Property Management

Property Management

Property Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

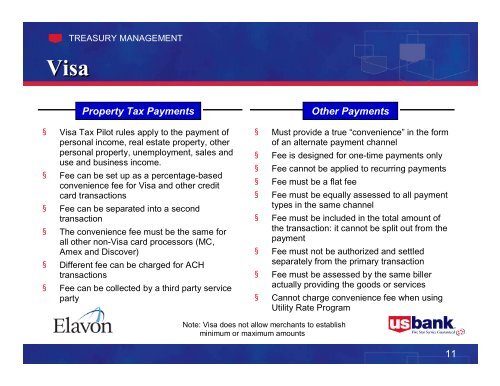

TREASURY MANAGEMENT<br />

Visa<br />

<strong>Property</strong> Tax Payments<br />

• Visa Tax Pilot rules apply to the payment of<br />

personal income, real estate property, other<br />

personal property, unemployment, sales and<br />

use and business income.<br />

• Fee can be set up as a percentagebased<br />

convenience fee for Visa and other credit<br />

card transactions<br />

• Fee can be separated into a second<br />

transaction<br />

• The convenience fee must be the same for<br />

all other nonVisa card processors (MC,<br />

Amex and Discover)<br />

• Different fee can be charged for ACH<br />

transactions<br />

• Fee can be collected by a third party service<br />

party<br />

Other Payments<br />

• Must provide a true “convenience”in the form<br />

of an alternate payment channel<br />

• Fee is designed for onetime payments only<br />

• Fee cannot be applied to recurring payments<br />

• Fee must be a flat fee<br />

• Fee must be equally assessed to all payment<br />

types in the same channel<br />

• Fee must be included in the total amount of<br />

the transaction: it cannot be split out from the<br />

payment<br />

• Fee must not be authorized and settled<br />

separately from the primary transaction<br />

• Fee must be assessed by the same biller<br />

actually providing the goods or services<br />

• Cannot charge convenience fee when using<br />

Utility Rate Program<br />

Note: Visa does not allow merchants to establish<br />

minimum or maximum amounts<br />

11