Inside the record-setting, no-contract purchase of ... - Meltzer Lippe

Inside the record-setting, no-contract purchase of ... - Meltzer Lippe

Inside the record-setting, no-contract purchase of ... - Meltzer Lippe

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Inside</strong> <strong>the</strong> <strong>record</strong>-<strong>setting</strong>, <strong>no</strong>-<strong>contract</strong> <strong>purchase</strong> <strong>of</strong> Soho’s 529 Broadway<br />

One building, many suitors ends with a $150M sale<br />

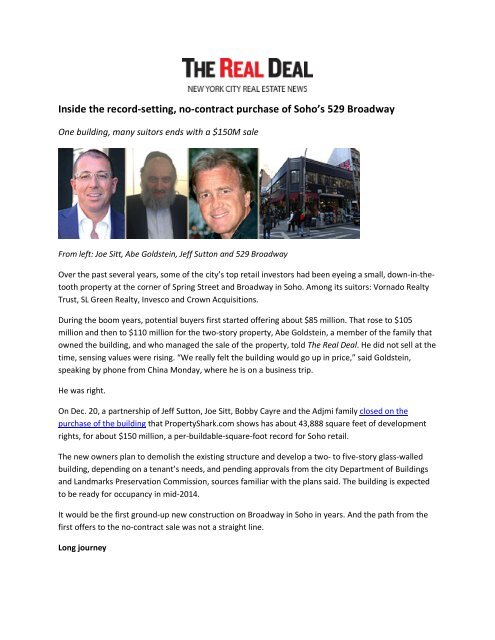

From left: Joe Sitt, Abe Goldstein, Jeff Sutton and 529 Broadway<br />

Over <strong>the</strong> past several years, some <strong>of</strong> <strong>the</strong> city’s top retail investors had been eyeing a small, down-in-<strong>the</strong>tooth<br />

property at <strong>the</strong> corner <strong>of</strong> Spring Street and Broadway in Soho. Among its suitors: Vornado Realty<br />

Trust, SL Green Realty, Invesco and Crown Acquisitions.<br />

During <strong>the</strong> boom years, potential buyers first started <strong>of</strong>fering about $85 million. That rose to $105<br />

million and <strong>the</strong>n to $110 million for <strong>the</strong> two-story property, Abe Goldstein, a member <strong>of</strong> <strong>the</strong> family that<br />

owned <strong>the</strong> building, and who managed <strong>the</strong> sale <strong>of</strong> <strong>the</strong> property, told The Real Deal. He did <strong>no</strong>t sell at <strong>the</strong><br />

time, sensing values were rising. “We really felt <strong>the</strong> building would go up in price,” said Goldstein,<br />

speaking by phone from China Monday, where he is on a business trip.<br />

He was right.<br />

On Dec. 20, a partnership <strong>of</strong> Jeff Sutton, Joe Sitt, Bobby Cayre and <strong>the</strong> Adjmi family closed on <strong>the</strong><br />

<strong>purchase</strong> <strong>of</strong> <strong>the</strong> building that PropertyShark.com shows has about 43,888 square feet <strong>of</strong> development<br />

rights, for about $150 million, a per-buildable-square-foot <strong>record</strong> for Soho retail.<br />

The new owners plan to demolish <strong>the</strong> existing structure and develop a two- to five-story glass-walled<br />

building, depending on a tenant’s needs, and pending approvals from <strong>the</strong> city Department <strong>of</strong> Buildings<br />

and Landmarks Preservation Commission, sources familiar with <strong>the</strong> plans said. The building is expected<br />

to be ready for occupancy in mid-2014.<br />

It would be <strong>the</strong> first ground-up new construction on Broadway in Soho in years. And <strong>the</strong> path from <strong>the</strong><br />

first <strong>of</strong>fers to <strong>the</strong> <strong>no</strong>-<strong>contract</strong> sale was <strong>no</strong>t a straight line.<br />

Long journey

Goldstein’s fa<strong>the</strong>r, Zoltan Goldstein, <strong>purchase</strong>d <strong>the</strong> building circa 1980 for about $1 million, Goldstein<br />

said. For <strong>the</strong> next decade, <strong>the</strong> family ran a wholesale and retail hosiery store in a portion <strong>of</strong> <strong>the</strong> building,<br />

and rented <strong>the</strong> rest to o<strong>the</strong>r tenants. In about 1990, <strong>the</strong>y closed <strong>the</strong> store, and continued to rent it out<br />

to o<strong>the</strong>r tenants. (Goldstein remains in <strong>the</strong> hosiery business.)<br />

In about 2005, Sutton, one <strong>of</strong> <strong>the</strong> city’s most active retail owners with investments estimated to be<br />

worth nearly $2 billion on Upper Fifth Avenue, Times Square, Soho and o<strong>the</strong>r areas, first made overtures<br />

to Zoltan to net lease <strong>the</strong> building.<br />

Those early efforts by Sutton never materialized. Meanwhile, o<strong>the</strong>r investors and some retailers took a<br />

closer look at <strong>the</strong> property. Zara, sources said, was looking to buy it for its own use. In addition to<br />

Vornado, SL Green and Crown, Cayre and Adjmi sought to buy <strong>the</strong> property. Retailers like Micros<strong>of</strong>t,<br />

Michael Kors, Nike and Adidas approached him to lease <strong>the</strong> building, Goldstein said.<br />

Sutton continued to pursue an acquisition — meeting with Goldstein or his fa<strong>the</strong>r over <strong>the</strong> years in<br />

Williamsburg and Borough Park. “Over <strong>the</strong> last two years every day <strong>the</strong>re were phone calls for <strong>the</strong><br />

building,” Goldstein said, although he <strong>no</strong>ted that Sutton was <strong>the</strong> most persistent suitor.<br />

Unusual terms<br />

But Goldstein, although he is involved with real estate development in Brooklyn, was wary <strong>of</strong> getting<br />

tied up with a <strong>contract</strong> for this property, and wanted to close before <strong>the</strong> end <strong>of</strong> <strong>the</strong> year to avoid paying<br />

higher capital gains taxes. So he made <strong>the</strong> extremely unusual demand to all potential buyers that <strong>the</strong><br />

hefty cash for <strong>the</strong> <strong>purchase</strong> be wired to his title company with <strong>no</strong> <strong>contract</strong>. The deed would be signed<br />

over and <strong>the</strong> money released to his account on <strong>the</strong> closing.<br />

“The biggest challenge to this deal was to meet <strong>the</strong> seller’s terms. There was <strong>no</strong> <strong>contract</strong> and you had to<br />

wire <strong>the</strong> money and close with <strong>no</strong> due diligence,” Adelaide Polsinelli, executive director at investment<br />

sales firm Eastern Consolidated, said.<br />

The total price tag is a <strong>record</strong> for a retail property in <strong>the</strong> Soho submarket, figures from Real Capital<br />

Analytics show. The sale price yields an eye-popping figure <strong>of</strong> $3,418 per developable foot, a <strong>record</strong> as<br />

well, insiders said.<br />

“There are so many <strong>contract</strong>s made in New York City, and until <strong>the</strong> closing, it takes this and that, and<br />

<strong>the</strong>re are a lot <strong>of</strong> fights. I wanted to sleep at night. Let’s go straight to closing,” Goldstein said. “It was<br />

my idea and it worked.”<br />

The closing<br />

Despite <strong>the</strong> seven-year process to land <strong>the</strong> property, by early December, with time running out, Sutton<br />

and his partners did <strong>no</strong>t have a deal. Then on Friday, Dec. 14, Sutton called Goldstein.

“‘This is my <strong>of</strong>fer to you. This is what I can do. The money is ready,’ ” Goldstein recalled Sutton saying.<br />

The price was about $150 million, including about $3 million to pay a defeasance penalty, because <strong>the</strong>re<br />

was a securitized loan on <strong>the</strong> property.<br />

The following Tuesday, Sutton agreed that he and his partners would wire <strong>the</strong> money <strong>the</strong> next day on<br />

December 19, a day before <strong>the</strong> closing, although <strong>the</strong>re was <strong>no</strong> <strong>contract</strong>. That seemed to bring an<br />

additional level <strong>of</strong> calm to Goldstein, a source said.<br />

Goldstein said <strong>the</strong> <strong>purchase</strong> went <strong>of</strong>f without a hitch.<br />

Sutton, Goldstein, Sitt, Goldstein’s attorney Gary <strong>Meltzer</strong>, a partner at <strong>Meltzer</strong>, <strong>Lippe</strong>, Goldstein &<br />

Breitstone, and several o<strong>the</strong>r people met at <strong>the</strong> law <strong>of</strong>fice <strong>of</strong> Morris Missry, a partner at law firm<br />

Wachtel Masyr & Missry, who represented <strong>the</strong> buyers, on Dec. 20. Over <strong>the</strong> day, <strong>the</strong> group ate bagels<br />

and made small talk while <strong>the</strong> lawyers hammered out small details. The deed was signed over to <strong>the</strong><br />

new owners and <strong>the</strong> money in escrow was released to Goldstein’s account.<br />

“It was like a <strong>no</strong>rmal closing,” Goldstein said.<br />

New building<br />

The buyers will reach out to tenants in <strong>the</strong> coming months, insiders said. They will likely look to <strong>the</strong><br />

retailers that wanted to lease <strong>the</strong> building, Goldstein said. One insider said <strong>the</strong> new owners are looking<br />

for between $1,200 per square foot and $1,500 per square foot on <strong>the</strong> ground floor, for one or two<br />

tenants.<br />

“It’s Main and Main,” Polsinelli, who was representing an investor who sought to buy <strong>the</strong> property, said.<br />

Joanne Podell, executive vice president at Cushman & Wakefield, said she believed <strong>the</strong>y might get that<br />

number if a major retailer opens a flagship store <strong>the</strong>re. Although, she added, with new construction <strong>the</strong><br />

numbers can be imprecise because <strong>the</strong> cost <strong>of</strong> construction can be folded into <strong>the</strong> lease.<br />

A<strong>no</strong><strong>the</strong>r potential tenant is <strong>the</strong> luxury retailer Prada, which has a lease expiring in about a year at its<br />

current 575 Broadway location, at Prince Street, insiders said. Sutton has Prada as a tenant at 724 Fifth<br />

Avenue, a building between 56th and 57th streets.<br />

The buyers have hired <strong>the</strong> architecture firm BKSK Architects – which redeveloped Cayre’s Aurora Capital<br />

Associates Meatpacking District building at 21-27 Ninth Avenue, which is home to Sephora and o<strong>the</strong>rs –<br />

to design <strong>the</strong> new building, sources said. Cayre, an active owner and developer <strong>of</strong> retail properties, is<br />

seen as an expert in construction, a source involved in <strong>the</strong> deal said.<br />

“This is real frontage, a real glass store,” one insider said.