FINANCIAL REVIEW - Commercial Bank of Kuwait

FINANCIAL REVIEW - Commercial Bank of Kuwait

FINANCIAL REVIEW - Commercial Bank of Kuwait

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26<br />

<strong>FINANCIAL</strong> <strong>REVIEW</strong><br />

<strong>Commercial</strong> <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>

27<br />

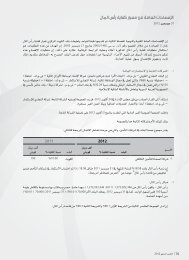

2011 Statement <strong>of</strong> Income<br />

The pr<strong>of</strong>it attributable to Shareholders <strong>of</strong> the Parent <strong>Bank</strong> for the year is KD 0.810 million.<br />

Net interest income <strong>of</strong> KD 91.6 million was KD 3.7 million or 4% higher than 2010. The average yield on interest<br />

earning assets declined to 3.99% from 4.15% in 2010. The average cost on interest bearing liabilities fell to 1.30%<br />

down from the 1.61% <strong>of</strong> 2010. The bank’s net spread was 2.68% and the net interest margin was 2.76%.<br />

Net gains from dealing in foreign currencies increased by KD 0.7 million or 15%. Dividend income <strong>of</strong> KD 3.2 million<br />

was up 61% on 2010.<br />

Staff expenses decreased KD 1.6 million or 9% on 2010. General and administration expenses for 2011 were slightly<br />

up on 2010.<br />

The charge for Impairment and other provisions for credit facilities and investments was KD 100.4 million for 2011, an<br />

increase compared to the KD 51.2 million <strong>of</strong> 2010.<br />

The <strong>Bank</strong> continues to enforce a strict credit policy and complies fully with the Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> provisioning<br />

requirements. Total provision cover for 2011, including general provisions, was 92% <strong>of</strong> non-performing loans. Nonperforming<br />

loans decreased KD 243.6 million to KD 154.0 million.<br />

2011 Balance Sheet<br />

Total assets increased by KD 91.7 million or 2% on 2010 with an increase in Due from banks and other financial<br />

institutions and Investment securities.<br />

The <strong>Bank</strong> continues to comply with the loans to deposits ratio introduced by Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong> in 2004, which<br />

requires <strong>Kuwait</strong>i banks to maintain an average ratio for loans to deposits <strong>of</strong> 85%.<br />

The capital adequacy ratio under Basel II regulations is 18.58% and comfortably exceeds the minimum 12%<br />

requirement <strong>of</strong> the Central <strong>Bank</strong> <strong>of</strong> <strong>Kuwait</strong>.<br />

Dividends and Proposed Appropriations<br />

The Net pr<strong>of</strong>it for the year attributable to shareholders <strong>of</strong> the Parent <strong>Bank</strong> <strong>of</strong> KD 810,000 will be retained.<br />

1. No dividend is proposed (2010: 15 fils) as recommended by the Board <strong>of</strong> Directors. This is subject to approval by the<br />

Shareholders at the Annual General Meeting.<br />

Annual Report 2011<br />

2. Nil to the Statutory Reserve, which now equals 50% <strong>of</strong> share capital and in accordance with the Law <strong>of</strong> <strong>Commercial</strong><br />

Companies any future transfers are on a voluntary basis.