Appendix A: Full State Reports - Sustainable Energy Utility

Appendix A: Full State Reports - Sustainable Energy Utility

Appendix A: Full State Reports - Sustainable Energy Utility

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

California <strong>Energy</strong> Efficiency Programs<br />

Legislation<br />

Building and appliance efficiency standards were first created in 1976 in response to a legislated<br />

mandate to reduce California’s energy consumption.<br />

Assembly Bill 1890 (1996):<br />

AB 1890 required the three investor owned electric utilities in California to collect a public<br />

goods charge (PGC) on electricity sales. PCG funds support cost-effective energy efficiency and<br />

conservation, low-income energy assistance, public interest R&D, and installation of renewable<br />

energy generation “not adequately provided by the competitive and regulated markets.”<br />

Assembly Bill 1002 (2000): AB 1002 added a public goods charge to utility gas rates.<br />

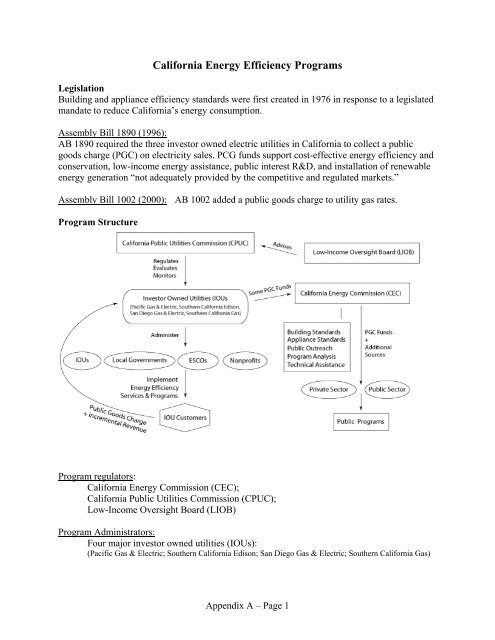

Program Structure<br />

Program regulators:<br />

California <strong>Energy</strong> Commission (CEC);<br />

California Public Utilities Commission (CPUC);<br />

Low-Income Oversight Board (LIOB)<br />

Program Administrators:<br />

Four major investor owned utilities (IOUs):<br />

(Pacific Gas & Electric; Southern California Edison; San Diego Gas & Electric; Southern California Gas)<br />

<strong>Appendix</strong> A – Page 1

Program Implementers:<br />

Any entity contracted by the IOUs, with the exception that implementers cannot be EM&V<br />

contractors. The CPUC has implemented a 20% minimum open bidding requirement to allow<br />

third-parties to implement competitively contracted services.<br />

Program Advisory Groups (PAGs):<br />

CPUC directed each utility to create a separate program advisory group for each service territory<br />

to “safeguard against potential bias in program selection and portfolio management.” 1<br />

Purpose of PAGs:<br />

1.Promote transparency in administrators’ decision making processes;<br />

2. Provide a forum to obtain technical expertise from stakeholders and non-market<br />

participants<br />

3. Encourage collaboration among stakeholders<br />

4. Create an additional venue for public participation<br />

5. Create an open exchange of information for utility program administrators, experts,<br />

and stakeholders,<br />

6. Provide independent assessment of utilities’ portfolio design and program selection<br />

PAGs meet at least once every quarter and must report to the CPUC’s “<strong>Energy</strong> Division with<br />

recommendations on (1) how the utilities can improve their effectiveness as administrators in<br />

managing the portfolio of programs, and (2) how the program selection process can be improved<br />

to better meet the Commission’s procurement goals.” 2<br />

Peer Review Groups (PRGs):<br />

Peer Review Groups are non-financially interested sub-groups of the Program Advisory Groups.<br />

PRGs review utilities’ submittals to the CPUC and assess the utilities’ overall portfolio plans,<br />

their plans to bid out pieces of the portfolio, and the proposed bid evaluation criteria. PRGs also<br />

assess the portfolio’s ability to meet or exceed short- and long-term savings goals. CPUC can<br />

also hire independent consultants to provide program assessments (paid for by efficiency<br />

programs). Utilities must include PRG assessments with their filings of program plans and final<br />

program offerings. Staff members of the CPUC <strong>Energy</strong> Division and the Office of Ratepayer<br />

Advocates (ORA) are ex officio members of each PAG and PRG. The CEC also participates as a<br />

member.<br />

Funding Sources<br />

All IOU electricity and gas customers pay a public goods charge equivalent to approximately 1%<br />

and 0.7% of their respective electric and gas bills. PGC funds yield approximately $540 million<br />

per year for public purpose programs.<br />

In addition to PGC funds, the CPUC approves IOU-proposed incremental revenue requirements<br />

to meet energy efficiency targets. IOUs establish energy efficiency targets and energy efficiency<br />

budget requirements, but if these budget requirements exceed available PGC funds, which they<br />

do, then IOUs are allowed to collect the difference through distribution rates.<br />

1 Page 12. http://www.cpuc.ca.gov/Published/Graphics/48668.pdf<br />

2 ibid<br />

<strong>Appendix</strong> A – Page 2

The CEC is funded by a combination of PGC, federal, and <strong>State</strong> trust monies.<br />

Budget<br />

Total 2006-2008 Budget for IOU Administered energy efficiency programs: $2.14 billion<br />

Expected program benefits for ratepayers (2006-2008) = $5 billion 3<br />

8%<br />

4%<br />

5%<br />

4% 4%3% 3%<br />

8%<br />

13%<br />

PG&E Annual Program Budget<br />

2006-2008=$942,900,260<br />

48%<br />

Mass Market<br />

Industrial<br />

EM&V<br />

Agricultural and Food Processing<br />

Education and Training<br />

Other<br />

Commercial (Office Buildings)<br />

Residential New Construction<br />

<strong>State</strong>wide Marketing<br />

Medical<br />

3%<br />

4%<br />

4%<br />

3%<br />

5%<br />

19%<br />

7%<br />

8%<br />

SDG&E Annual Program Budget<br />

2006-2008=$278,143,810<br />

12%<br />

20%<br />

15%<br />

Third Party Programs<br />

<strong>Energy</strong> Savings Bids<br />

Other<br />

Small Business Super Saver<br />

EM&V<br />

Upstream Lighting<br />

Savings by Design<br />

Partnerships (Cities/Universities)<br />

Standard Performance Prog.<br />

Express Efficiency Rebates<br />

<strong>State</strong>wide Marketing<br />

5%<br />

6%<br />

4% 3%<br />

4%<br />

5%<br />

16%<br />

SCE Annual Program Budget<br />

2006-2008=<br />

$728,818,559<br />

15%<br />

6%<br />

9%<br />

6%<br />

7%<br />

7%<br />

Business 7% Incentives Other<br />

Residential EE Rebates<br />

M ultifamily Rebates<br />

HVAC non-resid.<br />

Industrial Processes<br />

Agricultural EE<br />

Small Business<br />

EM &V<br />

Small Business<br />

Partnerships<br />

Appliance Recycling<br />

IDEEA<br />

Education Training<br />

16%<br />

5%<br />

21%<br />

4%<br />

4%<br />

Renewables<br />

Primary Staff Funds<br />

Other<br />

California <strong>Energy</strong> Commission<br />

Annual Program Budget<br />

2006/2007= $328,000,000<br />

50%<br />

Public Interest RD&D<br />

Nat. Gas Research<br />

Federal Funds<br />

3 CPUC Press Release, September 22, 2005. Accessed<br />

September 22, 2006<br />

<strong>Appendix</strong> A – Page 3

Annual Expenditure on Efficiency Programs 2000-2004 ($000) 4<br />

Year 2000 2001 2002 2003 2004<br />

PG&E $171,828 $166,828 $130,001 $139,967 $132,752<br />

SCE $105,943 $93,748 $77,361 $104,932 $146,763<br />

SDG&E $30,044 $41,489 $19,902 $34,364 $37,828<br />

Total $307,815 $302,065 $227,264 $279,263 $317,343<br />

Approved Funding for 2006-2008 (in Thousands of dollars) 5<br />

Year 2006<br />

% Diff<br />

from<br />

Previous<br />

Year 2007<br />

% Diff<br />

from<br />

Previous<br />

Year 2008<br />

% Diff<br />

from<br />

Previous<br />

Year Total Cost<br />

PG&E $276,000 111% $304,000 10% $373,000 23% $953,000<br />

SCE $243,000 43% $243,000 0% $243,000 0% $729,000<br />

SDG&E $81,000 30% $91,000 12% $106,000 16% $278,000<br />

SCG $48,000 47% $61,000 27% $73,000 20% $182,000<br />

Total $648,000 $699,000 $795,000 $2,142,000<br />

Projected IOU <strong>Energy</strong><br />

Savings (GWh) 2,152 2,482 2,724 7,358<br />

Current Program Targets<br />

Efficiency:<br />

Meet 50% of future electricity load growth and reduce demand by three large power<br />

plants (1,500 MW); achieve savings of $2.7 billion for consumers, decrease average<br />

customer bills by 2% by 2009.<br />

Achieve 90% of remaining cost-effective energy efficiency resource potential by 2013. 6<br />

Appliance Standards:<br />

Updates to the 2004 Building Appliance Standards will avoid five large power plants<br />

(2,500 MW) in the next 10 years and reduce customer bills by $3.3 billion.<br />

General:<br />

Establish an electricity system loading order as follows: energy efficiency and<br />

conservation plus demand response, renewables including distributed generation, cleanest<br />

available fossil fuel generation. 7<br />

4 CEC (2005) "Funding and <strong>Energy</strong> Savings from Investor-Owned <strong>Utility</strong> <strong>Energy</strong> Efficiency Programs in California<br />

for Program Years 2000 Through 2004,” Accessed September 21, 2006.<br />

5 ibid<br />

6 CEC (2005) "Funding and <strong>Energy</strong> Savings from Investor-Owned <strong>Utility</strong> <strong>Energy</strong> Efficiency Programs in California for Program<br />

Years 2000 Through 2004,” p. 14 Accessed September 21, 2006.<br />

7 CEC, CPUC, “<strong>Energy</strong> Action Plan I.”<br />

<strong>Appendix</strong> A – Page 4

Results<br />

Cost Effectiveness<br />

Cost of <strong>Energy</strong> Efficiency Compared to<br />

Electricity Generation in California<br />

(Prices from July 2006)<br />

Cost of <strong>Energy</strong> Efficiency<br />

Compared to Natural Gas<br />

Heating in California<br />

0.16<br />

0.1666<br />

0.1618<br />

1.2<br />

1<br />

1.087<br />

$/kWh<br />

0.12<br />

0.08<br />

0.04<br />

0<br />

0.0342<br />

Average<br />

Cost of EE<br />

Programs<br />

for 2000-04<br />

0.0302<br />

Average<br />

Cost of EE<br />

Programs<br />

for 2006-08<br />

Price of<br />

Residential<br />

Electricity<br />

Price of<br />

Commercial<br />

Electricity<br />

$/ccf<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0<br />

0.21255<br />

Average Cost<br />

of EE<br />

Programs for<br />

2006-08<br />

Average Price<br />

of Natural<br />

Gas (July<br />

2006)<br />

First-Year Demand and <strong>Energy</strong> Savings (2001-2004)<br />

Year Expenditure ($000) Demand Savings <strong>Energy</strong> Savings Gas Savings (million therms)<br />

2001 $302,065 436 MW 1,600 GWh 17.8<br />

2002 $227,264 355 MW 1,200 GWh 20<br />

2003 $279,263 291 MW 1,300 GWh 34.2<br />

2004 $317,343 377 MW 1,900 GWh 39<br />

Detail of 2004 Program Year Results<br />

First Year<br />

<strong>Energy</strong><br />

Savings<br />

(GWh)<br />

First year<br />

demand<br />

savings<br />

(MW)<br />

Total <strong>Utility</strong><br />

Retail<br />

Revenue<br />

($000)<br />

E-Eff.<br />

Funds As %<br />

of Retail<br />

Revenue<br />

% of Total<br />

% of Total Funding<br />

<strong>Utility</strong><br />

GWh<br />

MW ($000)<br />

PG&E 623 0.80% 141 0.60% $132,752 6,738,167 1.97%<br />

SCE 984 1.20% 185 0.90% $146,763 5,648,414 2.60%<br />

SDG&E 236 1.40% 51 1.40% $37,828 1,480,871 2.55%<br />

Total 1,843 1.00% 377 0.80% $317,343 13,867,452 2.29%<br />

Average levelized costs of 2004 energy efficiency programs = 1.1 cents per kWh 8<br />

8 California <strong>Energy</strong> Commission (2005) “Funding and <strong>Energy</strong> Savings From Investor-Owned <strong>Utility</strong> <strong>Energy</strong><br />

Efficiency Programs In California for Program Years 2000 Through 2004,” p. 11<br />

<strong>Appendix</strong> A – Page 5

CEC Programs<br />

Program Category Technologies Clients<br />

Standards and Regulations<br />

Appliance Efficiency & Regs. Determined by CEC All sectors<br />

Building Efficiency (Title 24) Determined by CEC All sectors<br />

Green Building Initiative <strong>Energy</strong>-star / LEED Certification Government and private<br />

buildings<br />

Incentives<br />

Agriculture<br />

Specific incentives and services for Specific ag. industries<br />

each industry<br />

Industrial Process <strong>Energy</strong> Specific to each project/industry Industrial sector<br />

Low Interest Loans & Tech. Assistance<br />

Water <strong>Energy</strong><br />

Technical assistance, technology<br />

demonstration<br />

Bright Schools Program<br />

Efficiency Financing for Local<br />

Government, Hospitals, Schools<br />

Engineering and architectural<br />

technical assistance<br />

Financing for any EE upgrades.<br />

Water pumping, water<br />

treatment, wastewater<br />

treatment<br />

Local government,<br />

hospitals, and schools<br />

Marketing<br />

Flex Your Power<br />

<strong>State</strong>-wide information clearinghouse<br />

for IOU administered EE services<br />

All sectors<br />

IOU Service Programs (Available in PG&E Service Territory as an example)<br />

Program Category Service Clients Description<br />

Audits<br />

-Online self-audit advice<br />

-Water conservation<br />

Diagnostic & Measurement Tools<br />

Tool lending library<br />

Residential,<br />

Commercial, Industrial,<br />

Agricultural<br />

Res., Com., Ind. Ag.<br />

Education<br />

Targeted to homeowners<br />

and professionals<br />

Classroom materials for<br />

teachers<br />

Targeted to construction<br />

professionals<br />

Equipment Testing, Tune-up, Repair<br />

Technologies serviced<br />

depend on industry<br />

Project Design Assistance<br />

<strong>State</strong>wide Savings By<br />

Design Program<br />

Res., Com., Ind., Ag<br />

Commercial, Industrial,<br />

Agricultural<br />

Commercial, Industrial,<br />

Agricultural<br />

Targeted to the food<br />

service industry<br />

Building design<br />

assistance specific to the<br />

project.<br />

Accessed<br />

September 22, 2006.<br />

<strong>Appendix</strong> A – Page 6

Training and Certification<br />

Savings By Design:<br />

<strong>Energy</strong> Design<br />

Resources<br />

Architects, engineers,<br />

lighting designers,<br />

facility owners,<br />

developers<br />

IOU Incentive Programs (available in PG&E service territory as an example)<br />

Program Category Technologies Clients<br />

Rebates<br />

Appliances<br />

-Clothes washers & dryers<br />

-Dishwashers<br />

-Refrigerators & Freezers<br />

Residential, Commercial,<br />

Industrial, Ag.<br />

Building Envelope<br />

Demand Response<br />

Equipment insulation<br />

-Doors<br />

-Insulation<br />

-Windows<br />

-Day-ahead notification<br />

Commercial, Industrial, Ag.<br />

Residential<br />

Residential, Commercial,<br />

Industrial, Ag.<br />

-Day-of Notification<br />

Commercial, Industrial, Ag.<br />

Low-income assistance Weatherization Residential<br />

Food Service Equipment<br />

Heating & Cooling<br />

Lighting<br />

Miscellaneous<br />

-Air conditioning & fans<br />

-Boilers<br />

-Water heaters<br />

-Furnaces<br />

-Heat pumps<br />

-CFLs<br />

-Controls & Sensors<br />

-Exit signs<br />

-Indoor lighting<br />

-Lighting fixtures<br />

-Outdoor lighting<br />

-Transportation (DOE rebates<br />

for hybrid vehicles)<br />

Commercial, Industrial, Ag.<br />

Residential, Commercial,<br />

Industrial, Ag<br />

Commercial, Industrial, Ag.<br />

Residential, Commercial,<br />

Industrial, Ag.<br />

Residential, Commercial,<br />

Industrial, Ag.<br />

-Fuel cells<br />

Commercial, Industrial, Ag.<br />

Motors & Drives -Microturbines Commercial, Industrial, Ag.<br />

Outdoors -Pool pumps & motors Residential<br />

Water Efficiency<br />

Whole Building & Systems<br />

-Aerators & Showerheads<br />

-Toilets & Urinals<br />

-ENERGY STAR homes<br />

-New construction<br />

-Lighting, HVAC, envelope<br />

Residential, Commercial,<br />

Industrial, Ag.<br />

-Residential<br />

-Commercial, Industrial, Ag.<br />

<strong>Appendix</strong> A – Page 7

Additional Results: 9<br />

9 California <strong>Energy</strong> Commission. “<strong>Energy</strong> Efficiency: California’s Highest-Priority Resource.”<br />

ftp://ftp.cpuc.ca.gov/Egy_Efficiency/Calif_EE_brochure_6.20.06.pdf. p. 4<br />

<strong>Appendix</strong> A – Page 8

California Renewable <strong>Energy</strong> Incentives<br />

Legislative History<br />

California <strong>Energy</strong> Commission’s Renewable <strong>Energy</strong> Program:<br />

AB 1890 (1996) required the IOUs to collect a total of $540 million for the Renewable <strong>Energy</strong><br />

Program from 1998 to 2001. 10<br />

SB 90 (1997) established the CEC’s Renewable <strong>Energy</strong> Program categories, four of which still<br />

continue: 11<br />

- Existing Renewable Resources:<br />

o Promote market competition among existing, typically utility-scale, renewable<br />

energy facilities. Incentives are performance based.<br />

- New Renewable Resources:<br />

o Encourage renewable generation projects that have the potential to become<br />

competitive with conventional technology. The CEC has interpreted this to<br />

include the following eligible technologies: biomass, digester gas, geothermal,<br />

landfill gas, small hydro, waste tire, and wind.<br />

- Emerging Renewables:<br />

o Incentives for end-use customer-sited renewable energy generation for PV, solar<br />

thermal electric, fuel cells with renewable fuels, small wind.<br />

- Consumer education.<br />

o Inform public about benefits of renewable energy; establish the Western Regional<br />

Generation Information System (WREGIS) to track renewable energy generation.<br />

AB 995 and SB 1194 (2000) refinanced the CEC’s Renewable <strong>Energy</strong> Programs by directing<br />

IOUs to collect $135 million/yr from 2002 through 2011 to support renewable energy. 12 The goal<br />

of this funding allocation is to establish a competitive, self-sustaining renewable energy industry.<br />

CPUC Self-Generation Incentive Program:<br />

AB 970 (2000) required the CPUC to implement load control and distributed generation<br />

programs. CPUC Decision 01-03-073, on March 27, 2001, mandated IOUs to implement a selfgeneration<br />

program to promote public benefits to all ratepayers, including gas ratepayers. 13 The<br />

SGIP program was designed to offer incentives from 2001 through 2007.<br />

California Solar Initiative:<br />

The CPUC made an administrative decision to create the California Solar Initiative (CSI) based<br />

on the Legislature’s stated goals to create a self-sustaining renewable energy industry and to<br />

install one million solar systems. The CSI will be funded by IOU demand rates. As of January 1,<br />

2007, the remaining funding and administrative structure of the Self-Generation Incentive<br />

Program will continue as the California Solar Initiative.<br />

SB 1: Passed Aug. 21, 2006:<br />

10 CEC 2005 Report, p. 2 http://www.energy.ca.gov/2005publications/CEC-300-2005-020/CEC-300-2005-020.PDF<br />

11 <br />

12 ibid<br />

13 Itron (2005), “CPUC Self-Generation Incentive Program Fourth-Year Impact Report,” p. 7.<br />

<strong>Appendix</strong> A – Page 9

California Senate Bill 1 requires developers (“sellers of production homes”) to offer home<br />

buyers option of a solar energy system, or else developers can forgo the option by participating<br />

in an offset program to be designed by the CEC. The CEC must determine to what extent solar<br />

systems should be required on new residential and nonresidential buildings. SB 1 also requires<br />

PV incentives offered in the CSI to decline by a rate of 7% annually until incentives are phased<br />

out by 2017. SB 1 expands the allowable net metering capacity to 2.5% of a utility’s aggregate<br />

customer demand.<br />

SB 1 also required all local publicly owned electric utilities that sell retail electricity to adopt,<br />

implement, and finance a solar initiative program to encourage increased installation of<br />

residential and commercial solar energy systems.<br />

RPS: 14<br />

Senate Bill 1078 (2002) requires an annual increase in renewable generation by the IOUs<br />

equivalent to at least 1% of sales, with an aggregate goal of 20% by 2017. The CPUC intends to<br />

accelerate the goals to 2010 (outlined in <strong>Energy</strong> Action Plans I and II). The CEC is now<br />

considering a new target of 33% renewable energy generation by 2020.<br />

Program Structure<br />

Self-Generation Incentive Program & Emerging Renewables Program Through 2006<br />

14 http://www.cpuc.ca.gov/static/energy/electric/renewableenergy/index.htm<br />

<strong>Appendix</strong> A – Page 10

CEC Renewable <strong>Energy</strong> Programs:<br />

• Emerging Renewables Program<br />

Until the end of 2006 the CEC will administer cash rebate programs for all end-use<br />

customer-sited PV, solar thermal electric, fuel cell with renewable fuels, and wind systems<br />

under 30kW installed capacity. After January 1, 2007, when the California Solar Initiative<br />

begins, the CEC will only manage PV rebates for new residential construction.<br />

System owners, or a third-party on their behalf, apply to the CEC for a conditional rebate<br />

reservation. Once a rebate reservation is accepted applicants have up to six months to<br />

complete their systems. Public and charter schools have up to 18 months to complete system<br />

installation.<br />

To be eligible the “systems must be located on the premises of customers of California’s<br />

investor-owned electrical utilities, and sized so that the electricity they produce offsets part or<br />

all of the electrical needs of the premises.” 15 Systems cannot be sized larger than the<br />

customer’s historic demand. There is no application fee to reserve an incentive.<br />

The CEC was formerly required to submit quarterly reports, a biennial report, and annual<br />

project activity reports to the Legislature. After the Legislature passed AB 2304, in<br />

September 2004, the CEC replaced these reports by a single, comprehensive, annual report.<br />

• New Renewable Facilities Program<br />

Funds from this program encourage new renewable energy generation technologies that are<br />

likely to become competitive with conventional technologies at utility scales. Funds are<br />

awarded through auctions. Auction-winning projects receive production incentives for the<br />

first five years of generation. 16<br />

Funding from this program can also be used to meet the above-market costs of renewable<br />

energy generation to meet RPS requirements. 17 Future funding will be awarded by RPS<br />

solicitations, not auctions.<br />

• Existing Renewable Facilities Program<br />

Provides previously determined incentives to existing facilities. Production incentives for<br />

existing renewable facilities have totaled $209 million in funding to support 4,400 MW of<br />

renewables already on-line by 1998. In FY2005, the CEC disbursed $10.7 million for 1,250<br />

GWh of generation. 18<br />

• Consumer Education<br />

The CEC administers grants and contracts to increase public awareness of renewable energy<br />

and its benefits. The CEC also contracts research to develop and implement WREGIS.<br />

15 http://www.energy.ca.gov/renewables/emerging_renewables/more_info.html<br />

16 CEC 2005 Annual Report, p. 3, http://www.energy.ca.gov/2005publications/CEC-300-2005-020/CEC-300-2005-<br />

020.PDF<br />

17 ibid<br />

18 ibid<br />

<strong>Appendix</strong> A – Page 11

Self-Generation Incentive Program:<br />

The CPUC’s Self Generation Incentive Program (SGIP), Decision 01-03-073, is administered on<br />

a regional joint-delivery basis by the IOUs, though SDG&E must contract with the San Diego<br />

Regional <strong>Energy</strong> Office (SDREO) for some administrative and all implementation<br />

responsibilities. 19<br />

The CPUC mandated that current SGIP program administrators meet the following program<br />

delivery requirements:<br />

- Incentives are fixed on a statewide basis<br />

- On-site inspections are conducted to verify equipment installation and operational<br />

status.<br />

- Measuring and verification include either a census or sampling of energy production<br />

from operational projects<br />

- Excepting measurement and verification expenses, program administration<br />

expenditure is limited to 5% of program funding.<br />

CPUC hired an independent analyst to study the two different program administration models:<br />

the IOU administrative model and a non-utility administrative model (SDG&E and SDREO). All<br />

IOUs plus SDREO, the CPUC, and the CEC comprise a statewide working group to address<br />

implementation problems and implementation modifications.<br />

Due to a long rebate wait-list and a high percentage of rebate applications that did not result in<br />

projects being continued to fruition, the CPUC increased the rebate application fee to 0.5% of the<br />

project’s qualifying rebate level 20 to discourage speculative projects from needlessly reserving<br />

funds.<br />

The SGIP will be rolled into the California Solar Initiative on January 1, 2007.<br />

California Solar Initiative:<br />

The CSI will be regulated by the CPUC and administered by current SGIP administrators<br />

(IOUs).<br />

Funding Sources<br />

Funds for both CEC programs and the Self-Generation Incentive Program come from Public<br />

Goods Charges (PGC) and incremental demand rates from all IOU ratepayers. If non-regulated<br />

utilities contribute funds then their customers may participate in either rebate program. Because<br />

of high interest in rebate programs for customer-sited renewables, AB 135 (2004) authorized the<br />

CEC to reallocate $60 million from the New Renewables Program to the Emerging Renewables<br />

Program.<br />

The CSI will be funded by incremental demand rates from all IOU ratepayers, which will yield<br />

$2.8 billion between 2007 until 2017. The average IOU electricity customer will pay $12 per<br />

year, and natural gas customers will pay $1.4 per year, though these costs are expected to have a<br />

19 Itron (2006) “Self-Generation Incentive Program Administrator Comparative Assessment,” p. 14.<br />

20 2006 Self-Generation Incentive Program Handbook, p. 4-3.<br />

<br />

<strong>Appendix</strong> A – Page 12

minimal impact on customers’ bills since rate reduction bonds from the 1996 electricity industry<br />

restructuring expire at the end of 2007 when the CSI program begins. 21<br />

Budget<br />

CEC Renewable Resource Trust<br />

Fund Annual Budget<br />

2003-2006: $135 million<br />

10% 1%<br />

Self Generation Incentive<br />

Program Total Incentives Paid<br />

2001-2006 (complete+active<br />

projects): = $891,800,000<br />

18%<br />

51%<br />

0.5%<br />

0.3%<br />

4.0%<br />

82.1%<br />

3.2%<br />

20%<br />

New Renewable Facilities<br />

Existing Renewable Facilities<br />

Emerging Renewables<br />

Customer Credit (Direct Access Customers)<br />

Consumer Education<br />

22<br />

New Renewable Facilities: Biomass, digester gas,<br />

geothermal, landfill gas, small hydro, wind.<br />

9.9%<br />

PV<br />

Microturbines<br />

Gas Turbines<br />

IC Engines<br />

Fuel Cells<br />

Wind<br />

IC Engines must use renewable fuels, use waste heat<br />

recovery, and meet air quality standards.<br />

Existing Renewable Facilities: Existing utility-scale<br />

renewable projects<br />

Emerging Renewables: On-site PV, solar thermal<br />

electric, fuel cells with renewable fuels, small wind.<br />

California Solar Initiative Program Budget<br />

Total 2007-2017=$2.85 billion<br />

(10% Allocated for low-income<br />

customers/affordable housing projects)<br />

$350 million<br />

CPUC<br />

CEC<br />

$2.5 billion<br />

21 http://www.cpuc.ca.gov/static/energy/solar/060112_solarfactsheet.htm<br />

22 Source: http://www.energy.ca.gov/renewables/emerging_renewables/more_info.html<br />

<strong>Appendix</strong> A – Page 13

Program Performance<br />

CEC Renewable <strong>Energy</strong> Programs:<br />

New Renewable Facilities June 1999- June 2005 (performance based incentives)<br />

Technology MW On-Line# of projectsPayments ($)<br />

Biomass 11.3 2<br />

Digester Gas 2.05 1<br />

Geothermal 59 2<br />

Landfill Gas 36.37 14<br />

Small Hydro 31.25 3<br />

Waste Tire 0 0<br />

Wind 348.12 25<br />

Total MW (on-line) 488.09 47 $49,994,181<br />

Total MW (on-line + in progress) 1,266 $217,038,000<br />

Emerging Renewables from June 1999 to June 2005<br />

Capacity Total Rebates Disbursed<br />

PV (online) 56 MW $210,000,000<br />

Emerging Renewables Installed from June 2005 to June 2006<br />

Capacity Total Rebates Disbursed<br />

PV (installed + in<br />

progress) 51.6 MW $144,000,000*<br />

*The CPUC provides no data for this year, but rebate levels were $2.8/W<br />

CPUC Self-Generation Incentive Program:<br />

New Renewable Facilities Program (July 2001 – June 2006)<br />

Capacity (kW) Incentives ($)<br />

% of total<br />

capacity<br />

% of total<br />

incentives<br />

PV 231,531 $732,157,769 51.5% 82.1%<br />

IC Engines 149,970 $88,475,163 33.3% 9.9%<br />

Microturbines 43,867 $28,926,171 9.8% 3.2%<br />

Fuel Cells 11,850 $35,519,673 2.6% 4.0%<br />

Gas Turbines 9,861 $2,404,000 2.2% 0.3%<br />

Wind 2,650 $4,326,455 0.6% 0.5%<br />

Total 449,729 $891,809,231 100.0% 100.0%<br />

SGIP PV Installations Performance as of April 2006<br />

# of Projects Total Capacity (MW)<br />

Projects Completed 516 59.4<br />

Projects Active 635 142<br />

Total Projects 1,151 201.5<br />

Wait list 75 24.4<br />

Average Retail $/Watt installed cost = $8.81/Watt +/- $1.86<br />

<strong>State</strong>-wide Totals:<br />

<strong>Appendix</strong> A – Page 14

Total New PV Installations (CEC+SGIP) Between 1999 and Sept. 1, 2006<br />

PV Installed from 1999 to 2006 (MW)<br />

339 MW<br />

Incentives disbursed $1,090,000,000<br />

Cost Premium to Sate for PV<br />

$0.077 / kWh<br />

California Solar Initiative:<br />

The CSI aims to add 3,000 MW of new solar capacity by 2017, which is roughly equal to 4% of<br />

California’s current summer electricity demand.<br />

Current Renewable <strong>Energy</strong> Incentives<br />

CEC Emerging Renewables Program:<br />

Rebates are for solar electric, solar thermal, and other emerging clean technologies in<br />

applications sized under 30kW. Rebates for PV are currently $2.50 per watt AC. System sizes<br />

cannot exceed 200% of the site’s historical or current demand.<br />

Rebates Available for Emerging Renewable Systems 23<br />

(Effective July 1, 2006)<br />

Technology Type Size Category Rebate Offered*<br />

Photovoltaic (Solar cells)** Less than 30 kilowatts $2.60 per watt<br />

Solar Thermal Electric Fuel Cells<br />

using a renewable fuel***<br />

Less than 30 kilowatts<br />

$3.00 per watt<br />

Wind<br />

First 7.5 kilowatts<br />

Increments between<br />

> 7.5 kW and < 30 kW<br />

$2.50 per watt<br />

$1.50 per watt<br />

* Rebates for owner installed systems are discounted by 15 percent.<br />

** Applicants may choose to receive incentive payments based on actual system performance instead of rebates.<br />

*** Fuel cells that operate on non-renewable fuels and are used in combined heat and power applications, may be<br />

eligible for rebates at a later date when funds from other sources, such as the Self-Generation Incentive Program, are no<br />

longer available.<br />

All of the rebate funds are available on a first-come and first-served basis until the funding is<br />

exhausted. Rebate levels vary depending on system size, technology and type of installation. The<br />

rebate levels for all technology types are scheduled to be reduced by 20 cents per watt every six<br />

months (January 1st and July 1st).<br />

23 http://www.consumerenergycenter.org/erprebate/program.html<br />

<strong>Appendix</strong> A – Page 15

Self-Generation Incentive Program:<br />

2006 Incentives Available for Installation<br />

of Qualifying Equipment 24<br />

Incentive Levels Eligible Technologies Incentive Minimum Maximum<br />

($/Watt) system system<br />

size size 1<br />

Level 1 Solar Photovoltaics (PV) $2.80 30 kW 5.0 MW<br />

Level 2 Renewable<br />

Non-Solar<br />

Level 3 Non-<br />

Renewable<br />

Wind Turbines $1.50 30 kW 5.0 MW<br />

Fuel Cells (renewable fuel) $4.50 30 kW 5.0 MW<br />

Microturbines and Small Gas Turbines<br />

(renewable fuel) 3 $1.30 None 5.0 MW<br />

IC Engines and Large Gas Turbines<br />

(renewable fuel)<br />

$1.00 None 5.0 MW<br />

Fuel Cells (non-renewable fuel) 2 $2.50 None 5.0 MW<br />

Microturbines and Small Gas Turbines (nonrenewable<br />

$.80 None 5.0 MW<br />

2,4<br />

fuel)<br />

IC Engines and Large Gas Turbines (nonrenewable<br />

$.60 None 5.0 MW<br />

2,4<br />

fuel)<br />

1<br />

Maximum system size is 5.0 MW, however, output capacity above the first 1.0 MW is not eligible for incentives.<br />

2<br />

System must utilize waste heat recovery meeting Public Utilities Code 218.5<br />

3<br />

Small Gas Turbines are defined as gas turbines < 1.0 MW<br />

4<br />

System must meet AB1685 Emissions standards<br />

Qualifying PV systems must be larger than 30kW, but no larger than 5MW. For very large PV<br />

installations only the first 1MW qualifies for rebates. Rebates cover PV systems, PV-hybrid<br />

systems and other approved technologies, sized up to 100% of the customer’s maximum demand<br />

within the last year. Rebates are currently $2.50 per watt AC and decline by $0.30 once each<br />

rebate-level quota is reached.<br />

Future Renewable <strong>Energy</strong> Incentives:<br />

A recent CPUC decision outlined the preliminary CSI program design.<br />

For systems larger than 100 kilowatts, incentive payments over the first five years of operation<br />

will be $0.39 per kilowatt-hour of output for taxable entities and $0.50 per kilowatt-hour of<br />

output for government/non-profit organizations. Incentives are managed regionally by existing<br />

self-generation program administrators (the IOUs). Residential and small commercial systems<br />

(under 30kW) will receive $2.50 per watt and will be eligible for federal tax credits. Government<br />

and non-profit organizations will receive $3.25 per watt to compensate for their lack of access to<br />

the federal tax credit. By 2010, all systems over 30kW but under 100kW will receive<br />

performance-based incentives after effective monitoring mechanisms are in place. All solar<br />

energy systems will be required to install separate meters to measure solar output.<br />

The CSI allocates the CEC $350 million to target new residential building construction.<br />

All electric and gas customers of the IOUs are eligible for CSI incentives.<br />

24 ibid.<br />

<strong>Appendix</strong> A – Page 16

Cost Premium to <strong>State</strong> for PV<br />

(Prices from July 2006)<br />

0.2<br />

0.16<br />

0.1666 0.1618<br />

$/kWh<br />

0.12<br />

0.08<br />

0.0771<br />

0.04<br />

0<br />

Cost Premium f or PV<br />

(through incentive programs)<br />

Price of Residential Electricity<br />

Price of Commercial<br />

Electricity<br />

<strong>Appendix</strong> A – Page 17

California Low-Income <strong>Energy</strong> Efficiency Programs<br />

<strong>Energy</strong> Efficiency and Fuel Assistance<br />

Federally Funded Programs<br />

The California Department of Community Services and Development administers both the<br />

federal Low Income Home <strong>Energy</strong> Assistance Program (LIHEAP) and the federal<br />

Weatherization Assistance Program (WAP); local governments, nonprofits, or other local<br />

agencies implement actual programs. All residents below the greater of 150% of the <strong>State</strong><br />

poverty level, or 60% of the median <strong>State</strong> income qualify for these services. For fiscal year 2006,<br />

federal LIHEAP funding is $152,032,389 and WAP funding is $7,085,364. LIHEAP funds are<br />

used to reduce low-income households’ energy bills and to prevent fuel or electricity shut-off<br />

due to bill non-payment. WAP services improve a household’s energy efficiency, thus reducing<br />

energy consumption and energy expenditures. Average LIHEAP benefits are $219 per<br />

household. Average WAP benefits are $300 per household.<br />

<strong>State</strong> Funded Programs<br />

LIEE (Low-Income <strong>Energy</strong> Efficiency Program):<br />

California’s Low-Income <strong>Energy</strong> Efficiency Program (LIEE) began in 1980. The CPUC recently<br />

expanded coverage eligibility for both LIEE and CARE from 175% of the Federal poverty level<br />

to 200% of the Federal poverty level. LIEE provides free energy efficiency services to lowincome<br />

households. The <strong>State</strong> PGC funds the LIEE program. CPUC Decision 05-12-026 in 2005<br />

aimed to increase the baseline participation in LIEE programs by 5-10% in 2006, and required<br />

IOUs to file augmented 2006 budget applications to meet this target.<br />

CARE (California Alternative Rates for <strong>Energy</strong>):<br />

<strong>Appendix</strong> A – Page 18

CARE began in 1989 (CA Public Utilities Code S. 739.1-739.2) to provide LIHEAP-like energy<br />

bill assistance to low-income ratepayers in IOU service territories. CARE pays up to 20% of a<br />

qualifying low-income household’s monthly utility bill. The cost of CARE services is not ‘borne<br />

solely by any single class of customer.’ 25 <strong>State</strong> PGC funds do not support CARE; all funds are<br />

collected by IOUs through customer rates.<br />

• Administration<br />

IOUs administer LIEE and CARE programs under the oversight of the CPUC and the<br />

Low-Income Oversight Board (LOIB). IOUs can contract with local governments and<br />

nonprofits. When assessing the cost-effectiveness of the LIEE programs, the CPUC and<br />

the IOUs include energy and non-energy benefits (e.g. less financial hardship, less stress).<br />

• CARE and LIEE Budgets 26<br />

2006 Program Year Authorized Budgets for IOUs<br />

LIEE Program<br />

CARE Budget Budget<br />

PG&E $332,069,000 $56,530,000<br />

SCE $172,299,000 $27,400,000<br />

SCG $99,143,249 $33,324,875<br />

SDG&E $36,845,932 $13,368,093<br />

Totals $640,357,181 $130,622,968<br />

2005 Program Year Authorized Budgets for IOUs<br />

CARE Admin<br />

Expenses<br />

CARE<br />

Subsidies & Benefits<br />

CARE Total<br />

Budget LIEE Budget<br />

PG&E $7,457,000 $191,300,000 $198,757,000 $56,530,000<br />

SCE $4,199,000 $168,100,000 $172,299,000 $27,400,000<br />

SCG $4,108,310 $75,315,876 $79,424,186 $33,966,503<br />

SDG&E $2,625,882 $32,907,285 $35,533,167 $13,060,172<br />

Totals $18,390,192 $467,623,161 $486,013,353 $130,956,675<br />

• <strong>State</strong>-Wide Available Funding for Low-Income <strong>Energy</strong> Assistance Programs<br />

California Low-Income Programs Total 2006 Funds = $804,087,781<br />

Average Household Savings = $300<br />

$7,085,364<br />

$152,032,389<br />

$28,000,000<br />

$130,956,675<br />

$486,013,353<br />

Federal LIHEAP<br />

Federal WAP<br />

<strong>State</strong> CARE (<strong>Energy</strong> Rate Assistance)<br />

<strong>State</strong> LIEE (<strong>Energy</strong> Efficiency)<br />

<strong>State</strong> LI Renewables (avg. between 2007-<br />

2016)<br />

25 CA Public Utilities Code S. 739.1-739.2<br />

26 CPUC R.04-01-006, D. 05-12-026, http://www.ligb.org/DOCS/<br />

<strong>Appendix</strong> A – Page 19

• LIEE Program Offerings<br />

LIEE program offerings are standardized state-wide by the four major IOUs. Customers<br />

receive comprehensive LIEE services – all feasible measures are provided for maximum<br />

benefits. Outreach is targeted to specific low-income customer groups (e.g. seniors,<br />

ethnic communities). Utilities can use census tract data to identify areas with likely high<br />

concentrations of low-income customers. All customers can self-certify for services by<br />

demonstrating their income level.<br />

California’s LIEE services focus on the “‘Big Six’ measures: (1) attic insulation; (2)<br />

caulking; (3) weather stripping; (4) low-flow showerheads; (5) water heater blankets and<br />

(6) door and building envelope repairs which reduce infiltration.” 27<br />

Program Category<br />

<strong>Energy</strong> Efficiency<br />

Landlord Co Pays<br />

Pilots<br />

Other<br />

Technology<br />

Gas Appliances<br />

Electric Appliances<br />

Weatherization<br />

Outreach/Assessment/Marketing<br />

In-Home <strong>Energy</strong> Education<br />

Air Conditioner Replacement, Central and<br />

Room<br />

Refrigerator (CoPay)<br />

Cool Center 3<br />

Cool Zones<br />

LIHEAP leveraging<br />

Natural Gas Appliance Testing<br />

Training Center<br />

Inspections<br />

Advertising<br />

Measurement and Evaluation<br />

Regulatory Compliance<br />

Other Administration<br />

27 Source: http://www.liheap.ncat.org/Supplements/2005/cauwx.htm) See SB 845 (PUCode 2790) amended by<br />

AB1393, Jan 2000.<br />

<strong>Appendix</strong> A – Page 20

• LIEE Program Performance 2001-2005 (Inclusive)<br />

LIEE Total Program Performance 2001-2005 (Inclusive)<br />

Households<br />

Served Expenditure<br />

<strong>Energy</strong><br />

Savings<br />

(MWh)<br />

Gas Savings<br />

(MTherms)<br />

Household <strong>Energy</strong><br />

Savings<br />

(kWh/hhld)<br />

Monthly Household<br />

<strong>Energy</strong> Savings<br />

(kWh/hhld/month)<br />

845,855 $573,570,220 233,414 10,928 276 23<br />

LIEE Average Annual Performance (between 2001-2005)<br />

<strong>Energy</strong><br />

Avg. Annual Mothly Household<br />

Households Expenditure<br />

Savings<br />

(MWh)<br />

Gas Savings<br />

(MTherms)<br />

Household <strong>Energy</strong><br />

(kWh/hh)<br />

<strong>Energy</strong> Savings<br />

(kWh/hh/month)<br />

169,171 $114,714,044 46,683 2,186 276 23<br />

• CARE Program Performance (2004):<br />

o 3,064,563 households (within IOU territories)<br />

o Benefit: 20% discounted electricity rates (roughly $209/yr)<br />

Low-Income Renewable <strong>Energy</strong> Programs<br />

CSI (California Solar Initiative) Affordable Housing Renewable <strong>Energy</strong> Incentives<br />

The CPUC established the CSI Jan. 2006, CPUC D.06-01-024, to take effect on January 1, 2007.<br />

The decision includes a reserve of 10% of program funding over 10 years ($280 million). IOUs<br />

plus the San Diego Regional <strong>Energy</strong> Office will administer the CSI under CPUC oversight.<br />

• Existing Low-Income Housing<br />

AB 2723 (Sept. 30, 2006) outlines low-income programs requirements for existing lowincome<br />

housing. The bill requires that not less than 10% of funds for the CSI be utilized<br />

for solar energy systems for low-income residential housing. The PUC must incorporate a<br />

revolving loan or loan guarantee program into the CSI for low-income residential<br />

housing. Money from loan repayments and any other remaining funds allocated for lowincome<br />

residential solar will be used to augment existing LIEE programs.<br />

Low-income housing means, 1) residential housing financed with low-income housing<br />

tax credits, tax-exempt mortgage revenue bonds, general obligation bonds, or local, state,<br />

or federal loans or grants; 2) a residential complex in which at least 20% of the total units<br />

are sold or rented to lower income households – low-income units must have a deed<br />

restriction that ensures the units will be available at affordable housing cost for at least 30<br />

years.<br />

• New Affordable Housing<br />

New affordable housing will receive 25% higher rebates, not to exceed 75% of total<br />

system cost, if the housing meets several criteria: Eligible projects include single/multifamily<br />

developments where at least 20% of units are reserved for low-to-moderateincome<br />

households for 45 years. In multi-family projects the solar systems must serve<br />

<strong>Appendix</strong> A – Page 21

only low to moderate-income households plus the manager’s unit. The solar systems may<br />

serve common areas only where all of the project’s units are reserved for low-income<br />

households. Each residential unit (single-family home; multi-family unit) must have an<br />

individual electric utility meter.<br />

To qualify, the homes must also be highly energy efficient. Each residential unit must<br />

save at least 15% on combined space heating, space cooling, and water heating compared<br />

to the CA 2005 Building <strong>Energy</strong> Efficiency Standards (for Tier I rebates - solar), and<br />

35% for space heating, space cooling and water heating and 40% of air conditioning for<br />

Tier II rebates (non-solar renewables). Developers must also document that all<br />

permanently installed electric lighting is high efficiency except in dining rooms and small<br />

closets, and that all appliances provided are <strong>Energy</strong> Star labeled. When solar systems are<br />

installed to power common areas, the entire affordable housing project must be 20%<br />

more efficiency than current standards in 2005 Building EE Standards. Developers/rebate<br />

applicants must provide energy efficiency calculations by an individual who is a Certified<br />

<strong>Energy</strong> Plans Examiner by the California Association of Building <strong>Energy</strong> Consultants.<br />

<strong>Appendix</strong> A – Page 22

Connecticut <strong>Energy</strong> Efficiency Fund<br />

(Draft – To Be Updated in January 2006)<br />

Legislative / Program History<br />

In 1998 the Connecticut General Assembly passed Public Act 98-28, which created the<br />

Conservation and Load Management Fund, which is now known as the Connecticut <strong>Energy</strong><br />

Efficiency Fund (CEEF)<br />

Structure and Governance<br />

The energy-efficiency programs are administered by the state's two large investor-owned<br />

utilities, subject to the regulatory oversight of the Connecticut Department of Public <strong>Utility</strong><br />

Control (DPUC). An independent advisory board, the <strong>Energy</strong> Conservation Management Board<br />

(ECMB), which holds regularly scheduled public meetings, was created to provide a forum for<br />

public input and to make recommendations to the DPUC and Legislature on energy-efficiency<br />

policies and program design, program mix, and budgets.<br />

The Connecticut <strong>Energy</strong> Conservation Management Board works with the Connecticut<br />

Department of Public <strong>Utility</strong> Control to advise and assist the utility companies in implementing<br />

energy efficiency and clean energy programs. The board is made up of people from various<br />

backgrounds, some from industry, some representing the power company, and some representing<br />

citizen or environmental interests. The CECMB was created with restructuring occurred in 1998<br />

to work as a liaison between the utility companies, the people and the Department of Public<br />

<strong>Utility</strong> Control. The utilities can provide feedback to the PUC through the CECMB.<br />

Connecticut <strong>Energy</strong><br />

Advisory Board<br />

Connecticut <strong>Energy</strong> Conservation<br />

Management Board<br />

advises<br />

advises<br />

Connecticut Department of<br />

Public <strong>Utility</strong> Control<br />

advises<br />

oversees<br />

Connecticut <strong>Energy</strong> Efficiency<br />

Fund<br />

provides<br />

feedback<br />

to<br />

Utilities (United Illuminating and<br />

Connecticut Light & Power)<br />

programs<br />

administered by<br />

<strong>Appendix</strong> A – Page 23

The Connecticut <strong>Energy</strong> Conservation Management Board’s (CECMB’s) primary goal is to<br />

eliminate utility disincentives that have led to energy profligacy in a restructured electricity<br />

sector. While CECMB does not directly supervise the CEEF, the CECMB is responsible for<br />

developing effective energy efficiency policies in Connecticut.<br />

Program Goals<br />

The CEEF is an initiative to help homeowners and renters, small and large businesses, and state<br />

and local governments to improve their energy efficiency. CEEF targets services especially to<br />

the southwest portion of Connecticut, where energy use is especially high and transmission lines<br />

constrained.<br />

Funding and Budget<br />

The Connecticut <strong>Energy</strong> Efficiency Fund has a total annual budget of approximately $80 million,<br />

which primarily supports commercial and industrial efficiency improvements. CEEF receives its<br />

money from a conservation surcharge on customers’ electric bills. This funding has been<br />

reduced in recent years. Due to Connecticut’s budget deficit, CEEF funding was reduced by 1/3<br />

in 2006 to pay for other state services.<br />

13<br />

1%<br />

3%<br />

1%<br />

3%<br />

CEEF Program Budget<br />

2005 = 80,000,000<br />

53%<br />

26%<br />

Residential<br />

Commercial<br />

Industrial<br />

Education<br />

Misc.<br />

Load<br />

Research<br />

Admin/Planning<br />

Services / Clients / Programs<br />

Incentive Programs<br />

Program Category Technologies Clients Description<br />

Rebates<br />

Appliance Retirement Old refrigerators Residential Gives 50$ to retire old,<br />

energy inefficient<br />

refrigerators.<br />

Connecticut Light &<br />

Power(CL&P) picks the<br />

old units up.<br />

<strong>Appendix</strong> A – Page 24

Green Buildings<br />

Construction Rebate<br />

<strong>Energy</strong> Conscious<br />

Blueprint Program<br />

Municipal Buildings<br />

Program<br />

New homes, green<br />

technologies<br />

New buildings<br />

<strong>Energy</strong> Efficiency<br />

Residential<br />

Commercial businesses<br />

making a new<br />

building/major<br />

renovations<br />

Municipal buildings,<br />

schools, large<br />

commercial.<br />

Provides funding to<br />

defray the additional<br />

costs of green buildings,<br />

to make them cost<br />

competitive with<br />

standard buildings.<br />

The program pays the<br />

average incremental<br />

costs associated with<br />

more expensive, energyefficient<br />

equipment.<br />

Technical and financial<br />

assistance through<br />

energy-efficiency<br />

improvements. CL&P<br />

will share up to fifty<br />

percent (50%) of the<br />

cost to install costeffective<br />

energy<br />

efficiency measures<br />

Service Programs<br />

Program Category Technologies Clients Description<br />

Audits<br />

PRIME <strong>Energy</strong> Efficiency Commercial, Industrial Provides no-cost,<br />

facility walk-through<br />

assessment of energy<br />

efficiency.<br />

Information/Awareness<br />

Smartliving Center<br />

Green technology<br />

generally<br />

Students, concerned<br />

citizens.<br />

EESmarts Packaged curriculums Teachers, grade school<br />

students.<br />

Weatherization<br />

WRAP Program<br />

Efficiency savingweatherization<br />

Low-income residential<br />

Provides information to<br />

the public regarding<br />

methods to improve<br />

energy efficiency.<br />

Provides grade-specific<br />

curriculums on how to<br />

be more energy<br />

conscious.<br />

Provides energy savingtechnologies<br />

like<br />

caulking,<br />

weatherstripping,<br />

fluorescent lighting, ect.<br />

Additional Information on specific projects:<br />

• <strong>Energy</strong>Star: For defraying the cost of more energy efficient lighting.<br />

• Appliance Retirement: Pick up inefficient appliances, recycle them, and pay the<br />

consumer a rebate.<br />

• <strong>Energy</strong> Conscious Construction: Rebates to encourage businesses and homeowners to<br />

build green buildings. The goal of this program is to promote the adoption of energy<br />

efficient technologies during building construction or remodeling defraying the initial<br />

costs of the technology.<br />

<strong>Appendix</strong> A – Page 25

• Low Income <strong>Energy</strong> Efficiency: This program helps low-income homeowners (or<br />

renters) with income up to 200% of the federal poverty level to improve their household<br />

energy efficiency. This program provides weatherization, low-flow shower heads, and<br />

energy efficient lights free of charge for those who qualify.<br />

• EESmarts: An education program that focuses on conscientious energy use, EESmarts is<br />

a series of grade-specific curricula that teach school-age children how to make important<br />

decisions about energy use in their daily lives. EESmarts is offered at no cost to schools<br />

in Connecticut.<br />

• PRIME: Free energy assessment audits to identify how individual businesses can<br />

improve their energy efficiency.<br />

Results<br />

The costs of saving energy are significantly lower than the costs to the consumer of electricity in<br />

the residential, commercial and industrial sectors.<br />

$/kWh<br />

0.2<br />

0.16<br />

0.12<br />

0.08<br />

0.04<br />

Cost of <strong>Energy</strong> Efficiency Compared to<br />

Electricity Generation in Connecticut<br />

(Prices from July 2006)<br />

0.032<br />

0.1636<br />

0.139<br />

0<br />

Average Cost of EE<br />

Programs<br />

Price of Residential<br />

Electricity<br />

Price of Commercial<br />

Electricity<br />

Costs vs Benefits of <strong>Energy</strong> Efficiency<br />

(2006 estimates)<br />

Dollars spent (millions)<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

22<br />

Costs of <strong>Energy</strong> Efficiency<br />

47<br />

Total <strong>Energy</strong> Savings<br />

<strong>Appendix</strong> A – Page 26

Connecticut Clean <strong>Energy</strong> Fund<br />

(Draft – To Be Updated in January 2006)<br />

The Connecticut Clean <strong>Energy</strong> Fund (CCEF) provides incentives for in-state renewable energy<br />

generation and can also finance energy efficiency improvements in conjunction with the<br />

Connecticut <strong>Energy</strong> Efficiency Fund. More detailed information about Connecticut’s Clean<br />

<strong>Energy</strong> Fund and Connecticut Innovations will be added to the subsequent edition of this<br />

document.<br />

Legislative / Program History<br />

In 1998 the Connecticut General Assembly passed Public Act 98-28, which created the<br />

Renewable <strong>Energy</strong> Investment Fund, which was later renamed the Connecticut Clean <strong>Energy</strong><br />

Fund.<br />

Structure and Governance<br />

Connecticut <strong>Energy</strong><br />

Advisory Board<br />

Connecticut <strong>Energy</strong> Conservation<br />

Management Board<br />

advises<br />

advises<br />

advises<br />

Connecticut Department of<br />

Public <strong>Utility</strong> Control<br />

oversees<br />

Connecticut Innovations<br />

provide<br />

feedback to<br />

administers<br />

oversees<br />

Connecticut Clean<br />

<strong>Energy</strong> Fund<br />

Implements<br />

programs with<br />

works with<br />

Utilities (United Illuminating and<br />

Connecticut Light & Power)<br />

Connecticut Innovations (CI) is a quasi-public organization that manages the Connecticut Clean<br />

<strong>Energy</strong> Fund. CI has existed since 1989 to support the growth of high-tech industries in<br />

<strong>Appendix</strong> A – Page 27

Connecticut, and has been responsible for managing the CCEF since it was created in 1998.<br />

More information about Connecticut Innovations is forthcoming.<br />

The Connecticut <strong>Energy</strong> Conservation Management Board (CECMB) works with the<br />

Connecticut Department of Public <strong>Utility</strong> Control to advise and assist investor-owned utilities as<br />

they implement the CCEF’s energy efficiency and clean energy programs. The Board is<br />

composed of representatives from the utility industry, environmental organizations and the<br />

public. The CECMB was created by Connecticut’s electricity sector restructuring legislation in<br />

1998 for the purpose of acting as a liaison between the investor-owned utilities, the Department<br />

of Public <strong>Utility</strong> Control, and the public. Investor-owned utilities can provide feedback to the<br />

PUC through the CECMB.<br />

Program Goals<br />

The CCEF was charged with promoting the development and commercialization of clean energy<br />

technologies and stimulating growth of an in-state market for clean energy technologies.<br />

Funding and Budget<br />

CCEF is funded by a surcharge on electric ratepayers' utility bills. Connecticut Innovations<br />

administers the activities and investments of the Fund.<br />

CCEF Program Budget<br />

2005=$37,000,000 million<br />

Fuel<br />

6%<br />

5% 8% 11%<br />

Solar <strong>Energy</strong><br />

11%<br />

On-Site DG<br />

Operation<br />

progra<br />

Education and<br />

59%<br />

Administrative<br />

<strong>Appendix</strong> A – Page 28

Services / Clients / Programs<br />

Incentive Programs<br />

Program Category Technologies Clients Description<br />

Rebates<br />

Small Solar PV Rebate<br />

Program<br />

Loans<br />

Renewable <strong>Energy</strong><br />

Projects in Pre-<br />

Development<br />

Grants<br />

On-Site Renewable DG<br />

Program<br />

Project 100<br />

Photovoltaics<br />

Solar Thermal Electric,<br />

Photovoltaics, Landfill<br />

Gas, Wind, Biomass,<br />

Fuel Cells, Anaerobic<br />

Digestion, Tidal <strong>Energy</strong>,<br />

Wave <strong>Energy</strong>, Ocean<br />

Thermal<br />

Solar Thermal Electric,<br />

Photovoltaics, Landfill<br />

Gas, Wind, Biomass,<br />

Hydroelectric, Fuel<br />

Cells<br />

Solar Thermal Electric,<br />

Photovoltaics, Landfill<br />

Gas, Wind, Biomass,<br />

Fuel Cells, Small<br />

Hydroelectric, Tidal<br />

<strong>Energy</strong>, Wave <strong>Energy</strong>,<br />

Ocean Thermal<br />

Residential, Nonprofit,<br />

Governmental,<br />

Institutional<br />

Commercial, Renewable<br />

energy project<br />

developers<br />

Commercial, Industrial,<br />

Schools, Govt.<br />

Buildings<br />

Commercial, Renewable<br />

energy project<br />

developers<br />

Rebates will be given to<br />

producers of solar<br />

energy, on the level of<br />

5$/Watt for the first<br />

50kW. Participation by<br />

installers is limited to<br />

those selected through a<br />

Request for Proposals<br />

(RFP) process<br />

A low-interest loan will<br />

be given to businesses<br />

interested in producing<br />

renewable energy, to<br />

reduce the risks of<br />

investment.<br />

Program budget of<br />

$20.55 million supports<br />

installation of smallmoderate<br />

sized<br />

renewables. Targeted<br />

funding of $9 million<br />

for solar and $9 million<br />

for fuel cells.<br />

Projects must have a<br />

capacity of at least 1<br />

MW and must begin<br />

operation after July 1,<br />

2003. Provides a<br />

premium grant of up to<br />

5.5¢ per kWh.<br />

Service Programs<br />

Program Category Technologies Clients Description<br />

Information/Awareness<br />

Community Innovations<br />

Grant Program<br />

Technical Assistance<br />

Operational<br />

Demonstration Program<br />

Solar Thermal Electric,<br />

Photovoltaics, Landfill<br />

Gas, Wind, Biomass,<br />

Fuel Cells,<br />

CHP/Cogeneration,<br />

Small Hydroelectric,<br />

Tidal <strong>Energy</strong>, Wave<br />

Eligible communities<br />

Commercial<br />

Provides a $5,000 block<br />

grant to support public<br />

awareness, education<br />

projects.<br />

Maximum funding of<br />

$750,000 to demonstrate<br />

the effectiveness of<br />

clean energy<br />

technologies. Funding<br />

will be provided in the<br />

form of a non-recourse,<br />

<strong>Appendix</strong> A – Page 29

<strong>Energy</strong>, Ocean Thermal,<br />

Other Distributed<br />

Generation<br />

Technologies<br />

unsecured debt<br />

instrument repaid upon<br />

the achievement of<br />

commercial success.<br />

Additional Information on specific projects:<br />

• Project 100: Detailed in P.A. 03-135, the legislation requires the <strong>State</strong>'s electric<br />

distribution companies to enter into at least 10-year contracts for not less than 100 MW<br />

of Class I renewable capacity. Pricing under these contracts will include a premium of<br />

5.5¢ per kWh. To be eligible, programs must have begun operation after July 1, 2003,<br />

and be larger than 1 MW in capacity.<br />

• Residential Solar PV Program: CCEF offers rebates for Connecticut residents who install<br />

solar photovoltaic systems on their homes. This program began on October 1, 2004.<br />

Incentives are available only through participating installers that have been approved by<br />

CCEF. Systems may be of any size but must be grid-connected. The program offers an<br />

incentive of $5 per Watt (PTC rating) for the first 5kW of system and installation costs,<br />

with a maximum rebate of $25,000 per household.<br />

• On-site Renewable DG Program: The On-site Renewable DG Program is a $21 million<br />

program that funds CCEF central goal of promoting clean energy generation in<br />

Connecticut. Through the On-site Renewable DG Program, CCEF offers financial<br />

support to buy down the cost of renewable energy generating equipment. The level of<br />

support for individual awards varies based on the specific economics of the installation.<br />

Funding is available for wind, solar, fuel cells, biomass, landfill gas, and small<br />

hydropower.<br />

Results<br />

Levelized Cost to Consumers<br />

(for 25 years, $8/W)<br />

Levelized Cost of Electricity<br />

¢/kWh (2006 US$)<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

50.96<br />

19.27<br />

14.28<br />

10.52<br />

0<br />

Commercial Building<br />

LCOE (no deductions<br />

or benefits)<br />

After Connecticut<br />

<strong>State</strong> Rebate<br />

After Federal Tax<br />

Credit<br />

After Avoided Fuel<br />

Cost Volatility Benefit<br />

<strong>Appendix</strong> A – Page 30

Cost Premium to <strong>State</strong> for PV<br />

(Prices from July 2006)<br />

0.2<br />

$/kWh<br />

0.16<br />

0.1477<br />

0.1636<br />

0.139<br />

0.12<br />

Cost Premium f or PV<br />

(through incentive programs)<br />

Price of Residential<br />

Electricity<br />

Price of Commercial<br />

Electricity<br />

Additional Information: Connecticut’s Renewable Portfolio Standard<br />

RPS requirements<br />

percent from renewables<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

2004 2005 2006 2007 2008 2009 2010<br />

Year<br />

Type 2 Renewables<br />

Type 1 Renewables<br />

<strong>Appendix</strong> A – Page 31

Connecticut Low Income Programs<br />

(Draft – To Be Updated in January 2006)<br />

Low Income <strong>Energy</strong> Efficiency and Fuel Assistance<br />

Structure:<br />

Federal LIHEAP and WAP funds are allocated to the Connecticut Department of Social Services<br />

(CDSS), which administers the Connecticut <strong>Energy</strong> Assistance Program and the Contingency<br />

Heating Assistance Program. In addition to federally funded programs, Connecticut has two<br />

investor-owned utility-administered programs, the Weatherization Residential Assistance<br />

Program (WRAP), administered by Connecticut Light & Power, and UI Helps, administered by<br />

United Illuminated. Both of these utility administered programs are funded through a system<br />

benefits charge. More detailed information about these programs will be included in the revised<br />

version of this document.<br />

Connecticut Low Income Structure<br />

Federal LIHEAP<br />

Money<br />

Federal WAP Money<br />

Utilities (United Illuminating<br />

and Connecticut Light &<br />

Power)<br />

Allocated To<br />

Allocated To<br />

Connecticut Department<br />

of Social Services<br />

Works With<br />

Connecticut <strong>Energy</strong><br />

Efficiency Fund<br />

Administers<br />

Administers<br />

Administers<br />

To Implement<br />

Connecticut <strong>Energy</strong><br />

Assistance Program<br />

and Contingency<br />

Heating Assistance<br />

Program<br />

Other LIHEAP<br />

Programs<br />

Weatherization<br />

Programs<br />

CL&Ps WRAP<br />

program and UI Helps<br />

<strong>Appendix</strong> A – Page 32

Budget:<br />

Connecticut Low Income Programs<br />

Total Annual Funds = $56,400,000<br />

$5,800,000<br />

$3,600,000<br />

$2,800,000<br />

$44,200,000<br />

LIHEAP funding<br />

WAP funding<br />

CEAP funding<br />

<strong>State</strong> EE programs<br />

Federal Programs<br />

LIHEAP and WAP<br />

LIHEAP is administered by the Department of Social Services in Connecticut.<br />

LIHEAP FY 2006 Funding: $47,809,073<br />

LIHEAP Households Served (Estimate for FY 2005 Heating): 66,300<br />

CT WAP FY2006 Funding: $2,759,107<br />

Connecticut <strong>Energy</strong> Assistance Program (CEAP) and (higher income) Contingency Heating<br />

Assistance Program (CHAP)<br />

$3.3 million in 2004 (estimated 3.6 million in 2006)<br />

Money is carved-out from LIHEAP emergency funding, and is allocated to the Department of<br />

Social Services in Connecticut.<br />

<strong>State</strong> Programs<br />

Connecticut Clean <strong>Energy</strong> Fund<br />

Connecticut’s WRAP program and UI Helps comprise the low-income energy efficiency<br />

program offerings of the CCEF. Households with an income of up to 200% of the federal<br />

poverty level qualify. WRAP and UI Helps are implemented by the two investor owned utilities,<br />

CP&L and UI, respectively. The Connecticut Department of Public <strong>Utility</strong> Control oversees the<br />

administration of both programs. Total program expenditure was $5.8 million in 2005, which<br />

served 18,421 households. The total lifetime energy efficiency savings for the 2005 program<br />

year are estimated at 144 million kWh, which will save customers about $18 million.<br />

Combined Program Results<br />

Total expenditures: 56.4 million dollars in 2006.<br />

<strong>Appendix</strong> A – Page 33

85,921 households served in 2005.<br />

<strong>Appendix</strong> A – Page 34

Massachusetts <strong>Energy</strong> Efficiency Programs<br />

Legislative/Program History<br />

All gas and electric investor-owned utilities (IOU) and municipal utilities have been mandated to<br />

provide Massachusetts energy efficiency programs to their customers since 1980 as per<br />

Massachusetts Statute, Chapter 465, and Regulations 225 CMR 4.00 and 5.00. The program was<br />

originally established as a result of the Federal Residential Conservation Service (RCS), and was<br />

enhanced by state regulation whose requirements exceed those of the federal regulation. In 1990<br />

when the Federal RCS regulation ended, the <strong>State</strong> requirement prevailed, leaving Massachusetts<br />

as one of the few states where home energy audits and services are universally provided.<br />

The focus of the utility residential programs in these early years centered on performing as many<br />

audits as possible and offering a few efficiency materials as demonstrations. After a review<br />

revealed that few residents were taking the proposed efficiency measures, the programs were<br />

redesigned in 2000 to attempt to increase participation. Goals of the redesign included increasing<br />

compatibility between the incentives from gas and electric utilities and providing more<br />

incentives for residents to perform efficiency upgrades. During the redesign, MassSAVE was<br />

created as a clearinghouse for residential customers.<br />

Program Goals<br />

MassSAVE is a clearinghouse for all utility-provided energy efficiency services for residential<br />

customers. Utilities provide their own programs for commercial and industrial customers.<br />

In August 2006 Gov. Romney unveiled a 10-year plan called Next-Gen <strong>Energy</strong>, which aims to<br />

reduce energy consumption, diversify supply with renewable energy, fix infrastructure problems,<br />

and promote an advanced energy technology sector. It aims to do this through time-of-day<br />

pricing for small customers and real-time pricing for industry, utilities paying customers for<br />

negawatts, and a conservation lottery, among other initiatives. No specific targets are set and the<br />

plan appears to be still in development.<br />

Services/Clients/Programs<br />

Incentive Programs<br />

Program Category Technologies Clients Description<br />

Rebates<br />

weatherization residential up to $1,500 rebates for<br />

major weatherization<br />

projects<br />

appliances<br />

commercial rebates<br />

air conditioners, air<br />

source heat pumps,<br />

water heaters, furnaces,<br />

boilers, washers<br />

equipment insulation,<br />

water heaters, furnaces,<br />

boilers, air conditioners,<br />

heat recovery,<br />

programmable<br />

thermostats, energy<br />

residential<br />

commercial<br />

up to $300 rebates on<br />

most appliances<br />

$100-$6,000 for heating<br />

equipment<br />

<strong>Appendix</strong> A – Page 35

other efficiency<br />

measures<br />

Loans<br />

HEAT Loan<br />

commercial assistance<br />

Grants<br />

building grants<br />

mgmt. systems/building<br />

controls, building<br />

insulation, boiler reset<br />

controls, steam trap<br />

replacements<br />

windows, thermostats,<br />

lighting, insulation<br />

attic, wall, basement<br />

insulation; high<br />

efficiency heating<br />

systems and water<br />

heaters; <strong>Energy</strong>Star<br />

windows; duct sealing<br />

and insulation<br />

water heaters, lighting,<br />

furnaces, boilers, heat<br />

pumps, air conditioners,<br />

windows, and motors<br />

energy recovery devices,<br />

combustion controls,<br />

building energy<br />

management systems,<br />

desiccant units, infrared<br />

space heating<br />

equipment, infrared<br />

process heating<br />

equipment<br />

residential<br />

residential<br />

commercial<br />

commercial, industrial<br />

various rebates<br />

loans at 0-3% for up to<br />

$15,000 and terms up to<br />

7 years<br />

0% loans<br />

grants for new or underutilized<br />

energy saving<br />

technologies<br />

Service Programs<br />

Program Category Technologies Clients Description<br />

Audits<br />

<strong>Energy</strong> Assessments residential, low-income free audits with<br />

incentive information<br />

assessments and<br />

technical assistance<br />

lighting and controls,<br />

HVAC systems, motors,<br />