Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Aberdeen UK OEIC Fund Range - Aberdeen Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

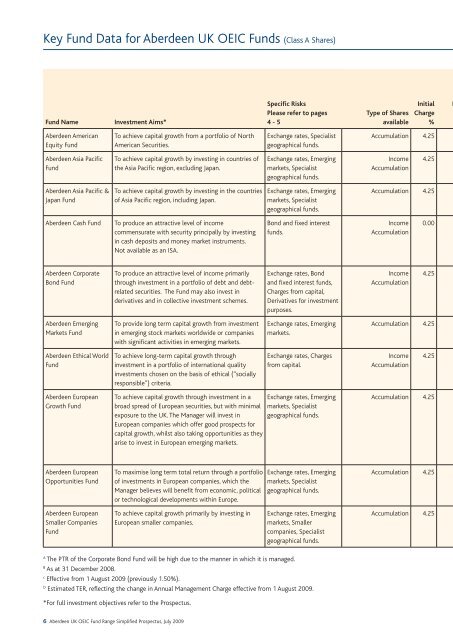

Key <strong>Fund</strong> Data for <strong>Aberdeen</strong> <strong>UK</strong> <strong>OEIC</strong> <strong>Fund</strong>s (Class A Shares)<br />

<strong>Fund</strong> Name<br />

Investment Aims*<br />

Specific Risks<br />

Please refer to pages<br />

4 - 5<br />

Type of Shares<br />

available<br />

Initial<br />

Charge<br />

%<br />

M<br />

<strong>Aberdeen</strong> American<br />

Equity <strong>Fund</strong><br />

To achieve capital growth from a portfolio of North<br />

American Securities.<br />

Exchange rates, Specialist<br />

geographical funds.<br />

Accumulation 4.25<br />

<strong>Aberdeen</strong> Asia Pacific<br />

<strong>Fund</strong><br />

To achieve capital growth by investing in countries of<br />

the Asia Pacific region, excluding Japan.<br />

Exchange rates, Emerging<br />

markets, Specialist<br />

geographical funds.<br />

Income<br />

Accumulation<br />

4.25<br />

<strong>Aberdeen</strong> Asia Pacific &<br />

Japan <strong>Fund</strong><br />

To achieve capital growth by investing in the countries<br />

of Asia Pacific region, including Japan.<br />

Exchange rates, Emerging<br />

markets, Specialist<br />

geographical funds.<br />

Accumulation 4.25<br />

<strong>Aberdeen</strong> Cash <strong>Fund</strong><br />

To produce an attractive level of income<br />

commensurate with security principally by investing<br />

in cash deposits and money market instruments.<br />

Not available as an ISA.<br />

Bond and fixed interest<br />

funds.<br />

Income<br />

Accumulation<br />

0.00<br />

<strong>Aberdeen</strong> Corporate<br />

Bond <strong>Fund</strong><br />

To produce an attractive level of income primarily<br />

through investment in a portfolio of debt and debtrelated<br />

securities. The <strong>Fund</strong> may also invest in<br />

derivatives and in collective investment schemes.<br />

Exchange rates, Bond<br />

and fixed interest funds,<br />

Charges from capital,<br />

Derivatives for investment<br />

purposes.<br />

Income<br />

Accumulation<br />

4.25<br />

<strong>Aberdeen</strong> Emerging<br />

Markets <strong>Fund</strong><br />

To provide long term capital growth from investment<br />

in emerging stock markets worldwide or companies<br />

with significant activities in emerging markets.<br />

Exchange rates, Emerging<br />

markets.<br />

Accumulation 4.25<br />

<strong>Aberdeen</strong> Ethical World<br />

<strong>Fund</strong><br />

To achieve long-term capital growth through<br />

investment in a portfolio of international quality<br />

investments chosen on the basis of ethical (“socially<br />

responsible”) criteria.<br />

Exchange rates, Charges<br />

from capital.<br />

Income<br />

Accumulation<br />

4.25<br />

<strong>Aberdeen</strong> European<br />

Growth <strong>Fund</strong><br />

To achieve capital growth through investment in a<br />

broad spread of European securities, but with minimal<br />

exposure to the <strong>UK</strong>. The Manager will invest in<br />

European companies which offer good prospects for<br />

capital growth, whilst also taking opportunities as they<br />

arise to invest in European emerging markets.<br />

Exchange rates, Emerging<br />

markets, Specialist<br />

geographical funds.<br />

Accumulation 4.25<br />

<strong>Aberdeen</strong> European<br />

Opportunities <strong>Fund</strong><br />

To maximise long term total return through a portfolio<br />

of investments in European companies, which the<br />

Manager believes will benefit from economic, political<br />

or technological developments within Europe.<br />

Exchange rates, Emerging<br />

markets, Specialist<br />

geographical funds.<br />

Accumulation 4.25<br />

<strong>Aberdeen</strong> European<br />

Smaller Companies<br />

<strong>Fund</strong><br />

To achieve capital growth primarily by investing in<br />

European smaller companies.<br />

Exchange rates, Emerging<br />

markets, Smaller<br />

companies, Specialist<br />

geographical funds.<br />

Accumulation 4.25<br />

A<br />

The PTR of the Corporate Bond <strong>Fund</strong> will be high due to the manner in which it is managed.<br />

B<br />

As at 31 December 2008.<br />

c<br />

Effective from 1 August 2009 (previously 1.50%).<br />

D<br />

Estimated TER, reflecting the change in Annual <strong>Management</strong> Charge effective from 1 August 2009.<br />

*For full investment objectives refer to the Prospectus.<br />

6 <strong>Aberdeen</strong> <strong>UK</strong> <strong>OEIC</strong> <strong>Fund</strong> <strong>Range</strong> Simplified Prospectus, July 2009