SARS gives some clarity on interest free loans - Grant Thornton

SARS gives some clarity on interest free loans - Grant Thornton

SARS gives some clarity on interest free loans - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

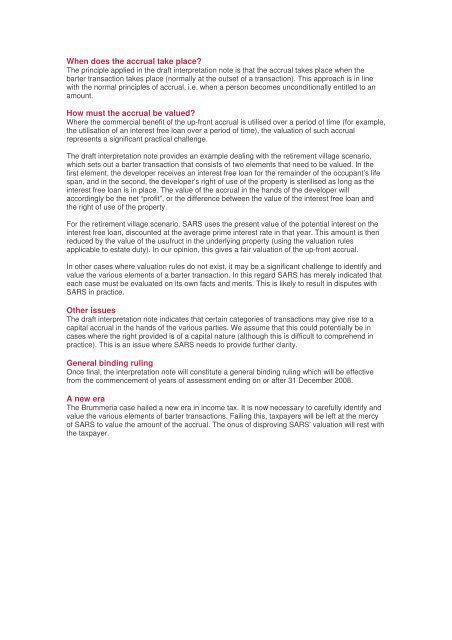

When does the accrual take place<br />

The principle applied in the draft interpretati<strong>on</strong> note is that the accrual takes place when the<br />

barter transacti<strong>on</strong> takes place (normally at the outset of a transacti<strong>on</strong>). This approach is in line<br />

with the normal principles of accrual, i.e. when a pers<strong>on</strong> becomes unc<strong>on</strong>diti<strong>on</strong>ally entitled to an<br />

amount.<br />

How must the accrual be valued<br />

Where the commercial benefit of the up-fr<strong>on</strong>t accrual is utilised over a period of time (for example,<br />

the utilisati<strong>on</strong> of an <strong>interest</strong> <strong>free</strong> loan over a period of time), the valuati<strong>on</strong> of such accrual<br />

represents a significant practical challenge.<br />

The draft interpretati<strong>on</strong> note provides an example dealing with the retirement village scenario,<br />

which sets out a barter transacti<strong>on</strong> that c<strong>on</strong>sists of two elements that need to be valued. In the<br />

first element, the developer receives an <strong>interest</strong> <strong>free</strong> loan for the remainder of the occupant’s life<br />

span, and in the sec<strong>on</strong>d, the developer’s right of use of the property is sterilised as l<strong>on</strong>g as the<br />

<strong>interest</strong> <strong>free</strong> loan is in place. The value of the accrual in the hands of the developer will<br />

accordingly be the net “profit”, or the difference between the value of the <strong>interest</strong> <strong>free</strong> loan and<br />

the right of use of the property.<br />

For the retirement village scenario, <str<strong>on</strong>g>SARS</str<strong>on</strong>g> uses the present value of the potential <strong>interest</strong> <strong>on</strong> the<br />

<strong>interest</strong> <strong>free</strong> loan, discounted at the average prime <strong>interest</strong> rate in that year. This amount is then<br />

reduced by the value of the usufruct in the underlying property (using the valuati<strong>on</strong> rules<br />

applicable to estate duty). In our opini<strong>on</strong>, this <str<strong>on</strong>g>gives</str<strong>on</strong>g> a fair valuati<strong>on</strong> of the up-fr<strong>on</strong>t accrual.<br />

In other cases where valuati<strong>on</strong> rules do not exist, it may be a significant challenge to identify and<br />

value the various elements of a barter transacti<strong>on</strong>. In this regard <str<strong>on</strong>g>SARS</str<strong>on</strong>g> has merely indicated that<br />

each case must be evaluated <strong>on</strong> its own facts and merits. This is likely to result in disputes with<br />

<str<strong>on</strong>g>SARS</str<strong>on</strong>g> in practice.<br />

Other issues<br />

The draft interpretati<strong>on</strong> note indicates that certain categories of transacti<strong>on</strong>s may give rise to a<br />

capital accrual in the hands of the various parties. We assume that this could potentially be in<br />

cases where the right provided is of a capital nature (although this is difficult to comprehend in<br />

practice). This is an issue where <str<strong>on</strong>g>SARS</str<strong>on</strong>g> needs to provide further <str<strong>on</strong>g>clarity</str<strong>on</strong>g>.<br />

General binding ruling<br />

Once final, the interpretati<strong>on</strong> note will c<strong>on</strong>stitute a general binding ruling which will be effective<br />

from the commencement of years of assessment ending <strong>on</strong> or after 31 December 2008.<br />

A new era<br />

The Brummeria case hailed a new era in income tax. It is now necessary to carefully identify and<br />

value the various elements of barter transacti<strong>on</strong>s. Failing this, taxpayers will be left at the mercy<br />

of <str<strong>on</strong>g>SARS</str<strong>on</strong>g> to value the amount of the accrual. The <strong>on</strong>us of disproving <str<strong>on</strong>g>SARS</str<strong>on</strong>g>’ valuati<strong>on</strong> will rest with<br />

the taxpayer.