Estate Planning for Forest Landowners - South Dakota Department ...

Estate Planning for Forest Landowners - South Dakota Department ...

Estate Planning for Forest Landowners - South Dakota Department ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

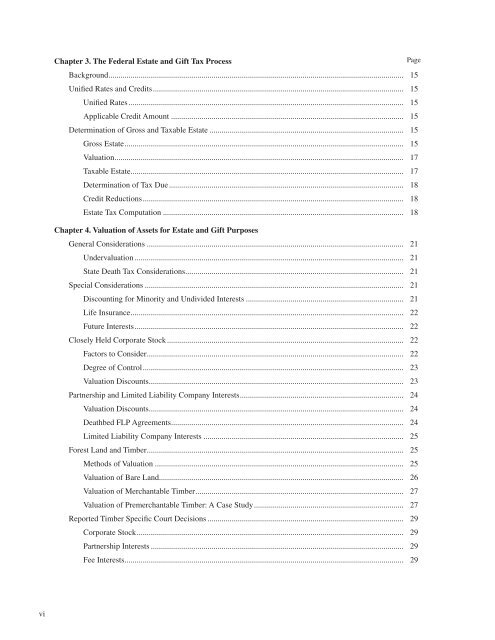

Chapter 3. The Federal <strong>Estate</strong> and Gift Tax Process<br />

Page<br />

Background.................................................................................................................................................. 15<br />

Unified Rates and Credits............................................................................................................................ 15<br />

Unified Rates......................................................................................................................................... 15<br />

Applicable Credit Amount.................................................................................................................... 15<br />

Determination of Gross and Taxable <strong>Estate</strong>................................................................................................. 15<br />

Gross <strong>Estate</strong>.......................................................................................................................................... 15<br />

Valuation............................................................................................................................................... 17<br />

Taxable <strong>Estate</strong>....................................................................................................................................... 17<br />

Determination of Tax Due..................................................................................................................... 18<br />

Credit Reductions................................................................................................................................. 18<br />

<strong>Estate</strong> Tax Computation........................................................................................................................ 18<br />

Chapter 4. Valuation of Assets <strong>for</strong> <strong>Estate</strong> and Gift Purposes<br />

General Considerations................................................................................................................................ 21<br />

Undervaluation...................................................................................................................................... 21<br />

State Death Tax Considerations............................................................................................................ 21<br />

Special Considerations................................................................................................................................. 21<br />

Discounting <strong>for</strong> Minority and Undivided Interests............................................................................... 21<br />

Life Insurance....................................................................................................................................... 22<br />

Future Interests...................................................................................................................................... 22<br />

Closely Held Corporate Stock...................................................................................................................... 22<br />

Factors to Consider............................................................................................................................... 22<br />

Degree of Control................................................................................................................................. 23<br />

Valuation Discounts.............................................................................................................................. 23<br />

Partnership and Limited Liability Company Interests................................................................................. 24<br />

Valuation Discounts.............................................................................................................................. 24<br />

Deathbed FLP Agreements................................................................................................................... 24<br />

Limited Liability Company Interests.................................................................................................... 25<br />

<strong>Forest</strong> Land and Timber............................................................................................................................... 25<br />

Methods of Valuation............................................................................................................................ 25<br />

Valuation of Bare Land......................................................................................................................... 26<br />

Valuation of Merchantable Timber....................................................................................................... 27<br />

Valuation of Premerchantable Timber: A Case Study.......................................................................... 27<br />

Reported Timber Specific Court Decisions.................................................................................................. 29<br />

Corporate Stock.................................................................................................................................... 29<br />

Partnership Interests.............................................................................................................................. 29<br />

Fee Interests.......................................................................................................................................... 29<br />

vi