pittsylvania county schools teacher aide salary schedule 2012-2013

pittsylvania county schools teacher aide salary schedule 2012-2013

pittsylvania county schools teacher aide salary schedule 2012-2013

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

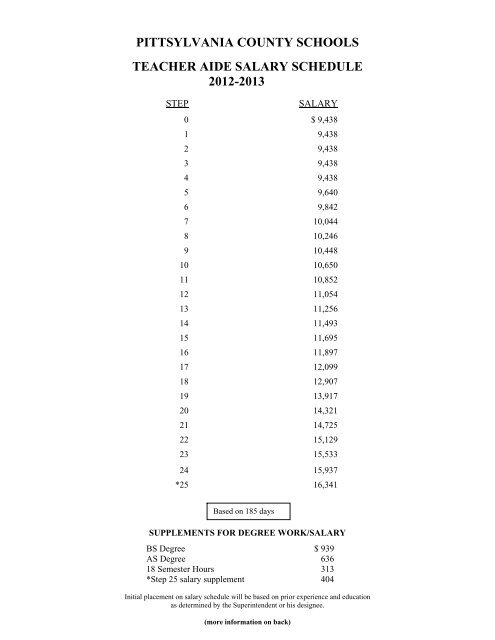

PITTSYLVANIA COUNTY SCHOOLS<br />

TEACHER AIDE SALARY SCHEDULE<br />

<strong>2012</strong>-<strong>2013</strong><br />

STEP<br />

SALARY<br />

0 $ 9,438<br />

1 9,438<br />

2 9,438<br />

3 9,438<br />

4 9,438<br />

5 9,640<br />

6 9,842<br />

7 10,044<br />

8 10,246<br />

9 10,448<br />

10 10,650<br />

11 10,852<br />

12 11,054<br />

13 11,256<br />

14 11,493<br />

15 11,695<br />

16 11,897<br />

17 12,099<br />

18 12,907<br />

19 13,917<br />

20 14,321<br />

21 14,725<br />

22 15,129<br />

23 15,533<br />

24 15,937<br />

*25 16,341<br />

Based on 185 days<br />

SUPPLEMENTS FOR DEGREE WORK/SALARY<br />

BS Degree $ 939<br />

AS Degree 636<br />

18 Semester Hours 313<br />

*Step 25 <strong>salary</strong> supplement 404<br />

Initial placement on <strong>salary</strong> <strong>schedule</strong> will be based on prior experience and education<br />

as determined by the Superintendent or his designee.<br />

(more information on back)

Notice To Employees<br />

All employees of Pittsylvania County Schools have the<br />

option to participate in a Tax-Sheltered Annuity Program.<br />

All employees shall abide by paragraphs A(1) and A(2) of<br />

School Board Policy GBEA, Unlawful Manufacture,<br />

Distribution, Dispensing, Possession or Use of a Controlled<br />

Substance, as a condition of employment.<br />

As provided under Chapter 822 of the <strong>2012</strong> Acts of<br />

Assembly (SB 497), all school division and political<br />

subdivision employees must begin paying the 5 percent<br />

member contribution effective July 1, <strong>2012</strong>. All employees<br />

hired or rehired on or after July 1, <strong>2012</strong>, must pay the full<br />

5 percent upon employment with no phase-in allowed. For<br />

current employees, the bill allows governing bodies to<br />

phase in the member contribution in each of the next five<br />

years or until current employees are paying the full 5<br />

percent contribution, whichever is earlier. Phase-in<br />

increases must be in whole percentages of at least 1 percent<br />

of creditable compensation per year, with comparable<br />

offsetting <strong>salary</strong> increases.