Growth Stock Index Fund - Mutual of Omaha

Growth Stock Index Fund - Mutual of Omaha

Growth Stock Index Fund - Mutual of Omaha

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Growth</strong> <strong>Stock</strong> <strong>Index</strong> <strong>Fund</strong><br />

Quarterly Summary<br />

Pr<strong>of</strong>ile as <strong>of</strong> June 30, 2007<br />

(except where noted)<br />

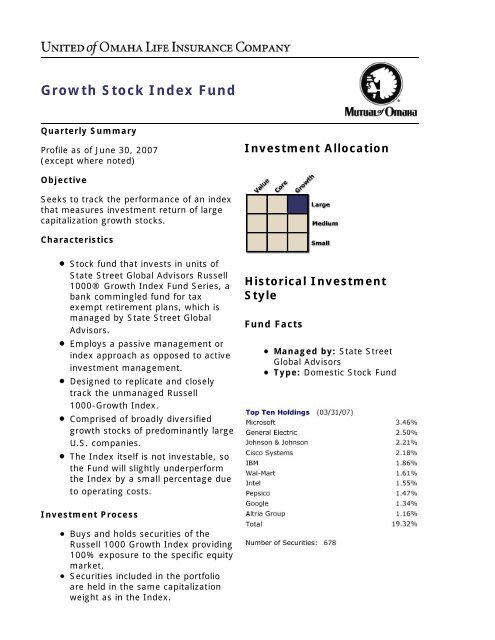

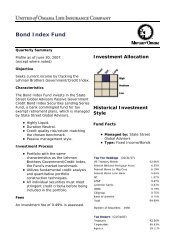

Investment Allocation<br />

Objective<br />

Seeks to track the performance <strong>of</strong> an index<br />

that measures investment return <strong>of</strong> large<br />

capitalization growth stocks.<br />

Characteristics<br />

<strong>Stock</strong> fund that invests in units <strong>of</strong><br />

State Street Global Advisors Russell<br />

1000® <strong>Growth</strong> <strong>Index</strong> <strong>Fund</strong> Series, a<br />

bank commingled fund for tax<br />

exempt retirement plans, which is<br />

managed by State Street Global<br />

Advisors.<br />

Employs a passive management or<br />

index approach as opposed to active<br />

investment management.<br />

Designed to replicate and closely<br />

track the unmanaged Russell<br />

1000-<strong>Growth</strong> <strong>Index</strong>.<br />

Comprised <strong>of</strong> broadly diversified<br />

growth stocks <strong>of</strong> predominantly large<br />

U.S. companies.<br />

The <strong>Index</strong> itself is not investable, so<br />

the <strong>Fund</strong> will slightly underperform<br />

the <strong>Index</strong> by a small percentage due<br />

to operating costs.<br />

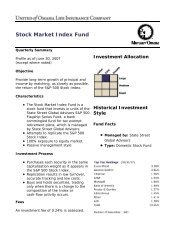

Historical Investment<br />

Style<br />

<strong>Fund</strong> Facts<br />

Managed by: State Street<br />

Global Advisors<br />

Type: Domestic <strong>Stock</strong> <strong>Fund</strong><br />

Investment Process<br />

Buys and holds securities <strong>of</strong> the<br />

Russell 1000 <strong>Growth</strong> <strong>Index</strong> providing<br />

100% exposure to the specific equity<br />

market.<br />

Securities included in the portfolio<br />

are held in the same capitalization<br />

weight as in the <strong>Index</strong>.

Replication results in low turnover<br />

and accurate tracking with trading<br />

occurring only when there is a<br />

change in the composition <strong>of</strong> the<br />

<strong>Index</strong>.<br />

Fees<br />

An investment fee <strong>of</strong> 0.38% is assessed.<br />

Returns shown represent past performance which cannot guarantee future results<br />

and are net <strong>of</strong> investment fees, but not administrative fees. Your plan's specific<br />

returns may be lower. Also, current performance may be lower or higher than the<br />

performance data quoted above. <strong>Fund</strong> values and investment returns will vary and<br />

principal value, when redeemed, may be worth more or less than the original<br />

investment. Contact your plan administrator or access your online account for your<br />

plan's returns current to the most recent month-end.

All funds may not be available as an investment option in a plan.<br />

<strong>Fund</strong> invests in State Street Global Advisors' Russell 1000 <strong>Growth</strong> <strong>Index</strong> <strong>Fund</strong><br />

Series, a bank commingled fund for tax exempt retirement plans (inception,<br />

5/31/94).<br />

The investment fee represents the total operating expense ratio assessed for<br />

this <strong>Fund</strong> and is subject to change. The investment fee and administrative fee<br />

charged to a plan will reduce the investment return <strong>of</strong> the <strong>Fund</strong> as set forth in<br />

the group annuity contract.<br />

Data for relevant risk statistics represent the State Street Global Advisor's<br />

Russell 1000® <strong>Growth</strong> <strong>Index</strong> <strong>Fund</strong> Series using quarterly data for the past five<br />

years.<br />

Comparative peer group style data is based on equity and fixed income<br />

databases maintained by Callan Associates Inc. Comparative database for the<br />

<strong>Stock</strong> Market <strong>Index</strong> is the Callan Large Cap <strong>Growth</strong> <strong>Mutual</strong> <strong>Fund</strong> database.<br />

There is no guarantee the funds will achieve their objectives, and past<br />

performance is no guarantee <strong>of</strong> future returns. <strong>Fund</strong> values and investment<br />

returns will vary and principal values, when redeemed may be more or less<br />

than the original investment. The funds are not insured by the FDIC or by any<br />

other governmental agency; they are not obligations <strong>of</strong> the FDIC nor are they<br />

deposits or obligations <strong>of</strong> or guaranteed by the investment managers or their<br />

organizations.<br />

Pr<strong>of</strong>ile statistics are provided by Callan Associates Inc. Data such as portfolio<br />

statistics, sectors, and holdings is subject to change daily and is not<br />

guaranteed for accuracy or completeness.<br />

<strong>Index</strong> names may contain trademarks and are the exclusive property <strong>of</strong> their<br />

respective owners.<br />

Russell 1000® <strong>Growth</strong> <strong>Index</strong> – a growth style index that is a subset <strong>of</strong> the<br />

Russell 1000 <strong>Index</strong>, which measures performance <strong>of</strong> those Russell 1000<br />

companies with higher price-to-book ratios and higher forecasted growth<br />

values. (The Russell 1000 <strong>Index</strong> is made up <strong>of</strong> 1,000 <strong>of</strong> the largest companies<br />

within the Russell 3000® <strong>Index</strong> that comprises the 3,000 largest US equities<br />

by market value.)<br />

Investment options are <strong>of</strong>fered through a group variable annuity (Form<br />

900-GAQC-97) issued by United <strong>of</strong> <strong>Omaha</strong> Life Insurance Company, which<br />

accepts full responsibility for all <strong>of</strong> United's contractual obligations under the<br />

annuity but does not guarantee any contributions or investment returns except<br />

as provided in the annuity for the Guaranteed Account. Neither United <strong>of</strong><br />

<strong>Omaha</strong> nor its representatives or affiliates <strong>of</strong>fers legal or investment advice in

connection with the product. United <strong>of</strong> <strong>Omaha</strong> is not licensed in New York. In<br />

New York, services are provided by <strong>Mutual</strong> <strong>of</strong> <strong>Omaha</strong> Insurance Company. For<br />

specific information about your benefits, please refer to your Summary Plan<br />

Description.<br />

Because <strong>of</strong> the higher valuations/lower dividend yields <strong>of</strong> growth stocks, fund<br />

prices could decline further in down markets than non-growth-focused funds.<br />

Any foreign holdings would be subject to risks inherent in non-U.S. securities,<br />

including currency fluctuations.<br />

AFN39584_0607