IFRS - there's nowhere to hide - Grant Thornton

IFRS - there's nowhere to hide - Grant Thornton

IFRS - there's nowhere to hide - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Volume 2. November 2005<br />

In this issue<br />

1. <strong>IFRS</strong> - <strong>there's</strong> <strong>nowhere</strong> <strong>to</strong> <strong>hide</strong><br />

2. the Guestline: To audit or not <strong>to</strong> audit<br />

3 2©<br />

3. B E - how does it all add up<br />

4. Tax implications of selling your business<br />

5. Occupational health & safety is a risk fac<strong>to</strong>r<br />

6. the Chat line<br />

<strong>IFRS</strong> - <strong>there's</strong> <strong>nowhere</strong> <strong>to</strong> <strong>hide</strong><br />

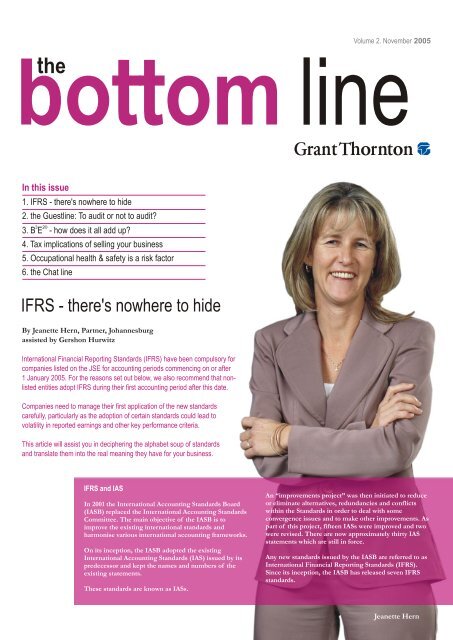

By Jeanette Hern, Partner, Johannesburg<br />

assisted by Gershon Hurwitz<br />

International Financial Reporting Standards (<strong>IFRS</strong>) have been compulsory for<br />

companies listed on the JSE for accounting periods commencing on or after<br />

1 January 2005. For the reasons set out below, we also recommend that nonlisted<br />

entities adopt <strong>IFRS</strong> during their first accounting period after this date.<br />

Companies need <strong>to</strong> manage their first application of the new standards<br />

carefully, particularly as the adoption of certain standards could lead <strong>to</strong><br />

volatility in reported earnings and other key performance criteria.<br />

This article will assist you in deciphering the alphabet soup of standards<br />

and translate them in<strong>to</strong> the real meaning they have for your business.<br />

<strong>IFRS</strong> and IAS<br />

In 2001 the International Accounting Standards Board<br />

(IASB) replaced the International Accounting Standards<br />

Committee. The main objective of the IASB is <strong>to</strong><br />

improve the existing international standards and<br />

harmonise various international accounting frameworks.<br />

On its inception, the IASB adopted the existing<br />

International Accounting Standards (IAS) issued by its<br />

predecessor and kept the names and numbers of the<br />

existing statements.<br />

These standards are known as IASs.<br />

An “improvements project” was then initiated <strong>to</strong> reduce<br />

or eliminate alternatives, redundancies and conflicts<br />

within the Standards in order <strong>to</strong> deal with some<br />

convergence issues and <strong>to</strong> make other improvements. As<br />

part of this project, fifteen IASs were improved and two<br />

were revised. There are now approximately thirty IAS<br />

statements which are still in force.<br />

Any new standards issued by the IASB are referred <strong>to</strong> as<br />

International Financial Reporting Standards (<strong>IFRS</strong>).<br />

Since its inception, the IASB has released seven <strong>IFRS</strong><br />

standards.<br />

Jeanette Hern

2<br />

Volume 2. November 2005<br />

The sheer volume of the various standards can make implementing<br />

<strong>IFRS</strong> a daunting task in any entity, particularly where management<br />

are not familiar with the new <strong>IFRS</strong> implications. To assist you in<br />

understanding the standard conversions a little better, we have<br />

enclosed a handy reference card for you.<br />

AC statements and South African GAAP<br />

Should you adopt <strong>IFRS</strong><br />

What most people don't realise is that, as a result of the<br />

All listed companies and public reporting institutions are required<br />

harmonisation process undertaken by the South African Institute <strong>to</strong> adopt <strong>IFRS</strong> with effect from 1 January 2005. Other entities<br />

of Chartered Accountants (SAICA) over the years, our South may choose <strong>to</strong> either convert <strong>IFRS</strong> or <strong>to</strong> remain on SA GAAP. So<br />

African statements were already closely aligned <strong>to</strong> the IASs. Thus, what should these other entities do<br />

many of the transitional changes and implications envisaged by<br />

the IASB in other countries are not applicable <strong>to</strong> South Africa. Convert <strong>to</strong> <strong>IFRS</strong>: On conversion <strong>to</strong> <strong>IFRS</strong> the entity will have <strong>to</strong><br />

make an explicit and unreserved statement that it has now<br />

At the time of the “improvements project” in March 2004, SAICA converted <strong>to</strong> <strong>IFRS</strong> and it can then apply <strong>IFRS</strong> 1. This allows<br />

made the South African aligned AC statements the same as the certain exemptions that make it easier <strong>to</strong> handle the effect of the<br />

amended IASs and the new <strong>IFRS</strong>s. Thus, all old AC statements implementation on prior year balances.<br />

have been improved (in accordance with the improvements<br />

project), revised (in addition <strong>to</strong> the improvements project) or Remain on SA GAAP: An unlisted entity may choose <strong>to</strong> continue<br />

aligned (<strong>to</strong> align the text thereof with the equivalent international <strong>to</strong> prepare its financial statements in terms of SA GAAP. As SA<br />

statement).<br />

GAAP has been aligned with international standards the entity<br />

will, in effect, still have <strong>to</strong> implement the same accounting policies<br />

All new <strong>IFRS</strong> statements are now issued as South African<br />

as under <strong>IFRS</strong>. The implementation exemptions allowed by <strong>IFRS</strong><br />

statements without any amendments with a dual AC number (e.g. 1 will however, not be available <strong>to</strong> the entity and all changes will<br />

<strong>IFRS</strong>3 was issued in South Africa as AC 140).<br />

have <strong>to</strong> be made retrospectively. We therefore encourage our<br />

clients <strong>to</strong> convert <strong>to</strong> <strong>IFRS</strong>.<br />

It is the practice of the various accounting bodies <strong>to</strong> issue<br />

interpretations which provide further guidance and clarity <strong>to</strong><br />

existing standards. In South Africa, these have been issued by<br />

What is the likely impact of the new standards<br />

SAICA within the AC 400 category. The his<strong>to</strong>rical international To bring an entity's accounting policies either in line with <strong>IFRS</strong> or<br />

equivalents were known as SICs. Under the new IASB,<br />

the newly aligned South African Standards (which, as set out<br />

interpretations are now known as IFRICs.<br />

above, are identical <strong>to</strong> <strong>IFRS</strong> with the exception of <strong>IFRS</strong> 1), a<br />

company needs <strong>to</strong> perform a detailed review of existing<br />

As part of the improvements project, many existing SICs were accounting policies. Experience has shown that the following<br />

incorporated in<strong>to</strong> the actual body of the standards and have thus areas require the most attention:<br />

now fallen away. There are currently eleven SICs and four IFRICs.<br />

These interpretations have the same force as the related property plant and equipment<br />

accounting standards. introduction of component accounting<br />

reassessment of useful lives and expected residual values<br />

Statements in the AC 500 series are issued <strong>to</strong> address South<br />

annually<br />

African specific matters which are not addressed in the goodwill is assessed for impairment and no longer amortised<br />

international standards. AC 501 - Secondary Taxation on accounting for share options and the recognition of the related<br />

Companies - is currently the only standard issued in this series.<br />

expense and liability in terms of <strong>IFRS</strong>2<br />

the requirements of <strong>IFRS</strong> 3 <strong>to</strong> allocate the purchase price in<br />

Re-looking at existing standards<br />

any business combinations after 1 March 2004 <strong>to</strong> the fair<br />

The increased focus on the content of the existing standards<br />

values of the underlying identifiable assets tangible and<br />

during the current year has identified various areas where South intangible, liabilities and contingent liabilities.<br />

African companies were incorrectly applying these standards. The financial instruments<br />

accounting profession is, therefore, currently experiencing a the removal of alternative accounting treatments for foreign<br />

refinement of opinions on paragraphs in the standards. Even<br />

operations.<br />

though the wording of the standards has not changed, the opinion reclassifying non-current assets held for sale.<br />

of what they mean has changed. An example of this is the wider related party definitions and disclosure requirements.<br />

requirement <strong>to</strong> recognise operating lease income or expenditure<br />

on a straight-line basis over the period of the lease.<br />

The <strong>Grant</strong> Thorn<strong>to</strong>n <strong>IFRS</strong> implementation team:<br />

Frank Timmins ftimmins@gt.co.za Jeanette Hern jhern@gt.co.za Jessica Saayman jsaayman@gt.co.za<br />

Chris Paul cpaul@gt.co.za Stephen Bruce sbruce@gtec.co.za Rudi Scholtz rscholltz@gtec.co.za<br />

Neil Adams nadams@gtct.co.za Catherine Tillard ctillard@gtdbn.co.za Anabel Vieira av@gtpta.co.za

Volume 2. November 2005 3<br />

the<br />

Guest<br />

line: To audit or not <strong>to</strong> audit<br />

By Linda de Beer, Senior Executive - Standards, South<br />

African Institute of Chartered Accountants (SAICA)<br />

Significant debate surrounds the nation's proposed corporate law<br />

reform, with the following questions being anxiously posed:<br />

<br />

<br />

<br />

<br />

should all companies be subjected <strong>to</strong> an audit<br />

do smaller companies only need an accounting officer's report<br />

should close corporations be abolished<br />

must every company comply with International Financial<br />

Reporting Standards (<strong>IFRS</strong>) including small companies<br />

Yet the debate has not addressed the heart of the matter, thereby<br />

rendering it impossible <strong>to</strong> come up with the appropriate answers.<br />

Corporate law - limited liability<br />

Of crucial importance is an appreciation of a vital principle of<br />

corporate law, that of limited liability which comes with<br />

extended responsibility. The shareholders or members of a<br />

limited liability entity (company or close corporation) have the<br />

privilege of decision-making, acting and running operations for<br />

which they, in their individual capacity, only take limited<br />

responsibility, albeit financial or otherwise.<br />

For this privilege, the limited liability entity must 'pay' by making<br />

information available <strong>to</strong> its stakeholders in a responsible,<br />

transparent and unbiased manner.<br />

The Triple Bot<strong>to</strong>mline<br />

Gone are the days when a company or close corporation could<br />

think it was only accountable <strong>to</strong> its shareholders or members.<br />

No company is an island; it is part of a complex infrastructure<br />

and, as a corporate citizen, it is accountable <strong>to</strong> the community,<br />

employees and others.<br />

Good governance requires a balance between economic,<br />

environmental and social interests, often referred <strong>to</strong> as the triple<br />

bot<strong>to</strong>m line.<br />

Public protection<br />

With this in mind, the broad objectives of corporate law can be<br />

evaluated and only then can all of the related questions be<br />

answered.<br />

The first such objective refers <strong>to</strong> protection for inves<strong>to</strong>rs and<br />

other stakeholders. As an economy dependent upon foreign<br />

investment, South African corporate law should give all inves<strong>to</strong>rs<br />

the peace of mind that financial reporting standards of the highest<br />

quality are applicable.<br />

South African corporate law should be in line with international<br />

best practice and the requirements should be familiar and<br />

understandable for a prospective foreign inves<strong>to</strong>r.<br />

Furthermore, mechanisms should be built in<strong>to</strong> law <strong>to</strong> ensure that<br />

external stakeholders such as shareholders, minorities, employees,<br />

credi<strong>to</strong>rs, suppliers, consumers and the public at large are<br />

protected. This can be done by spelling out the duties and<br />

obligations of direc<strong>to</strong>rs, financial reporting requirements, good<br />

governance principles, civil litigation processes and capital<br />

maintenance mechanisms.<br />

Impact on smaller businesses<br />

The objective of public protection must be balanced by the<br />

importance of small business within our economy. If South<br />

African corporate law does not encourage entrepreneurs <strong>to</strong><br />

establish small and medium sized businesses, our socio-economic<br />

problems such as the need for job creation and skills development<br />

will never be adequately addressed.<br />

HÄGAR the Horrible by Dik Browne

4<br />

Volume 2. November 2005<br />

Selling a business<br />

Have you considered the tax implications<br />

Corporate law should therefore be simple, accessible and not<br />

impede the activities of the small business sec<strong>to</strong>r.<br />

Even the less sophisticated businessman should be empowered<br />

<strong>to</strong> establish a company in a fairly simple and inexpensive<br />

manner, without having <strong>to</strong> go through unnecessary red tape,<br />

onerous reporting requirements and cumbersome registration<br />

processes.<br />

These are the two objectives on which we should hang our<br />

corporate law hat. Once this is in place, it becomes easy <strong>to</strong><br />

answer the questions. Thus:<br />

Should all companies be subjected <strong>to</strong> an audit<br />

Not necessarily, but if stakeholders require an audit, they should<br />

have the option <strong>to</strong> have one done. If the public interest is at<br />

stake (that is, external stakeholders are involved), an audit is a<br />

must.<br />

Do smaller companies only need an accounting officer's<br />

report<br />

Only if an accounting officer's report adds value; if not, don't<br />

even do that. However, again, if public interest is at stake or<br />

stakeholders require assurance, an accounting officer's report<br />

will not be enough; an audit must be done.<br />

Should close corporations be abolished<br />

The question should, rather, be: Does the Close Corporations Act<br />

meet its defined objectives, or is it complicating the issue; what is the<br />

difference between a close corporation and a private company<br />

If this difference is purely arbitrary and superficial, the Close<br />

Corporation Act is an obstacle rather than an aid, and should be<br />

abolished.<br />

By Justin Liebenberg, Senior Tax Manager, Johannesburg<br />

The radical changes in tax legislation over the past couple of years<br />

have had an impact on traditionally straightforward business<br />

transactions. In the past you could have sold a business with<br />

relatively minor tax consequences but <strong>to</strong>day, by ignoring the impact<br />

of Capital Gains Tax (CGT) and amendments <strong>to</strong> the Secondary Tax<br />

on Companies (STC) the effect of legislation on these transactions<br />

can be costly.<br />

In this article we highlight some of the pitfalls when selling your<br />

business, focusing specifically on the different tax consequences<br />

between selling the shares in a company and selling the business<br />

of a company.<br />

The use of a case study will best demonstrate the issues. For<br />

this purpose, assume the following facts:<br />

<br />

<br />

<br />

<br />

<br />

<br />

you own shares in the company, which were valued at<br />

R10m on 1 Oc<strong>to</strong>ber 2001 (the commencement date of<br />

CGT)<br />

the purchaser is willing <strong>to</strong> pay a purchase<br />

price of R20m<br />

the net asset value of the business is<br />

R5m at 1 Oc<strong>to</strong>ber 2001<br />

the net asset value at date of sale is<br />

unchanged at R5m<br />

the goodwill at 1 Oc<strong>to</strong>ber 2001 is<br />

valued at R5m<br />

(R10m - R5m)<br />

the goodwill at the date of<br />

sale is R15m (R20m - R5m)<br />

Must every company comply with International Financial<br />

Reporting Standards (<strong>IFRS</strong>) including small companies<br />

Yes if it enhances the credibility of our market. But no for<br />

small companies that do not operate at a higher, public interest<br />

level where <strong>IFRS</strong> is an operational obstacle.<br />

Ultimately, public interest should dictate. In this context, the<br />

notion of a public interest company is important.<br />

Public interest companies should be subjected <strong>to</strong> the highest<br />

standards, including accounting, auditing and corporate<br />

governance, reporting requirements and other checks and<br />

balances.<br />

The challenge however, is <strong>to</strong> accurately set the parameters so<br />

that the appropriate companies with external public interest are<br />

included in this definition.<br />

Justin Liebenberg

Volume 2. November 2005 5<br />

Tax implications if you sell your shares in the business<br />

The sale of a share amounts <strong>to</strong> the disposal of an asset and is<br />

consequently subject <strong>to</strong> CGT. Essentially, a capital gain or loss is<br />

determined by deducting the base cost of an asset from the<br />

proceeds realised on its disposal. Most CGT planning revolves<br />

around minimising your capital gains by maximising your base<br />

cost. The base cost of an asset would normally be enhanced by<br />

certain expenditure incurred in relation <strong>to</strong> the asset (the types of<br />

expenditure are specifically provided for in the legislation).<br />

CGT only became effective from 1 Oc<strong>to</strong>ber 2001 and therefore<br />

special rules apply <strong>to</strong> the determination of the base cost of an<br />

asset acquired before this date so as <strong>to</strong> ensure that only post 1<br />

Oc<strong>to</strong>ber 2001 growth is subject <strong>to</strong> CGT. The effect of these rules<br />

is that the value of the asset had <strong>to</strong> be determined at 1 Oc<strong>to</strong>ber<br />

2001, the so-called 'valuation date value'. This value is included in<br />

the asset's base cost <strong>to</strong>gether with any allowable expenditure<br />

incurred after 1 Oc<strong>to</strong>ber. The base cost can therefore be<br />

maximised by ensuring the highest possible valuation date value is<br />

applied and that all allowable expenditure after valuation date is<br />

included in the base cost.<br />

The legislation essentially allows for different methods of<br />

calculating your valuation date value:<br />

the time apportionment base cost (TABC) method, (which<br />

effectively apportions the gain between the period before and<br />

after 1 Oc<strong>to</strong>ber 2001 on a time basis)<br />

20% of proceeds;<br />

the market value at valuation date<br />

The determination of the valuation date value is not as simple as<br />

it appears - there are some complex rules that apply <strong>to</strong> limit<br />

capital losses by determining what valuation date value is used.<br />

The first step <strong>to</strong> take in maximising your base cost is (where the<br />

option is available) <strong>to</strong> determine which method will provide you<br />

with the highest valuation date value.<br />

If the market value is the best method, then keep in mind that<br />

this method can only be applied where you have determined such<br />

value before 30 September 2004. In addition, if the <strong>to</strong>tal value of<br />

your shares exceeded R10m then a valuation certificate (in the<br />

form prescribed by SARS) has <strong>to</strong> be submitted with your first tax<br />

return submitted after 30 September 2004.<br />

As previously mentioned, the base cost of your shares will consist<br />

of the valuation date value as well as certain expenditure incurred<br />

in respect of the shares after 1 Oc<strong>to</strong>ber 2001. The following<br />

types of expenditure can be included in the base cost of your<br />

shares (thereby limiting the tax payable):<br />

<br />

<br />

<br />

expenditure actually incurred in respect of the valuation of<br />

the asset for purpose of determining the capital gain or<br />

capital loss in respect of the asset<br />

expenditure actually incurred that directly relates <strong>to</strong> the<br />

disposal of the asset including:<br />

remuneration paid <strong>to</strong> your accountant or legal adviser for<br />

services rendered<br />

stamp duty arising from the transfer of the shares<br />

any expenditure that may have been incurred in maintaining<br />

or defending your legal rights <strong>to</strong> the shares<br />

A further important planning aspect <strong>to</strong> keep in mind is that you<br />

will need <strong>to</strong> maintain proper records providing evidence of the<br />

amounts that you wish <strong>to</strong> include in your base cost. Therefore<br />

you should ensure that you safeguard any valuations that you<br />

performed as at 1 Oc<strong>to</strong>ber 2001 as well as any invoices, etc which<br />

serve as proof of other costs incurred that can be taken in<strong>to</strong><br />

account in the determination of the base cost.<br />

The effective rate at which the CGT will be taxed in your hands,<br />

as an individual, is 10%. Therefore, assuming that the market<br />

value gives the highest valuation date value, your gain would be<br />

R20m - R10m = R10m and (assuming other expenditure incurred<br />

in respect of the shares are ignored) your CGT liability will be<br />

R1m.<br />

If the shares in our example are sold, the tax liability is calculated<br />

as follows:<br />

R<br />

Proceeds 20 000 000.00<br />

Base cost (10 000 000.00)<br />

Capital gain 10 000 000.00<br />

Less individual's annual exclusion (10 000.00)<br />

9 990 000.00<br />

Portion included in taxable income (25%) 2 497 500.00<br />

Taxed at 40% 999 000.00<br />

Consequences if you sell the business<br />

The sale of a business, as opposed <strong>to</strong> the sale of the shares, has<br />

tax implications at both the company level and shareholder level.<br />

At the company level, there are two main types of tax arising on<br />

the sale of the shares, CGT and STC.

6 Volume 2. November 2005<br />

Although not specifically mentioned, don't forget that there are some exclusions<br />

from CGT where business assets are disposed of by natural persons.<br />

CGT implications<br />

The portion subject <strong>to</strong> STC will be the difference between the<br />

The sale of a business implies the sale of a group of assets and proceeds arising from the disposal of capital assets and their<br />

liabilities comprising the business. To the extent that a business is market value at 1 Oc<strong>to</strong>ber 2001.Unlike the CGT provisions there<br />

worth more than its net assets, an intangible asset in the form of is no requirement that this valuation must be done prior <strong>to</strong> 30<br />

goodwill arises. (For the purpose of this illustration we will<br />

September 2004 or that any valuation had <strong>to</strong> have been<br />

assume that the assets other than goodwill are sold at cost and submitted. From a tax-planning perspective it may be worthwhile<br />

therefore no gain or loss is realised on these assets).<br />

<strong>to</strong> value the assets now as, the further you get from the valuation<br />

date, the more difficult it is <strong>to</strong> source accurate data on which <strong>to</strong><br />

The disposal of goodwill amounts <strong>to</strong> the disposal of an asset and base a valuation.<br />

is also subject <strong>to</strong> Capital Gains Tax. Once again, from a tax<br />

planning perspective, maximising the base cost of goodwill<br />

reduces your capital gain.<br />

Avoiding additional STC<br />

In addition, <strong>to</strong> ensure that at least the pre 1 Oc<strong>to</strong>ber 2001 capital<br />

There are some pitfalls surrounding the determination of the growth is not subject <strong>to</strong> STC, steps need <strong>to</strong> be taken <strong>to</strong> have the<br />

valuation date value of goodwill. It is SARS' view that the Time company liquidated or deregistered within 6 months (the Income<br />

Apportionment Base Cost (TABC) method is not available for Tax Act prescribes these steps).<br />

determining the base cost of goodwill (although, in our view, this<br />

is debatable). Because goodwill is an intangible asset, a valuation Assuming that the business is sold the calculation of the tax<br />

certificate needs <strong>to</strong> be submitted if its value thereof at valuation liability will be as follows:<br />

date exceeds R1m (not R10m as is the case of tangible assets).<br />

Remember that a business is not considered <strong>to</strong> be a separate asset<br />

for CGT purposes and therefore the valuation of the business as<br />

a whole may be inadequate. Because the taxpayer in this case is<br />

the company, the capital gain will be taxed at an effective rate of<br />

14.5% (as opposed <strong>to</strong> 10% in the case of a natural person).<br />

Proceeds on sale of goodwill *<br />

Base cost on sale of goodwill<br />

Capital gain<br />

Portion included in taxable income (50%)<br />

Taxed at 29%<br />

R<br />

15 000 000.00<br />

(5 000 000.00)<br />

10 000 000.00<br />

5 000 000.00<br />

1 450 000.00<br />

STC implications<br />

* remember the other assets are sold at their base so no CGT arises. If the<br />

Generally, STC is imposed on the net dividend declared by a<br />

company at a rate of 12.5%. Therefore, assuming that the<br />

company has no revenue reserves at the date of sale and the full<br />

proceeds arising from the sale of the business are distributed <strong>to</strong><br />

shareholders, the full amount will be subject <strong>to</strong> STC at a rate of<br />

12.5%.<br />

In the past it was possible for a company <strong>to</strong> distribute capital<br />

profits STC free if the distribution was made in the course of, or<br />

in anticipation of, the liquidation or deregistration of the<br />

company. With the introduction of CGT, only that portion of<br />

the capital profits that represent capital growth that occurred<br />

prior <strong>to</strong> valuation date will be exempt from STC under these<br />

circumstances (i.e. liquidation or deregistration).<br />

company subsequently deregisters/liquidates STC:<br />

R<br />

Total capital profit subject <strong>to</strong> STC 10 000 000.00<br />

Less CGT paid (1 450 000.00)<br />

Capital profits available for distribution 8 550 000.00<br />

STC @12.5% 1 068 750.00<br />

Total tax (CGT&STC) 2 518 750.00<br />

There are some important actions that can be taken <strong>to</strong> limit the<br />

CGT and STC costs of selling your business. For the reasons set<br />

out above it is generally always better <strong>to</strong> sell your shares rather<br />

than the business (the difference in our example is R1 519 750).<br />

These costs should be considered when negotiating with a<br />

potential purchaser.

Volume 2. November 2005<br />

7<br />

3 2©<br />

B E - how does it all add up<br />

By Lee-Anne Bac, Direc<strong>to</strong>r, <strong>Grant</strong> Thorn<strong>to</strong>n Strategic<br />

Solutions, Johannesburg & Marc Edelberg, Partner,<br />

Cape Town<br />

<strong>Grant</strong> Thorn<strong>to</strong>n's annual International Business Owners Survey<br />

(IBOS) indicates that Black Economic Empowerment (BEE) is one of<br />

the biggest issues keeping owners of medium sized businesses<br />

employing between 50 and 250 people awake at night - a trend that is<br />

definitely on the rise. In fact, 61% of business owners believe that<br />

BEE is a key issue for them in winning business, up from 51% in<br />

2003.<br />

3 2©<br />

BEE vs B E<br />

Throughout South Africa there is a lot of confusion about the<br />

3 2©<br />

difference between BEE and B E .<br />

Essentially BEE refers <strong>to</strong> a narrow form of empowerment,<br />

focused primarily on ownership, where more than 50% of an<br />

enterprise's equity is managed and controlled by a black person<br />

or group.<br />

3 2©<br />

B E goes beyond just ownership (with a target of 25%) and<br />

encourages the economic empowerment of all black people<br />

through integrated socio-economic strategies incorporating<br />

3 2©<br />

human resources and skills development. B E requires equitable<br />

representation in all occupational categories and levels in the<br />

workforce and beyond.<br />

Interestingly, during the focus group research conducted for<br />

IBOS it was determined that although BEE is a business<br />

imperative, many of these medium sized businesses are grappling<br />

with the issue of how best <strong>to</strong> implement Broad Based Black<br />

3 2©<br />

Economic Empowerment (B E ) in their organisation.<br />

Charters vs codes<br />

In particular business owners are confused by:<br />

3 2©<br />

the range and extent of the various B E charters that are 3 2©<br />

To date, around 29 different industry sec<strong>to</strong>r B E charters have<br />

impacting on their businesses<br />

been finalised or are in the pipeline. These charters outline<br />

the range, extent and complexity of the forms that they have<br />

3 2©<br />

specific B E targets that organisations within that sec<strong>to</strong>r should<br />

<strong>to</strong> complete for their clients or for tenders<br />

achieve by a certain date. While none of these charters have been<br />

the inconsistencies in interpretation of terms, data and<br />

gazetted as Sec<strong>to</strong>r Codes, they have been endorsed by the sec<strong>to</strong>r<br />

requirements in different charters and by rating agencies and<br />

and in some cases are referred <strong>to</strong> in various Acts of legislation.<br />

consultants<br />

the perception that there is a need <strong>to</strong> “give away shares in<br />

3 2©<br />

Over and above these B E charters, the<br />

their business”<br />

3 2©<br />

Department of Trade and Industry (DTI)<br />

the fact that government is punting B E but tender and<br />

has released a draft of the Codes of<br />

procurement documents focus on BEE ownership only,<br />

3 2©<br />

Good Practice for B E . These<br />

driven in some cases by charters 3 2©<br />

codes set out what B E is and<br />

how it should be measured. A<br />

Background<br />

generic scorecard has been<br />

developed that embodies the<br />

In the early 1990's businesses embarked upon a number of<br />

principles and stated objectives<br />

initiatives <strong>to</strong> incorporate BEE, primarily through equity<br />

of the act and is applicable <strong>to</strong><br />

partnerships. In many instances, the parties were accused of<br />

all industry sec<strong>to</strong>rs.<br />

fronting and <strong>to</strong>kenism as these partnerships appeared <strong>to</strong> lack real<br />

substance. This resulted in a formalised government strategy<br />

through the Broad Based Black Economic Empowerment Act of<br />

2003.<br />

The Government Gazette states the main objectives of<br />

3 2©<br />

this Act are <strong>to</strong> facilitate B E by promoting<br />

economic transformation in order <strong>to</strong> enable<br />

meaningful participation of black people in the<br />

economy, <strong>to</strong> achieve a substantial change in the<br />

racial composition of ownership, management<br />

structures and in the skilled occupations of<br />

existing and new enterprises.<br />

In the future, sec<strong>to</strong>r charters will remain a mission<br />

statement until the charter is gazetted as a Sec<strong>to</strong>r<br />

Code. Until such time, the Codes of Good Practice<br />

will outweigh the industry charter in terms of the<br />

application scorecard.<br />

Marc Edelberg

8<br />

Volume 2. November 2005<br />

3 2©<br />

It is possible <strong>to</strong> attain sufficient B E status<br />

without losing control over your business.<br />

The scorecard has been divided in<strong>to</strong> three core<br />

components namely,<br />

direct empowerment<br />

human resources development<br />

indirect empowerment<br />

These are further divided in<strong>to</strong> BEE elements,<br />

each of which is weighted as detailed alongside.<br />

Core Component BEE Element Weighting<br />

Direct<br />

empowerment<br />

Human<br />

resource<br />

development<br />

• Ownership<br />

• Management<br />

• Employment equity<br />

• Skills development<br />

30%<br />

30%<br />

Guidelines<br />

DTI currently setting out<br />

measurement criteria<br />

Not yet been issued<br />

by DTI (anticipated<br />

November 2005)<br />

Indirect<br />

development<br />

• Preferential procurement<br />

• Enterprise development<br />

• Residual element<br />

40%<br />

Not yet been issued<br />

by DTI (anticipated<br />

November 2005)<br />

BEE ratings<br />

Currently there are guidelines setting out measurement<br />

criteria for only the direct empowerment portion of the<br />

scorecard. These guidelines were also recently revised.<br />

At the time of writing this article, the guidelines dealing<br />

with the other two areas had not yet been issued by the<br />

DTI. It was anticipated that these guidelines would be<br />

released during November 2005 but thus far, we have<br />

not seen anything.<br />

The draft Codes have generated significant debate<br />

and comment from the interested and affected<br />

stakeholders. In general, the Codes provide<br />

significant variation from the targets, terms<br />

and definitions of the various Charters in<br />

existence.<br />

Must all businesses comply with<br />

BEE<br />

No business is required by law <strong>to</strong><br />

be BEE compliant. However, if you<br />

are currently doing business, or<br />

planning <strong>to</strong> do business with a<br />

government department, local<br />

authority or municipality, non-compliance<br />

could affect your business especially in<br />

relation <strong>to</strong> preferential procurement. These<br />

bodies will ask about your transformation<br />

or BEE status and if it is not rated highly<br />

enough, they are required <strong>to</strong> find an<br />

alternate supplier.<br />

Ratings provide an independent assessment of a<br />

company's empowerment status, risks and<br />

opportunities but when it comes <strong>to</strong> obtaining a rating,<br />

caution needs <strong>to</strong> be exercised.<br />

Rating agencies are currently providing ratings based<br />

on their own interpretation of the generic scorecard.<br />

This is resulting in a variance on scores for companies<br />

with very similar statuses which, in turn, is causing<br />

confusion in the market.<br />

3 2©<br />

When the DTI release the official guidelines for B E ,<br />

all businesses who already have a rating will have <strong>to</strong> be<br />

re-rated as the criteria initially employed by the rating<br />

agency will more than likely be out of line with the<br />

final DTI requirements.<br />

It is important <strong>to</strong> note that acquiring a rating is not a<br />

once off initiative and needs <strong>to</strong> be conducted annually.<br />

Because a business is dynamic, with a range of internal<br />

fac<strong>to</strong>rs regularly changing, a rating certificate is only<br />

valid for a period of twelve months.<br />

3 2©<br />

B E - the right thing <strong>to</strong> do<br />

Until all of the elements within the Codes of Good<br />

3 2©<br />

Practice have been finalised, B E remains a moving<br />

3 2©<br />

target for business owners. True B E is not<br />

something that is going <strong>to</strong> be achieved over night. The<br />

3 2©<br />

important thing <strong>to</strong> remember, however, is that B E is<br />

the right thing <strong>to</strong> do, regardless of whether you are<br />

looking for economic or ethical benefits.<br />

Lee-Anne Bac<br />

<strong>Grant</strong> Thorn<strong>to</strong>n consultants have a keen understanding of the<br />

Sec<strong>to</strong>r Codes and Charters. Through comprehensive analysis,<br />

3 2©<br />

we can provide you with strategic B E solutions that work for<br />

your company. For further information, please contact us.

Volume 2. November 2005<br />

9<br />

Occupational health & safety is a risk fac<strong>to</strong>r<br />

Non-compliance will result in severe penalties<br />

By An<strong>to</strong>n Barnard, Direc<strong>to</strong>r, Business Risk Service,<br />

Johannesburg<br />

With good corporate governance requiring enhanced accountability<br />

and transparency from direc<strong>to</strong>rs, occupational health and safety has<br />

come <strong>to</strong> the fore as a key fac<strong>to</strong>r of triple bot<strong>to</strong>m line reporting.<br />

In South Africa, occupational health and safety is also receiving a lot<br />

of attention from the Department of Labour and failure <strong>to</strong> adhere <strong>to</strong><br />

the Act could result in severe penalties, including hefty fines and jail<br />

sentences for business owners.<br />

Occupational health and safety is fast becoming one of the<br />

greatest risks for business, not only from a financial point of<br />

view but also in terms of good governance and organisational<br />

reputation.<br />

The Occupational Health and Safety Act (1993) states that an<br />

actual person, as opposed <strong>to</strong> the organisation, will be responsible<br />

for the implementation of the Act as well as taking<br />

accountability for any legal activity relating <strong>to</strong> the Act. This<br />

responsibility falls on the owner of the business and in the case<br />

of listed entities, the CEO. If any business is found <strong>to</strong> be in<br />

contravention of the Act, that person will face criminal<br />

prosecution and could be fined up <strong>to</strong> R50 000 or 12 months in<br />

prison. In terms of King II, no person with a criminal record<br />

can be a direc<strong>to</strong>r of a business.<br />

In addition, non-compliance could result in the business having<br />

<strong>to</strong> close until it is deemed <strong>to</strong> be compliant and the business will<br />

have <strong>to</strong> foot the bill for any resulting health and safety<br />

investigations.<br />

Non-compliance could be incredibly costly for any business and<br />

the state will no longer accept ignorance of the Act as an excuse<br />

for non-conformity.<br />

Easy implementation<br />

Misinterpretation of the Act is one of the biggest hurdles faced<br />

by businesses but by following these steps for implementing a<br />

formal health and safety strategy, you can rest assured that if<br />

investigated by the state, you will meet their occupational health<br />

and safety requirements.<br />

Step 1: Structures of defined roles and accountability<br />

Although the executive has <strong>to</strong> accept accountability for his<br />

responsibilities <strong>to</strong>wards health and safety, it is unders<strong>to</strong>od that<br />

he is a busy individual and may delegate the implementation and<br />

management <strong>to</strong> other members of the organisation.<br />

That being said, the buck still s<strong>to</strong>ps at the <strong>to</strong>p and the executive<br />

needs <strong>to</strong> ensure that his business's health and safety strategy is<br />

clearly defined with a clear reporting framework and, on a<br />

regular basis, assess the status of compliance <strong>to</strong> the<br />

Occupational Health And Safety Act requirements<br />

Part of the reporting framework must include a safety manager<br />

whose responsibility would include:<br />

developing, implementing and maintaining the safety, health<br />

environment and risk program for the whole organisation<br />

ensuring that the organisation complies with all relevant<br />

legislation<br />

making recommendations <strong>to</strong> management <strong>to</strong> eliminate,<br />

reduce, transfer and/or accept the identified risks<br />

performing risk assessments <strong>to</strong> determine the level of<br />

exposure <strong>to</strong> the whole organisation<br />

liaising with the relevant outside organisations with regards<br />

<strong>to</strong> safety, health, environment and risk related matters<br />

ensuring that all employees are aware of the rules regarding<br />

safety, health, environment and risk related matters<br />

ensuring that all incidents/accidents are reported <strong>to</strong> and<br />

investigated by the relevant authorities<br />

In addition, a safety committee is often recommended for larger<br />

organisations. This committee would:<br />

make recommendations <strong>to</strong> management concerning safety,<br />

health, environment and risk related matters<br />

discuss all incidents and/or accidents and make<br />

recommendations <strong>to</strong> management <strong>to</strong> prevent future such<br />

occurrences<br />

give management feedback on the safety, health,<br />

environment and risk progress of the organisation<br />

ensure that all safety, health, environment and risk related<br />

matters concerning the risk program are attended <strong>to</strong> on a<br />

regular basis<br />

Triple bot<strong>to</strong>m line reporting has gained favour since the introduction of the King II Report (2002) on corporate governance.<br />

Triple bot<strong>to</strong>m line reporting requires that businesses report <strong>to</strong> all their stakeholders (i.e. more than just their shareholders)<br />

on more than just their financial results. There is now a need <strong>to</strong> report on their ongoing sustainability as an organisation in<br />

terms of environmental responsibilities as well as their interpretation of and response <strong>to</strong> social responsibility.

10 Volume 2. November 2005<br />

"The system should contain a simple yet thorough process that<br />

when reviewed and reported on, should provide confirmation that a<br />

formal health and safety structure is in place."<br />

Depending on the type of workplace other safety responsibilities may<br />

be necessary, such as scaffolding safety, handling and s<strong>to</strong>rage of<br />

hazardous substances or managing contrac<strong>to</strong>rs on site.<br />

Step 2: Assessment<br />

Regardless of the type of working environment, an assessment needs<br />

<strong>to</strong> take place where any possible risks <strong>to</strong> health and safety are<br />

identified. These risks could range from anything as simple as smooth<br />

steps in the stairwell <strong>to</strong> more extreme cases relating <strong>to</strong> the s<strong>to</strong>rage of<br />

hazardous waste or poisonous emissions.<br />

All identified risks need <strong>to</strong> be documented.<br />

Step 3: Risk management procedures<br />

For every risk identified, a procedure for managing that risk needs <strong>to</strong><br />

be put in<strong>to</strong> place. For the more minor risks, their related<br />

management procedures could be as simple as making people<br />

aware of the smooth steps through a sign erected in close<br />

proximity. Of course, more extreme risks would need a<br />

more detailed management plan.<br />

Again, all management procedures need <strong>to</strong> be<br />

documented.<br />

Step 4: Training<br />

In line with a system of implementation,<br />

compliance and awareness, all staff must be put<br />

through induction training. This type of<br />

awareness training must deal with the identified<br />

health and safety aspects in the workplace as well<br />

as regula<strong>to</strong>ry requirements.<br />

Legislatively required responsibilities, such as<br />

safety representatives and first-aiders must<br />

formally be trained, certified and retrained at<br />

legally determined intervals set by the law.<br />

An<strong>to</strong>n Barnard<br />

The systems must involve the workforce at<br />

all levels and provide the necessary assistance<br />

<strong>to</strong> ensure that potentially hazardous job<br />

related functions are carried out safely and<br />

in accordance with the law. It is essential<br />

that the system provides documented means<br />

<strong>to</strong> substantiate that the Chief Executive<br />

Officer, in accordance with his assignment,<br />

has taken reasonable action in the event of<br />

litigation as well as the results of that<br />

action.

Volume 2. November 2005<br />

11<br />

Hot off the press…<br />

...some of our latest publications aimed <strong>to</strong> assist<br />

you in the various aspects of running your business.<br />

A guide <strong>to</strong> establishing a presence in South Africa…<br />

… is a handy reference outlining the most important facts<br />

<strong>to</strong> know when investing in South Africa.<br />

The publication provides information on South African<br />

taxation, investment incentives and exchange control and<br />

outlines the requirements for work and residential visa<br />

applications.<br />

A gu i de <strong>to</strong> es ta bli sh<br />

in g a<br />

presence<br />

i n Sou th Af ric. a ..<br />

Establishing a presence in South Africa also provides the<br />

information necessary for any business wanting <strong>to</strong> use South<br />

Africa as a springboard in<strong>to</strong> Africa.<br />

The effective direc<strong>to</strong>r's handbook<br />

Now that corporate governance is a business imperative,<br />

the duties and responsibilities of direc<strong>to</strong>rs as well as their<br />

associated personal liability have never been greater.<br />

Direc<strong>to</strong>rs need <strong>to</strong> possess sound business, legal and financial<br />

skills and the effective direc<strong>to</strong>rs guide, produced in conjunction<br />

with Edward Nathan, is intended <strong>to</strong> highlight areas of concern<br />

in all three spheres. Where appropriate, recommendations of<br />

the King II report on corporate governance for South Africa<br />

(2002) have been incorporated.<br />

The guide also includes a series of key questions that direc<strong>to</strong>rs<br />

may use <strong>to</strong> determine how effectively they are giving direction <strong>to</strong><br />

their companies.<br />

The first Fiscal File update<br />

Our Fiscal File, published jointly with Edward Nathan, outlines<br />

important tax, financial and exchange control information and is<br />

updated as the tax legislation changes. Because the legislation is<br />

a moving target, we now produce the Fiscal File as an A5 ring<br />

binder that allows us <strong>to</strong> supply replacement updates in looseleaf<br />

format when necessary.<br />

Our first loose-leaf update, which covers legislation<br />

promulgated earlier this year, has been printed. If you received<br />

the original product but have not yet received the update, please<br />

advise <strong>Grant</strong> Thorn<strong>to</strong>n Marketing.<br />

To receive a copy of any of these products, please<br />

contact Nicole Dudley at <strong>Grant</strong> Thorn<strong>to</strong>n Marketing<br />

on (011) 322 4701 or ndudley@gt.co.za

12<br />

Volume 2. November 2005<br />

You are always welcome <strong>to</strong><br />

contact us...<br />

chat line<br />

...features exciting developments at our firm.<br />

<strong>Grant</strong> Thorn<strong>to</strong>n International turns 25<br />

<strong>Grant</strong> Thorn<strong>to</strong>n International celebrates 25 years as the<br />

longest same-name international accounting network. This<br />

worldwide umbrella organisation of independent<br />

accounting firms now boasts 91 independent member<br />

firms in 88 countries.<br />

South Africa became a member of the international<br />

network in 1991, whilst still known as Kessel Feinstein.<br />

To celebrate this miles<strong>to</strong>ne, twenty-five year old employees<br />

were interviewed on why they joined <strong>Grant</strong> Thorn<strong>to</strong>n. Many were attracted by the<br />

integrity and professionalism of the firms, opportunities for personal and<br />

professional development and the work environment. Here is what Duan Brink,<br />

Assistant Audit Manager, Johannesburg, thinks of the firm:<br />

“The firm affords employees a lot of opportunity for growth, allowing them <strong>to</strong><br />

excel in their chosen fields.”<br />

New partner in Durban<br />

Congratulations <strong>to</strong> Ahmed Timol, who was appointed as<br />

partner in our Durban office in September. Ahmed joined<br />

<strong>Grant</strong> Thorn<strong>to</strong>n as a trainee in 1999 and, on completion<br />

of his articles, was appointed an Audit Supervisor and<br />

then Audit Manager in July 2002.<br />

Ahmed completed his BCom degree at the University of<br />

Natal, in 1991 and obtained his postgraduate diploma in<br />

accounting the following year.<br />

In the Queen's favour<br />

<strong>Grant</strong> Thorn<strong>to</strong>n International's Worldwide CEO, David<br />

McDonnell has been honoured by Queen Elizabeth II as a<br />

Commander of the British Empire (CBE) as part of<br />

her 2005 birthday honours list. These decorations are<br />

awarded <strong>to</strong> people who have made a distinguished<br />

contribution <strong>to</strong> the country or community.<br />

David, who has been with <strong>Grant</strong> Thorn<strong>to</strong>n for over<br />

40 years comments, “It is obviously a great honour <strong>to</strong><br />

receive the CBE on a personal level and I am<br />

genuinely delighted. However, it must be recognised<br />

that my appointment is a great reflection on the firm<br />

as a whole.”<br />

Fond farewell<br />

The Johannesburg office recently said goodbye <strong>to</strong> two<br />

partners.<br />

Janys Finn, the first female <strong>to</strong> have been made<br />

partner left <strong>Grant</strong> Thorn<strong>to</strong>n at the end of September<br />

<strong>to</strong> join Investec.<br />

Jack Laser, who has been a partner for 18 years retired at the end of Oc<strong>to</strong>ber.<br />

Jack will be staying on in a consultative capacity.<br />

Cape Town<br />

Deryck Woolley<br />

The Pinnacle, 5th Floor, Cnr Strand & Burg Street,<br />

Cape Town, 8001<br />

P O Box 1550, Cape Town, 8000<br />

T +27 (0) 21 481 9000<br />

F +27 (0) 21 481 9020<br />

E mail@gtct.co.za<br />

Durban<br />

Tony Berman<br />

2nd Floor, 4 Pencarrow Crescent, Pencarrow Park,<br />

La Lucia Ridge Office Estate, 4019.<br />

P O Box 752, Durban, 4000<br />

T +27 (0) 31 576 5500<br />

F +27 (0) 31 576 5555<br />

E mail@gtdbn.co.za<br />

East London<br />

Tony Balshaw<br />

26 Vincent Road, Vincent, 5247<br />

P O Box 313, East London, 5200<br />

T +27 (0) 43 726 9898<br />

F +27 (0) 43 726 9899<br />

E gtel@gtec.co.za<br />

Johannesburg<br />

Leonard Brehm<br />

137 Daisy Street, Cnr Grays<strong>to</strong>n Drive,<br />

Sandown, 2196<br />

Private Bag X28, Benmore, 2010<br />

T +27 (0) 11 322 4500<br />

F +27 (0) 11 322 4545<br />

E info@gt.co.za<br />

Port Elizabeth<br />

Tony Balshaw<br />

165 Cape Road, Port Elizabeth, 6001<br />

PO Box 35133, New<strong>to</strong>n Park, 6055<br />

T +27 (0) 41 373 4200<br />

F +27 (0) 41 373 4201<br />

E gtpe@gtec.co.za<br />

Pre<strong>to</strong>ria / Tshwane<br />

Johan Blignaut<br />

121 Boshoff Street,<br />

New Muckleneuk, 0181<br />

P O Box 1470, Pre<strong>to</strong>ria, 0001<br />

T +27 (0) 12 346 1430<br />

F +27 (0) 12 346 2502<br />

E gtpta@gtpta.co.za<br />

Media enquiries...<br />

Jennifer Kann<br />

T +27 (0) 11 322 4588<br />

E jkann@gt.co.za<br />

Edi<strong>to</strong>rial Panel: Leonard Brehm, National Chairman;<br />

Pamela Grayman, National Marketing Principal;<br />

Jennifer Kann, Communications Manager;<br />

David Reuben, Partner<br />

Audi<strong>to</strong>rs, Accountants & Business Advisers<br />

South African member of <strong>Grant</strong> Thorn<strong>to</strong>n International<br />

Sub-Saharan Offices in: Botswana, Kenya, Mauritius,<br />

Namibia, Tanzania, Uganda and Zambia<br />

Visit our website on www.gt.co.za<br />

Are you an Alumni You can update or register your details with us at www.gt.co.za<br />

Advisers <strong>to</strong> the independently minded