2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

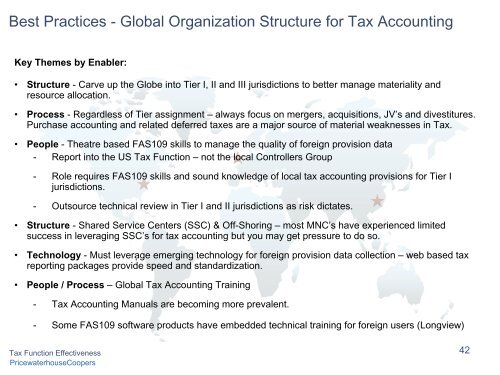

<strong>Best</strong> <strong>Practices</strong> - Global Organization Structure for <strong>Tax</strong> Accounting<br />

Key Themes by Enabler:<br />

• Structure - Carve up the Globe into Tier I, II and III jurisdictions to better manage materiality and<br />

resource allocation.<br />

• Process - Regardless of Tier assignment – always focus on mergers, acquisitions, JV’s and divestitures.<br />

Purchase accounting and related deferred taxes are a major source of material weaknesses in <strong>Tax</strong>.<br />

• People - Theatre based FAS109 skills to manage the quality of foreign provision data<br />

- Report into the US <strong>Tax</strong> Function – not the local Controllers Group<br />

- Role requires FAS109 skills and sound knowledge of local tax accounting provisions for Tier I<br />

jurisdictions.<br />

- Outsource technical review in Tier I and II jurisdictions as risk dictates.<br />

• Structure - Shared Service Centers (SSC) & Off-Shoring – most MNC’s have experienced limited<br />

success in leveraging SSC’s for tax accounting but you may get pressure to do so.<br />

• Technology - Must leverage emerging technology for foreign provision data collection – web based tax<br />

reporting packages provide speed and standardization.<br />

• People / Process – Global <strong>Tax</strong> Accounting Training<br />

- <strong>Tax</strong> Accounting Manuals are becoming more prevalent.<br />

- Some FAS109 software products have embedded technical training for foreign users (Longview)<br />

<strong>Tax</strong> Function Effectiveness<br />

PricewaterhouseCoopers<br />

42