Manufacturer Quarterly Performance 2011 - 2nd Quarter - Focus on ...

Manufacturer Quarterly Performance 2011 - 2nd Quarter - Focus on ...

Manufacturer Quarterly Performance 2011 - 2nd Quarter - Focus on ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

market review<br />

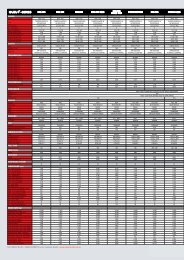

<str<strong>on</strong>g>Manufacturer</str<strong>on</strong>g> <str<strong>on</strong>g><str<strong>on</strong>g>Quarter</str<strong>on</strong>g>ly</str<strong>on</strong>g> <str<strong>on</strong>g>Performance</str<strong>on</strong>g> <str<strong>on</strong>g>2011</str<strong>on</strong>g>- <str<strong>on</strong>g>2nd</str<strong>on</strong>g> <str<strong>on</strong>g>Quarter</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Manufacturer</str<strong>on</strong>g><br />

MCV HCV EHCV Bus Total<br />

Market Share<br />

Market Positi<strong>on</strong><br />

Units Units Units Units Units This <str<strong>on</strong>g>Quarter</str<strong>on</strong>g> Last <str<strong>on</strong>g>Quarter</str<strong>on</strong>g> This <str<strong>on</strong>g>Quarter</str<strong>on</strong>g> Last <str<strong>on</strong>g>Quarter</str<strong>on</strong>g><br />

Mercedes-Benz SA 482 188 1 059 77 1 806 27,68 26,73 1 1<br />

Change 0,95 0<br />

Toyota/Hino 422 295 66 0 783 12,00 14,08 3 2<br />

Change -2,08 -1<br />

UD Trucks SA 169 347 275 0 791 12,12 11,71 2 3<br />

Change 0,41 1<br />

MAN Group 0 37 351 105 493 7,56 8,10 6 5<br />

Change -0,54 -1<br />

GMSA 376 249 77 9 711 10,90 10,37 4 4<br />

Change 0,53 0<br />

Volvo Trucks 0 0 490 15 505 7,74 6,88 5 6<br />

Change 0,86 1<br />

Iveco 121 13 36 36 206 3,16 3,33 10 10<br />

Change -0,17 0<br />

Internati<strong>on</strong>al 0 0 210 0 210 3,22 2,84 9 11<br />

Change 0,38 2<br />

Scania 0 0 314 44 358 5,49 4,89 7 8<br />

Change 0,60 1<br />

Tata 160 107 32 7 306 4,69 5,34 8 7<br />

Change -0,65 -1<br />

Peugeot 62 0 0 0 62 0,95 0,91 12 12<br />

Change 0,04 0<br />

Volkswagen 201 0 0 0 201 3,08 3,46 11 9<br />

Change -0,38 -2<br />

VDL 0 0 0 10 10 0,15 0,14 15 16<br />

Change 0,01 1<br />

Babcock/DAF 0 0 20 0 20 0,31 0,19 14 15<br />

Change 0,12 1<br />

Fiat 9 0 0 0 9 0,14 0,28 16 14<br />

Change -0,14 -2<br />

Nissan 0 0 0 0 0 0,00 0,00 n/a n/a<br />

Change 0,00 n/a<br />

Powerstar 0 0 53 0 53 0,81 0,77 13 13<br />

Change 0,04 0<br />

Totals 2 002 1 236 2 983 303 6 524 100,00<br />

was already a m<strong>on</strong>th c<strong>on</strong>taining less than the<br />

average number of working days.<br />

The early m<strong>on</strong>ths of <str<strong>on</strong>g>2011</str<strong>on</strong>g> were also<br />

characterised by an extremely volatile oil price,<br />

caused by political unrest in the Middle East,<br />

that impacted <strong>on</strong> the local cost of fuel, and<br />

c<strong>on</strong>sequently <strong>on</strong> the short-term profitability of<br />

haulage c<strong>on</strong>tractors.<br />

The recent pattern of vehicle deliveries<br />

has shown a clear bias towards heavier,<br />

more expensive units, c<strong>on</strong>firming that demand<br />

levels in the ec<strong>on</strong>omy are healthy, and that<br />

the availability of acquisiti<strong>on</strong> finance remains<br />

satisfactory. The broader macro-ec<strong>on</strong>omic<br />

picture in the South African ec<strong>on</strong>omy has<br />

suggested some softening of local business<br />

c<strong>on</strong>fidence, as evidenced by the most recent<br />

Kagiso Purchasing Managers’ Index, but the<br />

most important challenge facing the suppliers<br />

of trucks, buses and vans going forward will<br />

be in obtaining the optimum balance between<br />

the vehicles that they can supply, and the<br />

requirements of their customers.<br />

SEGMENTATION DYNAMICS<br />

During the sec<strong>on</strong>d quarter of <str<strong>on</strong>g>2011</str<strong>on</strong>g>, the premium<br />

payload EHCV segment has c<strong>on</strong>solidated,<br />

and strengthened the dominant positi<strong>on</strong> it has<br />

occupied in the overall market over the four<br />

most recent quarters, reaching a penetrati<strong>on</strong><br />

level of 45,7%, which is the highest ever <strong>on</strong><br />

record for this category. In stark c<strong>on</strong>trast, the<br />

entry level MCV grouping retreated to 30,7%<br />

market share, which is the lowest achieved by<br />

this segment since the mid-1980s.<br />

These c<strong>on</strong>trasting fortunes of the EHCV<br />

and MCV segments are worthy of comment,<br />

bearing in mind that the heavier vehicles are<br />

sold mainly to professi<strong>on</strong>al hauliers, often in<br />

19 FOCUS August <str<strong>on</strong>g>2011</str<strong>on</strong>g>