CHRISTOPHER MASEK AND DETLEF DINSEL: - IK Investment ...

CHRISTOPHER MASEK AND DETLEF DINSEL: - IK Investment ...

CHRISTOPHER MASEK AND DETLEF DINSEL: - IK Investment ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

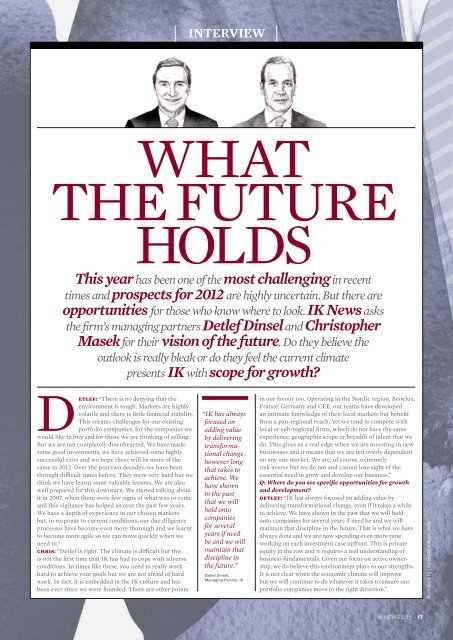

INTERVIEW<br />

XXXX XXXX<br />

WHAT<br />

THE FUTURE<br />

HOLDS<br />

This year has been one of the most challenging in recent<br />

times and prospects for 2012 are highly uncertain. But there are<br />

opportunities for those who know where to look. <strong>IK</strong> News asks<br />

the firm’s managing partners Detlef Dinsel and Christopher<br />

Masek for their vision of the future. Do they believe the<br />

outlook is really bleak or do they feel the current climate<br />

presents <strong>IK</strong> with scope for growth<br />

Detlef: “There is no denying that the<br />

environment is tough. Markets are highly<br />

volatile and there is little financial stability.<br />

This creates challenges for our existing<br />

portfolio companies, for the companies we<br />

would like to buy and for those we are thinking of selling.<br />

But we are not completely downhearted. We have made<br />

some good investments, we have achieved some highly<br />

successful exits and we hope there will be more of the<br />

same in 2012. Over the past two decades, we have been<br />

through difficult times before. They were very hard but we<br />

think we have learnt some valuable lessons. We are also<br />

well prepared for this downturn. We started talking about<br />

it in 2007, when there were few signs of what was to come<br />

and this vigilance has helped us over the past few years.<br />

We have a depth of experience in our chosen markets<br />

but, in response to current conditions, our due diligence<br />

processes have become even more thorough and we learnt<br />

to become more agile so we can move quickly when we<br />

need to.”<br />

chris: “Detlef is right. The climate is difficult but this<br />

is not the first time that <strong>IK</strong> has had to cope with a dverse<br />

conditions. In times like these, you need to really work<br />

hard to achieve your goals but we are not afraid of hard<br />

work. In fact, it is embedded in the <strong>IK</strong> culture and has<br />

been ever since we were founded. there are other points<br />

“<strong>IK</strong> has always<br />

focused on<br />

adding value<br />

by delivering<br />

transformational<br />

change,<br />

however long<br />

that takes to<br />

achieve. We<br />

have shown<br />

in the past<br />

that we will<br />

hold onto<br />

companies<br />

for several<br />

years if need<br />

be and we will<br />

maintain that<br />

discipline in<br />

the future.”<br />

Detlef Dinsel,<br />

Managing Partner, <strong>IK</strong><br />

in our favour too. operating in the Nordic region, Benelux,<br />

France, Germany and CEE, our teams have developed<br />

an intimate knowledge of their local markets but benefit<br />

from a pan-regional reach. Yet we tend to compete with<br />

local or sub-regional firms, which do not have the same<br />

experience, geographic scope or breadth of talent that we<br />

do. This gives us a real edge when we are investing in new<br />

businesses and it means that we are not overly dependent<br />

on any one market. We are, of course, extremely<br />

risk-averse but we do not and cannot lose sight of the<br />

essential need to grow and develop our business.”<br />

Q: Where do you see specific opportunities for growth<br />

and development<br />

detlef: “<strong>IK</strong> has always focused on adding value by<br />

delivering transformational change, even if it takes a while<br />

to achieve. We have shown in the past that we will hold<br />

onto companies for several years if need be and we will<br />

maintain that discipline in the future. That is what we have<br />

always done and we are now spending even more time<br />

working on each investment case upfront. This is private<br />

equity in the raw and it requires a real understanding of<br />

business fundamentals. Given our focus on active ownership,<br />

we do believe this environment plays to our strengths.<br />

It is not clear when the economic climate will improve<br />

but we will continue to do whatever it takes to ensure our<br />

portfolio companies move in the right direction.”<br />

Illustrations by Lina Ekstrand /Agent Molly<br />

<strong>IK</strong> NEWS 2/11 – 17