Sovereign Wealth Quarterly - Sovereign Wealth Fund Institute

Sovereign Wealth Quarterly - Sovereign Wealth Fund Institute

Sovereign Wealth Quarterly - Sovereign Wealth Fund Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 <strong>Sovereign</strong> <strong>Wealth</strong> <strong>Quarterly</strong> | October 2013<br />

U.S. Pension Executives Ink<br />

Letters Concerning PE<br />

Alignment Issues<br />

n general, U.S.<br />

I<br />

public pension<br />

funds - more than<br />

sovereign wealth<br />

funds - need<br />

private equity to help reach<br />

their annual target returns. This<br />

give-take relationship manifests<br />

across America, even when<br />

partner alignment issues arise.<br />

What has taken center stage is<br />

when private equity firms take<br />

monitor fees and transaction fees<br />

on failing portfolio companies.<br />

The debt binge left a nasty<br />

hangover for many pre-2007<br />

private equity funds. Side effects<br />

include poor fund performance,<br />

languishing portfolio companies<br />

and unemployed workers.<br />

Emboldened asset owners – some<br />

of the larger U.S. pensions are<br />

under fire from their support<br />

base, public sector unions, in<br />

what seems to be private equity<br />

firms making money from fees<br />

other than turning around actual<br />

portfolio companies.<br />

Take for example, Caesars<br />

Entertainment Corporation,<br />

which TPG Capital LP and Apollo<br />

Global Management LLC took<br />

private with investor money,<br />

mostly public funds. The casino<br />

operator became saddled with<br />

debt affecting the financial health<br />

of the balance sheet. Coupled with<br />

top-line revenue shortfalls due to<br />

losses in gambling revenues, their<br />

investment faltered. While this is<br />

taking place, the two buyout firms<br />

charged Caesars Entertainment a<br />

US$ 200 million transaction fee<br />

on the US$ 30.7 billion buyout<br />

deal in 2008. In addition, the<br />

private equity firms have been<br />

raking in US$ 30 million per<br />

annum in monitoring fees charged<br />

to the casino company. Usually,<br />

when buyout investments do well,<br />

limited partners tend to look the<br />

other way.<br />

What can institutional<br />

investors do<br />

First, they can write letters to<br />

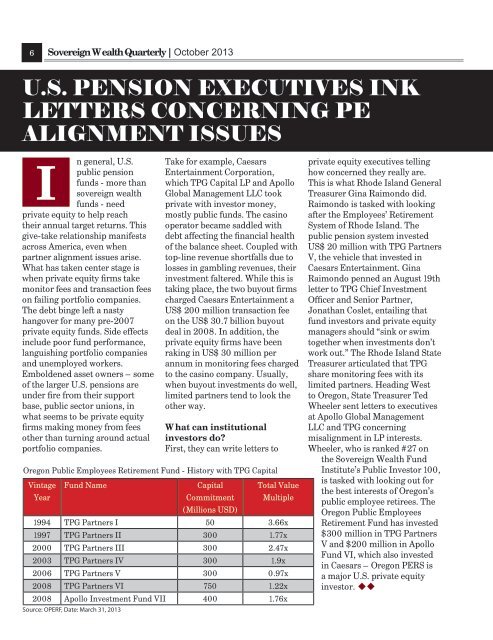

Oregon Public Employees Retirement <strong>Fund</strong> - History with TPG Capital<br />

Vintage<br />

Year<br />

<strong>Fund</strong> Name<br />

Capital<br />

Commitment<br />

Total Value<br />

Multiple<br />

(Millions USD)<br />

1994 TPG Partners I 50 3.66x<br />

1997 TPG Partners II 300 1.77x<br />

2000 TPG Partners III 300 2.47x<br />

2003 TPG Partners IV 300 1.9x<br />

2006 TPG Partners V 300 0.97x<br />

2008 TPG Partners VI 750 1.22x<br />

2008 Apollo Investment <strong>Fund</strong> VII 400 1.76x<br />

Source: OPERF, Date: March 31, 2013<br />

private equity executives telling<br />

how concerned they really are.<br />

This is what Rhode Island General<br />

Treasurer Gina Raimondo did.<br />

Raimondo is tasked with looking<br />

after the Employees’ Retirement<br />

System of Rhode Island. The<br />

public pension system invested<br />

US$ 20 million with TPG Partners<br />

V, the vehicle that invested in<br />

Caesars Entertainment. Gina<br />

Raimondo penned an August 19th<br />

letter to TPG Chief Investment<br />

Officer and Senior Partner,<br />

Jonathan Coslet, entailing that<br />

fund investors and private equity<br />

managers should “sink or swim<br />

together when investments don’t<br />

work out.” The Rhode Island State<br />

Treasurer articulated that TPG<br />

share monitoring fees with its<br />

limited partners. Heading West<br />

to Oregon, State Treasurer Ted<br />

Wheeler sent letters to executives<br />

at Apollo Global Management<br />

LLC and TPG concerning<br />

misalignment in LP interests.<br />

Wheeler, who is ranked #27 on<br />

the <strong>Sovereign</strong> <strong>Wealth</strong> <strong>Fund</strong><br />

<strong>Institute</strong>’s Public Investor 100,<br />

is tasked with looking out for<br />

the best interests of Oregon’s<br />

public employee retirees. The<br />

Oregon Public Employees<br />

Retirement <strong>Fund</strong> has invested<br />

$300 million in TPG Partners<br />

V and $200 million in Apollo<br />

<strong>Fund</strong> VI, which also invested<br />

in Caesars – Oregon PERS is<br />

a major U.S. private equity<br />

investor. uu