LEADERSHIP TEAM - Members 1st Federal Credit Union

LEADERSHIP TEAM - Members 1st Federal Credit Union

LEADERSHIP TEAM - Members 1st Federal Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

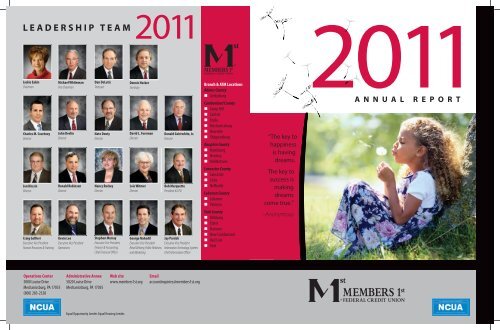

<strong>LEADERSHIP</strong> <strong>TEAM</strong><br />

Jackie Eakin<br />

Chairman<br />

Michael Whiteman<br />

Vice Chairman<br />

Dan DeLutis<br />

Treasurer<br />

Dennis Hocker<br />

Secretary<br />

Branch & ATM Locations<br />

Adams County<br />

• Gettysburg<br />

Charles M. Courtney<br />

Director<br />

John Devlin<br />

Director<br />

Nate Douty<br />

Director<br />

David L. Foreman<br />

Director<br />

Donald Geistwhite, Jr.<br />

Director<br />

Cumberland County<br />

• Camp Hill<br />

• Carlisle<br />

• Enola<br />

• Mechanicsburg<br />

• Newville<br />

• Shippensburg<br />

Dauphin County<br />

• Harrisburg<br />

• Hershey<br />

• Middletown<br />

“The key to<br />

happiness<br />

is having<br />

dreams.<br />

Jon Kirssin<br />

Director<br />

Ronald Robinson<br />

Director<br />

Nancy Rockey<br />

Director<br />

Lois Witmer<br />

Director<br />

Bob Marquette<br />

President & CEO<br />

Lancaster County<br />

• Lancaster<br />

• Lititz<br />

• Neffsville<br />

Lebanon County<br />

• Lebanon<br />

• Palmyra<br />

The key to<br />

success is<br />

making<br />

dreams<br />

come true.”<br />

Craig Golfieri<br />

Executive Vice President<br />

Human Resources & Training<br />

Kevin Lee<br />

Executive Vice President<br />

Operations<br />

Stephen Murray<br />

Executive Vice President,<br />

Finance & Accounting,<br />

Chief Financial Officer<br />

George Nahodil<br />

Executive Vice President<br />

Retail Delivery, Public Relations<br />

and Marketing<br />

Jay Parrish<br />

Executive Vice President<br />

Information Technology Systems<br />

Chief Information Officer<br />

York County<br />

• Dillsburg<br />

• Etters<br />

• Hanover<br />

• New Cumberland<br />

• Red Lion<br />

• York<br />

–Anonymous<br />

Operations Center Administrative Annex Web site Email<br />

5000 Louise Drive 5020 Louise Drive www.members<strong>1st</strong>.org accountinquiries@members<strong>1st</strong>.org<br />

Mechanicsburg, PA 17055 Mechanicsburg, PA 17055<br />

(800) 283-2328<br />

Equal Opportunity Lender. Equal Housing Lender.

Executive Summary<br />

We were fortunate to celebrate three milestones in 2011 including:<br />

• Exceeding $2 billion in assets as of April 30<br />

• Exceeding 200,000 members as of October 31<br />

• Opening our 50th branch location on Hempstead Road in Lancaster<br />

Our dedicated volunteers and staff have been committed to helping members to make their dreams come true<br />

and that’s why we can celebrate these milestones and set our sights toward achieving more in 2012. We note<br />

the following highlights from 2011:<br />

• According to recent data available as of September 30, 2011, we moved into the prestigious ranks of being<br />

one of the 59 credit unions in existence with $2 billion or more in assets (we are 58th) and remain one of the<br />

top three largest credit unions in Pennsylvania.<br />

• We achieved a 98.1% <strong>Members</strong>hip Satisfaction Rating and 86.5% of those randomly surveyed were very or<br />

extremely satisfied with our products and services.<br />

• We have relationships with 3,707 Select Employer Groups representing an increase of 887 from 2010.<br />

• Our associates participated in more than 239 community and charitable events and provided 4,554<br />

volunteer hours for the benefit of our local community. We also participated in a total of 153 chamber of<br />

commerce events. <strong>Members</strong> <strong>1st</strong> and our associates raised and contributed over $432,370 to charitable, civic<br />

and credit union industry organizations.<br />

• We opened four new stand-alone branches: Lebanon County – Quentin Road; Dauphin County –<br />

Middletown; Lancaster County – Lititz Pike and Hempstead Road. We also began construction of the first<br />

credit union ever in Perry County and will open our Duncannon branch in April 2012.<br />

• New products and services offered included: Debit Card Personalization; Merchant Lending; online VISA®<br />

balance transfers; 5/1 Adjustable Rate Mortgage; USDA Guaranteed Rural Development 100% financing;<br />

72-month term financing for qualified high-end model vehicle purchases; longer term/higher limit<br />

Signature Loans; VISA® eStatements; and online certificate renewal and certificate dividend payment option<br />

selection. We also expanded the availability of Settlement Services throughout our branch market areas.<br />

• Rewards Distribution – Consumer VISA® cash-back rewards totaled $955,758. Business VISA® Card cashback<br />

rewards totaled $129,741. VISA® Debit Card users received a total of $865,098 in Swipe 5® rebates<br />

while Business VISA® Debit Card users received $21,940 in rebates.<br />

• Electronic & Mobile Services – We introduced our new in-house bill payer service and iCal Bill Pay feed. We<br />

realized an increase in home banking usage with 143,726 home banking accounts. Mobile Banking usage<br />

increased to 10, 982 active accounts.<br />

• Local awards: We were named “Simply the Best” <strong>Credit</strong> <strong>Union</strong> from Harrisburg Magazine for the 8th time.<br />

We won “Best Bank” for Carlisle and the West Shore and “Best Mortgage Lender” for the West Shore from The<br />

Sentinel (Carlisle). We were named “Who’s Who in Business in York” from Susquehanna Style magazine.<br />

We are pleased to report that we remain financially sound and we will continue to plan well for our future and<br />

yours. Thank you for allowing us to bring you unparalleled service and experiences as we move forward in such<br />

uncertain economic times.<br />

Supervisory Committee Report<br />

The Supervisory Committee of <strong>Members</strong> <strong>1st</strong> <strong>Federal</strong><br />

<strong>Credit</strong> <strong>Union</strong> consists of independent volunteers and<br />

operates under a written charter adopted by the<br />

Committee and the Board of Directors. The members<br />

of the Committee are John Devlin (Chairman), Michael<br />

McGinley, Bob May, Dan Oneufer, and Karen Mashinski.<br />

The Committee has oversight responsibilities for the:<br />

1. Integrity of the <strong>Credit</strong> <strong>Union</strong>’s financial statements<br />

and related reporting processes;<br />

2. <strong>Credit</strong> <strong>Union</strong>’s system of internal controls regarding<br />

finance, accounting, legal, compliance, and ethics;<br />

3. Independent accountant’s qualifications and<br />

independence;<br />

4. Performance of the <strong>Credit</strong> <strong>Union</strong>’s internal audit<br />

function and independent accountants.<br />

The Supervisory Committee contracted the independent<br />

accounting firm of Orth, Chakler, Murnane & Co., CPAs,<br />

to perform the audit of the <strong>Credit</strong> <strong>Union</strong>’s June 30, 2011<br />

financial statements.<br />

The Committee met with the internal auditors<br />

and independent accountants, with and without<br />

management present, and discussed the results of their<br />

examinations, their evaluations of the <strong>Credit</strong> <strong>Union</strong>’s<br />

internal controls, and the quality of the <strong>Credit</strong> <strong>Union</strong>’s<br />

financial reporting. It is the Committee’s responsibility<br />

to monitor these processes by working closely with<br />

both the independent accounting firm and the <strong>Credit</strong><br />

<strong>Union</strong>’s internal auditors. Management has the primary<br />

responsibility for the <strong>Credit</strong> <strong>Union</strong>’s financial statement<br />

and reporting process, including the system of internal<br />

controls. The independent accountants are responsible<br />

for expressing an opinion on the conformity of the <strong>Credit</strong><br />

<strong>Union</strong>’s financial statements with accounting principles<br />

generally accepted in the U.S. We are pleased to report<br />

that the annual audit conducted for June 30, 2011was<br />

completed successfully and the <strong>Credit</strong> <strong>Union</strong>’s financial<br />

statements were certified without qualification.<br />

The Supervisory Committee acts as a liaison between the<br />

Board of Directors and our members. If members ever<br />

need assistance, or experience difficulties that cannot be<br />

resolved through normal channels, they are encouraged<br />

to contact the Supervisory Committee at: P.O. Box 3036,<br />

Shiremanstown, PA 17011. The Supervisory Committee<br />

reviews and responds in writing to all letters received.<br />

John Devlin<br />

Chairman<br />

Meeting Our <strong>Members</strong> Borrowing Needs<br />

Although the level of unemployment continues to remain high, 2011 did<br />

show some signs of recovery resulting in very strong growth in our loan<br />

portfolio. In the housing market, which was soft in both prices as well<br />

as demand, there were refinancing opportunities as a result of lower<br />

interest rates. Auto lending showed improvement and, even though<br />

banks became more competitive in this market, <strong>Members</strong> <strong>1st</strong> continued<br />

to be the leading financial institution for auto financing. Small business<br />

lending also experienced good growth, as did other areas of lending.<br />

We outpaced our peers and exceeded our financial plan ending with<br />

10.18% loan growth for 2011. Automobile loans increased by $39<br />

million as we held a market share of 10.04%, the highest of any<br />

financial institution in our 8-county market area. Real Estate secured<br />

business loans increased $21 million; fixed rate home equities increased<br />

$14 million; mortgages increased by $35 million and VISA® increased<br />

by $12 million. The overall quality of our loan portfolio remained high<br />

as the percentage of loans that are delinquent or charged off was<br />

significantly below our peer group.<br />

The number of approved applications increased in almost every loan<br />

category:<br />

Number of Approved $ Approved<br />

Applications<br />

Traditional Loans 20,058 $229,059,526.29<br />

On The Spot Vehicle Loans 27,784 461,490,558.03<br />

First Mortgages 1,649 269,397,260.00<br />

Fixed Rate Home Equity Loans 3,259 180,768,292.68<br />

Student Loans 1,621 8,518,854.00<br />

Business Loans 532 174,579,049.00<br />

At <strong>Members</strong> <strong>1st</strong>, we continue to offer a wide variety of loan and lineof-credit<br />

products. In 2011 we introduced higher-limit, longer-term<br />

signature loans to assist our members with their financing needs. We<br />

expanded our VISA® and Home Equity programs through competitive<br />

promotional offerings, added 19 new dealerships to our indirect loan<br />

program, 21 to our auto leasing program and 33 merchants to our new<br />

merchant lending program. In Business Lending, we closed over $74<br />

million in new business loans.<br />

We again offered our members the very popular holiday skip-a-pay<br />

promotion as well as a special one in the spring. Continuing our focus<br />

on member service, we maintained an average decision time on<br />

our consumer loans of less than 15 minutes while processing both a<br />

record number of loan applications and answering a record number of<br />

member phone calls. Through our commitment to member service, our<br />

technology, and the processes we employ, our loan products offer many<br />

value-added benefits to our members.<br />

Kevin Lee<br />

Executive Vice President<br />

Operations<br />

Condensed Financial Information<br />

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited)<br />

(Dollars in Thousands)<br />

Dec 31, 2011 Dec 31, 2010<br />

ASSETS<br />

Cash and Cash Equivalents $ 92,429 $ 95,925<br />

Investments<br />

Available-for-Sale 217,988 10,114<br />

Held-to-Maturity 79,878 242,555<br />

Other 5,545 5,300<br />

Loans - net of Allowance 1,561,691 1,433,493<br />

Accrued Income Receivable 9,474 8,468<br />

Property, Plant, Equipment 90,534 79,010<br />

Deposit NCUSIF 17,241 15,908<br />

Other Assets 6,834 10,892<br />

TOTAL ASSETS $ 2,081,614 $ 1,901,665<br />

LIABILITIES AND MEMBERS’ EQUITY<br />

Liabilities<br />

<strong>Members</strong>’ Shares $ 1,881,521 $ 1,733,208<br />

Other Liabilities 23,530 16,533<br />

Total Liabilities 1,905,051 1,749,741<br />

<strong>Members</strong>’ Equity 176,563 151,924<br />

TOTAL LIABILITIES AND MEMBERS’ EQUITY $ 2,081,614 $ 1,901,665<br />

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)<br />

(Dollars in Thousands)<br />

Dec 31, 2011 Dec 31, 2010<br />

INTEREST INCOME<br />

Interest on Loans $ 84,723 $ 81,734<br />

Investment Income 5,591 7,543<br />

Total Interest Income 90,314 89,277<br />

INTEREST EXPENSE<br />

Member Dividends & Interest 16,380 20,521<br />

Net Interest Income 73,934 68,756<br />

PROVISION FOR LOAN LOSSES 7,740 10,500<br />

Net Interest After Provision for Loan Losses 66,194 58,256<br />

NON-INTEREST INCOME<br />

Fees and Charges 17,942 15,815<br />

Other Non-Interest Income - net 17,085 16,588<br />

Total Non-Interest Income 35,027 32,403<br />

NON-INTEREST EXPENSES<br />

Compensation and Benefits 41,066 36,640<br />

Office Operations 34,185 32,103<br />

Other 502 454<br />

Total Non-Interest Expenses 75,753 69,197<br />

NET INCOME Before NCUSIF Stabilization Assessment 25,468 21,462<br />

NCUSIF Stabilization Assessment 4,310 4,080<br />

NET INCOME $ 21,158 $ 17,382<br />

Bob Marquette<br />

President & CEO<br />

Jackie Eakin<br />

Chairman<br />

<strong>Members</strong> <strong>1st</strong> <strong>Federal</strong> <strong>Credit</strong> <strong>Union</strong> is federally insured by the National <strong>Credit</strong> <strong>Union</strong> Administration.