2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

2008 0326 PPT_-_Best_Practices.pdf - Tax Executives Institute, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

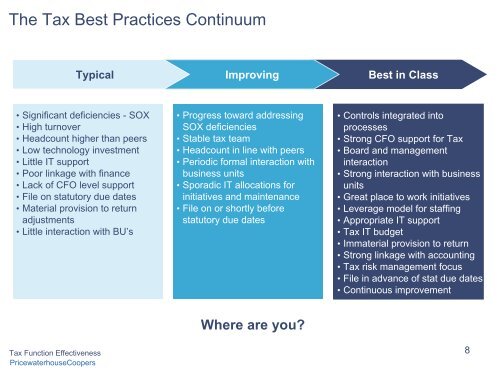

The <strong>Tax</strong> <strong>Best</strong> <strong>Practices</strong> Continuum<br />

Typical<br />

Improving<br />

<strong>Best</strong> in Class<br />

• Significant deficiencies - SOX<br />

• High turnover<br />

• Headcount higher than peers<br />

• Low technology investment<br />

• Little IT support<br />

• Poor linkage with finance<br />

• Lack of CFO level support<br />

• File on statutory due dates<br />

• Material provision to return<br />

adjustments<br />

• Little interaction with BU’s<br />

• Progress toward addressing<br />

SOX deficiencies<br />

• Stable tax team<br />

• Headcount in line with peers<br />

• Periodic formal interaction with<br />

business units<br />

• Sporadic IT allocations for<br />

initiatives and maintenance<br />

• File on or shortly before<br />

statutory due dates<br />

• Controls integrated into<br />

processes<br />

• Strong CFO support for <strong>Tax</strong><br />

• Board and management<br />

interaction<br />

• Strong interaction with business<br />

units<br />

• Great place to work initiatives<br />

• Leverage model for staffing<br />

• Appropriate IT support<br />

• <strong>Tax</strong> IT budget<br />

• Immaterial provision to return<br />

• Strong linkage with accounting<br />

• <strong>Tax</strong> risk management focus<br />

• File in advance of stat due dates<br />

• Continuous improvement<br />

<strong>Tax</strong> Function Effectiveness<br />

PricewaterhouseCoopers<br />

Where are you<br />

8