3. Benefits of investing in the Alpha Australian Blue Chip Fund

3. Benefits of investing in the Alpha Australian Blue Chip Fund

3. Benefits of investing in the Alpha Australian Blue Chip Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

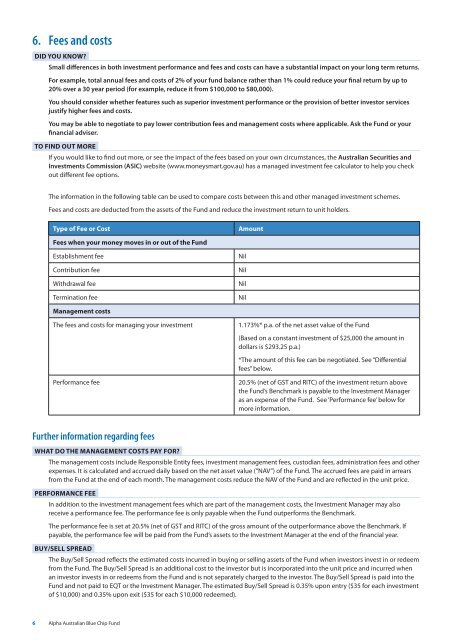

6. Fees and costs<br />

DID You knoW<br />

Small differences <strong>in</strong> both <strong>in</strong>vestment performance and fees and costs can have a substantial impact on your long term returns.<br />

For example, total annual fees and costs <strong>of</strong> 2% <strong>of</strong> your fund balance ra<strong>the</strong>r than 1% could reduce your f<strong>in</strong>al return by up to<br />

20% over a 30 year period (for example, reduce it from $100,000 to $80,000).<br />

You should consider whe<strong>the</strong>r features such as superior <strong>in</strong>vestment performance or <strong>the</strong> provision <strong>of</strong> better <strong>in</strong>vestor services<br />

justify higher fees and costs.<br />

You may be able to negotiate to pay lower contribution fees and management costs where applicable. Ask <strong>the</strong> <strong>Fund</strong> or your<br />

f<strong>in</strong>ancial adviser.<br />

to F<strong>in</strong>D out MORE<br />

If you would like to f<strong>in</strong>d out more, or see <strong>the</strong> impact <strong>of</strong> <strong>the</strong> fees based on your own circumstances, <strong>the</strong> <strong>Australian</strong> Securities and<br />

Investments Commission (ASIC) website (www.moneysmart.gov.au) has a managed <strong>in</strong>vestment fee calculator to help you check<br />

out different fee options.<br />

The <strong>in</strong>formation <strong>in</strong> <strong>the</strong> follow<strong>in</strong>g table can be used to compare costs between this and o<strong>the</strong>r managed <strong>in</strong>vestment schemes.<br />

Fees and costs are deducted from <strong>the</strong> assets <strong>of</strong> <strong>the</strong> <strong>Fund</strong> and reduce <strong>the</strong> <strong>in</strong>vestment return to unit holders.<br />

Type <strong>of</strong> Fee or Cost<br />

Amount<br />

Fees when your money moves <strong>in</strong> or out <strong>of</strong> <strong>the</strong> <strong>Fund</strong><br />

Establishment fee<br />

Contribution fee<br />

Withdrawal fee<br />

Term<strong>in</strong>ation fee<br />

Nil<br />

Nil<br />

Nil<br />

Nil<br />

Management costs<br />

The fees and costs for manag<strong>in</strong>g your <strong>in</strong>vestment<br />

Performance fee<br />

1.173%* p.a. <strong>of</strong> <strong>the</strong> net asset value <strong>of</strong> <strong>the</strong> <strong>Fund</strong><br />

(Based on a constant <strong>in</strong>vestment <strong>of</strong> $25,000 <strong>the</strong> amount <strong>in</strong><br />

dollars is $29<strong>3.</strong>25 p.a.)<br />

*The amount <strong>of</strong> this fee can be negotiated. See “Differential<br />

fees” below.<br />

20.5% (net <strong>of</strong> GST and RITC) <strong>of</strong> <strong>the</strong> <strong>in</strong>vestment return above<br />

<strong>the</strong> <strong>Fund</strong>’s Benchmark is payable to <strong>the</strong> Investment Manager<br />

as an expense <strong>of</strong> <strong>the</strong> <strong>Fund</strong>. See ‘Performance fee’ below for<br />

more <strong>in</strong>formation.<br />

Fur<strong>the</strong>r <strong>in</strong>formation regard<strong>in</strong>g fees<br />

What do <strong>the</strong> ManAGEMEnt costs PAY for<br />

The management costs <strong>in</strong>clude Responsible Entity fees, <strong>in</strong>vestment management fees, custodian fees, adm<strong>in</strong>istration fees and o<strong>the</strong>r<br />

expenses. It is calculated and accrued daily based on <strong>the</strong> net asset value (“NAV”) <strong>of</strong> <strong>the</strong> <strong>Fund</strong>. The accrued fees are paid <strong>in</strong> arrears<br />

from <strong>the</strong> <strong>Fund</strong> at <strong>the</strong> end <strong>of</strong> each month. The management costs reduce <strong>the</strong> NAV <strong>of</strong> <strong>the</strong> <strong>Fund</strong> and are reflected <strong>in</strong> <strong>the</strong> unit price.<br />

PERFoRMAnCE FEE<br />

In addition to <strong>the</strong> <strong>in</strong>vestment management fees which are part <strong>of</strong> <strong>the</strong> management costs, <strong>the</strong> Investment Manager may also<br />

receive a performance fee. The performance fee is only payable when <strong>the</strong> <strong>Fund</strong> outperforms <strong>the</strong> Benchmark.<br />

The performance fee is set at 20.5% (net <strong>of</strong> GST and RITC) <strong>of</strong> <strong>the</strong> gross amount <strong>of</strong> <strong>the</strong> outperformance above <strong>the</strong> Benchmark. If<br />

payable, <strong>the</strong> performance fee will be paid from <strong>the</strong> <strong>Fund</strong>’s assets to <strong>the</strong> Investment Manager at <strong>the</strong> end <strong>of</strong> <strong>the</strong> f<strong>in</strong>ancial year.<br />

Buy/sELL sPREAD<br />

The Buy/Sell Spread reflects <strong>the</strong> estimated costs <strong>in</strong>curred <strong>in</strong> buy<strong>in</strong>g or sell<strong>in</strong>g assets <strong>of</strong> <strong>the</strong> <strong>Fund</strong> when <strong>in</strong>vestors <strong>in</strong>vest <strong>in</strong> or redeem<br />

from <strong>the</strong> <strong>Fund</strong>. The Buy/Sell Spread is an additional cost to <strong>the</strong> <strong>in</strong>vestor but is <strong>in</strong>corporated <strong>in</strong>to <strong>the</strong> unit price and <strong>in</strong>curred when<br />

an <strong>in</strong>vestor <strong>in</strong>vests <strong>in</strong> or redeems from <strong>the</strong> <strong>Fund</strong> and is not separately charged to <strong>the</strong> <strong>in</strong>vestor. The Buy/Sell Spread is paid <strong>in</strong>to <strong>the</strong><br />

<strong>Fund</strong> and not paid to EQT or <strong>the</strong> Investment Manager. The estimated Buy/Sell Spread is 0.35% upon entry ($35 for each <strong>in</strong>vestment<br />

<strong>of</strong> $10,000) and 0.35% upon exit ($35 for each $10,000 redeemed).<br />

6 <strong>Alpha</strong> <strong>Australian</strong> <strong>Blue</strong> <strong>Chip</strong> <strong>Fund</strong>

![14 June 2011 [INSERT CLIENT NAME] [ADDRESS 1] [ADDRESS 2 ...](https://img.yumpu.com/44565527/1/184x260/14-june-2011-insert-client-name-address-1-address-2-.jpg?quality=85)