Portfoliofocus - Premium Retirement Service Investment ... - MLC

Portfoliofocus - Premium Retirement Service Investment ... - MLC

Portfoliofocus - Premium Retirement Service Investment ... - MLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

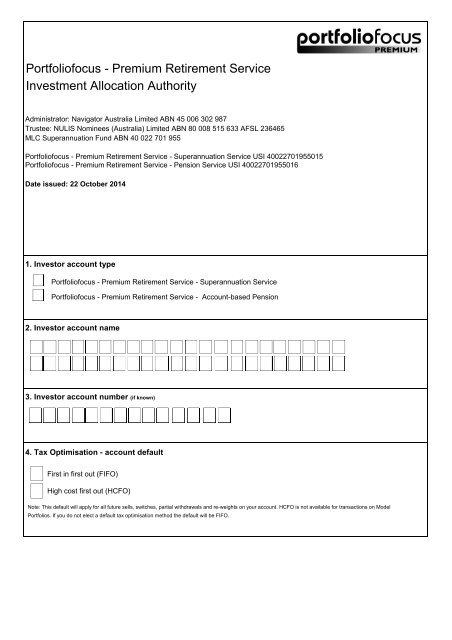

<strong>Portfoliofocus</strong> - <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong><br />

<strong>Investment</strong> Allocation Authority<br />

Administrator: Navigator Australia Limited ABN 45 006 302 987<br />

Trustee: NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465<br />

<strong>MLC</strong> Superannuation Fund ABN 40 022 701 955<br />

<strong>Portfoliofocus</strong> - <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong> - Superannuation <strong>Service</strong> USI 40022701955015<br />

<strong>Portfoliofocus</strong> - <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong> - Pension <strong>Service</strong> USI 40022701955016<br />

Date issued: 22 October 2014<br />

1. Investor account type<br />

<strong>Portfoliofocus</strong> - <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong> - Superannuation <strong>Service</strong><br />

<strong>Portfoliofocus</strong> - <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong> - Account-based Pension<br />

2. Investor account name<br />

3. Investor account number (if known)<br />

4. Tax Optimisation - account default<br />

First in first out (FIFO)<br />

High cost first out (HCFO)<br />

Note: This default will apply for all future sells, switches, partial withdrawals and re-weights on your account. HCFO is not available for transactions on Model<br />

Portfolios. If you do not elect a default tax optimisation method the default will be FIFO.

5. <strong>Investment</strong> allocation<br />

Minimum allocations per investment product:<br />

Initial investment into the <strong>Service</strong><br />

Lump Sum<br />

$20,000<br />

Regular <strong>Investment</strong> Facility<br />

(Superannuation only)<br />

$3,000<br />

Additional investment into the <strong>Service</strong><br />

$5,000<br />

$200<br />

Initial investment per:<br />

- <strong>Investment</strong> fund<br />

- Shares<br />

- SMA model portfolio<br />

No minimum<br />

$2,000<br />

$10,000<br />

No minimum<br />

Not applicable<br />

Not applicable<br />

Additional investment per:<br />

- <strong>Investment</strong> fund<br />

No minimum<br />

No minimum<br />

- Shares<br />

$500<br />

Not applicable<br />

- SMA model portfolio<br />

No minimum<br />

Not applicable<br />

Cash Account<br />

1% net of fees 1% net of fees<br />

# IMCs (‘<strong>Investment</strong> Management Charges’) are calculated on a gross asset basis as advised by the investment manager of the relevant investment fund. For most<br />

investment funds the gross asset basis will be the same as the net asset basis except for those funds with significant gearing. Further information regarding the fees and<br />

costs charged by the investment funds is generally contained in the product disclosure statement for the relevant investment fund. A copy of each investment fund’s product<br />

disclosure statement is available on request from your financial adviser.<br />

Note: ‘N/A’ means Not Available from Morningstar at the time of publication.<br />

¤ Fee rebate paid by the <strong>Investment</strong> Manager to the Administrator and passed onto the investor<br />

> IMCs (‘<strong>Investment</strong> Management Charges’) are as at 25 November 2009 for the Pre select options<br />

≠ Ongoing administration fee rebate may be payable by the Administrator and passed on to the investor. Please refer to your financial adviser for terms and conditions.<br />

* A minimum of 1%, net of initial adviser fees, must be allocated to the Cash Account.<br />

+ Some investment managers may charge a Performance fee. These Performance fees are the latest figures provided by Morningstar Australasia Pty Ltd ABN 95 090 665<br />

544.<br />

¬ The IMC is calculated on a gross asset basis. If a gearing ratio of 50% is assumed, the ongoing fee will be 2.11% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

× The IMC is calculated on a gross asset basis. If a gearing ratio of 50% is assumed, the ongoing fee will be 2.04% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

‡ The IMC is calculated on a gross asset basis. If a gearing ratio of 55% is assumed, the ongoing fee will be 2.42% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

^ This investment fund is classified as a Hedge Fund for the purpose of Trustee <strong>Investment</strong> Limits, Fast Track Transactions and Auto Re-weighting. Please refer to the<br />

<strong>Service</strong>'s PDS for the relevant impacts.<br />

† The IMC is calculated on a gross asset basis. If a gearing ratio of 33% is assumed, the ongoing fee will be 1.73% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

○ The investment manager has advised this fund complies with the Significant Investor Visa requirements.<br />

>> A maximum of 50% of your pension account balance can be invested in the option.<br />

~ <strong>Investment</strong> fund is classified as an illiquid investment. This investment fund will take longer to redeem from than other investment funds. If you invest in this investment<br />

fund you may not be able to transfer your benefit within 30 days. Refer to the <strong>Service</strong>'s current PDS.<br />

*A maximum of 25% of your account balance can be invested in the option.<br />

~<br />

Note: Separately Managed Account are Included last in the default sell down sequence<br />

»<br />

Note: Term Deposits are excluded from the default sell down sequence

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Separately Managed Account (SMA) model portfolios ~ »<br />

Australian Equity: model portfolios<br />

SMA Antares Core Opportunities○<br />

SMA Antares Dividend Builder○<br />

SMA Ausbil Australian Concentrated Equity<br />

SMA Blue Chip Top 20○<br />

SMA Goldman Sachs Core Australian Equities<br />

SMA Perennial Growth Shares<br />

SMA Perennial Value Shares for Income<br />

SMA UBS High Alpha Long Term Opportunity<br />

NUN0054AU 0.62 $ % N/A N N/A<br />

NUN0052AU 0.46 $ % N/A N N/A<br />

NUN0055AU 0.92 $ % N/A N N/A<br />

NUN0051AU 0.21 $ % N/A N N/A<br />

NUN0056AU 0.77 $ % N/A Y N/A<br />

NUN0057AU 0.77 $ % N/A Y N/A<br />

NUN0053AU 0.77 $ % N/A N N/A<br />

NUN0058AU 0.62 $ % N/A Y N/A<br />

Cash<br />

Cash: Cash<br />

BWA Cash Management Trust - IDPS<br />

Cash Account*<br />

Macquarie (Wholesale) Master Cash Fund¤<br />

UBS Cash Fund<br />

BWA0002AU 0.02 $ % % %<br />

N/A 0.12 $ % % %<br />

MAQ0187AU 0.51 $ % % %<br />

SBC0811AU 0.25 $ % % %<br />

Cash: Cash Enhanced<br />

UBS Cash Plus Fund¤<br />

Vanguard Cash Plus Fund<br />

SBC0812AU 0.30 $ % % %<br />

VAN0102AU 0.29 $ % % %<br />

Cash: Term Deposits ~<br />

Adelaide Bank TD - 12 months<br />

Adelaide Bank TD - 3 months<br />

Adelaide Bank TD - 6 months<br />

National Australia Bank TD - 1 month (minimum investment amount of $1000)<br />

National Australia Bank TD - 1 year (minimum investment amount of $1000)<br />

National Australia Bank TD - 2 months (minimum investment amount of $1000)<br />

National Australia Bank TD - 2 years (minimum investment amount of $1000)<br />

National Australia Bank TD - 3 months (minimum investment amount of $1000)<br />

National Australia Bank TD - 6 months (minimum investment amount of $1000)<br />

St George Bank TD - 1 month<br />

St George Bank TD - 1 year<br />

St George Bank TD - 2 months<br />

St George Bank TD - 2 years<br />

St George Bank TD - 3 months<br />

St George Bank TD - 6 months<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

N/A $ % % N/A N/A N/A<br />

Fixed Interest<br />

Fixed Interest: Annuities<br />

Challenger Guaranteed Income Fund 4.50 cents p.a. 30 June 2016 (MV$1)<br />

MLT0002AU - $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Fixed Interest: Australian<br />

BT Wholesale Fixed Interest Fund<br />

Macquarie (Wholesale) Australian Fixed Interest Fund ¤<br />

PIMCO EQT Wholesale Australian Bond Fund<br />

UBS Australian Bond Fund¤<br />

Vanguard (Wholesale) Australian Fixed Interest Index Fund<br />

RFA0813AU 0.50 $ % % %<br />

MAQ0061AU 0.62 $ % % %<br />

ETL0015AU 0.48 $ % % %<br />

SBC0813AU 0.45 $ % % %<br />

VAN0001AU 0.24 $ % % %<br />

Fixed Interest: Diversified<br />

Aberdeen Diversified Fixed Income Fund<br />

AMP Capital Corporate Bond Fund ¤ *<br />

Antares Premier Fixed Income Fund ¤<br />

Dimensional Five Year Diversified Fixed Interest (restricted use)"<br />

Dimensional Short Term Fixed Interest Trust (restricted use)"<br />

Dimensional Two Year Diversified Fixed Interest (restricted use)"<br />

Macquarie Diversified Fixed Interest Fund ¤<br />

OnePath Wholesale Diversified Fixed Interest Trust ¤<br />

PM CAPITAL Enhanced Yield Fund ◊ +<br />

Schroder (Wholesale) Fixed Income Fund<br />

UBS Diversified Fixed Income Fund ¤<br />

Vanguard International Credit Securities Index Fund (Hedged)<br />

CSA0062AU 0.60 $ % % %<br />

AMP0557AU 0.60 $ % % %<br />

PPL0114AU 0.55 $ % % %<br />

DFA0108AU 0.29 $ % % %<br />

DFA0100AU 0.19 $ % % %<br />

DFA0002AU 0.25 $ % % %<br />

MAQ0274AU 0.64 $ % % %<br />

ANZ0212AU 0.54 $ % % %<br />

PMC0103AU 1.36 $ % % %<br />

SCH0028AU 0.50 $ % % %<br />

SBC0007AU 0.55 $ % % %<br />

VAN0106AU 0.34 $ % % %<br />

Fixed Interest: International<br />

BlackRock Wholesale International Bond Fund ¤<br />

Colonial First State Wholesale Global Credit Income Fund<br />

Dimensional Global Bond Trust (restricted use)"<br />

PIMCO EQT Wholesale Global Bond Fund<br />

Vanguard (Wholesale) Inter'l Fixed Interest Index Fund (Hedged)<br />

PWA0825AU 0.55 $ % % %<br />

FSF0084AU 0.62 $ % % %<br />

DFA0028AU 0.35 $ % % %<br />

ETL0018AU 0.47 $ % % %<br />

VAN0103AU 0.26 $ % % %<br />

Fixed Interest: Multi-strategy Income<br />

Bentham Wholesale Global Income Fund ¤<br />

Goldman Sachs Income Plus Wholesale Fund¤<br />

Kapstream Wholesale Absolute Return Income Fund<br />

Macquarie Income Opportunities Fund ¤ +<br />

Perpetual's Wholesale Diversified Income Fund<br />

Schroder Credit Securities Fund¤<br />

UBS Diversified Credit Fund¤<br />

CSA0038AU 0.77 $ % % %<br />

JBW0016AU 0.68 $ % % %<br />

HOW0052AU 0.70 $ % % %<br />

MAQ0277AU 0.50 $ % % %<br />

PER0260AU 0.70 $ % % %<br />

SCH0103AU 0.75 $ % % %<br />

UBS0003AU 0.70 $ % % %<br />

Conservative<br />

Conservative: Diversified<br />

Colonial First State Wholesale Conservative Fund<br />

Pre Select Conservative Fund<br />

Russell Conservative Fund - Class C<br />

Vanguard Conservative Index Fund<br />

FSF0033AU 0.76 $ % % %<br />

NUN0001AU 0.60 $ % % %<br />

RIM0012AU 0.91 $ % % %<br />

VAN0109AU 0.33 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Balanced<br />

Balanced: Diversified<br />

Colonial First State Wholesale Balanced Fund<br />

<strong>MLC</strong> Wholesale Horizon 3 Conservative Growth Portfolio ¤ +<br />

Perpetual's Wholesale Diversified Growth Fund¤<br />

Pre Select Balanced Fund<br />

Russell Diversified 50 Fund - Class C<br />

Vanguard Balanced Index Fund<br />

FSF0040AU 0.86 $ % % %<br />

<strong>MLC</strong>0398AU 0.95 $ % % %<br />

PER0114AU 0.97 $ % % %<br />

NUN0002AU 0.65 $ % % %<br />

RIM0013AU 1.00 $ % % %<br />

VAN0108AU 0.34 $ % % %<br />

Growth<br />

Growth: Diversified<br />

Aberdeen Multi-Asset Real Return Fund ◊<br />

BlackRock Global Allocation Fund (Aust) - Class D ¤ +<br />

BlackRock Global Allocation Fund (Aust) - Class S +<br />

BlackRock Wholesale Balanced Fund ¤ ◊<br />

BT Wholesale Active Balanced Fund<br />

BT Wholesale Balanced Returns Fund<br />

Colonial First State Wholesale Diversified Fund<br />

Dimensional Multi-Factor Growth Trust (restricted use)"<br />

Legg Mason Diversified Trust - Class A<br />

<strong>MLC</strong> Wholesale Horizon 4 Balanced Portfolio ¤ +<br />

OnePath Tax Effective Income Fund ¤○<br />

OnePath Wholesale Balanced Trust ¤<br />

Perpetual Wholesale Balanced Growth Fund¤<br />

Pre Select Growth Fund<br />

Russell Balanced Fund - Class C<br />

UBS Balanced <strong>Investment</strong> Fund¤<br />

Vanguard Growth Index Fund<br />

Vanguard High Growth Index Fund<br />

Zurich <strong>Investment</strong>s Managed Growth Fund¤<br />

CRS0002AU 0.84 $ % % %<br />

MAL0018AU 1.75 $ % % %<br />

MAL0029AU 1.85 $ % % %<br />

PWA0822AU 0.95 $ % % %<br />

RFA0815AU 0.95 $ % % %<br />

BTA0806AU 0.88 $ % % %<br />

FSF0008AU 0.96 $ % % %<br />

DFA0029AU 0.48 $ % % %<br />

JPM0008AU 0.87 $ % % %<br />

<strong>MLC</strong>0260AU 0.99 $ % % %<br />

AJF0003AU 2.65 $ % % %<br />

AJF0802AU 0.89 $ % % %<br />

PER0063AU 1.10 $ % % %<br />

NUN0003AU 0.70 $ % % %<br />

RIM0011AU 1.08 $ % % %<br />

SBC0815AU 0.95 $ % % %<br />

VAN0110AU 0.36 $ % % %<br />

VAN0111AU 0.37 $ % % %<br />

ZUR0059AU 0.87 $ % % %<br />

Aggressive<br />

Aggressive: Diversified<br />

Colonial First State Wholesale High Growth Fund<br />

<strong>MLC</strong> Wholesale Horizon 5 Growth Portfolio ¤ +<br />

OnePath Wholesale High Growth Trust ¤<br />

Perpetual's Wholesale Split Growth Fund¤<br />

Pre Select High Growth Fund<br />

Russell Growth Fund - Class C<br />

Russell High Growth Fund - Class C +<br />

FSF0498AU 1.16 $ % % %<br />

<strong>MLC</strong>0265AU 0.99 $ % % %<br />

MMF0342AU 0.95 $ % % %<br />

PER0066AU 1.16 $ % % %<br />

NUN0004AU 0.85 $ % % %<br />

RIM0014AU 1.15 $ % % %<br />

RIM0030AU 1.24 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Property<br />

Property: Australian Listed<br />

AMP Capital Listed Property Trusts Fund (Class A) ¤<br />

Antares Listed Property Fund (PA) ¤○<br />

APN AREIT Fund ¤○<br />

BlackRock Indexed Australian Listed Property Fund<br />

BT Wholesale Property <strong>Investment</strong> Fund<br />

Challenger Wholesale Property Securities Fund ¤<br />

Colonial First State Wholesale Property Securities Fund<br />

Ironbark RREEF Paladin Property Securities Fund ¤<br />

UBS Property Securities Fund<br />

Vanguard Australian Property Securities Index<br />

AMP0255AU 0.97 $ % % %<br />

NFS0209AU 0.72 $ % % %<br />

APN0008AU 0.85 $ % % %<br />

BGL0108AU 0.20 $ % % %<br />

RFA0817AU 0.65 $ % % %<br />

HBC0008AU 0.85 $ % % %<br />

FSF0004AU 0.82 $ % % %<br />

PAL0002AU 0.88 $ % % %<br />

SBC0816AU 0.85 $ % % %<br />

VAN0004AU 0.24 $ % % %<br />

Property: Internationally Listed<br />

AMP Capital Global Property Securities Fund (Class A)¤<br />

CFS Wholesale Global Property Securites Fund<br />

Dimensional Global Real Estate Trust (restricted use)"<br />

Ironbark RREEF Global (ex-Australia) Property Securities Fund ¤<br />

UBS Clarion Global Property Securities Fund ¤<br />

Vanguard International Property Securities Index Fund (Hedged)<br />

AMP0974AU 0.99 $ % % %<br />

FSF0454AU 1.03 $ % % %<br />

DFA0005AU 0.42 $ % % %<br />

MGL0010AU 1.17 $ % % %<br />

HML0016AU 0.90 $ % % %<br />

VAN0019AU 0.43 $ % % %<br />

Property: Diversified<br />

AMP Capital Core Property Fund ¤<br />

Australian Unity Healthcare Property Trust Class A<br />

AMP1015AU 1.12 $ % % %<br />

AUS0037AU 0.95 $ % % %<br />

Australian Equity<br />

Australian Equity: Diversified<br />

Aberdeen Financials Fund<br />

Alphinity Wholesale Australian Share Fund¤<br />

Alphinity Wholesale Concentrated Australian Share Fund ¤<br />

Antares Dividend Builder○<br />

Antares Elite Opportunities Fund ○ +<br />

Arnhem Australian Equity Fund ¤<br />

Ausbil Australian Active Equity Fund¤<br />

BlackRock Scientific Australian Equity Fund¤<br />

BT Wholesale Australian Share Fund¤<br />

BT Wholesale Focus Australian Share Fund +<br />

BT Wholesale Imputation Fund<br />

Colonial First State Wholesale Australian Share Fund<br />

Colonial First State Wholesale Imputation Fund<br />

Custom Choice Wholesale Boutique Australian Share Portfolio<br />

Dimensional Australian Core Equity Trust (restricted use)"<br />

Dimensional Australian Large Company Trust (restricted use)"<br />

EQI0027AU 0.88 $ % % %<br />

PAM0001AU 0.90 $ % % %<br />

HOW0026AU 1.24 $ % % %<br />

PPL0002AU 0.87 $ % % %<br />

PPL0115AU 0.70 $ % % %<br />

ARO0011AU 0.85 $ % % %<br />

AAP0103AU 0.90 $ % % %<br />

BAR0814AU 0.79 $ % % %<br />

BTA0055AU 0.79 $ % % %<br />

RFA0059AU 0.75 $ % % %<br />

RFA0103AU 0.90 $ % % %<br />

FSF0002AU 0.96 $ % % %<br />

FSF0003AU 0.96 $ % % %<br />

HOW0019AU 0.90 $ % % %<br />

DFA0003AU 0.30 $ % % %<br />

DFA0103AU 0.22 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Dimensional Australian Value Trust (restricted use)"<br />

Fidelity Australian Equities Fund ¤<br />

Goldman Sachs Australian Equities Wholesale Fund¤<br />

Greencape Wholesale Broadcap Fund ¤<br />

Greencape Wholesale High Conviction Fund ¤<br />

Integrity Australian Share Fund ¤○<br />

Investors Mutual Australian Share Fund<br />

Investors Mutual Industrial Share Fund<br />

Maple-Brown Abbott Imputation Fund¤○<br />

Merlon Wholesale Australian Share Income Fund ¤<br />

OnePath Wholesale Australian Share Trust ¤○<br />

OnePath Wholesale Blue Chip Imputation Trust ¤○<br />

Perennial Value Shares Wholesale Trust¤○<br />

Perpetual's Wholesale Australian Fund<br />

Perpetual's Wholesale Concentrated Equity Fund<br />

Perpetual's Wholesale Industrial Fund○<br />

Pre Select Australian Equity Fund<br />

Russell Australian Share Fund - Class C<br />

Schroder (Wholesale) Australian Equity Fund¤<br />

Tyndall (Wholesale) Australian Share Portfolio¤<br />

UBS Australian Share Fund¤<br />

Vanguard (Wholesale) Australian Shares Index Fund<br />

Vanguard Australian Shares High Yield Fund<br />

Zurich <strong>Investment</strong>s Equity Income Fund ¤<br />

DFA0101AU 0.33 $ % % %<br />

FID0008AU 0.85 $ % % %<br />

JBW0009AU 0.95 $ % % %<br />

HOW0034AU 1.16 $ % % %<br />

HOW0035AU 0.90 $ % % %<br />

ITG0001AU 0.97 $ % % %<br />

IML0002AU 0.99 $ % % %<br />

IML0004AU 0.99 $ % % %<br />

ADV0046AU 0.92 $ % % %<br />

HBC0011AU 0.95 $ % % %<br />

AJF0804AU 0.90 $ % % %<br />

MMF0340AU 0.95 $ % % %<br />

IOF0206AU 0.92 $ % % %<br />

PER0049AU 0.99 $ % % %<br />

PER0102AU 1.11 $ % % %<br />

PER0046AU 0.99 $ % % %<br />

NUN0005AU 0.80 $ % % %<br />

RIM0015AU 1.03 $ % % %<br />

SCH0101AU 0.92 $ % % %<br />

TYN0028AU 0.80 $ % % %<br />

SBC0817AU 0.90 $ % % %<br />

VAN0002AU 0.18 $ % % %<br />

VAN0104AU 0.40 $ % % %<br />

ZUR0538AU 1.87 $ % % %<br />

Australian Equity: Smaller Companies<br />

Aberdeen Australian Small Companies Fund¤<br />

Antares Small Companies Fund (PA) ¤○<br />

Celeste Australian Small Companies Fund +<br />

Dimensional Australian Small Company Trust (restricted use)"<br />

Eley Griffiths Group Small Companies Fund +<br />

Goldman Sachs Emerging Leaders Wholesale Fund¤<br />

Invesco Wholesale Australian Smaller Companies Fund - Class A units<br />

Investors Mutual Future Leaders Fund +<br />

Kinetic Wholesale Emerging Companies Fund ¤<br />

NovaPort Wholesale Microcap Fund ¤<br />

NovaPort Wholesale Smaller Companies Fund¤<br />

Pengana Emerging Companies Fund +<br />

Perpetual's Wholesale Smaller Companies Fund ○<br />

Pre Select Australian Small Companies Fund<br />

CSA0131AU 1.26 $ % % %<br />

PPL0107AU 0.98 $ % % %<br />

FAM0101AU 2.65 $ % % %<br />

DFA0104AU 0.60 $ % % %<br />

EGG0001AU 2.13 $ % % %<br />

JBW0010AU 1.25 $ % % %<br />

CNA0812AU 1.25 $ % % %<br />

IML0003AU 0.99 $ % % %<br />

HOW0036AU 2.53 $ % % %<br />

HOW0027AU 6.00 $ % % %<br />

HOW0016AU 2.89 $ % % %<br />

PER0270AU 2.74 $ % % %<br />

PER0048AU 1.26 $ % % %<br />

NUN0038AU 1.20 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Australian Equity: Geared<br />

Ausbil Australian Geared Equity Fund¤<br />

Colonial First State Wholesale Geared Share Fund<br />

Perpetual's Wholesale Geared Australian Fund<br />

AAP0002AU 1.20 $ % % %<br />

FSF0043AU 2.17 $ % % %<br />

PER0071AU 2.57 $ % % %<br />

Australian Equity: Infrastructure<br />

Goldman Sachs Australian Infrastructure Wholesale Fund¤<br />

JBW0030AU 0.85 $ % % %<br />

Australian Equity: Long/Short<br />

Antares High Growth Shares Fund (PA) ¤ ◊ +<br />

BlackRock Australian Equity Opportunities Fund ¤ ◊ +<br />

Colonial First State Antares Wholesale Elite Opportunities Fund<br />

K2 Australian Absolute Return Fund ○ ◊ +<br />

Regal Long Short Australian Equity Fund ◊ +<br />

PPL0106AU 1.05 $ % % %<br />

MAL0072AU 1.22 $ % % %<br />

FSF0455AU 1.04 $ % % %<br />

KAM0101AU 4.34 $ % % % N/A<br />

AMR0006AU 1.37 $ % % %<br />

Australian Equity: Responsible <strong>Investment</strong><br />

Alphinity Wholesale Socially Responsible Share Fund<br />

Australian Ethical Smaller Companies Trust Class B<br />

BT Wholesale Ethical Share Fund<br />

Perpetual Wholesale Ethical SRI Fund ¤<br />

HOW0121AU 1.15 $ % % %<br />

AUG0018AU 0.95 $ % % %<br />

RFA0025AU 0.95 $ % % %<br />

PER0116AU 1.18 $ % % %<br />

Australian Equity: Larger Companies<br />

Antares Australian Equities Fund○<br />

PPL0110AU 0.60 $ % % %<br />

Australian Equities: Diversified<br />

Plato Australian Shares Income Fund<br />

WHT0039AU 0.90 $ % % %<br />

International Equity<br />

International Equity: Diversified<br />

Aberdeen Actively Hedged International Equities Fund<br />

BlackRock Scientific International Equity Fund¤<br />

BT Wholesale Core Global Share Fund<br />

Dimensional Global Core Equity Trust (restricted use)"<br />

Dimensional Global Large Company Trust (restricted use)"<br />

Dimensional Global Value Trust (restricted use)"<br />

Fidelity Global Equities Fund ¤<br />

Generation Global Share Fund¤<br />

Goldman Sachs International Wholesale Fund¤<br />

Grant Samuel Epoch Global Equity Shareholder Yield Fund ¤ +<br />

INVESCO Wholesale Global Matrix Fund - Unhedged<br />

Ironbark GTP Global Equity Thematic Fund¤<br />

Magellan Global Fund +<br />

CRS0005AU 0.98 $ % % %<br />

BAR0817AU 0.89 $ % % %<br />

RFA0821AU 0.97 $ % % %<br />

DFA0004AU 0.40 $ % % %<br />

DFA0105AU 0.36 $ % % %<br />

DFA0102AU 0.45 $ % % %<br />

FID0007AU 1.15 $ % % %<br />

FSF0908AU 1.24 $ % % %<br />

JBW0014AU 1.22 $ % % %<br />

GSF0002AU 1.25 $ % % %<br />

GTU0102AU 1.08 $ % % %<br />

MGL0004AU 0.99 $ % % %<br />

MGE0001AU 1.35 $ % % %<br />

Magellan Global Hedged Fund +<br />

MGE0007AU<br />

N/A<br />

Perpetual's Wholesale International Share Fund ¤<br />

Pre Select International Equity Fund<br />

Russell International Shares Fund - Class C<br />

PER0050AU 1.23 $ % % %<br />

NUN0006AU 0.95 $ % % %<br />

RIM0016AU 1.24 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

Schroder Global Active Value Fund ¤<br />

T.Rowe Price Global Equity Fund ¤<br />

UBS International Share Fund¤<br />

Vanguard (Wholesale) International Shares Index Fund<br />

Walter Scott Global Equity Fund<br />

Zurich <strong>Investment</strong>s Global Thematic Share Fund¤<br />

SCH0030AU 0.98 $ % % %<br />

ETL0071AU 1.20 $ % % %<br />

SBC0822AU 1.00 $ % % %<br />

VAN0003AU 0.18 $ % % %<br />

MAQ0410AU 1.28 $ % % %<br />

ZUR0061AU 0.98 $ % % %<br />

International Equity: Hedged<br />

Arrowstreet Global Equity Fund (Hedged)<br />

BlackRock Scientific Hedged International Equity Fund¤<br />

Dimensional Global Core Equity Trust AUD Hedged (restricted use)"<br />

Fidelity Hedged Global Equities Fund ¤<br />

Grant Samuel Epoch Gl Eq Shareholder Yield (Hedged) Fund ¤ +<br />

GVI Aubrey Global Growth & Income Fund - Hedged<br />

Invesco Wholesale Global Matrix Fund hedged - Class A units<br />

Schroder Global Active Value Fund (Hedged) ¤<br />

Vanguard International Shares Index Fund (Hedged)<br />

MAQ0079AU 1.28 $ % % %<br />

BGL0109AU 0.94 $ % % %<br />

DFA0009AU 0.40 $ % % %<br />

FID0014AU 1.20 $ % % %<br />

GSF0001AU 1.30 $ % % %<br />

TGP0004AU 1.11 $ % % %<br />

GTU0008AU 1.08 $ % % %<br />

SCH0032AU 0.98 $ % % %<br />

VAN0105AU 0.21 $ % % %<br />

International Equity: Smaller Companies<br />

BlackRock Hedged Global Small Cap Fund - Class D ¤<br />

Dimensional Global Small Company Trust (restricted use)"<br />

Goldman Sachs Global Small Companies Wholesale Fund<br />

MAL0135AU 1.30 $ % % %<br />

DFA0106AU 0.65 $ % % %<br />

JBW0103AU 1.43 $ % % %<br />

International Equity: Asia<br />

Aberdeen Asian Opportunities Fund ¤<br />

BT Wholesale Asian Share Fund<br />

Fidelity China Fund ¤<br />

Platinum (Wholesale) Japan Fund ◊<br />

Platinum Asia Fund ◊<br />

<strong>Premium</strong> China Fund ◊<br />

EQI0028AU 1.18 $ % % %<br />

BTA0054AU 1.00 $ % % %<br />

FID0011AU 1.20 $ % % %<br />

PLA0003AU 1.54 $ % % %<br />

PLA0004AU 1.54 $ % % %<br />

MAQ0441AU 2.30 $ % % %<br />

(blank)<br />

International Equity: Emerging Markets<br />

Aberdeen Emerging Opportunities Fund<br />

Dimensional Emerging Markets Trust (restricted use)"<br />

ETL0032AU 1.50 $ % % %<br />

DFA0107AU 0.71 $ % % %<br />

International Equity: Europe<br />

Platinum (Wholesale) European Fund ◊<br />

PLA0001AU 1.54 $ % % %<br />

International Equity: Infrastructure<br />

AMP Capital Core Infrastructure Fund (Class A) ¤<br />

Macquarie International Infrastructure Securities Fund ¤<br />

RARE Infrastructure Value Fund - Hedged +<br />

RARE Infrastructure Value Fund - Unhedged +<br />

AMP1179AU 1.20 $ % % %<br />

MAQ0432AU 1.02 $ % % %<br />

TGP0008AU 1.32 $ % % %<br />

TGP0034AU 1.27 $ % % %<br />

International Equity: Resources<br />

Colonial First State Wholesale Global Resources Fund<br />

FSF0038AU 1.18 $ % % %

5. <strong>Investment</strong> Allocation Authority<br />

<strong>Investment</strong> Products<br />

APIR<br />

ICR % pa #<br />

Initial investment<br />

Initial<br />

allocation<br />

($ or %)<br />

Progressive<br />

investment (%)<br />

Additional investment<br />

allocation (%)<br />

– ad hoc<br />

– regular (N/A for SMA's)<br />

Reinvestment<br />

of earnings ()<br />

Automatic<br />

re-weight ()<br />

Sell priority<br />

International Equity: Technology<br />

Platinum International Technology Fund<br />

PLA0101AU 1.54 $ % % %<br />

International Equity: Long/Short<br />

K2 Select International Absolute Return Fund ◊ +<br />

LHP Global Long/Short Fund ^ ¤ ◊ +<br />

Platinum (Wholesale) International Fund ◊<br />

Platinum International Brands Fund<br />

PM CAPITAL Absolute Performance Fund +<br />

ETL0046AU 5.45 $ % % % N/A<br />

HFL0108AU 2.63 $ % % % N/A<br />

PLA0002AU 1.54 $ % % %<br />

PLA0100AU 1.54 $ % % %<br />

PMC0100AU 4.68 $ % % %<br />

International Equity: Responsible <strong>Investment</strong><br />

AMP Capital Responsible <strong>Investment</strong> Leaders Int Share - Class A ¤<br />

AMP0455AU 1.13 $ % % %<br />

International Equity: Concentrated<br />

Magellan High Conviction Fund +<br />

Alternatives<br />

MGE0005AU<br />

N/A<br />

Alternatives: Hedge Funds<br />

Aspect Diversified Futures Fund ^ ¤ +<br />

BlackRock Multi Opportunity Absolute Return Fund ^ ◊ +<br />

Pengana Asian Special Events Fund ^ ◊ +<br />

Winton Global Alpha Fund ^ ◊ +<br />

FSF1086AU 1.61 $ % % %<br />

BLK0001AU 1.40<br />

PCL0004AU 1.50<br />

MAQ0482AU 2.26 $ % % %

SHARES*<br />

<strong>Portfoliofocus</strong> <strong>Premium</strong> <strong>Retirement</strong> <strong>Service</strong> gives you access to over 500 ASX<br />

listed investments such as direct shares and exchange traded funds. Refer to<br />

the Shares List on investinfo.com.au/portfoliofocus for the complete list of shares<br />

available. There i<br />

ASX CODE Initial investment ($ or %)<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

$ %<br />

SUB TOTAL SHARES<br />

SUB TOTAL INVESTMENT PRODUCTS<br />

TOTAL<br />

* Please note: The Administrator only accepts market trades not limit trades

Please ensure you sign the form below:<br />

I<br />

hereby authorise the designated investments to be made on my behalf, and acknowledge that this authority is provided on the basis<br />

the Trustee will effect it according to the terms and conditions of the <strong>Service</strong>.<br />

I confirm that I have:<br />

received and considered the disclosure document or product disclosure statement containing important information for each<br />

underlying investment product selected by me; and<br />

received share product information in relation to each share investment selected by me;<br />

understood, and accept, that a period of longer than the 30 days maximum for processing a transfer is required (possibly in<br />

respect of the whole of the transfer amount) where I have invested or subsequently invest in an investment product identified as<br />

an illiquid investment.<br />

Signature of investor<br />

Date

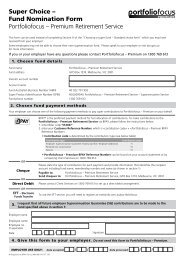

7. Adviser details (adviser only)<br />

Adviser name<br />

Adviser code Office<br />

Dealer group<br />

Contact name Contact phone number<br />

Adviser stamp<br />

Please refer to the <strong>Service</strong>’s current PDS and any applicable SPDS for the terms and conditions of membership of the <strong>Service</strong>.<br />

In this document references to ‘the Trustee’ are to NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 and references to ‘the<br />

Administrator’ are to Navigator Australia Limited ABN 45 006 302 987 AFSL 236466.<br />

Disclaimer:<br />

The information in this <strong>Investment</strong> Allocation Authority is of a general nature only and has not taken into account your individual investment objectives,<br />

financial situation or particular investment needs. Before making an investment decision, you should read the <strong>Service</strong>’s PDS carefully, which describes the<br />

main features of the <strong>Service</strong>, and talk to your financial adviser. Neither the Administrator nor the Trustee guarantees the capital or any particular rate of return<br />

from, or any increase in, the value of any investment product referred to in this document. This <strong>Investment</strong> Allocation Authority is not a Statement of Advice<br />

nor is it a Financial <strong>Service</strong>s Guide. You should obtain a current disclosure document or product disclosure statement for each of your selected investments.<br />

These documents can be obtained from your financial adviser.<br />

Neither the Administrator or the Trustee is acting as an agent of any issuers or investment managers of the investments available through the <strong>Service</strong>.<br />

<strong>Investment</strong>s made through the <strong>Service</strong> do not entitle you to legal ownership of the underlying investments. Please refer to the <strong>Service</strong>’s PDS for further<br />

information about your interest in the investments and the <strong>Service</strong>. None of the Administrator, the Trustee, the issuers or the investment managers guarantee<br />

the performance of the investment products available through the <strong>Service</strong> or any return of capital or income. <strong>Investment</strong>s made through the <strong>Service</strong> are<br />

subject to investment and other risks. The issuers and investment managers do not endorse or otherwise recommend the <strong>Service</strong> or guarantee or warrant the<br />

performance of the <strong>Service</strong>, Administrator, the Trustee or the selected investments.

![14 June 2011 [INSERT CLIENT NAME] [ADDRESS 1] [ADDRESS 2 ...](https://img.yumpu.com/44565527/1/184x260/14-june-2011-insert-client-name-address-1-address-2-.jpg?quality=85)