Rebuilding the Business 1986 - 1994 - Abigroup

Rebuilding the Business 1986 - 1994 - Abigroup

Rebuilding the Business 1986 - 1994 - Abigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

REBUILDING<br />

THE BUSINESS<br />

<strong>1986</strong> - <strong>1994</strong><br />

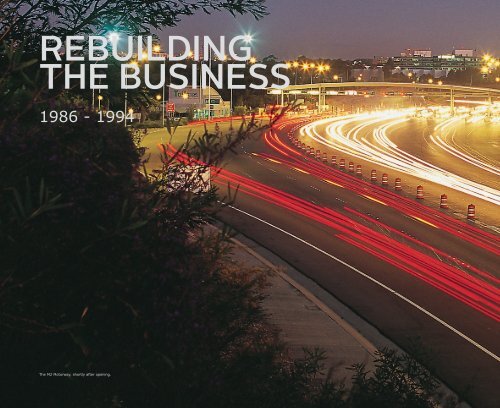

The M2 Motorway, shortly after opening.

Turning things<br />

around<br />

JOHN CASSIDY <strong>1986</strong> - 2004<br />

FORMER CHAIRMAN & CHIEF EXECUTIVE OFFICER<br />

John Cassidy was <strong>the</strong> man who turned <strong>Abigroup</strong> around. Without John and his team’s<br />

intervention in <strong>the</strong> mid to late eighties when <strong>the</strong> business was in a bad way, <strong>the</strong> <strong>Abigroup</strong><br />

flag could quite possibly not still be flying today.<br />

It was late in 1985 when <strong>the</strong> <strong>the</strong>n Chairman of Abignano, Clive Austin gave John a call.<br />

‘I’d basically retired after over a decade working in South East Asia, but Clive asked<br />

me to come and help for three months. The brief was to see if we could get some order<br />

in <strong>the</strong> current construction figures with Abignano and to bring all losses to account. I<br />

figured it was only three months, <strong>the</strong>n I’d settle into life outside engineering.’<br />

In <strong>the</strong> end, of course, John’s retirement lifestyle was delayed far more than three<br />

months, but how did his life in <strong>the</strong> industry evolve ‘I completed a civil engineering<br />

degree at Newcastle University and started work with Spie Batignolles, <strong>the</strong> French<br />

multinational through <strong>the</strong>ir Australian subsidiary, Citra Constructions. Then in 1975 I<br />

started my decade overseas by taking a role in Indonesia. Back <strong>the</strong>n <strong>the</strong>re was no tax<br />

on foreign nationals, which was great, and it stayed that way until 1984. Whilst working<br />

for <strong>the</strong> French I did stints mainly in Malaysia and Sri Lanka, working on major projects<br />

such as port construction, power stations, metros and building projects. After ten<br />

years abroad, travelling all over <strong>the</strong> world, we started thinking about coming home. In<br />

September 1985 we moved back and bought a grazing property in nor<strong>the</strong>rn NSW. I was<br />

married with one child and we came back to live a different kind of a life, but that life<br />

obviously didn’t last long!’<br />

John quickly saw <strong>the</strong> need for major change at Abignano as he got into his “three month”<br />

spell. ‘We brought $36 million worth of losses to account and could see that Enacon [<strong>the</strong><br />

major Abignano shareholder] was keeping <strong>the</strong> business afloat by taking on its losses.<br />

As my three months drew to a close, <strong>the</strong> company was starting to get into some order:<br />

people had been dismissed and roles had changed - but <strong>the</strong>re was still a lot to do. As<br />

long as Enacon continued to financially support <strong>the</strong> company <strong>the</strong>re was still hope. There<br />

were excellent skills within <strong>the</strong> workforce, but little direction. It was a matter of survival<br />

and <strong>the</strong> team was willing to fight.<br />

‘I was <strong>the</strong>n asked to stay on as General Manager and I had to make a decision – ano<strong>the</strong>r<br />

serious role in <strong>the</strong> industry versus spreading fertiliser on <strong>the</strong> farm. I talked it over with<br />

my wife and we decided that <strong>the</strong> farm could wait - but I had no idea it’d have to wait 18<br />

to 20 years! The main reason I decided to take on <strong>the</strong> role is that I could see <strong>the</strong> quality<br />

of people at Abignano and <strong>the</strong> potential of <strong>the</strong> business.’<br />

‘There were excellent skills within <strong>the</strong><br />

workforce, but little direction. It was<br />

a matter of survival and <strong>the</strong> team<br />

was willing to fight.’<br />

Lee Ming Tee was <strong>the</strong> major shareholder at <strong>the</strong> time as Jim Abignano had exited <strong>the</strong><br />

business. Jim’s long-term number two Allan Livingstone left shortly after and with <strong>the</strong><br />

wide and varied business interests Lee Ming was juggling, Abignano’s was rudderless.<br />

‘Lee Ming had a number of businesses and at different stages Wormald, Sunshine and<br />

Enacon actually owned Abignano as he tried to shuffle <strong>the</strong> debt around and minimise his<br />

risk. When Jim [Abignano] bought into Enacon, it meant Abignano took ownership of all<br />

sorts of unrelated businesses and put civil engineers in charge of running <strong>the</strong>m. Marina<br />

Cruisers [boat builders], for example, was losing $11 million a year. By 1988 Abignano<br />

Ltd shares were trading at three cents and <strong>the</strong>re were no buyers.’<br />

REBUILDING THE BUSINESS<br />

JOHN CASSIDY<br />

50

REMEMBER...<br />

• On 23 February, <strong>the</strong> first mobile phone call in Australia<br />

is made.<br />

• The Simpsons cartoon first appears on The Tracy<br />

Ullman Show.<br />

• Aretha Franklin becomes <strong>the</strong> first woman inducted into <strong>the</strong><br />

Rock and Roll Hall of Fame. Meanwhile, <strong>the</strong> Irish rock band<br />

U2 releases <strong>the</strong>ir studio album The Joshua Tree.<br />

Opposite Page:<br />

John Cassidy, 2010.<br />

Top:<br />

Sydney SuperDome under construction,<br />

1998.<br />

Middle:<br />

F3 Freeway under construction.<br />

Above:<br />

John Cassidy, 1987.<br />

Most people would baulk at that level of financial difficulty and strategic uncertainty, but<br />

John saw opportunities. ‘I had a good look at it and decided to form a buy-out group,<br />

mainly from within <strong>the</strong> management, to see if we could take over control from Lee Ming<br />

Tee and really focus our attentions on <strong>the</strong> core business of civil engineering and building.<br />

I formed a company called Vercot in which my wife and I were <strong>the</strong> major shareholder and<br />

also involved were Clive Austin, Darrell Hendry, Brian Allen and Norm Reich. We offered<br />

Enacon [Lee Ming] one cent a share and by mid-1988 <strong>the</strong> deal was done.’<br />

Abignano Ltd’s name was changed to <strong>Abigroup</strong> Ltd and <strong>the</strong> real work of turning <strong>the</strong><br />

company around began. ‘The company had 126 employees and a turnover of $126<br />

million. Vercot acquired all <strong>the</strong> assets (though <strong>the</strong> plant and equipment was ageing)<br />

but we also inherited some $76 million in debt. Vercot was supported by <strong>the</strong> (<strong>the</strong>n)<br />

State Bank of NSW. Darrell and I spent a lot of time convincing <strong>the</strong> banks that we were<br />

a viable operation. Enacon also took Abignano’s Thos Clark business in <strong>the</strong> buyout<br />

deal, which gave us some money, and we pursued our contractual claims through<br />

<strong>the</strong> courts. There were some clients who delayed or stopped paying us because <strong>the</strong>y<br />

thought we would go out of business, but we fought for our entitlements. I took some<br />

hard decisions in developing and refocusing <strong>the</strong> management team and Darrell focussed<br />

on <strong>the</strong> administrative and financial side of things. There was no time for niceties, but<br />

communicating to staff was easy because <strong>the</strong>y wanted success and <strong>the</strong>y were invigorated<br />

by <strong>the</strong> new purpose and direction. I also made a point of remembering everyone’s name<br />

and <strong>the</strong>ir kids’ names – it’s a small thing but we were a tight-knit group and this family<br />

approach really helped. We eventually offered shares to <strong>the</strong> staff, too, and most of <strong>the</strong>m<br />

bought. We were all in it toge<strong>the</strong>r. Meanwhile, we concentrated on winning blue chip and<br />

government work because we knew <strong>the</strong>y’d pay us. We settled most of <strong>the</strong> outstanding<br />

claims and slowly, we started clawing our way out of <strong>the</strong> hole.’<br />

As a symbol of <strong>the</strong> new beginning, John and his team also decided it was time to change<br />

<strong>the</strong> name of <strong>the</strong> business. ‘Jim [Abignano] had moved on, Enacon was gone and <strong>the</strong><br />

industry needed to know that this was a new start – a new dawn. Out of respect for Jim,<br />

we didn’t want to move too far from <strong>the</strong> Abignano name, and we’d generally been known<br />

as Abi’s anyway. So we kept <strong>the</strong> stylised A and Abi in blue, <strong>the</strong>n just added <strong>the</strong> group<br />

part. We didn’t have money for consultants, so we just did it ourselves in my office. We<br />

put <strong>the</strong> new <strong>Abigroup</strong> signage all over our equipment and sites and <strong>the</strong> word started<br />

getting around. We weren’t an entirely new business, but it was a new beginning.’<br />

But not everyone in <strong>the</strong> industry was happy with <strong>the</strong> changes afoot. ‘There was a lot of<br />

opposition from competitors when we started to get back on track and bidding for bigger<br />

jobs, and <strong>the</strong>y definitely would have preferred for us to remain on our knees – it’s a<br />

competitive industry.’<br />

Innovation has always been a hallmark of <strong>Abigroup</strong>’s success, and John has an<br />

interesting take on how this culture has evolved. ‘Innovation is a requirement of good<br />

business because it can save time and improve efficiency. But innovation comes from<br />

people within <strong>the</strong> company – people on <strong>the</strong> jobs. If you sit with say a bulldozer driver<br />

over a beer in a pub, <strong>the</strong>y’ll tell you what <strong>the</strong>y think can be done better. I do wonder how<br />

much business growth and new ideas have come about over a cold one after work!’<br />

Many people consider winning <strong>the</strong> M2 project <strong>the</strong> turning point that finally got <strong>Abigroup</strong><br />

out of financial trouble, but John believes two earlier projects laid <strong>the</strong> foundation. ‘The<br />

first one was <strong>the</strong> F3 in 1989. We were doing $5 million to $6 million jobs before <strong>the</strong>n,<br />

but that one jumped us up to $43 million. Then we won <strong>the</strong> Terrey Hills Golf Club job in<br />

1991 where we built <strong>the</strong> clubhouse and did <strong>the</strong> earthworks for <strong>the</strong> course. It was a good<br />

job financially, but <strong>the</strong> big thing was <strong>the</strong> relationship it helped us forge with Obayashi<br />

in Japan and <strong>the</strong>y were vital to us winning and succeeding with <strong>the</strong> M2 later on. We<br />

did a great, profitable job for <strong>the</strong>m without even signing a contract. After that Darrell<br />

51 REBUILDING THE BUSINESS<br />

JOHN CASSIDY

and I travelled to Japan to meet Obayashi’s Chairman and senior staff and <strong>the</strong>y asked if<br />

<strong>the</strong>re was anything else <strong>the</strong>y could do for us in Australia - I said that we needed a $500<br />

million bank guarantee for <strong>the</strong> M2 job. Over ano<strong>the</strong>r handshake, <strong>the</strong> deal was done and<br />

we successfully tendered in Joint Venture for <strong>the</strong> M2, which ended up earning <strong>the</strong>m $60<br />

million and putting us on <strong>the</strong> map.’<br />

After <strong>the</strong> M2 <strong>the</strong> next big thing for <strong>Abigroup</strong> was <strong>the</strong> 2000 Sydney Olympics in which<br />

<strong>the</strong> company secured six contracts including <strong>the</strong> building of <strong>the</strong> prestigious Sydney<br />

SuperDome for <strong>the</strong> basketball and gymnastics. John said <strong>the</strong> pressures on getting <strong>the</strong><br />

venues ready on time were immense. ‘We did a lot of construction for <strong>the</strong> Olympics –<br />

hockey, tennis, roads, water features – but <strong>the</strong> main project was <strong>the</strong> SuperDome because<br />

it was a complex design, construct and operate job and <strong>the</strong>re were so many obstacles<br />

to us reaching <strong>the</strong> Olympic opening deadline. For example, <strong>the</strong> roof was <strong>the</strong> largest<br />

unsupported roof in <strong>the</strong> sou<strong>the</strong>rn hemisphere and part way through, a major structural<br />

contractor walked off <strong>the</strong> job. So with <strong>the</strong> help of Bob Gusheh’s expertise (who at <strong>the</strong><br />

time was Senior Project Manager) we ended up putting <strong>the</strong> roof on ourselves. At first<br />

Peter Deane’s (<strong>the</strong>n Project Director) team said, “We can’t do it,” so I told <strong>the</strong>m to go<br />

away and think about it more. They came back again and said, “Maybe we can do it,” so<br />

I told <strong>the</strong>m to go away again. They came back again and this time said, “I think we can<br />

do it.” I told <strong>the</strong>m to try some more. Eventually <strong>the</strong>y came back and said, “We’ve found<br />

a way to do it.” I told <strong>the</strong>m that’s what I wanted to hear - <strong>the</strong> Olympics were knocking on<br />

our door and failure wasn’t an option! I was down at <strong>the</strong> site every day overseeing <strong>the</strong><br />

preparation of <strong>the</strong> venue. Two months before <strong>the</strong> opening, we still didn’t have any of <strong>the</strong><br />

external paving completed around <strong>the</strong> SuperDome and Sam “The Paving Man” said he<br />

couldn’t do it by <strong>the</strong> deadline. So I asked him what was needed to make it happen and<br />

he said four tickets to Pavarotti would be great. I told him he could have a corporate box<br />

and you should’ve seen it – he got family and friends and everyone down <strong>the</strong>re working<br />

and we got it completed on time.’<br />

With <strong>the</strong> success of <strong>the</strong> M2 and <strong>the</strong>n <strong>the</strong> Olympic projects <strong>Abigroup</strong> was in good shape<br />

and <strong>the</strong>n in 2003 with <strong>the</strong> winning of <strong>the</strong> $1.5 billion M7 contract in a joint venture<br />

with Leighton Contractors <strong>the</strong> company truly had entered <strong>the</strong> big league. It was all a<br />

far cry from those desperate days in <strong>the</strong> late eighties and early nineties. ‘There were<br />

huge financial risks for all of us and it was not until ’92 and ’93 that we were able to<br />

begin stabilising our debts. From ’94 onwards <strong>the</strong> pressure began to ease as <strong>the</strong> M2<br />

got underway. This major project, <strong>the</strong> first with electronic ticketing in Australia, was<br />

completed months ahead of schedule and earned us significant bonuses.’<br />

The financial risks John and <strong>the</strong> Vercot owners endured paid for <strong>the</strong>mselves after Vercot<br />

sold <strong>Abigroup</strong> to Bilfinger Berger with <strong>the</strong> aim of giving <strong>the</strong> business increased financial<br />

muscle that would allow for growth. It also meant that John could finally start thinking<br />

about spreading fertiliser on his long-neglected farm. His is initial 1982 land purchase<br />

of 8700 run-down acres in New England was subsequently added to, so that “Merilba” is<br />

now some 35,000 acres of prime farmland near Armidale where John now farms sheep,<br />

cattle, lambs and Boer goats. Merilba Estate now also makes wine and runs a cellar<br />

door and function centre. Life is different to what it was, but when he reflects on his<br />

emotional and financial rollercoaster with <strong>Abigroup</strong>, one thing supersedes all o<strong>the</strong>rs. ‘I’m<br />

still fantastically proud of <strong>the</strong> company and what it’s achieved. Our people are industry<br />

leaders – first class, world-class people. I’ll always be proud of <strong>Abigroup</strong> and what it<br />

continues to achieve. It was all worth it.’<br />

The management buy-out that John led, and <strong>the</strong> people that were trained and developed<br />

during that time, is perhaps Australia’s most successful corporate success story ever.<br />

REBUILDING THE BUSINESS<br />

JOHN CASSIDY<br />

52

This Photo:<br />

Sydney SuperDome,<br />

as it was known at<br />

<strong>the</strong> time.<br />

MILESTONE PROJECTS<br />

F3<br />

Information from ‘Abitorque’ internal<br />

company newsletter – thanks Peter Walton!<br />

Location: Sydney to Newcastle, NSW<br />

Delivery Method: Construct<br />

Commenced: 1984<br />

Completion: 1990<br />

Three main sections of <strong>the</strong> main arterial<br />

linking Sydney and Newcastle<br />

• 8 million cubic metres of bulk earthworks.<br />

• 46km of continuous concrete paving.<br />

• 14 bridges.<br />

Section 1, Kariong to Somersby – 1985<br />

($7.3 million)<br />

• 5.8km of dual carriageway.<br />

• The first freeway contract let by <strong>the</strong> DMR<br />

involving all complete works, including<br />

pavement.<br />

• Five main cuts of up to 19m deep, and<br />

four fills up to 18m high.<br />

• 1.5 million cubic metres of earthworks.<br />

• <strong>Abigroup</strong>’s first road job involving 78,000<br />

cubic metres of concrete.<br />

• Three bridges, including one with an<br />

82m span.<br />

Section 2, Pearce’s Corner to Mount<br />

Colah – 1989 ($43.5 million)<br />

• The second largest contract <strong>the</strong> DMR had<br />

let and <strong>the</strong> largest let on <strong>the</strong> F3.<br />

• Acknowledged as <strong>the</strong> most complicated<br />

contract of <strong>the</strong> time, with massive works<br />

through residential areas and adjacent to<br />

sensitive National Park land.<br />

• Continuously Reinforced Concrete<br />

Pavement was used for <strong>the</strong> first time in <strong>the</strong><br />

industry.<br />

• Over 77,000 cubic metres of concrete<br />

paving.<br />

OLYMPIC GAMES – SYDNEY 2000. NSW<br />

A number of projects were secured under<br />

tender for <strong>the</strong> 2000 Olympics.<br />

• State Hockey Centre<br />

Civil works to upgrade <strong>the</strong> centre.<br />

$3 million.<br />

• Tennis Centre<br />

Circular stadium with seating for 10,000.<br />

15 tennis courts with associated facilities.<br />

$35 million.<br />

• Regatta Centre, Penrith<br />

New pavilion and boatsheds.<br />

Irrigation works.<br />

$5.7 million.<br />

• Sydney SuperDome (Acer Arena)<br />

Australia’s largest indoor arena.<br />

Capacity in excess of 20,000 seats.<br />

$200 million.<br />

• Sydney SuperDome Carpark<br />

3,500 car spaces.<br />

Eight storeys.<br />

Largest carpark in <strong>the</strong> Sou<strong>the</strong>rn<br />

Hemisphere.<br />

Constructed in a record 18 months.<br />

$60 million.<br />

• Nor<strong>the</strong>rn and Central Water Features<br />

Prominent public spaces within<br />

Olympic Park.<br />

Environmentally friendly water<br />

reclamation.<br />

Wetland creation and restoration.<br />

$17 million.<br />

• Sou<strong>the</strong>rn Terminus<br />

Three structural steel pedestrian bridges.<br />

Flexible and block paving and extensive<br />

landscaping.<br />

Section 3, Palmers Road to Wakefield –<br />

1989-1990<br />

• 6.8km section.<br />

• Five bridges.<br />

• Continuously Reinforced Concrete<br />

Pavement for <strong>the</strong> entire Southbound<br />

length.<br />

• 82,000 cubic metres topsoil removal.<br />

• 21,800 cubic metres of excavation for<br />

stormwater drainage.<br />

• 2,656,300 cubic metres of earthworks.<br />

• 36,085 cubic metres of flexible pavement.<br />

53<br />

REBUILDING THE BUSINESS<br />

JOHN CASSIDY

Holding it<br />

toge<strong>the</strong>r<br />

DARRELL HENDRY 1984 - 2005<br />

FORMER CHIEF FINANCIAL OFFICER<br />

Darrell Hendry joined <strong>Abigroup</strong> in 1984. Back <strong>the</strong>n <strong>the</strong> business was still known as<br />

Abignano Limited and it was a turbulent, whirlpool kind of a time to start. ‘I was a<br />

Chartered Accountant working in <strong>the</strong> audit division of KPMG, but I was keen to move into<br />

a commercial role. Abignano Limited was looking to fill a new finance role in its Head<br />

Office, created to manage <strong>the</strong> financial affairs of a group of businesses recently acquired<br />

from Enacon Limited. The Enacon businesses included a large variety of operations, and<br />

each business had its own management team and was run as a separate unit. One of<br />

Enacon’s major investors, Lee Ming Tee, had structured <strong>the</strong> deal with Jim Abignano on<br />

<strong>the</strong> basis that Abignano Limited would acquire <strong>the</strong> Enacon businesses partly for cash and<br />

<strong>the</strong> balance by Abignano issuing additional shares.’<br />

The reasoning behind <strong>the</strong> decision to acquire <strong>the</strong> Enacon group was strategic – to<br />

move Abignano away from a total reliance on core civil engineering projects to a<br />

more diversified mix of businesses. It made sense on paper, but <strong>the</strong> reality was not as<br />

straightforward. ‘It’s fair to say that <strong>the</strong> integration process did not go smoothly and it<br />

didn’t take too long for everyone to realise that a number of Enacon’s businesses were<br />

bleeding cash terribly – <strong>the</strong> worst of which was <strong>the</strong> Graham Evans building group. I was<br />

six months into <strong>the</strong> new role when I was asked to become <strong>the</strong> CFO of that business, with<br />

<strong>the</strong> brief to put structure into its financial and administration reporting and processes.<br />

Graham Evans Victoria had senior management problems, <strong>the</strong> Queensland company was<br />

suffering losses from <strong>the</strong> construction of high-rise residential towers on <strong>the</strong> Gold Coast<br />

and in NSW <strong>the</strong>re were major union problems particularly with <strong>the</strong> construction of a new<br />

Sydney Police Headquarters in <strong>the</strong> CBD.’<br />

As <strong>the</strong> scale of <strong>the</strong> commercial problems in <strong>the</strong> Enacon business grew, so too did <strong>the</strong><br />

animosity between Jim Abignano and Lee Ming Tee. ‘In 1985 as <strong>the</strong> story goes, Jim<br />

went back to Lee Ming Tee and advised him that <strong>the</strong> acquisitions were performing so<br />

poorly that he intended to sue Enacon for breach of contract. It was a very messy<br />

period for <strong>the</strong> company as we did not only have to deal with many operational problems<br />

in <strong>the</strong> businesses but we were also attempting to manage <strong>the</strong> haemorrhaging cash<br />

situation. Litigation also commenced between Abignano Limited and one of its major<br />

shareholders. The string of events could easily have resulted in Abignano’s total demise,<br />

however Enacon purchased Jim’s personal investment in Abignano Limited. The deal<br />

was completed in late 1985, and in early <strong>1986</strong> Jim and [MD] Alan Livingstone left <strong>the</strong><br />

company.’<br />

Whilst <strong>the</strong> ownership issue had been settled, Abignano still had to deal with all <strong>the</strong><br />

operational problems. ‘Abignano needed a leader who could solve <strong>the</strong> big issues. Clive<br />

Austin, <strong>the</strong> new Chairman, who was appointed on <strong>the</strong> departure of Jim Abignano,<br />

approached John Cassidy. John was initially appointed as a consultant to come in and try<br />

to work out what could be done to turn <strong>the</strong> company around. John and Clive called and<br />

asked me to take over as <strong>the</strong> CFO of Abignano which <strong>the</strong>y intended to rename <strong>Abigroup</strong>.<br />

I agreed to stay on and work with John to try and turn <strong>the</strong> company around.’<br />

‘... with sweaty palms and a great<br />

deal of trepidation we completed<br />

<strong>the</strong> transaction (a management<br />

buyout) on 30 June 1988.’<br />

REBUILDING THE BUSINESS<br />

DARRELL HENDRY<br />

54

John and Darrell got to work, shedding what needed to be shed and restoring some<br />

confidence in <strong>the</strong> group. ‘Lee Ming Tee was still very much in <strong>the</strong> background. He had<br />

a reputation as a corporate raider but appeared to have no interest in <strong>the</strong> day to day<br />

operations of <strong>the</strong> businesses he had invested in. The problem for Lee Ming Tee was<br />

that if <strong>Abigroup</strong> went into receivership, it was likely clients would pull <strong>the</strong> outstanding<br />

bank guarantees <strong>the</strong> company had issued to undertake <strong>the</strong>ir projects and this would<br />

significantly increase <strong>the</strong> company’s exposure to <strong>the</strong> banks. So it was in his interest to<br />

continue to financially support <strong>Abigroup</strong>, but this wasn’t a sustainable situation. The<br />

balance sheet value of <strong>the</strong> business was close to zero at times and it was difficult to<br />

see how <strong>the</strong> company would survive. During this time, Lee Ming Tee also transferred<br />

his shares in <strong>Abigroup</strong> to his o<strong>the</strong>r investment vehicles with total disregard as to its<br />

impact on <strong>the</strong> company’s staff and o<strong>the</strong>r stakeholders. In a space of less than two<br />

years <strong>Abigroup</strong> had three different major shareholders. There was a significant level of<br />

uncertainty in <strong>the</strong> marketplace about <strong>the</strong> company’s future particularly with <strong>the</strong> banks –<br />

we were in a parlous state.’<br />

But John Cassidy saw opportunity, and Darrell felt <strong>the</strong> same way. ‘The only thing of real<br />

value in <strong>the</strong> business was <strong>the</strong> people and <strong>the</strong> culture, but you had to see it first hand to<br />

appreciate it and that wasn’t Lee Ming’s strength. So John and I started talking about<br />

forming a management group to buy out Lee Ming Tee’s interest in <strong>Abigroup</strong>. A company<br />

called Vercot was established with John, <strong>the</strong> major shareholder. The o<strong>the</strong>r shareholders<br />

were myself, Clive Austin, Brian Allen and Norm Reich. It was first necessary to ensure<br />

<strong>the</strong> company had sufficient banking and guarantee facilities going forward and this<br />

required significant negotiations with <strong>the</strong> bank. After much negotiation and soulsearching<br />

we made an offer. <strong>Abigroup</strong> needed stability, so <strong>the</strong> buyout decision came<br />

naturally, but in no way does that mean it was easy.’<br />

This Photo:<br />

Terrey Hills Golf Course<br />

under construction.<br />

Opposite Page:<br />

Darrell, 2010.<br />

REMEMBER...<br />

• Australia celebrates its bicentennial day with<br />

<strong>the</strong> arrival of <strong>the</strong> First Fleet re-enactment<br />

voyage and a tall ships parade in Sydney<br />

Harbour. World Expo opens in Brisbane later<br />

<strong>the</strong> same year.<br />

• Pan Am flight 103 is blown up over Lockerbie,<br />

Scotland, killing 270 people.<br />

History shows that <strong>the</strong> decision was a significant success, but not even in Vercot’s most<br />

positive, blue-sky dreaming could <strong>the</strong>y have imagined <strong>the</strong> business would get to where<br />

it did. ‘The bank required <strong>the</strong> Vercot shareholders to take out mortgages over <strong>the</strong>ir<br />

houses, to support <strong>the</strong> company’s bank facilities. We paid one cent a share for Lee Ming<br />

Tee’s shares plus 0.1 cent for all of his options, which came to around $256,000. It was<br />

actually a great deal for him considering <strong>the</strong> very poor state of <strong>the</strong> company’s balance<br />

sheet. With sweaty palms and a great deal of trepidation we completed <strong>the</strong> transaction<br />

on 30 June 1988. Part of <strong>the</strong> deal required all loans between Enacon and <strong>Abigroup</strong> to<br />

be cancelled which removed part of <strong>the</strong> debt burden and we immediately began working<br />

hard to convert <strong>the</strong> outstanding contractual claims into cash.’<br />

As expected <strong>the</strong>re wasn’t a quick fix to <strong>the</strong> company’s problems and until <strong>1994</strong>, things<br />

remained on a knife’s edge. ‘I regularly had to go to <strong>the</strong> banks and convince <strong>the</strong>m that<br />

we were on <strong>the</strong> road to financial recovery. We remained positive about our ability to<br />

survive, but <strong>the</strong> bank still required regular independent audits of our position. We had to<br />

be extremely careful in managing our cash so that we didn’t exceed our overdraft limit<br />

and this provided <strong>the</strong> bank with a level of confidence that we had control of <strong>the</strong> business.<br />

Everyone in <strong>the</strong> company was just brilliant in helping us to turn <strong>the</strong> ship around. In <strong>1994</strong><br />

we were awarded <strong>the</strong> M2, but it wasn’t until around 1996 that we felt secure that <strong>the</strong><br />

business was on track and that our houses were safe!’<br />

55 REBUILDING THE BUSINESS<br />

DARRELL HENDRY

But nothing is easy, and <strong>the</strong>re’s a story behind how <strong>the</strong> M2 was won. ‘In <strong>the</strong> early<br />

nineties we had bid for a proposed toll road project that didn’t eventuate, but through<br />

that process we established a relationship with <strong>the</strong> Obayashi Corporation of Japan. We<br />

<strong>the</strong>n successfully built <strong>the</strong> Terrey Hills golf course and club house for Obayashi and<br />

<strong>the</strong> relationship grew stronger. We knew <strong>the</strong>y wanted to participate in <strong>the</strong> Australian<br />

construction market more seriously, so we discussed with <strong>the</strong>m whe<strong>the</strong>r <strong>the</strong>y would be<br />

prepared to provide <strong>the</strong>ir balance sheet as security because we had no chance to even<br />

bid for <strong>the</strong> M2 using ours alone. Back in those days contractors were also required to<br />

leave some “skin in <strong>the</strong> game” and take equity in <strong>the</strong> project, we also needed a $15<br />

million bank guarantee to support our equity obligations. Obayashi indicated that <strong>the</strong>y<br />

would not only provide <strong>the</strong> performance guarantees but also <strong>the</strong> equity guarantee and<br />

we would only be required to provide <strong>the</strong>m with a $1 million bank guarantee in return.<br />

It was a massive leap of faith on <strong>the</strong>ir part and we all laughed that if we failed, we’d<br />

have to change our name to AbiYashi! We won <strong>the</strong> M2, but <strong>the</strong>re was still significant<br />

risk - <strong>the</strong>re was a change of government soon after we won and <strong>the</strong>y wanted to cancel<br />

<strong>the</strong> project. They couldn’t because contracts had already been signed, but <strong>the</strong>re were<br />

no assurances that we’d earn a good return from <strong>the</strong> job particularly when it required<br />

numerous government approvals. The penalty for not completing <strong>the</strong> project on time was<br />

<strong>the</strong> payment of liquidated damages that could have easily run into millions of dollars,<br />

so <strong>the</strong>re was plenty to be nervous about! However, we had selected <strong>Abigroup</strong>’s “A” team<br />

to build <strong>the</strong> project. Whilst we had real concerns around those issues that we could not<br />

control, we had total faith in our construction staff. The project director was Peter Brecht<br />

and he had a young engineer named David Jurd working for him. In fact looking back on<br />

those days <strong>the</strong>re are many people still employed by <strong>Abigroup</strong> that were part of <strong>the</strong> team<br />

on that company making project.’<br />

The success of <strong>the</strong> M2 underpinned <strong>the</strong> balance sheet for a number of years and <strong>the</strong><br />

share price rose up to over $4 in early 1997. The improvement had been a long time<br />

coming. ‘I think it was <strong>the</strong> late eighties, when <strong>the</strong> Stock Exchange contacted us to<br />

advise that we had less than 300 shareholders - <strong>the</strong> minimum required to remain a<br />

listed company. So we approached our staff and asked <strong>the</strong>m to consider buying $2,000<br />

worth of shares at 20 cents a share if my memory serves me. Many of our staff decided<br />

to invest - as did <strong>the</strong>ir family members - and remained shareholders for a long period.<br />

Those who invested at <strong>the</strong> time made <strong>the</strong>ir money a number of times over, which was<br />

great because <strong>the</strong>y deserved <strong>the</strong> reward – it was <strong>the</strong>y who had helped put <strong>the</strong> company<br />

back on its feet.’<br />

In 2005, Darrell moved on to become CFO of <strong>Abigroup</strong>’s parent company Valemus,<br />

previously known as Bilfinger Berger Australia. But how did Bilfinger Berger Germany get<br />

involved in <strong>the</strong> first place ‘In <strong>the</strong> early 2000s, it became clear that as projects became<br />

bigger and bigger, <strong>the</strong> bank guarantees required to support <strong>the</strong> bids were also growing.<br />

By 2003 <strong>Abigroup</strong>’s annual turnover had grown to in excess of $700 million and Vercot<br />

still held 51 per cent of <strong>the</strong> shares. To bid for <strong>the</strong> M7, which was approximately three<br />

times bigger than <strong>the</strong> M2, we needed to provide a $100 million guarantee to support<br />

our equity investment plus ano<strong>the</strong>r $70 million guarantee to provide security for <strong>the</strong><br />

construction. We managed to do that, but we were heavily penalised by <strong>the</strong> financiers<br />

and that rocked us. So to give ourselves a chance to take <strong>the</strong> next step in our growth<br />

path, we decided we would look for a cornerstone investor who could provide financial<br />

This Page, Top:<br />

Terrey Hills Golf Course<br />

under construction.<br />

This Page, Bottom:<br />

Terrey Hills Golf Course<br />

clubhouse.<br />

Opposite Page, Top<br />

and Bottom:<br />

M2 Mototrway.<br />

REBUILDING THE BUSINESS<br />

DARRELL HENDRY<br />

56

support for major projects. John and I travelled to Asia and Europe visiting past major<br />

construction partners to gauge <strong>the</strong>ir interest starting in Japan with Obayashi. In <strong>the</strong><br />

end, <strong>the</strong> German company Bilfinger Berger AG showed <strong>the</strong> most interest. We initially<br />

met <strong>the</strong>m in Singapore and within a few weeks <strong>the</strong>y asked if <strong>the</strong>y could undertake<br />

due diligence. They finally indicated that <strong>the</strong>y were interested – but only if <strong>the</strong>y could<br />

buy 100 per cent of <strong>the</strong> company. John and I were aware that Bilfinger had acquired<br />

Baulderstone Hornibrook some ten years earlier and left it in <strong>the</strong> hands of <strong>the</strong> Australian<br />

management. We both liked <strong>the</strong> concept that Bilfinger would keep <strong>the</strong> <strong>Abigroup</strong> name<br />

and leave it in <strong>the</strong> hands of <strong>the</strong> existing management, in addition to providing additional<br />

financial support for major projects. We were confident <strong>the</strong>y would just let us keep doing<br />

our own thing, and that’s what has happened. So Vercot sold its 51 per cent interest and<br />

Bilfinger <strong>the</strong>n made an on market takeover offer for <strong>the</strong> remaining 49 per cent. By March<br />

2004 all <strong>the</strong> shares in <strong>Abigroup</strong> had been acquired and ano<strong>the</strong>r page had turned.’<br />

John Cassidy exited <strong>the</strong> business, but Darrell stayed on, secure in <strong>the</strong> knowledge that<br />

his house was well and truly safe again, but not quite ready to leave <strong>Abigroup</strong> behind<br />

forever.<br />

MILESTONE FACTS<br />

Abignano Limited<br />

1985 Group Of Companies<br />

Air Conditioning (industrial)<br />

• Thos Clark & Son Pty Ltd<br />

Air Diffusion Equipment<br />

• Anemostat Pty Ltd<br />

Building Contractors<br />

• Graham Evans & Co. Pty Ltd<br />

• Graham Evans & Co. (Qld) Pty Ltd<br />

• Graham Evans & Co. (Vic) Pty Ltd<br />

Civil Engineering Contracting<br />

• Abignano Ltd<br />

• Abignano (Qld) Ltd<br />

• Abignano Constructions (NT) Pty Ltd<br />

• G. Abignano Construction Pty Ltd<br />

General Engineering<br />

• J. Kohler & Sons Ltd<br />

Industrial Fans<br />

• Pitstock Pty Ltd<br />

Medical Services<br />

• Cenrin Pty Ltd (50% owned)<br />

Printed Circuit Boards<br />

• Printronics Pty Ltd<br />

• Printronics China Ltd<br />

Pleasure Craft<br />

• Mariner Cruisers<br />

• Mariner Cruisers (Mfg) Pty Ltd<br />

• Mariner Cruisers (Overseas) Pty Ltd<br />

Welding Products<br />

• Armalloy Pty Ltd<br />

• Vida-Weld<br />

57 REBUILDING THE BUSINESS<br />

DARRELL HENDRY

Bridging <strong>the</strong> old<br />

and <strong>the</strong> new<br />

ERIC KING 1984 - 1997<br />

FORMER BOARD MEMBER<br />

Eric King and his wife Dawn are happily retired and living in Avalon Beach on<br />

Sydney’s nor<strong>the</strong>rn beaches. They have five children, 14 grandchildren and three great<br />

grandchildren to keep him busy. They are a great source of pride for Eric, but it is quickly<br />

obvious that <strong>the</strong>re is still a great deal of pride remaining for what <strong>Abigroup</strong> has become.<br />

Eric spent 42 years in <strong>the</strong> Department of Main Roads, chiefly as <strong>the</strong> Department’s<br />

Engineer for <strong>the</strong> construction of freeways. 1984 came around, and Eric was preparing for<br />

retirement but Jim Abignano had different ideas. ‘Jim had actually approached me earlier<br />

because he knew I was retiring. I was purposely slow in answering him because I was<br />

looking forward to retiring. However he was persistent and I began to get interested.<br />

Being on <strong>the</strong> Board means you aren’t at work every minute of <strong>the</strong> day, but it wasn’t long<br />

after joining that I ended up spending lots of time in <strong>the</strong> office and out on projects. It<br />

was always exciting and I took an active, personal interest. I stayed 14 years.’<br />

But don’t let that picture misguide you into thinking that everything was always rosy.<br />

The mid-eighties were tumultuous and Eric was <strong>the</strong>re on <strong>the</strong> front line. ‘It wasn’t <strong>the</strong> best<br />

situation at <strong>the</strong> time. Jim had ventured to take control of ano<strong>the</strong>r group called Enacon<br />

and we diversified too much. We had things like building and joinery, yacht building,<br />

small engineering operations and electrical circuit manufacture and were getting away<br />

from our core activity of civil engineering. The business we took over virtually took us<br />

over. At that time Clive Austin, <strong>the</strong> chairman of <strong>the</strong> board, informed me that <strong>the</strong>y were<br />

bringing in John Cassidy as managing director. I believe <strong>the</strong> motivation was to get him to<br />

sort things out and <strong>the</strong>n sell it all off. However John saw <strong>the</strong> possibilities and organised a<br />

company buyout.’<br />

Eric says that he will never forget <strong>the</strong> day John told him his plans. ‘John lived at<br />

Newport and he would often come around for a cup of tea and a chat on a weekend.<br />

One Saturday, he said he was considering a company buyout. I was surprised as I didn’t<br />

have that in my mind at all. It was very chancy, but something had to happen and John<br />

had <strong>the</strong> drive and ability to make it so. He gained <strong>the</strong> confidence of <strong>the</strong> staff and <strong>the</strong><br />

construction world and <strong>the</strong> loyalty he built up in <strong>the</strong> business is still <strong>the</strong>re. John was a<br />

compassionate man and was always interested in <strong>the</strong> welfare of all employees.’<br />

Eric became <strong>the</strong> only bridge between <strong>the</strong> old and new when <strong>the</strong> new board was formed.<br />

The new board quickly divested all <strong>the</strong> interests outside <strong>the</strong> core functions and focussed<br />

<strong>the</strong>ir attentions on turning things around. They also changed <strong>the</strong> name to <strong>Abigroup</strong><br />

to hold onto <strong>the</strong> strength of <strong>the</strong> past but also to herald a new dawn. ‘The shares went<br />

right down to something like two cents and it all rested on John and <strong>the</strong> buyout team to<br />

‘...we’re now a firmly established<br />

major player in <strong>the</strong> construction<br />

sector and that’s as good as it gets.<br />

<strong>Abigroup</strong> people still love <strong>the</strong>ir work<br />

and it shows.’<br />

REBUILDING THE BUSINESS<br />

ERIC KING<br />

58<br />

REMEMBER...<br />

• The fall of <strong>the</strong> Berlin wall on 9 November.<br />

• The “beginning of <strong>the</strong> end” for <strong>the</strong> communist<br />

rulers in Eastern Europe: <strong>the</strong> Cold War comes to<br />

an end.<br />

• Exxon Valdez oil disaster in Alaska in March has<br />

massive ecological and economic repercussions.<br />

• Milli Vanilli gets Best New Artist grammy, which<br />

is later stripped when it’s discovered <strong>the</strong>y were lip<br />

synching.

esurrect <strong>the</strong> company. There were times it looked as if it might all go down. However<br />

<strong>the</strong>re was a full, experienced board and administration and a much more professional<br />

show. The only things we held onto when selling <strong>the</strong> non-core activities were some blocks<br />

of land that took a long time to get rid of and a yacht which we decided to keep for a<br />

while.’<br />

Slowly, more jobs came in and <strong>the</strong> business became more robust. A commonly accepted<br />

turning point project was <strong>the</strong> M2 in <strong>1994</strong>, and Eric agrees. ‘It was <strong>the</strong> first of our really<br />

big jobs. We had support from Obayashi and we had <strong>the</strong> staff and <strong>the</strong> expertise. We were<br />

ready. It was not straightforward though – <strong>the</strong>re were all sorts of protesters out <strong>the</strong>re<br />

saving <strong>the</strong> trees.’<br />

For a long while <strong>the</strong> Eric King Award was presented to <strong>the</strong> top <strong>Abigroup</strong> project for<br />

engineering excellence in a given year. Not necessarily <strong>the</strong> largest but <strong>the</strong> one where<br />

engineering excellence and profitability were achieved. The award was symbolic of <strong>the</strong><br />

emphasis <strong>Abigroup</strong> placed on getting <strong>the</strong> job done well and <strong>the</strong> winners were often<br />

difficult to choose.<br />

The Eric King Award has now become known as <strong>the</strong> John Cassidy Award, and Eric could<br />

not be happier about it. The important thing, he believes, is <strong>the</strong> message <strong>the</strong> award<br />

conveys and how it is a celebration of how far <strong>Abigroup</strong> has come. ‘I’m intensely proud<br />

of <strong>Abigroup</strong> and what we’ve achieved. We may not be <strong>the</strong> largest but we’re now a firmly<br />

established major player in <strong>the</strong> construction sector and that’s as good as it gets. <strong>Abigroup</strong><br />

people still love <strong>the</strong>ir work and it shows.’<br />

Opposite Page:<br />

Eric, 2010.<br />

Top:<br />

M2 under construction.<br />

Above:<br />

F3 Opening, 1993 (Eric 2nd<br />

from right).<br />

Right:<br />

The Eric King Award.<br />

59 REBUILDING THE BUSINESS<br />

ERIC KING

A people-oriented<br />

business<br />

RICHARD FRENCH <strong>1986</strong> - to date<br />

GENERAL MANAGER PLANT<br />

When you’re running a fleet of equipment that takes 40,000 – 60,000 litres of fuel a<br />

day per project, and when each big scraper costs in <strong>the</strong> order of $2.3 million dollars –<br />

including an average $22,000 a tyre – you’ve got a serious job on your hands. Richard<br />

French is <strong>the</strong> man at <strong>the</strong> helm of <strong>the</strong> management and maintenance of one of <strong>the</strong> jewels<br />

in <strong>Abigroup</strong>’s crown, and it’s a job he takes very seriously.<br />

‘We’re here to make sure <strong>the</strong> machines are maintained and functioning to <strong>the</strong>ir capacity.<br />

Each project has its own maintenance team in <strong>the</strong> field, so it has to be a big problem if<br />

it makes it all <strong>the</strong> way to us [in <strong>the</strong> depot]. But what we do is try to cut those problems<br />

off before <strong>the</strong>y happen, with scheduled maintenance and lots of planning. It’s <strong>the</strong> same<br />

when we’re getting new equipment – we don’t really have issues with lead times or not<br />

getting what we want because we schedule things well in advance.’<br />

It’s <strong>the</strong> job of Richard’s team to work on machines and manage <strong>Abigroup</strong>’s fleet, but <strong>the</strong><br />

success in this division is largely due to <strong>the</strong> strength of relationships with people. ‘It’s<br />

unique for a business like ours to own, operate and maintain its own equipment and this<br />

helps us stand out. We love <strong>the</strong> machines, but <strong>the</strong> reason we’re all here is because it’s a<br />

people-oriented business. It’s a great aspect of our business internally, but it also helps<br />

externally. We’ve dealt with suppliers like Westrac [Caterpillar], Komatsu and Michelin for<br />

years and our relationships with <strong>the</strong>m have been very important for a long time.’<br />

Richard started life with <strong>Abigroup</strong> as Maintenance Manager in <strong>1986</strong>. He was poached<br />

from an <strong>Abigroup</strong> competitor, Citra, as a result of his relationship with John Cassidy, and<br />

he has seen plenty of change in his 25 years with <strong>the</strong> business. ‘In ’86 <strong>the</strong>re were around<br />

50 motor vehicles and now we have over a thousand. Our earth-moving equipment has<br />

trebled and our fleet is much more modern and presentable now. The big periods of<br />

growth were around <strong>the</strong> M2 and Yelgun to Chinderah Pacific Highway upgrade projects.<br />

We’ve now got 52 people in <strong>the</strong> team, but <strong>the</strong> thing that hasn’t changed is <strong>the</strong> passion of<br />

<strong>the</strong> crew – if we didn’t have that we wouldn’t achieve anything.’<br />

Originally, <strong>the</strong> plant depot used to be at Jim Abignano’s place, before it moved to Asquith.<br />

In <strong>the</strong> late eighties, <strong>the</strong> main depot shifted to <strong>the</strong> current site in Mt Kuring-gai, and <strong>the</strong>re<br />

are now support depots in Queensland and Victoria. Equipment and fleet training is held<br />

on each project site, and <strong>Abigroup</strong> now also has <strong>the</strong> only two mobile scraper simulators<br />

in <strong>the</strong> world to assist that process. ‘The simulators were developed with Cat – one of<br />

<strong>the</strong>m is based here [at <strong>the</strong> depot] and <strong>the</strong> o<strong>the</strong>r can be taken around to <strong>the</strong> jobs in a<br />

trailer. We also have an apprentice school here now for plant mechanics and we’ve had<br />

20 through to date who are now out in <strong>the</strong> field.’<br />

It’s an indication of <strong>Abigroup</strong>’s commitment to this area, and Richard is quick to agree.<br />

‘Management is always supportive of capital expenditure requests and it keeps us ahead<br />

of <strong>the</strong> pack. The fleet is always modernising and this gives us a tremendous advantage.’<br />

In <strong>the</strong> beginning, Jim Abignano’s plant and equipment consisted of a compressor and a<br />

shovel – soon followed by a wheelbarrow. These days it’s a fleet worth over $150 million,<br />

and <strong>the</strong> point is not lost on Richard. ‘History shows us how far we’ve come, but <strong>the</strong> place<br />

is still very much about people. It’s why we’re here. It’s very exciting times for <strong>Abigroup</strong><br />

and it’s great to feel so very much a part of it.’<br />

‘History shows us how far we’ve<br />

come, but <strong>the</strong> place is still very much<br />

about people. It’s why we’re here. It’s<br />

very exciting times for <strong>Abigroup</strong> and<br />

it’s great to feel so very much a part<br />

of it.’<br />

REMEMBER...<br />

• Hit singles of <strong>the</strong> time were <strong>the</strong> likes of Nothing<br />

Compares to You by Sinead O’Connor, Ice Ice Baby<br />

by Vanilla Ice, Vogue from Madonna and U Can’t<br />

Touch This by MC Hammer. Rock On!<br />

• The first McDonald’s in Moscow, Russia opens.<br />

REBUILDING THE BUSINESS<br />

RICHARD FRENCH<br />

60

Opposite Page:<br />

Richard, 2010.<br />

Above:<br />

The <strong>Abigroup</strong> fleet of <strong>the</strong> past.<br />

Left:<br />

Cooroy to Curra, Bruce<br />

Highway Project, 2010.

Cultural<br />

continuation<br />

RON LOVETT 1978 - to date<br />

EXECUTIVE MANAGER - SOUTHERN REGION<br />

In 1987, <strong>Abigroup</strong> was ailing and looking for a cure. Its building capacity needed a boost,<br />

as did its presence in Victoria, and a company called Robert Salzer Constructions Pty Ltd<br />

would prove to be just <strong>the</strong> tonic.<br />

Ron Lovett joined Salzer as Construction Manager in 1978 and witnessed <strong>the</strong> company’s<br />

development first hand. ‘Salzer began in 1969 and was owned and run by Bob Salzer, an<br />

immigrant from Austria. I applied for <strong>the</strong> job through a top head-hunter and had to do<br />

psychological testing, which was very unusual back <strong>the</strong>n. But it showed to me that Bob<br />

was serious and it was a good indication as to his personality.<br />

‘Next, I came down to Melbourne from <strong>the</strong> country, met a few senior managers and that<br />

was it. He’d already done his homework beforehand. He offered me <strong>the</strong> job, and <strong>the</strong> next<br />

thing I knew I was around at his home, walking past <strong>the</strong> grand piano in <strong>the</strong> parlour out<br />

to <strong>the</strong> sun deck, with Nola [Ron’s wife] having a cup of tea with Bob and his wife Betty.<br />

It was all very civilised and a great welcome to <strong>the</strong> Salzer family. Then on my first day<br />

at work, he pulled me aside and said, “Ron, I’m paying you enormous money and I’ve<br />

had to increase all <strong>the</strong> o<strong>the</strong>r management wages – now make sure you earn <strong>the</strong> business<br />

some money”. He was an affable, gentle and creative person, who beamed positiveness<br />

and was also deadly serious about his business and he wouldn’t accept second best. But<br />

he was also a believer in people – at 27 I was about to run half of his business!’<br />

Salzer’s first job back in 1969 had been building 15 Collins Street, Melbourne, a multistorey<br />

building that was <strong>the</strong> first high-rise apartment block in Melbourne’s commercial<br />

business district, and it set <strong>the</strong> tone for <strong>the</strong> success of <strong>the</strong> business. But it was a business<br />

with its owner at <strong>the</strong> fulcrum – not unlike Abignano Ltd with Jim at <strong>the</strong> reins. ‘A couple of<br />

weeks after starting, I asked to see <strong>the</strong> figures on <strong>the</strong> jobs I was managing – I saw a key<br />

part of my job managing projects as making sure each of <strong>the</strong>m were profitable, as I had<br />

done with my previous company. But Bob asked me why I wanted <strong>the</strong>m, so we discussed<br />

it for a while until he told me, “Don’t you worry about that – I’ll tell you if you’re losing<br />

any money.” Sometimes I’d see his perfectly-kept, handwritten ledger book in his bottom<br />

drawer, but for years he wouldn’t let anybody manage <strong>the</strong> profit and loss except himself.<br />

It was amazing when you think that we were a complete Master Builder with probably<br />

300-plus people on wages and multiple big projects on <strong>the</strong> go.’<br />

The seventies and eighties were a very active, aggressive time for <strong>the</strong> unions in <strong>the</strong><br />

building and construction game, but Salzer had a good reputation that kept <strong>the</strong>m largely<br />

out of trouble. ‘We paid <strong>the</strong> team well with outstanding performance and loyalty being<br />

rewarded. It meant that people liked working for Bob because he kept his word and was<br />

genuine. They felt part of his family because he related to you regardless of your position<br />

in <strong>the</strong> company and consequently, we had very few industrial issues.’<br />

‘John [Cassidy] and his team<br />

understood our can-do mentality<br />

and consequently this alignment of<br />

culture along with <strong>the</strong> continuity of<br />

employment meant that we were<br />

able to carry on being successful.’<br />

REBUILDING THE BUSINESS<br />

RON LOVETT<br />

62

Opposite Page:<br />

Ron Lovett, 2010.<br />

Left:<br />

Salzer’s first project at<br />

15 Collins Street, 1969.<br />

Bottom Left:<br />

Salzer’s second project,<br />

Chateau Commodore<br />

reception, 1970.<br />

Bottom Middle:<br />

Chateau Commodore<br />

project, Lonsdale street.<br />

Bottom Right:<br />

An early Salzer<br />

company brochure.<br />

Early company brochures encouraged prospective clients to “call Robert Salzer directly”<br />

with enquiries, but by <strong>the</strong> mid-eighties, Ron could sense that his boss and mentor was<br />

beginning to feel he’d run his race. ‘Many of <strong>the</strong> older management team were retiring<br />

and Bob himself was getting older. By <strong>1986</strong> he was looking for a buyer, and engaged<br />

a Sydney-based agent to find someone. At <strong>the</strong> time, Abignano was looking to acquire<br />

a building operation in Victoria that could take on its Graham Evans Victoria business<br />

down here – to take on <strong>the</strong> order book and <strong>the</strong> debts and manage <strong>the</strong> operation, which I<br />

believe was about $6 million in debt at <strong>the</strong> time. There were two interested parties when<br />

Bob finally decided to cash in his chips, but Bob was loyal to his workforce and wanted to<br />

sell to an operation that would keep <strong>the</strong>m on <strong>the</strong> books ra<strong>the</strong>r than let <strong>the</strong>m go and just<br />

use a sub-contracted labour force. <strong>Abigroup</strong> won out.’<br />

By this stage, <strong>the</strong> Salzer offices had moved to 15 Pickering Road, Mulgrave, a site out<br />

of <strong>the</strong> city that also housed <strong>the</strong> joinery, scaffolding, cranes and o<strong>the</strong>r equipment. It<br />

was Salzer’s philosophy to own as much as possible outright, and it wasn’t <strong>the</strong> only<br />

similarity Ron noticed after <strong>the</strong> 1987 buyout. ‘Look, Bob was wealthy, but he didn’t need<br />

to externally display his wealth. He’d wear gumboots out on jobs and get his hands<br />

dirty. His car was a Toyota Crown – comfortable but not flash. He was an inclusive,<br />

approachable person who had high standards for himself and his people and especially<br />

post-1988 and <strong>the</strong> John Cassidy management buyout; <strong>the</strong>re was a similar feel at<br />

<strong>Abigroup</strong>. John was more extroverted than Bob, but in many ways <strong>the</strong>y were <strong>the</strong> same<br />

and that made <strong>the</strong> transition much smoo<strong>the</strong>r than it could’ve been. Both were peopleorientated<br />

and liked to give individuals a chance and both would much ra<strong>the</strong>r take a punt<br />

and do something ra<strong>the</strong>r than sit around and talk about it. John and his team understood<br />

our can-do mentality and consequently this alignment of culture along with <strong>the</strong> continuity<br />

of employment meant that we were able to carry on being successful.’<br />

Two big jobs that straddled <strong>the</strong> 1987 takeover were 90 Collins Street ($46 million)<br />

in Melbourne’s CBD and The Pines shopping centre development ($20 million) in <strong>the</strong><br />

expanding outer suburb of Doncaster East. ‘The Pines in particular was a very successful<br />

flagship project. At that stage of my career I preferred <strong>the</strong> adrenaline rush of general<br />

management responsibility ra<strong>the</strong>r than specific project management, however Bob asked<br />

me to “come off <strong>the</strong> road” and do that job as a favour because it meant a lot to him. He’d<br />

been so good to my family, as with many o<strong>the</strong>rs in his family, <strong>the</strong>re was no way I could<br />

disappoint him, so of course <strong>the</strong> answer was yes. I remember John [Cassidy] coming<br />

out to <strong>the</strong> site with Abignano management to see <strong>the</strong> project before <strong>the</strong> management<br />

buyout he led in 1988, but he hardly said a word. Looking back, he was clearly assessing<br />

<strong>the</strong> work and assessing <strong>the</strong> people running <strong>the</strong> Victorian operations before he activated<br />

his management buyout of <strong>the</strong> business. Meanwhile, <strong>the</strong> now Salzer/<strong>Abigroup</strong> team<br />

was closing off <strong>the</strong> Graham Evans Victoria work and still making money on our projects,<br />

but it was awkward. The changing face of <strong>Abigroup</strong> ownership was both amusing and<br />

worrying during this period as our successful operation - still used to <strong>the</strong> stability and<br />

dependability of <strong>the</strong> Salzer regime - received payment drafts now controlled by <strong>the</strong><br />

central <strong>Abigroup</strong> treasury in Sydney. And <strong>the</strong>re appeared to be changing ownership<br />

by various group entities such as Wormald Securities, <strong>the</strong>n Sunshine or o<strong>the</strong>rs, so <strong>the</strong><br />

transition wasn’t always a comfortable time.’<br />

63 REBUILDING THE BUSINESS<br />

RON LOVETT

And <strong>the</strong> Vercot management buyout wasn’t a panacea to all <strong>Abigroup</strong>’s commercial<br />

woes ei<strong>the</strong>r. ‘It was frustrating because our operations were making money and were<br />

successful, but money we made was paying for o<strong>the</strong>r unsuccessful operations. Due to<br />

<strong>the</strong> failing Hughes Bro<strong>the</strong>rs cash flow issues, subbies began to factor into <strong>the</strong>ir prices <strong>the</strong><br />

fact that <strong>the</strong>y might not get paid on time, so costs began to balloon. We couldn’t deal<br />

easily with suppliers that we’d previously had good relationships with because <strong>the</strong>y were<br />

no longer getting paid on time and although Bob wasn’t involved anymore, he was angry<br />

because he felt it tarnished his reputation and his name was out <strong>the</strong>re associated with<br />

things he could no longer control. There was also a feeling in <strong>the</strong> Victorian operations<br />

that <strong>the</strong> money we made here was being sent up to Sydney but <strong>the</strong>re was never enough<br />

allocated for our business to be sustainable, and ultimately this would affect our viability.<br />

So it was far from perfect in many ways, even though <strong>the</strong> culture match was good.’<br />

Ron is also keen to explain that <strong>the</strong> financial difficulties weren’t solely related to Hughes<br />

Bro<strong>the</strong>rs acquisition and <strong>the</strong> Abignano ownership issues at that time. ‘In <strong>the</strong> late eighties,<br />

<strong>the</strong> whole industry went into a downward cycle and it was very tough. We [now <strong>Abigroup</strong><br />

Victoria as <strong>the</strong> Salzer name transitioned out] went from nearly $100 million to $35 million<br />

revenue in a year, with cuts in <strong>the</strong> workforce from 250 down to 50. The recent Global<br />

Financial Crisis could’ve potentially seen a repeat of this traumatic outcome, especially<br />

in <strong>the</strong> Building Division, had it not been for <strong>the</strong> growth in <strong>the</strong> capability and diversity<br />

of <strong>the</strong> business that was learnt from <strong>the</strong> late eighties experience. <strong>Abigroup</strong> in Sou<strong>the</strong>rn<br />

Region has consequently been able to grow its business by targeting critical opportunities<br />

in tough periods such as <strong>the</strong> Government stimulus program, and related opportunities<br />

where we’ve had over $300 million of work from schools program down here. Currently,<br />

<strong>the</strong> Sou<strong>the</strong>rn Region employs 700 people and <strong>the</strong>re are significant opportunities for more<br />

growth.<br />

‘Back <strong>the</strong>n, John [Cassidy] and Darrell [Hendry] had a way of making you feel you<br />

were on <strong>the</strong>ir team; toge<strong>the</strong>r we will get it done - hence <strong>the</strong> “can do” culture. In fact,<br />

John’s whole business model was based on it and it still serves <strong>the</strong> business well today.<br />

For those involved in <strong>the</strong> acquisition and transition it’s a continuation of <strong>the</strong> Bob Salzer<br />

business, really. There’s an <strong>Abigroup</strong> philosophy that was unsaid but very much lived at<br />

Salzer, and that’s to take your idea and get on with it – seek forgiveness later if you get<br />

it wrong. <strong>Abigroup</strong> is now a $2 billion dollar business with a conservative order book of<br />

$4.5 billion, but I think that philosophy will underpin <strong>Abigroup</strong>’s success no matter how<br />

big <strong>the</strong> place gets.’<br />

‘I have no doubt that Bob Salzer would be very proud that original contributors to his<br />

business with continuous service such as Mick McGuire (42 years), Frank Taverna (41<br />

years) and Brian Moody (37 years) have worked for <strong>Abigroup</strong> for so long. Bob’s wish<br />

when he sold his company to <strong>Abigroup</strong> in 1987 was that his legacy of a company that’s<br />

recognised as having a can do culture has continued through <strong>the</strong> actions and loyalty of<br />

people like <strong>the</strong>se who are held in <strong>the</strong> highest regard by <strong>the</strong>ir peers.’<br />

REBUILDING THE BUSINESS<br />

RON LOVETT<br />

64

ABOUT ROBERT SALZER<br />

Robert Salzer was born in Vienna in 1924, but <strong>the</strong> advance of Nazism forced his<br />

family to flee to Britain. It was <strong>the</strong>re, in 1950, that he met Betty Reid, whom<br />

he would marry in 1954. They moved to Melbourne in 1961, where Bob began<br />

<strong>the</strong> construction career for which he was awarded <strong>the</strong> Order of Australia (AO) in<br />

1993. After selling his business to <strong>Abigroup</strong> in 1987, he committed $500,000 to<br />

start <strong>the</strong> Robert Salzer Foundation to support <strong>the</strong> Victorian arts community, and<br />

his wife Betty added ano<strong>the</strong>r $500,000 upon Bob’s death in 1995, aged 72. The<br />

Foundation remains an important contributor to Victorian artistic life.<br />

MILESTONE PROJECTS<br />

Above:<br />

Bob’s retirement dinner. Bob is <strong>the</strong><br />

first man seated from <strong>the</strong> left.<br />

Far Left:<br />

A Salzer social event –<br />

Ron Lovett is in <strong>the</strong> red tie.<br />

Opposite Page:<br />

Ron Lovett, 2010.<br />

Early Salzer Milestone Projects:<br />

• 1969.<br />

15 Collins Street, Melbourne.<br />

Bob Salzer’s first job.<br />

• 1970.<br />

Chateau Commodore, Lonsdale Street,<br />

Melbourne.<br />

• 1971.<br />

15 Pickering Road, Mulgrave.<br />

(Salzer’s new premises.)<br />

• 1972.<br />

356 Collins Street, Melbourne.<br />

• 1973.<br />

Monash University’s physics and<br />

chemistry buildings, Clayton.<br />

Transition Projects:<br />

(1987-1988, completed during<br />

<strong>Abigroup</strong> acquisition)<br />

• 1987.<br />

16 Flinders Lane, Melbourne. Nine storey<br />

office / carpark development, linked to<br />

No. 1 Collins Street by covered suspended<br />

walkway.<br />

$12,000,000.<br />

St Moritz Hotel, St Kilda Esplanade.<br />

$23,000,000 (approx).<br />

90 Collins Street, Melbourne. 27 storey<br />

CBD office block with a composite steel /<br />

concrete construction.<br />

$46,000,000.<br />

Pines Shopping Centre, Donvale. Major<br />

retail centre comprising 44 specialty stores<br />

plus major chains and parking for over<br />

1000 cars.<br />

$20,000,000 (approx)<br />

• 1988.<br />

55 King Street, Melbourne. Eight storey<br />

office block with acoustic design plus<br />

fitout.<br />

$23,000,000.<br />

REMEMBER...<br />

• Gulf War: Operation Desert Storm begins<br />

with air strikes against Iraq on 16 January.<br />

• The United States Department of Justice<br />

announces that Exxon has agreed to pay $1<br />

billion for <strong>the</strong> clean-up of <strong>the</strong> Exxon Valdez oil<br />

spill in Alaska.<br />

• Paul Keating replaces Bob Hawke as Prime<br />

Minister of Australia.<br />

65 REBUILDING THE BUSINESS<br />

RON LOVETT

Employees<br />

come first<br />

PAUL McGILVRAY 1987 - to date<br />

COMMERCIAL MANAGER,<br />

GATEWAY UPGRADE PROJECT<br />

Paul McGilvray is <strong>the</strong> Commercial Manager on one of <strong>Abigroup</strong>’s biggest projects: <strong>the</strong><br />

$2.12 billion Gateway Upgrade Project in Brisbane. He has come a long way from his<br />

formative years in Canberra where he completed his trade as a carpenter. In <strong>the</strong> mideighties,<br />

he was made redundant following <strong>the</strong> completion of <strong>the</strong> Australian Defence<br />

Force Academy, but he didn’t let it slow him down. ‘I had a young family and a mortgage,<br />

so I straight away went to <strong>the</strong> social security office and got an in-fill job. A few weeks<br />

later I got a call from an ex-colleague who was working at Hughes Bro<strong>the</strong>rs. I joined<br />

<strong>the</strong>m as a building cadet and went to work on <strong>the</strong> new Parliament House. Our contracts<br />

were for <strong>the</strong> fitout of <strong>the</strong> Prime Minister’s office, <strong>the</strong> member and guest dining room<br />

and <strong>the</strong> cabinet room. I still remember <strong>the</strong> ceiling of <strong>the</strong> cabinet room, it was inlaid with<br />

detailed veneer that was all done on <strong>the</strong> Hughes Bro<strong>the</strong>rs’ premises. It was impressive<br />

stuff.’<br />

Formed by Tom and Bill Hughes in 1946, Hughes Bro<strong>the</strong>rs was a building company<br />

based in Port Kembla. In 1953 <strong>the</strong>y won work on <strong>the</strong> Snowy River Scheme, which led<br />

to <strong>the</strong> company’s diversification and expansion - with offices in Sydney, Canberra and<br />

Newcastle as well as Port Kembla - and work across NSW and ACT through <strong>the</strong> seventies<br />

and eighties. ‘The Canberra office was probably four or five full time staff. We were a<br />

tight group. During my time at Hughes Bro<strong>the</strong>rs (and later as part of <strong>Abigroup</strong>) I had<br />

<strong>the</strong> opportunity to work on a number of <strong>the</strong> landmark buildings around Canberra. I<br />

remember renovating <strong>the</strong> Queen’s room before her visit, and we couldn’t touch <strong>the</strong><br />

walls after <strong>the</strong>y were painted or we’d need to repaint <strong>the</strong>m to make sure <strong>the</strong>re were no<br />

fingerprints or marks.’<br />

But whilst <strong>the</strong> work was satisfying, <strong>the</strong> Hughes Bro<strong>the</strong>rs’ business was obviously in<br />

financial difficulty. ‘We finished Parliament House and had submitted a number of<br />

contractual claims. I went down to <strong>the</strong> Port Kembla head office to work as part of <strong>the</strong><br />

team negotiating <strong>the</strong> claims. Just prior to Christmas we were told that <strong>the</strong> directors had<br />

accepted an offer from <strong>the</strong> client to settle. We were told that <strong>the</strong> business needed <strong>the</strong><br />

cash for <strong>the</strong> Christmas holiday pays and that <strong>the</strong> settlement was about ten per cent of<br />

<strong>the</strong> submitted value. I remember driving home to Canberra disappointed at <strong>the</strong> outcome.<br />

They were worrying times in many ways.’<br />

In <strong>1986</strong>, Abignano became <strong>Abigroup</strong>, and one of its first acts under <strong>the</strong> new banner was<br />

to buy <strong>the</strong> Hughes Bro<strong>the</strong>rs business. It was a strategic decision because it meant taking<br />

on <strong>the</strong> Hughes Bro<strong>the</strong>rs debt, but <strong>the</strong> aim was to develop <strong>Abigroup</strong>’s building capacity<br />

in NSW – and as a long-term decision it has proven fruitful. ‘I was surprised about <strong>the</strong><br />

buyout, however it was like a second chance in some ways and it was business as usual<br />

for us in Canberra. Most of our work was with <strong>the</strong> ACT Government and whilst it wasn’t<br />

large in dollar terms, it gave us <strong>the</strong> opportunity to work on iconic buildings and keep <strong>the</strong><br />

team toge<strong>the</strong>r.’<br />

Paul could see <strong>the</strong> personal opportunities that might come from being employed by<br />

<strong>Abigroup</strong> – a much larger and diverse operation than he was used to. ‘While I enjoyed<br />

‘I had my wife and kids on site<br />

filling sand bags, climbing scaffold<br />

to try and divert a disaster. We<br />

succeeded.’<br />

REMEMBER...<br />

• One and two cent coins are withdrawn from<br />

circulation, forcing shopkeepers to<br />

round off items to <strong>the</strong> nearest five cents.<br />

• An historic High Court ruling in <strong>the</strong> Mabo case<br />

recognises Native Title to land.<br />

REBUILDING THE BUSINESS<br />

PAUL McGILVRAY<br />

66

Opposite Page:<br />

Paul, 2010.<br />

Left:<br />

Hughes Bro<strong>the</strong>rs Portfolio Cover,<br />

1980s.<br />

Below:<br />

Work underway on <strong>the</strong> second<br />

Gateway Bridge.<br />

my time in Canberra, I wanted to move to Sydney where I believed <strong>the</strong>re were greater<br />

opportunities. There weren’t any straight away, so I moved to Dubbo to work on a<br />

shopping centre extension. It was a real “family project” with a small, close group and<br />

it was a good chance for me to take a step up. Though I do remember we had a major<br />

concrete pour, it was 40-plus degrees during <strong>the</strong> day and too hot to undertake <strong>the</strong> pour,<br />

so we did it at night. We brought in three major concrete pumps from Sydney and had<br />

every concrete truck in Dubbo and <strong>the</strong> surrounding districts working that night. The slab<br />