Sonata Health User Guide - Great-West Life

Sonata Health User Guide - Great-West Life

Sonata Health User Guide - Great-West Life

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>User</strong> <strong>Guide</strong>

<strong>Sonata</strong> <strong>Health</strong> <strong>User</strong> <strong>Guide</strong><br />

This guide provides practical information for using your <strong>Sonata</strong> <strong>Health</strong> plan. It includes additional<br />

information on the features of <strong>Sonata</strong> <strong>Health</strong>, how to access services and how to claim benefits.<br />

This is not your <strong>Sonata</strong> <strong>Health</strong> policy. The actual terms and conditions of your <strong>Sonata</strong> <strong>Health</strong><br />

plan are set out in the policy issued to you by <strong>Great</strong>-<strong>West</strong> and included in your <strong>Sonata</strong> <strong>Health</strong><br />

information kit. The policy contains important information concerning terms, conditions,<br />

limitations, exceptions and exclusions. Please read it carefully.<br />

Your <strong>Sonata</strong> <strong>Health</strong> plan is underwritten by The <strong>Great</strong>-<strong>West</strong> <strong>Life</strong> Assurance Company.<br />

<strong>Great</strong>-<strong>West</strong> has been helping Canadians achieve financial security for more than a century.<br />

We are a leading provider of financial security products in Canada, offering a wide range of<br />

insurance, retirement savings and income plans for individuals, families, businesses<br />

and organizations.<br />

Electronic drug claim services with the Assure Card® are provided by a leading full-service pharmacy<br />

benefits manager in Canada, adjudicating drug claims online in the pharmacy. Currently, electronic<br />

adjudication services are provided for 10,500 groups covering more than 3.5 million Canadians.

Coverage highlights<br />

Who’s covered.................................................................................................... 1<br />

Where to find information on your coverage...................................................... 1<br />

Optional coverage<br />

Hospital Accommodation................................................................................... 2<br />

Emergency Travel Medical................................................................................... 2<br />

Accidental Death, Dismemberment and Specific Loss.......................................... 3<br />

Hospital Cash..................................................................................................... 3<br />

Prescription drug coverage<br />

The Assure Card................................................................................................. 4<br />

Using your Assure Card...................................................................................... 5<br />

Submitting claims<br />

Prescription drug claims...................................................................................... 6<br />

Other healthcare claims...................................................................................... 7<br />

Dental claims...................................................................................................... 7<br />

Hospital Accommodation claims......................................................................... 8<br />

Emergency Travel Medical claims........................................................................ 8<br />

Accidental Death, Dismemberment and Specific Loss claims............................... 9<br />

Hospital Cash claims........................................................................................... 9<br />

Included services<br />

Best Doctors....................................................................................................... 9<br />

PVS.................................................................................................................... 9<br />

Administration<br />

Premiums......................................................................................................... 10<br />

Renewing your coverage.................................................................................. 11<br />

Changing your coverage.................................................................................. 11<br />

When your coverage ends................................................................................ 13<br />

Surviving spouse and children coverage............................................................ 13<br />

Tax information<br />

Premiums ........................................................................................................ 14<br />

Sole proprietor or partner................................................................................. 14<br />

Incorporated business....................................................................................... 15<br />

Receipt for tax purposes................................................................................... 16<br />

Contact information........................................................................................ 17<br />

Online services ................................................................................................... 18

Coverage highlights<br />

Who’s covered<br />

Your <strong>Sonata</strong> <strong>Health</strong> Policy Specifications document lists everyone who is covered under your<br />

<strong>Sonata</strong> <strong>Health</strong> plan.<br />

Where to find information on your coverage<br />

Your <strong>Sonata</strong> <strong>Health</strong> policy booklet sets out the health and dental benefits provided by your policy.<br />

If you purchased any of the optional benefits available with <strong>Sonata</strong> <strong>Health</strong> Scales 1 to 6 (Hospital<br />

Accommodation, Emergency Travel Medical, Hospital Cash or Accidental Death, Dismemberment<br />

and Specific Loss), your information package will include a benefit booklet for each optional benefit<br />

you purchased.<br />

Your Policy Specifications document shows who is covered under your plan, your monthly premium<br />

and information such as your plan’s reimbursement levels and benefit maximums. It also includes<br />

information on any optional coverage you purchased and ID cards showing your policy number and<br />

effective date.<br />

You may have received a Conditional Offer of Acceptance if:<br />

• You signed and accepted coverage excluding certain medical conditions (the Conditional<br />

Offer of Acceptance sets out the medical conditions for which coverage is excluded), or<br />

• You did not qualify for <strong>Sonata</strong> <strong>Health</strong> Scales 1 to 6, and were offered our Guaranteed<br />

Acceptance Plan (GAP).<br />

If you can’t find the information you need, your representative or PDAdmin Group can help you.<br />

Turn to page 17 for contact information.<br />

1

Optional coverage<br />

Scales 1 to 6: While your <strong>Sonata</strong> <strong>Health</strong> package offers you comprehensive coverage, the following<br />

optional benefits are also available to you:<br />

• Hospital Accommodation<br />

• Emergency Travel Assistance<br />

• Accidental Death, Dismemberment and Specific Loss<br />

• Hospital Cash<br />

If you purchased any of these options, your information package will include a benefit booklet for<br />

each benefit, which sets out your coverage in detail.<br />

For additional information or to purchase these optional benefits, contact your representative or<br />

PDAdmin Group. Turn to page 17 for contact information.<br />

GAP: There are no options available with the GAP plan, as it already includes similar coverage for:<br />

• Hospital Accommodation<br />

• Emergency Travel Assistance<br />

• Accidental Death, Dismemberment and Specific Loss<br />

For information on submitting claims for these additional benefits, see page 8.<br />

Hospital Accommodation – optional for Scales 1–6; included with GAP<br />

The Hospital Accommodation Benefit pays benefits for semi-private accommodation in a hospital or<br />

for accommodation in a nursing home.<br />

Emergency Travel Medical<br />

Emergency Travel Assistance – optional for Scales 1–6; included with GAP<br />

There are two components to the Emergency Travel Assistance benefit:<br />

• Coverage for emergency treatment when you’re travelling outside of Canada<br />

• Assistance services when you’re in a medical emergency outside of Canada or more than 500<br />

kilometres from your home.<br />

With this benefit, your information package will include Emergency Travel Assistance wallet cards.<br />

2

Emergency Medical Treatment<br />

In a medical emergency, immediately call the toll-free Assistance Centre number on the<br />

back of your <strong>Sonata</strong> <strong>Health</strong> Emergency Travel Assistance card. You’ll reach the Assistance<br />

Centre, which will help you find qualified medical care and provide other emergency assistance.<br />

The Assistance Centre operates 24 hours a day, every day, and can help you locate hospitals, clinics<br />

and physicians who can provide appropriate medical care. If you do not notify the Assistance<br />

Centre as required in your policy, any benefits you receive may be reduced as outlined in<br />

your policy.<br />

Hospitals will not accept your <strong>Sonata</strong> <strong>Health</strong> Emergency Travel Assistance card as proof of coverage,<br />

but will use it to contact the Assistance Centre, which will, in turn, contact <strong>Great</strong>-<strong>West</strong> to verify<br />

your coverage.<br />

It is important that you read your Emergency Travel Medical Benefit Booklet carefully<br />

before travelling. Your coverage is subject to certain limitations and exceptions. An<br />

exclusion applies to pre-existing medical conditions and/or symptoms that existed before your<br />

trip. Your policy explains how this applies and how it relates to your travel departure date, date<br />

of purchase and effective date.<br />

You should also review your provincial coverage before travelling, to ensure you have sufficient<br />

insurance. Your provincial coverage may have time limits on submitting claims that would also apply<br />

to your <strong>Sonata</strong> <strong>Health</strong> policy.<br />

Who to call<br />

In a medical emergency while travelling, immediately call the toll-free Assistance Centre number<br />

on the back of your <strong>Sonata</strong> <strong>Health</strong> Emergency Travel Assistance card:<br />

• While travelling in Canada or the United States, call 1-800-527-0218<br />

• Outside of Canada or the United States, call collect to Baltimore, U.S., 410-453-6330<br />

To find out more, visit www.greatwestlife.com/sonata.<br />

Accidental Death, Dismemberment and Specific Loss –<br />

optional for Scales 1–6; included with GAP<br />

With this benefit, your <strong>Sonata</strong> <strong>Health</strong> Policy Specifications document will show the amount of<br />

coverage, including how much each family member is insured for. The benefit booklet describes the<br />

covered losses and the amount payable for those losses.<br />

Hospital Cash – optional for Scales 1–6; not available with GAP<br />

The Hospital Cash Benefit pays cash to the policy owner if anyone insured under the policy is<br />

hospitalized in Canada.<br />

3

Prescription drug coverage<br />

<strong>Sonata</strong> <strong>Health</strong> Scales 1, 2, 3, 5, 6 and the Guaranteed Acceptance Plan (GAP) include prescription<br />

drug coverage. This coverage offers you two convenient features:<br />

• The Assure Card<br />

• The Assure Claims Drug Utilization Review Program<br />

The Assure Card<br />

Paying for your prescriptions has never been so easy<br />

The Assure Card is an electronic payment system that provides on-the-spot processing of<br />

prescription drug claims at almost any pharmacy in Canada.<br />

It’s a convenient, easy-to-use alternative to submitting claim forms and waiting to be reimbursed.<br />

Your personalized Assure Card is provided to you as part of your <strong>Sonata</strong> <strong>Health</strong> coverage, and is<br />

administered by <strong>Great</strong>-<strong>West</strong>’s pharmacy benefits manager.<br />

The Assure Claims Drug Utilization Review Program<br />

It is not always practical or possible to visit the same pharmacist to have your prescriptions filled.<br />

We also realize how important it is for the pharmacist filling your prescriptions to be aware of your<br />

recent drug history. This helps ensure the safety of you and your family, wherever and whenever<br />

prescriptions are filled. That’s why your <strong>Sonata</strong> <strong>Health</strong> policy provides you and your pharmacist with<br />

access to the Assure Claims Drug Utilization Review Program.<br />

Assure Claims promotes safe and effective use of prescription drugs by reviewing the prescription<br />

being filled to help ensure it agrees with the drug manufacturer’s recommended use, and will not<br />

interfere with other prescriptions you have purchased with your Assure Card.<br />

If a risk is detected, the Assure Claims Network issues a warning to your pharmacist indicating the<br />

nature of the concern. Your pharmacist is then able to discuss the risk with you and consult your<br />

physician if required.<br />

4

Balancing safety with confidentiality<br />

With the Assure Card and Assure Claims, your personal prescription information is completely<br />

confidential. Our pharmacy benefits manager will only release information about your claims<br />

history and warning notices about possible drug conflicts to your pharmacist. No information<br />

concerning what you are being treated for is ever shared.<br />

Using your Assure Card<br />

When you fill a prescription:<br />

• Present your Assure Card to your pharmacist, before he or she fills the prescription.<br />

• Your pharmacist will require the following information about the patient:<br />

• Name<br />

• Address and postal code<br />

• Telephone number<br />

• Date of birth<br />

• Relationship to the policyowner<br />

• Policy number<br />

• Your pharmacist will use the card to verify your eligibility and drug coverage, and to apply<br />

any deductibles or coverage limits.<br />

• Our pharmacy benefits manager electronically pays your pharmacist the amount covered by<br />

your <strong>Sonata</strong> <strong>Health</strong> plan. You only pay fees not covered by <strong>Sonata</strong> <strong>Health</strong>.<br />

• You do not have to fill out claim forms or wait for reimbursement. It’s all handled on<br />

the spot.<br />

Pharmacies that recognize the Assure Card are also linked electronically with provincial Pharmacare<br />

plans. The pharmacist will know how much your provincial plan will cover, and how much you can<br />

claim under <strong>Sonata</strong> <strong>Health</strong>.<br />

Always provide your card when filling a prescription. For security reasons, pharmacies<br />

generally don’t share computer systems, even if they’re part of the same chain. If you forget your<br />

card, you can still get your prescription filled, but you will have to pay the full amount up front,<br />

submit a <strong>Health</strong>care Expenses Statement, and wait for reimbursement.<br />

Keep your information up to date. Be sure to advise PDAdmin Group if your marital status<br />

changes, you adopt or have a baby, or if any children are attending university. Turn to page 17 for<br />

contact information. Also, let your pharmacist know of any changes to your benefits, or if you are<br />

issued a new Assure Card.<br />

If your card is lost or stolen, report it to PDAdmin Group immediately. Your card number will<br />

be cancelled for your protection and a new card will be issued as a replacement. If you find your<br />

original card after receiving your new one, please return the original card to PDAdmin Group.<br />

You will still be covered by your <strong>Sonata</strong> <strong>Health</strong> plan if you forget your card. However, you may<br />

have to pay for your prescription in full at the pharmacy, then submit your receipt and a completed<br />

<strong>Health</strong>care Expenses Statement for the amount covered by your plan.<br />

The <strong>Health</strong>care Expenses Statement is available from PDAdmin Group, the Individual<br />

<strong>Health</strong> Unit, or in the Client Services section of www.greatwestlife.com.<br />

5

Submitting claims<br />

Prescription drug claims<br />

(Does not apply to Scale 4)<br />

Your prescription drug claims are settled right at the pharmacy, with your Assure Card. The Assure<br />

Card is recognized by more than 7,000 pharmacies nationwide. If, for some reason, you can’t use<br />

your Assure Card, you may use a paper claim form.<br />

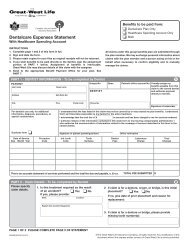

Using paper claim forms<br />

To submit prescription drug claims that have been made without providing the Assure Card,<br />

complete a <strong>Health</strong>care Expenses Statement and send it, along with your original receipts, to the<br />

Individual <strong>Health</strong> Unit. Turn to page 17 for contact information.<br />

A small supply of <strong>Health</strong>care Expenses Statement forms has been included in your <strong>Sonata</strong> <strong>Health</strong><br />

information package. If you need additional forms, contact PDAdmin Group, the Individual <strong>Health</strong><br />

Unit, your representative, or visit the Client Services section of www.greatwestlife.com.<br />

Dispensing fees<br />

There are two components to the cost of a prescription drug – the ingredient cost and the<br />

dispensing fee.<br />

The ingredient cost is the cost the drug manufacturer charges for the drug. The dispensing fee<br />

is charged by the pharmacy to cover the pharmacy’s business expenses, and can vary widely by<br />

pharmacy. The amount you are charged by the pharmacy is the sum of the ingredient cost plus<br />

the dispensing fee.<br />

<strong>Sonata</strong> <strong>Health</strong> plans pay a maximum dollar amount per eligible prescription for dispensing fees.<br />

See your policy booklet for the maximum that applies to your plan.<br />

6

Other healthcare claims<br />

For all medical, vision and drug claims (other than prescription drugs where the Assure Card has<br />

been used), please use the <strong>Health</strong>care Expenses Statement. Mail the completed form, along with<br />

your original receipts, to the Individual <strong>Health</strong> Unit. Turn to page 17 for contact information.<br />

Dental claims<br />

<strong>Great</strong>-<strong>West</strong> is linked electronically with many dentists across Canada. If your dentist has a link with<br />

<strong>Great</strong>-<strong>West</strong>, your claim can be settled right in the dentist’s office. The dentist submits the claim<br />

electronically and receives confirmation of coverage. You only pay for any expenses not covered by<br />

<strong>Sonata</strong> <strong>Health</strong>. Some claims, such as those for major dental work, must be submitted using paper<br />

claim forms.<br />

Before submitting your first claim, your dentist will need your <strong>Sonata</strong> <strong>Health</strong> policy number. Your<br />

policy and ID number are shown on your Policy Specifications document and on your ID card.<br />

Dental fee guides<br />

<strong>Great</strong>-<strong>West</strong> assesses dental claims using current fee guides developed and maintained by provincial<br />

dental associations. These fee guides offer a reasonable and consistent basis for assessing claims<br />

in each province. Since a fee guide is no longer published in Alberta, to assess claims incurred<br />

in Alberta, <strong>Great</strong>-<strong>West</strong> uses the 1997 Alberta Dental Association fee guide, plus an inflationary<br />

adjustment determined by <strong>Great</strong>-<strong>West</strong>.<br />

Prompt claims payment<br />

There are several things you can do to ensure your claims are paid as quickly as possible:<br />

• We need all the information that we ask for on the forms, so be sure to answer all the<br />

questions. Otherwise, we’ll return the form and ask you to provide the missing information.<br />

• Be sure to include your policy number on all claim forms. You can find your policy number<br />

on the Policy Specifications page, in your <strong>Sonata</strong> <strong>Health</strong> information package or on your<br />

personalized ID card.<br />

• Make sure that you’ve attached all the receipts supporting your claim and that all receipts are<br />

originals. We cannot accept photocopies. Your original receipts will not be returned. You will,<br />

however, receive an itemized statement for your records.<br />

• Please sign and date the claim form in ink.<br />

• If you’re uncertain about how to complete a form, call the Individual <strong>Health</strong> Unit at<br />

1-866-430-2863.<br />

You can ask <strong>Great</strong>-<strong>West</strong> to send payments directly to hospitals, dentists or providers of out-ofcountry<br />

emergency medical treatment. Otherwise, <strong>Great</strong>-<strong>West</strong> will mail all cheques, and a complete<br />

explanation of benefits paid, directly to your home address. You can have your claims paid faster<br />

and more conveniently by signing up for direct deposit; your explanation of benefits paid will still<br />

be mailed to your home address.<br />

Direct deposit<br />

If you completed the direct deposit section on your application for <strong>Sonata</strong> <strong>Health</strong> coverage, your<br />

health and dental claim payments will be directly deposited into the account you requested.<br />

If you did not request direct deposit and would now like to take advantage of this convenient and<br />

secure option for your claim payments, please contact your representative or the Individual <strong>Health</strong><br />

Unit, or visit the Client Services section of www.greatwestlife.com.<br />

7

Using paper forms for dental claims<br />

You can also submit claims by mail. You received a small supply of claim forms in your <strong>Sonata</strong><br />

<strong>Health</strong> information package. Complete the Policyowner Information and Patient Information<br />

sections of the form and have your dentist complete the Dentist section. Send the form to the<br />

Individual <strong>Health</strong> Unit. Turn to page 17 for contact information.<br />

You will receive an explanation of benefits for your records. Unless you indicate that you want<br />

the payment to go directly to the dentist, <strong>Great</strong>-<strong>West</strong> will send all cheques directly to you.<br />

It is a good idea to submit a treatment plan before proceeding with any treatment costing more<br />

than $200. <strong>Great</strong>-<strong>West</strong> will provide you with an estimate of the amount payable under your <strong>Sonata</strong><br />

<strong>Health</strong> policy. The estimate will be valid for 90 days. Send the treatment plan to the same address<br />

as the claim forms.<br />

Your <strong>Sonata</strong> <strong>Health</strong> information package includes an initial supply of the forms you are most likely<br />

to need. Included are:<br />

• <strong>Health</strong>care Expenses Statement<br />

• Dentalcare Claim Form<br />

If you need additional forms, contact PDAdmin Group, the Individual <strong>Health</strong> Unit or your<br />

representative, or visit the Client Services section of www.greatwestlife.com.<br />

Hospital Accommodation claims<br />

<strong>Great</strong>-<strong>West</strong> pays benefits for semi-private accommodation in hospitals and accommodation in nursing<br />

homes. Most hospitals and nursing homes use their own claim forms and will submit your claim directly<br />

to <strong>Great</strong>-<strong>West</strong> on your behalf. You will need to supply the hospital or nursing home with your policy<br />

number. Your policy number is shown on your Policy Specifications document and on your ID card.<br />

If the hospital or nursing home will not submit the claim on your behalf, complete the <strong>Health</strong>care<br />

Expenses Statement and mail it, along with your original receipts, to the Individual <strong>Health</strong> Unit. Turn<br />

to page 17 for contact information.<br />

Emergency Travel Medical claims<br />

Before entering a hospital or being treated for a medical emergency, call the toll-free<br />

number on your <strong>Sonata</strong> <strong>Health</strong> Emergency Travel Assistance card immediately or have<br />

someone call on your behalf. Your benefit amount may be reduced if you do not call<br />

before being treated. In addition to helping you find appropriate medical care, the Assistance<br />

Centre will obtain <strong>Great</strong>-<strong>West</strong>’s approval, where required, and will arrange to have hospital and<br />

doctor bills sent directly to us for payment.<br />

<strong>Great</strong>-<strong>West</strong> will pay your provincial health plan’s share of the claim for you, on the province’s behalf.<br />

The provincial health plan requires you to sign a release permitting them to reimburse <strong>Great</strong>-<strong>West</strong> for<br />

their portion of the claim.<br />

If you have paid a medical provider, contact <strong>Great</strong>-<strong>West</strong>’s Individual <strong>Health</strong> Unit when you return<br />

home. Turn to page 17 for contact information.<br />

8

<strong>Great</strong>-<strong>West</strong> will send you the necessary forms and assist you in preparing and submitting a claim.<br />

Claim forms are also available in the Client Services section of www.greatwestlife.com, or by calling<br />

<strong>Great</strong>-<strong>West</strong>’s Individual <strong>Health</strong> Unit.<br />

You should contact your provincial health plan representatives before leaving the country to<br />

determine the extent of coverage. Many provincial health plans have time limits for submitting<br />

claims. These time limits will apply to your <strong>Sonata</strong> <strong>Health</strong> claim as well.<br />

If your provincial health plan refuses payment, you may be asked to reimburse <strong>Great</strong>-<strong>West</strong> for any<br />

amount we have already paid on its behalf.<br />

Accidental Death, Dismemberment and Specific Loss claims<br />

To make a claim for Accidental Death, Dismemberment and Specific Loss benefits, contact your<br />

representative or the Individual <strong>Health</strong> Unit. They will assist you in making your claim.<br />

Hospital Cash claims<br />

You will receive your cash benefit automatically when you submit your claim for other hospital<br />

expenses. You do not have to file a separate claim or provide receipts.<br />

Included services<br />

Best Doctors ®<br />

Best Doctors provides you and your local doctor or specialist with access to the latest technologies,<br />

the opinions of world-class specialists and clinical guidance. Best Doctors can assist you with<br />

confirming a diagnosis, and can suggest the most effective treatment plan by drawing on a global<br />

database of 50,000 peer-ranked specialists.<br />

To access Best Doctors services, call 1-877-419-BEST (2378). Detailed information about Best Doctors<br />

is included in your <strong>Sonata</strong> <strong>Health</strong> information package.<br />

PVS<br />

The PVS program gives you a discount on prescription eyewear and hearing aids purchased from a<br />

registered PVS location.<br />

The discount applies to frames, prescription lenses, contact lenses and lens extras, such as scratch<br />

guard, tints, etc. Most locations will also apply the discount to non-prescription eyewear and<br />

accessory items.<br />

If your plan provides coverage for visioncare or hearing aids, submit your claim as usual. For the<br />

nearest PVS location, call the PVS information centre toll-free at 1-800-668-6444 or visit the PVS<br />

website at www.pvs.ca<br />

PVS also entitles you to a discount on laser eye surgery obtained through an organization that is<br />

part of the PVS network.<br />

9

Administration<br />

Premiums<br />

Your first year premium is set on your plan’s effective date, as shown in your Policy Specifications<br />

document. Your premium is based on:<br />

• The <strong>Sonata</strong> <strong>Health</strong> plan you chose<br />

• Any optional coverage you chose<br />

• Whether you’re insuring just yourself or yourself and your family<br />

• Your age<br />

• Your home province or territory<br />

• Your medical history<br />

If you chose family coverage, your premium is also based on the ages, provinces or territories of<br />

residence and medical histories of your family members.<br />

You can pay monthly or annually for your <strong>Sonata</strong> <strong>Health</strong> plan.<br />

Monthly payments<br />

A letter indicating your monthly premium payment* and due date is included in your<br />

<strong>Sonata</strong> <strong>Health</strong> information package. You have two options for payment:<br />

• Automatic debit from your bank account<br />

• Automatic charge to your Visa or MasterCard<br />

*Your monthly credit card or bank statement will show a payment to PDAdmin Group for your <strong>Sonata</strong> <strong>Health</strong> premium.<br />

PDAdmin Group is an agent of <strong>Great</strong>-<strong>West</strong>, and collects your premium on behalf of <strong>Great</strong>-<strong>West</strong>.<br />

10

Payments<br />

If you choose to make an annual premium payment, your full payment is due in advance. You have<br />

two options for payment:<br />

• Cheque<br />

• Visa or MasterCard<br />

You have a grace period of 30 days after the date your premium is due in which to pay your<br />

premium without losing your coverage.<br />

If your premium payment is returned due to non-sufficient funds, NSF charges may apply.<br />

Premium changes<br />

There are several points at which your premium can change:<br />

• At renewal<br />

• If you add or remove coverage for a dependant<br />

• If you change the level of coverage for your <strong>Sonata</strong> <strong>Health</strong> plan<br />

• If you add or remove optional coverage<br />

• If you or an insured family member moves to another province or territory<br />

Renewing your coverage<br />

Your policy is for a term of one year beginning on the effective date shown on your Policy<br />

Specifications document.<br />

<strong>Great</strong>-<strong>West</strong> will automatically renew your <strong>Sonata</strong> <strong>Health</strong> policy each year, on your policy’s annual<br />

renewal date. Your Policy Specifications document shows your annual renewal date. Your <strong>Sonata</strong><br />

<strong>Health</strong> coverage can continue until you reach age 65.<br />

At each renewal, <strong>Great</strong>-<strong>West</strong> will re-establish your premium. Your new premium will take effect on<br />

the annual renewal date. It will reflect such things as increasing healthcare costs, shifts in expenses<br />

from provincial to private plans, and whether you or members of your family have moved into a<br />

new age band. This means that your premium may increase on renewal. You will be notified at<br />

least 31 days before any change in premium.<br />

Changing your coverage<br />

Scales 1 to 6:<br />

You can upgrade your <strong>Sonata</strong> <strong>Health</strong> coverage at any time. You will have to provide updated<br />

medical information at the time you apply to upgrade your coverage. Any upgrade in coverage<br />

must be approved by <strong>Great</strong>-<strong>West</strong>, based on your medical information.<br />

You can also downgrade the level of your <strong>Sonata</strong> <strong>Health</strong> coverage. You can only downgrade your<br />

coverage after you’ve been covered at a higher level for at least one year.<br />

You can add optional coverage at any time – Hospital Accommodation Benefit, Emergency Travel<br />

Medical Benefit, Hospital Cash Benefit, and Accidental Death, Dismemberment and Specific Loss<br />

Benefit – if you did not purchase this coverage when you purchased your <strong>Sonata</strong> <strong>Health</strong> policy. You<br />

will have to complete a Supplementary Application form to make this additional purchase.<br />

You may cancel your optional coverage only at your annual policy renewal date.<br />

11

Guaranteed Acceptance Plan (GAP):<br />

If you chose this plan, you can apply to upgrade your coverage. However, if you were offered GAP<br />

based on your medical history, you can’t re-apply or upgrade your coverage.<br />

To add or remove coverage for a dependant<br />

Your Policy Specifications document lists all the dependants covered under your <strong>Sonata</strong> <strong>Health</strong><br />

policy. To add or remove coverage for a dependant, contact your representative or PDAdmin Group.<br />

To change a beneficiary<br />

All beneficiary changes must be made in writing. Complete the Change of Beneficiary form and<br />

return it to the address on the form. You will receive written confirmation of the beneficiary change.<br />

If you live in Quebec, indicate whether your beneficiary is revocable or non-revocable. If you<br />

designate your beneficiary as non-revocable, you will not be able to change that beneficiary unless<br />

you have the written consent of your beneficiary.<br />

To get forms, including the Supplementary Application, Change of Beneficiary, Accidental Death,<br />

Dismemberment and Specific Loss, and Direct Deposit forms, contact your representative or<br />

PDAdmin Group, or visit the Client Services section of www.greatwestlife.com.<br />

To change your bank account<br />

Changes that affect your monthly premium payment may be submitted, in writing, to<br />

PDAdmin Group.<br />

To change your account information for direct deposit of your health and dental claim payments,<br />

you must complete the form in the direct deposit brochure, M6656. Send the completed form to<br />

the Individual <strong>Health</strong> Unit, along with a cheque marked “void.”<br />

Other changes<br />

To change your address or to make corrections to information (such as birthdates or spelling of names),<br />

call, mail or email your change to PDAdmin Group. Turn to page 17 for contact information.<br />

Making changes<br />

Your representative, or PDAdmin Group, can provide the necessary forms and help you make any<br />

changes to your plan. Changes to your coverage will affect your premium. Turn to page 17 for<br />

contact information.<br />

12

When your coverage ends<br />

Your coverage will end automatically 30 days after you stop paying your premiums. Coverage will<br />

also end:<br />

• If you are no longer a permanent resident of Canada,<br />

• If you are no longer covered under the provincial government health plan,<br />

• When you reach age 65, or<br />

• In the event of your death<br />

If you’ve insured dependants under your <strong>Sonata</strong> <strong>Health</strong> plan, coverage for your dependants will<br />

end if they are no longer permanent residents of Canada, they are no longer covered under the<br />

provincial government health plan or they die. Coverage for your spouse will end when she or he<br />

turns age 65 or is no longer your spouse.<br />

Coverage for a child who is not a full-time student will end when the child turns 21 or works more than<br />

30 hours a week. Coverage for a child who is a full-time student will end when the child turns 25.<br />

Check your policy for information on when coverage ends for a child who is incapable of<br />

supporting him or herself because of a physical or psychiatric disorder.<br />

To reinstate your coverage<br />

If your policy was terminated because your premiums weren’t paid, you can apply to have your<br />

policy reinstated. Notify PDAdmin Group in writing within 60 days of the termination of your policy.<br />

You will have to pay all overdue premiums and any additional fees, including any NSF charges, with<br />

interest.<br />

If your policy was terminated for any reason other than not paying premiums, you can re-apply<br />

for coverage but not for at least two years from the date your coverage ended. Contact your<br />

representative or PDAdmin Group for an application and assistance in re-applying.<br />

To cancel your coverage<br />

To cancel your coverage or coverage for your dependants, please advise your representative or<br />

PDAdmin Group in writing. Your coverage will end on the last day of the month in which you<br />

cancel your coverage. If you’ve paid premiums in advance, your premium will be refunded from the<br />

first of the month following your cancellation.<br />

Surviving spouse and children coverage<br />

<strong>Great</strong>-<strong>West</strong> will automatically continue coverage for your spouse and children upon your death,<br />

unless your spouse terminates your policy. Your spouse will receive a new Policy Specifications<br />

document that lists the spouse as the policyowner and shows the change in premium. PDAdmin<br />

Group will mail the new Policy Specifications document within 31 days of receiving written notice<br />

of your death.<br />

13

Tax information<br />

Sole proprietors, partners and incorporated businesses may be able to claim <strong>Sonata</strong> <strong>Health</strong><br />

premiums as a business expense for federal income tax purposes.<br />

Premiums<br />

Premiums for benefits provided by a private health services plan, as defined by the Income Tax Act<br />

(Canada), may qualify as a business expense. A private health services plan is an insurance contract<br />

or plan that provides coverage for hospital and/or medical expenses. <strong>Great</strong>-<strong>West</strong> sends you an<br />

annual statement of the <strong>Sonata</strong> <strong>Health</strong> premiums that may be tax-deductible as a business expense.<br />

Premiums related to non-hospital/medical expense coverage are excluded from this statement.<br />

Sole proprietor or partner<br />

If you are a sole proprietor or partner, you may be able to deduct premiums paid or payable to a<br />

private health services plan if the following conditions are met:<br />

• Net income from self-employment (excluding losses and premiums for a private health<br />

services plan) for the current or previous year is more than 50 per cent of total income, or<br />

• Income from sources other than self-employment is $10,000 or less for the current or<br />

previous year<br />

• You are actively engaged in the business on a regular and continuous basis, and<br />

• The premiums are paid or payable to insure you, your spouse or common-law partner, or any<br />

member of your household<br />

14

A sole proprietor or partner who does not have any employees<br />

If you are a sole proprietor or partner with no employees you may deduct up to a maximum of:<br />

• $1,500 for yourself<br />

• $1,500 each for your spouse or common-law partner and household members 18 years of<br />

age or older at the start of the period when you were insured, and<br />

• $750 for each household member under the age of 18 at the start of the period.<br />

A sole proprietor or partner who has employees<br />

If you are a sole proprietor or partner who has employees, the rules are very technical and complex.<br />

You may not be able to deduct any premiums for a private health services plan as a business<br />

expense if you do not offer coverage to your employees. Instead, the premiums may be claimed as<br />

a medical expense for the purposes of the medical expense tax credit.<br />

As the sole proprietor or partner, you may be able to deduct premiums for a private health services<br />

plan in respect to yourself, your spouse or common-law partner, or household members based on<br />

the following criteria:<br />

• The percentage of insurable employees who are full-time, arm’s-length employees<br />

• The cost of the coverage provided to each employee that would be equivalent coverage for you<br />

• The percentage of the premium for each employee that is paid by you<br />

• The portion of the year that you had employees<br />

As a sole proprietor or partner, you should refer to the Canada Revenue Agency’s Business and<br />

Professional Income guide. This guide is available on the Canada Revenue Agency’s website at<br />

www.cra-arc.gc.ca.<br />

Incorporated business<br />

If you are an owner-operator of an incorporated business, you may be able to deduct premiums paid<br />

or payable to a private health services plan if the following conditions are met:<br />

• You work as an employee in the business<br />

• You offer similar coverage to the employees, and<br />

• The benefits are reasonable in the circumstances, among other considerations<br />

If coverage is offered only to major shareholders of the corporation (for example, only to owner-managers)<br />

and not to other employees, premiums paid may not be deductible from the company’s business income<br />

and may be considered a taxable benefit to the owner-managers.<br />

For more information about the tax deductibility of your <strong>Sonata</strong> <strong>Health</strong> premiums, we strongly<br />

recommend that you consult with your professional advisor about your particular circumstances.<br />

The above information is intended as general information only, and is not intended to be legal or<br />

tax advice.<br />

15

Receipt for tax purposes<br />

Early in the new year, you will receive a notice showing the portion of your premium that can be<br />

used for income tax purposes. The notice will show either:<br />

• The portion of your premium that is deductible if you are filing a claim as a sole proprietor,<br />

partner or incorporated business<br />

or<br />

• The portion of your premium that you can use in calculating the medical expense tax credit<br />

on your personal income tax return.<br />

If your <strong>Sonata</strong> <strong>Health</strong> coverage ended during the year, you will receive your tax information shortly<br />

after your policy terminates.

Contact information<br />

For claims information<br />

Contact <strong>Great</strong>-<strong>West</strong>’s Individual <strong>Health</strong> Unit to submit claims or if you have questions<br />

about your claims.<br />

By phone:<br />

Call toll-free 1-866-430-2863<br />

Monday to Friday, 8 a.m. to 5:30 p.m. (EST)<br />

By e-mail:<br />

Write to individual.health@gwl.ca<br />

By mail:<br />

The <strong>Great</strong>-<strong>West</strong> <strong>Life</strong> Assurance Company<br />

Individual <strong>Health</strong> Unit<br />

P.O. Box 6000<br />

Winnipeg, MB R3C 3A5<br />

For Best Doctors services<br />

To be connected with world-class medical specialists, call toll-free 1-877-419-BEST (2378)<br />

For PVS<br />

For information on the PVS discount, or the nearest PVS location, call the PVS information centre<br />

toll-free at 1-800-668-6444 or visit the PVS website at www.pvs.ca.<br />

For general inquiries and assistance<br />

Your <strong>Sonata</strong> <strong>Health</strong> policy is underwritten by The <strong>Great</strong>-<strong>West</strong> <strong>Life</strong> Assurance Company and<br />

administered by PDAdmin Group. If you would like more information on your policy, want to make<br />

changes or have any questions, contact your representative or PDAdmin Group.<br />

By phone:<br />

416-499-4125 or toll free 1-800-268-3489<br />

8 a.m. to 6 p.m., Monday to Friday (EST)<br />

By mail:<br />

PDAdmin Group<br />

211 Consumers Road, Suite 200<br />

Willowdale, Ontario M2J 4G8<br />

By e-mail:<br />

sonatahealth@pdadmin.com<br />

17

Online services<br />

To find forms, contact information and additional resources for your <strong>Sonata</strong> <strong>Health</strong> plan, visit the<br />

Client Services section of www.greatwestlife.com. Select Owner of an individual insurance or<br />

investment product – <strong>Health</strong> and Dental Insurance – <strong>Sonata</strong> <strong>Health</strong>.<br />

For additional information about <strong>Sonata</strong> <strong>Health</strong> plans and optional benefits you can add, visit<br />

www.greatwestlife.com/sonata.<br />

For more information about <strong>Great</strong>-<strong>West</strong> <strong>Life</strong>, visit www.greatwestlife.com.<br />

18

M6332-8/12<br />

<strong>Great</strong>-<strong>West</strong> <strong>Life</strong> and the key design and <strong>Sonata</strong> <strong>Health</strong> are trademarks of The <strong>Great</strong>-<strong>West</strong> <strong>Life</strong> Assurance Company.<br />

PDAdmin Group is a trademark of PlanDirect Insurance Services Inc., used under license by The <strong>Great</strong>-<strong>West</strong> <strong>Life</strong> Assurance Company.<br />

Best Doctors and the trademarks noted in relation to services offered by Best Doctors, Inc. are trademarks of Best Doctors, Inc.<br />

The Assure Card and Assure Claims are registered trademarks of Telus <strong>Health</strong> Solutions.