HOW TO READ A CREDIT REPORT - Tenant Data Services, Inc.

HOW TO READ A CREDIT REPORT - Tenant Data Services, Inc.

HOW TO READ A CREDIT REPORT - Tenant Data Services, Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

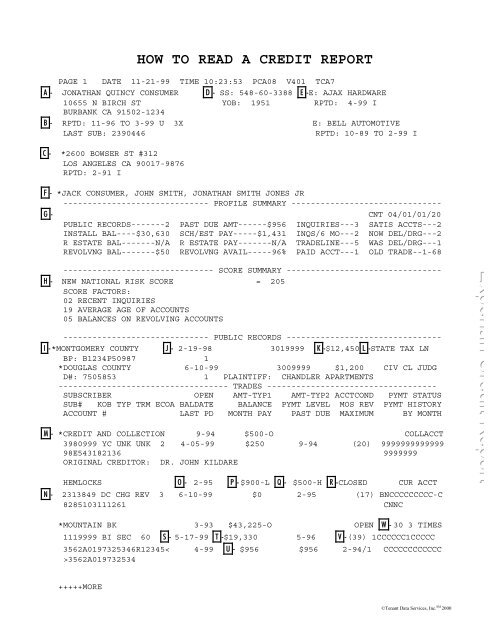

<strong>HOW</strong> <strong>TO</strong> <strong>READ</strong> A <strong>CREDIT</strong> <strong>REPORT</strong><br />

PAGE 1 DATE 11-21-99 TIME 10:23:53 PCA08 V401 TCA7<br />

A - JONATHAN QUINCY CONSUMER D - SS: 548-60-3388 E -E: AJAX HARDWARE<br />

10655 N BIRCH ST YOB: 1951 RPTD: 4-99 I<br />

BURBANK CA 91502-1234<br />

B - RPTD: 11-96 <strong>TO</strong> 3-99 U 3X<br />

E: BELL AU<strong>TO</strong>MOTIVE<br />

LAST SUB: 2390446<br />

RPTD: 10-89 <strong>TO</strong> 2-99 I<br />

C - *2600 BOWSER ST #312<br />

LOS ANGELES CA 90017-9876<br />

RPTD: 2-91 I<br />

F - *JACK CONSUMER, JOHN SMITH, JONATHAN SMITH JONES JR<br />

------------------------------ PROFILE SUMMARY -------------------------------<br />

G - CNT 04/01/01/20<br />

PUBLIC RECORDS-------2 PAST DUE AMT------$956 INQUIRIES---3 SATIS ACCTS---2<br />

INSTALL BAL----$30,630 SCH/EST PAY-----$1,431 INQS/6 MO---2 NOW DEL/DRG---2<br />

R ESTATE BAL-------N/A R ESTATE PAY-------N/A TRADELINE---5 WAS DEL/DRG---1<br />

REVOLVNG BAL-------$50 REVOLVNG AVAIL-----96% PAID ACCT---1 OLD TRADE--1-68<br />

------------------------------- SCORE SUMMARY --------------------------------<br />

H - NEW NATIONAL RISK SCORE = 205<br />

SCORE FAC<strong>TO</strong>RS:<br />

02 RECENT INQUIRIES<br />

19 AVERAGE AGE OF ACCOUNTS<br />

05 BALANCES ON REVOLVING ACCOUNTS<br />

------------------------------ PUBLIC RECORDS --------------------------------<br />

I -*MONTGOMERY COUNTY J - 2-19-98 3019999 K -$12,450 L -STATE TAX LN<br />

BP: B1234P50987 1<br />

*DOUGLAS COUNTY 6-10-99 3009999 $1,200 CIV CL JUDG<br />

D#: 7505853 1 PLAINTIFF: CHANDLER APARTMENTS<br />

----------------------------------- TRADES -----------------------------------<br />

SUBSCRIBER OPEN AMT-TYP1 AMT-TYP2 ACCTCOND PYMT STATUS<br />

SUB# KOB TYP TRM ECOA BALDATE BALANCE PYMT LEVEL MOS REV PYMT HIS<strong>TO</strong>RY<br />

ACCOUNT # LAST PD MONTH PAY PAST DUE MAXIMUM BY MONTH<br />

M - *<strong>CREDIT</strong> AND COLLECTION 9-94 $500-O COLLACCT<br />

3980999 YC UNK UNK 2 4-05-99 $250 9-94 (20) 9999999999999<br />

98E543182136 9999999<br />

ORIGINAL CREDI<strong>TO</strong>R: DR. JOHN KILDARE<br />

HEMLOCKS O - 2-95 P - $900-L Q - $500-H R -CLOSED CUR ACCT<br />

N - 2313849 DC CHG REV 3 6-10-99 $0 2-95 (17) BNCCCCCCCCC-C<br />

8285103111261 CNNC<br />

Experian Credit Report<br />

*MOUNTAIN BK 3-93 $43,225-O OPEN W - 30 3 TIMES<br />

1119999 BI SEC 60 S - 5-17-99 T -$19,330 5-96 V - (39) 1CCCCCC1CCCCC<br />

3562A0197325346R12345< 4-99 U - $956 $956 2-94/1 CCCCCCCCCCCC<br />

>3562A019732534<br />

+++++MORE<br />

©<strong>Tenant</strong> <strong>Data</strong> <strong>Services</strong>, <strong>Inc</strong>. SM 2000

BRC3 TDS 5861287<br />

CONSUMER, JONATHAN Q 548603388; CA-10655 NORTH BIRCH #1/BURB<br />

PAGE 2<br />

DATE 11-21-99 TIME 10:23:53 PCA08 V401 TCA7<br />

SUBSCRIBER OPEN AMT-TYP1 AMT-TYP2 ACCTCOND PYMT STATUS<br />

SUB# KOB TYP TRM ECOA BALDATE BALANCE PYMT LEVEL MOS REV PYMT HIS<strong>TO</strong>RY<br />

ACCOUNT # LAST PD MONTH PAY PAST DUE MAXIMUM BY MONTH<br />

*BAY COMPANY 1-68 $1,400-L $1,200-H OPEN CUR WAS 90<br />

2390446 DC CHG REV 3 5-16-99 $50 3-96 (99) C0C321CCCC000<br />

525556601 3-99 $10-E X - CCCCCCCCCCCC<br />

Y - **ACCOUNT WAS IN DISPUTE-NOW RESOLVED-<strong>REPORT</strong>ED BY SUBSCRIBER**<br />

CENTRAL BANK 12-93 $22,350-O OPEN CUR ACCT<br />

1132912 BI AUT 48 1 6-15-99 $11,050 12-93 (31) CCCCCCCCCCCCC<br />

23802654388 5-99 $465 CCCCCCCCCCCC<br />

COLLATERAL: 1994 FORD TAURUS<br />

--------------------------------- INQUIRIES ----------------------------------<br />

Z - TENANT DATA SERVICES 10-31-98 2958076 ZT<br />

HEMLOCKS<br />

5-05-99 2313849 DC<br />

BAY COMPANY 5-03-99 2390446 DC $1,500 CHG REV<br />

HILLSIDE BANK<br />

3-21-99 2240679 BC<br />

CONSUMER ASSISTANCE CONTACT: EXPERIAN<br />

701 EXPERIAN PARKWAY, PO BOX 2002, ALLEN, TX 75013 888.397.3742<br />

END – EXPERIAN<br />

©<strong>Tenant</strong> <strong>Data</strong> <strong>Services</strong>, <strong>Inc</strong>. SM 2000

The Experian Credit Report<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

G<br />

H<br />

I<br />

J<br />

The identifying information of your applicant. The<br />

name and address will appear as reported to<br />

Experian.<br />

Rptd identifies the dates the above address was<br />

reported to Experian. It does not necessarily<br />

represent the move-in or move-out date. The letters<br />

after the dates identify the source the information<br />

came from.<br />

U = Update by tradeline<br />

I = Inquiry<br />

M = Manual data<br />

P = By consumer<br />

A number followed by an X (a 3 in this case)<br />

identifies how many times this address has been<br />

reported.<br />

Applicant’s previous addresses with source, in order<br />

by reliability of source. Up to two may display.<br />

This is the Social Security Number (SSN) Experian<br />

has on file. If the consumer has used multiple SSN’s<br />

or Experian has more than one on file, they will all<br />

be displayed. SSN’s are listed in order of most<br />

frequent use, with the most frequent on top. SSN’s<br />

with an asterisk following indicates that it is not the<br />

one you entered to request the report with. The<br />

applicant’s date or year of birth is listed below the<br />

SSN.<br />

Applicant’s current and previous employer’s name<br />

& address including time frame reported and source.<br />

The current one precedes the previous one.<br />

U = Update by trade line<br />

I = Inquiry<br />

Alternate names such as aliases, maiden, previous<br />

surnames or nicknames are listed.<br />

See “Experian Profile Summary” for detail.<br />

(You may not be utilizing this feature)<br />

The National Risk Score’s range of 0 to 1000 (low<br />

score = low risk) translates directly into statistical<br />

probability. For example, a score of 100 equals a<br />

10% chance that at least one tradeline will become<br />

seriously delinquent in the next 24 months. When<br />

calculating the Risk Score, Experian identifies up to<br />

four characteristics that had the most negative<br />

impact on the score.<br />

The name of the court the public record was filed.<br />

The date the public record was filed. A second date<br />

following this would indicate the date the case was<br />

completed, satisfied, released, discharged, or<br />

dismissed. If there is not a second date, the case<br />

may still be pending or may have been dismissed.<br />

O<br />

P<br />

Q<br />

R<br />

S<br />

T<br />

U<br />

V<br />

The date the account was opened.<br />

The initial amount or limit of the account. The<br />

amount may be followed by the following letters:<br />

L = Credit Limit<br />

H = High Balance<br />

O = Original Loan<br />

C = Initial Charge-off<br />

Blank = Unknown<br />

Two amounts may display. They indicate the<br />

account has a (L)imit and a (H)igh balance.<br />

The account condition indicates the current state of<br />

the account.<br />

The date the balance was last reported on open<br />

accounts, or the date paid on paid accounts.<br />

The balance as of the date listed in “S”.<br />

This is the payment amount the consumer is<br />

scheduled to pay on the account. (E)stimated,<br />

(A)ctual or (S)cheduled may follow the payment<br />

amount.<br />

This indicates the total number of months that a<br />

history has been maintained for the account.<br />

W This comment reflects the payment history of the<br />

account as of the balance date.<br />

X<br />

Y<br />

Z<br />

The 25-month payment history. The upper left is the<br />

most current month reported.<br />

C = Current<br />

N = Current account/zero balance-no update rec’d<br />

0 = Current account/zero balance-update rec’d<br />

1 = 30 days past due date<br />

2 = 60 days past due date<br />

3 = 90 days past due date<br />

4 = 120 days past due date<br />

7 = Chapter 13 Bankruptcy<br />

8 = Derogatory, e.g. foreclosure proceeding<br />

9 = Chapter 7, 11, or 12 Bankruptcy<br />

G = Collection<br />

H = Foreclosure<br />

J = Voluntary surrender<br />

K = Repossession<br />

L = Charge-off<br />

B = Account condition change, payment code N/A<br />

Dash = No history reported for that month<br />

Blank = No history maintained<br />

This message section may include general consumer<br />

statements, informational or other special messages.<br />

The name of the company that requested a credit<br />

report. <strong>Inc</strong>ludes date requested, subscriber number<br />

and Kind of Business (KOB).<br />

K The amount of the public record.<br />

L The type of the public record.<br />

M The name of the company (subscriber).<br />

N The company’s subscriber number.<br />

©<strong>Tenant</strong> <strong>Data</strong> <strong>Services</strong>, <strong>Inc</strong>. SM 2000

Experian Profile Summary<br />

------------------------------ PROFILE SUMMARY -------------------------------<br />

PUBLIC RECORDS------2 PAST DUE AMT-----$956 INQUIRIES--3 SATIS ACCTS---2<br />

INSTALL BAL---$30,630 SCH/EST PAY----$1,431 INQS/6 MO--2 NOW DEL/DRG---2<br />

R ESTATE BAL------N/A R ESTATE PAY------N/A TRADELINE--5 WAS DEL/DRG---1<br />

REVOLVNG BAL------$50 REVOLVNG AVAIL----96% PAID ACCT--1 OLD TRADE--1-68<br />

ABBREVIATION<br />

PUBLIC RECORDS<br />

INSTALL BAL<br />

R ESTATE BAL<br />

REVOLVNG BAL<br />

PAST DUE AMT<br />

SCH/EST PAY<br />

R ESTATE PAY<br />

REVOLVING AVAIL<br />

INQUIRIES<br />

INQ/6 MO<br />

TRADELINE<br />

PAID ACCT<br />

SATIS ACCTS<br />

NOW DEL/DRG<br />

WAS DEL/DRG<br />

OLD TRADE<br />

DESCRIPTION<br />

Total number of public record items.<br />

Total installment loan account balance owed by the consumer. Examples of<br />

installment balances include car loans, student loans or other fixed term loans excluding<br />

mortgages.<br />

Total real estate loan account balance owed by the consumer. This primarily consists<br />

of mortgages.<br />

Total revolving charge account balance owed by the consumer. This is primarily<br />

from credit cards or accounts that can be charged up and paid off many times.<br />

Total dollar amount of past due payments owed by the consumer. It includes ALL<br />

types of accounts.<br />

Combined total of scheduled and estimated monthly payments owed by the consumer<br />

with the exception of real estate accounts.<br />

Total dollar amount of real estate payments owed by the consumer.<br />

Total percentage of revolving credit still available to the consumer.<br />

Total number of inquiries in the past two years.<br />

Total number of inquiries made within six months preceding the date of the credit<br />

report.<br />

Total number of tradelines on the credit report. This does not include public records or<br />

inquires. An example of a tradeline would be Visa, Sears or GMAC.<br />

Total of accounts that have been paid satisfactorily or paid after having been<br />

previously delinquent.<br />

Total of accounts that are current or paid satisfactorily.<br />

Total of accounts that are now delinquent or derogatory.<br />

Total of accounts that were delinquent or derogatory, and either have been paid in<br />

full or brought current.<br />

Date the oldest tradeline on the report was opened. This allows you to quickly find<br />

how long credit has been established.<br />

Note:<br />

A plus sign (+) following a Profile Summary total indicates not all tradelines had an amount that could be<br />

included in the total.<br />

©<strong>Tenant</strong> <strong>Data</strong> <strong>Services</strong>, <strong>Inc</strong>. SM 2000