Steven Baruch - Health Care Compliance Association

Steven Baruch - Health Care Compliance Association

Steven Baruch - Health Care Compliance Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Volume Twelve<br />

Number Twelve<br />

December 2010<br />

Published Monthly<br />

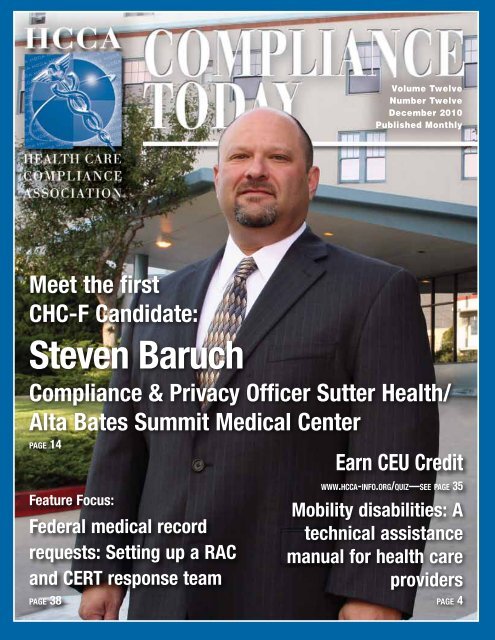

Meet the first<br />

CHC-F Candidate:<br />

<strong>Steven</strong> <strong>Baruch</strong><br />

<strong>Compliance</strong> & Privacy Officer Sutter <strong>Health</strong>/<br />

Alta Bates Summit Medical Center<br />

page 14<br />

Feature Focus:<br />

Federal medical record<br />

requests: Setting up a RAC<br />

and CERT response team<br />

page 38<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

Earn CEU Credit<br />

www.hcca-info.org/quiz—see page 35<br />

Mobility disabilities: A<br />

technical assistance<br />

manual for health care<br />

providers<br />

page 4<br />

1<br />

December 2010

Global <strong>Compliance</strong>:<br />

Good for BusinessSM<br />

Hotline<br />

Solutions<br />

Training &<br />

Education<br />

Expert Advice<br />

Expert solutions and insight to<br />

protect your organization’s integrity –<br />

helping you avoid costly and<br />

potentially devastating ethics<br />

and compliance issues.<br />

Performance &<br />

Benchmarking<br />

Learn more about our<br />

complete ethics and<br />

compliance solutions.<br />

Contact us today at<br />

800-876-6023 or contactus@<br />

globalcompliance.com.<br />

December 2010<br />

2<br />

www.globalcompliance.com<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org

Publisher:<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong>, 888-580-8373<br />

Executive Editor:<br />

Roy Snell, CEO, roy.snell@hcca-info.org<br />

Contributing Editor:<br />

Gabriel Imperato, Esq., CHC<br />

Editor:<br />

Margaret R. Dragon, 781-593-4924, margaret.dragon@hcca-info.org<br />

Copy Editor:<br />

Patricia Mees, CHC, CCEP, 888-580-8373, patricia.mees@hcca-info.org<br />

Layout and Production Manager:<br />

Gary DeVaan, 888-580-8373, gary.devaan@hcca-info.org<br />

HCCA Officers:<br />

Jennifer O’Brien, JD, CHC<br />

HCCA President<br />

Medicare <strong>Compliance</strong> Officer<br />

United<strong>Health</strong> Group<br />

Frank Sheeder, JD, CCEP<br />

HCCA 1st Vice President<br />

Partner<br />

Jones Day<br />

Shawn Y. DeGroot, CHC-F, CHRC, CCEP<br />

HCCA 2nd Vice President<br />

Vice President Of Corporate Responsibility<br />

Regional <strong>Health</strong><br />

John C. Falcetano, CHC-F, CIA, CCEP-F, CHRC<br />

HCCA Treasurer<br />

Chief Audit/<strong>Compliance</strong> Officer<br />

University <strong>Health</strong> Systems<br />

of Eastern Carolina<br />

Catherine M. Boerner, JD, CHC<br />

HCCA Secretary<br />

President<br />

Boerner Consulting, LLC<br />

Daniel Roach, Esq.<br />

Non-Officer Board Member<br />

to the Executive Committee<br />

Vice President <strong>Compliance</strong> and Audit<br />

Catholic <strong>Health</strong>care West<br />

Julene Brown, RN, MSN, BSN, CHC, CPC<br />

HCCA Immediate Past President<br />

Director of Corporate <strong>Compliance</strong><br />

Innovis <strong>Health</strong><br />

CEO/Executive Director:<br />

Roy Snell, CHC, CCEP-F<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong><br />

Counsel:<br />

Keith Halleland, Esq.<br />

Halleland Habicht PA<br />

Board of Directors:<br />

Urton Anderson, PhD, CCEP<br />

Chair, Department of Accounting and<br />

Clark W. Thompson Jr. Professor in<br />

Accounting Education<br />

McCombs School of Business<br />

University of Texas<br />

Marti Arvin, JD, CPC, CCEP-F, CHC-F, CHRC<br />

Chief <strong>Compliance</strong> Officer<br />

UCLA <strong>Health</strong> Sciences<br />

Angelique P. Dorsey, JD, CHRC<br />

Research <strong>Compliance</strong> Director<br />

MedStar <strong>Health</strong><br />

Brian Flood, JD, CHC, CIG, AHFI, CFS<br />

National Managing Director<br />

KPMG LLP<br />

Margaret Hambleton, MBA, CPHRM, CHC<br />

Senior Vice President<br />

Ministry Integrity, Chief <strong>Compliance</strong> Officer<br />

St. Joseph <strong>Health</strong> System<br />

Dave Heller<br />

VP and Chief Ethics and <strong>Compliance</strong> Officer<br />

Edison International<br />

Rory Jaffe, MD, MBA<br />

Executive Director, California Hospital Patient<br />

Safety Organization (CHPSO)<br />

Matthew F. Tormey, JD, CHC<br />

Vice President<br />

<strong>Compliance</strong>, Internal Audit, and Security<br />

<strong>Health</strong> Management Associates<br />

Debbie Troklus, CHC-F, CCEP-F, CHRC<br />

Assistant Vice President<br />

for <strong>Health</strong> Affairs/<strong>Compliance</strong><br />

University of Louisville<br />

Sheryl Vacca, CHC-F, CCEP, CHRC<br />

Senior Vice President/Chief <strong>Compliance</strong><br />

and Audit Officer<br />

University of California<br />

Sara Kay Wheeler, JD<br />

Partner–Attorney<br />

King & Spalding<br />

<strong>Compliance</strong> Today (CT) (ISSN 1523-8466) is published by the <strong>Health</strong> <strong>Care</strong><br />

<strong>Compliance</strong> <strong>Association</strong> (HCCA), 6500 Barrie Road, Suite 250, Minneapolis, MN<br />

55435. Periodicals postage-paid at Minneapolis, MN 55435. Postmaster: Send<br />

address changes to <strong>Compliance</strong> Today, 6500 Barrie Road, Suite 250, Minneapolis,<br />

MN 55435. Copyright 2010 <strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong>. All rights<br />

reserved. Printed in the USA. Except where specifically encouraged, no part of this<br />

publication may be reproduced, in any form or by any means without prior written<br />

consent of the HCCA. For Advertising rates, call Margaret Dragon at 781-593-<br />

4924. Send press releases to M. Dragon, 41 Valley Road, Nahant, MA 01908.<br />

Opinions expressed are not those of this publication or the HCCA. Mention of<br />

products and services does not constitute endorsement. Neither the HCCA nor<br />

CT is engaged in rendering legal or other professional services. If such assistance is<br />

needed, readers should consult professional counsel or other professional advisors for<br />

specific legal or ethical questions.<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

INSIDE<br />

4 CEU: Mobility disabilities: A technical assistance manual<br />

for health care providers By David H. Ganz and Gary W. Herschman<br />

New guidance on the accommodations that are required when<br />

providing accessible care for patients with disabilities.<br />

9 RACs are coming to Medicare Advantage, Part D and<br />

Medicaid By Gloryanne Bryant<br />

An expansion of RAC oversight means more time and resources<br />

will be needed and annual work plans may need revision.<br />

10 Provider signature guidelines and solutions: Autograph<br />

please! By Janet Marcus<br />

Verifiable author of record signatures on medical records are key<br />

for continuity of care and smooth claims processing.<br />

13 Social Networking By John Falcetano<br />

14 Meet the first CHC-F Candidate: <strong>Steven</strong> <strong>Baruch</strong>, Sutter<br />

<strong>Health</strong>/Alta Bates Summit Medical Center<br />

An interview by Debbie Troklus<br />

16 Newly Certified CHCs and CHRCs<br />

17 Letter from the CEO By Roy Snell<br />

Whistleblower<br />

22 CEU: The complexity of compliance basics: A CCO’s<br />

pursuit of knowledge By H. Rebecca Ness<br />

<strong>Compliance</strong> professionals need a wealth of knowledge and more<br />

than ordinary management skills to succeed.<br />

24 The evolving role of the chief compliance and ethics<br />

officer: A survey by the HCCA and SCCE By Adam Turteltaub<br />

Publicly traded, privately held, and non-profit entities vary widely<br />

on factors that affect the independence of compliance professionals.<br />

26 Physician compliance education outside of the hospital<br />

environment By Kia R. Earp<br />

A savvy office manager will keep compliance issues on the radar<br />

and keep the physicians and office staff informed to prevent fraud.<br />

29 <strong>Compliance</strong> 101: Stark and academic medical centers:<br />

A primer By Kenneth DeVille and Joan A. Kavuru<br />

A broad introduction to basic Stark issues to help compliance<br />

professionals find trouble spots that require further legal assistance.<br />

34 <strong>Health</strong> care reform and its effect on compliance<br />

programs By Cathy Cahill-Egolf<br />

As the regulatory landscape changes, new methods to combat<br />

fraud, waste, and abuse may change the way we do business.<br />

38 CEU: Feature Focus: Federal medical record requests:<br />

Setting up a RAC and CERT response team<br />

By Michael G. Calahan<br />

An effective, three-step approach to help you stay ahead of the<br />

curve as the number of record requests increases.<br />

42 Patient visits: Reforms increase provider responsibilities<br />

By Angela Miller<br />

Providers are required to make more face-to-face visits and be<br />

prepared to justify billing for services based on medical records.<br />

44 Individual liability for health care fraud: Enforcement<br />

agencies raise the stakes By Gabriel L. Imperato<br />

Recent settlements demonstrate the government’s willingness to<br />

hold individuals accountable, not just organizations.<br />

46 Medicare beneficiaries remain vulnerable to Medicare<br />

Advantage marketing schemes By Mark Stiglitz<br />

CMS is working to remove agents who don’t play by the rules.<br />

49 New HCCA Members<br />

3<br />

December 2010

December 2010<br />

4<br />

Mobility disabilities:<br />

A technical assistance<br />

manual for health<br />

care providers<br />

Editor’s note: David H. Ganz is Of Counsel to<br />

the Sills Cummis & Gross Employment and<br />

Labor Practice Group. David may be contacted<br />

by telephone in Newark, New Jersey at 973/ 643-<br />

4852 or by e-mail at dganz@sillscummis.com.<br />

Gary W. Herschman is Chair of the Sills Cummis<br />

& Gross <strong>Health</strong> and Hospital Law Practice<br />

Group. Gary may be contacted by telephone at<br />

973/ 643-5783 or by e-mail at gherschman@<br />

sillscummis.com.<br />

On July 22, 2010, the Civil Rights<br />

Division of the US Department<br />

of Justice and the Office for Civil<br />

Rights of the US Department of <strong>Health</strong> and<br />

Human Services issued Access to Medical <strong>Care</strong><br />

for Individuals with Mobility Disabilities, a<br />

technical assistance manual designed to help<br />

persons with mobility disabilities (such as<br />

those who use wheelchairs, scooters, walkers,<br />

or crutches) obtain accessible medical care.<br />

The manual will also assist medical providers<br />

in understanding how the Americans with<br />

Disabilities Act of 1990 (ADA) and Section<br />

504 of the Rehabilitation Act of 1973 (Section<br />

504) apply to them. This article provides an<br />

overview of the new publication, which is<br />

comprised of four parts.<br />

Overview and general requirements<br />

The ADA is a federal law that prohibits<br />

discrimination against individuals with<br />

disabilities in everyday activities, including<br />

access to medical services. Section 504 is<br />

By David H. Ganz and Gary W. Herschman<br />

another federal statute that prohibits discrimination<br />

against individuals with disabilities<br />

in programs or activities that receive federal<br />

financial assistance.<br />

Public hospitals, as well as clinics and medical<br />

offices operated by state and local governments,<br />

are covered by Title II of the ADA.<br />

Private hospitals and medical offices are<br />

covered by Title III of the ADA as places of<br />

public accommodation. Section 504 covers<br />

any of these facilities that receive federal<br />

financial assistance, which can include<br />

Medicare and Medicaid reimbursement.<br />

Titles II and III of the ADA and Section 504<br />

require that medical care providers provide<br />

individuals with disabilities (1) full and equal<br />

access to their health care services and facilities;<br />

and (2) reasonable modifications to policies,<br />

practices, and procedures when necessary to<br />

make health care services fully available to<br />

such individuals, except where to do so would<br />

fundamentally alter the nature of the services.<br />

The ADA sets out requirements for new<br />

construction of, and alterations to, buildings<br />

and facilities, including health care facilities.<br />

These requirements may be found in the<br />

federal regulations. 1 In addition, all buildings<br />

(including those constructed before the ADA<br />

became effective) are subject to accessibility<br />

requirements. For example, under Title II, a<br />

public entity must ensure that its program as<br />

a whole is accessible—a requirement which<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

may entail removing architectural barriers.<br />

Under Title III, existing facilities are required<br />

to remove architectural barriers where such<br />

removal is readily achievable. If barrier removal<br />

is not readily achievable, the entity must make<br />

its services available through alternative methods,<br />

if those methods are readily achievable.<br />

Frequently asked questions<br />

The technical assistance manual answers<br />

eleven commonly asked questions relating to<br />

the provision of medical services to individuals<br />

with mobility disabilities. The topics covered<br />

by these questions are varied, but many<br />

of the answers share a common theme—that<br />

patients with mobility disabilities should be<br />

treated like all other patients.<br />

For example, one of the questions asks whether<br />

a provider can refuse to treat a patient because<br />

the provider does not have accessible medical<br />

equipment. Another asks whether it is permissible<br />

to refuse to treat a patient with a disability<br />

because more time will be spent on his or her<br />

exam, and a third asks whether a patient with a<br />

disability can be made to wait until a particular<br />

room becomes available. A fourth question<br />

asks whether a nurse with a bad back must<br />

nonetheless lift a patient with a disability onto<br />

an exam table. Given that individuals with<br />

mobility impairments are to be treated like<br />

other non-disabled patients, the answers are<br />

not altogether surprising.<br />

The technical assistance manual provides that<br />

generally no service can be denied simply<br />

because a patient has a disability. Nor may a<br />

patient be refused treatment simply because<br />

the exam may take more of the provider’s<br />

time—time which an insurance carrier may<br />

not reimburse—or be forced to wait longer<br />

than other patients, so that a particular exam<br />

table becomes available. Accessibility needs can<br />

be determined in advance so that equipment is<br />

ready for a particular person’s appointment. As

for the nurse with the bad back, the guidance<br />

provides that while staff should be protected<br />

from injury, that concern does not justify the<br />

failure to provide equal medical services to<br />

disabled patients. Staff injuries can be avoided<br />

by providing accessible equipment (e.g., adjustable<br />

exam tables, patient lifts) and training on<br />

proper patient handling techniques.<br />

Several questions address assistants; namely,<br />

whether a patient with a disability must bring<br />

an assistant to the exam, and if he or she does,<br />

whether the assistant must remain in the room<br />

while the patient is being examined and his or<br />

her condition is being discussed. The manual<br />

provides that a patient with a disability can,<br />

if he or she chooses, bring a friend or family<br />

member to the exam, but the patient is not<br />

required to do so. If the patient comes to the<br />

exam alone, then the provider must provide<br />

reasonable assistance (e.g., help with dressing<br />

and undressing, getting on and off equipment)<br />

so that medical care can be delivered. When<br />

the patient brings an assistant, the provider<br />

should address the patient. Whether the<br />

assistant remains in the room for the exam and<br />

ensuing discussion is the patient’s choice.<br />

Other questions concern exam tables. For<br />

example, can a doctor examine a patient who<br />

uses a wheelchair in that wheelchair because he<br />

or she cannot independently get onto an exam<br />

table The answer is generally no, because an<br />

examination in a wheelchair is less thorough<br />

than an exam on a table. The technical guidance<br />

manual makes clear that it is important that the<br />

patient with a disability receives medical services<br />

equal to those received by the patient without a<br />

disability. The manual also addresses the question<br />

of whether an office or clinic with multiple<br />

exam rooms must have an accessible exam table<br />

in every room. The answer is probably not,<br />

as the number of accessible exam tables will<br />

depend on several factors, including the size of<br />

the practice and the patient population.<br />

Two questions deal with the financial cost<br />

of making exam rooms and other parts of<br />

the office accessible to the patient with a<br />

disability: (1) Whose responsibility is it and<br />

(2) Are there tax benefits for making accessibility<br />

changes The manual provides that<br />

both tenants and landlords are responsible<br />

for complying with the ADA, and the lease<br />

may speak to who in particular must make an<br />

accessibility change. As for tax breaks, both<br />

tax credits and deductions are available to<br />

private businesses to offset expenses incurred<br />

to comply with the ADA.<br />

A final question asks what a provider should<br />

do if the staff does not know how to help a<br />

disabled patient. Training is the answer –<br />

training on how to operate accessible equipment,<br />

on how to assist with transfers and positions<br />

of disabled individuals, and on how not<br />

to discriminate. The manual identifies several<br />

resources where such training can be found.<br />

Accessible exam rooms<br />

For the patient with a mobility disability<br />

to receive appropriate medical care, it is<br />

critical that they are able to enter the exam<br />

room, move around, and use the accessible<br />

equipment provided. Features that make an<br />

exam room accessible to the disabled patient<br />

include:<br />

n an accessible route to and through the<br />

room;<br />

n an entry door with adequate clearance<br />

width, maneuvering clearance, and<br />

accessible hardware;<br />

n appropriate models and placement of<br />

accessible examination equipment; and<br />

n adequate floor space inside the room.<br />

An accessible doorway must have a minimum<br />

clear opening width of 32 inches when the<br />

door is opened to 90 degrees. Door hardware<br />

must not require tight grasping, tight pinching,<br />

or twisting of the wrist in order to use it.<br />

The hallway outside the door should be kept<br />

clear of obstacles, such as boxes or chairs.<br />

Once inside the exam room, a patient who<br />

uses a wheelchair or other mobility device<br />

must be able to approach the exam table<br />

and other areas of the room. There must be<br />

sufficient clear floor space next to an exam<br />

table so that a patient with a disability can<br />

approach the side of the table for transfer<br />

onto it. The minimum amount of space<br />

required is 30 inches by 48 inches.<br />

While clear floor space is needed along at<br />

least one side of an adjustable-height examination<br />

table, providing clear floor space on<br />

both sides allows one table to serve both right<br />

and left side transfers (for those individuals<br />

who can only transfer from the right or left<br />

side). Where more than one accessible room<br />

is available, a reverse furniture layout in the<br />

additional room allows for transfers from<br />

either side of the exam table.<br />

Accessible exam rooms should also have<br />

enough turning space for an individual in a<br />

wheelchair to make a 180-degree turn, using<br />

a clear space of 60 inches in diameter or a 60<br />

inch by 60 inch T-shaped space. Chairs and<br />

other objects should be moved to provide<br />

sufficient clear floor space for maneuvering<br />

and turning. Where portable patient lifts or<br />

stretchers are used (as opposed to ceilingmounted<br />

lifts), additional clear floor space will<br />

be needed to maneuver the lift or stretcher.<br />

Accessible medical equipment<br />

To ensure that a person with a mobility<br />

disability receives medical services equal<br />

to those received by a person without a<br />

disability, accessible medical equipment is<br />

important. If a patient must be lying down<br />

to be thoroughly examined, then a person<br />

with a disability must also be examined lying<br />

Continued on page 7<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

5<br />

December 2010

MediRegs ® CCH ®<br />

The<br />

ComplyTrack Suite<br />

Total Solutions for Enterprise<br />

<strong>Compliance</strong> and Risk Management<br />

Regulatory<br />

Risk Assessment<br />

and<br />

Remediation<br />

Electronic<br />

Survey Tools<br />

& Audit<br />

Templates<br />

Incident<br />

Activity<br />

Management<br />

The<br />

ComplyTrack <br />

Suite<br />

Policy,<br />

Procedure &<br />

Document<br />

Management<br />

RAC and<br />

Claims-Based<br />

Audit<br />

Management<br />

Contract &<br />

Relationship<br />

Management<br />

MediRegs.com<br />

Aspen Publishers<br />

MediRegs ®

Mobility disabilities: A technical assistance manual for health care providers ...continued from page 5<br />

down. Similarly, if an examination calls for a<br />

specialized position, such as a gynecological<br />

examination, then a person with a disability<br />

must be able to access the equipment used for<br />

that examination.<br />

attached to the ceiling and run along one or<br />

more tracks. Free-standing overhead lifts are<br />

supported by a frame that rests on the floor.<br />

They work well when the provider does not<br />

want the lift to be permanently installed or<br />

where the existing ceiling structure cannot<br />

mammography machine will need to adjust<br />

to the individual’s height in the wheelchair or<br />

other chair. For weight scales, the technical<br />

assistance manual recognizes the importance<br />

of a patient’s weight for diagnostics and<br />

treatment, but acknowledges that individuals<br />

Traditional fixed-height tables and chairs<br />

are too high for many persons with mobility<br />

disabilities. Adjustable-height tables are better<br />

suited for them. At a minimum, an accessible<br />

exam table or chair should have (1) the<br />

ability to lower to the height of a wheelchair<br />

seat, 17-19 inches (possibly lower) from the<br />

floor, and (2) features, such as rails, straps,<br />

stabilization cushions, wedges, or rolled up<br />

towels, which stabilize and support a patient<br />

during the transfer and while on the table.<br />

The ability to get on to an exam table is a<br />

function of the patient’s capabilities and<br />

disability, as some persons may be able to<br />

affect the transfer without any assistance, but<br />

others may require help from a staff member<br />

or some other device, such as a transfer board<br />

or patient lift.<br />

support a ceiling-mounted lift.<br />

In some instances, neither a portable lift nor<br />

ceiling-mounted lift is feasible or possible.<br />

Such is the case where, for example, the<br />

medical equipment to be used lacks space to<br />

accommodate a lift or the metal components<br />

of a lift may not be compatible with some<br />

radiologic technologies. In these circumstances,<br />

an adjustable-height stretcher or<br />

gurney may be used. This typically entails a<br />

two-step process in which the patient first<br />

transfers from the wheelchair to the stretcher,<br />

and then from the stretcher to the table.<br />

Radiologic technologies and equipment, such<br />

as MRI, x-ray, CT scan, bone densitometry,<br />

and ultrasound machines present additional<br />

challenges. Because many of the technologies<br />

who use wheelchairs often are not weighed<br />

at the doctor’s office or hospital, because<br />

the provider does not have a scale that can<br />

accommodate a wheelchair. For this reason,<br />

the manual recommends that medical providers<br />

have either a scale with a platform large<br />

enough to accommodate a wheelchair, or a<br />

scale that is already integrated into a patient<br />

lift, hospital bed, or exam table.<br />

Properly trained staff<br />

Although the technical assistance manual<br />

focuses, in large part, on accessible equipment<br />

for people with mobility disabilities, it also<br />

emphasizes the importance of staff training in<br />

helping to ensure that such patients have an<br />

equal opportunity to receive accessible health<br />

care services. Accessible medical equipment<br />

can only do so much, unless staff knows<br />

A transfer board is made of a smooth rigid<br />

material which acts as a bridge between a<br />

wheelchair and another surface, along which<br />

the individual slides. A patient lift is a more<br />

elaborate device, and generally involves a sling,<br />

which is attached to a lift, and positioned under<br />

the patient who is sitting in a wheelchair. Once<br />

the person is moved to the table, he or she is<br />

then lowered onto the table, stabilized, and the<br />

sling is detached from the lift.<br />

are integrated into the table, the table may<br />

not be capable of being lowered sufficiently.<br />

Consequently, a patient lift or other transferand-position<br />

technique is especially important<br />

for access to this equipment. In addition,<br />

many of these technologies require the patient<br />

to keep still, which may be particularly<br />

difficult for some persons with mobility<br />

disabilities. In such circumstances, a staff<br />

person may need to hold on to the patient or<br />

support them with pillows, rolled-up towels,<br />

where it is stored and how to operate it. The<br />

guidance suggests that when new equipment<br />

is acquired, staff should be immediately<br />

trained on its use and maintenance. Similarly,<br />

new staff should be trained as soon as they<br />

are hired, and all staff should receive annual<br />

refresher training regarding the accessible<br />

medical equipment.<br />

Finally, the technical assistance manual<br />

stresses the importance of instructing and<br />

The most common types of lifts in medical<br />

settings are portable lifts. These typically have<br />

a U-shaped base that moves along the floor<br />

on wheels. The base goes under or fits around<br />

the exam table. Although these lifts can be<br />

moved from room to room, they require<br />

more maneuvering and storage space than<br />

overhead lifts, of which there are two general<br />

or wedges.<br />

The technical assistance manual also provides<br />

guidance on two others types of equipment:<br />

mammography equipment and scales. For<br />

mammography, wheelchair-bound patients<br />

and individuals who cannot stand for<br />

prolonged periods of time will have to be<br />

encouraging staff to ask questions of the<br />

patient, such as whether they need help and<br />

if so, how best they can help the individual.<br />

Because people with mobility disabilities use<br />

devices of different types, sizes, and weights,<br />

transfer in different ways, and have differing<br />

levels of physical abilities, understanding<br />

what assistance, if any, is needed and how to<br />

types. Ceiling-mounted lifts are permanently examined while the person is seated, so the<br />

Continued on page 8<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

7<br />

December 2010

Mobility disabilities: A technical assistance manual for health care<br />

providers ...continued from page 7<br />

provide that assistance will contribute to providing safe and accessible<br />

health care for people with mobility disabilities.<br />

HEALTH CARE COMPLIANCE ASSOCIATION’S<br />

15 th Annual<br />

COMPLIANCE<br />

INSTITUTE<br />

April 10–13, 2011<br />

Orlando, FL<br />

The Walt Disney World<br />

Swan and Dolphin Resort<br />

EARLY BIRD<br />

REGISTRATION<br />

Register by or on<br />

January 6, 2011,<br />

and save $575!<br />

AGENDA AVAILABLE & REGISTER AT<br />

www.compliance-institute.org<br />

Conclusion<br />

Access to Medical <strong>Care</strong> for Individuals with Mobility Disabilities provides<br />

important and helpful information on how to realize the ADA’s<br />

requirement of providing accessible health care to persons with mobility<br />

disabilities. It provides guidance in the form of narrative explanation<br />

and illustrated examples of accessible medical equipment, room and<br />

office configuration, and lifting and transfer equipment and techniques.<br />

The publication should prove to be a valuable resource to both health<br />

care providers who treat patients with mobility impairments and to<br />

those individuals with mobility disabilities who may have encountered<br />

obstacles in the past.<br />

In addition to the practical tips, the manual can also be a source of<br />

authority, if a dispute were to land in court. For example, a mobilityimpaired<br />

individual or the Equal Employment Opportunity Commission<br />

may cite to the guidance in support of a claim that accessible health<br />

care was denied. A provider of medical services may rely on the guidance<br />

as evidence that it complied with the obligations imposed by the ADA.<br />

Courts may also look to the technical assistance manual as support for<br />

its interpretation of what is and is not required by the ADA. 2 However,<br />

the guidance is precisely that—guidance. Courts can also reject it. 3<br />

Nonetheless, the manual provides a valuable resource for health care<br />

providers who seek to comply with the ADA and ensure that individuals<br />

with disabilities receive equal access to care. For those wishing to review<br />

the manual in its entirety, it may be viewed at, and downloaded from,<br />

the ADA website. 4 n<br />

The authors would like to thank Matthew J. McKennan, a law clerk at the<br />

Firm, for his assistance in preparing this article. The views and opinions<br />

expressed in this article are those of the authors and do not necessarily reflect<br />

those of Sills Cummis & Gross PC.<br />

1 See 28 CFR 35.151 (for Title II entities) and 28 CFR Part 36, Subpart D (for Title III entities). Available at www.<br />

ada.gov/reg2.html and www.ada.gov/reg3a.html.<br />

2 See, e.g., Buckley v. Consolidated Edison Co. of N.Y., Inc., 127 F.3d 270, 273 (2d Cir. 1997) (referring to EEOC’s<br />

Technical Assistance Manual on ADA, appeals court states that “EEOC interpretive guidelines ‘while not controlling<br />

upon the courts by reason of their authority, do constitute a body of experience and informed judgment to which<br />

courts and litigants may properly resort for guidance.’”) (quoting Meritor Sav. Bank, FSB v. Vinson, 477 U.S. 57, 65<br />

(1986)), vacated on other grounds, 155 F.3d 150 (2d Cir. 1998) (en banc); Shafer v. Preston Mem’l Hosp. Corp., 107<br />

F.3d 274, 280 n.5 (4th Cir. 1997) (same).<br />

3 See, e.g., Parker v. Metropolitan Life Ins. Co., 121 F.3d 1006, 1014 n.5 (6th Cir. 1997) (en banc appeals court<br />

declines to adopt interpretation found in Department of Justice Technical Assistance Manual, finding that interpretation<br />

inconsistent with regulations and text of ADA), cert. denied, 522 U.S. 1084 (1998); Soileau v. Guilford of<br />

Me., Inc., 105 F.3d 12, n.3 (1st Cir. 1997) (“While this court has found reference to the EEOC <strong>Compliance</strong> Manual<br />

to be helpful on occasion…the manual is hardly binding.”).<br />

4 See http://www.ada.gov/medcare_ta.htm.<br />

December 2010<br />

8<br />

2011CI_EarlyBird_halfpagevert_ad_2c.indd 1<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

11/4/2010 12:03:30 PM

RACs are coming to<br />

Medicare Advantage,<br />

Part D, and Medicaid<br />

By Gloryanne Bryant, RHIA, RHIT, CCS, CCDS<br />

Editor’s note: Gloryanne Bryant is Regional<br />

Managing Director at HIM Northern California,<br />

Revenue Cycle, Kaiser Foundation <strong>Health</strong><br />

Plan Inc & Hospitals. Gloryanne may be contacted<br />

by e-mail at Gloryanne.h.bryant@kp.org.<br />

Yes, the Recovery Audit Contractors<br />

(RACs) are coming to Medicare<br />

Advantage Part C, Part D, and<br />

Medicaid under the oversight of the Centers<br />

for Medicare and Medicare Services (CMS).<br />

Section 1902(a)(42)(B)(i) of the Social<br />

Security Act, requires states to establish programs<br />

to contract with one or more Medicaid<br />

RACs for the purpose of identifying underpayments<br />

and recouping overpayments under<br />

the state plan, and any waiver of the state<br />

plan, with respect to all services for which payment<br />

is made to any entity under such plan or<br />

waiver. Keep in mind that the three-year RAC<br />

demonstration program that was launched in<br />

California, Florida, and New York in 2005<br />

identified roughly $1 billion in Medicare overpayments,<br />

according to CMS reports.<br />

State Medicaid programs will have to contract<br />

with one or more RACs to identify underpayments<br />

and overpayments (and recoup overpayments),<br />

including in-state waiver plans.<br />

Medicaid RAC compensation will be linked<br />

to the payment inaccuracies they are able to<br />

identify, both over- and under-payments. The<br />

Medicaid RAC audits will be separate from<br />

the Medicaid Integrity Program (MIP) audits<br />

that are already being completed by Medicaid<br />

Integrity Contractors (MICs) in many states.<br />

Deborah Taylor, Director and Chief<br />

Financial Officer of CMS’ Office of Financial<br />

Management, told a Congressional panel in<br />

July 1 that CMS is farther ahead in implementing<br />

RAC audits for the Medicare Part<br />

D prescription program for seniors. The new<br />

law requires RACs to ensure plans under<br />

Parts C and D:<br />

n have anti-fraud policies in effect and to<br />

review the effectiveness of such policies;<br />

n examine claims for reinsurance payments<br />

to determine whether plans submitting the<br />

claims incurred costs in excess of allowable<br />

reinsurance costs; and<br />

n review estimates of prescription drug plans<br />

for high-cost beneficiaries submitted by<br />

private plans and compare estimates with<br />

the number of high-cost beneficiaries actually<br />

enrolled in those plans.<br />

The start date for these government activities<br />

is no later than December 31, 2010 according<br />

to the Patient Protection and Affordable<br />

<strong>Care</strong> Act, section 6411. Thus, the health<br />

care industry can expect to see a significant<br />

expansion of the RAC program. Sen. Tom<br />

Carper (D, Del.) chair of the Senate Homeland<br />

Security and Governmental Affairs subcommittee<br />

on Federal Financial Management,<br />

Government Information, Federal Services and<br />

International Security, encouraged CMS to<br />

meet the December 31 deadline imposed by the<br />

Patient Protection and Affordable <strong>Care</strong> Act.<br />

Adding to this RAC expansion is that fact<br />

that President Obama signed in July the<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

Improper Payments Elimination and Recovery<br />

Act of 2010, and this may open the door<br />

to more widespread private audits, industry<br />

experts say. The law also would add sanctions<br />

for programs that do not comply.<br />

Your <strong>Compliance</strong> Committee, RAC Committee,<br />

<strong>Health</strong> Information Management<br />

(HIM), and Business Office/Billing leadership<br />

should be aware of possible additional<br />

external audits. <strong>Compliance</strong> staff will need<br />

to make revisions to their annual work<br />

plans to address this expansion as well. So,<br />

we will need to monitor this closely and<br />

wait patiently for the details so we can plan<br />

accordingly. Be sure to include this topic on<br />

the agenda for your next compliance meeting.<br />

Either way, more time and resources will be<br />

needed from providers in the near future. n<br />

Resources:<br />

Fierce <strong>Health</strong> Finance<br />

(www.fiercehealthfinance.com)<br />

RAC Monitor (www.RACmonitor.com)<br />

AAPC (www.news.aapc.com)<br />

<strong>Health</strong>care Finance News<br />

(www.healthcarefinancenews.com)<br />

Lexology (www.lexology.com)<br />

1. Committee on Homeland Security and Government Affairs Subcommittee<br />

on Federal Financial Management, Government Information, Federal<br />

Services, International Security, United States Senate, July 15, 2010.<br />

<br />

Contact Us!<br />

www.hcca-info.org<br />

info@hcca-info.org<br />

Fax: 952/988-0146<br />

6500 Barrie Road, Suite 250<br />

Minneapolis, MN 55435<br />

Phone: 888/580-8373<br />

To learn how to place an advertisment<br />

in <strong>Compliance</strong> Today, contact Margaret<br />

Dragon: e-mail: margaret.dragon@hccainfo.org<br />

phone: 781/593-4924<br />

9<br />

December 2010

December 2010<br />

10<br />

Provider signature<br />

guidelines and<br />

Editor’s note: Janet Marcus is Director of Revenue<br />

Cycle Services at Sinaiko <strong>Health</strong>care Consulting,<br />

one of the nation’s leading independent<br />

healthc are management consulting firms. She<br />

works with health care organizations nationwide<br />

on a diverse range of compliance issues. For<br />

more information, please go to www.sinaiko.<br />

com or e-mail janet.marcus@sinaiko.com.<br />

The Centers for Medicare & Medicaid<br />

Services (CMS) requires providers<br />

to authenticate the author of record<br />

for all Medicare services provided or ordered.<br />

The author of the entry is the individual<br />

who provided or ordered the service.<br />

Authentication may be accomplished through<br />

the provision of a hand-written or an<br />

electronic signature. CR 5971 (Transmittal<br />

#248), effective retroactively from September<br />

2007, was issued to prohibit the use of<br />

stamped signatures. These requirements<br />

are intended to apply to all providers. As<br />

of March 2008, CMS clarified that stamp<br />

signatures are unacceptable on any medical<br />

record.<br />

Providers of health care services have always<br />

been required to append their signature<br />

to entries in the patient’s medical record<br />

documentation. Specifically, the CMS manual<br />

states “documentation must be dated and<br />

include a legible signature or identity.” The<br />

Federal Register, 42 CFR 482.24, also makes<br />

a similar statement.<br />

solutions:<br />

“Autograph, please!”<br />

By Janet Marcus, CPC<br />

For certain services, in addition to the signature,<br />

the note describing the service ordered<br />

or performed requires a notation of time.<br />

This is particularly true for services:<br />

n which depend on chronological order for<br />

care over a short period of time (this is<br />

most often seen during an acute observation<br />

or inpatient facility stay); or<br />

n where time is a factor for the reimbursement;<br />

or<br />

n to fully describe the extent to which<br />

services were rendered.<br />

Importance of adhering to guidelines<br />

There are more than enough challenges in<br />

today’s health care environment. The most<br />

important reason the signature guidelines<br />

exist is to support appropriate and accurate<br />

patient care. When providers do not take<br />

the time to append their signatures in an<br />

acceptable format, it could potentially have<br />

a negative impact on the continuity of care<br />

for their patients and could also create future<br />

“headaches” as a finding during an audit.<br />

In addition to the challenges of patient care,<br />

it can be difficult to follow all the documentation<br />

and billing rules, submit a clean claim,<br />

and collect an accurate payment for services.<br />

So, after all that hard work, no one wants<br />

their claim to fail an audit due to the lack<br />

of a “proper” provider signature, and no<br />

one wants to suffer the associated potential<br />

consequence of lost revenue.<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

Guidelines<br />

CMS recently published Transmittal 327,<br />

entitled “Signature Guidelines for Medical<br />

Review Purposes,” effective March 1, 2010,<br />

with an implementation date of April 16,<br />

2010. This guidance gives us an inside view<br />

of the requirements various government claim<br />

audit programs may utilize when they review<br />

medical records and claims as part of an audit.<br />

This viewpoint focuses on a claim that has<br />

been submitted for payment and subsequently<br />

selected for audit. The medical record is often<br />

requested as part of that review process.<br />

When the auditor/reviewer is determining<br />

whether signature guidelines have been met,<br />

they may have reason to contact the billing<br />

provider and ask a non-standardized follow-up<br />

question. The auditor may contact the provider<br />

or organization that submitted the claim and<br />

ask if they would like to submit an attestation<br />

statement or signature log within 20 calendar<br />

days. This is another opportunity for the<br />

provider to meet the signature guidelines.<br />

In summary, the guidelines, as stated in the<br />

CMS Program Integrity Manual, Chapter<br />

3, under section 3.4.1.1 D, “Signature<br />

Requirements” and as outlined in Transmittal<br />

327 include:<br />

n Services provided and/or ordered must be<br />

authenticated by the author. (There are<br />

several signature guideline exceptions outlined<br />

in the CMS Transmittal 327 which<br />

can be found at: http://www.cms.gov/<br />

transmittals/downloads/R327PI.pdf);<br />

n Method used may be handwritten or an<br />

electronic signature;<br />

n Stamp signatures are not acceptable;<br />

n Handwritten signatures signify that the<br />

individual who has signed the record has<br />

knowledge, approval, acceptance, or obligation<br />

for the entry;<br />

n For illegible signatures, auditors can<br />

consider evidence in a signature log or

an attestation statement for the purpose<br />

of identifying the author of the medical<br />

record entry; and<br />

n Situations where the auditor may call upon<br />

the provider to inquire if they would like<br />

to submit an attestation statement or<br />

signature log.<br />

Auditors may consider that the handwritten<br />

signature requirement has been met if there is:<br />

n a legible full signature;<br />

n a legible first initial and last name;<br />

n an illegible signature where the letterhead,<br />

or other information on the page indicates<br />

the identity of the signatory;<br />

n an illegible signature accompanied by a<br />

signature log or an attestation statement;<br />

n the initials over a typed or printed name;<br />

n the initials not over a typed or printed<br />

name but accompanied by a signature log<br />

or attestation statement; and<br />

n an unsigned handwritten note where<br />

other entries on the same page in the same<br />

handwriting are signed.<br />

CMS considers an electronic signature as<br />

meeting the signature requirement; however,<br />

they caution providers regarding the potential<br />

misuse or abuse of alternate signature<br />

methods. If your practice is utilizing an<br />

electronic signature on medical records, it is<br />

generally recommended, that the electronic<br />

signature process, policy, and procedure be<br />

reviewed by legal counsel to validate the<br />

accuracy and appropriateness of the process.<br />

Further, a quality review of the electronic<br />

signature process should be conducted along<br />

with validation that the electronic signature<br />

process in place meets all of the required<br />

HIPAA-related guidance.<br />

presented; however, no indication was noted<br />

that the name and credential on the document<br />

was created as the result of secure user<br />

access. In this instance, the signature was not<br />

considered an acceptable final authenticated<br />

signature. In other cases, no indication of the<br />

author is found on the printed record, even<br />

though electronic history would substantiate<br />

the user actually made the entry themselves.<br />

Solutions<br />

To ensure your providers append their<br />

signature according to the guidelines, we<br />

recommend that you start with a review of<br />

your current provider signature procedures.<br />

Identify if there are providers who are<br />

appending illegible hand-written signatures<br />

to their medical records. Depending on the<br />

results of your assessment, changes may need<br />

to be implemented so that the signature<br />

guidelines and “best practice” for your group<br />

of providers is followed.<br />

Developing a corresponding written policy and<br />

procedure that is user friendly will ensure that<br />

new providers have a document they can refer<br />

to, and providers who may need a refresher<br />

have an accessible, accurate policy reference<br />

document. Implementing an internal quality<br />

review process will go a long way to ensure that<br />

the best practice for provider signature, policy,<br />

and procedure are followed.<br />

In situations where there are handwritten signatures,<br />

illegibility has been a long-standing<br />

issue we have observed during our medical<br />

record and claim audits. To combat this issue<br />

we recommend:<br />

n implementation of an electronic medical<br />

record;<br />

n if this is not an option, creation of a signature<br />

log for the “illegible” signors;<br />

n a quality assurance review of the medical<br />

notes for the “illegible” providers, prior<br />

to claims submission, and you address the<br />

issue promptly; and<br />

n review all signature guidelines with providers<br />

and give them an outline of what is<br />

considered an acceptable signature and<br />

what is not.<br />

As Benjamin Franklin once said and, as we<br />

say in health care, “an ounce of prevention is<br />

worth a pound of cure.” n<br />

COMPLIANCE REVIEWS,<br />

CODING SUPPORT SERVICES,<br />

UP-TO-DATE EDUCATION,<br />

REAL RESULTS<br />

By working together, we can help<br />

create this picture in your facility.<br />

Call RMC today!<br />

In our experience, we have observed situations<br />

where the accurate application of the<br />

electronic signature came into question when<br />

a printed copy of the medical record was<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

December 2010<br />

11

ARE YOU<br />

PREPARED<br />

FOR THE<br />

RAC AUDITOR<br />

Take control with a strong defense<br />

December 2010<br />

12<br />

www.compliance360.com<br />

The RAC Auditors will soon be calling on your hospital. The RAC appeals<br />

process is very complex and missed deadlines can result in the automatic<br />

recoupment of your legitimate revenues. To minimize your risk of financial<br />

losses, you need to be prepared with practical, reliable processes and<br />

controls to ensure that critical appeals deadlines are met, with complete,<br />

substantiated information.<br />

<strong>Compliance</strong> 360 is the leader in compliance and risk management solutions<br />

for healthcare. More than 300 hospitals nationwide rely on us every day to<br />

ensure compliance with legal and industry regulations. Using our unique<br />

software solutions, they are always “audit ready” with both proactive<br />

defenses and the audit management tools needed to ensure successful<br />

audit response and appeals. We are proud to help these healthcare<br />

organizations prevent and contain compliance sanctions and we stand<br />

ready to help you as well.<br />

To learn more about the <strong>Compliance</strong> 360 Claims Auditor for managing<br />

RAC audits, visit www.compliance360.com/RAC or call us at 678-992-0262<br />

NEEDS A LO<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org

Social Networking<br />

John Falcetano<br />

Editor’s note: John Falcetano, CHC-F,<br />

CCEP-F, CHRC, CHPC, CIA is<br />

Chief Audit/<strong>Compliance</strong> Officer for<br />

University <strong>Health</strong> Systems of Eastern<br />

Carolina and Treasurer of the HCCA<br />

Board of Directors. John may be<br />

contacted by e-mail at<br />

jfalcetano@uhseast.com.<br />

This month, I though I would focus on another function of our social<br />

networking site: The ability to blog and comment on particular compliance<br />

topics. Today’s column provides some insight to the world of blogs.<br />

Suj Shah, from Chicago recently blogged about two ways to strengthen<br />

your employee hotline. The following are excerpts from his blog.<br />

Two ways to strengthen your employee hotline<br />

“Fear of retaliation for speaking up about ethical violations in the workplace<br />

not only affects whether workers are willing to report wrongdoing<br />

to management, it drives the level of misconduct itself,” according to a<br />

recent study released by the Ethics Research Center. See Research Brief,<br />

Retaliation: The Cost to Your Company and Its Employees (http://<br />

www.ethics.org/files/u5/Retaliation.pdf).<br />

Second, employees are less willing to report wrongdoing when it is<br />

perceived that the report will not be taken seriously. One of the proposed<br />

amendments to the Organizational Sentencing Guidelines also emphasizes<br />

“taking reasonable steps” in reaction to incidents. See Amendments<br />

to the Sentencing Guidelines: http://www.ussc.gov/2010guid/20100503_<br />

Reader_Friendly_Proposed_Amendments.pdf.<br />

Strengthen your employee hotline by a clear non-retaliation policy and a<br />

commitment to appropriate and timely report follow-up.”<br />

Web 2.0 is about the<br />

new, faster, everyone<br />

connected Internet.<br />

HCCA is embracing this approach and offers you<br />

a number of ways to build out your network,<br />

connect with compliance professionals, and<br />

leverage this new technology. Take advantage of<br />

these online resources; keep abreast of the latest<br />

in compliance news; and stay ahead of the curve.<br />

Dozens of discussion groups and<br />

more than 6,000 participants<br />

http://community.hcca-info.org<br />

Profiles of over 3,800 compliance<br />

and ethics professionals<br />

http://www.hcca-info.org/LinkedIn<br />

Follow HCCA_News to keep up with the<br />

latest compliance news and events<br />

http://twitter.com/HCCA_News<br />

To participate in the discussion, review the comments, or just talk<br />

with your peers, you can access the Social Network site by going to the<br />

following link: www.hcca-info.org/sn n<br />

Connect with compliance and ethics<br />

professionals on Facebook<br />

http://www.hcca-info.org/Facebook<br />

Each resource is 100% dedicated to<br />

compliance and ethics management.<br />

So sign up for whichever one works<br />

best for you, or for all four if you’re<br />

already living the Web 2.0 life.<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

HCCASocialNetworking_halfpage_301nK_CTad.indd 1<br />

December 2010<br />

13<br />

9/2/2010 9:36:00 AM

feature<br />

article<br />

Meet the first CHC-Fellow Candidate:<br />

<strong>Steven</strong> <strong>Baruch</strong>, CHC, MA, MPA<br />

<strong>Compliance</strong> & Privacy Officer<br />

Sutter <strong>Health</strong>/Alta Bates Summit Medical Center<br />

December 2010<br />

14<br />

Editor’s note: This interview with <strong>Steven</strong><br />

<strong>Baruch</strong>, the first CHC-F Candidate, was<br />

conducted in late summer by Debbie Troklus,<br />

President of the <strong>Compliance</strong> Certification Board<br />

and Assistant Vice President, <strong>Health</strong> Affairs/<br />

<strong>Compliance</strong>, University of Louisville <strong>Health</strong> Sciences<br />

Center. <strong>Steven</strong> may be contacted by e-mail<br />

at baruchs@sutterheatlh.org. Debbie Troklus<br />

may be contacted by e-mail at debbie.troklus@<br />

louisville.edu.<br />

DT: <strong>Steven</strong>, please tell our readers a little<br />

bit about yourself, your background, and<br />

how you got involved in the compliance<br />

profession.<br />

SB: Having completed graduate degrees<br />

in both biological science and health care<br />

administration, I had a long interest in<br />

working in health care operations. Early in<br />

my career, I managed various outpatient and<br />

health care programs. Through that work, I<br />

gained a great deal of experience in reviewing<br />

documentation related to regulatory and<br />

billing requirements.<br />

I later led a project focused on CMS and<br />

OIG documentation at a hospital affiliate<br />

of a health care network. My responsibilities<br />

evolved into leading the implementation of<br />

a comprehensive compliance program at the<br />

hospital. Network leaders recommended<br />

and supported joining HCCA, attending the<br />

academies, and obtaining my certification. I<br />

joined Sutter <strong>Health</strong> in January 2009.<br />

DT: Tell us about Sutter <strong>Health</strong> and Alta<br />

Bates Summit Medical Center and its compliance<br />

program.<br />

SB: Alta Bates Summit Medical Center is<br />

the San Francisco East Bay’s largest private,<br />

not-for-profit medical center. Our multicampus<br />

medical center has more than 1,000<br />

beds, 5,000 employees, and 1,000 physicians.<br />

Alta Bates Summit Medical Center is part<br />

of Sutter <strong>Health</strong>, a not-for-profit health care<br />

network. With 24 affiliated hospitals, relationships<br />

with 5,000 physicians, home health<br />

and hospice services, and education, training,<br />

and research centers, the Sutter <strong>Health</strong> family<br />

serves patients in more than 100 Northern<br />

California cities and towns.<br />

The Sutter <strong>Health</strong> compliance program is<br />

always evolving and improving. A 2007 internal<br />

analysis supported significantly expanding<br />

the program. Sutter <strong>Health</strong> recruited full time,<br />

dedicated compliance officers for the entire<br />

network’s affiliated hospitals and medical foundations,<br />

and expanded staff and resources at<br />

the system level to further advance consistency<br />

and support throughout the organization.<br />

DT: What resources did you use to develop<br />

your compliance program<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

SB: I am fortunate to have a variety of<br />

resources and subject matter experts to call<br />

upon for information and support. I can<br />

reach out to my peer group of compliance<br />

officers and resource support in the Sutter<br />

<strong>Health</strong> network. I can also contact experts<br />

in HCCA. I regularly access the <strong>Health</strong> <strong>Care</strong><br />

<strong>Compliance</strong> Professional’s Manual, the CMS<br />

and OIG websites, and documents and strategies<br />

I’ve developed over the years. And, I still<br />

reference my <strong>Compliance</strong> 101 manual and<br />

<strong>Compliance</strong> Academy material periodically.<br />

DT: What are some recent successes you have<br />

experienced with your compliance program

SB: I am the first full-time, dedicated<br />

compliance officer at Alta Bates Summit<br />

Medical Center. I am focused on building<br />

strong relationships with employees and<br />

leaders and establishing the <strong>Compliance</strong><br />

department as a resource and partner in<br />

supporting the goals of the medical center.<br />

Ensuring that the <strong>Compliance</strong> department is<br />

included in the planning stages of a project<br />

often can help ensure that goals are achieved.<br />

DT: What do you find to be the most challenging<br />

about your work as compliance officer<br />

SB: Aside from expected workload and<br />

budget challenges, it can also be challenging<br />

while analyzing an issue to ensure that all<br />

stakeholders have the opportunity to share<br />

their thoughts and concerns. A focus on<br />

fostering strong relationships can ensure that<br />

<strong>Compliance</strong> is considered a partner and a<br />

resource in activities.<br />

DT: What do you see as the most important<br />

traits for a compliance officer to be successful<br />

in the role<br />

SB: I am asked this question frequently by<br />

others considering a career in <strong>Compliance</strong>. I<br />

believe the most important trait for a compliance<br />

officer is the ability to build relationships<br />

across the large spectrum of people you<br />

will encounter within an organization.<br />

Almost anyone can learn the basics of<br />

compliance laws and regulations; however,<br />

the compliance officer must have the skills to<br />

translate and facilitate the implementation of<br />

these laws and regulations at an operational<br />

level.<br />

<strong>Compliance</strong> officers must effectively communicate<br />

with executives, business leaders,<br />

clinical teams, and general employees. Each<br />

of these audiences may operate uniquely and<br />

have different goals and expectations.<br />

Although <strong>Compliance</strong> may not always be<br />

the most popular voice in an organization,<br />

building and maintaining our relationships<br />

with our stakeholders is the key to a successful<br />

compliance program.<br />

DT: Let’s talk for a moment about HCCA.<br />

Why did you join<br />

SB: While I had been doing a lot of compliance<br />

activity early in my career, I had no idea<br />

that there was a dedicated profession and title<br />

for this work. When a previous employer<br />

identified the title and supported joining<br />

HCCA, it was a logical move to support my<br />

career interests.<br />

DT: What benefits has HCCA brought<br />

about for you<br />

SB: I have found tremendous value in<br />

HCCA’s <strong>Compliance</strong> Academies. These<br />

courses provided important perspective and<br />

education, as well as practical tips that have<br />

helped advance my career as a compliance<br />

officer. HCCA also provides unique opportunities<br />

to network with other compliance<br />

professionals, allowing me to learn from their<br />

experiences, tap their knowledge, share ideas,<br />

and continue to learn and grow professionally.<br />

DT: You have earned your Certification in<br />

<strong>Health</strong>care <strong>Compliance</strong> (CHC). How has<br />

that helped you in your current role<br />

SB: I believe that compliance, as an<br />

organized profession, continues to grow.<br />

Additionally, health care, as an industry, is<br />

in the midst of a massive transformation.<br />

Earning my certification in health care<br />

compliance establishes my expertise in this<br />

evolving field. The certification also lends<br />

credibility as I work to build strong partnerships<br />

and support the strategic goals of my<br />

hospital and health system. People are often<br />

surprised to learn that there is a professional<br />

organization and certification available for<br />

health care compliance.<br />

DT: Did you attend a <strong>Compliance</strong><br />

Academy or study for the CHC on your own<br />

SB: Fortunately, I attended HCCA’s<br />

<strong>Compliance</strong> Academy to prepare for the<br />

certification exam. The opportunity to spend<br />

five days with knowledgeable professionals<br />

and peers, focusing solely on all aspects of<br />

compliance to study for the exam, was a great<br />

experience. I strongly advocate this approach<br />

with colleagues and others I mentor. I believe<br />

it is the best way to prepare for the exam.<br />

DT: You are the first CHC-F Candidate;<br />

Please tell us what prompted you to apply for<br />

status of Certified in <strong>Health</strong>care <strong>Compliance</strong>-<br />

Fellowship<br />

SB: I have always sought ways to challenge<br />

myself and continue learning. My family<br />

especially encouraged me to reach for this<br />

goal. Although I was intrigued when the<br />

fellowship was announced, I gave it quite<br />

some thought before choosing to move<br />

forward with the application. Ultimately, the<br />

enthusiasm for our profession I enjoyed after<br />

attending the annual <strong>Compliance</strong> Institute<br />

each year prompted me to complete the application<br />

process and become more involved<br />

with HCCA.<br />

DT: What was the process of being accepted<br />

into the CHC-F candidate status like for you<br />

SB: I learned that there were no previous<br />

candidates immediately after I had submitted<br />

my application. I was both excited and nervous<br />

about that prospect. I was excited that I<br />

would be challenged by the process and be in<br />

a position to set a standard. At the same time,<br />

I was not certain that I would be accepted. It<br />

was very exciting and a great honor to receive a<br />

telephone call from Roy Snell informing me I<br />

had been accepted as a candidate.<br />

DT: Tell us what you see in the future for<br />

compliance professionals<br />

SB: <strong>Compliance</strong> departments typically<br />

operate on lean budgets. Given the changes<br />

Continued on page 16<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org<br />

December 2010<br />

15

Meet the first CHC-F Candidate: <strong>Steven</strong> <strong>Baruch</strong><br />

...continued from page 15<br />

coming with health care reform, I anticipate<br />

a great deal more scrutiny in health care<br />

compliance. Keeping up with the changes and<br />

the growing workload will be a tremendous<br />

challenge for all compliance officers. I’m<br />

also interested to learn how reform will truly<br />

impact all health care operations budgets in<br />

the next few years.<br />

DT: What advice do you have for individuals<br />

interested in a career in health care<br />

compliance<br />

SB: Talk to a compliance officer! I’d also<br />

definitely consider attending an HCCA<br />

Academy. A clinical, legal, or health care<br />

administration degree doesn’t hurt either.<br />

DT: What do you enjoy most about your<br />

job<br />

SB: I truly enjoy the variety of tasks<br />

that come my way. Very few positions in a<br />

hospital allow you to become involved in<br />

so many aspects of hospital operations. I’m<br />

never bored. I also get to work with many<br />

interesting people, with different backgrounds,<br />

education, and knowledge. I learn<br />

new things every day about clinical issues,<br />

hospital operations, regulations, and laws. n<br />

The CCB offers<br />

certifications in<br />

<strong>Health</strong>care <strong>Compliance</strong><br />

(CHC), <strong>Health</strong>care<br />

Research <strong>Compliance</strong><br />

(CHRC), and the<br />

Certified in <strong>Health</strong>care<br />

<strong>Compliance</strong> Fellowship<br />

(CHC-F).<br />

Certification benefits:<br />

n Enhances the credibility<br />

of the compliance<br />

practitioner<br />

n Establishes professional<br />

standards and status for<br />

compliance professionals<br />

in <strong>Health</strong>care and<br />

<strong>Health</strong>care Research<br />

n Heightens the credibility<br />

of compliance practitioners<br />

and the compliance<br />

programs staffed by these<br />

certified professionals<br />

n Ensures that each certified<br />

practitioner has the<br />

knowledge base necessary<br />

to perform the compliance<br />

function<br />

n Facilitates communication<br />

with other industry<br />

professionals, such as<br />

physicians, government<br />

officials and attorneys<br />

n Demonstrates the hard<br />

work and dedication<br />

necessary to succeed in the<br />

compliance field<br />

CCB<br />

The <strong>Compliance</strong><br />

Professional’s<br />

Certification<br />

The <strong>Compliance</strong> Certification Board (CCB)<br />

compliance certification examinations are<br />

available in all 50 states. Join your peers and<br />

demonstrate your compliance knowledge by<br />

becoming certified today.<br />

Congratulations! The following individuals<br />

have recently successfully completed the CHC<br />

certification exam, earning their certification:<br />

Claire A. Arcamone Debbi Mark<br />

Christine W. Austin<br />

Kimberly L. Brandt<br />

Aja M. Brooks<br />

Tracey A. Conley<br />

Paul G. Daniels<br />

Joanne De Sarlo<br />

Annemarie Engelhardt<br />

Amy E. Freitas<br />

Lisa A. Hylton<br />

Angie Iturrino<br />

Terry P. Matherne<br />

Kimberly A. McGuire<br />

Kourtney K. Nett<br />

Jacqueline S. Petro<br />

Joshua L. Proffitt<br />

Carla A. Russo<br />

Kenneth R. Smoot<br />

Brenda Turner<br />

Patrick R. Z. Wilder<br />

Rachel E. Williams<br />

Congratulations! The following individuals<br />

have recently successfully completed the CHRC<br />

certification exam, earning their certification:<br />

Diane M. Bauer<br />

Julia M. Campbell<br />

Paula Carney<br />

Kimberly Dupage<br />

Linda M. Gonia<br />

S. Rebecca Holland<br />

Sheri D. Lindsay<br />

James William Luca<br />

Stephanie G. Madrigal<br />

Blanca A. Malagon<br />

Michael K. Meeks<br />

Gregory A. Pesely<br />

Susan M. Torok-Rood<br />

Bruce A. Uveges<br />

Kenneth F. Winter<br />

Emily B. Wood<br />

For more information about certification, please call 888/580-8373, email<br />

ccb@hcca-info.org, or visit our website at www.hcca-info.org.<br />

December 2010<br />

16<br />

<strong>Health</strong> <strong>Care</strong> <strong>Compliance</strong> <strong>Association</strong> • 888-580-8373 • www.hcca-info.org

If you have any questions that you would like<br />

Roy to answer in future columns, please e-mail<br />

them to: roy.snell@corporatecompliance.org.<br />

Whistleblower<br />

I had an interesting phone call from another association that wanted<br />

help telling the government about all the problems associated with<br />

the whistleblower provisions of the Dodd-Frank bill. The bill says<br />

that whistleblowers can receive large cash bonuses for turning in a<br />

company, if there is a prosecution. Their concern was that the bill<br />

would cause people to bypass the in-house anonymous reporting<br />

mechanism, because the government was offering money. My first<br />

reaction was one of agreement. Then I realized that we already had a<br />

lot of experience with this situation and something didn’t smell right.<br />

But, we talked quite a bit before it hit me.<br />

I told them that we try to spend the majority of our time helping our<br />

members set up compliance programs to find and fix ethics, policy, and<br />

regulatory problems, so we don’t really get into regulatory lobbying. I also<br />

said that we don’t really want to come down in favor of, or in opposition<br />

to, a regulation we may need to enforce. I mentioned how independence<br />

is the key to our success, and we really need to be impartial.<br />

Then I talked a little about their concerns with her. I really had not<br />

thought about their concerns, so it was interesting. At one point I<br />

said, you know that those who contract with the government have<br />

had this for 150 years, with the False Claims Act. It was set up to fine<br />

those who billed the government for horses but delivered donkeys<br />

during the Civil War (true story). If you pointed out a false claim,<br />

you got bucket loads of money. The False Claims Act was not used for<br />

years, and then an enterprising prosecutor dusted off the 150-year-old<br />

law. Soon there were hundreds of prosecutors using it. For the last<br />

16 years, the government had been actively using the False Claims Act<br />

to fine those who have billed them for things that they didn’t deliver,<br />

such as toilet seats, hammers, and medical services. In fact, so far this<br />

year, the government has received several billion dollars in fines and<br />

penalties with the use of the False Claims Act. Much of that could<br />

have had a significant payout to whistleblowers, if the government<br />

started the case on a tip. The reward is typically in the mid-teens to<br />