ZAIC2012-1 - Zurich Producer Compensation

ZAIC2012-1 - Zurich Producer Compensation

ZAIC2012-1 - Zurich Producer Compensation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL STATEMENT FOR THE YEAR 2012 OF THE ZURICH AMERICAN INSURANCE COMPANY<br />

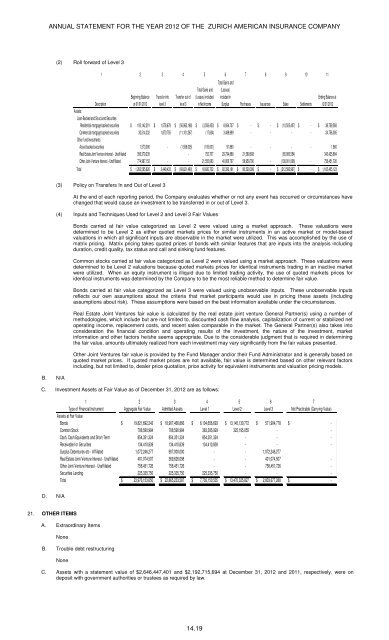

(2) Roll forward of Level 3<br />

1<br />

2 3 4 5 6 7<br />

8<br />

9 10<br />

11<br />

Beginning Balance<br />

at 01/01/2012<br />

Transfer into<br />

level 3<br />

Transfer out of<br />

Total Gains and<br />

(Losses) included<br />

Total Gains and<br />

(Losses)<br />

included in<br />

Ending Balance at<br />

12/31/2012<br />

Description<br />

level 3 in Net Income Surplus Purchases Issuances Sales Settlements<br />

Assets:<br />

Loan-Backed and Structured Securities<br />

Residential mortgage backed securities $ 100,142,201 $ 1,578,678 $ (56,962,188) $ (3,558,453) $ 8,064,737 $ - $ - $ (10,505,407) $ - $ 38,759,568<br />

Commercial mortgage backed securities 30,514,232 1,870,755 (11,101,267) (17,634) 3,489,999 - - - - 24,756,085<br />

Other fund Investments<br />

Asset-backed securities 1,573,006 - (1,558,005) (105,001) 91,860 - - - - 1,860<br />

Real Estate Joint Venture Interest - Unaffiliated 356,379,235 - 752,707 29,794,888 21,569,608 (65,060,554) 343,435,884<br />

Other Joint-Venture Interest - Unaffiliated 774,987,152 - - 21,555,083 40,950,707 58,959,790 - (138,001,006) - 758,451,726<br />

Total $ 1,263,595,826 $ 3,449,433 $ (69,621,460) $ 18,626,702 $ 82,392,191 $ 80,529,398 $ - $ (213,566,967) $ - $ 1,165,405,123<br />

B. N/A<br />

(3) Policy on Transfers In and Out of Level 3<br />

At the end of each reporting period, the Company evaluates whether or not any event has occurred or circumstances have<br />

changed that would cause an investment to be transferred in or out of Level 3.<br />

(4) Inputs and Techniques Used for Level 2 and Level 3 Fair Values<br />

Bonds carried at fair value categorized as Level 2 were valued using a market approach. These valuations were<br />

determined to be Level 2 as either quoted markets prices for similar instruments in an active market or model-based<br />

valuations in which all significant inputs are observable in the market were utilized. This was accomplished by the use of<br />

matrix pricing. Matrix pricing takes quoted prices of bonds with similar features that are inputs into the analysis including<br />

duration, credit quality, tax status and call and sinking fund features.<br />

Common stocks carried at fair value categorized as Level 2 were valued using a market approach. These valuations were<br />

determined to be Level 2 valuations because quoted markets prices for identical instruments trading in an inactive market<br />

were utilized. When an equity instrument is illiquid due to limited trading activity, the use of quoted markets prices for<br />

identical instruments was determined by the Company to be the most reliable method to determine fair value.<br />

Bonds carried at fair value categorized as Level 3 were valued using unobservable inputs. These unobservable inputs<br />

reflects our own assumptions about the criteria that market participants would use in pricing these assets (including<br />

assumptions about risk). These assumptions were based on the best information available under the circumstances.<br />

Real Estate Joint Ventures fair value is calculated by the real estate joint venture General Partner(s) using a number of<br />

methodologies, which include but are not limited to, discounted cash flow analysis, capitalization of current or stabilized net<br />

operating income, replacement costs, and recent sales comparable in the market. The General Partner(s) also takes into<br />

consideration the financial condition and operating results of the investment, the nature of the investment, market<br />

information and other factors he/she seems appropriate. Due to the considerable judgment that is required in determining<br />

the fair value, amounts ultimately realized from each investment may vary significantly from the fair values presented.<br />

Other Joint Ventures fair value is provided by the Fund Manager and/or their Fund Administrator and is generally based on<br />

quoted market prices. If quoted market prices are not available, fair value is determined based on other relevant factors<br />

including, but not limited to, dealer price quotation, price activity for equivalent instruments and valuation pricing models.<br />

C. Investment Assets at Fair Value as of December 31, 2012 are as follows:<br />

1 2 3 4 5 6 7<br />

Type of Financial Instrument<br />

Assets at Fair Value<br />

Bonds $<br />

Aggregate Fair Value<br />

19,821,692,243 $<br />

Admitted Assets<br />

18,907,466,866 $<br />

Level 1<br />

6,104,656,693 $<br />

Level 2<br />

13,145,130,772 $<br />

Level 3<br />

571,904,778 $<br />

Not Practicable (Carrying Value)<br />

-<br />

Common Stock 708,590,984 708,590,984 383,395,929 325,195,055 - -<br />

Cash, Cash Equivalents and Short-Term 854,351,324 854,351,324 854,351,324 - - -<br />

Receivable for Securities 134,410,839 134,410,839 134,410,839 - - -<br />

Surplus Debentures etc - Affiliated 1,072,246,277 907,000,000 - - 1,072,246,277<br />

Real Estate Joint-Venture Interest - Unaffiliated 401,074,507 369,626,098 - - 401,074,507 -<br />

Other Joint-Venture Interest - Unaffiliated 758,451,726 758,451,726 - - 758,451,726 -<br />

Securities Lending 225,335,750 225,335,750 225,335,750 - - -<br />

Total $ 23,976,153,650 $ 22,865,233,587 $ 7,702,150,535 $ 13,470,325,827 $ 2,803,677,288 $ -<br />

D. N/A<br />

21. OTHER ITEMS<br />

A. Extraordinary Items<br />

None<br />

B. Trouble debt restructuring<br />

None<br />

C. Assets with a statement value of $2,646,447,401 and $2,192,715,694 at December 31, 2012 and 2011, respectively, were on<br />

deposit with government authorities or trustees as required by law.<br />

14.19