IFRS - there's nowhere to hide - Grant Thornton

IFRS - there's nowhere to hide - Grant Thornton

IFRS - there's nowhere to hide - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 Volume 2. November 2005<br />

Although not specifically mentioned, don't forget that there are some exclusions<br />

from CGT where business assets are disposed of by natural persons.<br />

CGT implications<br />

The portion subject <strong>to</strong> STC will be the difference between the<br />

The sale of a business implies the sale of a group of assets and proceeds arising from the disposal of capital assets and their<br />

liabilities comprising the business. To the extent that a business is market value at 1 Oc<strong>to</strong>ber 2001.Unlike the CGT provisions there<br />

worth more than its net assets, an intangible asset in the form of is no requirement that this valuation must be done prior <strong>to</strong> 30<br />

goodwill arises. (For the purpose of this illustration we will<br />

September 2004 or that any valuation had <strong>to</strong> have been<br />

assume that the assets other than goodwill are sold at cost and submitted. From a tax-planning perspective it may be worthwhile<br />

therefore no gain or loss is realised on these assets).<br />

<strong>to</strong> value the assets now as, the further you get from the valuation<br />

date, the more difficult it is <strong>to</strong> source accurate data on which <strong>to</strong><br />

The disposal of goodwill amounts <strong>to</strong> the disposal of an asset and base a valuation.<br />

is also subject <strong>to</strong> Capital Gains Tax. Once again, from a tax<br />

planning perspective, maximising the base cost of goodwill<br />

reduces your capital gain.<br />

Avoiding additional STC<br />

In addition, <strong>to</strong> ensure that at least the pre 1 Oc<strong>to</strong>ber 2001 capital<br />

There are some pitfalls surrounding the determination of the growth is not subject <strong>to</strong> STC, steps need <strong>to</strong> be taken <strong>to</strong> have the<br />

valuation date value of goodwill. It is SARS' view that the Time company liquidated or deregistered within 6 months (the Income<br />

Apportionment Base Cost (TABC) method is not available for Tax Act prescribes these steps).<br />

determining the base cost of goodwill (although, in our view, this<br />

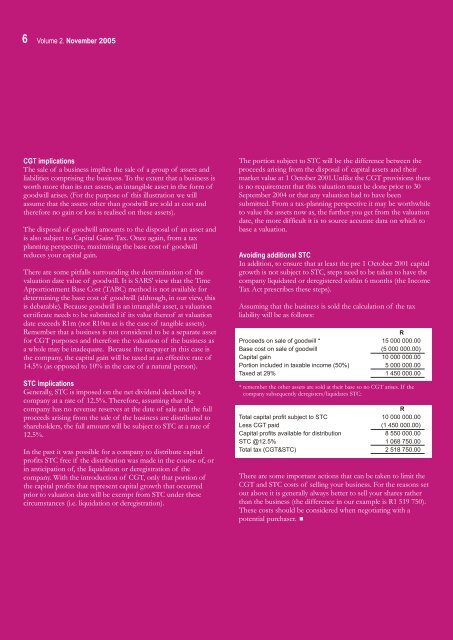

is debatable). Because goodwill is an intangible asset, a valuation Assuming that the business is sold the calculation of the tax<br />

certificate needs <strong>to</strong> be submitted if its value thereof at valuation liability will be as follows:<br />

date exceeds R1m (not R10m as is the case of tangible assets).<br />

Remember that a business is not considered <strong>to</strong> be a separate asset<br />

for CGT purposes and therefore the valuation of the business as<br />

a whole may be inadequate. Because the taxpayer in this case is<br />

the company, the capital gain will be taxed at an effective rate of<br />

14.5% (as opposed <strong>to</strong> 10% in the case of a natural person).<br />

Proceeds on sale of goodwill *<br />

Base cost on sale of goodwill<br />

Capital gain<br />

Portion included in taxable income (50%)<br />

Taxed at 29%<br />

R<br />

15 000 000.00<br />

(5 000 000.00)<br />

10 000 000.00<br />

5 000 000.00<br />

1 450 000.00<br />

STC implications<br />

* remember the other assets are sold at their base so no CGT arises. If the<br />

Generally, STC is imposed on the net dividend declared by a<br />

company at a rate of 12.5%. Therefore, assuming that the<br />

company has no revenue reserves at the date of sale and the full<br />

proceeds arising from the sale of the business are distributed <strong>to</strong><br />

shareholders, the full amount will be subject <strong>to</strong> STC at a rate of<br />

12.5%.<br />

In the past it was possible for a company <strong>to</strong> distribute capital<br />

profits STC free if the distribution was made in the course of, or<br />

in anticipation of, the liquidation or deregistration of the<br />

company. With the introduction of CGT, only that portion of<br />

the capital profits that represent capital growth that occurred<br />

prior <strong>to</strong> valuation date will be exempt from STC under these<br />

circumstances (i.e. liquidation or deregistration).<br />

company subsequently deregisters/liquidates STC:<br />

R<br />

Total capital profit subject <strong>to</strong> STC 10 000 000.00<br />

Less CGT paid (1 450 000.00)<br />

Capital profits available for distribution 8 550 000.00<br />

STC @12.5% 1 068 750.00<br />

Total tax (CGT&STC) 2 518 750.00<br />

There are some important actions that can be taken <strong>to</strong> limit the<br />

CGT and STC costs of selling your business. For the reasons set<br />

out above it is generally always better <strong>to</strong> sell your shares rather<br />

than the business (the difference in our example is R1 519 750).<br />

These costs should be considered when negotiating with a<br />

potential purchaser.