Aberdeen Property Investors - Aberdeen Asset Management

Aberdeen Property Investors - Aberdeen Asset Management

Aberdeen Property Investors - Aberdeen Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Highlights of the year<br />

Sustained organic growth. In the financial year to<br />

30 September 2007:<br />

• <strong>Asset</strong>s under management (AuM) increased by 39%<br />

to €13.1 billion.<br />

• Revenues increased by 12% to €102.5 million.<br />

• We completed €4.3 billion of property transactions,<br />

predominantly new acquisitions for our funds.<br />

The acquisition of leading German fund manager DEGI at the<br />

end of December 2007* meant that we started 2008 with:<br />

• A greatly increased presence and client base in the<br />

strategically important German market.<br />

• AuM of some €20 billion with added expertise and<br />

economies of scale in fund management.<br />

<strong>Asset</strong>s in property funds increased from 27% to 48% of total<br />

AuM in the financial year and to some 65% including the<br />

DEGI property funds.<br />

Final closing of two funds of funds when they achieved their<br />

target sizes: AIPP Asia and AIPP.<br />

Launches of new funds:<br />

• A single-country fund: Russia.<br />

• Two new funds of funds: AIPP Asia Select and AIPP II.<br />

Scandinavian <strong>Property</strong> Development ASA made a strong start<br />

in 2007 towards its goal of becoming Scandinavia’s leading<br />

property development player.<br />

• Set up in January with its first investment of €600 million.<br />

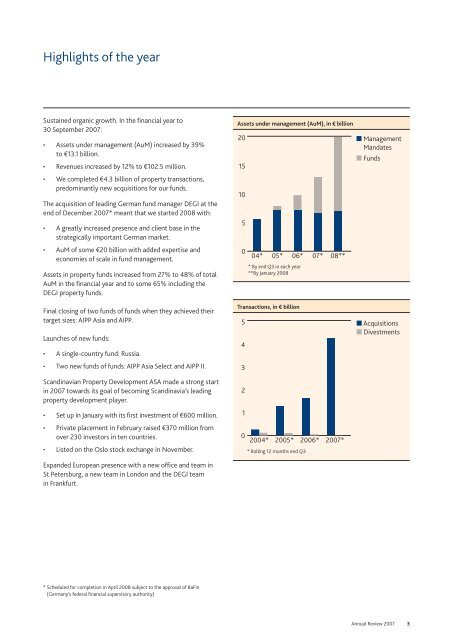

<strong>Asset</strong>s under management (AuM), in € billion<br />

20<br />

15<br />

10<br />

5<br />

0<br />

04*<br />

05*<br />

06*<br />

* By end Q3 in each year<br />

**By January 2008<br />

Transactions, in € billion<br />

5<br />

4<br />

3<br />

2<br />

1<br />

07*<br />

08**<br />

■ <strong>Management</strong><br />

Mandates<br />

■ Funds<br />

■ Acquisitions<br />

■ Divestments<br />

• Private placement in February raised €370 million from<br />

over 230 investors in ten countries.<br />

• Listed on the Oslo stock exchange in November.<br />

Expanded European presence with a new office and team in<br />

St Petersburg, a new team in London and the DEGI team<br />

in Frankfurt.<br />

0<br />

2004* 2005* 2006*<br />

* Rolling 12 months end Q3<br />

2007*<br />

* Scheduled for completion in April 2008 subject to the approval of BaFin<br />

(Germany’s federal financial supervisory authority)<br />

Annual Review 2007 3