Annual Report 2011 (Part I) - Wawasan TKH Holdings Berhad

Annual Report 2011 (Part I) - Wawasan TKH Holdings Berhad

Annual Report 2011 (Part I) - Wawasan TKH Holdings Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WAWASAN <strong>TKH</strong> HOLDINGS BERHAD (540218-A) • ANNUAL REPORT <strong>2011</strong><br />

041<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER <strong>2011</strong> (cont’d)<br />

4. SIGNIFICANT ACCOUNTING POLICIES (cont’d)<br />

4.3 Business combinations (cont’d)<br />

Business combinations before 1 January <strong>2011</strong> (cont’d)<br />

(a)<br />

reassess the identification and measurement of the acquiree’s identifiable assets, liabilities and<br />

contingent liabilities and the measurement of the cost of the business combination; and<br />

(b) recognise immediately in profit or loss any excess remaining after that reassessment.<br />

When a business combination includes more than one exchange transaction, any adjustment to the fair<br />

values of the subsidiary’s identifiable assets, liabilities and contingent liabilities relating to previously held<br />

interests of the Group is accounted for as a revaluation.<br />

4.4 Property, plant and equipment and depreciation<br />

All items of property, plant and equipment are initially measured at cost. Cost includes expenditure that<br />

is directly attributable to the acquisition of the asset.<br />

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as<br />

appropriate, only when the cost is incurred and it is probable that the future economic benefits associated<br />

with the asset will flow to the Group and the cost of the asset can be measured reliably. The carrying<br />

amount of parts that are replaced is derecognised. The costs of the day-to-day servicing of property,<br />

plant and equipment are recognised in profit or loss as incurred. Cost also comprises the initial estimate<br />

of dismantling and removing the asset and restoring the site on which it is located for which the Group is<br />

obligated to incur when the asset is acquired, if applicable.<br />

Each part of an item of property, plant and equipment with a cost that is significant in relation to the total<br />

cost of the asset and which has different useful life, is depreciated separately.<br />

After initial recognition, property, plant and equipment, except for land and buildings, are stated at cost<br />

less any accumulated depreciation and any accumulated impairment losses. The land and buildings are<br />

stated at valuation, which is the fair value at the date of revaluation less any subsequent accumulated<br />

depreciation and subsequent accumulated impairment losses.<br />

The land and buildings are revalued with sufficient regularity to ensure that the carrying amount does not<br />

differ materially from that which would be determined using fair value at the end of the reporting period.<br />

The surplus arising from such revaluations is credited to shareholders’ equity as a revaluation reserve,<br />

net of deferred tax, if any, and any subsequent deficit is offset against such surplus to the extent of a<br />

previous increase for the same property. In all other cases, the deficit will be charged to profit or loss. For<br />

a revaluation increase subsequent to a revaluation deficit of the same asset, the surplus is recognised as<br />

income to the extent that it reverses the deficit previously recognised as an expense with the balance of<br />

increase credited to revaluation reserve.<br />

At the commencement of the lease term, leasehold land classified as finance leases shall be recognised at<br />

amounts equal to the fair value of the leased property or, if lower, the present value of the minimum lease<br />

payments, each determined at the inception of the lease. Any initial direct costs are added to the amount<br />

recognised as an asset.<br />

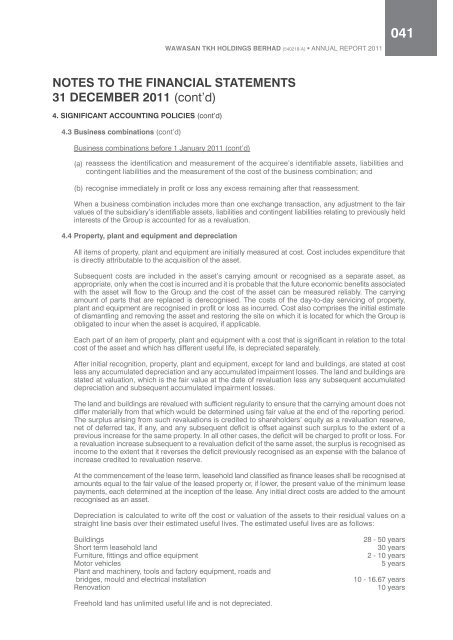

Depreciation is calculated to write off the cost or valuation of the assets to their residual values on a<br />

straight line basis over their estimated useful lives. The estimated useful lives are as follows:<br />

Buildings<br />

Short term leasehold land<br />

Furniture, fittings and office equipment<br />

Motor vehicles<br />

Plant and machinery, tools and factory equipment, roads and<br />

bridges, mould and electrical installation<br />

Renovation<br />

28 - 50 years<br />

30 years<br />

2 - 10 years<br />

5 years<br />

10 - 16.67 years<br />

10 years<br />

Freehold land has unlimited useful life and is not depreciated.