Portfoliofocus - Premium Retirement Service Investment ... - MLC

Portfoliofocus - Premium Retirement Service Investment ... - MLC

Portfoliofocus - Premium Retirement Service Investment ... - MLC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

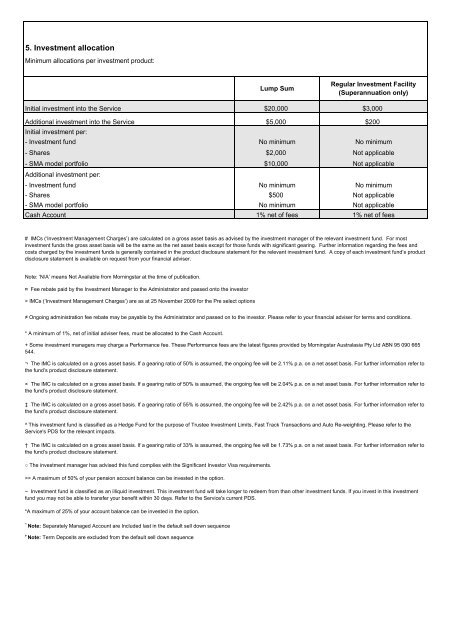

5. <strong>Investment</strong> allocation<br />

Minimum allocations per investment product:<br />

Initial investment into the <strong>Service</strong><br />

Lump Sum<br />

$20,000<br />

Regular <strong>Investment</strong> Facility<br />

(Superannuation only)<br />

$3,000<br />

Additional investment into the <strong>Service</strong><br />

$5,000<br />

$200<br />

Initial investment per:<br />

- <strong>Investment</strong> fund<br />

- Shares<br />

- SMA model portfolio<br />

No minimum<br />

$2,000<br />

$10,000<br />

No minimum<br />

Not applicable<br />

Not applicable<br />

Additional investment per:<br />

- <strong>Investment</strong> fund<br />

No minimum<br />

No minimum<br />

- Shares<br />

$500<br />

Not applicable<br />

- SMA model portfolio<br />

No minimum<br />

Not applicable<br />

Cash Account<br />

1% net of fees 1% net of fees<br />

# IMCs (‘<strong>Investment</strong> Management Charges’) are calculated on a gross asset basis as advised by the investment manager of the relevant investment fund. For most<br />

investment funds the gross asset basis will be the same as the net asset basis except for those funds with significant gearing. Further information regarding the fees and<br />

costs charged by the investment funds is generally contained in the product disclosure statement for the relevant investment fund. A copy of each investment fund’s product<br />

disclosure statement is available on request from your financial adviser.<br />

Note: ‘N/A’ means Not Available from Morningstar at the time of publication.<br />

¤ Fee rebate paid by the <strong>Investment</strong> Manager to the Administrator and passed onto the investor<br />

> IMCs (‘<strong>Investment</strong> Management Charges’) are as at 25 November 2009 for the Pre select options<br />

≠ Ongoing administration fee rebate may be payable by the Administrator and passed on to the investor. Please refer to your financial adviser for terms and conditions.<br />

* A minimum of 1%, net of initial adviser fees, must be allocated to the Cash Account.<br />

+ Some investment managers may charge a Performance fee. These Performance fees are the latest figures provided by Morningstar Australasia Pty Ltd ABN 95 090 665<br />

544.<br />

¬ The IMC is calculated on a gross asset basis. If a gearing ratio of 50% is assumed, the ongoing fee will be 2.11% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

× The IMC is calculated on a gross asset basis. If a gearing ratio of 50% is assumed, the ongoing fee will be 2.04% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

‡ The IMC is calculated on a gross asset basis. If a gearing ratio of 55% is assumed, the ongoing fee will be 2.42% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

^ This investment fund is classified as a Hedge Fund for the purpose of Trustee <strong>Investment</strong> Limits, Fast Track Transactions and Auto Re-weighting. Please refer to the<br />

<strong>Service</strong>'s PDS for the relevant impacts.<br />

† The IMC is calculated on a gross asset basis. If a gearing ratio of 33% is assumed, the ongoing fee will be 1.73% p.a. on a net asset basis. For further information refer to<br />

the fund’s product disclosure statement.<br />

○ The investment manager has advised this fund complies with the Significant Investor Visa requirements.<br />

>> A maximum of 50% of your pension account balance can be invested in the option.<br />

~ <strong>Investment</strong> fund is classified as an illiquid investment. This investment fund will take longer to redeem from than other investment funds. If you invest in this investment<br />

fund you may not be able to transfer your benefit within 30 days. Refer to the <strong>Service</strong>'s current PDS.<br />

*A maximum of 25% of your account balance can be invested in the option.<br />

~<br />

Note: Separately Managed Account are Included last in the default sell down sequence<br />

»<br />

Note: Term Deposits are excluded from the default sell down sequence

![14 June 2011 [INSERT CLIENT NAME] [ADDRESS 1] [ADDRESS 2 ...](https://img.yumpu.com/44565527/1/184x260/14-june-2011-insert-client-name-address-1-address-2-.jpg?quality=85)