ZAIC2012-1 - Zurich Producer Compensation

ZAIC2012-1 - Zurich Producer Compensation

ZAIC2012-1 - Zurich Producer Compensation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL STATEMENT FOR THE YEAR 2012 OF THE ZURICH AMERICAN INSURANCE COMPANY<br />

claims made in the litigation. On October 30, 2012, the plaintiffs filed a notice of voluntary dismissal of claims against the<br />

<strong>Zurich</strong> defendants with prejudice that was so ordered by the Court on December 20, 2012. The plaintiffs have requested to<br />

be excluded as members of the Class Action Settlement.<br />

b. On or about January 2005, a state-wide Massachusetts putative class action suit entitled Van Emden Mgmt. Corp. v. Marsh<br />

& McLennan Cos., Inc., et al., was served on Steadfast Insurance Company (“Steadfast”), a ZAIC subsidiary, alleging a bidrigging<br />

and a contingent commission payment scheme in violation of state antitrust law, breach of fiduciary duty and state<br />

conspiracy laws. The complaint seeks unspecified damages, treble damages, injunctive relief and attorneys’ fees. By order<br />

dated September 19, 2005, the proceeding is currently stayed pending further order of the court. On November 30, 2012,<br />

Steadfast entered into a confidential settlement agreement with plaintiff pursuant to which the parties agreed to settle the<br />

claims made in the litigation. On December 17, 2012, a Stipulation of Dismissal was filed with the court whereby plaintiff<br />

dismissed all claims against Steadfast with prejudice. The plaintiff has excluded itself from the Class Action Settlement.<br />

c. On or about October 31, 2007, an amended complaint was filed in an individual action (not a class action) pending in Texas<br />

state court that named ZAIC, American Guarantee and Liability Insurance Company, Steadfast Insurance Company, <strong>Zurich</strong><br />

North America, and <strong>Zurich</strong> Insurance Company LTD. as defendants under the caption RSR Corp., Inc. v. Marsh, et al.<br />

Service of the amended complaint was not accepted on behalf of <strong>Zurich</strong> Insurance Company Ltd. and <strong>Zurich</strong> North America.<br />

The complaint, as amended, alleges violations of state antitrust law, aiding and abetting fraud and breaches of fiduciary<br />

duties, and civil conspiracy, as well as additional claims against the broker defendant for breach of contract, breach of<br />

fiduciary duty, and fraud. The complaint seeks unspecified compensatory damages, treble and punitive damages,<br />

disgorgement, prejudgment, prejudgment interest, forfeiture of payments and attorneys'fees and costs. On December 18,<br />

2012, ZAIC and certain of its insurance subsidiaries entered into a confidential settlement agreement with plaintiff pursuant<br />

to which the parties agreed to settle the claims made in the litigation. On January 4, 2013, the court entered an order<br />

formally dismissing the <strong>Zurich</strong> defendants form the proceeding. The plaintiff has excluded itself from the Class Action<br />

Settlement.<br />

(2) Other Lawsuits<br />

An action entitled Fuller-Austin Asbestos Settlement Trust, et al. v. <strong>Zurich</strong> American Insurance Company, et al., was filed in May<br />

2004 in the Superior Court for San Francisco County, California. Three other similar actions were filed in 2004 and 2005 and<br />

have been coordinated with the Fuller-Austin action (together, the "Fuller-Austin Case"). In addition to ZAIC and four of its<br />

insurance company subsidiaries, <strong>Zurich</strong> Insurance Company Ltd (“ZIC”) and Orange Stone Reinsurance Dublin (“Orange<br />

Stone”) are named as defendants. The plaintiffs, who are historical policyholders of the Home Insurance Company (“Home”),<br />

plead claims for, inter alia, fradulent transfer, tortious interference, unfair business practices, alter ego and agency liability<br />

relating to the recapitalization of Home, which occurred in 1995 following regulatory review and approval. The plaintiffs allege<br />

that, pursuant to the recapitalization and subsequent transactions, various <strong>Zurich</strong> entities took assets of Home without giving<br />

adequate consideration in return and this forced Home into liquidation. The plaintiffs further allege that the defendants should<br />

be held responsible for Home’s alleged obligations under their Home policies. The trial judge designated plaintiffs’ claims for<br />

constructive fraudulent transfer for adjudication before all other claims; he subsequently ordered an initial bench trial on certain<br />

threshold elements of those fraudulent transfer claims and on certain of defendants’ affirmative defenses. The trial commenced<br />

on November 1, 2010, and trial testimony has concluded. Closing arguments were heard on February 22 and 23, 2012, and a<br />

decision is pending. ZAIC maintains that the Fuller-Austin case is without merit.<br />

Various other lawsuits against the Company have arisen in the ordinary course of the Company's business. Contingent liablities<br />

arising from such litigation, income tax and other matters are not considered material to the Company's results of operations,<br />

financial position, established reserves and anticipated insurance and reinsurance recoverables.<br />

15. LEASES<br />

A. Lessee Operating Leases<br />

(1) The Company leases some of its office space and data processing equipment under various non-cancelable operating lease<br />

agreements that expire through February 28, 2023. Rent expense for office space under operating leases and sub-leases<br />

was $61,156,435 and $57,489,850 for 2012 and 2011, respectively. Rent expense for data processing equipment was<br />

$4,100,592 and $3,748,550 for 2012 and 2011, respectively.<br />

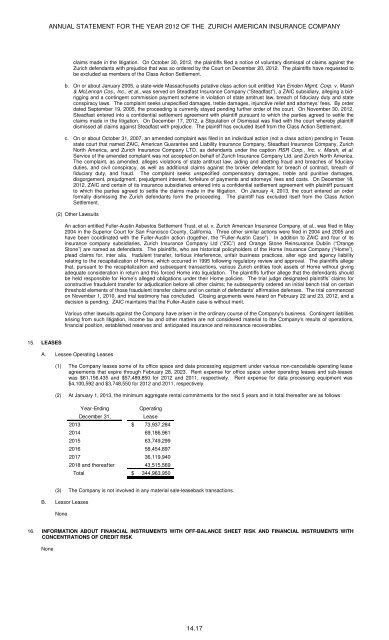

(2) At January 1, 2013, the minimum aggregate rental commitments for the next 5 years and in total thereafter are as follows:<br />

Year-Ending<br />

December 31,<br />

Operating<br />

Lease<br />

2013 $ 73,937,284<br />

2014 69,186,961<br />

2015 63,749,299<br />

2016 58,454,897<br />

2017 36,119,940<br />

2018 and thereafter 43,515,569<br />

Total $ 344,963,950<br />

(3) The Company is not involved in any material sale-leaseback transactions.<br />

B. Lessor Leases<br />

None<br />

16. INFORMATION ABOUT FINANCIAL INSTRUMENTS WITH OFF-BALANCE SHEET RISK AND FINANCIAL INSTRUMENTS WITH<br />

CONCENTRATIONS OF CREDIT RISK<br />

None<br />

14.17