Download (PDF 904Kb) - Great Portland Estates

Download (PDF 904Kb) - Great Portland Estates

Download (PDF 904Kb) - Great Portland Estates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GREAT PORTLAND ESTATES<br />

P.L.C.<br />

Interim Report 2000

Portfolio Analysis<br />

(as at 30th September 2000)<br />

West End 48.9%<br />

Shopping Centres 21.5%<br />

City 16.6%<br />

Other Offices 5.3%<br />

South East Offices 7.7%<br />

Offices Retail Total<br />

£m £m £m<br />

London West End - North of Oxford Street 358.3 58.5 416.8 26.3%<br />

West End - Other 225.9 131.3 357.2 22.6%<br />

West End - Total 584.2 189.8 774.0 48.9%<br />

City 263.4 - 263.4 16.6%<br />

London - Total 847.6 189.8 1,037.4 65.5%<br />

South East Offices 122.8 - 122.8 7.7%<br />

Other Offices 83.8 - 83.8 5.3%<br />

Shopping Centres - 340.6 340.6 21.5%<br />

1,054.2 530.4 1,584.6 100.0%<br />

2

Highlights<br />

" Adjusted earnings up 7% to 5.8p per share (1999: 5.4p)<br />

" Interim dividend up 4% to 3.25p (1999: 3.125p)<br />

" Net assets per share up 4% to 408p<br />

" Fully diluted net assets per share up 6% to 399p<br />

" 80p per share returned to shareholders in accordance<br />

with timetable<br />

" Over £300 million of property sales in last six months<br />

" Over £1 billion of properties held in central London<br />

Results in Brief<br />

(Six months to 30th September) 2000 1999<br />

Rent receivable £57.5m £58.7m<br />

Profit before taxation £7.9m £28.3m<br />

Profit after taxation £3.1m £21.6m<br />

Earnings per share – basic 0.9p 5.7p<br />

Earnings per share – adjusted 5.8p 5.4p<br />

Dividends per share 3.25p 3.125p<br />

3

GREAT TITCHFIELD STREET<br />

Statement by the Chairman<br />

This period has seen the<br />

successful implementation<br />

of radical restructuring<br />

initiatives<br />

RICHARD PESKIN<br />

Chairman<br />

INTRODUCTION<br />

RESULTS AND DIVIDEND<br />

Since my Statement in the Annual<br />

Profit on ordinary activities, before<br />

Report and Accounts last June, most<br />

taxation and exceptional items, for<br />

shareholders will have received two<br />

the six months to 30th September<br />

further letters from me in August<br />

2000, amounted to £26.8 million.<br />

and September and will be aware,<br />

The headline figure of £7.9 million<br />

therefore, that the period under<br />

is, therefore, misleading as it includes<br />

review has seen the successful<br />

£6.9 million of costs in connection<br />

implementation of the radical<br />

with the restructuring, coupled with<br />

initiatives for the restructuring of<br />

disappointing losses of £12.0 million<br />

the Group presaged in March. The<br />

on the sale of investment properties.<br />

return of capital of £285 million,<br />

Adjusted earnings per share, however,<br />

or 80p per share, was duly made<br />

were 7% ahead at 5.8p (1999: 5.4p)<br />

on 20th September, and our aim to<br />

and your directors have declared<br />

deliver greater shareholder value is,<br />

an interim dividend of 3.25p<br />

in my view, reflected by the<br />

(1999: 3.125p), an increase of 4%,<br />

outperformance of <strong>Great</strong> <strong>Portland</strong>’s<br />

payable on 4th January 2001.<br />

share price against the FTSE All Share,<br />

FTSE 100, FTSE 250 and FTSE Real<br />

Estate indices since the original<br />

announcement of our strategic<br />

review.<br />

EXISTING HOLDINGS<br />

GREAT TITCHFIELD STREET, W1<br />

MORTIMER STREET<br />

LITTLE PORTLAND STREET<br />

32<br />

34<br />

24 - 30<br />

55 53 51<br />

20 - 22<br />

49<br />

47<br />

WELLS STREET<br />

55 58<br />

A MAJOR SCHEME TO THE NORTH OF OXFORD<br />

STREET WHICH WILL COMPRISE 250,000 SQ.FT.<br />

MARGARET STREET<br />

OF PRIMARILY OFFICE AND RETAIL SPACE.<br />

RIGHT:<br />

COMPUTERISED VISUAL OF THE FINAL<br />

DEVELOPMENT<br />

©Crown Copyright MC 100031974<br />

4

Statement by the Chairman<br />

CB Hillier Parker were instructed, for<br />

the first time at the half-yearly stage,<br />

to provide an independent valuation<br />

of the entire investment portfolio, and<br />

the properties have been valued at<br />

£1.58 billion, representing an overall<br />

uplift of 2.2%. Continued strong<br />

occupational demand in London has<br />

contributed to further good increases<br />

in rents, which have been the main<br />

driving force in capital values rising<br />

by 5.6%, with the City and Holborn<br />

holdings growing by 6.5%, and the<br />

West End and Covent Garden by 5.3%.<br />

However, negative sentiment towards<br />

retailing in general has meant a<br />

softening of yields for shopping<br />

centres and, despite modest rental<br />

growth, their values fell by 4.7%,<br />

whilst regional offices were down<br />

by 1.8%. Net assets per share,<br />

despite the previously mentioned<br />

exceptional losses, stood at 408p,<br />

an uplift of 3.7% over the equivalent<br />

figure at 31st March 2000, and<br />

diluted net assets per share increased<br />

by 5.8% to 399p.

7<br />

Statement by the Chairman<br />

PORTFOLIO REVIEW<br />

For the period under review, the<br />

main concentration has been on<br />

the rationalisation of the portfolio.<br />

Our entire industrial, distribution,<br />

retail warehousing and other non-core<br />

retail holdings were sold, together<br />

with regional offices offering limited<br />

growth prospects. Aggregate proceeds<br />

amounted to £305 million and since<br />

30th September further disposals of<br />

£12 million have been effected; this<br />

means that within twenty months<br />

some 73 properties have been sold to<br />

realise £411 million.<br />

MARGARET STREET<br />

GREAT PORTLAND STREET<br />

10 9 8 6<br />

MARKET PLACE<br />

OXFORD STREET<br />

MARKET PLACE<br />

KENT HOUSE<br />

GREAT TITCHFIELD STREET<br />

©Crown Copyright MC 100031974<br />

PEDESTRIANISED AREA<br />

EXISTING HOLDINGS<br />

MARKET PLACE, W1<br />

THE “PIAZZANISATION” OF THIS THOROUGHFARE<br />

HAS ENHANCED THE LOCAL ENVIRONMENT<br />

6

Statement by the Chairman<br />

With one half of the portfolio now<br />

situated in the West End and Covent<br />

Garden, active management here, as<br />

elsewhere, is a key ingredient in<br />

creating added value. We have<br />

succeeded in increasing rents north<br />

of Oxford Street by 10% since<br />

March, and, within fifteen months<br />

of purchase, 28 Savile Row<br />

(12,000 sq.ft.) has been completely<br />

refurbished and 66% let at rents<br />

well above original expectations.<br />

This was one of the properties on<br />

the Pollen Estate where our active<br />

involvement resulted in a highly<br />

satisfactory outcome, through the<br />

profitable sale of our beneficial stake<br />

in the Pollen Trust and the<br />

simultaneous regearing of our long<br />

leasehold interests.<br />

As previously mentioned, modest<br />

rental growth was achieved in our<br />

shopping centres. With 560,000 sq.ft.<br />

of space now under our control at<br />

Harlow, we continue to consolidate<br />

our dominant position in the town<br />

and we are constructing a 60,000 sq.ft.<br />

store for Woolworths which should be<br />

open in the spring of 2002.<br />

Discussions are taking place with<br />

adjoining developers and the<br />

local authority with a view to<br />

strengthening the town’s position in<br />

the retail hierarchy of the north east<br />

quadrant of the M25. In High<br />

Wycombe our development partners<br />

and the local authority are facing<br />

serious delays in fulfilling the<br />

conditions of our funding<br />

arrangement, and we are, therefore,<br />

reviewing with them our commitment<br />

to the proposed 400,000 sq.ft.<br />

Western Sector extension to our<br />

adjoining Octagon Centre.<br />

Construction has started on the<br />

200,000 sq.ft. Sol Central leisure<br />

complex in Northampton, where<br />

the building is already 65% pre-let<br />

and has a scheduled completion date<br />

of summer 2001. It is a testimony to<br />

our management skills that the void<br />

element of our entire portfolio<br />

remains at only 1% of the current rent<br />

roll.<br />

With regard to our medium-term<br />

office development programme,<br />

good progress is being made with<br />

the relevant planning authorities at<br />

Frimley (81,000 sq.ft.), 22/25<br />

Northumberland Avenue, WC2<br />

(18,000 sq.ft.), 190 <strong>Great</strong> <strong>Portland</strong><br />

Street, W1 (135,000 sq.ft.) and the<br />

scheme at Mortimer Street/<strong>Great</strong><br />

Titchfield Street, W1 (240,000 sq.ft.).<br />

In the City, a consortium is being<br />

formed with two adjoining<br />

landowners to investigate the<br />

redevelopment potential of a large<br />

site incorporating our holdings in<br />

St. Mary Axe, Camomile Street and<br />

Bishopsgate, EC2.<br />

7

Statement by the Chairman<br />

FINANCIAL REVIEW<br />

The portfolio rationalisation<br />

programme, capital reduction and<br />

return of cash to shareholders<br />

generated a number of one-off, or<br />

exceptional, items in the six months<br />

to 30th September 2000. £1.9 million<br />

of exceptional administration costs<br />

were incurred on the capital<br />

restructuring, and the £52.4 million<br />

9.5% Convertible Unsecured Loan<br />

Stock 2002 was redeemed at a<br />

premium of £5.0 million on 1st June.<br />

Without this redemption the Company<br />

would neither have been able to effect<br />

the capital reduction nor to buy in<br />

further shares, and it added 8p to<br />

diluted net assets per share.<br />

Furthermore, by saving £3.2 million<br />

of interest over the following two and<br />

a half years, the overall cost will only<br />

be £1.2 million after tax. The loss on<br />

the sale of investment properties of<br />

£12.0 million comprised selling costs<br />

of £3.8 million and a loss against<br />

March 2000 values of £8.2 million.<br />

The redemption of the Loan Stock,<br />

as mentioned above, was the only<br />

change in the Company’s gross<br />

debt in the six months to<br />

30th September 2000, and the<br />

weighted average cost of debt<br />

remained at 8.3%. Following the<br />

capital reduction, gearing at 30th<br />

September 2000 rose to 79%<br />

(31st March 2000: 60%) net of<br />

cash balances of £23 million and<br />

the Group had in place undrawn<br />

bank facilities of £40 million. Under<br />

Financial Reporting Standard 13,<br />

the market value of the Group’s<br />

financial instruments at 30th<br />

September 2000 exceeded the<br />

amount at which they were shown<br />

in the consolidated balance sheet by<br />

£90 million, representing a potential<br />

reduction in net assets per share<br />

of 29p after tax; there remained<br />

no inherent liability to taxation on<br />

capital gains within the portfolio<br />

as a whole. The Company aims<br />

to maintain a sensible balance<br />

of long-term, fixed rate and<br />

medium-term debt commensurate<br />

with the size of the business which<br />

it helps to finance and, following<br />

the capital reduction, steps are under<br />

consideration to address the size and<br />

nature of the Group’s borrowings.<br />

8

25 24<br />

Statement by the Chairman<br />

In May, shareholders gave formal<br />

approval to the capital reduction,<br />

which gained Court confirmation in<br />

early September, and 80p per share<br />

was duly returned to shareholders<br />

on 20th September. Our shares were<br />

consolidated on the basis of three<br />

for every five previously in issue,<br />

effective on 11th September, and the<br />

closing share price on that day was<br />

257 1 /2p, for the purpose of tax on<br />

capital gains. At the Annual General<br />

Meeting in July, shareholders renewed<br />

the authority to buy in a further 15%<br />

of the issued share capital, and, in<br />

September, we bought back 250,000<br />

shares at a cost of 224p each, which<br />

had a small incremental effect on net<br />

asset value per share.<br />

Following the sale of most of our<br />

non-core properties, our rent roll<br />

now stands at £97.7 million per<br />

annum, and is now estimated to<br />

be reversionary to the tune of<br />

£14.0 million within the next five<br />

years; an analysis of the portfolio at<br />

30th September 2000 is set out<br />

on page 2.<br />

BOARD CHANGES<br />

David Godwin became Deputy<br />

Chairman on the retirement of Roger<br />

Payton after the Annual General<br />

Meeting in July. In October, Patrick<br />

Hall, the director in charge of<br />

acquisitions and disposals since<br />

joining us nine years ago and Joint<br />

Managing Director since last April,<br />

resigned from the Board as he felt<br />

that, with the sales programme<br />

substantially complete, it was an<br />

appropriate time for him to move<br />

on. Peter Shaw, who was appointed<br />

Joint Managing Director along with<br />

Patrick in April and who also joined<br />

the Group in 1991, became Managing<br />

Director.<br />

PROSPECTS<br />

A great deal of work has been done<br />

during the past few months in<br />

restructuring the portfolio and further<br />

sensible rationalisation is proceeding.<br />

Although current economic conditions<br />

appear to remain relatively calm, there<br />

are some indications that the United<br />

Kingdom property market is slowing<br />

down and, indeed, it would be<br />

surprising to expect the very strong<br />

rental and capital growth of the last<br />

two to three years to be sustained.<br />

Having said that, however,<br />

I believe that there is still good<br />

potential within our chosen spheres<br />

of operation and that shareholder<br />

value will best be realised by our<br />

strategy of continued investment and<br />

development in London and in South<br />

East offices.<br />

RICHARD PESKIN<br />

Chairman<br />

21st November 2000<br />

CHARING CROSS STATION<br />

NORTHUMBERLAND STREET<br />

CRAVEN STREET<br />

EXISTING HOLDINGS<br />

CRAVEN PASSAGE<br />

22/25 NORTHUMBERLAND AVENUE, WC2<br />

A DEVELOPMENT CLOSE TO TRAFALGAR SQUARE<br />

SUBJECT TO A PLANNING APPLICATION TO<br />

INCREASE THE FLOOR SPACE BY 45% ON AN<br />

18,500 SQ.FT. OFFICE SITE<br />

23 22<br />

NORTHUMBERLAND AVENUE<br />

©Crown Copyright MC 100031974<br />

9

Unaudited Group Profit and Loss Account<br />

For the six months ended 30th September 2000<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m NOTES £m £m<br />

119.8 Rent receivable 2 57.5 58.7<br />

(2.0) Ground rents (1.0) (0.9)<br />

117.8 Net rental income 56.5 57.8<br />

(3.5) Property and refurbishment costs (1.7) (1.7)<br />

(4.5) Administration expenses 3 (4.7) (2.2)<br />

109.8 50.1 53.9<br />

1.0 Trading profits – –<br />

110.8 Operating profit 50.1 53.9<br />

4.7 (Loss)/profit on sale of investment properties (12.0) 1.3<br />

115.5 Profit on ordinary activities before interest 38.1 55.2<br />

3.0 Interest receivable 4 1.9 2.2<br />

(58.0) Interest payable 5 (32.1) (29.1)<br />

60.5 Profit on ordinary activities before taxation 7.9 28.3<br />

(14.4) Tax on profit on ordinary activities 6 (4.8) (6.7)<br />

46.1 Profit on ordinary activities after taxation 3.1 21.6<br />

(34.5) Dividends 7 (7.0) (11.8)<br />

11.6 Retained (loss)/profit for the period (3.9) 9.8<br />

12.3p Earnings per share – basic 8 0.9p 5.7p<br />

11.1p Earnings per share – adjusted 8 5.8p 5.4p<br />

9.5p Dividend per share 7 3.25p 3.125p<br />

10

Unaudited Group Balance Sheet<br />

As at 30th September 2000<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m NOTES £m £m<br />

Tangible fixed assets<br />

1,845.0 Investment properties 9 1,584.6 1,707.7<br />

14.9 Investments – 12.2<br />

1,859.9 1,584.6 1,719.9<br />

Current assets<br />

1.4 Stock of trading properties 4.5 3.6<br />

21.6 Debtors 32.7 12.8<br />

85.4 Cash at bank and short-term deposits 23.0 25.9<br />

108.4 60.2 42.3<br />

79.1 Creditors: amounts falling due within one year 63.3 68.9<br />

29.3 Net current (liabilities)/assets (3.1) (26.6)<br />

1,889.2 Total assets less current liabilities 1,581.5 1,693.3<br />

Creditors: amounts falling due after more<br />

than one year<br />

454.1 Debenture loans 454.1 456.0<br />

109.6 Convertible loans 56.7 110.8<br />

197.7 Bank and other loans 197.7 47.8<br />

761.4 708.5 614.6<br />

1,127.8 873.0 1,078.7<br />

Capital and reserves<br />

178.4 Called up share capital 107.0 188.7<br />

238.4 Share premium account 24.3 238.4<br />

607.3 Revaluation reserve 596.3 533.6<br />

19.3 Other reserves 19.4 85.5<br />

84.4 Profit and loss account 126.0 32.5<br />

1,127.8 Equity shareholders’ funds 873.0 1,078.7<br />

11

Unaudited Group Statement of Total Recognised Gains and Losses<br />

For the six months ended 30th September 2000<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

46.1 Profit for the period 3.1 21.6<br />

85.7 Unrealised surplus on revaluation of fixed assets 34.9 –<br />

131.8 Total recognised gains and losses for the period 38.0 21.6<br />

Unaudited Note of Historical Cost Profits and Losses<br />

For the six months ended 30th September 2000<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

60.5 Reported profit on ordinary activities before taxation 7.9 28.3<br />

34.5 Realisation of revaluation surpluses of previous years 45.9 22.5<br />

95.0 Historical cost profit on ordinary activities before taxation 53.8 50.8<br />

Historical cost profit for the period retained after<br />

46.1 taxation and dividends 42.0 32.3<br />

12

Unaudited Group Statement of Cash Flows<br />

For the six months ended 30th September 2000<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

112.7 Net cash inflow from operating activities 35.6 46.2<br />

Returns on investments and servicing of finance<br />

3.5 Interest received 2.0 2.8<br />

(57.8) Interest paid (19.7) (29.2)<br />

Net cash outflow from returns on investments<br />

(54.3) and servicing of finance (17.7) (26.4)<br />

(13.0) Tax paid (4.3) (2.1)<br />

Capital expenditure<br />

(144.7) Payments to acquire investment properties (11.4) (24.0)<br />

86.4 Receipts from sale of investment properties 288.4 31.7<br />

(0.5) Payments to acquire investments – (0.5)<br />

– Receipts from sale of investments 14.9 –<br />

(58.8) Net cash inflow/(outflow) from capital expenditure 291.9 7.2<br />

(35.4) Equity dividends paid (22.7) (23.6)<br />

Net cash inflow/(outflow) before use of liquid resources<br />

(48.8) and financing 282.8 1.3<br />

Management of liquid resources<br />

87.4 Cash withdrawn from short-term deposit 65.7 150.4<br />

Financing<br />

– Redemption of shares (285.4) –<br />

(38.4) Purchase of shares (0.4) –<br />

(3.5) Redemption of loans (57.9) (170.0)<br />

– Drawdown of bank loans – 20.0<br />

(41.9) Net cash outflow from financing (343.7) (150.0)<br />

(3.3) Increase/(decrease) in cash 4.8 1.7<br />

13

Reconciliation of Operating Profit<br />

to Net Cash Inflow from Operating Activities<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

110.8 Operating profit 50.1 53.9<br />

2.0 (Increase)/decrease in stock of trading properties (3.1) (0.2)<br />

(1.3) (Increase)/decrease in debtors (4.9) (3.9)<br />

1.2 (Decrease)/increase in creditors (6.5) (3.6)<br />

112.7 Net cash inflow from operating activities 35.6 46.2<br />

Reconciliation of Net Cash Flow to Movement in Net Debt<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

(3.3) Increase/(decrease) in cash in the period 4.8 1.7<br />

(87.4) Decrease in short-term deposits (65.7) (150.4)<br />

3.5 Cash outflow from redemption of loans 57.9 170.0<br />

– Cash inflow from increase in debt – (20.0)<br />

(87.2) Change in net debt arising from cash flows (3.0) 1.3<br />

0.2 Other non-cash movements (5.0) 0.1<br />

(87.0) Movement in net debt in the period (8.0) 1.4<br />

(590.5) Net debt at the beginning of the period (677.5) (590.5)<br />

(677.5) Net debt at the end of the period (685.5) (589.1)<br />

Analysis of Net Debt<br />

AT<br />

AT<br />

1ST APRIL CASH FLOW NON-CASH 30TH SEPTEMBER<br />

2000 CHANGES 2000<br />

£m £m £m £m<br />

Cash (1.5) 4.8 – 3.3<br />

Short-term deposits 85.4 (65.7) – 19.7<br />

Debt due after one year (761.4) 57.9 (5.0) (708.5)<br />

(677.5) (3.0) (5.0) (685.5)<br />

14

Notes Forming Part of the Interim Statement<br />

1 BASIS OF PREPARATION OF INTERIM FINANCIAL INFORMATION<br />

The interim financial information has been prepared on the basis of the accounting policies set out in the Group’s 2000<br />

statutory accounts. The financial information contained in this report does not constitute statutory accounts within the<br />

meaning of section 240 of the Companies Act 1985. The abridged accounts for the year ended 31st March 2000 are an<br />

extract from the accounts for that year which, together with an unqualified audit report, have been delivered to the<br />

Registrar of Companies.<br />

2 TURNOVER AND SEGMENTAL ANALYSIS<br />

Rent receivable by location:<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

18.2 West End – North of Oxford Street 9.6 8.8<br />

19.9 Other West End and Covent Garden 10.3 9.8<br />

16.8 City and Holborn 9.1 8.0<br />

22.7 South East of England 9.9 11.5<br />

42.2 Rest of United Kingdom 18.6 20.6<br />

119.8 57.5 58.7<br />

Rent receivable is stated exclusive of value added tax, and arose wholly from continuing operations in the United<br />

Kingdom. No operations were discontinued during the period.<br />

3 ADMINISTRATION EXPENSES<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

Administration expenses<br />

4.5 Other 2.8 2.2<br />

Exceptional item<br />

– Capital restructuring 1.9 –<br />

4.5 4.7 2.2<br />

4 INTEREST RECEIVABLE<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

2.5 Short-term deposits 1.5 1.9<br />

0.5 Other 0.4 0.3<br />

3.0 1.9 2.2<br />

15

Notes Forming Part of the Interim Statement<br />

5 INTEREST PAYABLE<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 1999<br />

£m £m £m<br />

Interest payable<br />

10.5 Bank loans and overdrafts 5.0 5.3<br />

47.5 Other 22.1 23.8<br />

58.0 27.1 29.1<br />

Exceptional item<br />

– Premium on early redemption of loan stock 5.0 –<br />

58.0 32.1 29.1<br />

6 TAXATION<br />

Taxation has been calculated using the estimated effective tax rate for the full year. The difference between the standard<br />

rate of tax and the effective rate principally reflects the benefit of capital allowances available on plant and equipment in<br />

respect of investment properties.<br />

7 DIVIDENDS<br />

An interim dividend of 3.25p per share (1999: 3.125p) will be paid on 4th January 2001 to shareholders on the<br />

register at 1st December 2000.<br />

8 EARNINGS PER SHARE<br />

Earnings per share for the six months are based on income attributable to ordinary shareholders of £3,100,000<br />

(1999: £21,600,000) and on the weighted average of 341,215,548 shares in issue (1999: 377,462,638 shares). There<br />

is no impact on earnings per share of conversion of the convertible bonds, or the exercise of share options.<br />

The directors believe that earnings per share before exceptional items and profits or losses on sales of investment<br />

properties and investments provide a more meaningful measure of the Group’s performance. Accordingly, earnings per<br />

share on that adjusted basis have been disclosed on the face of the profit and loss account, and calculated as follows:<br />

YEAR TO SIX MONTHS TO SIX MONTHS TO SIX MONTHS TO SIX MONTHS TO<br />

31ST MARCH 30TH SEPTEMBER 30TH SEPTEMBER 30TH SEPTEMBER 30TH SEPTEMBER<br />

2000 2000 2000 1999 1999<br />

EARNINGS PROFIT EARNINGS PROfiT EARNINGS<br />

PER SHARE AFTER TAX PER SHARE AFTER TAX PER SHARE<br />

PENCE £m PENCE £m PENCE<br />

12.3 Basic 3.1 0.9 21.6 5.7<br />

– Exceptional items 4.8 1.4 – –<br />

Loss/(profit) on sale of<br />

(1.2) investment properties 12.0 3.5 (1.3) (0.3)<br />

11.1 Adjusted 19.9 5.8 20.3 5.4<br />

16

Notes Forming Part of the Interim Statement<br />

9 INVESTMENT PROPERTIES<br />

LEASEHOLD<br />

FREEHOLD/ OVER LEASEHOLD<br />

FEUHOLD 900 YEARS 50-250 YEARS TOTAL<br />

£m £m £m £m<br />

At 1st April 2000 1,391.7 170.8 282.5 1,845.0<br />

Additions at cost 6.8 0.1 11.5 18.4<br />

Disposals (254.3) (54.8) (4.6) (313.7)<br />

1,144.2 116.1 289.4 1,549.7<br />

Surplus on revaluation 27.5 4.7 2.7 34.9<br />

At 30th September 2000 1,171.7 120.8 292.1 1,584.6<br />

17

Independent Review Report to<br />

<strong>Great</strong> <strong>Portland</strong> <strong>Estates</strong> P.L.C.<br />

INTRODUCTION<br />

We have been instructed by the Company to review the financial information set out on pages 10 to 17, and we have<br />

read the other information contained in the interim report and considered whether it contains any apparent<br />

misstatements or material inconsistencies with the financial information.<br />

DIRECTORS’ RESPONSIBILITIES<br />

The interim report, including the financial information contained therein, is the responsibility of, and has been<br />

approved by, the directors. The Listing Rules of the Financial Services Authority require that the accounting policies and<br />

presentation applied to the interim figures should be consistent with those applied in preparing the preceding annual<br />

accounts except where any changes, and the reasons for them, are disclosed.<br />

REVIEW WORK PERFORMED<br />

We conducted our review in accordance with guidance contained in Bulletin 1999/4 issued by the Auditing Practices<br />

Board. A review consists principally of making enquiries of group management and applying analytical procedures to<br />

the financial information and underlying financial data and based thereon, assessing whether the accounting policies<br />

and presentation have been consistently applied unless otherwise disclosed. A review excludes audit procedures such as<br />

tests of controls and verification of assets, liabilities and transactions. It is substantially less in scope than an audit<br />

performed in accordance with Auditing Standards and therefore provides a lower level of assurance than an audit.<br />

Accordingly we do not express an audit opinion on the financial information.<br />

REVIEW CONCLUSION<br />

On the basis of our review we are not aware of any material modifications that should be made to the financial<br />

information as presented for the six months ended 30th September 2000.<br />

ERNST & YOUNG<br />

Registered Auditor<br />

London<br />

21st November 2000<br />

18

Directors<br />

RICHARD PESKIN MA, LLM, FRSA, CIMGT<br />

Chairman, Non-Executive<br />

DAVID GODWIN<br />

Deputy Chairman, Non-Executive<br />

PETER SHAW FRICS, ACIARB<br />

Managing Director<br />

JOHN WHITELEY BA(ECON), FCA<br />

Finance Director<br />

PAUL GITTENS FRICS<br />

Executive Director<br />

HOWARD PERLIN FCA<br />

Non-Executive Director<br />

ANTHONY GRAHAM FRICS<br />

Non-Executive Director<br />

JOHN EDGCUMBE BSc FRICS<br />

Non-Executive Director<br />

SECRETARY<br />

Desna Martin BCOM, CA(AUST)<br />

Shareholders’ Information<br />

FINANCIAL CALENDAR 2000<br />

Ex-dividend date for interim dividend<br />

27th November<br />

Registration qualifying date for interim dividend<br />

1st December<br />

Interim dividend payable<br />

Announcement of full year results<br />

Circulation of Annual Report and Accounts 2001<br />

Annual General Meeting<br />

Final dividend payable<br />

* Provisional<br />

2001<br />

4th January<br />

5th June*<br />

15th June*<br />

17th July*<br />

20th July*<br />

DESIGNED BY CITIGATE LLOYD NORTHOVER PRODUCED BY CL CITY<br />

SHAREHOLDER ENQUIRIES<br />

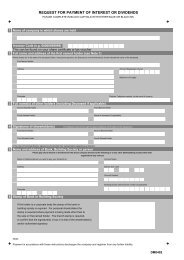

All enquiries relating to holdings<br />

of shares, loan stock, bonds or<br />

debentures in <strong>Great</strong> <strong>Portland</strong> <strong>Estates</strong>,<br />

including notification of change<br />

of address, queries regarding<br />

dividend/interest payments or<br />

the loss of a certificate, should be<br />

addressed to the Company’s Registrars:<br />

Capita IRG plc<br />

Bourne House<br />

34 Beckenham Road<br />

Beckenham<br />

Kent BR3 4TU<br />

Tel 020 8639 2000<br />

WEB SITE<br />

The Company has a corporate web<br />

site which holds, amongst other<br />

information, a copy of our latest<br />

annual report and accounts, a list of<br />

properties held by the Group and<br />

copies of all press announcements<br />

released over the last twelve months.<br />

It can be found at www.gpe.co.uk<br />

PERSONAL EQUITY PLANS (PEPs)<br />

Following changes in legislation, the<br />

Company can no longer offer PEPs to<br />

private shareholders. Existing General<br />

and Single Company PEP holders can,<br />

however, continue their PEPs under<br />

the original arrangements and for<br />

further information should contact<br />

the Plan Manager at:<br />

Bank of Scotland<br />

Personal Equity Plans<br />

PO Box 17122<br />

600 Gorgie Road<br />

Edinburgh EH11 3WA<br />

Tel 0131 442 8271<br />

LOW COST DEALING SERVICE<br />

This service provides both existing<br />

and prospective shareholders with a<br />

simple, postal, low-cost method of<br />

buying and selling <strong>Great</strong> <strong>Portland</strong><br />

<strong>Estates</strong> shares. For further information,<br />

or a dealing form, contact:<br />

Cazenove & Co.<br />

12 Tokenhouse Yard<br />

London EC2R 7AN<br />

Tel 020 7606 1768<br />

REGISTERED OFFICE<br />

Knighton House<br />

56 Mortimer Street<br />

London W1N 8BD<br />

Tel 020 7580 3040<br />

Fax 020 7631 5169<br />

Registered Number 596137