distribution network with wide urban and retail penetration<br />

Strong brand positioning to drive growth<br />

Experienced management team backed by distinguished board<br />

Robust, sustainable business strategy<br />

Strong financial track record<br />

Diversified Product & Business portfolio – Both Consumer facing and Industry /<br />

Infrastructure facing<br />

54

Nationwide distribution network<br />

Distribution ib ti network<br />

• 19 branches<br />

• 600 distributors<br />

• 5,000 dealers<br />

• 240 service centers<br />

• 300,000+ retail outlets<br />

Parwanoo<br />

Chandigarh<br />

Zirakpur<br />

Dehradun<br />

Noida<br />

Delhi<br />

Faridabad<br />

Jaipur<br />

Lucknow<br />

Patna<br />

Guwahati<br />

Ahmedabad<br />

Indore<br />

Raipur<br />

Ranchi<br />

Calcutta<br />

Daman<br />

Nagpur<br />

Bhubaneshwar<br />

Mumbai<br />

Has a strong pan India footprint and has displayed great<br />

strengths in distribution, logistics & project execution…<br />

plans to further amplify its retail network<br />

Pune<br />

Goa<br />

Hyderabad<br />

Bangalore<br />

Cochin<br />

Chennai<br />

Branch<br />

Depot<br />

55

Strong brand positioning to drive growth<br />

<strong>Bajaj</strong> Appliances<br />

• Tie up with Morphy Richards (UK) for<br />

manufacturing & marketing premium products in<br />

India<br />

• <strong>Bajaj</strong> Platini introduced at the Premium end<br />

• New Ad-campaign on “Rock star mommy”<br />

launched<br />

<strong>Bajaj</strong> Fans<br />

• Tie up with one of the world’s<br />

leading fan manufacturers - <strong>Bajaj</strong><br />

Midea<br />

• Targeting kids segment by<br />

supplying specially designed fans<br />

through a tie up with Disney<br />

<strong>Bajaj</strong> Luminaires<br />

• Tie up with Trilux Lenze<br />

<strong>Bajaj</strong> j Lighting<br />

g<br />

(Germany) for premium technical<br />

lighting and RUUD Lighting (US)<br />

• Significant network expansion<br />

undertaken<br />

for LED<br />

• Significant capacity expansion in<br />

• New Foray into IBMS , HVAC ,<br />

Starlite Lighting for CFLs<br />

Fire Alarms and Security systems<br />

• Focus on Rural markets<br />

Strong brand name created in consumer durables & lighting businesses over the last seven decades<br />

56

Experienced management team backed by eminent board<br />

Top Management<br />

Shekhar <strong>Bajaj</strong>, Chairman & MD - <strong>Bajaj</strong> <strong>Electricals</strong> Ltd.<br />

Shekhar <strong>Bajaj</strong><br />

Chairman & Managing Director<br />

— Worked previously at <strong>Bajaj</strong> Sevashram and <strong>Bajaj</strong><br />

International<br />

— Present on Board of Directors for <strong>Bajaj</strong> Auto<br />

— Former President of ASSOCHAM, IMC, Elcoma, IFMA etc.<br />

Anant <strong>Bajaj</strong> R. Ramakrishnan P. P. Jathar<br />

Executive Director<br />

Executive Director<br />

Executive VP & CFO<br />

— 11 years of experience in the industry<br />

— Holds a BCom and PGDFMB<br />

— Director on Board of <strong>Bajaj</strong><br />

International<br />

— B.Sc. (Hons.) and PGDBM from XLRI Jamshedpur<br />

— Associated with the Company since last 10 years<br />

after 17 yrs in Asian Paints<br />

— Earlier President & COO of Company<br />

— Actively associated with ISA, ASCI – CCC, BMA,<br />

CII and IMC<br />

Eminent Board<br />

— 26+ years of experience in the industry<br />

— Holds a bachelors degree in commerce and<br />

a qualified chartered accountant<br />

— Responsible for all financial and accounting<br />

matters<br />

H. V. Goenka<br />

A.K.Jalan<br />

Ajit Gulabchand<br />

Dr.(Mrs) Shahani<br />

Director<br />

Director<br />

Director<br />

Director<br />

V.B.Haribhakti<br />

Director<br />

Madhur <strong>Bajaj</strong><br />

Director<br />

Dr. R P Singh<br />

Director<br />

57

Robust business strategy<br />

Focusing on high<br />

growth businesses<br />

• Engineering & Projects revenue has expanded more than 5 fold from INR 950 mn<br />

(FY04) to INR 5,230 mn (FY09). TLT, Rural Electrification have large growth potential<br />

• Focusing on premium brands like Morphy Richards and Trilux and making them<br />

successful<br />

Leveraging strong<br />

brand equity<br />

• Created a strong brand name in consumer durables and lighting businesses over the<br />

last seven decades<br />

• Continuously focusing on brand building and expanding retail network<br />

Substantial<br />

market share<br />

• One of India’s leading players in the small appliances , fans and Lighting markets<br />

• One of the market leaders in mixers, irons OTGs & water heaters<br />

• Strong Distribution and presence in urban and rural markets<br />

Diversified player<br />

• Diversified player with good presence in:<br />

• Consumer facing business (Appliances, Fans and Lighting)<br />

• Industry facing business (Luminaires)<br />

• Infrastructure facing business (Engineering & projects- High mast, turnkey<br />

lighting project, Transmission Line tower and Rural Electrification)<br />

58

BAJAJ ELECTRICALS LTD.<br />

Thank you!<br />

59