9am with Emkay - Emkay Global Financial Services Ltd.

9am with Emkay - Emkay Global Financial Services Ltd.

9am with Emkay - Emkay Global Financial Services Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

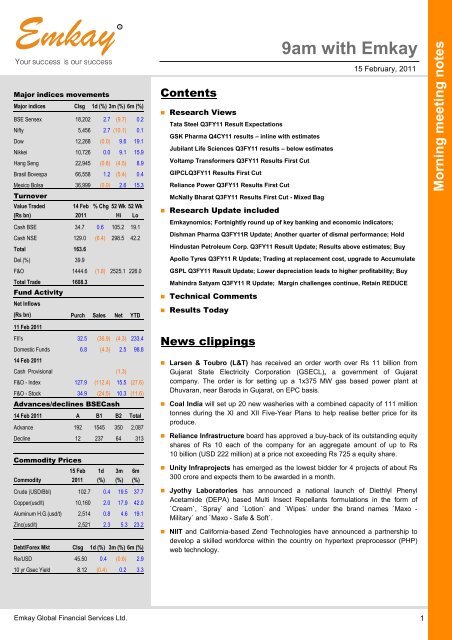

Major indices movements<br />

Major indices Clsg 1d (%) 3m (%) 6m (%)<br />

BSE Sensex 18,202 2.7 (9.7) 0.2<br />

Nifty 5,456 2.7 (10.1) 0.1<br />

Dow 12,268 (0.0) 9.6 19.1<br />

Nikkei 10,726 0.0 9.1 15.9<br />

Hang Seng 22,945 (0.8) (4.5) 8.9<br />

Brasil Bovespa 66,558 1.2 (5.4) 0.4<br />

Mexico Bolsa 36,999 (0.0) 2.6 15.3<br />

Turnover<br />

Value Traded<br />

14 Feb % Chg 52 Wk 52 Wk<br />

(Rs bn)<br />

2011<br />

Hi Lo<br />

Cash BSE 34.7 0.6 105.2 19.1<br />

Cash NSE 129.0 (6.4) 298.5 42.2<br />

Total 163.6<br />

Del.(%) 39.9<br />

F&O 1444.6 (1.8) 2525.1 226.0<br />

Total Trade 1608.3<br />

Fund Activity<br />

Net Inflows<br />

(Rs bn) Purch Sales Net YTD<br />

Contents<br />

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

15 February, 2011<br />

Research Views<br />

Tata Steel Q3FY11 Result Expectations<br />

GSK Pharma Q4CY11 results – inline <strong>with</strong> estimates<br />

Jubilant Life Sciences Q3FY11 results – below estimates<br />

Voltamp Transformers Q3FY11 Results First Cut<br />

GIPCLQ3FY11 Results First Cut<br />

Reliance Power Q3FY11 Results First Cut<br />

McNally Bharat Q3FY11 Results First Cut - Mixed Bag<br />

Research Update included<br />

<strong>Emkay</strong>nomics; Fortnightly round up of key banking and economic indicators;<br />

Dishman Pharma Q3FY11R Update; Another quarter of dismal performance; Hold<br />

Hindustan Petroleum Corp. Q3FY11 Result Update; Results above estimates; Buy<br />

Apollo Tyres Q3FY11 R Update; Trading at replacement cost, upgrade to Accumulate<br />

GSPL Q3FY11 Result Update; Lower depreciation leads to higher profitability; Buy<br />

Mahindra Satyam Q3FY11 R Update; Margin challenges continue, Retain REDUCE<br />

Technical Comments<br />

Results Today<br />

Morning meeting notes<br />

11 Feb 2011<br />

FII's 32.5 (36.9) (4.3) 233.4<br />

Domestic Funds 6.8 (4.3) 2.5 98.8<br />

14 Feb 2011<br />

Cash Provisional (1.3)<br />

F&O - Index 127.9 (112.4) 15.5 (27.6)<br />

F&O - Stock 34.9 (24.5) 10.3 (11.6)<br />

Advances/declines BSECash<br />

14 Feb 2011 A B1 B2 Total<br />

Advance 192 1545 350 2,087<br />

Decline 12 237 64 313<br />

Commodity Prices<br />

15 Feb 1d 3m 6m<br />

Commodity<br />

2011 (%) (%) (%)<br />

Crude (USD/Bbl) 102.7 0.4 19.5 37.7<br />

Copper(usd/t) 10,160 2.0 17.9 42.0<br />

Aluminum H.G.(usd/t) 2,514 0.8 4.6 19.1<br />

Zinc(usd/t) 2,521 2.3 5.3 23.2<br />

Debt/Forex Mkt Clsg 1d (%) 3m (%) 6m (%)<br />

Re/USD 45.50 0.4 (0.6) 2.9<br />

10 yr Gsec Yield 8.12 (0.4) 0.2 3.3<br />

News clippings<br />

Larsen & Toubro (L&T) has received an order worth over Rs 11 billion from<br />

Gujarat State Electricity Corporation (GSECL), a government of Gujarat<br />

company. The order is for setting up a 1x375 MW gas based power plant at<br />

Dhuvaran, near Baroda in Gujarat, on EPC basis.<br />

Coal India will set up 20 new washeries <strong>with</strong> a combined capacity of 111 million<br />

tonnes during the XI and XII Five-Year Plans to help realise better price for its<br />

produce.<br />

Reliance Infrastructure board has approved a buy-back of its outstanding equity<br />

shares of Rs 10 each of the company for an aggregate amount of up to Rs<br />

10 billion (USD 222 million) at a price not exceeding Rs 725 a equity share.<br />

Unity Infraprojects has emerged as the lowest bidder for 4 projects of about Rs<br />

300 crore and expects them to be awarded in a month.<br />

Jyothy Laboratories has announced a national launch of Diethlyl Phenyl<br />

Acetamide (DEPA) based Multi Insect Repellants formulations in the form of<br />

`Cream`, `Spray` and `Lotion` and `Wipes` under the brand names `Maxo -<br />

Military` and `Maxo - Safe & Soft`.<br />

NIIT and California-based Zend Technologies have announced a partnership to<br />

develop a skilled workforce <strong>with</strong>in the country on hypertext preprocessor (PHP)<br />

web technology.<br />

<strong>Emkay</strong> <strong>Global</strong> <strong>Financial</strong> <strong>Services</strong> <strong>Ltd</strong>. 1

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Research views<br />

Tata Steel<br />

Reco CMP TP<br />

Accumulate 619 712<br />

Jagdish Agarwal<br />

jagdish.agarwal@emkayglobal.com<br />

+91 22 6612 1381<br />

Goutam Chakraborty<br />

goutam.chakraborty@emkayglobal.com<br />

+91 22 6612 1275<br />

Tata Steel Q3FY11 Result Expectations<br />

We expect Tata Steel to show a marginal revenue growth of 3.8% YoY on<br />

consolidated basis<br />

We estimate sales volume of 3.5 mn tonnes for the European operations<br />

EBITDA margins are likely to improve both on YoY and QoQ by 300 bps and 150<br />

bps respectively for the consolidated business<br />

Standalone EBITDA margin is likely to improve by 560 bps and 240 bps<br />

respectively on YoY and QoQ basis<br />

The standalone APAT is likely to grow by 32% and 9% on YoY and QoQ<br />

respectively<br />

The consolidated APAT though is expected to grow 102% YoY, however, it is<br />

likely to fall 2% on QoQ basis<br />

Tata Steel (Standalone)<br />

(Rs mn) Q3FY11E Q3FY10 Q2FY11 YoY (%) QoQ (%)<br />

Revenue 73857.8 63748.8 71070.5 15.9 3.9<br />

EBITDA 29121.0 21569.0 26293.2 35.0 10.8<br />

EBITDA Margin (%) 39.4 33.8 37.0 +560 bps +240 bps<br />

APAT 15742.8 11917.5 14384.3 32.1 +9.4<br />

Tata Steel (Consolidated)<br />

(Rs mn) Q3FY11E Q3FY10 Q2FY11 YoY (%) QoQ (%)<br />

Revenue 272075.3 262020.1 286461.9 3.8 -5.0<br />

EBITDA 38798.53 29505.7 36723.3 31.5 5.7<br />

EBITDA Margin (%) 14.3 11.3 12.8 +300 bps +150 bps<br />

PAT 13523.7 6683.7 13833.9 102.3 -2.2<br />

Basic EPS (Rs) 15.3 7.5 15.6 102.3 -2.2<br />

Diluted EPS (Rs) 14.1 7.0 14.4 102.3 -2.2<br />

Things to look at:<br />

Sales volumes and margins at European operations and guidance on Tata Steel<br />

Europe’s EBITDA/ tonne<br />

Update on raw material costs for European operations going forward<br />

EBITDA margin at Indian operation<br />

Update on further balance sheet restructuring<br />

Update on Riversdale and New Millennium mines<br />

Update on Orissa Project<br />

<strong>Financial</strong>s<br />

(Rs bn)<br />

Home<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs)<br />

%<br />

chg<br />

(%) P/E EBITDA P/BV<br />

FY09 1,456.9 181.3 12.4 49.5 60.4 -63.0 17.4 9.3 5.2 3.7<br />

FY10 1,017.6 80.4 7.9 -20.1 -22.6 NA -8.5 -27.9 12.1 6.8<br />

FY11E 1,116.5 172.5 15.5 76.4 79.7 NA 22.6 7.3 5.0 2.9<br />

FY12E 1,230.2 199.7 16.2 90.0 92.7 16.3 21.5 6.2 4.1 1.9<br />

<strong>Emkay</strong> Research 15 February, 2011 2

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Research views<br />

GSK Pharma<br />

Reco CMP TP<br />

Hold 2201 UR<br />

<strong>Financial</strong>s<br />

Y/e Mar Q3FY10 Q3FY11 % YoY<br />

Net Sales (Rs<br />

mn) 4499 5007 11.3%<br />

EBITDA (Rs<br />

mn) 1438 1574 9.4%<br />

EBITDA % 32.0 31.4 -54 bps<br />

APAT (Rs mn) 1057 1223 15.7%<br />

EPS (Rs) 12.6 13.7 8.4%<br />

GSK Pharma Q4CY11 results – inline <strong>with</strong> estimates<br />

The growth in total sales was 11.3% to Rs5bn (expected Rs5.1bn). Revenue growth<br />

was driven by strong growth in the vaccines business and key specialties such as<br />

dermatology, oncology and critical care. Operating margins contracted marginally by<br />

54bps to 31.4%, however, higher other income led to expansion in net profit margin<br />

by 94bps to 24.4%. EPS for the quarter stood at Rs13.7. For the full year (CY10),<br />

EPS stands at Rs68.6.<br />

Deepak Malik<br />

deepak.malik@emkayglobal.com<br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.com<br />

+91 22 6612 1254<br />

Rashmi Sancheti<br />

rashmi.sancheti@emkayglobal.com<br />

+91 22 6612 1238<br />

Jubilant Life Sciences<br />

Reco CMP TP<br />

UR 204 UR<br />

<strong>Financial</strong>s<br />

Y/e Mar Q3FY10 Q3FY11 % YoY<br />

Net Sales (Rs<br />

mn) 9664 8690 -10.1%<br />

EBITDA (Rs<br />

mn) 2301 1322 -42.6%<br />

EBITDA % 23.8 15.2<br />

-1090<br />

bps<br />

APAT (Rs mn) 1416 464 -67.2%<br />

EPS (Rs) 6.8 2.8 -59.5%<br />

Jubilant Life Sciences Q3FY11 results – below estimates<br />

Revenues at Rs8.7bn was down 10% YoY on account of decline of 32% in <strong>Services</strong><br />

business i.e. CMO and DDDS and 13% growth in Products business i.e.<br />

Intermediates & Generics business. EBITDA at Rs1.3bn was down 43% YoY and<br />

decline of Margins by 860 bps to 15.2%. There were realized forex gains of 570 mn<br />

in Q3 FY10 versus realized forex loss of Rs30mn in Q3FY11. PAT at Rs464mn was<br />

down 67% YoY, mainly on account of increase in depreciation and reduction in<br />

EBITDA. EPS for the quarter and 9MFY11 stood at Rs2.8 and Rs10.5 respectively.<br />

Deepak Malik<br />

deepak.malik@emkayglobal.com<br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.com<br />

+91 22 6612 1254<br />

Rashmi Sancheti<br />

rashmi.sancheti@emkayglobal.com<br />

+91 22 6612 1238<br />

Home<br />

<strong>Emkay</strong> Research 15 February, 2011 3

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Voltamp Transformers Q3FY11 Results First Cut<br />

Same story continuing – Competition in full flow<br />

Amit Golchha<br />

amit.golchha@emkayglobal.com<br />

+91 22 66242408<br />

Nihag Shah, CFA<br />

nihag.shah@emkayglobal.com<br />

+91 22 6624 2486<br />

Against our expectations of 29% growth, revenues actually declined by 5% yoy<br />

to Rs1.3bn.<br />

EBITDA declined by 49% yoy to Rs145mn, below estimates due to low EBITDA<br />

margins of 10.8% (lower than estimated 13% margins) against 20.2% in<br />

Q3FY10.<br />

APAT declined by 39% yoy to Rs128mn - below our estimate of Rs166mn.<br />

EPS for the quarter stood at Rs12.6/Share.<br />

For 9mFY11 EPS stood at Rs32.5/share, down 42% yoy. Q411 is the last qtr of<br />

high margin base (19.2%), after which the base impact should play out (Q1 11<br />

EBITDA margins at 10.9%).<br />

Our FY11E/FY12E EPS estimate stands at Rs57.1/Share and Rs72.1/shares.<br />

Likely downgrade (8-10%) in earnings.<br />

At CMP of Rs630, the stock is trading at 8.7xFY11E earnings & 1.5xFY11E<br />

Book Value (ROE of 18%).<br />

<br />

Though we believe that the valuations are not demanding at current level on<br />

absolute basis (20-25% expensive on relative basis) but more important to<br />

watch is the competition panning out in Q4FY11 and Q1FY12 especially in the<br />

order inflows and then take a call. We currently have a Hold rating on the stock.<br />

Detailed note to follow.<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) 9mFY10 9mFY11 YoY (%)<br />

Revenue 1,400 1,801 1,193 1,243 1,336 -4.5 7.5 3,554 3,773 6.2<br />

Expenditure -1,117 -1,452 -1,063 -1,118 -1,192 6.7 6.6 -2,910 -3,373 15.9<br />

as % of sales -79.8% -80.6% -89.1% -89.9% -89.2% -81.9% -89.4%<br />

Consumption of RM -1,062 -1,384 -996 -1,045 -1,133 6.7 8.4 -2,648 -3,175 19.9<br />

as % of sales -75.9% -76.8% -83.5% -84.1% -84.8% -74.5% -84.1%<br />

Power and Fuel 0 0 0 0 0 0 0<br />

as % of sales 0 0 0 0 0 0 0<br />

Other Mfg Expenses 0 0 0 0 0 0 0<br />

as % of sales 0 0 0 0 0 0 0<br />

Employee Cost -36 -40 -41 -41 -39 8.1 -4.6 -114 -121 6.1<br />

as % of sales -2.6% -2.2% -3.4% -3.3% -2.9% -3.2% -3.2%<br />

Other expenditure -18 -28 -26 -32 -19 3.6 -40.6 -147 -77 -47.5<br />

as % of sales -1.3% -1.5% -2.2% -2.6% -1.4% -4.1% -2.0%<br />

EBITDA 283 349 130 125 145 -48.8 15.7 644 400 -37.9<br />

Depreciation -20 -20 -18 -16 -18 -9.0 9.6 -40 -52 30.8<br />

EBIT 263 330 112 109 127 -51.8 16.7 604 347 -42.5<br />

Other Income 0 0 0 0 0 0 0<br />

Interest 43 68 44 43 47 8.9 7.6 177 134 -24.3<br />

PBT 306 398 156 152 173 -43.3 14.1 781 481 -38.4<br />

Total Tax -110 -133 -48 -59 -46 -58.5 -22.6 -264 -153 -42.2<br />

Adjusted PAT 196 265 107 93 128 -34.7 37.2 516 328 -36.4<br />

Extra ordinary items 45 0 0 0 0 45 0<br />

Reported PAT 241 265 107 93 128 -46.9 37.2 561 328 -41.5<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 0 0 0 0<br />

PAT after MI 241 265 107 93 128 -46.9 37.2 561 328 -41.5<br />

Reported EPS 23.8 26.1 10.6 9.2 12.6 -46.9 37.2 55.4 32.5 -41.5<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 20.2 19.4 10.9 10.1 10.8 -936 77 18.1 10.6 -752<br />

EBIT 18.8 18.3 9.4 8.7 9.5 -930 75 17.0 9.2 -778<br />

EBT 25.1 22.1 13.0 12.2 13.0 -1208 75 22.0 12.8 -921<br />

PAT 14.0 14.7 9.0 7.5 9.6 -442 207 15.8 8.7 -709<br />

Effective Tax rate 31.3 33.5 31.0 38.7 26.3 -506 -1245 33.9 31.7 -214<br />

Home<br />

<strong>Emkay</strong> Research 15 February, 2011 4

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Research views<br />

Amit Golchha<br />

amit.golchha@emkayglobal.com<br />

+91 22 66242408<br />

Nihag Shah, CFA<br />

nihag.shah@emkayglobal.com<br />

+91 22 6624 2486<br />

GIPCLQ3FY11 Results First Cut<br />

Results ahead of expectations<br />

GIPCL’s Q3FY11 revenues stood at Rs3.1bn up 29.2% yoy ahead of our estimate<br />

of Rs2.6bn might be due to lower under recoveries in the Surat Expansion – Have<br />

to check the billing as of now – is it as per CERC regulations pending GERC<br />

order.<br />

Company reported EBITDA margin of 26.6% up 138bps yoy ahead of our<br />

estimate of 23.5% .The reason is higher Interest and depreciation recovery in<br />

revenues arising from new plant.<br />

PAT stood at Rs244mn down 15% yoy however ahead of our estimate of<br />

Rs146mn. Current quarter PAT includes income tax refund of at least Rs80mn.<br />

GIPCL’s reported EPS of Rs1.6/share. 9mFY11 stands at Rs5.4/share our<br />

forecast for FY11E/FY12E EPS is Rs6.2/share and Rs12.6/share.<br />

We have an “Accumulate” rating on the stock. At CMP of Rs92 the stock is trading<br />

at 1xFY12E book value.<br />

Detail note to follow….<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) 9mFY10 9mFY11 YoY (%)<br />

Revenue 2,383 2,502 2,489 2,120 3,078 29.2 45.2 6,891 7,686 11.5<br />

Expenditure -1,782 -1,921 -1,885 -1,702 -2,259 26.8 32.7 -5,282 -5,846 10.7<br />

as % of sales -74.8% -76.8% -75.7% -80.3% -73.4% -76.7% -76.1%<br />

Consumption of RM -1,548 -1,663 -1,623 -1,297 -1,872 21.0 44.3 -4,446 -4,793 7.8<br />

as % of sales -65.0% -66.5% -65.2% -61.2% -60.8% -64.5% -62.4%<br />

Power and Fuel 0 0 0 0 0 0 0<br />

as % of sales 0 0 0 0 0 0 0<br />

Other Mfg Exenses 0 0 0 0 0 0 0<br />

as % of sales 0 0 0 0 0 0 0<br />

Employee Cost -76 -78 -73 -109 -158 106.4 44.5 -196 -340 73.1<br />

as % of sales -3.2% -3.1% -2.9% -5.1% -5.1% -2.8% -4.4%<br />

Other expenditure -158 -180 -189 -296 -229 45.2 -22.5 -640 -714 11.5<br />

as % of sales -6.6% -7.2% -7.6% -13.9% -7.4% -9.3% -9.3%<br />

EBITDA 601 581 604 418 819 36.3 95.8 1,609 1,841 14.4<br />

Depreciation -219 -216 -215 -273 -388 76.9 42.2 -664 -876 31.9<br />

EBIT 381 365 389 145 431 -24.4 196.5 944 965 2.2<br />

Other Income 5 41 41 30 2 -59.2 -93.4 97 74 -23.9<br />

Interest -35 -33 -41 -119 -267 668.0 124.9 -129 -426 229.1<br />

PBT 352 373 390 57 166 -52.8 191.2 912 613 -32.8<br />

Total Tax -64 -12 29 98 78 -222.2 -20.8 -204 205 -200.1<br />

Adjusted PAT 288 361 419 155 244 -15.4 57.2 707 817 15.6<br />

Extra ordinary items 0 0 0 0 0 0 0<br />

Reported PAT 288 361 419 155 244 -15.4 57.2 707 817 15.6<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 0 0 0 0<br />

PAT after MI 288 361 419 155 244 -15.4 57.2 707 817 15.6<br />

Reported EPS 1.9 2.4 2.8 1.0 1.6 -15.4 57.2 4.7 5.4 15.6<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 25.2 23.2 24.3 19.7 26.6 138 688 23.3 23.9 60<br />

EBIT 16.0 14.6 15.6 6.8 14.0 -202 714 13.7 12.6 -115<br />

EBT 14.8 14.9 15.7 2.7 5.4 -936 271 13.2 8.0 -526<br />

PAT 12.1 14.4 16.8 7.3 7.9 -418 60 10.3 10.6 37<br />

Effective Tax rate 18.1 3.2 -7.4 -171.9 -46.7 -6481 12518 22.4 -33.4 -5580<br />

Home<br />

<strong>Emkay</strong> Research 15 February, 2011 5

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Reliance Power Q3FY11 Results First Cut<br />

Results ahead of expectations<br />

Amit Golchha<br />

amit.golchha@emkayglobal.com<br />

+91 22 66242408<br />

Nihag Shah, CFA<br />

nihag.shah@emkayglobal.com<br />

+91 22 6624 2486<br />

Revenues of Rs2.5bn up 49% qoq – ahead of our estimate of Rs2.1bn.<br />

Company reported EBITDA of Rs617mn up 119% qoq, EBITDA margin of 24.6%<br />

significantly higher than our margin estimate of 16.7% mainly due to higher per<br />

unit realizations.<br />

Other Income for the quarter stood at Rs1bn.<br />

Net profit for the quarter stood at Rs1.4bn up 7.5% yoy but it declined sequentially<br />

by 39% higher than our estimate of Rs982mn led by higher revenue growth,<br />

EBITDA margin expansion and lower depreciation.<br />

The company reported EPS of Rs 0.5/share and for 9mFY11 the EPS stands at<br />

Rs2.0/share and our FY11E/12E EPS is Rs2.2/share and Rs3.2/share.<br />

At CMP of Rs118, stock is trading at 1.9xFY12E Book Value <strong>with</strong> an FY11E-<br />

FY15E average ROE of 12.0%.<br />

We currently have an Accumulate rating on the stock.<br />

Detailed note to follow.<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) 9mFY10 9mFY11 YoY (%)<br />

Revenue 0 0 1,393 1,687 2,512 48.9 0 5,593<br />

Expenditure -267 -759 -2,037 -2,402 -1,895 608.8 -21.1 -743 -6,334 752.8<br />

as % of sales -146.2% -142.4% -75.4% -113.3%<br />

Consumption of RM 0 0 0 0 0 0 0<br />

as % of sales 0.0% 0.0% 0.0% 0.0%<br />

Power and Fuel 0 -221 -736 -997 -1,242 35.5 0 -2,975 -100.0<br />

as % of sales -52.8% -59.1% -49.5% -53.2%<br />

Other Mfg Exenses 0 0 0 0 0 0 0<br />

as % of sales 0 0 0 0<br />

Employee Cost -121 -154 -161 -153 -196 62.0 27.9 -279 -510 83.1<br />

as % of sales -11.5% -9.1% -7.8% -9.1%<br />

Other expenditure -146 -383 -1141 -1252 -457 212.1 -63.5 -464 -2,849 513.9<br />

as % of sales -81.9% -74.2% -18.2% -50.9%<br />

EBITDA -267 -759 -644 -715 617 -330.7 -186.3 -743 -742 -0.1<br />

Depreciation -2 -53 -238 -375 -77 4740.3 -79.3 -4 -690 18545.2<br />

EBIT -269 -812 -881 -1,090 540 587.4 -149.5 -747 -1,432 91.8<br />

Other Income 1792 826 2874 3437 1038 -42.0 -69.8 7,608 7,350 -3.4<br />

Interest 0 -70 -290 -499 -685 37.3 0 -1,474<br />

PBT 1,523 -57 1,703 1,848 893 -41.4 -51.7 6,862 4,444 -35.2<br />

Total Tax -186 760 -485 -497 544 -392.2 -209.4 -947 -438 -53.7<br />

Adjusted PAT 1337 703 1218 1351 1436 7.5 6.3 5915 4006 -32.3<br />

Extra ordinary items 0 0 0 0 0 0 0<br />

Reported PAT 1337 703 1218 1351 1436 7.5 6.3 5915 4006 -32.3<br />

(Profit)/loss from JV's/Ass/MI 0 0 0 0 0 -100.0 0 0<br />

PAT after MI 1337 703 1218 1351 1436 7.5 6.3 5915 4006 -32.3<br />

Reported EPS 0.5 0.3 0.7 0.8 0.5 7.5 -38.8 2.1 2.0 -3.0<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 6.6 16.7 24.6 785 -13.3<br />

EBIT -10.4 -5.5 21.5 2699 -25.6<br />

EBT 175.0 168.7 35.5 -13312 79.5<br />

PAT 140.2 139.2 57.2 -8201 71.6<br />

Effective Tax rate 12.2 -462.4 19.9 17.5 -60.9 -7313 -7838 13.8 9.9 -393<br />

Home<br />

<strong>Emkay</strong> Research 15 February, 2011 6

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Research views<br />

McNally Bharat<br />

Reco CMP TP<br />

Buy 214 418<br />

Consolidated Key <strong>Financial</strong>s<br />

Y/E, Mar (Rs.<br />

mn)<br />

FY10 FY11E FY12E<br />

Revenues 18,028 25,474 31,102<br />

EBITDA 1,478 2,040 2,477<br />

EBITDA Margin<br />

(%)<br />

8.2 8.0 8.0<br />

APAT 521 754 950<br />

EPS (Rs) 16.7 24.3 30.6<br />

PER 12.7 8.8 7.0<br />

Pritesh Chheda, CFA<br />

pritesh.chheda@emkayglobal.com<br />

+91 22 6612 1273<br />

Prerna Jhavar<br />

prerna.jhavar@emkayglobal.com<br />

+91 22 6612 1337<br />

McNally Bharat Q3FY11 Results – First Cut<br />

Standalone net profit above estimates, But subsidiaries disappoint<br />

Standalone Revenues grew 14% yoy to Rs3.8 bn below expectation of Rs4.3<br />

bn<br />

EBITDA margins declined 40 bps yoy to 6.5% marginally ahead estimates of<br />

6.4%<br />

Led by lower revenue growth, EBITDA growth was subdued at 7.5% yoy to Rs247<br />

mn below estimate of Rs272 mn<br />

However, APAT growth at 54% yoy to Rs113 mn was ahead estimates of Rs83<br />

mn – led by high other income (up 322% yoy to Rs53 mn)<br />

McNally Sayaji (MSE) – Revenues grew 9% yoy to Rs742 mn, EBITDA margins<br />

declined 280 bps yoy to 16.8% and net profits increased 20% yoy to Rs73 mn –<br />

Below estimates.<br />

The CMT business (coal & mineral beneficiation technology), Germany –<br />

Revenues declined 67% qoq (on a high base) to Rs365 mn while PBT stood at<br />

Rs21 mn (-83% qoq) – below estimates<br />

MBE (group) witnessed order inflows worth Rs3.5 bn (-64% yoy). The group order<br />

book increased 16% yoy to Rs43.7 bn. MBE is L1 in orders worth Rs4.7 bn.<br />

MBE has also revised its consolidated guidance down<br />

In Q2FY11 press release<br />

In Q3FY11 press release<br />

Revenue Rs25 bn Rs23.5 bn<br />

EBITDA margin 9% 8-9%<br />

We were always at the lower end of consensus estimates and had factored<br />

conservative EBITDA margin assumptions – hence post above revision in guidance,<br />

our earnings downgrade will be limited to 3-5% only. We currently have consolidated<br />

earnings of Rs24.3 and Rs30.6 per share for FY11E and FY12E respectively. We<br />

continue to maintain a positive bias towards MBE and retain our BUY rating<br />

<strong>Emkay</strong> Research 15 February, 2011 7

<strong>9am</strong> <strong>with</strong> <strong>Emkay</strong><br />

Research views<br />

McNally Bharat Q3FY11 Results – First Cut (Cont’d…)<br />

Quarterly <strong>Financial</strong>s<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) YTD’11 YTD’10 Gr (%)<br />

Revenue 3,325 5,624 2,839 4,018 3,788 13.9 -5.7 10,645 8,907 19.5<br />

Expenditure 3,095 5,216 2,683 3,799 3,541 14.4 -6.8 10,023 8,294 20.9<br />

Consumption of RM 2,238 3,345 1,411 2,245 1,810 -19.1 -19.4 5,467 5,724 -4.5<br />

as % of sales 67.3 59.5 49.7 55.9 47.8 51.4 64.3<br />

Job Work Outsourcing Exps 571 1,171 680 759 721 26.2 -5.1 2,160 1,558 38.6<br />

as % of sales 17.2 20.8 24.0 18.9 19.0 20.3 17.5<br />

Employee Cost 194 205 246 314 326 67.8 3.8 885 506 74.9<br />

as % of sales 5.8 3.6 8.7 7.8 8.6 8.3 5.7<br />

Other expenditure 93 495 346 481 684 636.5 42.2 1,511 506 198.6<br />

as % of sales 2.8 8.8 12.2 12.0 18.1 14.2 5.7<br />

EBITDA 230 408 156 219 247 7.5 12.9 622 614 1.3<br />

Depreciation 13 15 18 21 22 68.8 3.8 60 27 120.1<br />

EBIT 217 394 138 198 225 3.9 13.9 561 586 -4.2<br />

Other Income 13 13 15 35 53 321.6 49.7 103 18 461.7<br />

Interest 136 69 60 87 106 -22.1 22.4 253 327 -22.8<br />

PBT 93 337 93 146 172 84.5 17.5 412 277 48.4<br />

Total Tax 24 122 32 50 59 149.4 17.7 140 66 111.2<br />

Adjusted PAT 70 215 62 97 113 62.7 17.4 272 211 28.7<br />

Extra ordinary items 4 10 0 0 0 -100.0 NA 0 -48 -100.0<br />

Reported PAT 74 224 62 97 113 53.5 17.4 272 163 66.6<br />

Adjusted EPS 2.2 6.9 2.0 3.1 3.6 62.7 17.4 8.7 6.8 28.7<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 6.9 7.3 5.5 5.4 6.5 -40 110 5.8 6.9 360<br />

EBIT 6.5 7.0 4.9 4.9 6.0 -60 100 5.3 6.6 420<br />

PBT 2.8 6.0 3.3 3.6 4.5 170 90 3.9 3.1 340<br />

PAT 2.1 3.8 2.2 2.4 3.0 90 60 2.6 2.4 180<br />

Effective Tax rate 25.2 36.3 33.9 34.0 34.1 890 10 34.0 23.9 610<br />

McNally Sayaji<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11<br />

Revenues 683 1,246 522 620 742<br />

Growth (yoy) 57.8% 66.4% 17% -10% 9%<br />

EBITDA 134 196 72 100 125<br />

Growth (yoy) 39.5% 47.9% -17% -15% -7%<br />

EBITDA Margin (%) 19.6% 15.7% 13.9% 16.1% 16.8%<br />

PAT 61 107 15 52 73<br />

Growth (yoy) 35.3% 44.7% -66% -24% 20%<br />

CMT Business, Germany<br />

Rs mn Q1FY11 Q2FY11 Q3FY11<br />

Revenues 760 1,112 365<br />

Growth (qoq) 46% -67%<br />

EBITDA 30 152 3<br />

Growth (qoq) 407% -98%<br />

EBITDA Margin (%) 3.9% 13.7% 0.9%<br />

PBT 24 126 21<br />

Growth (qoq) 425% -83%<br />

Home<br />

<strong>Emkay</strong> Research 15 February, 2011 8

February 14, 2011<br />

Arjun G Nagarajan<br />

Arjun.Nagarajan@emkayglobal.com<br />

+91 22 6624 2494<br />

Kashyap Jhaveri<br />

kashyap.jhaveri@emkayglobal.com<br />

+91 22 6612 1249<br />

<strong>Emkay</strong>nomics<br />

Fortnightly round up of key banking and economic indicators<br />

¾ The growth in non food credit has moved down marginally to<br />

23.1% for the week ended January 28, 2011 as growth in<br />

deposit mobilisation dropped to 16%<br />

¾ The CD ratio has marginally inched down to 75% for the week<br />

ended January 28, 2010 <strong>with</strong> TTM CD ratio moving up to<br />

103%. The incr. CD ratio has moderated to 100%<br />

¾ Money supply growth has eased to 16.9% and the money<br />

multiplier stood up at 5x<br />

Economy<br />

¾ Call money rates have risen to 6.58% as on February 11, 2011<br />

from 6.39% last fortnight<br />

¾ The shortage of liquidity in the system moved up and stood at<br />

Rs291.1bn. The net repo balances stood at ~ Rs561bn for the<br />

week ended February 04, 2011<br />

¾ The spread between the long and short end OIS has risen<br />

marginally to 43bps as opposed to 41 bps last fortnight<br />

Econometer<br />

Dec-10 Sep-10 Jun-10 Mar-10 Dec-09 Sep-09 Jun-09 Mar-09<br />

GDP# (% yoy chg) NA 8.89 8.88 8.57 6.53 8.68 6.33 5.76<br />

IIP (% yoy chg) 1.60 4.90 7.17 15.55 17.95 8.22 8.61 0.52<br />

Trade Balance (US$ bn) (21.30) (35.08) (32.27) (27.15) (28.63) (22.14) (15.50) (15.05)<br />

Current account balance (US$ bn) NA (15.80) (12.10) (13.00) (12.03) (12.60) (5.80) 4.70<br />

Fiscal balance (US$ bn) (8.41) (20.23) (8.63) (22.49) (24.06) (15.18) (25.54) (23.24)<br />

Inflation (%) 8.43 8.93 10.28 9.45 4.50 -0.62 0.48 3.05<br />

10-year bond yield (%) 7.92 7.85 7.55 7.83 7.14 7.14 6.60 7.01<br />

INR/$ (avg) 45.16 46.01 46.57 45.50 46.63 48.41 48.67 49.76<br />

INR/$ (quarter end) 44.86 44.93 45.63 45.14 46.20 47.98 47.87 50.95<br />

# Base: 2004-2005<br />

<strong>Emkay</strong> <strong>Global</strong> <strong>Financial</strong> <strong>Services</strong> <strong>Ltd</strong> 1

<strong>Emkay</strong>nomics Economy<br />

Non food credit<br />

Deposits<br />

38.0<br />

28.0<br />

52.0<br />

19.0<br />

36.0<br />

34.0<br />

24.0<br />

50.0<br />

48.0<br />

17.0<br />

32.0<br />

20.0<br />

46.0<br />

30.0<br />

44.0<br />

15.0<br />

28.0<br />

16.0<br />

42.0<br />

26.0<br />

15-Jan-10<br />

26-Feb-10<br />

9-Apr-10<br />

21-May-10<br />

2-Jul-10<br />

13-Aug-10<br />

24-Sep-10<br />

5-Nov-10<br />

17-Dec-10<br />

28-Jan-11<br />

12.0<br />

40.0<br />

15-Jan-10<br />

26-Feb-10<br />

9-Apr-10<br />

21-May-10<br />

2-Jul-10<br />

13-Aug-10<br />

24-Sep-10<br />

5-Nov-10<br />

17-Dec-10<br />

28-Jan-11<br />

13.0<br />

Rs tn (LHS)<br />

% yoy chg (RHS)<br />

Rs tn (LHS)<br />

% yoy chg (RHS)<br />

• The growth in non food credit has marginally moved down to<br />

23.1% for the week ended January 28, 2011 from 23.2%<br />

last fortnight.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

• The growth in deposit mobilization has dropped to 16% from<br />

16.6% last fortnight.<br />

ource: RBI, <strong>Emkay</strong> Research<br />

CD Ratio (%) TTM CD Ratio (%)<br />

77.0<br />

115<br />

76.0<br />

105<br />

75.0<br />

74.0<br />

73.0<br />

72.0<br />

71.0<br />

70.0<br />

69.0<br />

95<br />

85<br />

75<br />

65<br />

55<br />

45<br />

68.0<br />

35<br />

29-Jan-10<br />

26-Feb-10<br />

26-Mar-10<br />

23-Apr-10<br />

21-May-10<br />

18-Jun-10<br />

16-Jul-10<br />

13-Aug-10<br />

10-Sep-10<br />

8-Oct-10<br />

5-Nov-10<br />

3-Dec-10<br />

31-Dec-10<br />

28-Jan-11<br />

29-Jan-10<br />

26-Feb-10<br />

26-Mar-10<br />

23-Apr-10<br />

21-May-10<br />

18-Jun-10<br />

16-Jul-10<br />

13-Aug-10<br />

10-Sep-10<br />

8-Oct-10<br />

5-Nov-10<br />

3-Dec-10<br />

31-Dec-10<br />

28-Jan-11<br />

• Consequently the CD ratio has marginally inched down to<br />

75% for the week ended January 28, 2011.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

CASA as % of total<br />

• The TTM CD ratio has moved past 100% to 103% for the week<br />

ended January 28, 2011. The incremental CD ratio has<br />

dropped to 100% from 105% last fortnight.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

SLR as % of NDTL<br />

14.0<br />

%<br />

33.0<br />

13.5<br />

32.0<br />

13.0<br />

12.5<br />

12.0<br />

11.5<br />

31.0<br />

30.0<br />

29.0<br />

11.0<br />

15-Jan-10<br />

26-Feb-10<br />

9-Apr-10<br />

21-May-10<br />

2-Jul-10<br />

13-Aug-10<br />

24-Sep-10<br />

5-Nov-10<br />

17-Dec-10<br />

28-Jan-11<br />

28.0<br />

15-Jan-10<br />

26-Feb-10<br />

9-Apr-10<br />

21-May-10<br />

2-Jul-10<br />

13-Aug-10<br />

24-Sep-10<br />

5-Nov-10<br />

17-Dec-10<br />

28-Jan-11<br />

• The demand deposits stood at 11.8% of the total deposits<br />

for week ended January 28, up from 11.6% last fortnight.<br />

• SLR ratio inched up and stood at 29.3% for the week ended<br />

January 28, 2011.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

Source: RBI, <strong>Emkay</strong> Research<br />

<strong>Emkay</strong> Research 14 February 2011 2

<strong>Emkay</strong>nomics Economy<br />

Inflation (%) Government bond yields (%)<br />

12.0<br />

%<br />

8.5<br />

10.0<br />

7.5<br />

8.0<br />

6.5<br />

6.0<br />

4.0<br />

2.0<br />

5.5<br />

4.5<br />

0.0<br />

Dec-09<br />

Jan-10<br />

Feb-10<br />

Mar-10<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

All commodities Mfg Articles Ex-Food<br />

3.5<br />

12-Feb-10<br />

12-Mar-10<br />

9-Apr-10<br />

7-May-10<br />

10-yr<br />

4-Jun-10<br />

2-Jul-10<br />

30-Jul-10<br />

27-Aug-10<br />

24-Sep-10<br />

22-Oct-10<br />

19-Nov-10<br />

1-yr<br />

17-Dec-10<br />

14-Jan-11<br />

11-Feb-11<br />

• Inflation has jumped up sharply 8.4% in December 2010 from<br />

7.5% in November. This move is mainly due to an increase in<br />

food inflation.<br />

• The 10-year bond yields as on February 11, 2011, remain<br />

relatively unchanged from last fortnight at 8.13%.<br />

M3<br />

Source: RBI, <strong>Emkay</strong> Research<br />

Source: RBI, <strong>Emkay</strong> Research<br />

Money multiplier (x)<br />

64.0<br />

22.0<br />

5.4<br />

62.0<br />

21.0<br />

60.0<br />

58.0<br />

56.0<br />

20.0<br />

19.0<br />

18.0<br />

17.0<br />

5.2<br />

54.0<br />

16.0<br />

5.0<br />

52.0<br />

15.0<br />

50.0<br />

29-Jan-10<br />

26-Feb-10<br />

26-Mar-10<br />

23-Apr-10<br />

21-May-10<br />

Rs tn (LHS)<br />

18-Jun-10<br />

16-Jul-10<br />

13-Aug-10<br />

10-Sep-10<br />

8-Oct-10<br />

5-Nov-10<br />

3-Dec-10<br />

31-Dec-10<br />

% yoy chg (RHS)<br />

28-Jan-11<br />

14.0<br />

4.8<br />

29-Jan-10<br />

26-Feb-10<br />

26-Mar-10<br />

23-Apr-10<br />

21-May-10<br />

18-Jun-10<br />

16-Jul-10<br />

13-Aug-10<br />

10-Sep-10<br />

8-Oct-10<br />

5-Nov-10<br />

3-Dec-10<br />

31-Dec-10<br />

28-Jan-11<br />

• M3 growth has eased to 16.9% for the week ended January<br />

28, 2011.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

• The money multiplier inched up to 5 from 4.93 last fortnight.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

Excess liquidity (Rs bn) Call money borrowing rate (%)<br />

1,500.0<br />

1,000.0<br />

500.0<br />

0.0<br />

8.0<br />

6.0<br />

%<br />

-500.0<br />

-1,000.0<br />

4.0<br />

-1,500.0<br />

5-Feb-10<br />

26-Feb-10<br />

19-Mar-10<br />

16-Apr-10<br />

7-May-10<br />

28-May-10<br />

18-Jun-10<br />

9-Jul-10<br />

30-Jul-10<br />

20-Aug-10<br />

10-Sep-10<br />

1-Oct-10<br />

22-Oct-10<br />

12-Nov-10<br />

3-Dec-10<br />

24-Dec-10<br />

14-Jan-11<br />

4-Feb-11<br />

2.0<br />

12-Feb-10<br />

12-Mar-10<br />

9-Apr-10<br />

7-May-10<br />

4-Jun-10<br />

2-Jul-10<br />

30-Jul-10<br />

27-Aug-10<br />

24-Sep-10<br />

22-Oct-10<br />

19-Nov-10<br />

17-Dec-10<br />

14-Jan-11<br />

11-Feb-11<br />

MSS LAF Govt balance<br />

Repo Reverse repo Call money<br />

• The net shortage of liquidity in the system stood at<br />

Rs291.1bn. The net repo balances stood at Rs 561bn. for the<br />

week ended February 04, 2011.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

• The call money rates have risen to 6.58% compared to<br />

6.39% last fortnight<br />

• The spread between call money and repo rates as on<br />

February 11, 2011 stood at 8bps, as the rates are still<br />

marginally above the LAF corridor.<br />

Source: RBI, <strong>Emkay</strong> Research<br />

<strong>Emkay</strong> Research 14 February 2011 3

<strong>Emkay</strong>nomics Economy<br />

10-year AAA corporate bond yield<br />

3 year – 3 month swap spread<br />

9.3<br />

9.2<br />

9.1<br />

9.0<br />

8.9<br />

8.8<br />

8.7<br />

8.6<br />

8.5<br />

12-Feb-10<br />

%<br />

12-Mar-10<br />

9-Apr-10<br />

7-May-10<br />

4-Jun-10<br />

2-Jul-10<br />

30-Jul-10<br />

27-Aug-10<br />

24-Sep-10<br />

22-Oct-10<br />

19-Nov-10<br />

17-Dec-10<br />

bps<br />

14-Jan-11<br />

11-Feb-11<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

300<br />

200<br />

100<br />

0<br />

-100<br />

-200<br />

-300<br />

Feb-06<br />

May-06<br />

Aug-06<br />

Dec-06<br />

Mar-07<br />

Jun-07<br />

Oct-07<br />

Jan-08<br />

Apr-08<br />

Jul-08<br />

Nov-08<br />

Feb-09<br />

May-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Jul-10<br />

Oct-10<br />

Jan-11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

AAA corp bond yield<br />

Spread over 10yr Gsec<br />

3yr-3m swap (bps-LHS) Repo (%-RHS) Rev repo (%-RHS)<br />

• The spread between the yield on 10-year AAA corporate<br />

bonds and similar tenure G-Sec, have increased to 108bps as<br />

on February 11, 2011.<br />

Source: Bloomberg, <strong>Emkay</strong> Research<br />

• The spread between the long and short end OIS have risen<br />

to marginally to 46bps as opposed to 42bps last fortnight.<br />

Source: Bloomberg, <strong>Emkay</strong> Research<br />

Government auction calendar<br />

Period of auction<br />

January 31-February 4, 2011<br />

Amount (Rs bn)<br />

100<br />

Term of the Security<br />

i) 5-9 Years for Rs. 3,000-4,000 cr.<br />

ii) 10-14 Years for Rs. 4,000-5,000 cr.<br />

February 7-11, 2011 100<br />

iii) 20 Years & Above for Rs. 2,000-3,000 cr.<br />

i) 5-9 Years for Rs. 3,000-4,000 cr.<br />

ii) 10-14 Years for Rs. 4,000-5,000 cr.<br />

iii) 15-19 Years for Rs. 2,000-3,000 cr.<br />

Total 200<br />

Source: RBI<br />

<strong>Emkay</strong> Research 14 February 2011 www.emkayglobal.com 4

February 14, 2011<br />

Reco<br />

Hold<br />

CMP<br />

Rs117<br />

Previous Reco<br />

Hold<br />

Target Price<br />

Rs118<br />

EPS change FY11E/12E (%) -25 / -38<br />

Target Price change (%) -38<br />

Nifty 5,310<br />

Sensex 17,729<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute (19) (33) (43) (43)<br />

Rel. to Nifty (10) (22) (42) (49)<br />

Source: Bloomberg<br />

Relative Price Chart<br />

250<br />

220<br />

190<br />

160<br />

130<br />

Rs<br />

%<br />

10<br />

-4<br />

-18<br />

-32<br />

-46<br />

Dishman Pharma<br />

Another quarter of dismal performance<br />

• Q3FY11 was significantly below our expectations <strong>with</strong><br />

a) Revenues at Rs2.38bn (est. Rs2.32bn), EBIDTA at Rs315mn<br />

(est. Rs488mn) and APAT at Rs17mn (est. Rs203mn)<br />

• Profitability was largely impacted because of continued<br />

underperformance in Indian CRAMS, poor show at Carbogen<br />

Amcis (CA) and high material cost in Marketable Molecules<br />

• Delay in commencement of new European order in CRAMS,<br />

major restructuring required at CA and postponement of<br />

commercialization of HIPO & China facility are key concerns<br />

¾ Poor 9MFY11, lack of base business visibility & delay in new<br />

contracts ramp-up leads to earnings downgrade by 28%/35%<br />

for FY11E/FY12E; revise target to Rs117; retain Hold<br />

Results disappoint once again; CA gets into restructuring mode<br />

Dishman’s Q3FY11 revenue (incl. operating income) at Rs2.38bn (est. of Rs2.32bn; up<br />

by 7% YoY) and APAT at Rs17mn (est. of Rs203mn; down by 93% YoY) was way<br />

below our expectations. The lower than expected performance was on account of a)<br />

subdued performance in the Indian CRAMS segment, delay in commencement of new<br />

European contract b) poor show at Carbogen Amcis, led by internal problems and c)<br />

high raw material cost in the Marketable Molecules (MM) business.<br />

Result Update<br />

100<br />

Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10<br />

Source: Bloomberg<br />

Stock Details<br />

Sector<br />

Bloomberg<br />

Dishman Pharma (LHS) Rel to Nifty (RHS)<br />

-60<br />

Pharmaceuticals<br />

DISH@IN<br />

Equity Capital (Rs mn) 161<br />

Face Value(Rs) 2<br />

No of shares o/s (mn) 81<br />

52 Week H/L 235/108<br />

Market Cap (Rs bn/USD mn) 9/197<br />

Daily Avg Volume (No of sh) 198339<br />

Daily Avg Turnover (US$mn) 0.6<br />

Shareholding Pattern (%)<br />

D’10 S’10 J’10<br />

Promoters 60.9 60.9 60.9<br />

FII/NRI 9.2 9.7 9.1<br />

Institutions 9.3 11.1 12.5<br />

Private Corp 14.0 13.3 13.0<br />

Public 6.5 5.1 4.6<br />

Source: Capitaline<br />

Deepak Malik<br />

deepak.malik@emkayglobal.com<br />

+91 22 6612 1257<br />

Ashish Thavkar<br />

ashish.thavkar@emkayglobal.com<br />

+91 22 6612 1254<br />

Rashmi Sancheti<br />

rashmi.sancheti@emkayglobal.com<br />

+91 22 6612 1238<br />

Going ahead, management has guided for a recovery in the business from FY12E<br />

onwards on the back of a) commencement of operations at China facility, b) execution<br />

of order worth US$25-30mn in FY12 for a European customer, c) commencement of<br />

HIPO facility, and d) new contract signed <strong>with</strong> an MNC pharma player (has already<br />

signed master supply agreements in CRAMS business). However, we are of the view<br />

that, recovery in base business will be gradual and ramp-up from new contracts to be<br />

slower than anticipated. In lieu of major restructuring at CA, we expect revenues from<br />

CA to be flat in FY11E and expect recovery post FY12E. The MM segment continues to<br />

do well for Dishman <strong>with</strong> 19% YoY and 42% QoQ growth in revenues. However, higher<br />

raw material cost dented profitability in the MM segment. On the back of delay in<br />

commencement of new CRAMS contract, major restructuring required at CA and<br />

postponement of commercialization of HIPO & China facility, we tone down our<br />

FY11E/12E sales estimates by 4% and 6% for FY11E/12E respectively.<br />

Segment wise revenue break-up<br />

Rs mn<br />

Q3FY11 Q3FY10 Q2FY11 YoY % QoQ %<br />

CRAMS 1504.4 1607.0 1608.1 -6.4 -6.4<br />

Solvay and Other MNC 748.7 937.5 656.4 -20.1 14.1<br />

CA 755.7 669.5 951.7 12.9 -20.6<br />

MM 735.8 615.8 519.9 19.5 41.5<br />

MM (Quats) 361.0 327.1 272.7 10.4 32.4<br />

Vit-D 374.8 288.7 247.2 29.8 51.6<br />

Total Sales 2240.2 2222.8 2128.0 0.8 5.3<br />

<strong>Financial</strong>s<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Rs mn<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY09 10,625 3,328 31.3 1,469 18.1 20.7 23.3 6.5 6.4 1.3<br />

FY10 9,154 2,038 22.3 983 12.1 (33.1) 16.0 9.7 8.4 1.2<br />

FY11E 8,925 1,500 16.8 625 7.7 (36.4) 4.1 15.2 12.3 1.1<br />

FY12E 10,162 1,829 18.0 740 9.1 18.4 8.7 12.9 10.0 1.1<br />

<strong>Emkay</strong> <strong>Global</strong> <strong>Financial</strong> <strong>Services</strong> <strong>Ltd</strong> 1

Dishman Pharma Result Update<br />

Quarterly financials<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11A Q3FY11A YoY (%) QoQ (%) YTD'11 YTD'10 YoY (%)<br />

Revenue 2,223 2,480 2,018 2,128 2,379 7.0 11.8 6,525 6,674 (2.2)<br />

Expenditure 1,710 1,984 1,574 1,759 2,064 20.7 17.4 5,397 5,132 5.2<br />

as % of sales 76.9 80.0 78.0 82.6 86.8 82.7 76.9<br />

Consumption of RM 590 1,017 559 597 838 41.9 40.4 1,993 1,750 13.9<br />

as % of sales 26.6 41.0 27.7 28.0 35.2 30.6 26.2<br />

Employee Cost 677 450 631 693 728 7.7 5.1 2,053 2,091 (1.8)<br />

as % of sales 30.4 18.1 31.3 32.6 30.6 31.5 31.3<br />

Other expenditure 443 517 384 469 498 12.4 6.2 1,350 1,290 4.6<br />

as % of sales 19.9 20.9 19.0 22.0 20.9 20.7 19.3<br />

AEBITDA 513 496 444 369 315 (38.6) (14.8) 1,128 1,543 (26.9)<br />

EBITDA (incl. forex impact) 444 369 315 (14.8) 1,128 0<br />

Depreciation 141 135 161 168 171 21.5 1.7 500 459 8.9<br />

EBIT 372 361 282 201 144 (61.4) (28.5) 628 1,083 (42.1)<br />

Other Income 13 (6) 3 (7) - (100.0) (100.0) (4) 20 (119.0)<br />

Interest 85 100 82 95 133 56.4 39.7 311 288 8.1<br />

PBT 300 255 203 99 10 (96.5) (89.4) 313 816 (61.6)<br />

Total Tax (6) 74 34 14 (7) 10.3 (60.2) 41 75 (46.2)<br />

Adjusted PAT 314 181 169 85 (33) (110.7) (139.1) 221 748 (70.4)<br />

(Profit)/loss from JV's/Ass/MI 60.2 0 0 0 0 60.2<br />

APAT after MI 253 181 169 85 (33) (113.2) (139.1) 221 688 (67.8)<br />

Extra ordinary items 77 30 101 198 51 (34.3) (74.2) 349 276 26.6<br />

Reported PAT 331 211 270 283 17 (94.7) (93.8) 570 963 (40.8)<br />

EPS 4.1 2.7 3.4 3.5 0.2 (94.7) (93.8) 7.1 11.9 (40.7)<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 23.1 20.0 22.0 17.4 13.2 -984 -413 17.3 23.1 (583)<br />

EBIT 16.8 14.6 14.0 9.5 6.0 -1070 -341 9.6 16.2 (661)<br />

EBT 13.5 10.3 10.1 4.7 0.4 -1306 -421 4.8 12.2 (743)<br />

PAT 11.4 7.3 8.4 4.0 (1.4) -1281 -542 3.4 10.3 (691)<br />

Effective Tax rate (2.1) 29.1 16.7 13.7 (66.8) -6464 -8045 13.0 9.3 373<br />

EBIDTA margins crash 984bps to 13.2% (lowest in Dishman’s history)<br />

EBITDA margins for the quarter contracted 984bps to 13.2% on account of a) 500bps<br />

contraction in gross margins, led by higher raw material cost (up 42% YoY/ 40% QoQ; led<br />

by 30-40% increase in solvent prices and 20-25% increase in other key inputs). b) Increase<br />

in other expenditures (up 100bps YoY, led by increase in contract research expenses for<br />

which revenues will be recognized in future) and c) staff cost (up 20bps YoY), further<br />

eroded the margins. We expect EBITDA margins to be around 16-18% levels, until there is<br />

an up-tick in the base business and commencement of new contracts.<br />

PAT at Rs17mn led by overall deterioration in business<br />

PAT registered a decline of 93% to Rs17mn on account of overall deterioration in the<br />

business and increase in interest cost by 56% (led by increase in debt) The EPS for the<br />

quarter and 9MFY11 stood at Rs0.2 (against our expectation of Rs2.5) and Rs7.1<br />

respectively.<br />

<strong>Emkay</strong> Research 14 February 2011 2

Dishman Pharma Result Update<br />

Lack of visibility in base business pick-up and delay in ramp-up from new<br />

contracts; downgrade earnings and target price<br />

We lower our FY11/12E earning estimates by 28%/35% respectively due to lack of<br />

momentum in base business and delay in ramp-up from new contracts. We believe<br />

Dishman’s under-performance (49% relative to Nifty) to continue for some more time until<br />

clarity emerges in CRAMS business. Against the management’s expectation of a recovery<br />

in Q1FY12, we believe that a meaningful recovery may get delayed to H2FY12E. Among<br />

the key notables, a) revenues at Carbogen Amcis may decline next year due to<br />

restructuring, b) delay in ramp-up from newly signed contracts, and c) lower than expected<br />

utilizations at the China and HIPO facility, weigh negatively on the company. In lieu of<br />

continued subdued performance, we downgrade our full year earning estimates by<br />

28%/35% for FY11E/12E. Our revised EPS estimates now stands at Rs7.7 (earlier Rs10.7)<br />

for FY11E and Rs9.1 (earlier Rs13.9) for FY12E. Owing to earnings downgrade, we cut our<br />

target price from Rs181 to Rs118. At 13x FY12E earnings, we retain our Hold rating on the<br />

stock.<br />

Dishman Pharma continues to disappoint on revenues and earnings front (13 th consecutive<br />

quarter of under-performance). Though we believe that operating environment in the<br />

CRAMS space is going to ease out going forward, we do not foresee immediate triggers for<br />

Dishman to get re-rated. The management has guided revenue growth to be flat in FY11E<br />

(from 10% growth guidance in last quarter) and 15% growth in standalone business in<br />

FY12E.<br />

Revision of estimates<br />

Rs mn. Old Estimates Revised Estimates % change in estimates<br />

FY11E FY12E FY11E FY12E FY11E FY12E<br />

Revenues 9341 10854 8925 10162 -4.5 -6.4<br />

EBITDA 1915 2366 1500 1829 -21.7 -22.7<br />

Net Profit 867 1127 625 740 -28.2 -34.6<br />

EPS 10.7 13.9 7.7 9.1 -28.2 -34.6<br />

Target Price (Rs) 181 118 -34.6<br />

Rating Hold Hold<br />

Key upside risk to our call<br />

• Positive outcome on the drug Brilinta would trigger supplies of intermediates to<br />

AstraZeneca (peak potential of US$50mn for Dishman)<br />

• Earlier than expected ramp-up in supplies to US clients may lead to incremental revenue<br />

contribution in early FY12E from the HIPO facility in Bavla<br />

<strong>Emkay</strong> Research 14 February 2011 3

Dishman Pharma Result Update<br />

<strong>Financial</strong>s<br />

Income Statement<br />

Balance Sheet<br />

Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E<br />

Net Sales 10,625 9,154 8,925 10,162 Equity share capital 161 161 161 161<br />

Growth (%) 32.3 -13.8 -2.5 13.9 Reserves & surplus 6,981 7,619 8,101 8,698<br />

Expenditure 7,297 7,116 7,425 8,333 Net worth 7,143 7,780 8,262 8,860<br />

Raw Materials 3,242 2,768 2,905 3,150 Minority Interest 0 63 63 63<br />

SGA 1,146 1,808 1,794 2,642 Secured Loans 6,643 7,169 7,969 7,769<br />

Employee Cost 2,730 2,541 2,725 2,541 Unsecured Loans 594 571 1,071 1,171<br />

Other Exp 179 0 0 0 Loan Funds 7,237 7,739 9,039 8,939<br />

EBITDA 3,328 2,038 1,500 1,829 Net deferred tax liability 208 316 316 316<br />

Growth (%) 70.9 -22.1 -26.4 22.0 Total Liabilities 14,588 15,898 17,681 18,178<br />

EBITDA margin (%) 31.3 22.3 16.8 18.0<br />

Depreciation 629 594 709 719 Gross Block 9,733 10,910 17,485 18,485<br />

EBIT 2,699 1,444 791 1,110 Less: Depreciation 1,953 2,481 3,189 3,909<br />

EBIT margin (%) 25.4 15.8 8.9 10.9 Net block 7,781 8,429 14,295 14,576<br />

Other Income 48 13 -8 50 Capital work in progress 2,227 3,574 0 0<br />

Interest expenses 459 388 410 328 Investment 14 14 14 14<br />

PBT 1,576 1,326 672 831 Current Assets 6,850 5,880 5,841 6,399<br />

Tax 107 150 47 91 Inventories 3,040 2,423 2,380 2,795<br />

Effective tax rate (%) 6.8 11.3 7.0 11.0 Sundry debtors 1,494 1,131 1,487 1,694<br />

Adjusted PAT 1,463 983 625 740 Cash & bank balance 452 455 634 387<br />

(Profit)/loss from JV's/Ass/MI -5 0 0 0 Loans & advances 1,865 1,871 1,339 1,524<br />

Adjusted PAT after MI 1,469 983 625 740 Other current assets 0 0 0 0<br />

Growth (%) 20.7 -33.1 -36.4 18.4 Current liab & Prov 2,284 2,000 2,469 2,811<br />

Net Margin (%) 13.8 10.7 7.0 7.3 Current liabilities 1,588 1,617 1,934 2,202<br />

E/O items 0 256 298 0 Provisions 696 382 535 610<br />

Reported PAT 1,469 1,239 625 740 Net current assets 4,566 3,880 3,371 3,588<br />

Growth (%) 20.7 -15.7 -49.5 18.4 Total Assets 14,588 15,898 17,681 18,178<br />

Cash Flow<br />

Key Ratios<br />

Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E Y/E, Mar FY09 FY10 FY11E FY12E<br />

PBT (Ex-Other income) 1,528 1,313 680 781 Profitability (%)<br />

Depreciation 629 594 709 719 EBITDA Margin 31.3 22.3 16.8 18.0<br />

Interest Provided 459 388 410 328 Net Margin 13.8 10.7 7.0 7.3<br />

Other Non-Cash items 0 0 0 0 ROCE 14.3 9.2 4.6 6.0<br />

Chg in working cap -651 562 815 -464 ROE 23.3 16.0 4.1 8.7<br />

Tax paid -107 -35 -47 -91 RoIC 14.5 8.8 4.6 5.8<br />

Operating Cashflow 1,858 2,822 2,566 1,274 Per Share Data (Rs)<br />

Capital expenditure -2,394 -1,771 -3,000 -1,000 EPS 18.1 12.1 7.7 9.1<br />

Free Cash Flow -535 1,051 -434 274 CEPS 25.8 16.2 12.7 17.9<br />

Other income 48 13 -8 50 BVPS 87.8 98.0 102.4 109.7<br />

Investments -1 0 0 0 DPS 1.2 1.5 1.5 1.5<br />

Investing Cashflow -2,347 -1,758 -3,008 -950 Valuations (x)<br />

Equity Capital Raised 373 -190 0 0 PER 6.5 9.7 15.2 12.9<br />

Loans Taken / (Repaid) 937 503 1,300 -100 P/CEPS 4.5 7.2 9.2 6.5<br />

Interest Paid -459 -388 -410 -328 P/BV 1.3 1.2 1.1 1.1<br />

Dividend paid (incl tax) -114 -113 -143 -143 EV / Sales 1.6 1.9 2.1 1.8<br />

Income from investments 0 0 0 0 EV / EBITDA 6.4 8.4 12.3 10.0<br />

Others -167 -873 -126 0 Dividend Yield (%) 1.0 1.3 1.1 1.0<br />

Financing Cashflow 570 -1,061 621 -571 Gearing Ratio (x)<br />

Net chg in cash 81 3 180 -248 Net Debt/ Equity 0.9 0.9 1.0 0.9<br />

Opening cash position 371 452 455 634 Net Debt/EBIDTA 2.5 3.5 5.5 4.6<br />

Closing cash position 452 455 634 387 Working Cap Cycle (days) 165 152 134 137<br />

<strong>Emkay</strong> Research 14 February 2011 4

February 14, 2011<br />

Reco<br />

Buy<br />

CMP<br />

Rs. 340<br />

EPS change FY11E/12E (%)<br />

Previous Reco<br />

Buy<br />

Target Price<br />

Rs. 444<br />

NA<br />

Target Price change (%) -14<br />

Nifty 5,310<br />

Sensex 17,729<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute (11) (25) (30) (2)<br />

Rel. to Nifty (2) (13) (28) (11)<br />

Source: Bloomberg<br />

Relative Price Chart<br />

550<br />

490<br />

430<br />

370<br />

310<br />

250<br />

Rs<br />

Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10<br />

Source: Bloomberg<br />

Stock Details<br />

Sector<br />

Bloomberg<br />

HPCL (LHS) Rel to Nifty (RHS)<br />

%<br />

40<br />

26<br />

12<br />

-2<br />

-16<br />

-30<br />

Oil & Gas<br />

HPCL@IN<br />

Equity Capital (Rs mn) 3386<br />

Face Value(Rs) 10<br />

No of shares o/s (mn) 339<br />

52 Week H/L 555/293<br />

Market Cap (Rs bn/USD mn) 115/2,517<br />

Daily Avg Volume (No of sh) 1190251<br />

Daily Avg Turnover (US$mn) 10.4<br />

Shareholding Pattern (%)<br />

D’10 S’10 J’10<br />

Promoters 51.1 51.1 51.1<br />

FII/NRI 8.6 9.0 6.8<br />

Institutions 27.7 27.9 29.4<br />

Private Corp 6.6 6.0 6.6<br />

Public 5.9 6.0 6.2<br />

Source: Capitaline<br />

Dhaval Joshi<br />

dhaval.joshi@emkayglobal.com<br />

+91 22 6612 1282<br />

¾ HPCL reported results which were above our estimates at<br />

EBIDTA and PAT Level, primarily due to issuance of oil<br />

bonds/Cash receivables during the quarter<br />

¾ EBIDTA at Rs.7.8bn, against Rs.3.5bn, growth of 120% YoY,<br />

mainly due to Inventory gain and issuance of oil bonds/cash<br />

receivables from the government of India<br />

¾ Average gross refining margin for 9mths FY11 was at<br />

$3.96/bbl as compared to $3.73/bbl (increase of 6.1% YoY)<br />

¾ Post correction, stock trades at 0.8x FY12E ABV, which looks<br />

attractive considering the recent reforms, Continue BUY<br />

rating <strong>with</strong> TP of Rs.444<br />

Highlights of the results<br />

HPCL reported results which were above our estimates at EBIDTA and PAT Level,<br />

primarily due to issuance of oil bonds/cash pay out by the government during the<br />

quarter. Revenue for the quarter was at Rs. 340bn (against our expectation of Rs.<br />

319bn), growth of 22% YoY, mainly on account of higher volumes and cash<br />

compensation received from the government of Rs.17.4bn. EBIDTA during the quarter<br />

was at Rs.7.8bn, against of Rs.3.5bn, growth of 120%, YoY. During the quarter<br />

company reported inventory gain of Rs.16.8bn as against inventory loss of Rs.8.3bn a<br />

year ago. Interest cost increased by 10% to Rs.2.4bn. During the quarter the company<br />

reported net profit of Rs.2.1bn, against Rs.0.3bn, growth of 572% YoY.<br />

The company received upstream discount of Rs.11.3bn, in respect of crude<br />

Oil/LPG/SKO purchased from them has been accounted during the quarter. The<br />

company has received budgetary support of Rs.17.4bn from the GOI for the underrecovery<br />

of cooking fuel and auto fuel during the quarter.<br />

Better clarity on subsidy sharing mechanism<br />

After years of ad-hoc subsidy arrangements, a proper subsidy sharing mechanism is<br />

being worked out. The Oil secretary S Sudarshan has clarified that the 1/3rd of the<br />

under recovery would be absorbed by the upstream companies, the government would<br />

certainly absorb 50% or more, the balance 17% would be based on the companies<br />

performance over the quarter.<br />

Interest cost increased by 10% to Rs.2.4bn<br />

During the quarter, interest costs have increased significantly by 10% to Rs.2.4bn in<br />

tandem <strong>with</strong> increase in borrowings during the quarter.<br />

GRM was at $5.1 per bbl as against $2.7 per bbl on QoQ<br />

Higher product demand, especially in light distillate, has seen product spreads<br />

increasing in Q3FY11. Gross refining margin was at $5.1/bbl as compared to $2.7/bbl<br />

(Increased by 88% QoQ). We expect GRM’s to improve further in the coming quarters,<br />

in tandem <strong>with</strong> the improvement in the global economy, which will improve the petro<br />

product spreads.<br />

Valuation table<br />

Y/E, Mar Net EBIDTA APAT AEPS EPS RoE P/E EV/ P/<br />

Rs Mn Sales (Rs mn) (%) % chg (%) EBIDTA BV<br />

FY09 1271091 32655 2.9 7573 22.3 (44.5) 7.5 15.2 6.6 1.0<br />

FY10 1158103 38146 3.4 14761 43.5 94.9 13.5 7.8 5.7 1.0<br />

FY11E 1183804 40343 3.8 17436 51.4 18.1 15.0 6.6 5.3 0.9<br />

FY12E 1232503 43509 3.9 19628 57.9 12.6 15.3 5.9 4.6 0.8<br />

Source: Company, <strong>Emkay</strong> Research<br />

HPCL<br />

Results above estimates<br />

Result Update<br />

<strong>Emkay</strong> <strong>Global</strong> <strong>Financial</strong> <strong>Services</strong> <strong>Ltd</strong> 1

HPCL Result Update<br />

<strong>Financial</strong> Snapshot<br />

Rs Mn<br />

Rs mn Q3 FY10 Q4 FY10 Q1 FY11 Q2 FY11 Q3FY11 YoY (%) QoQ (%) YTD’10 YTD’09 YoY (%)<br />

Revenue 278742.0 315584.1 293015.0 308702.0 340559.9 22.2 10.3 942276.9 769393.1 22.5<br />

Expenditure 275198.4 300074.0 308354.0 283872.9 332757.6 20.9 17.2 924984.5 750868.9 23.2<br />

as % of sales 98.7 95.1 105.2 92.0 97.7<br />

Consumption of RM 258984.7 269740.9 295366.8 264633.0 312146.0 20.5 18.0 872145.8 701813.6 24.3<br />

as % of sales 92.9 85.5 100.8 85.7 91.7<br />

Employee Cost 3142.6 5342.4 3662.1 4405.7 4244.1 35.1 (3.7) 12311.9 10830.8 13.7<br />

as % of sales 1.1 1.7 1.2 1.4 1.2<br />

Other expenditure 13071.1 24990.7 9325.1 14834.2 16367.5 25.2 10.3 40526.8 38224.5 6.0<br />

as % of sales 4.7 7.9 3.2 4.8 4.8<br />

EBITDA 3543.6 15510.1 -15339.0 24829.1 7802.3 120.2 (68.6) 17292.4 18524.2 -6.6<br />

Depreciation 3007.0 3175.4 3174.1 3233.5 3646.7 21.3 12.8 10054.3 8468.6 18.7<br />

EBIT 536.6 12334.7 -18513.1 21595.6 4155.6 674.4 (80.8) 7238.1 10055.6 -28.0<br />

Other Income 2250.4 2079.1 1652.5 2213.3 1448.9 -35.6 (34.5) 5314.7 5779.9 -8.0<br />

Interest 2202.3 1639.9 1968.3 2199.7 2416.6 9.7 9.9 6584.6 7397.6 -11.0<br />

PBT 584.7 12773.9 -18828.9 21609.2 3187.9 445.2 (85.2) 5968.2 8437.9 -29.3<br />

Total Tax 270.7 5235.5 0.0 711.6 1077.6 298.1 51.4 1789.2 3001.1 -40.4<br />

Adjusted PAT 314.0 7538.4 -18828.9 20897.6 2110.3 572.1 (89.9) 4179.0 5436.8 -23.1<br />

(Profit)/loss from JV's/Ass/MI - - - - -<br />

APAT after MI 314.0 7538.4 -18828.9 20897.6 2110.3 572.1 (89.9) 4179.0 5436.8 -23.1<br />

Extra ordinary items - (36.9) 14.0 - - 14.0 -1.5<br />

Reported PAT 314.0 7575.3 -18842.9 20897.6 2110.3 572.1 (89.9) 4165.0 5438.3 -23.4<br />

Reported EPS 0.9 22.2 -55.6 61.7 6.2 575.9 (89.9) 12.3 16.0 -23.0<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 1.3 4.9 (5.2) 8.0 2.3 102.0 (575.2) 1.8 2.4 (57.2)<br />

EBIT 0.2 3.9 (6.3) 7.0 1.2 102.8 (577.5) 0.8 1.3 (53.9)<br />

EBT 0.2 4.0 (6.4) 7.0 0.9 72.6 (606.4) 0.6 1.1 (46.3)<br />

PAT 0.1 2.4 (6.4) 6.8 0.6 50.7 (615.0) 0.4 0.7 (26.5)<br />

Effective Tax rate 46.3 41.0 0.0 3.3 33.8 (1,249.4) 3,051.0 30.0 35.6 (558.8)<br />

Valuations<br />

Though there has been some clarity on sharing mechanism, more budgetary support from<br />

GOI is needed to keep HPCL in black. We expect GOI’s budgetary support to increase only<br />

if it is able to garner larger funds from disinvestment or by full implementation of Kirit Parekh<br />

committee recommendation. However, pressure on the US dollar has been diverting<br />

interest of investors towards commodities including crude oil. If US dollar continues to<br />

remain under pressure, the commodities are likely to stay firm including crude oil, hurting<br />

the OMC’s performance. Also lower contribution from the government during the quarter<br />

has raised concern for Q4 FY11 contribution as well. Hence, we have downgraded our<br />

target multiple from 1.2x to 1x for FY12E P/BV and reduced our target price to Rs.444<br />

(Rs.515, earlier), maintains our BUY rating on the stock.<br />

<strong>Emkay</strong> Research 14 February 2011 2

HPCL Result Update<br />

<strong>Financial</strong>s<br />

Income Statement<br />

Balance Sheet<br />

Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E<br />

Net Sales 1,271,091 1,158,103 1,183,804 1,232,503 Equity share capital 3,390 3,390 3,390 3,390<br />

Growth (%) 12.7 (8.9) 2.2 4.1 Reserves & surplus 108,023 118,025 131,495 147,158<br />

Expenditure Net worth 111,413 121,415 134,885 150,548<br />

Materials Consumed 1,180,167 1,039,098 1,053,492 1,097,681 Minority Interest 27 0 0 0<br />

Employee Cost 11,627 16,428 20,125 20,698 Secured Loans 17,232 18,232 19,232 20,232<br />

Other Exp 46,643 64,431 69,844 70,615 Unsecured Loans 223,380 183,380 158,380 120,380<br />

EBITDA 32,655 38,146 40,343 43,509 Loan Funds 240,612 201,612 177,612 140,612<br />

Growth (%) 70 17 6 8 Net deferred tax liab. 16,864 16,864 16,864 16,864<br />

EBITDA margin (%) 2.9 3.4 3.8 3.9 Total Liabilities 368,928 339,891 329,361 308,024<br />

Depreciation 10,661 12,505 12,677 12,933<br />

EBIT 21,994 25,641 27,666 30,576 Gross Block 219,496 223,496 230,496 239,496<br />

EBIT margin (%) 1.7 2.2 2.3 2.5 Less: Depreciation 92,873 105,379 118,056 130,989<br />

Other Income 9,243 7,835 5,462 4,345 Net block 126,622 118,117 112,440 108,507<br />

Interest expenses 21,123 9,321 7,104 5,624 CWIP 64,547 74,047 81,047 86,047<br />

PBT 10,118 24,154 26,023 29,296 Investment 128,274 88,274 68,274 48,274<br />

Tax 2,545 9,393 8,588 9,668 Current Assets 174,155 166,834 171,440 173,400<br />

Effective tax rate (%) 25.2 38.9 33.0 33.0 Inventories 91,163 93,764 98,650 101,459<br />

Adjusted PAT 7,573 14,761 17,436 19,628 Sundry debtors 24,920 21,638 22,765 23,414<br />

Growth (%) (44.5) 94.9 18.1 12.6 Cash & bank bal. 12,763 12,309 8,863 6,195<br />

Net Margin (%) 0.7 1.3 1.6 1.8 Loans & advances 1,853 1,617 1,701 1,749<br />

(Profit)/loss from JVs/Ass/MI - - - - Other current assets 1,853 1,617 1,701 1,749<br />

Adj. PAT After JVs/Ass/MI 7,573 14,761 17,436 19,628 Current lia & Prov 124,665 113,575 110,035 114,399<br />

E/O items - - - - Current liabilities 112,294 102,283 98,529 102,453<br />

Reported PAT 7,573 14,761 17,436 19,628 Provisions 12,371 11,293 11,506 11,946<br />

PAT after MI 7,573 14,761 17,436 19,628 Net current assets 49,490 53,258 61,405 59,001<br />

Growth (%) (44.5) 94.9 18.1 12.6 Misc. exp 10.5 - - -<br />

Total Assets 368,928 339,891 329,361 308,024<br />

Cash Flow<br />

Key Ratios<br />

Y/E, Mar (Rs. mn) FY09 FY10 FY11E FY12E Y/E, Mar FY09 FY10 FY11E FY12E<br />

PBT (Ex-Other income) 10,118 24,154 26,023 29,296 Profitability (%)<br />

Depreciation 10,661 12,505 12,677 12,933 EBITDA Margin 3.7 4.1 4.3 4.3<br />

Interest Provided 21,123 9,321 7,104 5,624 Net Margin 0.7 1.3 1.6 1.8<br />

Other Non-Cash items - - - - ROCE 12.1 10.0 9.3 10.4<br />

Chg in working cap 27,099 (10,173) (11,593) (263) ROE 7.5 13.5 15.0 15.3<br />

Tax paid 2,153 6,607 8,588 9,668 RoIC 20.2 18.7 20.2 20.8<br />

Operating Cash flow 61,772 21,367 20,162 33,578 Per Share Data (Rs)<br />

Capital expenditure (30,734) (13,500) (14,000) (14,000) EPS 22.3 43.5 51.4 57.9<br />

Free Cash Flow 31,038 7,867 6,162 19,578 CEPS 53.8 80.4 88.8 96.1<br />

Other income (4,177) (7,835) (5,462) (4,345) BVPS 328.7 358.2 397.9 444.2<br />

Investments 92,755 40,000 20,000 20,000 DPS 5.2 12.0 10.0 10.0<br />

Investing Cash flow -97,095 26,500 6,000 6,000 Valuations (x)<br />

Equity Capital Raised - - - - PER 15.2 7.8 6.6 5.9<br />

Loans Taken / (Repaid) 57,207 (39,000) (24,000) (37,000) P/CEPS 6.3 4.2 3.8 3.5<br />

Interest Paid (25,862) (9,321) (7,104) (5,624) P/BV 1.0 1.0 0.9 0.8<br />

Dividend paid (incl tax) (1,621) (4,759) (3,966) (3,966) EV / Sales 0.2 0.2 0.2 0.2<br />

Income from investments - - - - EV / EBITDA 6.6 5.7 5.3 4.6<br />

Others - - - - Dividend Yield (%) 2.0 3.5 2.9 2.9<br />

Financing Cash flow 42,202 -45,245 -29,608 -42,246 Gearing Ratio (x)<br />

Net chg in cash 6,879 2,621 -3,446 -2,668 Net Debt/ Equity 2.0 1.6 1.3 0.9<br />

Opening cash position 2,810 9,688 12,309 8,863 Net Debt/EBIDTA 7.0 5.0 4.2 3.1<br />

Closing cash position 9,688 12,309 8,863 6,195 Wrkng Cap Cycl 5.7 1.2 4.0 6.9<br />

<strong>Emkay</strong> Research 14 February 2011 3

February 14, 2011<br />

Reco<br />

Accumulate<br />

CMP<br />

Rs51<br />

EPS change FY11E/12E (%)<br />

Previous Reco<br />

Hold<br />

Target Price<br />

Rs58<br />

+1 / -13<br />

Target Price change (%) -17<br />

Nifty 5,130<br />

Sensex 17,729<br />

Price Performance<br />

(%) 1M 3M 6M 12M<br />

Absolute (18) (28) (21) (9)<br />

Rel. to Nifty (10) (16) (19) (17)<br />

Source: Bloomberg<br />

Apollo Tyres <strong>Ltd</strong>.<br />

Trading at replacement cost, upgrade to ACCUMULATE<br />

¾ Conso. EBIDTA at Rs2.5bn (est. Rs 2.3bn) is marginally ahead.<br />

Net profits at Rs 1.2bn was significantly above est. of<br />

Rs647mn due to lower tax rate (23.6%) and interest cost<br />

¾ Change in rubber purchasing policy (quarterly contracts) to<br />

provide some given the high rubber prices. However, quantum<br />

is not disclosed<br />

¾ Revise our FY11/FY12 conso EPS by 1%/-13% to Rs 6.1/Rs7.2.<br />

Upgrade our rating to ACCUMULATE as stock trades 1x FY12<br />

P/BV and near replacement cost<br />

¾ FY12 earnings growth of 18% will be back ended driven by<br />

stable rubber prices and price hikes. Near term margins<br />

remain a concern<br />

Result Update<br />

Relative Price Chart<br />

90 Rs<br />

80<br />

70<br />

60<br />

50<br />

40<br />

Feb-10 Apr-10 Jun-10 Aug-10 Oct-10 Dec-10<br />

%<br />

40<br />

26<br />

12<br />

-2<br />

-16<br />

-30<br />

Net sales – Below estimate due to lower volumes<br />

Apollo Tyre (ATL) sold ~111,000 MT in 3QFY11, 22% QoQ growth but declined 12% Yoy.<br />

We had est. tonnage sales of 125,600 MT. The disappointment is largely due to lower<br />

sales in the standalone business at ~Rs 78,600 MT against our est. of ~98,000 MT. ATL<br />

has a finished goods inventory of Rs 6.8bn, which was not sold in 3QFY11. Conso. net<br />

sales stood at Rs 23.5bn, significantly below est. of Rs 27.4bn. Realization per ton was<br />

Rs 213,380 (15% YoY, 0-0.4% QoQ).<br />

Source: Bloomberg<br />

Stock Details<br />

Sector<br />

Bloomberg<br />

Apollo Tyres (LHS) Rel to Nifty (RHS)<br />

Auto Ancillaries<br />

APTY@IN<br />

Equity Capital (Rs mn) 504<br />

Face Value(Rs) 1<br />

No of shares o/s (mn) 504<br />

52 Week H/L 89/44<br />

Market Cap (Rs bn/USD mn) 26/569<br />

Daily Avg Volume (No of sh) 4736391<br />

Daily Avg Turnover (US$mn) 6.5<br />

Shareholding Pattern (%)<br />

S’10 J’10 M’10<br />

Promoters 39.8 39.8 39.4<br />

FII/NRI 26.3 29.3 26.1<br />

Institutions 9.4 12.1 15.5<br />

Private Corp 9.1 4.3 6.0<br />

Public 15.4 14.6 13.2<br />

Source: Capitaline<br />

Chirag Shah<br />

chirag.shah@emkayglobal.com<br />

+91 22 612 1252<br />

Segmental Details (Rs Mn) 3QFY10 2QFY11 3QFY11 YoY (%) QoQ(%)<br />

Europe<br />

Net Sales 6,810 5,247 6,492 (4.7) 23.7<br />

Results 1,230 432 883 (28.2) 104.4<br />

Margins (%) 18.1 8.2 13.6<br />

Capital Employed 3,964 5,608 5,941 49.9 5.9<br />

ROCE (%) 31.0 7.7 14.9<br />

South Africa<br />

Net Sales 2,919 2,632 2,995 2.6 13.8<br />

Results 202 (73) 78 (61.4)<br />

Margins (%) 6.9 (2.8) 2.6<br />

Capital Employed 1,424 2,256 2,332 63.8 3.4<br />

ROCE (%) 14.2 (3.2) 3.3<br />

India<br />

Net Sales 13,233 11,756 14,320 8.2 21.8<br />

Results 1,761 915 1,155 (34.4) 26.2<br />

Margins (%) 13.3 7.8 8.1<br />

Capital Employed 18,515 20,379 21,178 14.4 3.9<br />

ROCE (%) 9.5 4.5 5.5<br />

Source: Company. <strong>Emkay</strong> Research<br />

<strong>Financial</strong> Snapshot<br />

YE- Net EBITDA EPS EPS RoE EV/<br />

Mar Sales (Core) (%) APAT (Rs) % chg (%) P/E EBITDA P/BV<br />

FY09 49,841 4,162 8.4 1,392 2.8 (50.0) 11.0 18.1 8.2 1.9<br />

FY10 81,207 11,750 14.5 5,661 11.2 306.6 34.1 4.5 3.6 1.3<br />

FY11E 90,640 8,844 9.8 3,059 6.1 (46.0) 14.6 8.2 5.4 1.1<br />

FY12E 112,343 10,307 9.2 3,614 7.2 18.1 15.2 7.0 4.7 1.0<br />

Source: Company. <strong>Emkay</strong> Research<br />

<strong>Emkay</strong> <strong>Global</strong> <strong>Financial</strong> <strong>Services</strong> <strong>Ltd</strong> 1

Apollo Tyres <strong>Ltd</strong>. Result Update<br />

Quarterly Summary - Consolidated<br />

Rs mn Q3FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) YTD’11 YTD’10 YoY (%)<br />

Revenue 22,953 18,207 19,489 23,686 3.2 21.5 61,382 59,766 2.7<br />

Expenditure 19,128 16,222 17,636 20,955 9.6 18.8 54,813 51,010 7.5<br />

as % of sales 83.3 89.1 90.5 88.5 89.3 85.4<br />

Consumption of RM 12,284 10,224 11,476 13,912 13.3 21.2 35,612 32,703 8.9<br />

as % of sales 53.5 56.2 58.9 58.7 58.0 54.7<br />

Employee Cost 2,965 2,911 3,013 3,126 5.4 3.7 9,051 7,911 14.4<br />

as % of sales 12.9 16.0 15.5 13.2 14.7 13.2<br />

Other expenditure 3,879 3,087 3,147 3,917 1.0 24.5 10,151 10,396 (2.4)<br />

as % of sales 16.9 17.0 16.1 16.5 16.5 17.4<br />

EBITDA 3,825 1,985 1,853 2,731 (28.6) 47.4 6,569 8,755 (25.0)<br />

Depreciation 674 638 669 673 (0.0) 0.6 1,981 1,901 4.2<br />

EBIT 3,151 1,347 1,183 2,058 (34.7) 73.9 4,588 6,855 (33.1)<br />

Other Income 30 35 4 50 67.2 1,136.0 89 76 16.6<br />

Interest 435 338 442 529 21.5 19 1,309 1,025 27.7<br />

PBT 2,746 1,043 745 1,579 (42.5) 112.0 3,368 5,906 (43.0)<br />

Total Tax 882 301 213 372 (57.8) 75.2 887 2,012 (55.9)<br />

Adjusted PAT 1,864 742 533 1,207 (35.3) 126.7 2,481 3,893 (36.3)<br />

(Profit)/loss from JV's/Ass/MI - - - - - -<br />

Adjusted PAT after MI 1,864 742 533 1,207 (35.3) 126.7 2,481 3,893 (36.3)<br />

Extra ordinary items - - - - - - - - -<br />

Reported PAT 1,864 742 533 1,207 (35.3) 126.7 2,481 3,893 (36.3)<br />

Reported EPS 3.7 1.5 1.1 2.4 (35.3) 126.7 4.9 7.7 (36.3)<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 16.7 10.9 9.5 11.5 (513) 202 10.7 14.6 (395)<br />

EBIT 13.7 7.4 6.1 8.7 (504) 262 7.5 11.5 (399)<br />

EBT 12.0 5.7 3.8 6.7 (530) 285 5.5 9.9 (439)<br />

PAT 8.1 4.1 2.7 5.1 (303) 236 4.0 6.5 (247)<br />

Effective Tax rate 32.1 28.9 28.5 23.6 (854) (495) 26.3 34.1 (775)<br />

<strong>Emkay</strong> Research 14 February 2011 2

Apollo Tyres <strong>Ltd</strong>. Result Update<br />

Quarterly Summary - Standalone<br />

Rs mn Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11 YoY (%) QoQ (%) YTD’11 YTD’10 YoY (%)<br />

Revenue 13,233 13,128 11,213 11,756 14,321 8.2 21.8 37,290 37,238 0.1<br />

Expenditure 11,183 11,282 10,044 10,541 12,830 14.7 21.7 33,415 31,246 6.9<br />

as % of sales 84.5 85.9 89.6 89.7 89.6 89.6 83.9<br />

Consumption of RM 8,567 8,903 7,642 7,886 9,926 15.9 25.9 25,454 22,837 11.5<br />

as % of sales 64.7 67.8 68.2 67.1 69.3 68.3 61.3<br />

Employee Cost 800 715 774 769 779 (2.6) 1.3 2,322 2,180 6.5<br />

as % of sales 6.0 5.4 6.9 6.5 5.4 6.2 5.9<br />

Other expenditure 1,817 1,664 1,627 1,887 2,126 17.0 12.7 5,640 6,230 (9.5)<br />

as % of sales 13.7 12.7 14.5 16.0 14.8 15.1 16.7<br />

EBITDA 2,050 1,846 1,169 1,215 1,491 (27.3) 22.7 3,875 5,992 (35.3)<br />

Depreciation 293 294 341 377 367 25.4 (2.5) 1,085 933 16.3<br />

EBIT 1,757 1,551 828 838 1,123 (36.1) 34.0 2,789 5,058 (44.9)<br />

Other Income 3 88 7 58 31 970.3 (46.1) 95 21 345.5<br />

Interest 211 200 259 362 434 105.9 20 1,055 539 95.8<br />

PBT 1,549 1,439 575 534 720 (53.5) 34.9 1,829 4,541 (59.7)<br />

Total Tax 529 277 169 160 172 (67.5) 7.4 501 1,555 (67.8)<br />

Adjusted PAT 1,019 1,162 406 374 548 (46.2) 46.7 1,328 2,986 (55.5)<br />

(Profit)/loss from JV's/Ass/MI - 1 2 3 4 4 -<br />

Adjusted PAT after MI 1,019 1,161 404 371 544 (46.6) 46.8 1,324 2,986 (55.7)<br />

Extra ordinary items - - - - - - -<br />

Reported PAT 1,019 1,161 404 371 544 (46.6) 46.8 1,324 2,986 (55.7)<br />

Reported EPS 2.0 2.3 0.8 0.7 1.1 (46.2) 46.7 2.6 5.9 (55.5)<br />

Margins (%) (bps) (bps) (bps)<br />

EBIDTA 15.5 14.1 10.4 10.3 10.4 (508) 8 10.4 16.1 (570)<br />

EBIT 13.3 11.8 7.4 7.1 7.8 (543) 71 7.5 13.6 (610)<br />

EBT 11.7 11.0 5.1 4.5 5.0 (668) 49 4.9 12.2 (729)<br />

PAT 7.7 8.8 3.6 3.2 3.8 (388) 65 3.6 8.0 (446)<br />

Effective Tax rate 34.2 19.3 29.4 30.0 23.9 (1,028) (612) 27.4 34.2 (683)<br />

EBIDTA – Standalone EBIDTA in line, VBBV disappoints<br />

Consolidated EBIDTA at Rs 2.5bn was above our est. of Rs 2.3bn due to better than expected<br />

performance at standalone business. The key reasons for the deviation are the cost of rubber<br />

price (Rs 185 per kg vs est. of Rs 195 per kg) and higher inventory. Standalone EBIDTA<br />

margins at 10.4% were significantly above our est. of 7.4%.<br />

EBIDTA and Inventory Q3FY10 Q4FY10 Q1FY11 Q2FY11 Q3FY11<br />

EBIDTA<br />

Standalone 2,050 1,846 1,169 1,215 1,491<br />

Margins (%) 15.5 14.1 10.4 10.3 10.4<br />

Subsdiaries 1,775 (1,846) 816 638 1,240<br />

Margins (%) 18.3 14.1 11.7 8.3 13.2<br />

(Inc) / Dec in Inventory - Conso 854.2 - (1,314.6) (1,103.9) (2,023.7)<br />

% sales 3.7 - 2.7 (7.2) (5.7)<br />

<strong>Emkay</strong> Research 14 February 2011 3

Apollo Tyres <strong>Ltd</strong>. Result Update<br />