Scenario planning â how to find the right strategy at ... - Roland Berger

Scenario planning â how to find the right strategy at ... - Roland Berger

Scenario planning â how to find the right strategy at ... - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

06/2012<br />

Study<br />

In-depth knowledge for decision makers<br />

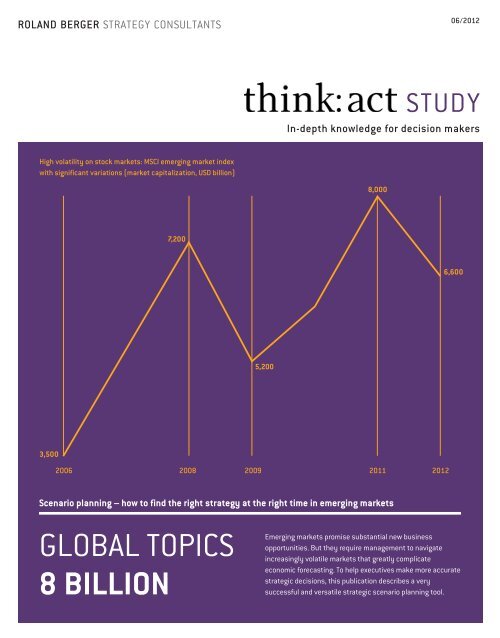

High vol<strong>at</strong>ility on s<strong>to</strong>ck markets: MSCI emerging market index<br />

with significant vari<strong>at</strong>ions (market capitaliz<strong>at</strong>ion, USD billion)<br />

8,000<br />

7,20 0<br />

6,600<br />

5,200<br />

3,500<br />

2006<br />

2008 2009 2011 2012<br />

<strong>Scenario</strong> <strong>planning</strong> – <strong>how</strong> <strong>to</strong> <strong>find</strong> <strong>the</strong> <strong>right</strong> <strong>str<strong>at</strong>egy</strong> <strong>at</strong> <strong>the</strong> <strong>right</strong> time in emerging markets<br />

global <strong>to</strong>pics<br />

8 billion<br />

Emerging markets promise substantial new business<br />

opportunities. But <strong>the</strong>y require management <strong>to</strong> navig<strong>at</strong>e<br />

increasingly vol<strong>at</strong>ile markets th<strong>at</strong> gre<strong>at</strong>ly complic<strong>at</strong>e<br />

economic forecasting. To help executives make more accur<strong>at</strong>e<br />

str<strong>at</strong>egic decisions, this public<strong>at</strong>ion describes a very<br />

successful and vers<strong>at</strong>ile str<strong>at</strong>egic scenario <strong>planning</strong> <strong>to</strong>ol.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

<strong>Scenario</strong>s <strong>planning</strong> can improve <strong>the</strong> forecasting of company-relevant<br />

trends in highly vol<strong>at</strong>ile markets like <strong>the</strong> au<strong>to</strong>motive industry.

Study 3<br />

global <strong>to</strong>pics<br />

8 billion<br />

<strong>Scenario</strong> <strong>planning</strong> – <strong>how</strong> <strong>to</strong> <strong>find</strong> <strong>the</strong> <strong>right</strong> <strong>str<strong>at</strong>egy</strong><br />

<strong>at</strong> <strong>the</strong> <strong>right</strong> time in emerging markets<br />

Introduction<br />

Guidance in uncertain times –<br />

<strong>Scenario</strong> <strong>planning</strong> step by step<br />

Conclusion<br />

p 4<br />

p 8<br />

p 20

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

introduction<br />

Highly sensitive, linked and vol<strong>at</strong>ile emerging markets<br />

complic<strong>at</strong>e forecasting considerably

Study 5<br />

"In emerging markets, vol<strong>at</strong>ility is <strong>the</strong> new normality.<br />

We cannot look more than three years ahead in <strong>the</strong>se countries."<br />

Siegfried Gänßlen, CEO of Hansgrohe, a leading German<br />

sanitary and fittings company<br />

Signs of more vol<strong>at</strong>ility are everywhere. The s<strong>to</strong>ck markets of<br />

emerging countries are one good example. Over <strong>the</strong> last five years,<br />

for instance, <strong>the</strong> Shanghai Composite moved between 1,500 and<br />

6,000 points, and EGX, Egypt's leading share price index, swung<br />

between 12,000 and 5,000 points. During this same period, oil<br />

prices fluctu<strong>at</strong>ed from USD 40 <strong>to</strong> 140 a barrel – a range exceeding<br />

250%. O<strong>the</strong>r commodities, such as raw m<strong>at</strong>erials from emerging<br />

markets and <strong>the</strong> developing world, also s<strong>how</strong> large price<br />

swings. For example, aluminum prices over <strong>the</strong> same five years<br />

ranged between USD 1,400 and 3,300 a <strong>to</strong>n, a difference of<br />

more than 100%.<br />

Vol<strong>at</strong>ility is found not only in <strong>the</strong> economic sphere, but in politics<br />

as well. A prime example here is <strong>the</strong> Arab world. Since <strong>the</strong><br />

Arab Spring began in January 2011, one country after <strong>the</strong> next has<br />

experienced some degree of upheaval. Foreign companies are<br />

uncertain about <strong>the</strong> consequences for <strong>the</strong>ir Middle East business<br />

and investments, which recently <strong>to</strong>taled USD 15 billion annually.<br />

f1 Given this vol<strong>at</strong>ility, managers <strong>find</strong> it increasingly difficult <strong>to</strong><br />

anticip<strong>at</strong>e <strong>how</strong> changes and trends could impact <strong>the</strong>ir business.<br />

Traditional foreign investment <strong>planning</strong> cycles of ten years or<br />

more are no longer feasible. Plans must be reviewed and revised<br />

<strong>at</strong> much shorter intervals.<br />

f2<br />

Wh<strong>at</strong> are successful companies<br />

doing differently<br />

As this book seeks <strong>to</strong> s<strong>how</strong>, emerging markets have enormous<br />

business potential. Emerging countries plan <strong>to</strong> invest a <strong>to</strong>tal<br />

of nearly USD 30 trillion in <strong>the</strong>ir B2B and B2C sec<strong>to</strong>rs over <strong>the</strong> next<br />

20 years, according <strong>to</strong> <strong>Roland</strong> <strong>Berger</strong> estim<strong>at</strong>es. These immense<br />

disbursements will improve <strong>the</strong> lives of millions of citizens across<br />

<strong>the</strong> world. But leveraging <strong>the</strong> full potential of <strong>the</strong>se investments<br />

can be achieved only by companies th<strong>at</strong> correctly position <strong>the</strong>ir<br />

str<strong>at</strong>egies.<br />

Companies must adapt skillfully <strong>to</strong> market movements. Rapid<br />

economic growth in China, for example, is turning many people<br />

in<strong>to</strong> millionaires. The number of Chinese households worth<br />

<strong>at</strong> least USD 1 million leapt by over 60% in 2010. China recorded<br />

1.1 million millionaire households th<strong>at</strong> year, considerably more<br />

than <strong>the</strong> 670,000 it had in 2009. Many of <strong>the</strong>se new millionaires<br />

prefer products th<strong>at</strong> c<strong>at</strong>er <strong>to</strong> <strong>the</strong>ir unique cultural tastes.<br />

Foreign companies now need <strong>to</strong> design and deliver products<br />

<strong>to</strong> s<strong>at</strong>isfy a more diverse cus<strong>to</strong>mer base.<br />

A good example is Hansgrohe, which wins plaudits for intern<strong>at</strong>ional<br />

competitiveness based on high-style, high-quality minimalist

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

F1<br />

A consequence of <strong>the</strong> high vol<strong>at</strong>ility is<br />

th<strong>at</strong> traditional <strong>planning</strong> cycles are no<br />

longer any good. Forecasts of business<br />

experts also differ significantly<br />

Global GDP growth, 2000 -2011 (%)<br />

4.8<br />

IMF<br />

4.5<br />

IMF<br />

5.4<br />

IMF<br />

2007<br />

2000<br />

2005<br />

2011<br />

3.9<br />

IMF<br />

2001<br />

2.9<br />

Consensus<br />

2.4<br />

IMF<br />

Time horizons of traditional corpor<strong>at</strong>e <strong>planning</strong>, 2000 – 2011<br />

Str<strong>at</strong>egic <strong>planning</strong><br />

Traditional organiz<strong>at</strong>ional structure<br />

Medium-term <strong>planning</strong><br />

Oper<strong>at</strong>ional <strong>planning</strong><br />

10 years<br />

5-7 years<br />

3-5 years<br />

1 year<br />

2009<br />

-0.6<br />

IMF<br />

Source: IMF, <strong>Roland</strong> <strong>Berger</strong>

Study 7<br />

F2<br />

Emerging countries plan <strong>to</strong> invest a <strong>to</strong>tal of nearly USD 30 trillion<br />

in <strong>the</strong>ir B2B and B2C sec<strong>to</strong>rs over <strong>the</strong> next 20 years, according<br />

<strong>to</strong> <strong>Roland</strong> <strong>Berger</strong> estim<strong>at</strong>es<br />

USD<br />

30,000,<br />

000,000,000<br />

faucet designs. But after entering China, <strong>the</strong> company soon<br />

discovered th<strong>at</strong> Chinese homeowners do not favor sleek and trim<br />

faucets. They want very visible, substantial handles and bodies.<br />

After some in-house soul-searching, Hansgrohe designed a line of<br />

heavyweight mixers exclusively for China. These b<strong>at</strong>hroom fixtures<br />

are now marketed very successfully <strong>to</strong> Chinese homeowners, but<br />

<strong>the</strong>y don't fe<strong>at</strong>ure in <strong>the</strong> product c<strong>at</strong>alog outside China.<br />

When <strong>planning</strong> <strong>to</strong> enter emerging markets, successful companies<br />

respond <strong>to</strong> trends outside <strong>the</strong>ir core industry. Siemens serves as<br />

an excellent example of <strong>how</strong> <strong>to</strong> derive <strong>str<strong>at</strong>egy</strong> from meg<strong>at</strong>rends.<br />

The company set up a dedic<strong>at</strong>ed department for sustainable urban<br />

development. By tracking and analyzing broad long-term trends,<br />

such as popul<strong>at</strong>ion change and urbaniz<strong>at</strong>ion, Siemens became a<br />

global pioneer in sustainable urban development, especially<br />

among emerging and developing countries. Siemens also bet on<br />

higher emerging market demand for cheap and easy <strong>to</strong> use SMART<br />

products: Simple, Maintenance-friendly, Affordable, Reliable<br />

and Timely <strong>to</strong> market. With <strong>the</strong>se design principles, <strong>the</strong>y design<br />

products pitched <strong>to</strong> <strong>the</strong> needs of newly industrializing and<br />

developing countries. A good example is portable X-ray equipment,<br />

which is now indispensable for doc<strong>to</strong>rs in Africa practicing in<br />

clinics distributed across a large geographical area.<br />

Wh<strong>at</strong> are <strong>the</strong> risks<br />

However, if executives do not correctly interpret emerging and<br />

developing economy market conditions, companies may<br />

experience difficulties. According <strong>to</strong> <strong>Roland</strong> <strong>Berger</strong> estim<strong>at</strong>es,<br />

German companies investing in emerging markets with <strong>the</strong> wrong<br />

<strong>str<strong>at</strong>egy</strong> miss potential revenues of several USD 100 million<br />

a year. Wh<strong>at</strong>'s more, industrialized countries will <strong>find</strong> <strong>the</strong>ir<br />

innov<strong>at</strong>ive edge quickly dulled if <strong>the</strong>y miss <strong>to</strong>morrow's trends.<br />

Asia's au<strong>to</strong>motive industry has already leapt over several<br />

development stages in a single bound <strong>to</strong> domin<strong>at</strong>e b<strong>at</strong>tery<br />

technology, a critical e-mobility component. Chinese, Indian and<br />

Arab companies increasingly bid for European and American<br />

acquisitions. In 2011, for <strong>the</strong> first time, Europe was <strong>the</strong> <strong>to</strong>p<br />

destin<strong>at</strong>ion for Chinese direct investment, <strong>to</strong>taling<br />

USD 10.4 billion.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

Guidance in uncertain<br />

times – <strong>Scenario</strong> <strong>planning</strong><br />

step by step<br />

An approach th<strong>at</strong> guides companies <strong>to</strong> str<strong>at</strong>egic success

Study 9<br />

Wh<strong>at</strong> approach can guide companies<br />

<strong>to</strong> success in uncertain times<br />

Changes in <strong>the</strong> macro environment outside of a company's<br />

industry, such as political, social, ecological, economic or<br />

technological developments, often play a decisive role in <strong>the</strong><br />

success of <strong>the</strong> company's business model. A holistic perspective<br />

is <strong>the</strong>refore strongly recommended <strong>to</strong> incorpor<strong>at</strong>e macroenvironment<br />

fac<strong>to</strong>rs in a flexible str<strong>at</strong>egic plan.<br />

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants collabor<strong>at</strong>ed with HHL Leipzig<br />

<strong>to</strong> design a scenario <strong>planning</strong> methodology th<strong>at</strong> can give companies<br />

faster and earlier warning about important macroenvironment<br />

events, trends and changes. This analytical method<br />

works like radar <strong>to</strong> track movements far beyond a company and<br />

its industry. The methodology can detect "weak signal" influences<br />

th<strong>at</strong> typically only become evident in <strong>the</strong> long run. "Blind spots"<br />

th<strong>at</strong> are hidden in companies preoccupied by internal perspectives<br />

become transparent. To develop this holistic view, our scenario<br />

<strong>planning</strong> analytic techniques take in<strong>to</strong> account <strong>the</strong> opinions of<br />

many internal and external stakeholders.<br />

<strong>Scenario</strong> <strong>planning</strong> is an appropri<strong>at</strong>e <strong>to</strong>ol for global companies in<br />

all industries – whe<strong>the</strong>r au<strong>to</strong>motive or pharmaceuticals, manufacturing<br />

or services, avi<strong>at</strong>ion or energy utilities – th<strong>at</strong> wish <strong>to</strong><br />

position <strong>the</strong>mselves successfully in emerging and developing<br />

countries.<br />

Our method for developing key future scenarios involves<br />

five core steps.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

1. Defining<br />

<strong>the</strong> scope<br />

The first step defines <strong>the</strong> project focus, <strong>the</strong> markets <strong>to</strong> develop<br />

scenarios for and <strong>the</strong> time frame. To illustr<strong>at</strong>e in general<br />

terms <strong>how</strong> <strong>the</strong> process works, we will use a recent scenario<br />

<strong>planning</strong> study from <strong>the</strong> global manufacturing industry.<br />

"Manufacturing industry" here refers <strong>to</strong> a wide spectrum of<br />

sec<strong>to</strong>rs, from mining and chemicals <strong>to</strong> metals manufacturing<br />

and m<strong>at</strong>erials fabric<strong>at</strong>ion.<br />

f3 Manufacturing sec<strong>to</strong>rs are surging ahead in many emerging<br />

economies. Over <strong>the</strong> past five years, <strong>the</strong>ir share of global<br />

manufacturing output climbed from 30% <strong>to</strong> 50%. Annual revenues<br />

now reach around USD 20 trillion. 1 Emerging economy governments<br />

recognize <strong>the</strong> special importance of a manufacturing base.<br />

Not only does industry employ a significant share of <strong>the</strong>ir<br />

labor force, but it also supplies str<strong>at</strong>egically important products<br />

<strong>to</strong> improve critical sec<strong>to</strong>rs such as <strong>the</strong> n<strong>at</strong>ional infrastructure.<br />

How a country's manufacturing industry will evolve is clearly<br />

str<strong>at</strong>egically relevant <strong>to</strong> foreign producers and suppliers seeking<br />

<strong>to</strong> enter and expand in emerging markets. But manufacturing's<br />

diversity presents a challenge for developing coherent manufacturing<br />

industry scenarios. To tackle this challenge, <strong>Roland</strong> <strong>Berger</strong><br />

Str<strong>at</strong>egy Consultants has defined a set of scenarios and<br />

appropri<strong>at</strong>e business opportunities within <strong>the</strong> general manufacturing<br />

industry. The concept development was grounded in <strong>the</strong><br />

cus<strong>to</strong>mer and industry needs and trends of 2020 and fac<strong>to</strong>red in<br />

input from internal stakeholders and external experts.<br />

F3<br />

Manufacturing sec<strong>to</strong>rs are surging ahead in many<br />

emerging economies. Over <strong>the</strong> past five years, <strong>the</strong>ir share<br />

of global manufacturing output climbed from 30% <strong>to</strong> 50%<br />

2012<br />

50%<br />

2007<br />

30%<br />

1) IHS Global Insight (2012) Source: IHS Global Insight

Study 11<br />

2. Selecting<br />

stakeholders<br />

3. Conducting<br />

<strong>the</strong> survey<br />

<strong>Scenario</strong> <strong>planning</strong> can help companies better anticip<strong>at</strong>e <strong>how</strong><br />

macro-environment events could affect future performance and<br />

business opportunities. A key initial step is <strong>to</strong> canvass <strong>the</strong> views<br />

and opinions of <strong>the</strong> most important internal stakeholders, such<br />

as board members, <strong>to</strong>p executives, key str<strong>at</strong>egic and managerial<br />

staff, and industry experts. When assessing emerging country<br />

markets, we also identify appropri<strong>at</strong>e external stakeholders and<br />

market experts, such as politicians, members of <strong>the</strong> chamber of<br />

commerce or local cus<strong>to</strong>mers and suppliers. Identifying and<br />

accessing <strong>the</strong> most knowledgeable individuals may not proceed<br />

as efficiently as in familiar or advanced markets, but <strong>the</strong>ir voices<br />

are critically important. It's also advisable <strong>to</strong> interview people<br />

who work <strong>at</strong> competi<strong>to</strong>rs. One leading German electronics group,<br />

for example, always <strong>at</strong>tempts <strong>to</strong> talk with local competi<strong>to</strong>rs' staff<br />

before launching oper<strong>at</strong>ions in a newly industrializing country.<br />

Plant visits can also offer valuable insights in<strong>to</strong> local conditions.<br />

In our survey, we approach a broad range of stakeholders and<br />

generally 40 <strong>to</strong> 50 respondents particip<strong>at</strong>e.<br />

To illustr<strong>at</strong>e <strong>how</strong> we conduct <strong>the</strong> survey and apply its <strong>find</strong>ings <strong>to</strong><br />

cre<strong>at</strong>e key scenarios, we'll refer <strong>to</strong> <strong>the</strong> previously mentioned<br />

global manufacturing industry study. We start by using <strong>Roland</strong><br />

<strong>Berger</strong>'s "360° stakeholder feedback questionnaire" <strong>to</strong> identify<br />

those fac<strong>to</strong>rs most likely <strong>to</strong> affect <strong>the</strong> global manufacturing<br />

industry. First, we list influencing fac<strong>to</strong>rs along <strong>the</strong> so-called STEEP<br />

dimensions – Social, Technological, Economic, Environmental and<br />

Political/legal – and develop a questionnaire about <strong>the</strong>m. We <strong>the</strong>n<br />

distribute this questionnaire <strong>to</strong> internal stakeholders (across<br />

functions) and external experts (e.g. from local industry, think<br />

tanks, academia, etc.) across critical manufacturing sec<strong>to</strong>rs<br />

and geographical loc<strong>at</strong>ions. The respondents identify 40 <strong>to</strong> 50<br />

separ<strong>at</strong>e influencing fac<strong>to</strong>rs, which are <strong>the</strong>n clustered in a second<br />

survey <strong>to</strong> score each fac<strong>to</strong>r in terms of two key criteria:<br />

Impact – How significant<br />

is <strong>the</strong> influencing fac<strong>to</strong>r<br />

in a global context<br />

Certainty – Wh<strong>at</strong> is <strong>the</strong><br />

probability <strong>the</strong> influencing<br />

fac<strong>to</strong>r will occur

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

4.<br />

Detecting weak signals<br />

and blind spots<br />

The next step is <strong>to</strong> compare internal and external stakeholders'<br />

assessments and consolid<strong>at</strong>e <strong>find</strong>ings. All fac<strong>to</strong>rs th<strong>at</strong> s<strong>how</strong><br />

potentially significant influence are identified, paying particular<br />

<strong>at</strong>tention <strong>to</strong> "weak signals" and "blind spots".<br />

"Weak signals" are trends only a few stakeholders mention in <strong>the</strong><br />

first survey, but nearly all second-round respondents r<strong>at</strong>e as<br />

fac<strong>to</strong>rs th<strong>at</strong> could become highly relevant <strong>to</strong> a company's future<br />

performance. For example, <strong>the</strong> global manufacturing study<br />

detected th<strong>at</strong> companies gre<strong>at</strong>ly underestim<strong>at</strong>e <strong>the</strong> importance<br />

of securing access <strong>to</strong> rare earth metals. Future demand will be<br />

enormous. The industry already uses around 130,000 <strong>to</strong>ns per<br />

year of <strong>the</strong>se rare metals worldwide. Neodymium and yttrium, for<br />

example, are particularly important in electric car b<strong>at</strong>teries and<br />

engines. Rising use of <strong>the</strong>se m<strong>at</strong>erials is also boosted by<br />

electronic equipment like fl<strong>at</strong>-screen televisions and industrial<br />

superconduc<strong>to</strong>rs. Analysts predict th<strong>at</strong> demand will reach<br />

190,000 <strong>to</strong>ns in 2015. To meet th<strong>at</strong> demand, Europe is highly<br />

dependent on maintaining good rel<strong>at</strong>ionships with supplier<br />

countries, notably China.<br />

"Blind spots" are differences in <strong>how</strong> internal and external<br />

stakeholders interpret a fac<strong>to</strong>r's importance. For example,<br />

our pharmaceutical and au<strong>to</strong>motive sec<strong>to</strong>r studies s<strong>how</strong><br />

th<strong>at</strong> when management gives excessive <strong>at</strong>tention <strong>to</strong> internal<br />

perceptions and preoccup<strong>at</strong>ions, important market<br />

opportunities may be missed.<br />

A recent pharmaceutical industry survey of all stakeholders<br />

detected insufficient in-house appreci<strong>at</strong>ion of biosimilars. These<br />

are bioengineered follow-on drugs officially approved after <strong>the</strong><br />

original drug's p<strong>at</strong>ent has expired. Experts predict <strong>the</strong> biosimilar<br />

market, with <strong>to</strong>tal sales of USD 400 million in 2010, will grow in<br />

four years <strong>to</strong> USD 2 or 3 billion. 2 The reason why biosimilars are<br />

an exciting option for <strong>the</strong> pharmaceutical industry is th<strong>at</strong><br />

more and more emerging countries will demand and have <strong>the</strong><br />

resources <strong>to</strong> pay for improved healthcare. The trends are already<br />

apparent. Over <strong>the</strong> past five years, per capita health spending<br />

in <strong>the</strong> BRIC countries rose by USD 87. In absolute terms,<br />

this means people purchased an additional USD 252 billion 3<br />

in healthcare services.<br />

Our survey of <strong>the</strong> au<strong>to</strong>motive sec<strong>to</strong>r discovered ano<strong>the</strong>r blind spot:<br />

some managers severely underestim<strong>at</strong>e <strong>the</strong> market potential of<br />

simpler, more affordable vehicles. In India, small or economy<br />

cars account for over 70% of all new vehicle registr<strong>at</strong>ions. Ano<strong>the</strong>r<br />

internal misperception was a failure <strong>to</strong> appreci<strong>at</strong>e emerging<br />

economy manufacturers' competitive strengths. Over <strong>the</strong> last five<br />

years, passenger car production in developed countries decreased<br />

by 2% annually <strong>to</strong> 32 million, but in developing countries, car<br />

assembly doubled from 16 <strong>to</strong> 32 million cars. Emerging market<br />

manufacturers now also venture in<strong>to</strong> European terri<strong>to</strong>ry:<br />

Gre<strong>at</strong> Wall Mo<strong>to</strong>rs will be <strong>the</strong> first Chinese au<strong>to</strong>maker <strong>to</strong><br />

assemble cars in <strong>the</strong> European Union when <strong>the</strong> company opens<br />

a car manufacturing plant in Bulgaria. The plant will have an<br />

annual production capacity of 50,000 units and assemble four<br />

different models – a sports utility vehicle (SUV), a pickup and<br />

two passenger car models – which are all expected <strong>to</strong> be sold in<br />

<strong>the</strong> European Union.<br />

Qoros, a Chinese brand previously unknown in Germany, recently<br />

announced plans <strong>to</strong> sell cars in Europe. Starting in mid-2013,<br />

some 150,000 vehicles will roll off Qoros production lines and<br />

capacity will ramp up <strong>to</strong> double <strong>the</strong> output within <strong>the</strong> next few<br />

years. The company intends <strong>to</strong> earn half its revenue in Europe.<br />

These examples s<strong>how</strong> <strong>how</strong> European-based companies may<br />

miss market opportunities and lose revenue if <strong>the</strong>y concentr<strong>at</strong>e<br />

<strong>to</strong>o intently on internal opinions and priorities.<br />

2) Global Industry Analysts (2010) 3) Euromoni<strong>to</strong>r (2011)

Study 13<br />

5. Deriving<br />

scenarios<br />

To illustr<strong>at</strong>e this step, we return <strong>to</strong> our study of <strong>the</strong> global<br />

manufacturing industry. Based on stakeholder evalu<strong>at</strong>ions, <strong>the</strong><br />

fac<strong>to</strong>rs th<strong>at</strong> influence global manufacturing can be alloc<strong>at</strong>ed<br />

in<strong>to</strong> <strong>the</strong> following c<strong>at</strong>egories:<br />

F4<br />

Influencing fac<strong>to</strong>rs are c<strong>at</strong>egorized<br />

by potential impact and certainty<br />

High<br />

Critical uncertainties<br />

or weak signals (low certainty but highest<br />

impact on <strong>the</strong> scenarios)<br />

Definite trends*<br />

(high certainty, high impact)<br />

Potential<br />

impact<br />

Secondary elements<br />

These elements elements are elimin<strong>at</strong>ed<br />

(low impact)<br />

LOW<br />

LOW<br />

Certainty<br />

high<br />

*<br />

Definite trends:<br />

Growth of developing countries as end-use<br />

markets (e.g. China and India)<br />

Use of nanotechnology, mini<strong>at</strong>uriz<strong>at</strong>ion<br />

and microelectronics<br />

Transition <strong>to</strong> lightweight m<strong>at</strong>erials (e.g. composites)<br />

Source: <strong>Roland</strong> <strong>Berger</strong>

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

F5<br />

<strong>Scenario</strong> building process following<br />

a step-by-step approach<br />

Long list of relevant<br />

uncertainties<br />

Uncertain<br />

Yes Cluster by<br />

Yes Build scenario<br />

Trends<br />

Yes<br />

common<br />

m<strong>at</strong>rix using key<br />

stable in<br />

<strong>the</strong>me<br />

uncertainties<br />

each future<br />

Move <strong>to</strong> trend<br />

No No No<br />

Check importance<br />

of "un-clustered"<br />

uncertainty<br />

Important uncertainty<br />

Re-cut dimensions<br />

Re-cut common<br />

<strong>the</strong>mes & scenario<br />

dimensions<br />

Source: <strong>Roland</strong> <strong>Berger</strong><br />

We found th<strong>at</strong> resource intensity and economic protectionism are<br />

<strong>the</strong> major key uncertainties likely <strong>to</strong> have <strong>the</strong> largest impact<br />

across <strong>the</strong> entire industrial sec<strong>to</strong>r. These uncertainties become<br />

<strong>the</strong> scenario m<strong>at</strong>rix axes pictured in figures 5 and 6.<br />

M<strong>at</strong>rix dimension: resource intensity<br />

Resource intensity refers <strong>to</strong> <strong>the</strong> level of n<strong>at</strong>ural resource<br />

consumption, such as <strong>the</strong> use of metals or w<strong>at</strong>er. Government<br />

subsidies and regul<strong>at</strong>ions can substantially determine an<br />

in dustrial economy's resource intensity, and consumer pre f-<br />

erences for green and sustainable products play a role as well.<br />

Impact of <strong>the</strong> resource intensity dimension<br />

Resource intensity exerts considerable influence on product<br />

development, production processes and end-product handling.<br />

New altern<strong>at</strong>ive m<strong>at</strong>erials and more economical production<br />

technologies may ease future resource constraints. But this<br />

possibility doesn't neg<strong>at</strong>e <strong>the</strong> substantial his<strong>to</strong>rical and continuing<br />

investment in large-scale manufacturing using conventional<br />

technologies and energy sources.

Study 15<br />

F6<br />

Four major future scenarios for <strong>the</strong> global<br />

manufacturing industry<br />

High protectionism<br />

Protectionism<br />

(incl. trade blocs)<br />

Compliance with green<br />

regul<strong>at</strong>ions but no level<br />

playing field<br />

Cus<strong>to</strong>mer-driven mfg.<br />

aligned with domestic<br />

demand<br />

Low resource intensity<br />

I<br />

Antagonistic<br />

age<br />

II<br />

Polarized<br />

world<br />

High resource intensity<br />

Globaliz<strong>at</strong>ion restrained<br />

by n<strong>at</strong>ional interests<br />

Poor compliance with<br />

green/waste regul<strong>at</strong>ions<br />

Manufacturing close<br />

<strong>to</strong> demand<br />

Free movement<br />

of goods and ideas<br />

Collective emphasis<br />

on sustainability and<br />

waste reduction<br />

Modular mfg. with made<strong>to</strong>-order<br />

products<br />

IV<br />

Green<br />

capitalism<br />

III<br />

Squandering<br />

society<br />

Free trade, incl. thre<strong>at</strong>s<br />

of dumping<br />

Low sustainability<br />

awareness – focus on<br />

personal utility<br />

Mass production with<br />

homogeneous products<br />

Source: <strong>Roland</strong> <strong>Berger</strong><br />

Low protectionism<br />

M<strong>at</strong>rix dimension: protectionism<br />

Protectionism refers <strong>to</strong> market-dis<strong>to</strong>rting mechanisms, such as<br />

duties, tariffs and foreign ownership restrictions th<strong>at</strong> n<strong>at</strong>ions and<br />

regions apply <strong>to</strong> advance <strong>the</strong>ir own trade interests and economic<br />

agendas. These techniques seek <strong>to</strong> preserve critical resources and<br />

can extend <strong>to</strong> intellectual property, p<strong>at</strong>ent protection and, more<br />

dram<strong>at</strong>ically, industrial espionage.<br />

These two key uncertainties, protectionism and resource<br />

intensity, let us explore comprehensive scenario s<strong>to</strong>rylines. We<br />

will now consider four plausible scenarios by valid<strong>at</strong>ing trends and<br />

describing scenario dimensions in more detail, with particular<br />

<strong>at</strong>tention <strong>to</strong> <strong>how</strong> companies in developed countries might enter<br />

emerging markets.<br />

Impact of <strong>the</strong> protectionism dimension<br />

Economic protectionism significantly influences global markets,<br />

and frequently complic<strong>at</strong>es production and logistics.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

An antagonistic age of low resource<br />

intensity and high protectionism<br />

In this vision of <strong>the</strong> future, countries with abundant raw m<strong>at</strong>erials<br />

focus on production technologies, while those without, such<br />

as those in Western Europe, design or develop altern<strong>at</strong>ives. Novel<br />

m<strong>at</strong>erials are designed for specific applic<strong>at</strong>ions and scientists<br />

cre<strong>at</strong>e a new periodic table of nanom<strong>at</strong>erials. Industrialized and<br />

high-tech regions of Western Europe, North America and Australia<br />

benefit most from <strong>the</strong>se developments because <strong>the</strong>y can leverage<br />

and exchange <strong>the</strong>ir valuable expertise and skills for commodities.<br />

This defines trade flows with such emerging markets as China and<br />

Brazil. Winning industries include energy, especially those<br />

companies th<strong>at</strong> can produce green energy, due <strong>to</strong> rising demand<br />

for renewables from equipment manufacturers. Micro-gener<strong>at</strong>ion<br />

and co-gener<strong>at</strong>ion technologies are particularly important.<br />

High protectionist barriers make it very difficult for European hightech<br />

companies <strong>to</strong> penetr<strong>at</strong>e emerging markets. The au<strong>to</strong>motive<br />

industry sees a boost in demand for electric cars. But as cars are<br />

no longer sold globally, major car exporting n<strong>at</strong>ions like Germany<br />

and <strong>the</strong> US lose substantial market share across Asia and L<strong>at</strong>in<br />

America. Resource constraints and environmental protection hit<br />

<strong>the</strong> cement and energy sec<strong>to</strong>rs particularly hard.<br />

Complying with regional environmental standards<br />

<strong>to</strong> s<strong>at</strong>isfy regul<strong>at</strong>ions<br />

Securing access <strong>to</strong> n<strong>at</strong>ural resources<br />

(or cooper<strong>at</strong>ing with organiz<strong>at</strong>ions for indirect access)<br />

Leveraging expert know-<strong>how</strong> and innov<strong>at</strong>ive<br />

technologies <strong>to</strong> develop substitute m<strong>at</strong>erials<br />

Attracting and retaining well-educ<strong>at</strong>ed human capital<br />

with emerging market expertise<br />

Forging str<strong>at</strong>egic trade rel<strong>at</strong>ions with local<br />

emerging market suppliers

Study 17<br />

A polarized world with high resource<br />

intensity and high protectionism<br />

Enterprises in resource-rich countries prosper <strong>at</strong> <strong>the</strong> expense of<br />

large multin<strong>at</strong>ionals. This shift in economic power leaves resourcepoor<br />

economies such as Western Europe and Japan scrambling<br />

<strong>to</strong> source raw m<strong>at</strong>erials. Countries with n<strong>at</strong>ural resources focus on<br />

production technologies, while resource-poor countries design<br />

and develop altern<strong>at</strong>ive m<strong>at</strong>erials. Resource-rich regions,<br />

especially those with large regional markets and technologically<br />

advanced economies, flourish. These include North America, China,<br />

India, Russia, Brazil, Australia and <strong>the</strong> Middle East. But Japan<br />

and Western Europe lose out in this future vision because high<br />

protectionism inhibits trade in resources.<br />

Developing regions' demand for steel and cement soars as<br />

countries pursue ambitious agendas <strong>to</strong> modernize infrastructures<br />

and c<strong>at</strong>ch up with <strong>the</strong> developed world. Substantial chemical<br />

production shifts <strong>to</strong> China, Russia and <strong>the</strong> Middle East as<br />

manufacturers move closer <strong>to</strong> cus<strong>to</strong>mers and markets. Due <strong>to</strong><br />

high protectionism, developed n<strong>at</strong>ion manufacturers <strong>find</strong> it<br />

difficult <strong>to</strong> install production facilities in <strong>the</strong> new emerging<br />

markets.<br />

Energy remains a core industry domin<strong>at</strong>ed by fossil fuels. The<br />

mining sec<strong>to</strong>r invests in underground extraction as minerals<br />

become harder and harder <strong>to</strong> <strong>find</strong>. The au<strong>to</strong>motive sec<strong>to</strong>r suffers<br />

from market fragment<strong>at</strong>ion, and protectionism signals <strong>the</strong> end<br />

of global brand cars like <strong>the</strong> Ford Focus. European manufacturers<br />

lose significant market share as emerging countries focus on<br />

regional car brands.<br />

Securing access <strong>to</strong> n<strong>at</strong>ural resources<br />

(or cooper<strong>at</strong>ing with organiz<strong>at</strong>ions for indirect access)<br />

Optimizing costs by exploiting resources cost-effectively<br />

<strong>to</strong> ensure competitively priced products<br />

Restructuring oper<strong>at</strong>ions (incl. small-scale plants)<br />

<strong>to</strong> supply local/regional markets<br />

Forging str<strong>at</strong>egic rel<strong>at</strong>ions with local emerging market<br />

suppliers <strong>to</strong> provide technologies and services for<br />

<strong>the</strong> booming infrastructure sec<strong>to</strong>r<br />

Taking marketing actions <strong>to</strong> establish a regional brand<br />

among emerging market suppliers

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

A squandering society with high resource<br />

intensity and low protectionism<br />

Developed n<strong>at</strong>ions can potentially profit by supporting emerging<br />

n<strong>at</strong>ions' efforts <strong>to</strong> mass-produce low-cost goods. A particularly<br />

apt example is Siemens' SMART product line. In this scenario,<br />

more global <strong>at</strong>tention is paid <strong>to</strong> "reverse innov<strong>at</strong>ion", inventions<br />

cre<strong>at</strong>ed in developing countries and dissemin<strong>at</strong>ed <strong>to</strong> <strong>the</strong><br />

industrialized world. An example is <strong>the</strong> T<strong>at</strong>a Nano au<strong>to</strong>mobile,<br />

upgraded for Western markets and marketed as T<strong>at</strong>a Europe.<br />

Gigantic, complex supply chains cre<strong>at</strong>e immense business value<br />

for companies th<strong>at</strong> have <strong>the</strong> capability <strong>to</strong> orchestr<strong>at</strong>e <strong>the</strong>se<br />

chains and delay cus<strong>to</strong>miz<strong>at</strong>ion. Technology companies th<strong>at</strong> can<br />

"glue" <strong>the</strong> manufacturing economy <strong>to</strong>ge<strong>the</strong>r will increasingly<br />

capture value. Large-scale fossil fuel power plants still domin<strong>at</strong>e<br />

<strong>the</strong> energy sec<strong>to</strong>r, driving open-pit mining for coal and more<br />

exploit<strong>at</strong>ion of resources in Africa. Gas guzzlers domin<strong>at</strong>e<br />

<strong>the</strong> au<strong>to</strong>motive landscape. Millions of first-time car buyers in<br />

<strong>the</strong> emerging markets of China and India crave prestige cars<br />

from <strong>the</strong> West. Western manufacturers are able <strong>to</strong> exploit<br />

this lucr<strong>at</strong>ive market. Electric vehicle technology transfers<br />

from developed <strong>to</strong> developing countries, only <strong>to</strong> languish in a<br />

niche existence. Industrialized n<strong>at</strong>ions' renewable energy<br />

solutions take a backse<strong>at</strong>, as do micro energy gener<strong>at</strong>ion<br />

technologies.<br />

Setting up local R&D facilities <strong>to</strong> fulfill cus<strong>to</strong>mer needs<br />

and ensure know-<strong>how</strong> transfer<br />

Guaranteeing access <strong>to</strong> well-educ<strong>at</strong>ed personnel with local<br />

market know-<strong>how</strong> <strong>to</strong> develop innov<strong>at</strong>ive products and solutions<br />

Developing mass production capabilities <strong>to</strong> address<br />

emerging market demand<br />

Optimizing costs <strong>to</strong> offer competitively priced products<br />

Setting up a global supply chain <strong>to</strong> guarantee delivery<br />

of Western products like prestige cars <strong>to</strong> emerging markets<br />

and also <strong>to</strong> market reverse innov<strong>at</strong>ions back <strong>to</strong><br />

industrialized n<strong>at</strong>ions

Study 19<br />

Capitalism goes green with low resource<br />

intensity and low protectionism<br />

Developed economies pursue strong market opportunities in a<br />

low protectionist environment conducive <strong>to</strong> foreign direct<br />

investment and knowledge transfer. There is high uptake in <strong>the</strong><br />

renewable energy sec<strong>to</strong>r, which benefits developed country<br />

providers and equipment manufacturers. Micro energy gener<strong>at</strong>ion<br />

technologies are widespread. With <strong>the</strong> required infrastructure<br />

in place, electric vehicles are prevalent. Western companies have<br />

<strong>the</strong> opportunity <strong>to</strong> export <strong>the</strong>ir car technologies <strong>to</strong> emerging<br />

markets. Novel m<strong>at</strong>erials are designed for specific uses and<br />

environments. Additive manufacturing moves out of niche<br />

applic<strong>at</strong>ions in<strong>to</strong> mainstream manufacturing. Increased use of<br />

steel and glass, especially in buildings, lowers demand for cement.<br />

A potentially large market develops for Western construction<br />

companies. The regional winners will be Western Europe, North<br />

America, Japan, Brazil, India and China.<br />

This future also sees an end <strong>to</strong> rising energy demand as fossil fuel<br />

power gener<strong>at</strong>ion declines. Traditional Middle East fossil fuel<br />

economies are <strong>the</strong> losers in this scenario. Western dependence<br />

on oil-exporting countries such as Iran decreases significantly.<br />

Green capitalism stresses <strong>the</strong> mining industry as substitutes are<br />

found and consumers lobby against excessive and destructive<br />

mining practices.<br />

Complying with environmental standards <strong>to</strong> s<strong>at</strong>isfy<br />

regul<strong>at</strong>ions and consumer requirements<br />

Setting up local R&D facilities <strong>to</strong> fulfill cus<strong>to</strong>mer needs<br />

and ensure know-<strong>how</strong> transfer<br />

Securing access <strong>to</strong> well-educ<strong>at</strong>ed personnel <strong>to</strong> develop<br />

innov<strong>at</strong>ive products and solutions, such as lightweight<br />

m<strong>at</strong>erials and biodegradable components<br />

Instituting a green product life cycle, including a<br />

green global supply chain<br />

Adopting a modular manufacturing philosophy with<br />

made-<strong>to</strong>-order production

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

Conclusion<br />

How <strong>to</strong> benefit from <strong>the</strong> different scenarios

Study 21<br />

Trying <strong>to</strong> identify business opportunities in an uncertain future is<br />

a <strong>to</strong>ugh challenge. But <strong>the</strong> scenario <strong>planning</strong> designed by HHL<br />

Leipzig and <strong>Roland</strong> <strong>Berger</strong> helps str<strong>at</strong>egic planners and decisionmakers<br />

identify <strong>the</strong> most relevant future scenarios in specific<br />

industries and regions.<br />

Each of <strong>the</strong> four scenarios described for <strong>the</strong> global manufacturing<br />

industry represents an extreme vision of <strong>the</strong> future. The world may<br />

never resemble any of <strong>the</strong>se positions exactly, but <strong>the</strong> trends and<br />

issues identified in each will shape <strong>the</strong> eventual outcomes.<br />

Industries in any region could exhibit characteristics from different<br />

scenarios depending on <strong>how</strong> protectionism and resource intensity<br />

affect industry-specific dynamics. Companies from developed<br />

n<strong>at</strong>ions will succeed if <strong>the</strong>y can identify opportunities th<strong>at</strong> cut<br />

across several scenarios and, with a little tweaking, <strong>find</strong> str<strong>at</strong>egies<br />

<strong>to</strong> capture <strong>the</strong> full potential of any possible scenario.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

Author<br />

Bernd Brunke<br />

Partner and Member of <strong>the</strong><br />

Global Executive Committee, Berlin<br />

bernd.brunke@rolandberger.com<br />

Benno van Dongen<br />

Partner, Amsterdam<br />

benno.dongen@rolandberger.com<br />

William Downey<br />

Partner, New York<br />

william.downey@rolandberger.com<br />

Co-Authors<br />

Chris<strong>to</strong>phe Angoulvant<br />

Partner, Paris<br />

chris<strong>to</strong>phe.angoulvant@rolandberger.com<br />

Duce Go<strong>to</strong>ra<br />

Project Manager, London<br />

duce.go<strong>to</strong>ra@rolandberger.com<br />

Dr. Wilfried Aulbur<br />

Partner, Mumbai<br />

wilfried.aulbur@rolandberger.com<br />

Carolin Griese-Michels<br />

Principal, Hamburg<br />

carolin.griese@rolandberger.com<br />

Andreas Bauer<br />

Partner, Munich<br />

andreas.bauer@rolandberger.com<br />

Maren Hauptmann<br />

Partner, Munich<br />

maren.hauptmann@rolandberger.com

Study 23<br />

Daniel Himmel<br />

Project Manager, Berlin<br />

daniel.himmel@rolandberger.com<br />

Per I. Nilsson<br />

Partner, S<strong>to</strong>ckholm<br />

per-i.nilsson@rolandberger.com<br />

Nicklas Holgersson<br />

Project Manager, London<br />

nicklas.holgersson@rolandberger.com<br />

Dr. Verena Reichl<br />

Senior Expert, Munich<br />

verena.reichl@rolandberger.com<br />

Fabian Huhle<br />

Principal, Munich<br />

fabian.huhle@rolandberger.com<br />

Tina Wang<br />

Partner, Beijing<br />

tina.wang@rolandberger.com<br />

Dr. Johannes Klein<br />

Principal, Berlin<br />

johannes.klein@rolandberger.com<br />

Dr. Tim Zimmermann<br />

Partner, Munich<br />

tim.zimmermann@rolandberger.com<br />

Frank L<strong>at</strong>eur<br />

Principal, Brussels<br />

frank.l<strong>at</strong>eur@rolandberger.com<br />

Dr. Michael Zollenkop<br />

Principal, Stuttgart<br />

michael.zollenkop@rolandberger.com

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

Sources<br />

African Business Magazine (2012)<br />

ICT: Silicon Savanna ready <strong>to</strong> take on <strong>the</strong> world<br />

Allfacebook.de (2012)<br />

Facebook user st<strong>at</strong>istics<br />

S. D. Anthony et al. (2006)<br />

Seven principles of disruptive innov<strong>at</strong>ion<br />

S. Arrison (2011)<br />

100 plus: How <strong>the</strong> coming age of longevity will change everything,<br />

from careers and rel<strong>at</strong>ionships <strong>to</strong> family and faith<br />

G. O. Barney (1980)<br />

The Global 2000 Report <strong>to</strong> <strong>the</strong> President<br />

B<strong>at</strong>telle (2012)<br />

Global R&D Funding Forecast (2012)<br />

K. Below et al. (2012)<br />

Der Aufstieg der BIC-Sta<strong>at</strong>en als Wissensmächte<br />

Bloomberg (2012)<br />

Share price and index d<strong>at</strong>a<br />

W. H. Buiter and E. Rahbari (2011)<br />

Global growth genera<strong>to</strong>rs: Moving beyond<br />

emerging markets and BRICs<br />

C<strong>at</strong>alyst (2005)<br />

The bot<strong>to</strong>m line: Connecting corpor<strong>at</strong>e performance and gender<br />

diversity<br />

M. Chutnik and K. Grzesik (2009)<br />

Leading a virtual intercultural team. Implic<strong>at</strong>ions for virtual team<br />

leaders<br />

CNN Money (2011)<br />

Global Fortune 500<br />

Credit Suisse (2012)<br />

Emerging Markets Research Institute –<br />

Opportunities in an urbanizing world<br />

CTPartners (2012)<br />

Emerging markets trend talk report<br />

DB Research (2011)<br />

Research follows production<br />

Diabetes Atlas (2010)<br />

Global estim<strong>at</strong>es of <strong>the</strong> prevalence of diabetes<br />

for 2010 and 2030<br />

Digital Capital Advisors (2012)<br />

The evolutionary shift <strong>to</strong> mobile<br />

Discover Digital Arabia (2012)<br />

Online shopping in <strong>the</strong> Arab world<br />

Economist (2012)<br />

Consumer goods in Africa – A continent goes shopping<br />

Economist Intelligence Unit<br />

– Country d<strong>at</strong>a (2011, 2012)<br />

– People for growth: The talent challenge<br />

in emerging markets (2008)<br />

Edelman (2012)<br />

goodpurpose® study<br />

Y. Emmanuel and B.D. Gelb (2010)<br />

Better marketing <strong>to</strong> developing countries: Why and <strong>how</strong><br />

Euromoni<strong>to</strong>r (2011, 2012)<br />

Country and consumer d<strong>at</strong>a<br />

Eurost<strong>at</strong> (2012)<br />

Innov<strong>at</strong>ion and research d<strong>at</strong>a<br />

Experientia (2012)<br />

Designing for emerging markets<br />

Food and Agriculture Organiz<strong>at</strong>ion (2009/2010)<br />

How <strong>to</strong> feed <strong>the</strong> world in 2050<br />

Forbes (2011)<br />

Diversity & inclusion: Unlocking global potential<br />

Global diversity rankings by country, sec<strong>to</strong>r and occup<strong>at</strong>ion

Study 25<br />

S. S. Garr (2011)<br />

Retaining talent in emerging markets<br />

Gartner Inc. (2011)<br />

Market Trends: Mobile payments worldwide<br />

General Electric (2012)<br />

Global Innov<strong>at</strong>ion Barometer<br />

Global Industry Analysts (2010)<br />

Biosimilars: A global str<strong>at</strong>egic business report<br />

Goldman Sachs (2010)<br />

Global Economics Paper No. 170 and 204<br />

The power of <strong>the</strong> purse<br />

V. Govindarajan (2012)<br />

The $2,000 car<br />

S. A. Hewlett et al. (2010)<br />

Winning <strong>the</strong> war for talent in emerging markets<br />

S. A. Hewlett and R. Rashid (2010)<br />

The globe: The b<strong>at</strong>tle for female talent in emerging markets<br />

IBM (2011)<br />

Global Loc<strong>at</strong>ion Trends<br />

IHS Global Insight (2011, 2012)<br />

D<strong>at</strong>a Insight Web<br />

J. R. Immelt (2009)<br />

How GE is disrupting itself<br />

Innov<strong>at</strong>ion 360 Group (2012)<br />

The missing link between innov<strong>at</strong>ion <strong>str<strong>at</strong>egy</strong><br />

and leadership in <strong>the</strong> Middle East<br />

INSEAD (2011)<br />

The Global Innov<strong>at</strong>ion Index 2011<br />

Interbrand (2012)<br />

Best global brands 2011<br />

Intern<strong>at</strong>ional Institute for Applied Systems Analysis (2007)<br />

2007 upd<strong>at</strong>e of probabilistic world popul<strong>at</strong>ion projections<br />

Intern<strong>at</strong>ional Labor Organiz<strong>at</strong>ion (2011)<br />

Global employment trends 2012<br />

Intern<strong>at</strong>ional Monetary Fund (2011)<br />

World Economic Outlook d<strong>at</strong>abases<br />

Internet World St<strong>at</strong>s (2011)<br />

Usage and popul<strong>at</strong>ion st<strong>at</strong>istics<br />

jana.com (2012)<br />

Why mobile ads in emerging markets are <strong>the</strong> future<br />

B. Jaruzelski, Kevin Dehoff (2008)<br />

The Global Innov<strong>at</strong>ion 1000<br />

Knight Frank (2012)<br />

Prime Intern<strong>at</strong>ional Residential Index (PIRI)<br />

Leipzig Gradu<strong>at</strong>e School of Management (2010)<br />

Future scenarios for <strong>the</strong> European airline industry<br />

T. R. Malthus (1798)<br />

An essay on <strong>the</strong> principle of popul<strong>at</strong>ion<br />

B. Minching<strong>to</strong>n (2011)<br />

Employer branding without borders – a p<strong>at</strong>hway<br />

<strong>to</strong> corpor<strong>at</strong>e success<br />

N<strong>at</strong>ional Science Board (2012)<br />

Science and engineering indica<strong>to</strong>rs 2012<br />

new economic found<strong>at</strong>ion, Centre for Well-being (2012)<br />

Happy Planet Index<br />

OECD (2010)<br />

The emerging middle class in developing countries<br />

F. Pearce (2011)<br />

The coming popul<strong>at</strong>ion crash – And our planet's surprising future<br />

Popul<strong>at</strong>ion Resource Center (2008)<br />

Popul<strong>at</strong>ion and <strong>the</strong> food crisis<br />

C. K. Prahalad (2006)<br />

The innov<strong>at</strong>ion paradox

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

I. Razak (2009)<br />

The correl<strong>at</strong>ion between popul<strong>at</strong>ion and<br />

economic growth in Malaysia<br />

P. Reddy (2008)<br />

Global innov<strong>at</strong>ion in emerging economies –<br />

Implic<strong>at</strong>ions for o<strong>the</strong>r developing countries<br />

Q. M. Robinson and H. J. Park (2006)<br />

Examining <strong>the</strong> link between diversity and firm performance:<br />

The effects of diversity reput<strong>at</strong>ion and leader racial diversity<br />

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

– Au<strong>to</strong>motive Landscape 2025 (2011)<br />

– Corpor<strong>at</strong>e headquarters study (2005, 2008, 2010)<br />

– Frugal products (2012)<br />

– Manufacturing futures – Using scenario <strong>planning</strong> <strong>to</strong> identify<br />

opportunities in a multi-sec<strong>to</strong>r industry (2011)<br />

– Modular products – How <strong>to</strong> leverage modular product kits<br />

for growth and globaliz<strong>at</strong>ion (2012)<br />

– Organizing and managing R&D in high-tech industries (2011)<br />

– think: act CONTENT – Diversity and inclusion <strong>to</strong>o soft a subject<br />

Not <strong>at</strong> all (2010)<br />

– think: act CONTENT – <strong>Scenario</strong> <strong>planning</strong> (2009)<br />

– think: act STUDY – Chinese consumer report (2009)<br />

– think: act STUDY – Delivering financial services in<br />

sub-Saharan Africa (2011)<br />

– Trend Compendium 2030 (2011)<br />

<strong>Roland</strong> <strong>Berger</strong> School of Str<strong>at</strong>egy and Economics (2012)<br />

<strong>Scenario</strong> upd<strong>at</strong>e 2012<br />

Saleschase (2012)<br />

Why mobile marketing in emerging markets is <strong>the</strong> next big thing<br />

F. Siebdr<strong>at</strong>, M. Hoegl and H. Ernst (2009)<br />

How <strong>to</strong> manage virtual teams<br />

L. Taylor (2011)<br />

Diabetes - pharma's fastest-growing market<br />

The German Found<strong>at</strong>ion for World Popul<strong>at</strong>ion (2011, 2012)<br />

Online project: 7 billion<br />

United N<strong>at</strong>ions Conference on Trade and Development<br />

(2010, 2011)<br />

World Investment Report<br />

United N<strong>at</strong>ions (1960, 2009, 2010, 2011)<br />

The future growth of <strong>the</strong> world popul<strong>at</strong>ion (1960)<br />

World Popul<strong>at</strong>ion Prospects – The 2009 and 2010 Revision<br />

World Urbaniz<strong>at</strong>ion Prospects – The 2009 and 2011 Revision<br />

W. W. Weber (2008)<br />

Managing complexity – Lessons from Peter Drucker and<br />

Niklas Luhmann<br />

T. Yasuyuki and S. Hi<strong>to</strong>shi (2011)<br />

Effects of CEOs' characteristics on intern<strong>at</strong>ionaliz<strong>at</strong>ion of<br />

small and medium enterprises in Japan<br />

W. Zhang (2011)<br />

Understanding China's economic trajec<strong>to</strong>ry<br />

World Bank (2011)<br />

The Ease of Doing Business Index<br />

World Economic Forum et al. (2010)<br />

Stimul<strong>at</strong>ing economies through fostering talent mobility<br />

World Economic Forum (2012)<br />

WEF Global Competitiveness Report 2011/2012<br />

WorldPay (2012)<br />

Global Online Shopping Report<br />

Simon Kucher (2011)<br />

Dax Management: Sehr intern<strong>at</strong>ional aber kaum weiblich<br />

Spiegel Magazine (44/2011)<br />

Das große Schrumpfen<br />

Süddeutsche Zeitung (6/2012)<br />

Die digitale Revolution erobert Afrika

Study 27<br />

Credits<br />

Pages 2: sinopictures/viewchina<br />

Special thanks <strong>to</strong><br />

Our interviewees:<br />

Siegfried Gänßlen, CEO Hansgrohe AG<br />

Manfred Grundke, General Partner Knauf Gips KG<br />

Ruth Schaefer, CEO Ruth Schaefer Intercultural

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

Global Topics<br />

project description<br />

With our GLOBAL TOPICS initi<strong>at</strong>ive, we<br />

assess <strong>the</strong> most pressing issues for<br />

leaders in society, business and politics<br />

and outline possible solutions.

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants<br />

For more inform<strong>at</strong>ion, please visit:<br />

www.rolandberger.com/global<strong>to</strong>pics<br />

If you have any questions, please contact us <strong>at</strong>:<br />

global_<strong>to</strong>pics@rolandberger.com<br />

<strong>Roland</strong> <strong>Berger</strong> Str<strong>at</strong>egy Consultants GmbH<br />

HighLight Towers, Mies-van-der-Rohe-Str. 6, 80807 Munich, Germany

Study 30