Tug Boat Market Report - May 2013 - Marcon International, Inc.

Tug Boat Market Report - May 2013 - Marcon International, Inc.

Tug Boat Market Report - May 2013 - Marcon International, Inc.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

Vessels and Barges for Sale or Charter Worldwide<br />

P.O. Box 1170, 9 NW Front Street, Suite 201<br />

Coupeville, WA 98239 U.S.A.<br />

Telephone (360) 678 8880<br />

Fax (360) 678-8890<br />

E Mail: info@marcon.com<br />

http://www.marcon.com<br />

<strong>May</strong> <strong>2013</strong><br />

<strong>Tug</strong> <strong>Market</strong> <strong>Report</strong><br />

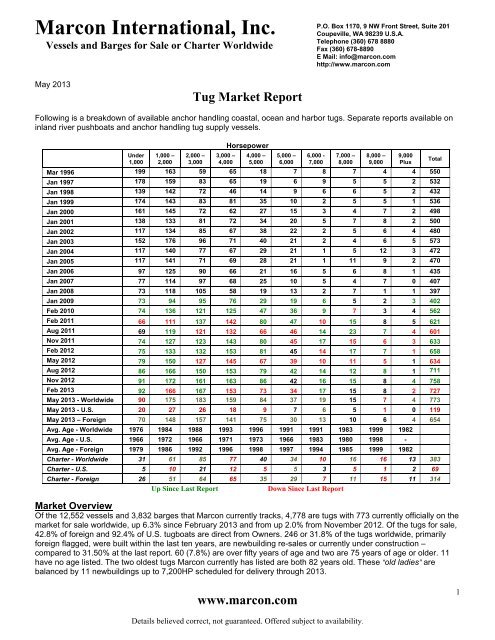

Following is a breakdown of available anchor handling coastal, ocean and harbor tugs. Separate reports available on<br />

inland river pushboats and anchor handling tug supply vessels.<br />

Under<br />

1,000<br />

1,000 –<br />

2,000<br />

2,000 –<br />

3,000<br />

3,000 –<br />

4,000<br />

Horsepower<br />

Mar 1996 199 163 59 65 18 7 8 7 4 4 550<br />

Jan 1997 178 159 83 65 19 6 9 5 5 2 532<br />

Jan 1998 139 142 72 46 14 9 6 6 5 2 432<br />

Jan 1999 174 143 83 81 35 10 2 5 5 1 536<br />

Jan 2000 161 145 72 62 27 15 3 4 7 2 498<br />

Jan 2001 138 133 81 72 34 20 5 7 8 2 500<br />

Jan 2002 117 134 85 67 38 22 2 5 6 4 480<br />

Jan 2003 152 176 96 71 40 21 2 4 6 5 573<br />

Jan 2004 117 140 77 67 29 21 1 5 12 3 472<br />

Jan 2005 117 141 71 69 28 21 1 11 9 2 470<br />

Jan 2006 97 125 90 66 21 16 5 6 8 1 435<br />

Jan 2007 77 114 97 68 25 10 5 4 7 0 407<br />

Jan 2008 73 118 105 58 19 13 2 7 1 1 397<br />

Jan 2009 73 94 95 76 29 19 6 5 2 3 402<br />

Feb 2010 74 136 121 125 47 36 9 7 3 4 562<br />

Feb 2011 66 111 137 142 80 47 10 15 8 5 621<br />

Aug 2011 69 119 121 132 66 46 14 23 7 4 601<br />

Nov 2011 74 127 123 143 80 45 17 15 6 3 633<br />

Feb 2012 75 133 132 153 81 45 14 17 7 1 658<br />

<strong>May</strong> 2012 79 150 127 145 67 39 10 11 5 1 634<br />

Aug 2012 86 166 150 153 79 42 14 12 8 1 711<br />

Nov 2012 91 172 161 163 86 42 16 15 8 4 758<br />

Feb <strong>2013</strong> 92 166 167 153 73 34 17 15 8 2 727<br />

<strong>May</strong> <strong>2013</strong> - Worldwide 90 175 183 159 84 37 19 15 7 4 773<br />

<strong>May</strong> <strong>2013</strong> - U.S. 20 27 26 18 9 7 6 5 1 0 119<br />

<strong>May</strong> <strong>2013</strong> – Foreign 70 148 157 141 75 30 13 10 6 4 654<br />

4,000 –<br />

5,000<br />

5,000 –<br />

6,000<br />

6,000 -<br />

7,000<br />

7,000 –<br />

8,000<br />

8,000 –<br />

9,000<br />

Avg. Age - Worldwide 1976 1984 1988 1993 1996 1991 1991 1983 1999 1982<br />

Avg. Age - U.S. 1966 1972 1966 1971 1973 1966 1983 1980 1998 -<br />

Avg. Age - Foreign 1979 1986 1992 1996 1998 1997 1994 1985 1999 1982<br />

Charter - Worldwide 31 61 85 77 40 34 10 16 16 13 383<br />

Charter - U.S. 5 10 21 12 5 5 3 5 1 2 69<br />

Charter - Foreign 26 51 64 65 35 29 7 11 15 11 314<br />

Up Since Last <strong>Report</strong><br />

Down Since Last <strong>Report</strong><br />

<strong>Market</strong> Overview<br />

Of the 12,552 vessels and 3,832 barges that <strong>Marcon</strong> currently tracks, 4,778 are tugs with 773 currently officially on the<br />

market for sale worldwide, up 6.3% since February <strong>2013</strong> and from up 2.0% from November 2012. Of the tugs for sale,<br />

42.8% of foreign and 92.4% of U.S. tugboats are direct from Owners. 246 or 31.8% of the tugs worldwide, primarily<br />

foreign flagged, were built within the last ten years, are newbuilding re-sales or currently under construction –<br />

compared to 31.50% at the last report. 60 (7.8%) are over fifty years of age and two are 75 years of age or older. 11<br />

have no age listed. The two oldest tugs <strong>Marcon</strong> currently has listed are both 82 years old. These “old ladies” are<br />

balanced by 11 newbuildings up to 7,200HP scheduled for delivery through <strong>2013</strong>.<br />

9,000<br />

Plus<br />

Total<br />

www.marcon.com<br />

1<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Breakdown by Built &BHP<br />

Built 9000 Total<br />

1930 2 2<br />

1939 1 1<br />

1941 1 1<br />

1943 1 1 1 3<br />

1944 1 2 2 1 6<br />

1945 1 1 2<br />

1948 1 1 2<br />

1949 1 1<br />

1950 1 1<br />

1951 1 1 2<br />

1952 2 1 3<br />

1953 1 1 2<br />

1954 3 3<br />

1955 1 1 2<br />

1956 2 2 2 6<br />

1957 1 1 2 4<br />

1958 2 2 4<br />

1959 3 3<br />

1960 1 1 1 3<br />

1961 1 1<br />

1962 3 1 4<br />

1963 1 2 1 4<br />

1964 1 1 2 3 7<br />

1965 3 3 3 9<br />

1966 2 4 1 4 11<br />

1967 6 3 2 1 2 14<br />

1968 5 2 1 8<br />

1969 1 2 2 1 1 7<br />

1970 2 4 2 4 1 2 1 16<br />

1971 1 4 3 1 1 10<br />

1972 2 2 5 3 3 1 16<br />

1973 1 2 4 8 2 1 1 19<br />

1974 2 4 3 3 3 1 16<br />

1975 1 9 6 3 2 2 23<br />

1976 1 2 5 3 3 1 1 4 1 21<br />

1977 2 7 6 2 3 2 2 2 1 27<br />

1978 3 6 4 1 1 1 1 17<br />

1979 2 1 6 2 1 12<br />

1980 1 4 1 3 1 10<br />

1981 4 5 9 9 2 1 30<br />

1982 2 6 7 1 1 2 2 1 22<br />

1983 1 3 2 2 1 1 10<br />

1984 1 1 1 2 1 1 7<br />

1985 1 2 4 2 9<br />

1986 2 1 1 1 1 6<br />

1987 1 1 1 3<br />

1988 2 3 1 3 1 10<br />

1989 1 2 3<br />

1990 2 1 2 5<br />

1991 1 3 4 8<br />

1992 5 3 2 1 11<br />

1993 2 2 1 5<br />

1994 1 1 2<br />

1995 4 4 1 9<br />

1996 1 5 2 3 1 12<br />

1997 1 4 1 1 4 2 13<br />

1998 1 2 3 1 7<br />

1999 1 1 2 1 1 6<br />

2000 1 2 1 1 5<br />

2001 4 1 3 2 1 11<br />

2002 1 3 1 4 1 10<br />

2003 3 1 4 1 9<br />

2004 2 2 8 3 4 1 20<br />

2005 1 6 6 3 1 17<br />

2006 4 5 5 14<br />

2007 1 4 11 16<br />

2008 4 3 10 2 1 20<br />

2009 7 14 2 2 2 27<br />

2010 4 1 8 3 3 1 1 21<br />

2011 3 2 4 13 6 5 3 1 37<br />

2012 18 13 7 8 7 1 54<br />

<strong>2013</strong> 1 3 5 2 11<br />

Unknown 8 1 5 4 1 1 20<br />

Total 90 175 183 159 84 37 19 15 7 4 773<br />

www.marcon.com<br />

2<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

The majority of tugs <strong>Marcon</strong> tracks for sale are in Southeast Asia with<br />

151 tugs officially on the market (up from 148 last report), followed by<br />

Europe with 133 (vs. 120), 116 in the Far East (100), 115 in the U.S.<br />

(132), 77 in the Mediterranean (72), 43 in the Mid East (40), 33<br />

Caribbean (31), 26 where location unstated (21), 21 in Latin America<br />

(14), 18 in Canada (18), 16 in Africa (11), 15 in the South Pacific (11)<br />

and 9 in Southwest Asia (9). CAT diesels still power most tugs for sale<br />

with machinery in 148 or 20% of the tugs <strong>Marcon</strong> lists. This is followed<br />

by 108 Cummins, 62 Yanmar, 59 Niigata, 57 EMD, 34 Deutz, 27<br />

Mitsubishi, 24 Ruston, 19 MAK and 18 GM powered tugs. 196 tugs are<br />

powered by machinery from other manufacturers from ABC to Zibo<br />

with, as always, 12 Fairbanks Morse boats out there looking for a new<br />

home. Conventional single and twin screw tugs prevail with 157<br />

(20.3%) and 458 (59.2%), respectively, for sale worldwide.<br />

These are followed by 124 azimuthing tugs (16.0%) on the market, 27<br />

Voith Schneider tractor tugs (3.5%), five triple screw and two shallow draft quad screws (1.0%). Compared to last<br />

November 2012’s report, we have 3 fewer twin screw tugs, 15 more single screw, three more azimuthing, one more<br />

tractor, one less triple screw and the same number of quad screw tugs for sale. There has been a little juggling around<br />

of the locations of the tugs listed, but generally no major change. Greatest changes were in the Europe, Far East and<br />

Latin America where a few more tugs are available and in the U.S. with fewer tugs. (Note that locations refer to the<br />

actual physical locations and not flag).<br />

<strong>Marcon</strong> currently has listed a record number of 773 tugs worldwide<br />

currently on the market officially for sale worldwide, after seeing a<br />

slight decline for some reason between November 2012 and<br />

February <strong>2013</strong>. It does not look like we are going to see any major<br />

and steady reduction in the number of worldwide tug listings any<br />

time soon. When I was predicting a fall-off in the numbers, I was<br />

expecting the world to be further along in an economic recovery<br />

than where we are today, four years after the official ending of this<br />

latest “Great Recession”. 654 of the tugs presently listed are<br />

foreign, up 63 from February <strong>2013</strong> and 44 from last November.<br />

Most of the increases comes from more foreign tugs in the<br />

1,000HP to 3,999BHP horsepower ranges, which represent the<br />

greatest numbers of tugs listed. The 119 U.S. flag tugs listed for<br />

sale are down 29 vessels from November 2012 and down 17 from<br />

February <strong>2013</strong>. The largest decline in U.S. flag tugs since February <strong>2013</strong> was in the 1,000 – 1,999BHP and 3,000 –<br />

3,999HP ranges, again with the greatest number of tugs listed also within those range.<br />

The wide gap still continues today in what most Buyers are willing or able to pay and Seller’s expectations –<br />

sometimes up to 50% - and please note that <strong>Marcon</strong> did not make this market. We only react to it, accurately report on<br />

it and try to represent and protect both buyers and sellers fairly. Shooting the messenger does no good. By <strong>May</strong> <strong>2013</strong>,<br />

<strong>Marcon</strong>’s average sale price/BHP was US$ 327/BHP for a “generic” 1979 built tug, down from US$ 334 in November<br />

2012. There is still a lot of downward pressure on<br />

second-hand prices. How far it will continue to fall<br />

before we see any steady price improvement I can<br />

only guess – but it is not “just right around the<br />

corner”. There is still a lot of old “cold iron” which first<br />

must disappear from the market – especially with the<br />

increasing regulatory pressures on older tugs.<br />

The number of appraisals <strong>Marcon</strong> is performing has<br />

increased dramatically during first half of <strong>2013</strong>. This<br />

activity in the past was seen as a forerunner of<br />

increased sales, but as they say in small print about<br />

investing in the stock market – “past performance is<br />

no guarantee of future results”.<br />

www.marcon.com<br />

3<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Recent <strong>Marcon</strong> <strong>Tug</strong> Sales & Charters<br />

<strong>Marcon</strong> has sold or chartered ten vessels and barges so far in <strong>2013</strong>, including five tugs with a total horsepower of<br />

17,048BHP. Several additional sales and charters are pending.<br />

Vessel Management Services, <strong>Inc</strong>., a Delaware corporation, has sold their twin<br />

screw tug “Sinuk” to King River LLC of Palmer, Alaska. The 85.8’ x 28.5’ x 10.0’<br />

depth, model bow tug was built in 1995 by J. Ray McDermott Shipyard in<br />

Morgan City, Louisiana. The tug, along with her sister “Siku”, were designed for<br />

coastwise towing and lightering of deck cargo / petroleum barges supplying the<br />

numerous remote sites and villages in southwestern and western Alaska.<br />

“Sinuk” is powered by a pair of CAT<br />

3412DITA diesels totaling 1,248BHP,<br />

turning 5-blade stainless steel props<br />

through Twin Disc MG540 6.18:1 marine<br />

reduction gears. Her stern configuration shrouds both propellers in tunnels,<br />

allowing the tug to work at a shallow draft of about 5.5’ light and 8.25’ loaded.<br />

Bollard pull for the class is about 25,000lbs. ahead and 18,720lbs. astern.<br />

“Sinuk’s” towing gear consists of a<br />

Markey TYS-24 single drum winch with<br />

a pendant drum, plus push knees<br />

forward. Ship’s power is supplied by a<br />

pair of 105kW generators driven by CAT 3304s. Tankage includes about<br />

40,000g. fuel, 700g lube oil and 2,800g fresh water. The 117GRT tug is<br />

classed ABS +A1, Unrestricted Service, +AMS and carries an ABS<br />

<strong>International</strong> Load Line. “Sinuk” was laid up for the winter in Bethel, Alaska out<br />

of the water at the time of purchase. New Owners have renamed the vessel<br />

“Ari Cruz”. This is the fifth vessel transaction that <strong>Marcon</strong> has concluded with<br />

the buyer. <strong>Marcon</strong> has handled over 100 sales and purchases for the seller and<br />

acted as sole broker in this sale.<br />

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>. is pleased to announce the sale of the two<br />

U.S. flag, 3,900BHP twin screw sister-tugs "Atlantic Service" (ex-<br />

Atlantic Star) and "Brooklyn Service" (ex-Peggy Sheridan, Gulf Star)<br />

to private buyers. Both tugs were built in 1975 by Halter Marine<br />

Services, <strong>Inc</strong>. of New Orleans, Louisiana for Sheridan Transportation<br />

to handle their 11,000 – 15,000dwt petroleum barges “Hygrade 95”<br />

and “S.T. 114”. The tugs both worked for Red Star Towing and<br />

Amerada Hess Corp. of New York until the Hess fleet was acquired<br />

by Leevac Marine / Hornbeck. The tugs measure 109' length overall x<br />

31' beam x 14' depth. Both “Atlantic Service” and the “Brooklyn<br />

Service” are powered by twin EMD 16-645E2 main engines, Falk gears and 4-blade 100” x 76” high-efficiency props,<br />

which develops bollard pull of about 34.5 tons and free running<br />

speeds of abt. 8.5 – 10kn. Although laid-up at the time of the<br />

sale, both tugs were still actively classed ABS +A1, Towing<br />

Service, +AMS, Unrestricted Service. Each tug is fitted with a<br />

single drum Markey TDS-32 towing winch with a capacity of<br />

2,000' of 2" wire. Other features include raised pilot houses<br />

and air conditioned quarters for 10 crew aboard each boat.<br />

New owners plan to reactivate both tugs under U.S. flag for<br />

use for in-house service. <strong>Marcon</strong> acted as sole broker in this<br />

transaction and has handled multiple sales for Seller.<br />

www.marcon.com<br />

4<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

A two-year old, 65 ton bollard pull ASD firefighting tug has been bareboat chartered in Central America for a three year<br />

period on a private and confidential basis. This charter follows on the heels of a previously successful six month<br />

charter to a different Caribbean client of the same tug which was concluded in March of this year. <strong>Marcon</strong> acted as<br />

sole broker in this latest charter.<br />

After six months of charter, Marigny <strong>Tug</strong> LLC of St. Augustine,<br />

Florida (d/b/a Tradewinds Towing) closed on the purchase of the<br />

U.S. flag, twin screw, ocean tug “Leslie Foss” (ex-Caribe Pioneer,<br />

Leslie Foss) which they had chartered from Foss Maritime of<br />

Seattle, Washington. New Owners are in the process of<br />

renaming the tug “Simone”, after one of the principal’s oldest<br />

daughters. The 120’ x 31’ x 14.9’ depth / 13.5’ draft tug was built<br />

in 1970 at McDermott Shipyard in Amelia, Louisiana and<br />

underwent a life extension program in 2000. The ABS load-lined<br />

tug is powered by EMD 12-645E2s developing a total of<br />

3,000BHP and turning 5-blade 103” x 82” Coolidge props through Lufkin RHS 2524 4.128:1 gears. <strong>Tug</strong>’s bollard pull is<br />

37.5 tons and free running speed about 12kn. Ship’s power is supplied by two 99kW main and one 75kW emergency<br />

gensets, all driven by John Deere 6068s. With her 96,000g fuel capacity, the tug has long-legs which help when<br />

making tandem tows with her Markey TDSD-32 double drum winch, tow pins and stern roller. She also carries a<br />

hydraulic combination windlass / bow winch with Plasma line for barge handling. To assist in salvage work “Simone”<br />

carries a welding machine, hydraulic deck crane, Orville Hook for barge retrieval, 3” portable salvage pump and a full<br />

complement of towing shackles, wire bridles, portable running lights and hawsers. The tug has quarters for nine in<br />

seven cabins. “Leslie Foss” was the second in a series of four sistertugs<br />

built for Foss by McDermott. She was also the second tug of this<br />

name - the first being the long-gone, former Miki-class wood, single<br />

screw “LT-495” built for the U.S. Army in 1944 and operated by Foss<br />

between 1951 and 1968. The second “Leslie Foss’” first job right out of<br />

the shipyard was the 5,500nm tow<br />

of a new ocean deck barge with<br />

oil drilling equipment eventually<br />

destined for Prudhoe Bay. During<br />

42 years of Foss’ ownership,<br />

“Leslie Foss” spent much of her time towing in the Pacific Northwest and making<br />

Alaskan runs, sometimes as far out as the Aleutian Islands chain to the<br />

westernmost island of Attu and Shemya - considered to be one of the worst ports<br />

in all of Alaska. New owners have kept the tug actively employed on various<br />

towing projects in the U.S. Gulf. This is the tug second sale that <strong>Marcon</strong> has<br />

brokered to the Buyer. <strong>Marcon</strong> has been involved in<br />

around a dozen transactions with the Seller. <strong>Marcon</strong><br />

acted as sole broker in this sale.<br />

In addition to a number of other vessels and barges<br />

presently under offer or being inspected, sales or<br />

charters are pending on six additional vessels<br />

including a three year old 5,150BHP AHTS and two<br />

additional 65 – 75 ton bollard pull ASD tugs, with<br />

<strong>Marcon</strong> acting as sole brokers. Once these two tugs<br />

are delivered, <strong>Marcon</strong> will have four modern ASD<br />

tugs in the 65 – 75 ton bollard pull range on longterm<br />

charters at the same time.<br />

<strong>Marcon</strong> has sold or chartered 1,302 vessels and<br />

barges to date, including 286 tugs with total<br />

horsepower of 883,320BHP, 72 AHTS (342,134BHP)<br />

and 34 inland river pushboats (77,750BHP). A full list of sales and charters are available on our website.<br />

www.marcon.com<br />

5<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Once Again – Yet Another Record Number of <strong>Tug</strong>s Worldwide<br />

Once again the worldwide number of tugs hit another record - even in today’s economy. While information in IHS<br />

Fairplay Sea-web only covers “sea-going” vessels over 100GRT, there are many tugs either under that tonnage or in<br />

inland service. According to Sea-web, as of <strong>May</strong> 20th, <strong>2013</strong>, there were 15,908 “sea-going” tugs over 100GRT<br />

worldwide, up from 15,191 in <strong>May</strong> 2012, and up 206 vessels from last February’s report. Total horsepower is<br />

41,851,241BHP, up 570,979BHP since February. Even taking into account flags of convenience, the largest national<br />

fleet of tugs over 100GRT sails under Indonesian flag, which recently overtook the U.S. for first place in horsepower,<br />

after being ahead in the actual number of tugs for some years. The U.S. operates 1,450 “sea-going” tugs over<br />

100GRT, or 9.11% of the world market, totaling 4,814,740BHP (11.50% globalBHP). Average age of tugs worldwide<br />

is 21 years with the U.S. flag “sea-going” fleet now at 34 years (built 1979).<br />

Top 50 “Sea-Going” <strong>Tug</strong> Fleets By Units As Of <strong>May</strong><strong>2013</strong> According to HIS Fairplay Sea-web<br />

Flag TotalBHP % # <strong>Tug</strong>s % AvgBHP Avg Age<br />

Worldwide 41,851,241 100.00% 15,908 100.00<br />

2,631 1992<br />

Indonesia 5,378,335 12.85% % 3,323 20.89% %<br />

1,619 2002<br />

United States Of America 4,814,740 11.50% 1,450 9.11% 3,321 1980<br />

Unknown 1,386,064 3.31% 819 5.15% 1,692 1979<br />

Japan 2,461,692 5.88% 760 4.78% 3,239 1997<br />

Singapore 1,856,708 4.44% 651 4.09% 2,852 2006<br />

Malaysia 988,651 2.36% 488 3.07% 2,026 2003<br />

Korea, South 1,361,589 3.25% 483 3.04% 2,819 1990<br />

Panama 1,455,443 3.48% 467 2.94% 3,117 1991<br />

India 1,062,347 2.54% 398 2.50% 2,669 1995<br />

Russia 1,020,191 2.44% 377 2.37% 2,706 1988<br />

Italy 1,011,762 2.42% 322 2.02% 3,142 1985<br />

United Kingdom 805,557 1.92% 253 1.59% 3,184 1991<br />

Australia 865,252 2.07% 251 1.58% 3,447 1995<br />

China, People's Republic Of 803,507 1.92% 226 1.42% 3,555 1993<br />

Canada 638,070 1.52% 220 1.38% 2,900 1975<br />

Brazil 772,580 1.85% 213 1.34% 3,627 2002<br />

St Vincent & The Grenadines 699,792 1.67% 207 1.30% 3,381 2002<br />

Iran 411,315 0.98% 185 1.16% 2,223 1989<br />

Philippines 382,197 0.91% 180 1.13% 2,123 1979<br />

United Arab Emirates 521,276 1.25% 179 1.13% 2,912 1996<br />

Turkey 497,078 1.19% 177 1.11% 2,808 1992<br />

Spain 599,201 1.43% 168 1.06% 3,567 1992<br />

Netherlands 541,023 1.29% 160 1.01% 3,381 2002<br />

Mexico 525,952 1.26% 157 0.99% 3,350 1987<br />

Venezuela 431,725 1.03% 153 0.96% 2,822 1987<br />

Saudi Arabia 467,307 1.12% 149 0.94% 3,136 1992<br />

Egypt 434,953 1.04% 147 0.92% 2,959 1989<br />

Ukraine 242,449 0.58% 120 0.75% 2,020 1984<br />

Greece 203,026 0.49% 111 0.70% 1,829 1973<br />

France 380,520 0.91% 108 0.68% 3,523 1993<br />

Thailand 281,083 0.67% 108 0.68% 2,603 1985<br />

Vietnam 214,585 0.51% 107 0.67% 2,005 1997<br />

Chinese Taipei 241,172 0.58% 97 0.61% 2,486 1988<br />

Germany 331,266 0.79% 90 0.57% 3,681 1990<br />

Norway 236,279 0.56% 84 0.53% 2,813 1980<br />

Nigeria 175,234 0.42% 80 0.50% 2,190 1987<br />

Cyprus 278,257 0.66% 78 0.49% 3,567 2002<br />

Bahrain 224,662 0.54% 75 0.47% 2,995 1991<br />

Chile 265,545 0.63% 70 0.44% 3,794 2000<br />

Honduras 124,181 0.30% 65 0.41% 1,910 1969<br />

Algeria 259,274 0.62% 64 0.40% 4,051 1991<br />

Malta 304,683 0.73% 60 0.38% 5,078 2002<br />

Argentina 163,380 0.39% 59 0.37% 2,769 1980<br />

Portugal 138,113 0.33% 58 0.36% 2,381 1980<br />

Finland 152,615 0.36% 57 0.36% 2,677 1971<br />

Kuwait 216,886 0.52% 56 0.35% 3,873 1998<br />

Colombia 170,661 0.41% 53 0.33% 3,220 1995<br />

Libya 138,975 0.33% 53 0.33% 2,622 1991<br />

Belgium 240,365 0.57% 52 0.33% 4,622 2000<br />

Sweden 119,411 0.29% 51 0.32% 2,341 1965<br />

www.marcon.com<br />

6<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

I continue to expect global fleet numbers to decline instead of hitting a<br />

record every new market report, but industry-wide statistics are always<br />

slow to change. Although today’s worldwide fleet is 1,434 tugs greater<br />

than two years ago, most likely many vessels counted are idle or at<br />

least under-utilized. Just a real quick sort of Sea-Web data shows 230<br />

tugs listed as “laid-up”, “in casualty or repairing”, or “to be broken up”.<br />

At the time of our <strong>May</strong> 2011 report, the average horsepower for the<br />

world’s 14,474 “sea-going” tugs was 2,646BHP with an average year<br />

built of 1990. Today’s average of 15,908 tugs is 2,631BHP with a year<br />

built of 1992. The U.S. fleet in <strong>May</strong> 2011 includes 1,492 “sea-going”<br />

tugs with an average horsepower of 3,214 and year built of 1978.<br />

Today’s U.S. fleet declined 2.8% to 1,450 tugs over the last two years<br />

while average horsepower increased slightly to 3,321BHP.<br />

Breakdown of U.S. “Sea-Going” Fleet<br />

Following is a breakdown of the U.S. sea-going tug fleet as of <strong>May</strong><br />

<strong>2013</strong>, according to IHS Fairplay Sea-web, compared with last quarter.<br />

As of February <strong>2013</strong>, the U.S. domestic tug fleet consisted of 1,450<br />

“sea-going” tugs totaling 4,783,238HP. The U.S. flag fleet remained at<br />

1,450 while total horsepower grew by 31,502BHP to 4,814,740HP. High<br />

horsepower and large tugs are easy to track, but Sea-web has data on<br />

only 52 U.S. tugs under 999BHP. As most of the “under thousand<br />

horsepower” tugs in the U.S. are below 100 gross register tons, they<br />

are generally not included in the Registry. Not counting pushboats,<br />

there are eight to nine hundred additional small tugs in U.S. coastal<br />

waters.<br />

U.S. Sea-Going <strong>Tug</strong> Fleet Over 100GRT ByBHP According to Lloyd’s Register as of <strong>May</strong> <strong>2013</strong><br />

Unknown Under 1000- 2000- 3000- 4000- 5000- 6000- 7000- 8000-<br />

BHP 999 1999 2999 3999 4999 5999 6999 7999 8999<br />

9000 Plus Total<br />

Total # 116 52 270 220 271 246 101 71 52 10 41 1,450<br />

Avg.BHP 789 1,503 2,357 3,418 4,354 5,447 6,418 7,153 8,066 11,227<br />

Avg. LOA 88 82 87 96 106 106 114 113 137 137 140<br />

Avg. Beam 28 23 26 29 32 34 35 38 39 42 45<br />

Avg. Depth 12 9 11 13 15 15 17 17 20 21 23<br />

Avg. Year Built 1,973 1,952 1,966 1,975 1,980 1,992 1,990 1,999 1,983 1,996 2,004<br />

Previous U.S. Sea-Going <strong>Tug</strong> Fleet Over 100GRT According to Lloyd’s Register as of February <strong>2013</strong><br />

Unknown Under 1000- 2000- 3000- 4000- 5000- 6000- 7000- 8000-<br />

9000 Plus Total<br />

BHP 999 1999 2999 3999 4999 5999 6999 7999 8999<br />

Total # 122 52 270 221 270 244 97 71 52 10 41 1,450<br />

Avg.BHP 789 1,505 2,356 3,417 4,355 5,446 6,418 7,153 8,066 11,227<br />

Avg. LOA 89 82 87 97 105 106 115 113 137 137 141<br />

Avg. Beam 28 23 26 29 32 34 36 38 39 42 47<br />

Avg. Depth 12 9 11 13 15 15 17 17 20 20 24<br />

Avg. Year Built 1,974 1,952 1,966 1,975 1,980 1,992 1,990 1,999 1,983 1,996 2,004<br />

Of the 1,450 U.S. flag tugs in Lloyd’s, 204 have unknown engines. 485, or 39% where<br />

type is known, are powered by EMDs; 390 (31%) by CATs; 111 (9%) by General<br />

Motors / Detroit Diesels and Alco has 4% and Cummins, Fairbanks Morse and M.T.U.<br />

are tied with 3% market share each. Of 1,450 U.S. tugs; 388 (27%) and 776 (53%) are<br />

conventional single screw and twin screw, respectively. The remaining 20% are 226<br />

azimuthing, 37 triple screw and 23 Voith-Schneider tractor tugs. Two years ago, of<br />

1,492 U.S. flag tugs, 401 or 32% were powered by EMDs, 363 (29%) by CATs and 211<br />

(17%) by General Motors / DD. Some of the change involving EMDs and GM/DDs is<br />

probably more a juggling of categories vs. a real change in the market, as EMDs have<br />

in the past shown up in records under the GM designation. As expected, there are 62<br />

fewer single screw tugs and 27 more azimuthing tugs in today’s domestic fleet.<br />

www.marcon.com<br />

7<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

New Construction, Shipyard and Conversion News<br />

According to “Fairplay Newbuildings”, as of 20 th <strong>May</strong> <strong>2013</strong>,<br />

there were 6,193 ships over 299GRT on the World Orderbook,<br />

down 212 or about 3.31% from 6,405 ships in February, and<br />

showing a further decline from 7,316 newbuildings one year ago.<br />

This is the lowest number of ships on the World Orderbook since<br />

<strong>Marcon</strong> started tracking newbuildings over five years ago. Many<br />

overseas shipyards continue to face bankruptcy and are laying off<br />

even more workers as the World Orderbook continues to shrink.<br />

In contrast, of the total number on today’s orderbook, 553, or<br />

8.93% are tugs or “towing / pushing” vessels, up seven from 546<br />

in <strong>May</strong>. This is, of course, down from a peak of 768 in October 2008,<br />

but still healthy. 735 of today’s newbuildings, up 18 from our last<br />

report, are OSVs and 280, up 14, are “Offshore – Other”. Of 553 tugs<br />

listed by Fairplay under construction, Malaysia leads the order book<br />

with 119 tugs being built, down 11 from February. They are followed<br />

by China PR at 106 (up 11) tugs, Vietnam 50, Turkey 35, 27<br />

Romania, 22 Brazil, Egypt and Indonesia 19 each, 17 each Poland<br />

and Spain, Japan 16, the USA 14, 13 Russia, 11 India, the<br />

Netherlands 9, 8 each Qatar and South Korea, Singapore 6, Iran and<br />

the UAE 5 each, 4 each Cuba and Peru, 3 Serbia, Canada,<br />

Germany, Thailand, the Ukraine and Venezuela 2 each and 1 each<br />

Azerbaijan, Belgium, Colombia, Latvia, Libya and South Africa.<br />

Of 553 tugs being built, abt. 77.2% are to be delivered in <strong>2013</strong>,<br />

19.7% in 2014 and 3.1% during 2015.These figures though do not<br />

cover all tugs, towboats and pushers actually under construction.<br />

Many ordered by government agencies or navies, or domestic<br />

internal trade vs. export in China never show up on the World<br />

Orderbook. I would not be surprised to see one hundred and fifty or<br />

more tugs added to the orderbook each year If they were included –<br />

and this would still exclude the inland river towboats or pushboats<br />

operating on the Mississippi River system in the United States and<br />

other internal waterways across the world. As of 16 th <strong>May</strong>,<br />

MarineLog and Tim Colton U.S. Shipbuilding Contracts tallied 359<br />

vessels and barges on order, excluding inland barges and<br />

recreational vessels. Just over 30% is being built for governmental<br />

agencies, such as the U.S. and other various Navies, U.S. Coast<br />

Guard, Army Corps. of Engineers and police departments. These<br />

range from 32’ transportable port security boats for the U.S. Coast Guard (actual order is for up to 80 vessels) to two<br />

85,000ldt aircraft carriers. About 245 of the vessels and barges on order are for traditional commercial operators.<br />

These include approx. 30 tugs and 39 inland river pushboats at latest<br />

count. Determining the precise number of newbuildings is always like<br />

trying to hit a moving target as this is constantly changing, plus there<br />

are also others we know of that do not show up on the list. CAT<br />

power still leads in popularity for propulsion in new sea-going tugs<br />

with main engines in 159 tugs. This is followed by Yanmar in 74<br />

boats, Cummins in 46, Niigata diesels in 43, 33 Wartsila, 14 General<br />

Electric, 12 Mitsubishi, 11 MTU, 8 each A.B.C. and Chinese Standard<br />

Type, 5 Daewoo, 3 MAN/MAN-B&W, 2 each Daihatsu, Deutz, MaK<br />

and Volvo Penta and 1 each with Baudouin, Hanshin, Iveco Aifo,<br />

John Deere, MWM and Yamaha. Engines were not listed for 123<br />

tugs. Only 40 tugs below 1,000BHP are shown under construction. As<br />

discussed earlier, many lower horsepower tugs are under 299GRT.<br />

Summary of Horsepower – Fairplay Worldwide <strong>Tug</strong> Orderbook Over 299GRT<br />

Under 1,000 – 2,000- 3,000- 4,000- 5,000- 6,000- 7,000- 8,000- 9,000- Over Unk. Total<br />

1,000HP 1,999HP 2,999HP 3,999HP 4,999HP 5,999HP 6,999HP 7,999HP 8,999HP 9,999HP 10,000HP<br />

<strong>Tug</strong>s 40 83 83 135 13 30 1 0 4 0 5 159 553<br />

www.marcon.com<br />

8<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Damen Shipyards has introduced their newly designed Damen AHTS 200, a versatile<br />

deepwater 89.1m x 22.0m x 7.0m summer draft Anchor Handling <strong>Tug</strong> Supplier able to<br />

operate in water depths in excess of 3,000m. The 3,200mtdw AHTS 200 is the latest<br />

addition to the ongoing Damen Offshore Series. Following the company’s ambitions to increase its market share in the<br />

offshore industry, Damen heavily invests in designing state of the art<br />

vessels for several offshore sub-markets, noticeably the Offshore<br />

Support, Offshore Wind, Seismic Research and Transport &<br />

Installation industries. Backed by ample R&D and engineering<br />

capacity, its own construction yards, specialized partner yards and a<br />

rapid expanding service organization, Damen feels confident that the<br />

chosen approach will be successful. The Damen AHTS 200 includes a<br />

new and innovative winch arrangement which is quite decisive for the<br />

overall dimensions and layout of the vessel. For the development of<br />

this extensive winch package Damen teamed-up with Huisman<br />

Equipment, The Netherlands, which specializes in heavy lift and deepwater cranes, winches and drilling equipment.<br />

The deepwater winch package consists of two 400 ton @ 10m/min pull AH/towing drums with a capacity of 3,000m<br />

87mm wire, a 400T pull special handling drum capable of holding 7,000m 87mm wire, two<br />

140T @ 10m/min secondary with 1,600m 208mm rope and a storage winch holding 2 x<br />

3,200m 208mm rope. The electrically driven winches resulting from this cooperation may<br />

be considered an innovative approach, as the market is traditionally dominated by lowpressure<br />

hydraulics. The electrical-drive winches provide a clean, green, economical,<br />

functional and safe solution for the anticipated operations. The vessel is suited to generate<br />

200-250T bollard pull and is fitted with engines in a father-son layout, featuring twin-in<br />

single-out gearboxes driving CP propellers in a nozzle. The layout of the propulsion<br />

installation may be either diesel-direct, diesel-electric or hybrid, pending on the anticipated<br />

operational profile of the vessel. High performance flap-type rudders fitted to rotary vane<br />

steering gears facilitate a high degree of maneuverability supported by ample side thrust capacity, including two<br />

900kW tunnel thrusters as well as two 900kW retractable thrusters in fore and aft ship. Forward of the winches ample<br />

space has been reserved for the fitting of a high-end ROV system with the possibility of launching through a side door.<br />

The high beam AHTS could serve as a suitable platform for mounting a subsea construction crane. The design can<br />

easily be upgraded with dedicated anti-heeling systems, moon pools and sophisticated diving systems. The<br />

comfortable accommodation can host up to 45 persons in single and double cabins<br />

fitted according to the Damen Business or Executive Line comprising modern and<br />

durable materials. Special attention is paid to sufficient natural lighting through<br />

maximum-sized windows. State-of-the-art infotainment systems, offering multiple<br />

levels of data communication, support the functionality and comfort of the vessel.<br />

Although driven by its standardization philosophy Damen offers ample opportunities<br />

to include owner’s standards and component choices for maximal support of their<br />

operations. The vessel is designed following an extensive DNV-class notation,<br />

although other class societies may be considered as well.<br />

“SL Gabon” delivered in December 2012 represents the first one of a series of<br />

two Stan <strong>Tug</strong>s 4011 ordered by Smit Lamnalco Gabon SA fitted for the basic<br />

functions of offshore towing, berthing, anchor handling, pollution control,<br />

salvage and fire-fighting. The vessel will provide support in offshore oilfields<br />

and assist tanker operations at an onshore terminal. The 40.75m x 11.6m x<br />

4.9m depth twin screw tug is powered by twin CAT 3516C TA HD/C developing<br />

a total of 5,000BHP at 1,600RPM through Reintjes 7.526:1 gears to 2,815mm<br />

bronze fixed pitch props in kort nozzles. Bollard pull is 74.8 ton.<br />

Maneuverability is assisted by a 215kW bow thruster. Towing gear consists of<br />

a DMT double drum waterfall winch with a 140 ton brake holding force, Karmoy remote controlled fork / tow pins, two<br />

7.5T tugger winches, a 5T capstan, Mampaey 75 ton disc type tow hook and Heila 1T @ 16.72m. Air-conditioned<br />

accommodations are provided for 16 persons. The Panamanian flagged tug is classed BV 1 +Hull, +Mach, <strong>Tug</strong><br />

Unrestricted Navigation, IWS MON-SHAFT AUT UMS. Hull was built by Santierul Naval Damen Galati in Romania and<br />

completed by B.V. Scheepswerf Damen in Gorinchem.<br />

www.marcon.com<br />

9<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Just a few months after opening an office in Stavanger, Damen delivered<br />

second Stan <strong>Tug</strong> to a Norwegian owner - EB Marine A/S - a family-owned<br />

diving company, which is one of the oldest diving companies in Norway. This<br />

latest order followed an order for a Stan <strong>Tug</strong> 1004 earlier this year. Damen<br />

Shipyards opened the office in October 2012 to serve the offshore industry and<br />

Norwegian owners, the first time Damen opened a sales office outside the<br />

Netherlands. The STu 1205 was delivered on March 20 th in Stavanger. Torgeir<br />

Erga, Deputy Manager EB Marine, says: “We have been awarded a contract for<br />

the subsea work for the foundations of a new bridge in Molde, in northern Norway, therefore we needed a new<br />

tugboat, with a lot of power that had to be delivered in a very short time.” The contract began in April. Sales Manager<br />

of Damen Shipyards Stavanger, Remko Hottentot, said: “The advantage of Damen is that we can deliver from stock<br />

and this proved ideal for EB Marine. Damen builds its standard vessels for stock, which means that companies can<br />

still take part in tenders even if they don’t immediately have resources in-house. Damen can then provide a vessel in<br />

just two to three weeks.” EB Marine visited Damen in Gorinchem and took the new vessel “Broltus” out for a trial. Mr.<br />

Erga was impressed with how much power the Stan <strong>Tug</strong> 1205 has. “Probably half of our work involves pulling heavy,<br />

weighted pipelines so the tug will be very suited to this work, as well as the foundation contract. We were looking at<br />

yards in Norway and Turkey, but with Damen, we know that is has built tugs for decades so we know exactly what we<br />

are getting.” After some modifications, including extra navigation equipment, she sailed from Gorinchem to Rotterdam<br />

where she was transported on a Wagenborg carrier to Stavanger. “Broltus” in Norwegian translates as someone who<br />

does a “hell of a job”. Mr. Erga laughed, saying that this is what EB Marine expects from its new tug.<br />

Multraship Towage & Salvage BV continued its fleet renewal with two new<br />

Damen ASD 2810 tugs with state-of-the-art, FiFi 1 “Multratug 26” (Hull 1236)<br />

and “Multratug 27” (Hull 1237) building for delivery June/July <strong>2013</strong>. Contracts<br />

for the 28.7m x 10.4m x 4.6m tugs were signed during Multraship’s annual<br />

client gathering in Terneuzen on 18 th April, where Multraship managing director<br />

Leendert Muller said, “We are delighted to have concluded deals for these<br />

vessels, built to a proven design by a yard with extensive experience and<br />

expertise in this sector. The new tugs will be mostly engaged in harbor towage<br />

activities in the Zeeland Seaports and Antwerp areas. In addition to primary duties, they will also be on standby, ready<br />

to respond in the event of fire- or explosion-related emergencies in the western and central part of the River Scheldt,<br />

as part of a February <strong>2013</strong> commitment entered into with the Zeeland Safety Region to keep two FiFi 1 tugs on<br />

standby. The new tugs provide confirmation of Multraship’s commitment to invest for both the present and future. In<br />

towage and salvage, if you don’t invest, you risk getting left behind. It is also important to demonstrate to all sectors of<br />

the maritime industry that you are prepared to invest money, time and resources in everything from research &<br />

development to fleet renewal in order to provide a valuable towage, emergency response and salvage capability,” said<br />

Muller, who currently serves as VP, <strong>International</strong> Salvage Union. The tugs, powered by twin 1,920kW CAT 3516B-<br />

HDs, develop a total 5,220HP and have minimum bollard pulls of 62.5mt and max speeds of 13.5kn. They are being<br />

built at Santierul Naval Damen Galati in Romania, where Multraship has an office providing towage and salvage<br />

services as its part of covering the Black Sea.<br />

“Coastal Voyager” was named by Acta Marine in Amsterdam on 28 th February at<br />

the Het Scheepvaartmuseum (National Maritime Museum). Both Damen and Acta<br />

look back on a festive event of the new Shoalbuster, which was delivered precisely<br />

on the contract date. “That is customary”, remarked Damen Shipyards Hardinxveld<br />

MD Jos van Woerkum, who added that the multi-purpose vessel has been custombuilt<br />

to do dredging and marine contacting projects on hand. “Coastal Voyager” is<br />

planned to be deployed for offshore wind farm projects in the North Sea. Acta<br />

Marine MD Govert-Jan van Oord says that it is possible to deploy the Shoalbuster<br />

anchor handling tug elsewhere, in case its assistance is needed. “End last year,<br />

early this year, we also bought three of these vessels from the existing Damen Marine Services charter fleet. The<br />

fourth one is newbuild. In fact it is the fifth of the series, as Damen Shipyards Hardinxveld delivered Shoalbuster<br />

‘Coastal Vanguard’ December, 2010.” Van Oord proudly added that – having five Shoalbuster vessels deployed – Acta<br />

Marine can be considered as being one of the larger players worldwide in the dredging and marine contracting market,<br />

in the oil and gas industry and in the market for offshore wind. Its Shoalbuster 2609s are deployed in the Persian Gulf.<br />

The third of the series Shoalbuster 3209 – active in Singapore – and the new vessels are larger: 3,300HP units with a<br />

bollard pull of 45-50 tons. These two vessels are sister ships of “Coastal Vanguard”.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

10

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

A symbolic keel-laying ceremony was held on 17 th of April in Gorinchem as Damen officially launched the construction<br />

phase of 14 ASD <strong>Tug</strong>s for Kuwait Oil Company. The series consists of two types - 9 of Damen’s recently launched<br />

3212 and 5 units of the well-known 2810 design, with 80 and 50 tons of bollard pull respectively. At the festive<br />

launching ceremony Damen was very pleased to host a delegation of Kuwait Oil Company. The two company-logos<br />

were welded together as a symbol for the substantial project and the companies’ longstanding relation. The logos will<br />

hold a place of honor in Damen’s Romania-based Galati shipyard during the construction period. All 14 tugs will be<br />

built there starting shortly, with deliveries scheduled from 2014 onwards. Damen’s naval architects and designers in<br />

The Netherlands tailored KOC’s exacting requirements on layout, systems and performances. Existing Damen designs<br />

have been masterfully combined with state-of-the-art technology and dedicated features. The new tugs assist tankers<br />

at near-shore loading terminals and single point moorings further offshore. All tugs will be equipped with a powerful<br />

firefighting system in case of emergency. The cooperation between KOC and Damen dates back to the late 1980s,<br />

when Damen delivered its first set of ships to KOC. In the 1990s, Damen delivered a complete new fleet of tugs, crew<br />

tenders, work boats and mooring boats to KOC.<br />

Damen Shipyards Group is launching a new vessel type in its ASD <strong>Tug</strong> series.<br />

The ASD <strong>Tug</strong> 2913 has been designed primarily as a highly maneuverable,<br />

powerful tug suited for busy harbors where space is limited. The highly<br />

esteemed German towage operator Petersen & Alpers GmbH of Hamburg,<br />

Germany is the first customer for the new 28.9m x 13.23m tug, which will be<br />

delivered end 2014. The new type answers market demand for more powerful<br />

tugs as vessels continue to get larger and for more spacious accommodation.<br />

Frank de Lange, Damen Sales Director South, North and West Europe, explains<br />

why Damen decided to introduce a new tug in the ASD series. “Vessel sizes are<br />

increasingly growing, while ports are still restricted to their physical size. Customers were requesting more powerful<br />

tugs, but they still have to be compact so they can operate in harbors which are lacking space.” This new tug standard<br />

slots in between the Damen ASD <strong>Tug</strong> 2810 with a 60 tons bollard pull and the powerful, recently introduced offshore<br />

terminal ASD <strong>Tug</strong> 3212. Developing a new compact type with a bollard pull of 75-80 tons was a logical step for<br />

Damen, he adds. “For the ASD <strong>Tug</strong> 2913 we adopted a similar design philosophy as for the new ASD <strong>Tug</strong> 3212 and<br />

although the vessel is primarily a harbor tug, it also has very good sea-keeping capabilities.” At 13m wide, the tug is<br />

very stable and comfortable for the crew. The new type has push/pull capabilities and can be fitted with an aft winch as<br />

an option.<br />

The tug is also the first Damen tug to have a double hull to comply with the latest safety<br />

regulations and to answer customer demand. Peter Lindenau, Managing Director of<br />

Petersen & Alpers, is very pleased to be the launching customer for the new tug. This will<br />

be the second Damen tug in the company’s fleet, following on from an ASD <strong>Tug</strong> 2411,<br />

which has been in operation for the last four years in Hamburg. And indeed, through a<br />

previous joint venture via its affiliated company Towmar Baltic in Klaipeda with Smit,<br />

Petersen & Alpers also had experience of the Damen ASD <strong>Tug</strong> 2810. “We have had a<br />

good experience with Damen tugs and have also seen our competitors using them!” says Mr. Lindenau. “The crew<br />

were very happy with our first Damen tug and that is very important to us. The quality of the build, the 2411’s<br />

performance was what we were looking for. It has proven itself in being able to operate bow-to-bow when a lot of ASD<br />

tugs have problems doing this properly.” The 70 ton bollard pull ASD <strong>Tug</strong> 2411 “Peter” built in 2008 is performing well<br />

and is great at going alongside, making fast and the thrust is easily controlled with the slipping clutch, he emphasizes.<br />

“And with Rolls-Royce thrusters and Caterpillar 3516 engines the acceleration is great. Our new Damen vessel will be<br />

particularly suited for the port of Hamburg, which has very small basins. Seagoing<br />

vessels are getting bigger and bigger. A highly maneuverable, compact tug with more<br />

power was needed. So the Damen ASD <strong>Tug</strong> 2913 was the right tool for Hamburg.” Low<br />

maintenance costs are also important, he says. Petersen & Alpers has had a good<br />

experience with the 25.92m x 11.34m x 5.85m draft ASD <strong>Tug</strong> 2411, which requires<br />

only limited maintenance because the coating is such good quality. Crucially, Petersen<br />

& Alpers has a great deal of confidence in Damen. “We trust each other, which is the<br />

most important. It is not just price but performance, service and maintenance. We are<br />

lucky to be the launching customer. We have been able to have a lot of input, with Damen really listening to our<br />

requirements.” For instance, Petersen & Alpers requested an oil fired heating system. Mr. Lindenau adds: “Perhaps we<br />

look at things in a similar way to Damen, both being family owned companies; we are always considering the next<br />

generation, so a long-term, trusting relationship is very important.”<br />

www.marcon.com<br />

11<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Leningrad shipyard Open JSC Pella concluded a contract with Gryphon Ltd. of St.<br />

Petersburg for construction of a new 2,000HP Project 90600 design tug for delivery in<br />

September 2014. The 25.4m tug will be powered by CAT C32 diesels and Rolls-Royce US<br />

155 azimuthing drives…… The day before, the keel layout for the close sister-ship “Hull<br />

No. 938” was started. “Hull 938” is being built for the Russian Navy Northern Fleet and is<br />

expected to be put into operation within the Northern<br />

Fleet later this year……The 25.4m ASD tug “RB-398”<br />

(Hull No. 936) has been launched and will be delivered to<br />

the Russian Navy for operation within the Black Fleet<br />

later this year. The 2,000HP tug is fitted with a bow<br />

electro-hydraulic anchor-towing-mooring winch, 23T SWL tow hook aft, a Palfinger<br />

cargo crane and an 800m3/h external firefighting system with two water monitors and<br />

a water curtain system…...Pella shifted the new 25.4m x 8.8m x 4.2m ASD tug “RB-<br />

395” hull No. 934 to the Baltic Fleet naval base in<br />

the port of Baltiysk on 26 th December after being<br />

accepted. The tug is designed for towing and berthing operations in harbors,<br />

roadsteads and coastal areas and classed КМ Arc4 R3 Aut3 <strong>Tug</strong> by Russian<br />

Maritime Register of Shipping. <strong>Tug</strong> “RB-395” is powered by a pair of 746kW CAT C32<br />

diesels developing a total of 2,000HP to her Rolls-Royce US 155 FP azimuthing<br />

drives. Towing gear consists of a forward mounted Fluidmecanica electro-hydraulic<br />

anchor-towing-mooring winch providing 10 tons of pull and a 23T SWL quick release<br />

tow hook aft. 800m3/h firefighting is<br />

provided by two FFS water monitors and a<br />

water curtain system. Baltiysk is the westernmost town in Russia and a<br />

major naval base for the Baltic Fleet. The town, along with Kalingrad,<br />

remains one of only two year-your, ice-free ports along the Baltic Sea<br />

coastline available to Russia……The 34.4m x 12.1m x 6.0m depth / 4.4m<br />

draft new tug “Alexandr Zryachev” (Hull 502) was successfully delivered<br />

2,600nm in mid-December by Pella by the Northern Sea Route to the Port<br />

of Arkhangelsk under her own steam. Upon arrival the tug was put into<br />

operation within the fleet of JSC Zvyozdochka of Arkhangelskaya oblast.<br />

The twin screw tug is powered by a pair of 1,641kW CAT 3516Bs developing<br />

a total of 4,460BHP at 1,600RPM, bollard pull of 63 tons and free running<br />

speed of 13kn. Vessel is classed under the Russian Maritime Register……<br />

The sister-tug to the ASD tug “RB-395” above, “RB-392” (Hull 935) was<br />

launched with the assistance of the ASD tug “CTP. N 201” on a cold winter’s<br />

day and is scheduled to be delivered to the RF Navy and put into operation<br />

this year within the Black Fleet. Like her sister-tug, the 2,000HP “RB-392” is<br />

powered by twin 746kW CAT C32 diesels with Rolls-Royce fixed pitch US<br />

155 azimuthing drives. <strong>Tug</strong> is classed КМ Arc4 R3 Aut3 by Russian<br />

Maritime Register of Shipping.<br />

In February, VT Halter Marine, <strong>Inc</strong>. of Pascagoula, Mississippi, a<br />

subsidiary of VT Systems, <strong>Inc</strong>., announced a new contract to build an<br />

articulated tug barge unit with an option for one additional unit for<br />

Bouchard Transportation Co., <strong>Inc</strong>. The option for the second unit was<br />

exercised on 21 st March. The barges measures 625’ by 91’ by 47’, have a 250,000-barrel capacity, and will be used to<br />

transport liquid petroleum. Both barges are ABS classed and USCG certified for Jones Act service. The 10,000HP twin<br />

screw ATB tugs will be classed by ABS as +A1 Towing Vessel, Dual Mode ATB, USCG Subchapter M, and will be<br />

equipped with an Intercon coupler system. Construction of the unit will begin during April <strong>2013</strong> at VT Halter Marine’s<br />

Pascagoula facility, with delivery scheduled for mid-2015. This unit will enter into Bouchard’s fleet service in New York.<br />

Morton Bouchard III, President & CEO of Bouchard Transportation commented: “We are pleased to enter into this<br />

contract with VT Halter Marine for the construction of the ATB M/V ‘Bouchard Boys’ and ‘B.No.270’, with an option for<br />

the construction of a second unit. The Bouchard Boys & ‘B.No.270’ will compliment Bouchard’s growing gulf coast fleet<br />

and further our ongoing commitment to the Jones Act. Bouchard is pleased to have chosen VT Halter Marine for this<br />

project due to our long relationship and history of successful projects.” The second will begin fourth quarter <strong>2013</strong> with<br />

delivery scheduled for February 2016.<br />

www.marcon.com<br />

12<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

Sanmar Denizcilik Ltd. reports that its new build contract to deliver the world’s first LNG<br />

powered escort tugs for Buksér og Berging AS of Norway, is proceeding smoothly despite<br />

it being ground-breaking technology for the tug sector. Ali Gürün explained: “Cooperation<br />

between the shipyard team, the owners and designers Bukser og Berging, the classification<br />

society DNV and the Norwegian Maritime Authority is proceeding well. Some 90% of the<br />

steel construction is already finished and the critical process of installing the LNG tanks and<br />

engines has been completed successfully without any hitches. The rest of the outfitting<br />

continues as planned. Furthermore, we do not anticipate any slippage of the original delivery<br />

schedule despite the ‘learning curve’. Both vessels will be in service by the end of this year<br />

on long term charter with Statoil ASA, the international energy company, and Gassco, the<br />

operator of the gas transportation network off the Norwegian coast.” The LNG system has<br />

been designed by AGA Cryo and integrated with the Rolls-Royce propulsion system. This<br />

single tank LNG system has got full gas redundancy i.e. no diesel back up is required. The vessels, presently<br />

designated “Sanmar Hull 15” and “Sanmar Hull 16”, will be equipped with two Rolls-Royce azimuthing drives. A<br />

cleaner engine room, less waste oil and no switch-over problems are amongst operational benefits of a gas fuelled<br />

propulsion system. Other environmental benefits with the spark ignition gas engines incorporated in the new design<br />

include 92% reduced NOx emissions, 17% reduced greenhouse gas emissions, 98-100% reduced SOx emissions and<br />

98% reduced particulates. The system is compliant with Tier III regulations. The vessels will measure 38 x 14.5m,<br />

have accommodation for 5 crew and achieve a static bollard pull of 70 tons with about 20% greater efficiency than<br />

standard designs. Furthermore, hull and layout design has been optimized for potential installation of 9-cylinder<br />

engines to give a bollard pull of 70 tons. Moreover, a DNV classed 120 tons steering-force at 10 knots is not just a<br />

revolutionary result but will have considerable appeal in the escort tug market.<br />

Smit Lamnalco of Sharjah, UAE, has placed an order with Sanmar for the<br />

construction of a pair of 34.0m x 14.5m beam x 6.2m depth / 4.5m draft RAstar 3400<br />

explosion-proof terminal escort tugs. This design has been especially developed by<br />

the Canada-based specialist tug design team, Robert Allan Ltd., for LNG terminal<br />

operations. The sister ASD configuration vessels are each expected to have a bollard<br />

pull in excess of 85 tons and will feature frequency controlled electric escort winches<br />

specifically designed for operation in hazardous areas. Other items of deck<br />

equipment will also be explosion proof even up to the navigation lights. Sensors able<br />

to detect gas in the atmosphere will automatically shut off all engine room vents if any gas is present. These tugs will<br />

not only add to the builder’s ever-growing portfolio of available models but will build on its experience with LNG<br />

generally. Delivery is expected early 2015.<br />

One of Sanmar’s most popular tugs is the neat, compact and yet surprisingly roomy<br />

Ulupinar series. Some 15 of this exclusive and versatile ASD model designed by<br />

Robert Allan Limited with considerable input from Ali Gurun, project director at<br />

Sanmar Denizcilik Ltd., have now been built – with three sold through the auspices<br />

of <strong>Marcon</strong>. “Ulupinar 14”, although completed back in July 2012, has only just been<br />

handed over to new owners, UK’s SMS Towage with the new name of “Statesman”.<br />

The vessel had spent the intervening six months on a successful charter with<br />

Egyptian interests. Measuring 24.40m x 9.15m with a maximum draft of 4.40m, there<br />

are various power options available on the Ulupinar series but this version, utilizing a<br />

propulsion arrangement comprising a pair of Caterpillar 3512 diesels, each<br />

developing 1,230kW at 1,800RPM and driving Rolls-Royce US 155 FP azimuthing thrusters gives bollard pulls ahead<br />

and astern of approx. 45 tons and a free-running speed of 13 knots. Winches on fore and aft decks with brake holding<br />

loads of 125 tons were supplied by DMT. A Palfinger deck crane and Data Hidrolic tow pins complete the deck<br />

machinery fit-out. The main tow winch has capacity for 600m 40mm wire. Clever use of space and a very high degree<br />

of quality ensures that both officers and crew enjoy a level of comfort and convenience rarely found in a vessel of just<br />

24m in length. Remarkably low noise levels have been recorded in all areas of living quarters and at approx. 80%<br />

engine load are below 60dBA in the two single and two twin berth cabins. Like “Statesman”, the majority of the<br />

Ulupinar series so far completed have been exported. The first boat went to Schramm in Germany and this was<br />

followed by a repeat order. Several minor modifications were made to the initial design to meet strict German<br />

standards and these were incorporated as standard in all subsequent deliveries including three which made their way<br />

to the Dominican Republic (through <strong>Marcon</strong>), another to Russia and three to the Middle East. Sanmar has also<br />

retained several to augment its own fleet at the Port of Mersin, the leading port of southern Turkey.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

13

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

On 19th January <strong>2013</strong>, Sanmar held a special re-naming and delivery ceremony<br />

at its custom-built construction facility located near Istanbul to mark handover of<br />

a new, high-spec, fire-fighting terminal tug to leading Norwegian operator,<br />

Østensjø Rederi. The 80 ton bollard pull vessel departed Turkey for Norway a<br />

couple of days later in the capable hands of a crew from TOS (Transport &<br />

Offshore Services). Originally named “Sanmar Terminal VII” during construction<br />

to comply with Turkish regulations, the Robert Allen design is now named<br />

“Lomax” to match Østensjø’s other tugs which all have names ending in an “x”. It<br />

is the 95 th tug built by Sanmar. Accepting the vessel on behalf of Østensjø, CEO<br />

Johan Rokstad said: “We are happy to be in Turkey for the second time. Since<br />

2006, we have a very good relationship with Sanmar. We have taken delivery of<br />

high quality, state-of-the-art vessels.” He concluded by hoping that the two<br />

companies would continue working together in the future. In response,<br />

Sanmar’s project director, Ali Gurun, said: “We have worked together with<br />

Østensjø in great harmony. I always mention that Turkey is amongst the top<br />

three nations involved in the construction of high quality tugboats. Now, in<br />

addition, I can proudly say that Sanmar has reached the apex in terms of<br />

respecting the environment and with our carefully selected business partners,<br />

highly qualified employees and talented engineers, we can construct any kind<br />

of vessel.” Østensjø is renowned for insisting on highest standards of fit-out<br />

aboard its tugs. It is discerning enough to only use builders that it knows can<br />

provide the high quality finish to which its crews have become accustomed.<br />

“Lomax” is Sanmar’s enhanced version of Robert Allan RAstar 2800 ASD which the builder designates its Terminal<br />

Class. It measures 28.0m x 12.6m with an extreme draft of 4.97m and built to ABS A1 Escort Vessel, FiFi 1,<br />

Unrestricted Service. Power is provided by a pair of CAT 3516Cs, each developing 2,350kW at 1,800RPM. These turn<br />

Rolls-Royce type US 255 Z-drives with 2,800mm four-blade, fixed pitch props. Auxiliary power is supplied by a pair of<br />

150kW CAT C9 generators. The tug achieves a bollard pull region 80 tons with a free-running speed of 13 knots.<br />

Winches fitted are also by Rolls-Royce. Forward is a unit capable of dynamic self-tensioning up to 80 tons for escort<br />

operations whilst aft is a single drum tow winch having a brake load of 170T. Other deck items include a Palfinger<br />

knuckle boom crane, Triplex tow pins and a stern roller. Vessel is fully fendered by Trelleborg. “Lomax” has an<br />

exceptionally high standard of air-conditioned accommodations for six – two<br />

single officer cabins and two twin crew cabins. Sanitary spaces all have<br />

heated floors. The electronics fit-out is also comprehensive with GMDSS A3,<br />

Fleet 250, remote operated VHF’s, radar, GPS, chart plotter, DGPS Compass,<br />

magnetic compass, auto pilot, echo sounder, AIS, speed log, bridge watch<br />

alarm, independent general alarm system from such leading manufacturers as<br />

Furuno, Jotron, Alphatron and Kongsberg. “Lomax” arrived at the port of<br />

Ulsteinvik, Norway on 7 th March delivering the tow of the newbuilding 83.4m x<br />

18.0m x 8.0m depth, Casco X-Bow vessel “Blue Guardian” hull built by ATVT<br />

Sudnobudivnyi Zavod “Zaliv” of Kerch, Ukraine for Ulstein Verft AS.<br />

“Lomax” sailed under TOS management and crew.<br />

Grandweld Shipyards of Dubai launched their first AHTS, “Halul 63”<br />

(H097/11) for Halul Offshore Services of Qatar on 4 th March. The contract<br />

was signed in July 2011 to build and deliver two sister vessels. The 67.0 x 16.8<br />

x 6.8m depth AHTS is completely outfitted and equipped for anchor handling,<br />

offshore supply, oil recovery, rescue, standby and other related duties. The<br />

1,800mtdw vessel is classed Lloyds A1 for unrestricted service, and is<br />

equipped with dynamic positioning capability of DP2. She is powered by two<br />

2,720kW MAN-B&W 8L27/38 main engines, and is fitted with controllable pitch<br />

propellers, two stern tunnel thrusters, and two bow tunnel thrusters. Bollard pull<br />

will be 90 tons and service speed abt. 13.5kn. Vessel is scheduled for delivery<br />

end of July <strong>2013</strong>.<br />

www.marcon.com<br />

14<br />

Details believed correct, not guaranteed. Offered subject to availability.

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

In December 2012, the Robert Allan Ltd. design “Tarua 302” was delivered by<br />

Italthai Marine Limited of Samut Prakarn Thailand to her owners, the Port<br />

Authority of Thailand. This is the second RAmparts 2800 Class tug built for the<br />

Port Authority of Thailand to this widely accepted design. This tug is a more<br />

powerful version of the Port Authorities first RAmparts 2800 tug delivered last<br />

summer. Working in close cooperation with Italthai Marine personnel, Robert<br />

Allan staff customized standard RAmparts 2800 design to meet Client’s<br />

requirements for propulsion equipment, accommodations, tank capacities and<br />

outfit. Principal dimensions of “Tarua 302” are 28.2m length overall x 11.5m beam x 5.35m depth with a maximum<br />

draft of 5.1m. <strong>Tug</strong> is classed LR +100 A1, TUG, +LMC, Thailand Coastal Service. <strong>Tug</strong> has been outfitted to high<br />

standards for a crew of up to 10 people. The large main deckhouse contains a well sized combined lounge/mess<br />

room, galley, two officer cabins. The lower deck contains 2 - 1 man cabins and 1 - 6 man cabin. Wheelhouse is<br />

designed for maximum all-round visibility with fore and aft control stations providing<br />

maximum visibility to both fore and aft deck working areas. Extensive use of decorative<br />

wood trim has been used throughout the vessel and particularly in the wheelhouse. Main<br />

propulsion comprises a pair of Daihatsu 6DKM-26e diesels, each rated 1,618kW at<br />

750RPM, Schottel SRP 1212 fixed pitch units with 2.3m props, in ASD configuration.<br />

Electrical plant consists of two identical 200ekW gensets powered by MAN D 2866 LXEs.<br />

Deck machinery comprises a forward hawser winch from Fluid Mechanica with a brake<br />

holding load of 100 tons and line pull of 60 tons at 5m/. Aft deck has a 65 ton SWL tow<br />

hook from Mampaey. An independent FIFI pump is fitted, comprising of a 362kW Deutz BF<br />

8M 1015 MC diesel driving a Fire Fighting Systems SFP250x350HD horizontal centrifugal<br />

pump delivering 600m3/hr sea water to two FFS300, 300m3/hr remote operated<br />

water/foam monitors. “Tarua 302” met or exceeded all performance expectations,<br />

achieving a bollard pull ahead of 55.7 tons and free running speed of 12.7kn.<br />

On January 25th, <strong>2013</strong>, the Voith Schneider tractor tug “Media Luna” sailed<br />

into Puerto de Bolivar, Colombia after sailing under her own power across the<br />

Atlantic from Turkey. She was welcomed by other Cerrejón towing vessels<br />

providing fire monitor displays. “Media Luna” was constructed at Uzmar <strong>Tug</strong><br />

and Work <strong>Boat</strong> Factory in Izmit, Turkey. This is the first of a two boat order<br />

for the AVT 3000 Class <strong>Tug</strong>s designed by Robert Allan. “Media Luna” will<br />

replace the 2,400HP, 1981 built “Ciudad de Riohacha” (ex-Gelderland) as part<br />

of a Cerrejón’s fleet renewal program. The sister vessel “Cabo del Vela” is<br />

expected to be delivered to Cerrejón’s Puerto Bolivar marine operations in<br />

March. The AVT 3000 was designed to meet Cerrejón’s requirements for performance, propulsion equipment,<br />

accommodations, tank capacities and outfit. She features a partial raised foc’sle for operation in rough weather and a<br />

large functional aft working deck for efficient ship handling ops. Designed for a bollard pull of 60 tons, she will be the<br />

most powerful tug in the Puerto Bolivar fleet. Principal dimensions are 30.75m x 12.0m x 4.80m depth x 6.2m max<br />

draft. <strong>Tug</strong> was designed and constructed to BV 1 +Hull, +Mach, <strong>Tug</strong> Unrestricted requirements and has been outfitted<br />

to high standards for a crew of four. The main deckhouse contains the galley, mess, and two officer cabins. Lower<br />

deck contains 1 double berth cabin, a laundry, galley stores, and a common WC space. Wheelhouse is designed with<br />

frameless bonded windows for minimum window mullion obstruction and a single split control station which provides<br />

maximum visibility for ahead and astern operation with excellent visibility over the aft working deck. A pilot boarding<br />

platform is provided at the bridge deck level. Engine room features a small sound resistant switchboard room. A<br />

workshop and stores area is located in the aft hold. Main propulsion consists of a pair of<br />

General Electric 12V228s, each rated 2,289kW at 1,050RPM driving a Voith Schneider<br />

30R5-250 cycloidal prop. Aft deck machinery includes a Rolls Royce ATWH 1500/200<br />

render-recover hawser/towing winch with horizontal warping head and pull of 20 tons at<br />

18m/min. Also on the aft deck is a Hella deck crane rated 5 tons at 5m reach. On the<br />

foredeck is a Rolls Royce AW20.5U2H anchor windlass with two cable lifters and two<br />

horizontal warping heads. An independent FIFI pump set is fitted comprising a 546kW<br />

@ 1,800RPM Caterpillar C18 ACERT driving a Fire Fighting Systems horizontal<br />

centrifugal pump delivering 1,200m3/hr water to a FFS1200LB, 1,200/300m3/hr<br />

water/foam remote monitor. On trials, Media Luna met or exceeded all performance<br />

expectations, achieving a bollard pull ahead of 63.1 tons and free running speed of<br />

13.6kn.<br />

www.marcon.com<br />

Details believed correct, not guaranteed. Offered subject to availability.<br />

15

<strong>Marcon</strong> <strong>International</strong>, <strong>Inc</strong>.<br />

<strong>Tug</strong> <strong>Boat</strong> <strong>Market</strong> <strong>Report</strong> – <strong>May</strong> <strong>2013</strong><br />

On March 30th, <strong>2013</strong>, “Cabo de la Vela” departed Uzmar<br />

Shipyard in Turkey on her delivery voyage to Columbia. “Cabo de<br />

la Vela” was constructed at Uzmar in Izmit, Turkey. This is the<br />

second of a two boat order from Carbones del Cerrejón for the<br />

AVT 3000 Class <strong>Tug</strong>s designed by Robert Allan Ltd. “Cabo de la<br />

Vela” will join her sister vessel, the “Media Luna”, in Puerto de<br />

Bolivar. The AVT 3000 tugs for Cerrejón were designed to meet<br />

Cerrejón’s requirements for performance, propulsion equipment,<br />

accommodations, tankage and outfit. “Cabo de la Vela” features a<br />

partial raised foc’sle for operation in rough weather and a large<br />

functional aft working deck for efficient ship handling operations.<br />

Designed for a bollard pull of 60 tons, she and her sister will be the<br />

most powerful tugs in the Puerto Bolivar fleet.<br />

“Pilbara Apollo”, the latest addition to the RAstar 3200 escort tug<br />

series was delivered to its owners, Rio Tinto Ltd. earlier this year.<br />

The vessel was constructed at Uzmar Shipbuilding Industry Co. in<br />

Turkey and will operate at Rio Tinto’s iron ore export facilities at Cape<br />

Lambert (Port Walcott) and Dampier, Australia. The “Pilbara Apollo” is<br />

the first of six new RAstar 3200 tugs to be delivered to Rio Tinto as<br />

part of this contract. These tugs will assist very large ore carriers in<br />

berthing and un-berthing at exposed, open water berths in severe<br />

wind and wave conditions. The unique sponsoned hull form of the<br />

RAstar Class vessels gives these new tugs a level of safety and<br />

comfort that will enable operation in conditions that were previously<br />

deemed unworkable. This unique RAstar hull form developed by Robert Allan Ltd. has<br />

been proven in both model and full-scale testing to provide significantly enhanced escort<br />

towing and seakeeping performance. The motions and accelerations are less than half<br />

those of comparable sized, wall- sided “standard” tug hulls. Principal dimensions are<br />

32.00 x 12.80 x 5.37m depth with a navigational draft of 6.03m. Vessel was classed by<br />

Bureau Veritas during construction, but will be converted to Lloyd’s Register once in<br />

Australia. Tank capacities are 129m3 fuel and 39m3 fresh water. On trials, “Pilbara<br />