FCP OP MEDICAL BioHealth Trends FCP OP ... - Sal. Oppenheim

FCP OP MEDICAL BioHealth Trends FCP OP ... - Sal. Oppenheim

FCP OP MEDICAL BioHealth Trends FCP OP ... - Sal. Oppenheim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

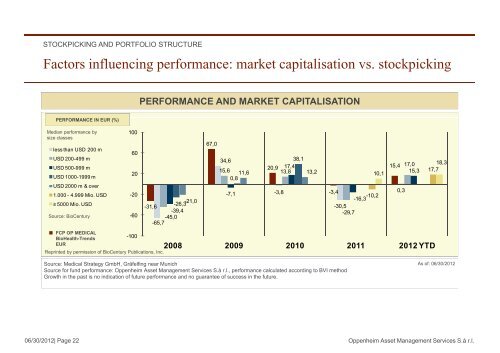

STOCKPICKING AND PORTFOLIO STRUCTURE<br />

Factors influencing performance: market capitalisation vs. stockpicking<br />

PERFORMANCE IN EUR (%)<br />

Median performance by<br />

size classes<br />

less than USD 200 m<br />

USD 200-499 m<br />

USD 500-999 m<br />

USD 1000-1999 m<br />

USD 2000 m & over<br />

11.000 000 - 44.999 999 Mio Mio. USD<br />

≥ 5000 Mio. USD<br />

Source: BioCentury<br />

<strong>FCP</strong> <strong>OP</strong> <strong>MEDICAL</strong><br />

<strong>BioHealth</strong>-<strong>Trends</strong><br />

EUR<br />

100<br />

60<br />

20<br />

-20 20<br />

-60<br />

-100 100<br />

Reprinted by permission of BioCentury Publications, Inc.<br />

PERFORMANCE AND MARKET CAPITALISATION<br />

-31,6<br />

-26,3<br />

-39,4<br />

-45,0<br />

-65,7<br />

-21,0<br />

67,0<br />

34,6<br />

38,1<br />

15,6<br />

0,8<br />

11,6<br />

20,9 17,4<br />

13,8 13,2<br />

Source: Medical Strategy GmbH, Gräfelfing near Munich<br />

Source for fund performance: <strong>Oppenheim</strong> Asset Management Services S.à r.l., performance calculated according to BVI method<br />

Growth in the past is no indication of future performance and no guarantee of success in the future.<br />

-7,1 ,<br />

-3,8<br />

10,1<br />

-3,4<br />

-10 -10,2 2<br />

-16,3<br />

-30,5<br />

-29,7<br />

15,4<br />

0,3<br />

17,0<br />

15,3<br />

2008 2009 2010 2011 2012 YTD<br />

18,3<br />

17,7<br />

As of: 06/30/2012<br />

06/30/2012| Page 22 <strong>Oppenheim</strong> Asset Management Services S.à r.l.