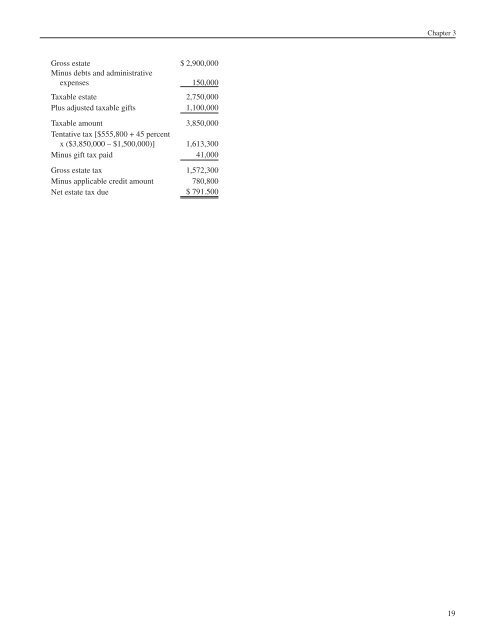

The Federal <strong>Estate</strong> and Gift Tax Process or educational organizations; fraternal societies (<strong>for</strong> gifts used exclusively <strong>for</strong> religious, charitable, scientific, literary, or educational purposes); and veterans’ organizations incorporated by an act of Congress. There is no limitation on the amount of the charitable deduction, but it cannot exceed the net value of the property that passes to charity as reflected in the gross estate. Marital deduction—The value of certain property interests that pass from the decedent to his (her) surviving spouse can be deducted from the decedent’s gross estate. Generally, in the case of simultaneous death, local law governs as to a presumption of who was the first to die. Determination of Tax Due The next step is to compute the tentative tax on the sum of the taxable estate, plus adjusted taxable gifts. Adjusted taxable gifts are defined as the total amount of taxable gifts made by the decedent after December 31, 1976, other than those gifts that must be included in the gross estate. Lifetime gifts that must be included in the gross estate <strong>for</strong> one reason or another are discussed in chapter 8. The current unified rate schedule is then applied to this cumulative total (sometimes referred to as the “estate tax base”) comprised of transfers both during life and at death. The result is the tentative estate tax. Once the tentative tax is determined, it is reduced by the gift taxes (those previously paid, plus those not yet paid) on gifts made after December 31, 1976. The result is the gross estate tax. The tax payable on a post-1976 lifetime gift is the amount owed on that gift after the gift tax otherwise payable is reduced by the unified credit or applicable credit amount. The estate tax reduction <strong>for</strong> gift taxes paid on such gifts is based on the rate schedule in effect on the date of death, not on the schedule in effect at the time of the gift, if the two are different. Credit Reductions Once the gross estate tax is determined, it is reduced by certain credits to determine the net estate tax due. There are four such credits: (1) the unified credit (applicable credit amount) discussed above; (2) the credit <strong>for</strong> Federal gift taxes paid on certain pre-1977 transfers; (3) the <strong>for</strong>eign death tax credit; and (4) the credit <strong>for</strong> Federal estate taxes on prior transfers. Applicable credit amount —The amount of the applicable credit amount available at the decedent’s death ($780,800 in 2008, minus any of the credit applied to lifetime gifts) will be reduced if the decedent made a taxable gift at any time after September 8, 1976, and be<strong>for</strong>e January 1, 1977. Prior to unification of estate and gift taxes in 1977, a specific lifetime gift exemption of $30,000 was permitted. The applicable credit amount must be reduced by 20 percent of the exemption allowed <strong>for</strong> a gift made during this period. For example, if the decedent had made a gift on October 15, 1976, and used the entire lifetime exemption of $30,000, the applicable credit amount would be reduced by $6,000 (20 percent of $30,000). Credit <strong>for</strong> taxes on pre-1977 gifts—A credit is allowed <strong>for</strong> gift taxes paid on pre-1977 gifts that must be included in the donor’s gross estate under any provision of law that mandates such inclusion. These provisions are discussed in detail in chapter 8. The credit is limited to the lesser of: (1) the gift tax paid on the gift that is included in the gross estate, or (2) the amount of estate tax attributable to the inclusion of the gift in the gross estate. Foreign death tax credit—A credit is allowed <strong>for</strong> <strong>for</strong>eign death taxes paid with respect to property in the decedent’s estate if the property actually is situated in a <strong>for</strong>eign country. The credit is the lesser of the <strong>for</strong>eign death tax or the Federal estate tax attributable to the property. Credit <strong>for</strong> estate taxes on prior transfers—A credit is allowed <strong>for</strong> all or part of the Federal estate tax paid on transfers to the present decedent of property from a transferor who died within 10 years be<strong>for</strong>e or 2 years after the present decedent’s death. The credit is the smaller of (1) the amount of the Federal estate tax attributable to the transferred property in the prior decedent’s estate, or (2) the amount of the Federal estate tax attributable to the transferred property in the present decedent’s estate. If the transferor dies within 2 years be<strong>for</strong>e or 2 years after the present decedent’s death, the full credit is allowed. If the transferor dies more than 2 years be<strong>for</strong>e the present decedent, the credit is reduced by 20 percent <strong>for</strong> each full 2-year period by which the death of the transferor preceded the death of the present decedent. <strong>Estate</strong> Tax Computation Example 3.1. Assume that the decedent died in 2008 with a gross estate valued at $2.9 million. In 2005 the decedent had made a taxable lifetime gift of property valued at $1.1 million to his daughter. He had filed a gift tax return and, after deducting the applicable credit amount available in 2005, paid a net gift tax of $41,000 (tentative gift tax of $386,800, minus $345,800 credit). There were no other lifetime taxable gifts. The decedent’s gross estate of $2.9 million includes the gift tax of $41,000 that was paid but not the value of the gift itself. Because the entire gift was taxable and is not included in the gross estate, it is added to the taxable estate to determine the tentative tax, as discussed above. The net estate tax is computed as follows: 18

Chapter 3 Gross estate $ 2,900,000 Minus debts and administrative expenses 150,000 Taxable estate 2,750,000 Plus adjusted taxable gifts 1,100,000 Taxable amount 3,850,000 Tentative tax [$555,800 + 45 percent x ($3,850,000 – $1,500,000)] 1,613,300 Minus gift tax paid 41,000 Gross estate tax 1,572,300 Minus applicable credit amount 780,800 Net estate tax due $ 791.500 19