Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

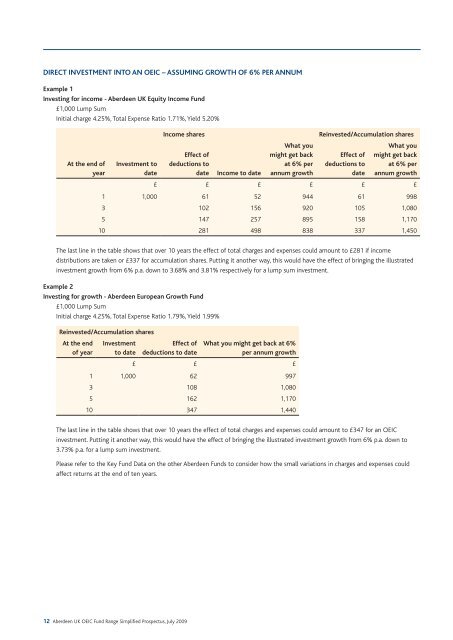

DIRECT INVESTMENT INTO AN <strong>OEIC</strong> – ASSUMING GROWTH OF 6% PER ANNUM<br />

Example 1<br />

Investing for income - <strong>Aberdeen</strong> <strong>UK</strong> Equity Income <strong>Fund</strong><br />

£1,000 Lump Sum<br />

Initial charge 4.25%, Total Expense Ratio 1.71%, Yield 5.20%<br />

At the end of<br />

year<br />

Investment to<br />

date<br />

Income shares<br />

Effect of<br />

deductions to<br />

date<br />

Income to date<br />

What you<br />

might get back<br />

at 6% per<br />

annum growth<br />

Reinvested/Accumulation shares<br />

Effect of<br />

deductions to<br />

date<br />

What you<br />

might get back<br />

at 6% per<br />

annum growth<br />

£ £ £ £ £ £<br />

1 1,000 61 52 944 61 998<br />

3 102 156 920 105 1,080<br />

5 147 257 895 158 1,170<br />

10 281 498 838 337 1,450<br />

The last line in the table shows that over 10 years the effect of total charges and expenses could amount to £281 if income<br />

distributions are taken or £337 for accumulation shares. Putting it another way, this would have the effect of bringing the illustrated<br />

investment growth from 6% p.a. down to 3.68% and 3.81% respectively for a lump sum investment.<br />

Example 2<br />

Investing for growth - <strong>Aberdeen</strong> European Growth <strong>Fund</strong><br />

£1,000 Lump Sum<br />

Initial charge 4.25%, Total Expense Ratio 1.79%, Yield 1.99%<br />

Reinvested/Accumulation shares<br />

At the end<br />

of year<br />

Investment<br />

to date<br />

Effect of<br />

deductions to date<br />

What you might get back at 6%<br />

per annum growth<br />

£ £ £<br />

1 1,000 62 997<br />

3 108 1,080<br />

5 162 1,170<br />

10 347 1,440<br />

The last line in the table shows that over 10 years the effect of total charges and expenses could amount to £347 for an <strong>OEIC</strong><br />

investment. Putting it another way, this would have the effect of bringing the illustrated investment growth from 6% p.a. down to<br />

3.73% p.a. for a lump sum investment.<br />

Please refer to the Key <strong>Fund</strong> Data on the other <strong>Aberdeen</strong> <strong>Fund</strong>s to consider how the small variations in charges and expenses could<br />

affect returns at the end of ten years.<br />

12 <strong>Aberdeen</strong> <strong>UK</strong> <strong>OEIC</strong> <strong>Fund</strong> <strong>Range</strong> Simplified Prospectus, July 2009