bdo aml/kyc questionnaire

bdo aml/kyc questionnaire

bdo aml/kyc questionnaire

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

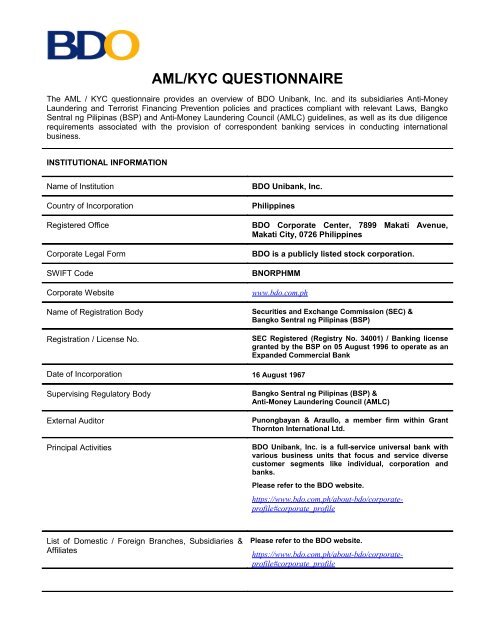

AML/KYC QUESTIONNAIRE<br />

The AML / KYC <strong>questionnaire</strong> provides an overview of BDO Unibank, Inc. and its subsidiaries Anti-Money<br />

Laundering and Terrorist Financing Prevention policies and practices compliant with relevant Laws, Bangko<br />

Sentral ng Pilipinas (BSP) and Anti-Money Laundering Council (AMLC) guidelines, as well as its due diligence<br />

requirements associated with the provision of correspondent banking services in conducting international<br />

business.<br />

INSTITUTIONAL INFORMATION<br />

Name of Institution<br />

Country of Incorporation<br />

Registered Office<br />

Corporate Legal Form<br />

SWIFT Code<br />

Corporate Website<br />

Name of Registration Body<br />

Registration / License No.<br />

BDO Unibank, Inc.<br />

Philippines<br />

BDO Corporate Center, 7899 Makati Avenue,<br />

Makati City, 0726 Philippines<br />

BDO is a publicly listed stock corporation.<br />

BNORPHMM<br />

www.<strong>bdo</strong>.com.ph<br />

Securities and Exchange Commission (SEC) &<br />

Bangko Sentral ng Pilipinas (BSP)<br />

SEC Registered (Registry No. 34001) / Banking license<br />

granted by the BSP on 05 August 1996 to operate as an<br />

Expanded Commercial Bank<br />

Date of Incorporation 16 August 1967<br />

Supervising Regulatory Body<br />

External Auditor<br />

Principal Activities<br />

Bangko Sentral ng Pilipinas (BSP) &<br />

Anti-Money Laundering Council (AMLC)<br />

Punongbayan & Araullo, a member firm within Grant<br />

Thornton International Ltd.<br />

BDO Unibank, Inc. is a full-service universal bank with<br />

various business units that focus and service diverse<br />

customer segments like individual, corporation and<br />

banks.<br />

Please refer to the BDO website.<br />

List of Domestic / Foreign Branches, Subsidiaries &<br />

Affiliates<br />

Please refer to the BDO website.<br />

https://www.<strong>bdo</strong>.com.ph/about-<strong>bdo</strong>/corporateprofile#corporate_profile<br />

https://www.<strong>bdo</strong>.com.ph/about-<strong>bdo</strong>/corporateprofile#corporate_profile

OWNERSHIP AND MANAGEMENT INFORMATION<br />

Stock Exchange Listing<br />

Ownership Structure<br />

Management Structure<br />

Philippine Stock Exchange (PSE), under the trading<br />

name of BDO Unibank, Inc. & BDO as the stock code.<br />

Please refer to the BDO website.<br />

https://www.<strong>bdo</strong>.com.ph/corporate-governance/ownership<br />

Please refer to the BDO website.<br />

List of Directors:<br />

https://www.<strong>bdo</strong>.com.ph/corporate-governance/board-andshareholder-matters<br />

Principal Officers:<br />

https://www.<strong>bdo</strong>.com.ph/corporate-governance/ownership<br />

then click Annual Stockholder Meeting (DIS)<br />

Anti-Money Laundering Questionnaire<br />

I. General AML Policies, Practices and Procedures: Yes No<br />

1. Is the AML compliance program approved by the FI’s board or a senior committee<br />

2. Does the FI have a legal and regulatory compliance program that includes a designated<br />

officer that is responsible for coordinating and overseeing the AML framework<br />

3. Has the FI developed written policies documenting the processes that they have in place<br />

to prevent, detect and report suspicious transactions<br />

4. In addition to inspections by the government supervisors/regulators, does the FI client<br />

have an internal audit function or other independent third party that assesses AML<br />

policies and practices on a regular basis<br />

5. Does the FI have a policy prohibiting accounts/relationships with shell banks (A shell<br />

bank is defined as a bank incorporated in a jurisdiction in which it has no physical<br />

presence and which is unaffiliated with a regulated financial group.)<br />

6. Does the FI have policies to reasonably ensure that they will not conduct transactions<br />

with or on behalf of shell banks through any of its accounts or products<br />

7. Does the FI have policies covering relationships with Politically Exposed Persons<br />

(PEP’s), their family and close associates<br />

8. Does the FI have record retention procedures that comply with applicable law<br />

9. Are the FI’s AML policies and practices being applied to all branches and subsidiaries of<br />

the FI both in the home country and in locations outside of that jurisdiction<br />

Our policy applies to all local and foreign branches and subsidiaries of BDO. Our foreign<br />

branches and subsidiaries abroad also comply with the AML laws, rules and regulations<br />

of their respective host countries/jurisdictions.

10. Is money laundering and terrorist financing considered a crime in you country<br />

11. Has your country established laws designed to prevent money laundering and terrorist<br />

financing<br />

12. If ‘Yes’ to Question 11, please indicate the official name of the law which regulates AML<br />

procedure in your country and the date on which this law and subsequent amendments,<br />

if any, were passed / gazetted.<br />

1. Republic Act (R.A.) No. 9160: The Anti-Money Laundering Act of 2001 with the following<br />

amendments:<br />

a. R.A. No 9194: An Act Amending Republic Act No. 9160 (effective 2003)<br />

b. R.A. 10167: An Act to Further Strengthen the Anti-Money Laundering Law<br />

(took effect on 06 July 2012)<br />

c. R.A. 10365: An Act Further Strengthening the Anti-Money Laundering Law<br />

(effective on 19 April 2013)<br />

2. R.A. 10168: The Terrorism Financing Prevention and Suppression Act of 2012<br />

(took effect on 05 July 2012)<br />

3. BSP Circular No. 706: Updated Anti-Money Laundering Rules and Regulations<br />

(took effect on 05 January 2011)<br />

13. Is your institution subject to such laws designed to prevent money laundering and<br />

terrorist financing<br />

14. In case of conflict between your Home Country AML/CFT laws and / or regulations and<br />

the local laws and / or regulations in the foreign jurisdiction where you have branches or<br />

subsidiaries, do you apply the highest standard<br />

15. Are the FI’s AML policies and procedures according to local laws, rules, standards and<br />

benchmark against international standards<br />

16. Does the FI have a policy prohibiting anonymous accounts<br />

17. How long are records kept<br />

All transactions records are preserved for at least five (5) years from the dates of<br />

transactions. For closed accounts, client identification, account files and business<br />

correspondences are maintained for at least five (5) years from the dates when<br />

they were closed.<br />

18. Is implementation of AML policies and procedures consistently updated wherever there<br />

are new laws and regulations<br />

19. Has the FI been cited by your regulatory agency for any violation of AML laws, rules or<br />

regulations in the past 5 years

II. Risk Assessment Yes No<br />

20. Does the FI have a risk-based assessment of its client base and their transactions<br />

21. Does the FI determine the appropriate level of enhanced due diligence necessary for<br />

those categories of clients and transactions that the FI has reason to believe<br />

pose a heightened risk of illicit activities at or through the FI<br />

III. Know Your Client, Due Diligence and Enhanced Due Diligence Yes No<br />

22. Has the FI implemented processes for the identification of those clients on whose behalf<br />

it maintains or operates accounts or conducts transactions<br />

23. Does the FI have a requirement to collect information regarding its clients’ business<br />

activities<br />

24. Does the FI assess its FI clients’ AML policies or practices<br />

25. Does the FI have a process to review and, where appropriate, update client information<br />

relating to high risk client information<br />

26. Does the FI have procedures to establish a record for each new client noting their<br />

respective identification documents and ‘Know Your Client’ information<br />

27. Does the FI complete a risk-based assessment to understand the normal and expected<br />

transactions of its clients<br />

28. Does the FI take steps to understand the normal and expected transactions of its clients<br />

based on its risk assessment of its clients<br />

29. Does the FI require the presentation of identification documents issued by official<br />

authority<br />

30. Does the FI provide services to “walk – in” clients<br />

31. If ‘Yes’ to Question 30, does your institution identify them<br />

We entertain walk-in clients but before we start any relationship with them, we<br />

establish their true identity through proper KYC.<br />

32. Does the FI follow FATF recommendations on money laundering and terrorist financing<br />

33. Does the FI provide services to Offshore Banks, Internet Banking based institutions or<br />

banks located in high risk areas as highlighted by FATF<br />

34. Does the FI identify and verify the transactions related to persons / entities suspected of<br />

ML / TF, comprised in official lists of appropriate authorities<br />

35. Does the FI have a process to review and, where appropriate, update client information<br />

relating to high risk client information<br />

36. Does the FI identify and verify the transactions related to persons / entities suspected of<br />

ML / TF

37. Does the FI ensure that effective anti-money laundering and counter-terrorism controls<br />

are in place on new technologies and when dealing in non-face to face interactions or<br />

through intermediaries<br />

38. Does your compliance program include establishing policies, procedures and processes<br />

for managing Economic & Trade Sanctions<br />

If ‘Yes’ please indicate the Sanctions program(s) incorporated in your compliance<br />

program:<br />

OFAC, United Nations Security Council and FATF<br />

39. Do you screen your clients and transactions including telegraphic transfer against a<br />

particular Sanctions program<br />

If ‘Yes’, please indicate the Sanctions program(s) used:<br />

OFAC and United Nations Security Council<br />

40. How frequent does the FI screen its existing client database<br />

Daily and when there are new accounts opened.<br />

41. Do you include originator information with outgoing wire transfer<br />

42. If ‘Yes’ to Question 41, are you required by your local regulator to do so<br />

IV. Reportable Transactions and Prevention and Detection of Transactions with<br />

Illegally Obtained Funds<br />

43. Does the FI have policies or practices for the identification and reporting of transactions<br />

that are required to be reported to the authorities<br />

44. Is the FI mandated to report transactions above a certain thresholds<br />

45. If ‘Yes’ to Question 44, does the FI have procedures to identify transactions structured to<br />

avoid such obligations<br />

46. Does the FI have a monitoring program for unusual and potentially suspicious activity<br />

that covers funds transfers and monetary instruments such as travelers checks, money<br />

orders, etc<br />

47. Does the FI ensure the confidentiality of Suspicious Transaction Report (STR) filings or<br />

any information that would reveal the existence of a STR<br />

Yes<br />

No<br />

V. Correspondent Banking Relationship Yes No<br />

48. Does the FI have policies to reasonably ensure that it only operates with correspondent<br />

banks that possess licenses to operate in their countries of origin<br />

49. Does the FI allow direct use of the correspondent account by third parties to transact<br />

business on their behalf (Payable-through accounts)<br />

50. Does the FI have a standard AML / KYC <strong>questionnaire</strong> that is provided to correspondent<br />

banks

VII. AML Training Yes No<br />

51. Does the FI provide AML training to relevant employees that includes:<br />

<br />

<br />

<br />

Identification and reporting of transactions that must be reported to government<br />

authorities.<br />

Examples of different forms of money laundering involving the FI’s products and<br />

services.<br />

Internal policies to prevent money laundering.<br />

52. Does the FI retain records of its training sessions including attendance records and<br />

relevant training materials used<br />

53. Does the FI communicate new AML related laws or changes to existing AML related<br />

policies or practices to relevant employees<br />

54. Does the FI employ third parties to carry out some of the functions of the FI<br />

55. If the answer to question 54 is yes, does the FI provide AML training to relevant third<br />

parties that includes:<br />

<br />

<br />

<br />

Identification and reporting of transactions that must be reported to government<br />

authorities.<br />

Examples of different forms of money laundering involving the FI’s products and<br />

services.<br />

Internal policies to prevent money laundering.<br />

The Bank outsources some of its functions except those that are inherently bank<br />

functions (e.g. Deposit related operation). The Bank however does not provide<br />

AML training to these relevant agents. If these service providers are covered<br />

institutions as defined under the Anti-Money Laundering Act, as amended, they<br />

are mandated to conduct their own AML Training.<br />

VIII. Contact Details Yes No<br />

56 Has the FI appointed a Compliance Officer for the AML / KYC program<br />

57 If yes, please give the name and title of Compliance Officer responsible for the AML /<br />

KYC program and his / her contact details for future references.<br />

Name:<br />

Title:<br />

E-mail:<br />

Address:<br />

Phone No: +63 2 878-4803<br />

Fax No: +63 2 878-4205<br />

Rebecca S. Torres<br />

Senior Vice President and Chief Compliance Officer<br />

torres.becky@<strong>bdo</strong>.com.ph<br />

14 th Floor, BDO North Tower, BDO Corporate Center<br />

7899 Makati Avenue, Makati City, 0726 Philippines<br />

Signature: _______________________________<br />

Date: 04 July 2013

CERTIFICATION<br />

I, REBECCA S. TORRES, Senior Vice President and Chief Compliance Officer of<br />

BDO Unibank, Inc., do hereby certify the following:<br />

• That the answers and statements made in our AML / KYC Questionnaire are<br />

complete, accurate to the best of our knowledge and reflective of our Anti-<br />

Money Laundering & Know Your Client policies, procedures and program.<br />

• That all Officers and Staff of our bank are aware of these policies, procedures<br />

and program and there is an adequate compliance oversight process in place.<br />

• That we also require our correspondent banks and tie-ups with which we do<br />

business maintain procedures for such purpose.<br />

• That I am the duly authorized officer of BDO Unibank, Inc. to complete and<br />

execute the AML KYC Questionnaire<br />

REBECCA S. TORRES<br />

SVP and Chief Compliance Officer